Market Overview

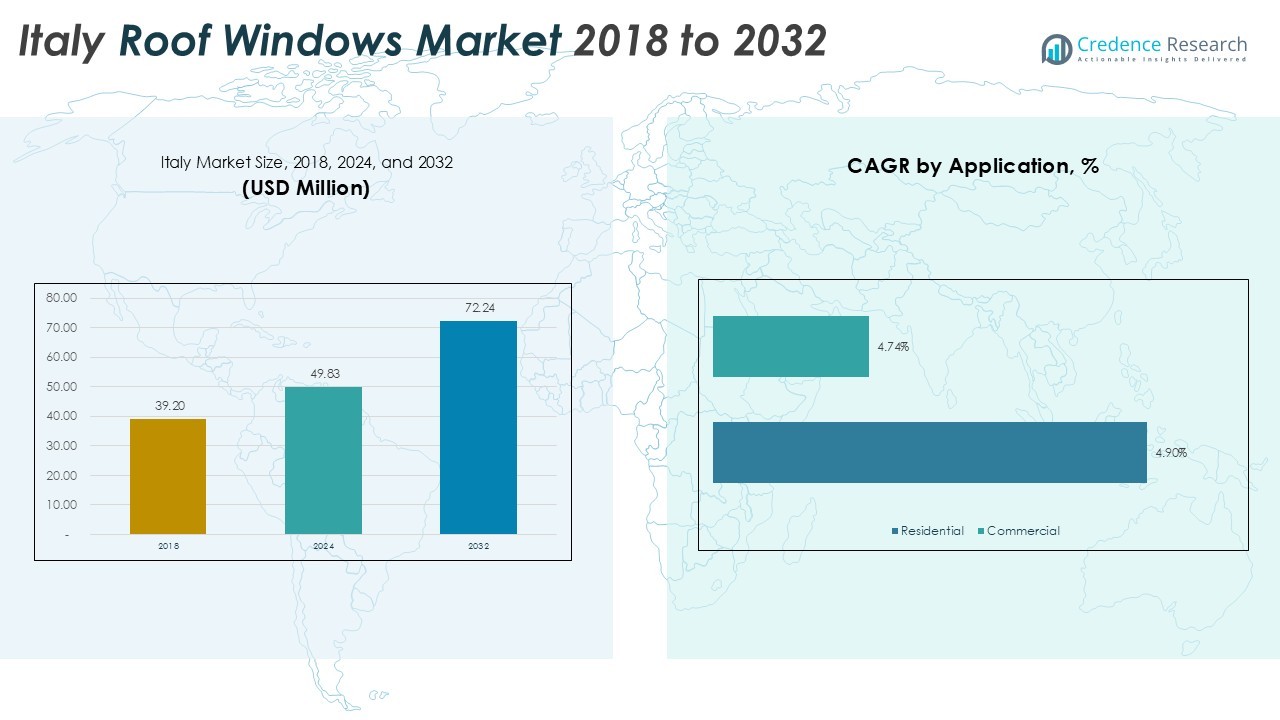

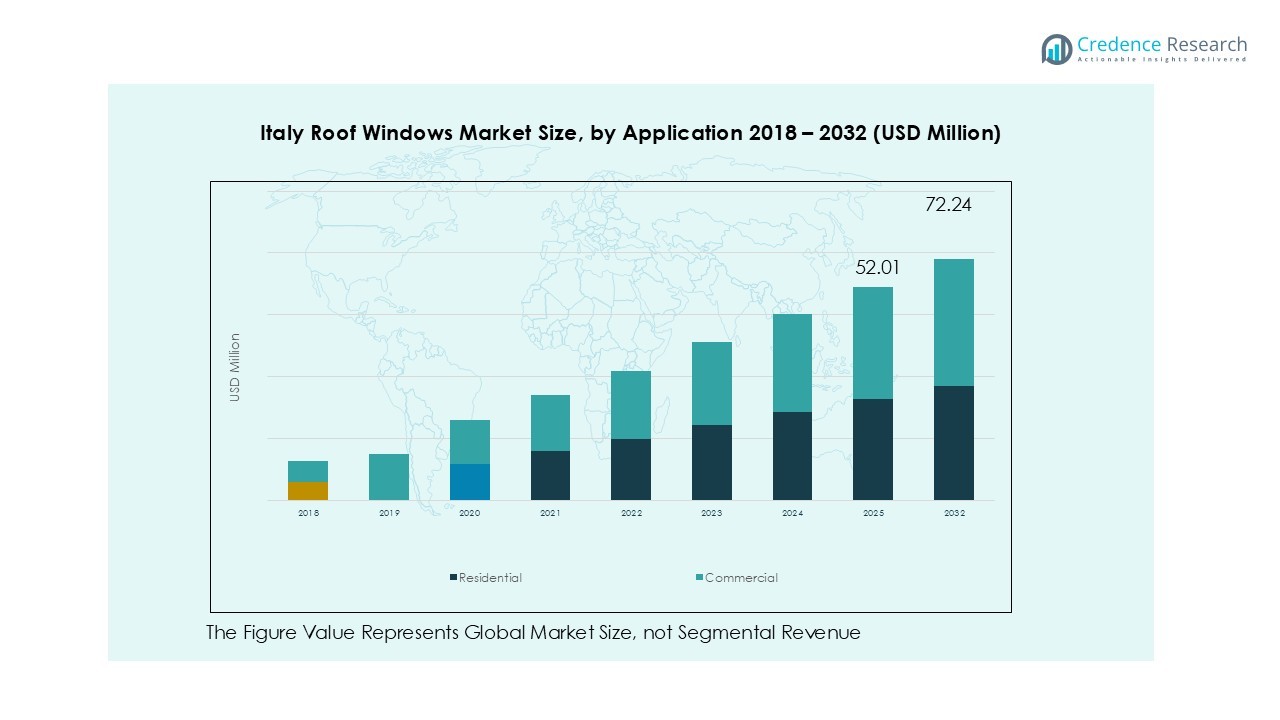

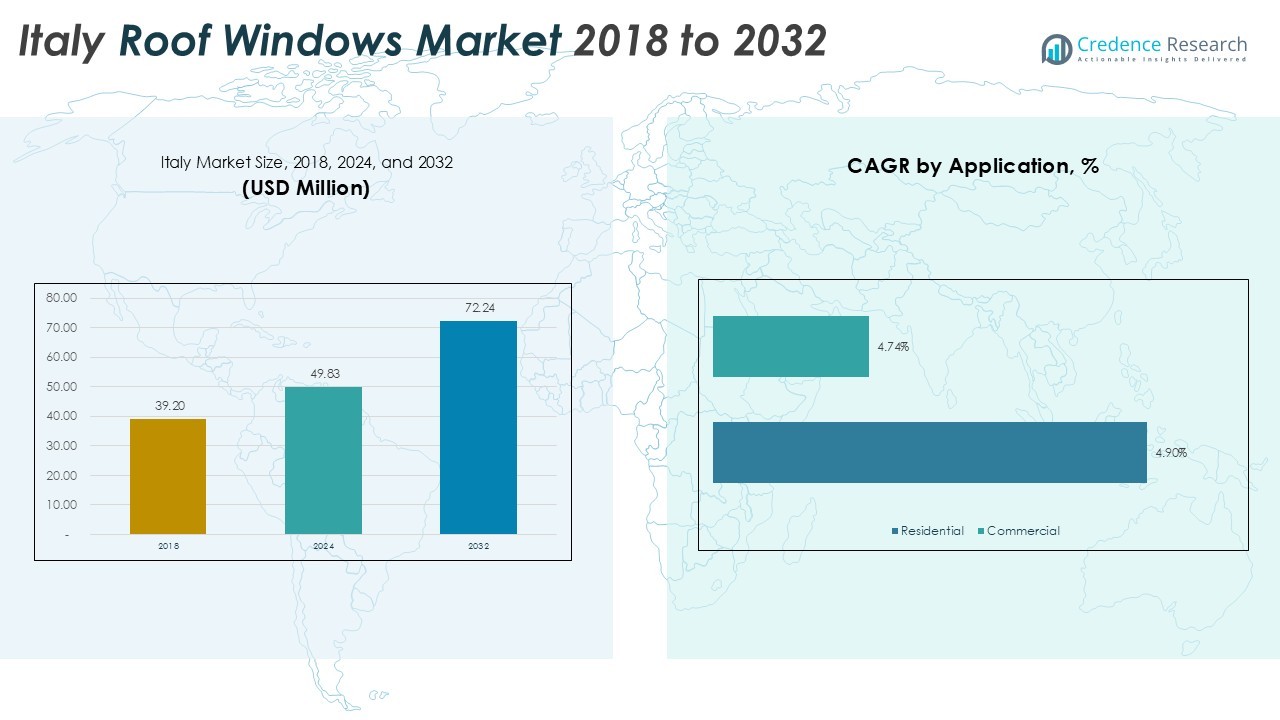

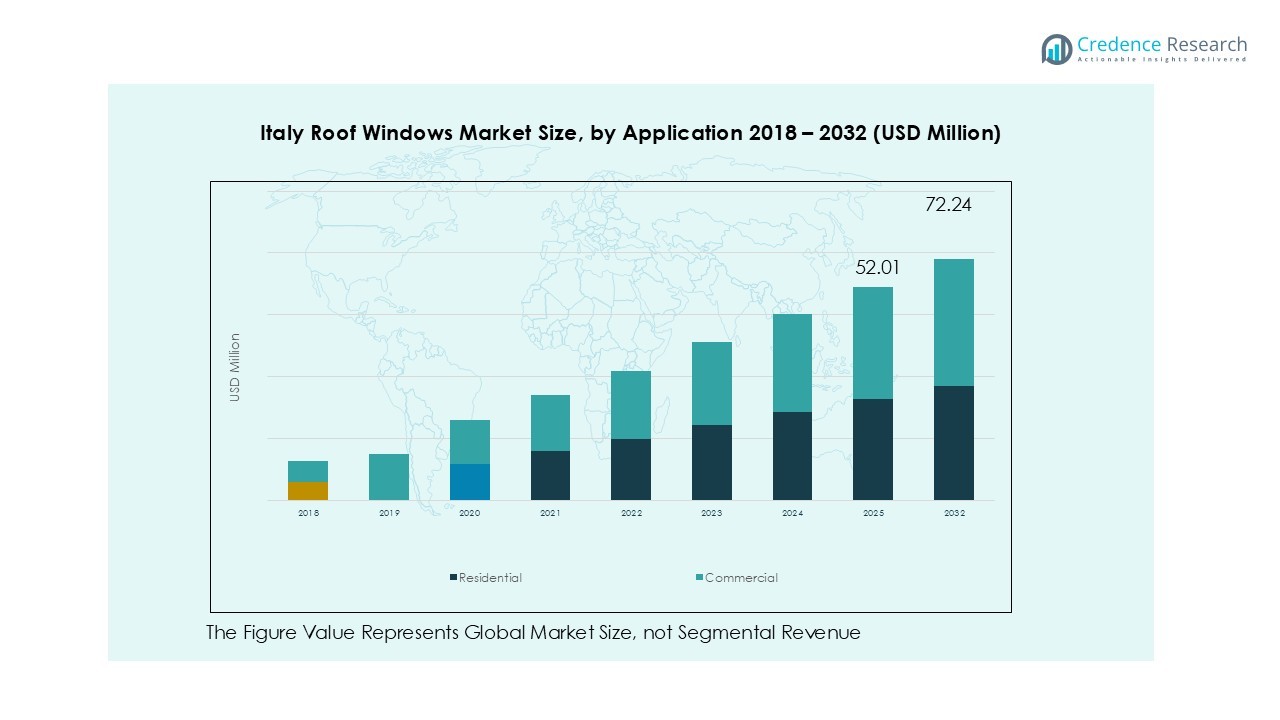

Italy Roof Windows market size was valued at USD 39.20 million in 2018 to USD 49.83 million in 2024 and is anticipated to reach USD 72.24 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Roof Windows Market Size 2024 |

USD 49.83 Million |

| Italy Roof Windows Market, CAGR |

4.9% |

| Italy Roof Windows Market Size 2032 |

USD 72.24 Million |

The Italy Roof Windows market is led by major players such as Tulderhof, Velux Group, Roto Frank AG, Farko, and Lamilux, supported by regional competitors including Piva Group, Chirenti Group, Emica, Beckmann GmbH, and Dakota Group. These companies focus on developing energy-efficient, double- and triple-glazed solutions and smart automation features to meet EU performance standards. Northern Italy holds over 45% market share, driven by strong renovation activity and high adoption of premium roof windows. Central Italy follows with around 30% share, supported by heritage restoration projects, while Southern Italy and islands collectively account for 25%, showing growing demand fueled by residential construction and hospitality sector investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Roof Windows market was valued at USD 49.83 million in 2024 and is projected to reach USD 72.24 million by 2032, growing at a CAGR of 4.9% during the forecast period.

- Rising demand for energy-efficient and sustainable building solutions drives adoption, supported by government incentives for renovation projects and compliance with EU energy standards.

- Key trends include increasing preference for double- and triple-glazed windows, smart automation features, and use of eco-friendly materials like sustainably sourced wood and advanced PU coatings.

- The market is moderately consolidated with major players such as Tulderhof, Velux Group, Roto Frank AG, Farko, and Lamilux focusing on innovation, partnerships, and expanded distribution networks.

- Northern Italy leads with over 45% share, followed by Central Italy at 30% and Southern Italy & Islands at 25%; by type, wood roof windows hold over 40% share, making it the dominant segment.

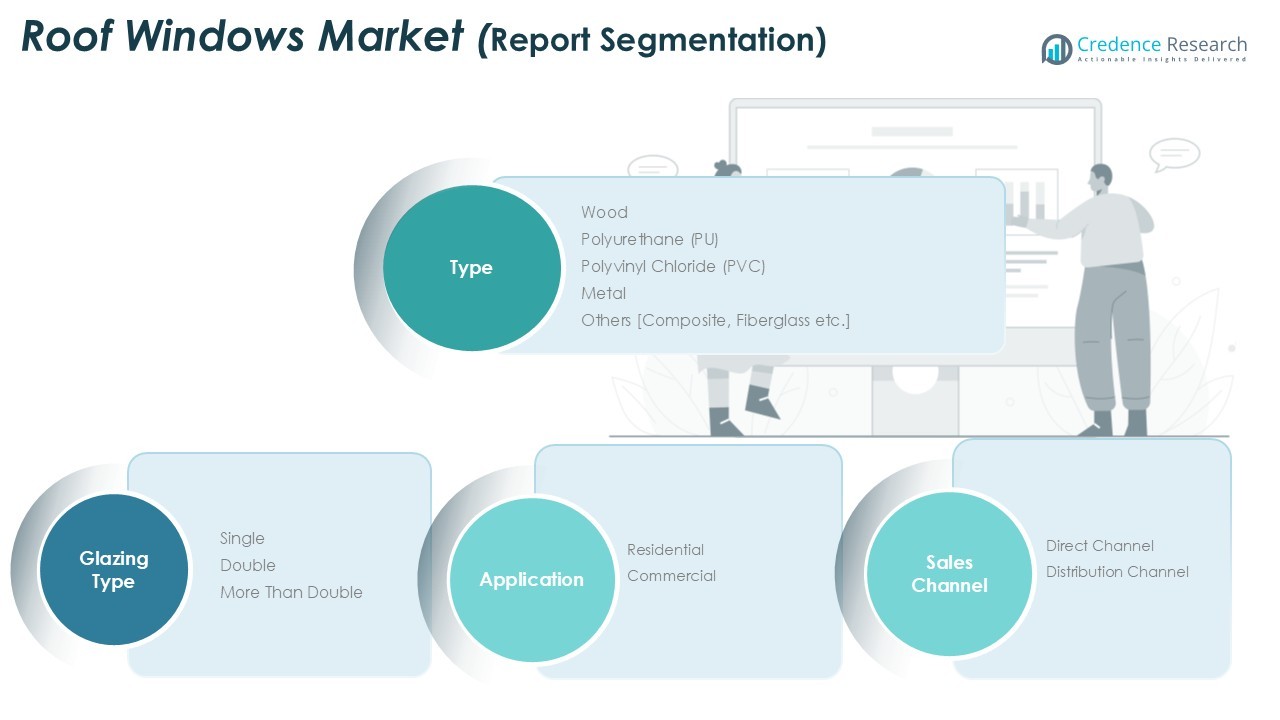

Market Segmentation Analysis:

By Type

The Italy Roof Windows market by type is dominated by wood-based roof windows, holding over 40% market share in 2024. Wood windows remain preferred for their natural aesthetic, insulation properties, and suitability in traditional Italian architecture. Demand is supported by renovation projects in historic towns and energy-efficiency upgrades under EU guidelines. Polyurethane (PU) and PVC segments grow steadily due to their moisture resistance and low maintenance requirements, making them ideal for kitchens and bathrooms. Metal windows cater to modern buildings, while the “others” category includes hybrid materials targeting niche applications.

- For instance, Roto offers its Wooden roof window RotoQ product with a service life of 40 years, as declared in its Environmental Product Declaration.

By Application

Residential applications lead the Italy Roof Windows market with more than 65% market share in 2024, driven by rising home renovation activity and adoption of energy-efficient daylight solutions. Demand is high in single-family homes and urban apartments seeking improved ventilation and natural lighting. Commercial usage, though smaller, is growing with office spaces and hospitality projects integrating roof windows for sustainability compliance and enhanced occupant comfort. Government incentives for green building design and daylight optimization in public infrastructure further support both segments’ growth prospects.

- For instance, Roto’s “RotoQ pivoting window” achieves a thermal insulation value (Uw) of 1.1 W/m²K, making it suitable for direct replacement in renovation projects.

By Glazing Type

Double-glazed roof windows dominate the market, accounting for over 55% share in 2024, as they offer a balance between cost and thermal performance. Their ability to reduce heat loss and improve energy efficiency aligns with Italy’s building energy regulations. Triple-glazed windows are gaining traction in northern regions with colder climates, offering superior insulation and noise reduction. Single-glazed windows see declining demand, mainly restricted to low-cost refurbishments. Manufacturers focus on low-emissivity coatings and argon-filled glazing to meet EU energy performance standards and improve overall comfort in residential and commercial spaces.

Key Growth Drivers

Rising Residential Renovation and Energy Efficiency Initiatives

The Italy Roof Windows market benefits from increasing residential renovation activities, particularly in urban and suburban areas. Government incentives under EU energy-efficiency programs encourage homeowners to install roof windows to improve insulation and reduce energy costs. Growing consumer focus on natural lighting and improved ventilation drives replacement demand for older windows. Renovation projects in historical towns also favor wooden roof windows to maintain aesthetic appeal, while energy-efficient double- and triple-glazed models meet modern performance standards, supporting consistent market expansion across both new-build and retrofit applications.

- For instance, Cocif offers roof windows with glazing that yields a noise reduction of up to 47 dB, helping both acoustic comfort and insulation.

Growing Adoption of Sustainable and Smart Building Solutions

Sustainability goals across Italy fuel demand for roof windows that enhance indoor comfort while reducing carbon footprint. Builders integrate energy-efficient roof windows in compliance with Italy’s building energy performance codes. Smart roof windows with automated sensors, rain detectors, and remote-control features are increasingly popular among modern homeowners. Their ability to optimize daylight, regulate indoor temperature, and improve air quality aligns with green building certifications. This convergence of eco-friendly materials and IoT-enabled products creates a favorable environment for premium roof window adoption in residential and commercial projects.

- For instance, FAKRO roof windows include electric and solar powered models using Z-Wave wireless protocol, allowing remote opening/closing and integration with home automation systems.

Expansion of Commercial and Hospitality Construction Projects

Italy’s hospitality and commercial real estate sectors are witnessing steady growth, driving demand for roof windows in hotels, offices, and retail spaces. Developers integrate roof windows to provide natural daylight, reduce electricity consumption, and enhance occupant well-being. Modern designs with sleek frames and advanced glazing options support architectural aesthetics and sustainability compliance. Government-backed initiatives promoting energy-efficient public infrastructure further boost adoption. The growing preference for daylight-optimized interiors in commercial workspaces reinforces market opportunities, encouraging suppliers to expand offerings tailored for large-scale projects and high-traffic environments.

Key Trends & Opportunities

Increasing Demand for Triple-Glazed Roof Windows

Triple-glazed roof windows are gaining traction in Italy, especially in northern regions with colder climates. Their superior insulation properties and noise reduction capabilities make them ideal for residential areas near busy streets. Manufacturers focus on developing affordable triple-glazed models with improved thermal performance to meet stricter EU energy directives. This trend opens opportunities for market players to target eco-conscious consumers and green building developers, positioning triple-glazed windows as a premium solution that delivers long-term energy savings and enhances overall occupant comfort.

- For instance, VELUX’s Glazing No. 66 triple-glazed roof window has a thermal transmittance (Uw) of 1.0 W/m²K and sound insulation of 37 dB, which meets stricter EU energy directives.

Integration of Smart Technologies in Roof Windows

Automation is emerging as a major trend in the Italy Roof Windows market. Smart roof windows equipped with sensors can automatically close during rain, adjust ventilation based on indoor air quality, and be controlled through smartphones. Integration with home automation systems is expanding their appeal among tech-savvy homeowners. This opportunity allows manufacturers to offer differentiated solutions that command higher margins. Partnerships with IoT solution providers further strengthen innovation pipelines, making smart roof windows a growth driver for both residential and commercial projects.

- For instance, VELUX 3-in-1 roof windows include a built-in rain sensor that detects rain and triggers automatic closing to protect interiors.

Key Challenges

High Installation and Product Costs

One of the primary challenges for the Italy Roof Windows market is the relatively high cost of roof windows and installation services. Premium models with double or triple glazing, automation, and energy-efficient features can be expensive, deterring cost-sensitive homeowners. Skilled labor shortages in some regions also increase installation expenses, extending project timelines. These factors limit adoption in lower-income segments and smaller renovation projects, pushing manufacturers to explore cost-reduction strategies and flexible pricing models to improve market penetration without compromising quality.

Limited Awareness in Rural and Low-Density Areas

Despite growing demand in urban regions, rural and low-density areas in Italy show limited adoption of roof windows. Lack of awareness about energy-efficiency benefits, combined with fewer renovation projects, constrains market potential. Distribution challenges and lower availability of skilled installers in these regions further reduce accessibility. Manufacturers and distributors face the task of expanding outreach programs, providing educational campaigns, and incentivizing installers to cater to these areas. Addressing this gap can unlock untapped opportunities and support balanced market growth nationwide.

Regional Analysis

Northern Italy

Northern Italy dominates the Italy Roof Windows market, holding over 45% market share in 2024. The region benefits from a strong construction sector, high-income households, and strict adherence to EU energy-efficiency standards. Demand is driven by renovation of historic residential buildings and adoption of triple-glazed windows for superior thermal insulation, particularly in colder Alpine areas. Industrial hubs like Lombardy and Veneto invest heavily in sustainable construction, supporting commercial segment growth. Government incentives for energy-efficient upgrades and the popularity of premium wood and polyurethane roof windows further boost demand, making Northern Italy the key contributor to overall market revenue.

Central Italy

Central Italy accounts for around 30% market share of the Italy Roof Windows market, supported by steady residential renovation activity and tourism-related infrastructure projects. Tuscany and Lazio lead demand, with heritage conservation programs encouraging installation of energy-efficient wooden roof windows to maintain architectural harmony. The growing adoption of double-glazed windows in residential units improves energy performance and aligns with EU directives. Commercial demand is also rising in Rome and Florence, where office and hospitality projects integrate roof windows to optimize daylight and improve occupant comfort, sustaining healthy market growth across both residential and commercial applications in the region.

Southern Italy & Islands

Southern Italy and the islands collectively represent approximately 25% market share, showing strong potential despite lower per-capita income compared to the north. Growing investments in residential construction and government incentives for energy-efficient renovations stimulate demand. The preference for PVC and PU roof windows is higher due to their cost-effectiveness and durability in humid coastal climates. Adoption of double-glazed solutions is increasing as consumers seek better thermal regulation during hot summers. Expansion of hospitality projects in Sicily and Sardinia creates additional opportunities, particularly for premium roof window solutions aimed at enhancing guest experiences and reducing energy consumption in hotels.

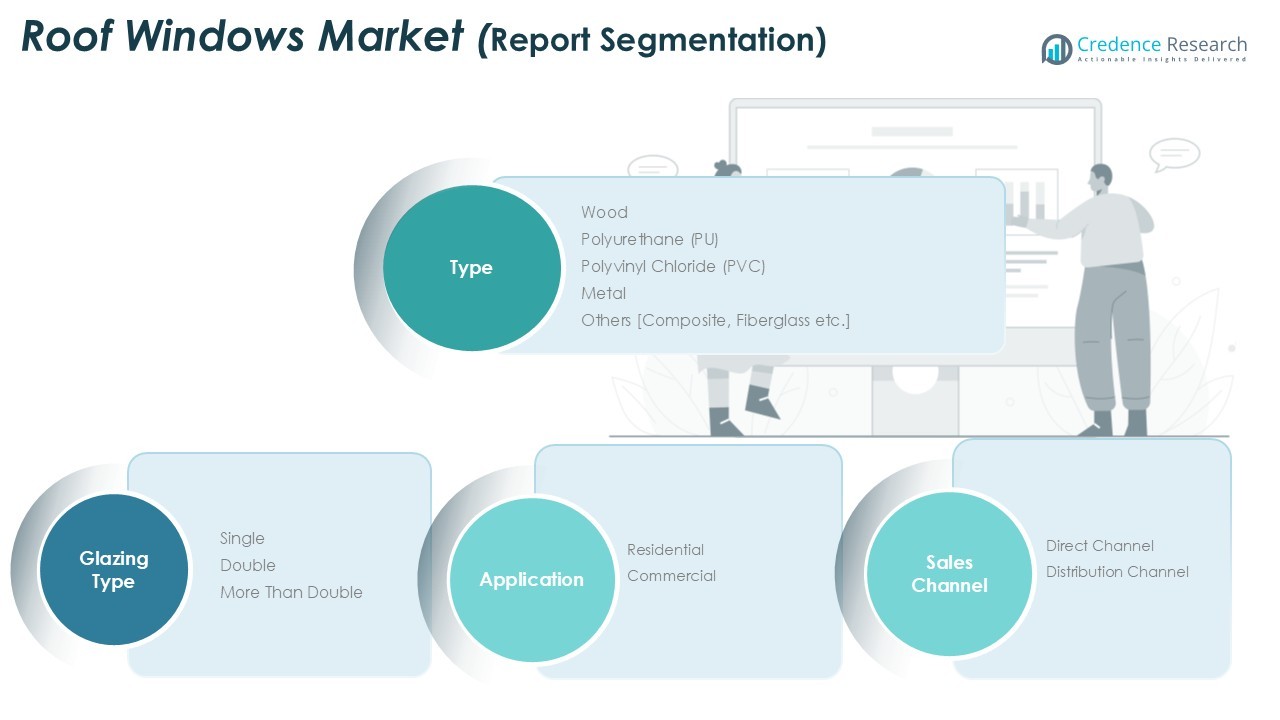

Market Segmentations:

By Type

- Wood

- Polyurethane (PU)

- Polyvinyl Chloride (PVC)

- Metal

- Others

By Application

By Glazing Type

- Single

- Double

- Triple and More

By Sales Channel

- Direct Channel

- Distribution Channel

By Geography

- Northern Italy

- Central Italy

- Southern Italy & Islands

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tulderhof

- Velux Group

- Roto Frank AG

- Farko

- Lamilux

- Piva Group

- Chirenti Group

- Emica

- Beckmann GmbH

- Arcolux

- Dakota Group

- Capoferri Serramenti

Recent Developments

- In 2023, LAMILUX launched the Modular Glass Skylight MS78 (also referred to as a Modular Glass Roof), a customizable daylight system for buildings that combines flexibility, rapid installation, and a focus on aesthetics and sustainability.

- In April 2025, Velux launched the VELUX Skylight System, with a solar-powered, pre-installed room-darkening shade as a standard feature on all glass skylights from April 7, 2025. The new shade design lets in more daylight and provides improved thermal performance (45% U-value improvement, 19% better solar heat gain coefficient). The Skylight System supports smart home integration and features built-in rain sensors.

- In March 2025, Velux and Guardian Glass announced a joint development agreement for tempered vacuum insulated glass (VIG). This collaboration aims to advance VIG technology, focusing on developing manufacturing processes and capabilities to meet the growing demand for high-performance, energy-efficient windows.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Glazing Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Roof Windows market will grow steadily, supported by rising renovation and construction projects.

- Demand for energy-efficient and triple-glazed windows will increase due to stricter EU regulations.

- Smart and automated roof windows will gain popularity among tech-savvy homeowners.

- Manufacturers will focus on sustainable materials like FSC-certified wood and recyclable PVC.

- Commercial and hospitality sectors will drive adoption for improved daylighting and energy savings.

- Online sales channels will expand, making premium roof windows more accessible nationwide.

- Northern Italy will remain the largest regional market, driven by high renovation activity.

- Central Italy will see growth from heritage building restoration and tourism-driven construction.

- Southern Italy and islands will offer emerging opportunities with rising residential demand.

- Competition will intensify as players invest in R&D, product innovation, and digital marketing strategies.