Market Overview

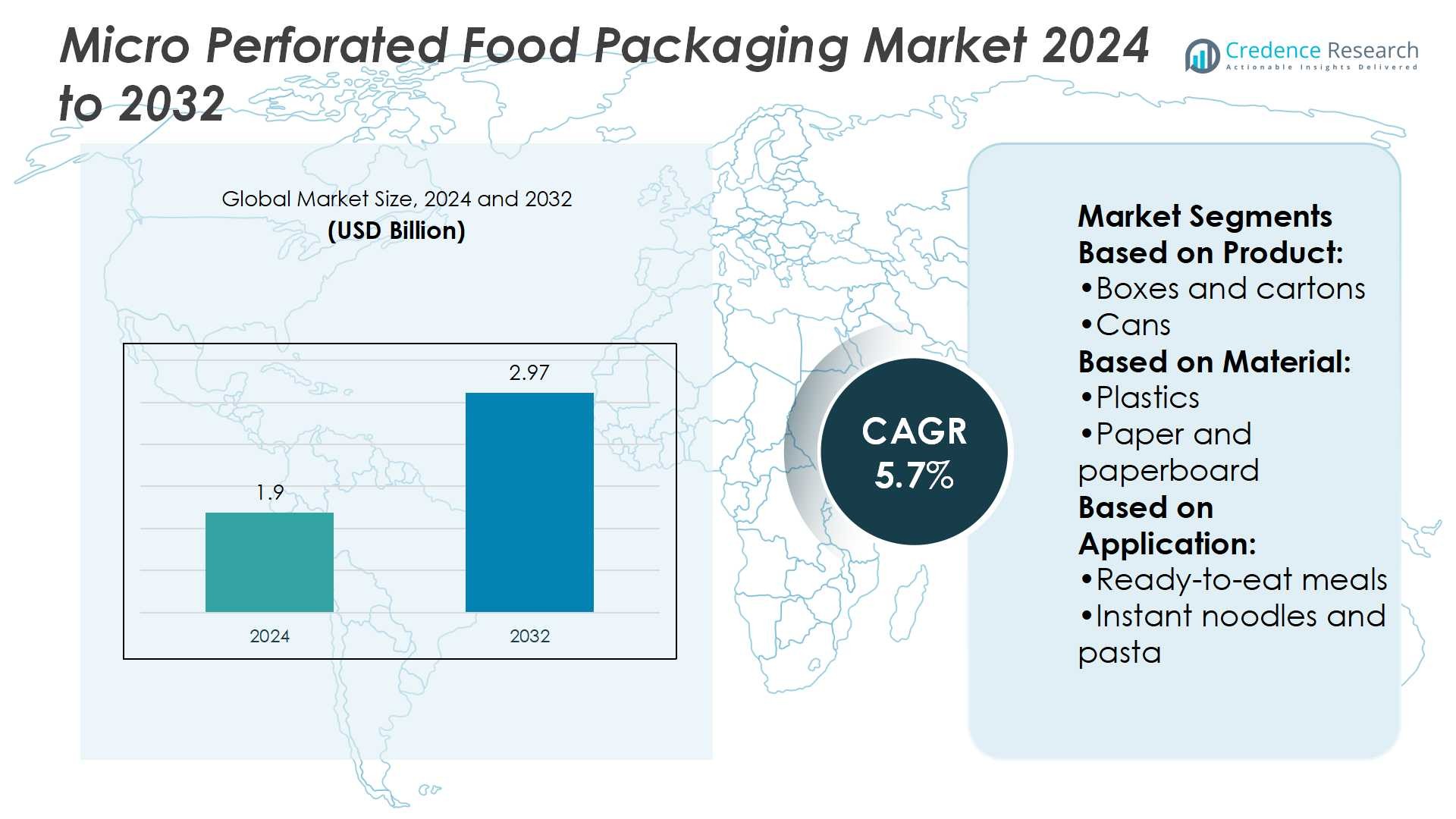

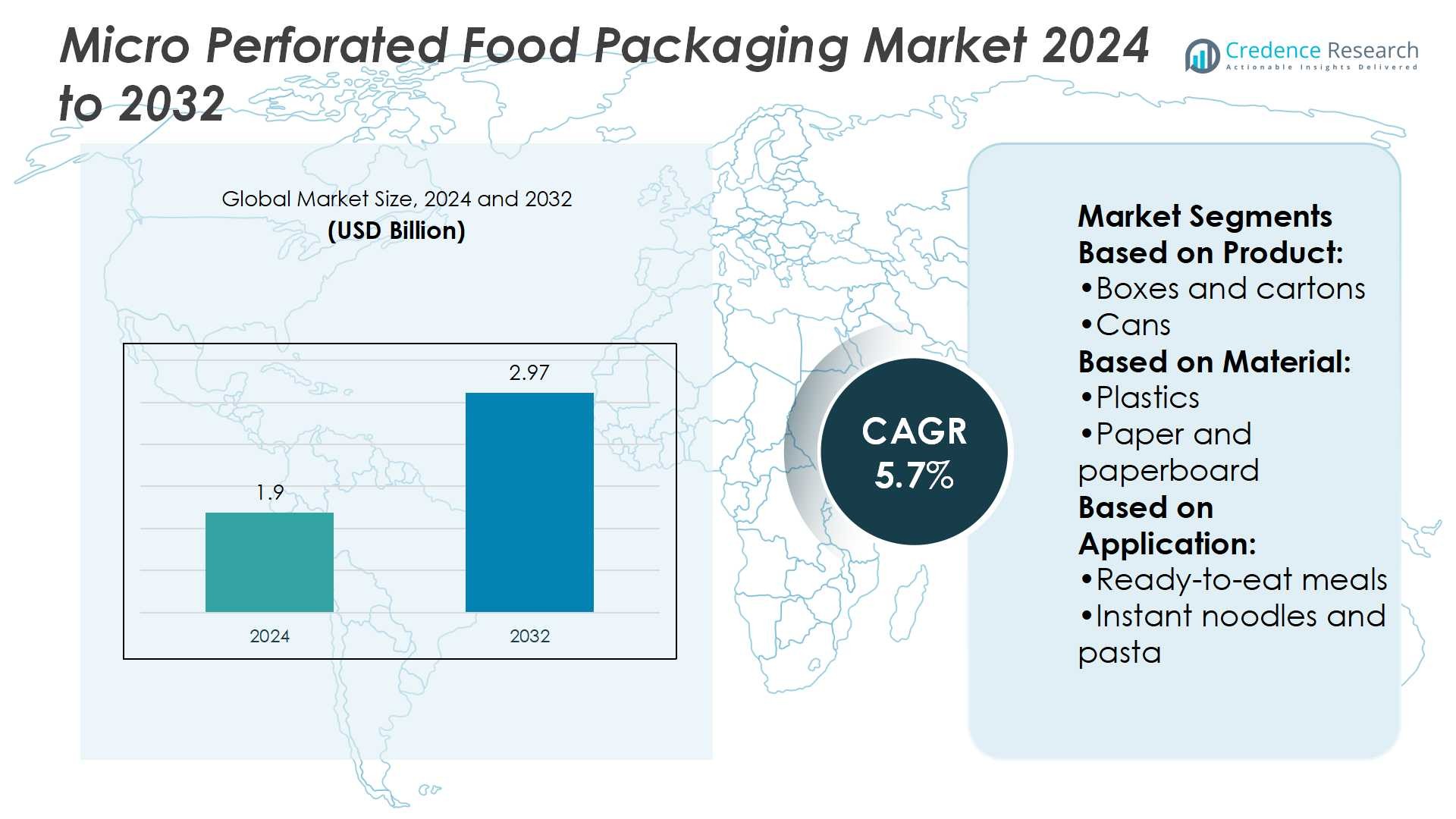

Micro Perforated Food Packaging Market size was valued USD 1.9 billion in 2024 and is anticipated to reach USD 2.97 billion by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Micro Perforated Food Packaging Market Size 2024 |

USD 1.9 Billion |

| Micro Perforated Food Packaging Market, CAGR |

5.7% |

| Micro Perforated Food Packaging Market Size 2032 |

USD 2.97 Billion |

The micro perforated food packaging market is driven by the presence of leading players such as Amcor plc, Mondi plc, Coveris Holdings S.A., Constantia Flexibles Group GmbH, Bemis Company, Inc., DuPont de Nemours, Inc., Exxon Mobil Corporation, Futamura Chemical Co., Ltd., Polyplex Corporation Limited, and Innovia Films. These companies focus on sustainability, material innovation, and advanced laser perforation technologies to strengthen their market positions. Asia-Pacific leads the global market with a 34% share, supported by rapid urbanization, rising consumption of fresh produce, and expanding retail and e-commerce channels, making it the most dynamic region for growth.

Market Insights

- The Micro Perforated Food Packaging Market size was USD 1.9 billion in 2024 and will reach USD 2.97 billion by 2032, growing at a CAGR of 5.7%.

- Key drivers include rising demand for fresh produce preservation, expansion of ready-to-eat meals, and strong emphasis on sustainable packaging solutions.

- Market trends highlight adoption of laser perforation, bio-based films, and smart packaging features enhancing shelf life, traceability, and consumer safety.

- Competitive dynamics show leading players focusing on innovation, eco-friendly materials, and strategic partnerships, while restraints include high production costs and strict regulatory compliance.

- Asia-Pacific dominates with 34% share, followed by North America at 32% and Europe at 28%, while films and wraps lead product segments, driven by extensive use in fresh produce and bakery applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The By Product segment in the Micro Perforated Food Packaging Market is dominated by Pouches as the preferred packaging format. Their flexibility, lightweight nature, and ease of sealing make them ideal for preserving freshness and extending shelf life of various food products. Increasing consumer demand for convenient, ready-to-eat, and on-the-go packaging is driving adoption. For instance, pouches are widely used in snacks, instant meals, and beverages, as they support high-barrier properties against oxygen and moisture, enhancing product quality while reducing transportation costs compared to rigid packaging options like boxes and cans.

- For instance, Mondi has developed FunctionalBarrier Paper Ultimate, a paper-based high barrier material with an oxygen transmission rate (OTR) below 0.5 cm³/m²·day and a water vapour transmission rate (WVTR) below 0.5 g/m²·day.

By Material

In the By Material segment, Plastics are the leading material due to their versatility, durability, and cost-effectiveness. Plastic materials, including polypropylene and polyethylene, allow for micro-perforation, enabling controlled oxygen exchange, moisture resistance, and enhanced food preservation. Rising demand for lightweight, sustainable, and tamper-evident packaging solutions across ready-to-eat meals and snacks is driving growth. Manufacturers are increasingly investing in recyclable and biodegradable plastic films to align with environmental regulations and consumer preferences, making plastics the most preferred material in the micro-perforated packaging space.

- For instance, ExxonMobil and partners developed stretch hood films with 35% post-consumer recycled (PCR) content for stretch applications, and 50% PCR content for shrink hood films, without loss of strength or clarity.

By Application

For the By Application segment, Ready-to-eat meals are the dominant application, fueled by urbanization and busy lifestyles. Consumers increasingly prefer packaged meals that are convenient, safe, and retain freshness over time. Micro-perforated packaging ensures optimal gas exchange, preventing spoilage while maintaining flavor and texture. Rising demand from retail and e-commerce channels, coupled with the growth of quick-service restaurants, supports market expansion. The application also benefits from increasing health-consciousness, as micro-perforated packaging allows for longer shelf life without chemical preservatives, making ready-to-eat meals more appealing to consumers.

Key Growth Drivers

Rising Demand for Fresh Produce Preservation

The market is expanding due to rising consumer preference for fresh and minimally processed food. Micro perforated packaging extends shelf life by maintaining optimal gas exchange for fruits, vegetables, and baked goods. Supermarkets and e-commerce grocery platforms are adopting this technology to reduce food waste and ensure consistent product quality. Growing urbanization, busy lifestyles, and rising disposable incomes further strengthen the demand. The ability of this packaging to balance convenience with freshness makes it a crucial driver of industry growth.

- For instance, Optimal biodegradable microperforated package had shelf life extended by 4 days compared with open containers, and by 2 days compared with the best commercial plastic package.

Expansion of Ready-to-Eat and Convenience Foods

The increasing popularity of ready-to-eat meals, snacks, and frozen foods fuels market growth. Micro perforated films help maintain texture, flavor, and safety of these products during distribution and storage. Food manufacturers rely on these solutions to meet consumer demand for convenient yet fresh options. Additionally, rising working populations, especially in urban areas, support higher adoption rates. Packaging innovations that provide visibility, lightweight design, and sustainability features also contribute to expanding product usage across multiple applications.

- For instance, the packaging achieves an OTR of 0.5 cc/m²·day at 23 °C and 50% relative humidity, confirming the figure in the statement. Testing has confirmed a shelf life of up to 12 months for liquids packaged in the new sachets, aligning with the statement.

Growing Focus on Sustainable Packaging Solutions

Sustainability is becoming a critical growth driver as governments and consumers demand eco-friendly materials. Micro perforated packaging solutions, particularly recyclable and biodegradable films, align with global sustainability goals. Food manufacturers and retailers are shifting toward reduced plastic use and sustainable alternatives to meet regulatory and environmental targets. Companies investing in bio-based materials gain a competitive edge in attracting environmentally conscious consumers. This shift toward eco-friendly packaging drives innovation and adoption in both developed and emerging markets.

Key Trends & Opportunities

Technological Advancements in Packaging Materials

Advancements in film technology are creating new growth opportunities for the market. Innovations in laser perforation and high-precision micro-hole designs enhance gas permeability and improve product performance. Smart packaging integration, including QR codes and freshness indicators, is also gaining traction. These technologies improve traceability, consumer interaction, and food safety compliance. Manufacturers adopting advanced technologies stand to differentiate their products and meet the evolving expectations of both consumers and regulators.

- For instance, DuPont Teijin Films’ Mylar® Harvest Fresh rPET films incorporate up to 50% post-consumer recycled (PCR) content in the base polyester film.These films maintain comparable heat seal, mechanical and optical performance versus virgin material.

Expansion in Emerging Markets

Emerging economies are presenting strong growth opportunities due to rapid urbanization and changing consumption habits. Countries in Asia-Pacific and Latin America are witnessing higher demand for packaged fruits, vegetables, and bakery products. Increasing disposable incomes, growing retail networks, and expansion of online grocery platforms support packaging adoption. Governments are also investing in reducing post-harvest losses through improved packaging solutions. These developments provide significant opportunities for global and regional players to expand their presence in high-growth markets.

- For instance, modern digital printing technology enables high-coverage color reproduction, with some presses capable of achieving over 90% of Pantone colors. Using digital printing on substrates like aluminum and PET.

Shift Toward Functional and Smart Packaging

A key trend in the market is the integration of functional features into micro perforated packaging. Retailers and brands are adopting designs that balance aesthetics with performance, such as moisture regulation and resealable closures. Smart packaging elements, including freshness indicators and RFID tags, enhance supply chain management and consumer confidence. The trend reflects rising demand for packaging that not only preserves food but also enhances convenience, safety, and transparency throughout distribution.

Key Challenges

High Production Costs and Price Sensitivity

The production of micro perforated films involves advanced manufacturing technologies, increasing costs compared to conventional packaging. Small and medium-sized food producers often face challenges in adopting these solutions due to budget constraints. Price-sensitive markets, particularly in developing regions, limit large-scale adoption. Balancing high performance with cost efficiency remains a key challenge for manufacturers aiming to expand market penetration while maintaining profitability.

Regulatory Compliance and Sustainability Pressures

Stringent regulations on plastic usage and food safety standards present a challenge to manufacturers. Companies must continually invest in research and innovation to develop compliant materials that meet sustainability goals without compromising performance. Compliance with varying regional regulations increases operational complexity. Moreover, consumer scrutiny over environmental impacts adds further pressure on businesses to balance eco-friendliness with functionality. These challenges demand strong R&D investments and agile adaptation to shifting regulatory landscapes.

Regional Analysis

North America

North America holds a 32% share of the micro perforated food packaging market, supported by strong demand for fresh produce, bakery products, and ready-to-eat meals. The region benefits from advanced food processing technologies and widespread adoption of sustainable packaging solutions. Major retail chains and e-commerce grocery platforms emphasize packaging that reduces food waste and ensures extended shelf life. Strict food safety regulations further encourage manufacturers to adopt high-performance films. The United States dominates the regional market, while Canada contributes with rising demand for eco-friendly and recyclable materials in fresh food packaging.

Europe

Europe accounts for 28% of the market, driven by strict environmental regulations and strong consumer preference for sustainable packaging. Countries such as Germany, France, and the UK lead in adopting recyclable and biodegradable films. The region has a well-established packaged food industry, with high consumption of bakery and fresh produce requiring advanced packaging solutions. European Union policies targeting plastic reduction also accelerate the shift toward bio-based micro perforated materials. The region’s innovation in laser perforation and eco-friendly films positions it as a key market for growth and technological advancements.

Asia-Pacific

Asia-Pacific holds the largest share at 34%, fueled by rapid urbanization, rising disposable incomes, and growing retail and e-commerce channels. Countries such as China, India, and Japan are major contributors, driven by high consumption of fruits, vegetables, and convenience foods. The region faces challenges with post-harvest losses, making efficient packaging crucial for supply chain management. Growing adoption of sustainable packaging in response to government regulations further supports expansion. Local and global players are investing in capacity expansions to serve the increasing demand, positioning Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America represents a 4% share of the global market, with growth led by Brazil and Mexico. Rising consumption of packaged fruits, vegetables, and snacks is driving demand for micro perforated films. The region’s expanding supermarket networks and increasing penetration of online grocery services also contribute to adoption. However, the market faces challenges due to cost sensitivity and limited awareness of advanced packaging solutions. Despite these constraints, rising consumer interest in fresh and convenient food options presents opportunities for growth, particularly with sustainable packaging solutions gaining traction.

Middle East & Africa

The Middle East & Africa account for 2% of the market, with growth concentrated in the Gulf countries and South Africa. Rising urban populations, changing dietary preferences, and increasing demand for packaged fresh produce are driving adoption. The food retail sector, especially in the UAE and Saudi Arabia, emphasizes packaging that extends shelf life under hot climatic conditions. However, market expansion is limited by lower awareness and higher costs of advanced films compared to conventional packaging. Despite challenges, growing investment in modern retail and rising health awareness are gradually supporting market growth.

Market Segmentations:

By Product:

By Material:

- Plastics

- Paper and paperboard

By Application:

- Ready-to-eat meals

- Instant noodles and pasta

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The micro perforated food packaging market players such as Coveris Holdings S.A., Mondi plc, Exxon Mobil Corporation, Polyplex Corporation Limited, Amcor plc, Bemis Company, Inc., Futamura Chemical Co., Ltd., DuPont de Nemours, Inc., Constantia Flexibles Group GmbH, and Innovia Films. The micro perforated food packaging market is marked by intense competition, with companies emphasizing innovation, sustainability, and cost efficiency. Manufacturers are investing in advanced film technologies, including precision laser perforation, to enhance shelf life and product safety. Growing demand for eco-friendly and recyclable packaging solutions is pushing firms to develop bio-based materials and reduce plastic usage. Strategic moves such as mergers, acquisitions, and partnerships are common as companies aim to expand geographic reach and strengthen product portfolios. In addition, the integration of smart packaging features, such as freshness indicators and traceability tools, is becoming a differentiating factor, allowing businesses to cater to evolving consumer expectations and comply with stringent regulatory standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Coveris Holdings S.A.

- Mondi plc

- Exxon Mobil Corporation

- Polyplex Corporation Limited

- Amcor plc

- Bemis Company, Inc.

- Futamura Chemical Co., Ltd.

- DuPont de Nemours, Inc.

- Constantia Flexibles Group GmbH

- Innovia Films

Recent Developments

- In May 2025, Kapag’s innovative Changemaker concept uses Sappi’s premium materials to create exceptional barrier packaging. This groundbreaking solution, developed by Kapag, combines Sappi’s premium Algro Design paperboard or Fusion Topliner with AvantGuard functional barrier paper to deliver a 100% paper-based, mono-material, recyclable solution for food products that eliminates the need for plastic-based alternatives.

- In May 2025, Metsä Group and Amcor, a global leader in developing and producing responsible packaging solutions, announced a strategic collaboration to develop three-dimensional moulded fibre packaging solutions with lidding and liner for a variety of food applications.

- In April 2025, SÜDPACK, BASF Gastronomie collaborate to utilize BASF polyamide Ultramid Cycled material for meat and sausage packaging in the hotel, restaurant, and catering sector.

- In April 2024, Sev-Rend expanded its macro- and micropreforating product offerings as part of its broader strategy to enhance packaging solutions, including the acquisition of Wolarmann Enterprises, which strengthens its market presence in North America and broadens its product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fresh produce packaging will continue to drive market expansion.

- Adoption of laser perforation technology will improve efficiency and product quality.

- Sustainable and bio-based materials will dominate future packaging innovations.

- Online grocery and e-commerce growth will accelerate packaging requirements.

- Functional packaging with resealable and moisture-control features will gain traction.

- Smart packaging integration will enhance traceability and consumer engagement.

- Regulatory pressures will push manufacturers toward eco-friendly product development.

- Emerging markets will experience rapid adoption due to changing consumption patterns.

- Investments in R&D will create advanced films with higher performance benefits.

- Strategic partnerships and acquisitions will reshape the competitive landscape globally.