Market Overview

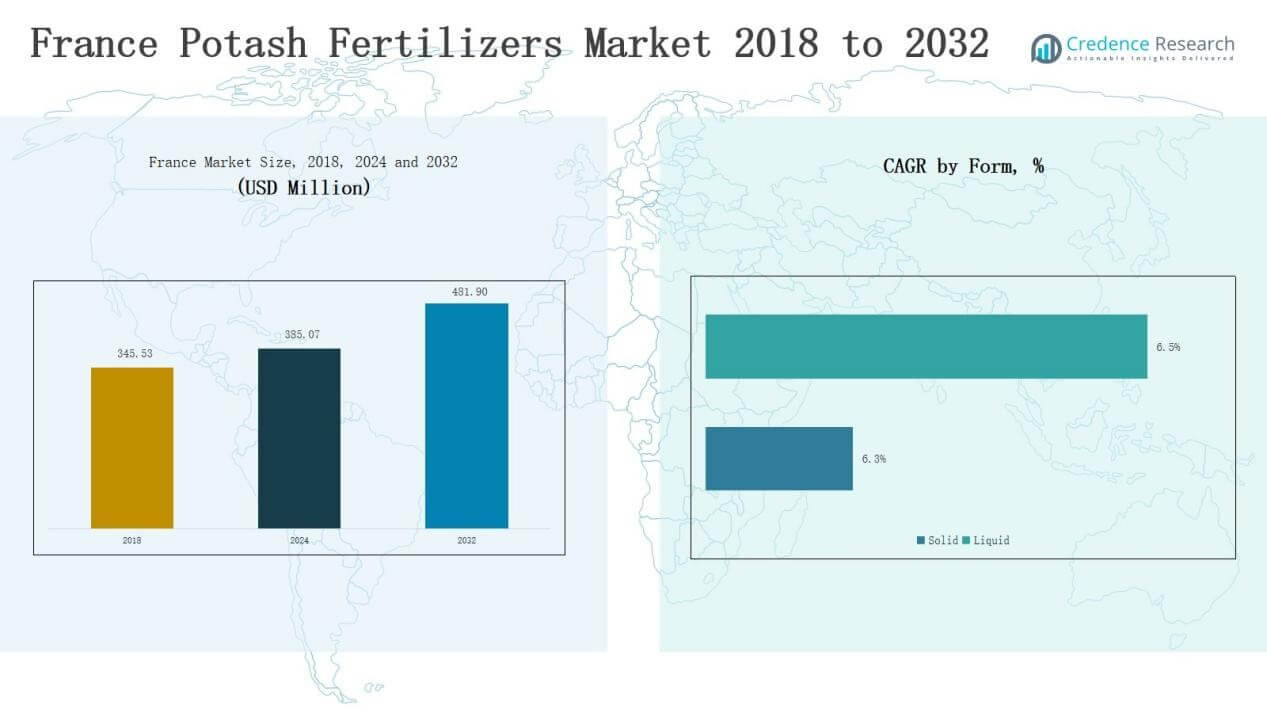

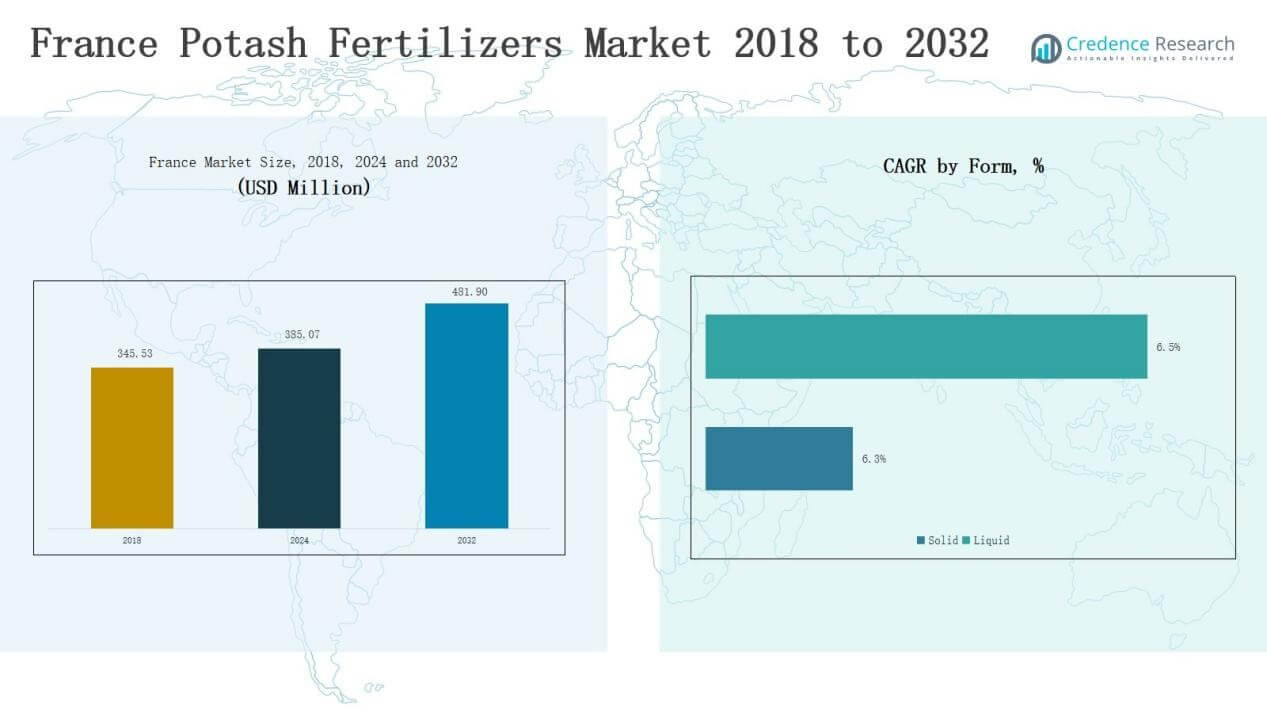

France Potash Fertilizers Market size was valued at USD 345.53 million in 2018 to USD 385.07 million in 2024 and is anticipated to reach USD 481.90 million by 2032, at a CAGR of 2.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Potash Fertilizers Market Size 2024 |

USD 385.07 Million |

| France Potash Fertilizers Market, CAGR |

2.84% |

| France Potash Fertilizers Market Size 2032 |

USD 481.90 Million |

The France Potash Fertilizers Market is shaped by global leaders and regional suppliers that strengthen their positions through supply chain integration, product innovation, and strategic partnerships. Key companies include EuroChem Group AG, Yara International ASA, Nutrien Ltd., The Mosaic Company, JSC Belaruskali, Borealis AG, Israel Chemicals Ltd. (ICL), K+S Aktiengesellschaft, and Uralkali. These players focus on expanding chloride-free fertilizers such as sulphate of potash and potassium nitrate to meet the needs of high-value crops, including fruits, vegetables, and vineyards. Regionally, Northern France led the market with 32% share in 2024, supported by extensive cereal and grain production, large-scale farming practices, and strong fertilizer adoption. This leadership reflects the region’s critical role in sustaining the market’s overall growth trajectory.

Market Insights

- The France Potash Fertilizers Market grew from USD 345.53 million in 2018 to USD 385.07 million in 2024 and will reach USD 481.90 million by 2032, expanding at 2.84%.

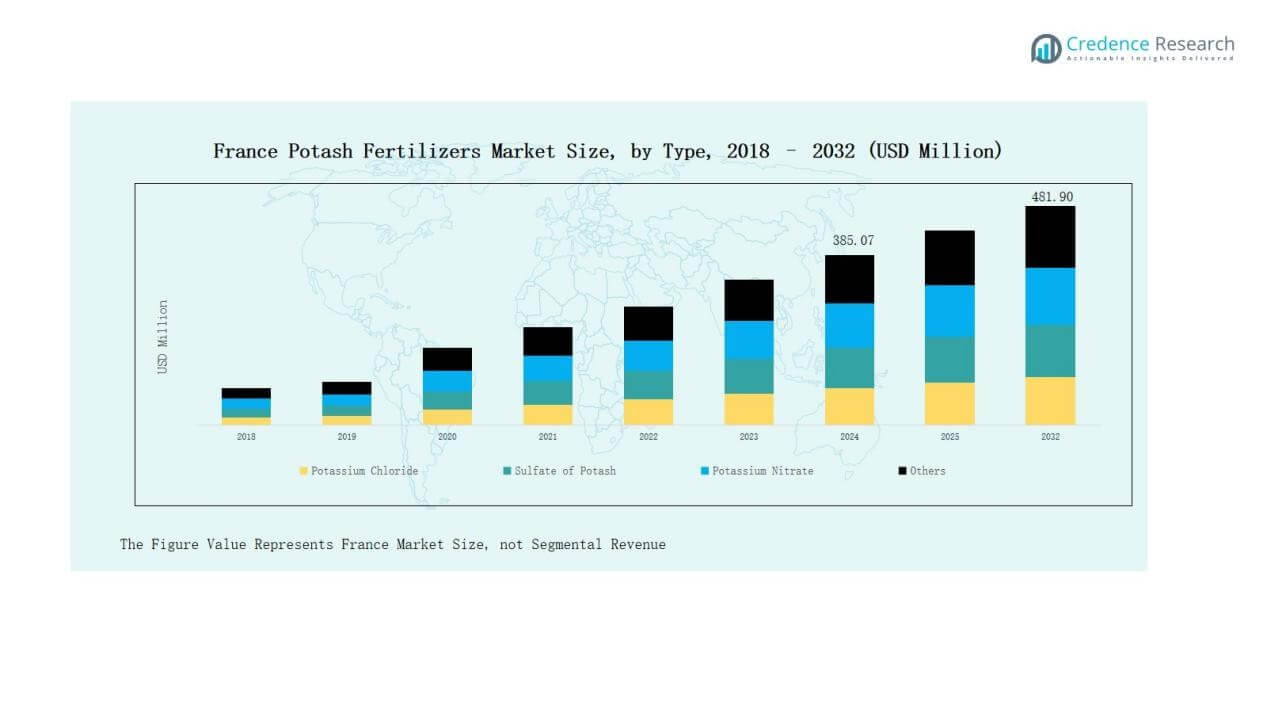

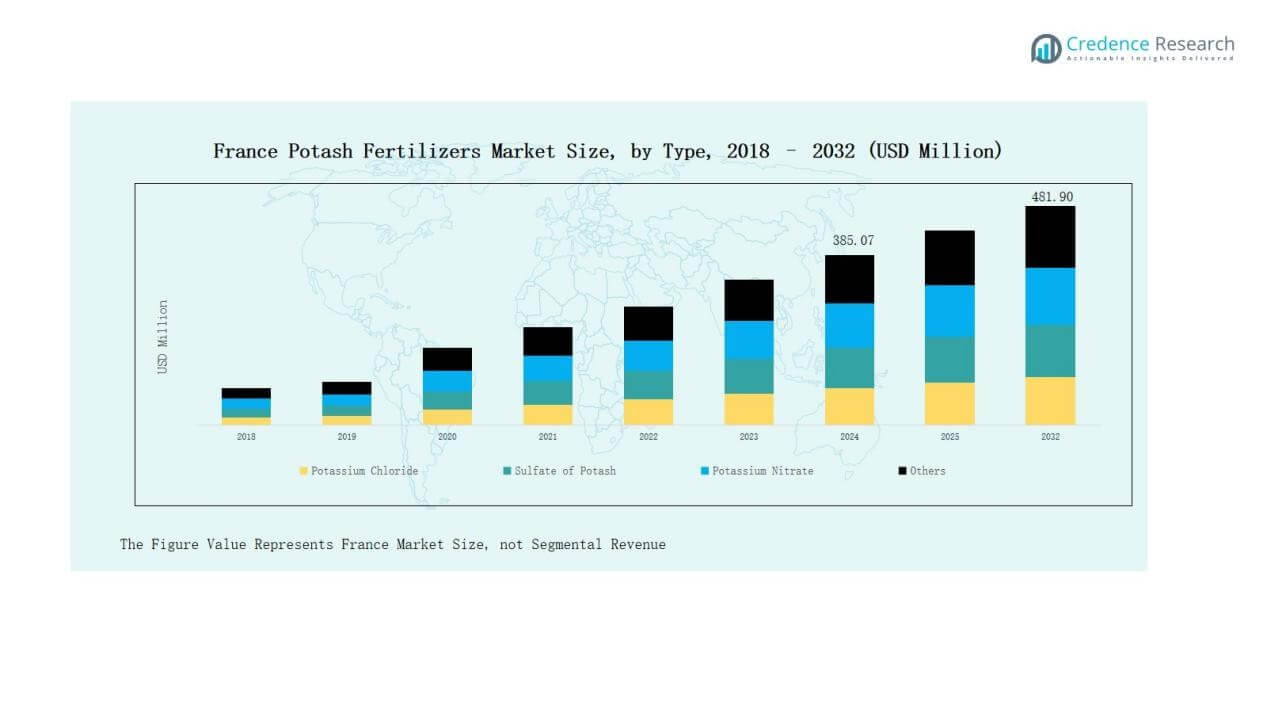

- Potassium Chloride dominated with 56% share in 2024 due to cost efficiency and high suitability for cereals and grains, while sulphate of potash gained traction in fruits and vegetables.

- Broadcasting led application methods with 48% share in 2024, widely adopted for cereals and oilseeds, while fertigation showed strong growth with modern irrigation systems improving nutrient efficiency.

- Solid fertilizers commanded 68% share in 2024, favored for easy storage and broad use across cereals and oilseeds, while liquid fertilizers gained ground with precision and controlled-environment farming.

- Northern France led with 32% share in 2024, followed by Western France at 27%, Southern France at 23%, and Eastern France at 18%, highlighting varied agricultural practices driving demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Potassium Chloride held the dominant 56% share in 2024, making it the most widely used potash fertilizer in France. Its cost efficiency, high potassium concentration, and suitability for cereals and grains drive adoption across large-scale farms. Sulphate of Potash followed, supported by demand in fruits and vegetables where low chloride content improves crop quality. Potassium Nitrate gained importance in horticulture and specialty crops due to its dual nutrient supply, while other potash-based fertilizers addressed niche applications.

For instance, ICL Group expanded its production of sulfate of potash (SOP) at its Dead Sea facilities, explicitly targeting fruit and vegetable growers requiring chloride-free nutrients.

By Application Method

Broadcasting led the segment with a 48% share in 2024, remaining the most common application method due to its simplicity, low cost, and adaptability to broadacre crops. French farmers rely on broadcasting for cereals and oilseeds where uniform field coverage is essential. Fertigation is expanding with modern irrigation systems, improving nutrient efficiency and water use. Foliar spraying supports high-value crops by ensuring fast nutrient uptake, while other methods remain limited to specialized farming practices with smaller demand.

For instance, Yara International launched its YaraVita OptimumTipp foliar fertilizer, designed to improve nutrient absorption in fruit and vegetable crops.

By Form

Solid potash fertilizers dominated with a 68% share in 2024, supported by ease of transport, long storage stability, and cost-effective use across large farmland areas. Their strong adoption in cereals, grains, and oilseeds underlines farmer preference for broad coverage and reliability. Liquid fertilizers, although smaller in share, are gaining ground with intensive farming and controlled-environment agriculture. Their faster nutrient absorption and suitability for fertigation systems align with precision farming trends, supporting steady growth despite higher production and application costs.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Yield Crops

The growing pressure to increase food production in France is driving potash fertilizer adoption. Farmers seek higher yields to meet demand from both domestic and export markets. Potassium-based fertilizers such as potassium chloride and sulphate of potash play a central role in enhancing crop resistance, improving root strength, and ensuring better grain filling. The focus on food security, combined with expanding cultivated land and intensive farming practices, strengthens the demand for potash fertilizers across major French agricultural regions.

For instance, in a long-term field experiment near Toulouse, adding annual potash equivalent to average grain offtake maintained soil potassium levels and prevented yield decline in cereal-oilseed-legume rotations.

Expansion of Horticulture and Specialty Crops

France’s strong horticulture sector, particularly fruits, vegetables, and vineyards, is fueling demand for premium potash fertilizers. Sulphate of Potash and Potassium Nitrate are preferred in these crops due to their ability to improve fruit size, taste, and shelf life while avoiding chloride sensitivity. High-value crops benefit from targeted nutrient application, making potash critical in sustaining quality standards required for domestic consumption and exports. The steady rise in organic farming and greenhouse cultivation further boosts specialized potash fertilizer adoption in the market.

For instance, ICL Group expanded its soluble potash fertilizer offerings in Europe, including France, to support vineyard and fruit growers with chloride-free potassium solutions tailored to greenhouse cultivation.

Government Support and Sustainable Farming Practices

Government initiatives promoting balanced fertilization and sustainable agriculture are key drivers for potash fertilizer consumption in France. Subsidies, farmer training programs, and EU-backed agricultural policies encourage efficient use of nutrients to reduce environmental impact. Potash fertilizers play a vital role in sustainable soil management by restoring potassium depletion and enhancing long-term soil fertility. These measures align with France’s broader goals of sustainable crop production, lower carbon footprint, and meeting consumer preferences for eco-friendly agricultural practices.

Key Trends & Opportunities

Key Trends & Opportunities

Precision Farming and Fertigation Adoption

The adoption of advanced farming practices, such as fertigation and precision nutrient management, is creating new opportunities for potash fertilizers in France. Fertigation through drip and sprinkler systems enhances nutrient uptake efficiency while reducing waste. Potash-based liquid fertilizers are increasingly integrated with these systems to support high-value crops. The trend aligns with digital agriculture and smart farming solutions that allow real-time monitoring of soil nutrients, enabling farmers to optimize fertilizer use while boosting productivity and minimizing environmental impacts.

For instance, the Mosaic Company launched MicroEssentials® SZ Fusion, which combines potash, sulfur, and zinc into a single granule using their Fusion® technology. This fertilizer is designed for precision nutrient management to achieve higher crop yields by providing uniform nutrient distribution and season-long nutrient availability in intensive cropping regions.

Shift Toward Chloride-Free Fertilizers

An emerging trend in France is the growing preference for chloride-free potash fertilizers, such as Sulphate of Potash and Potassium Nitrate. These products are particularly suited for sensitive crops like fruits, vegetables, and vineyards, where quality parameters such as taste, color, and storage life are critical. Increasing consumer demand for premium and organic produce is also influencing the shift. Companies are capitalizing on this trend by expanding offerings in low-chloride fertilizers, creating long-term opportunities for market growth.

For instance, ICL Group launched a chloride-free fertilizer solution, Nova PeaK, targeted at specialty crops and adopted in the French market for improving yield and taste in high-value fruit production.

Key Challenges

Price Volatility of Potash Fertilizers

One of the major challenges in the France potash fertilizers market is price volatility caused by fluctuating global supply-demand balances. France relies heavily on imports from major producing nations, making the market vulnerable to geopolitical risks and supply chain disruptions. Variations in global commodity prices, freight charges, and raw material costs further influence retail fertilizer prices. Such volatility creates uncertainty for farmers, limiting their ability to plan long-term investments in fertilizer usage, especially during periods of economic stress.

Environmental Regulations and Compliance Pressure

Strict environmental regulations in France and the European Union present significant hurdles for the potash fertilizers market. Policies aimed at reducing soil degradation, water pollution, and greenhouse gas emissions push farmers to adopt more efficient nutrient management practices. While these rules promote sustainability, they also increase compliance costs and restrict overuse of fertilizers. Market players face the challenge of innovating eco-friendly formulations that balance regulatory requirements with farmer affordability, which could impact fertilizer application rates and overall market growth.

Competition from Alternative Nutrient Sources

The increasing adoption of organic fertilizers, biofertilizers, and integrated nutrient management solutions poses a challenge to potash fertilizer demand in France. Farmers are shifting toward sustainable inputs to align with consumer preferences for organic produce and to meet environmental standards. While potash fertilizers remain essential for high-yield agriculture, the growth of alternatives threatens their dominance. Market participants must adapt by offering blended solutions, promoting efficient usage, and demonstrating the long-term benefits of potash to maintain competitiveness.

Regional Analysis

Northern France

Northern France accounted for 32% share in 2024, making it the leading region in the France Potash Fertilizers Market. The region benefits from extensive cereal and grain cultivation supported by fertile soils and large-scale farming practices. Farmers prefer potassium chloride due to its cost efficiency and strong yield improvement for wheat and barley. Fertigation and broadcasting are widely adopted to optimize productivity across large farmlands. Growing demand for sustainable crop practices is also supporting the use of chloride-free fertilizers. The region continues to dominate due to its strong agricultural base and high fertilizer penetration.

Western France

Western France held 27% share in 2024, supported by its dominance in horticulture, vineyards, and vegetable farming. Sulphate of potash and potassium nitrate are highly preferred for grapes, fruits, and vegetables due to their ability to enhance crop quality and shelf life. Liquid fertilizers are gaining attention with fertigation systems in greenhouse farming. Farmers in this region invest in premium fertilizers to meet strict quality standards for both local consumption and exports. Strong adoption of sustainable and organic practices further supports the demand for chloride-free formulations. The region shows steady growth potential through expanding high-value crop production.

Southern France

Southern France represented 23% share in 2024, driven by its Mediterranean climate and high demand for specialty crops. Fruits, olives, and vineyards dominate the agricultural landscape, creating strong reliance on sulphate of potash and potassium nitrate. Broadcasting remains common, but fertigation use is increasing with modern irrigation systems. Farmers focus on crop quality and resilience against heat stress, boosting potash application. Growing export-oriented production in the wine and olive sector enhances fertilizer demand. The region continues to be a critical consumer of potash fertilizers for both quality and yield improvement.

Eastern France

Eastern France accounted for 18% share in 2024, the smallest among the regions but showing steady progress. Cereals and oilseeds dominate crop production, with potassium chloride being the most widely used fertilizer. Adoption of foliar applications is increasing for specialty crops in controlled farming environments. Smaller farm sizes and cost constraints influence fertilizer use patterns, but efficiency-focused practices are expanding. Government programs promoting balanced fertilization and soil management support potash adoption. The region’s contribution remains vital in sustaining overall growth within the France Potash Fertilizers Market.

Market Segmentations:

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Region

- Nortern France

- Soutern France

- Eastern France

- Western France

Competitive Landscape

The France Potash Fertilizers Market is characterized by the presence of global leaders and regional suppliers competing through pricing strategies, product innovation, and supply chain integration. Key players such as EuroChem Group AG, Yara International ASA, Nutrien Ltd., The Mosaic Company, JSC Belaruskali, Borealis AG, Israel Chemicals Ltd. (ICL), K+S Aktiengesellschaft, and Uralkali maintain strong positions through extensive distribution networks and strategic partnerships with local cooperatives. Companies focus on expanding low-chloride potash formulations, including sulphate of potash and potassium nitrate, to cater to high-value crops such as vineyards, fruits, and vegetables. Investments in sustainable fertilizer solutions and digital farming support tools strengthen their competitive edge. Market concentration remains moderate, with leading companies controlling significant supply through import channels while smaller regional distributors provide flexibility to farmers. The competitive landscape is shaped by regulatory compliance, farmer training initiatives, and innovation that aligns with France’s shift toward sustainable and precision agriculture practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- EuroChem Group AG

- Yara International AS

- Nutrien Ltd. (incl. former Agrium & PotashCorp)

- The Mosaic Company

- JSC Belaruskali

- Borealis AG

- Israel Chemicals Ltd. (ICL)

- K+S Aktiengesellschaft

- Uralkali

Recent Developments

- In June 2025, The Mosaic Company forecasted stable mine-gate potash prices for the second quarter at US$230–250 per ton, despite volatile market conditions.

- In August 2024, ICL signed a five-year agreement with AMP Holdings Group (China) valued at approximately USD 170 million, expanding its Growing Solutions product offerings and positioning for growth in major end markets including Europe, which includes France.

- In August 2025, The Mosaic Company confirmed the sale of its 450,000 ton per year Taquari-Vassouras potash mine in Brazil to VL Mineração.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Method, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for potash fertilizers will rise with the growing need for higher crop yields.

- Chloride-free potash products will gain momentum in vineyards, fruits, and vegetables.

- Adoption of fertigation and precision farming will expand liquid fertilizer usage.

- Government support for sustainable agriculture will increase balanced fertilizer application.

- Import dependence will continue, keeping supply chain strategies crucial for market players.

- Innovation in eco-friendly and slow-release potash formulations will strengthen product portfolios.

- Farmers will increasingly adopt digital tools to optimize potash fertilizer usage.

- Expansion of organic farming will drive demand for specialized potash blends.

- High-value crop exports will create stronger opportunities for premium fertilizer products.

- Competition will intensify as global producers and regional suppliers expand their presence.

Key Growth Drivers

Key Growth Drivers Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: