Market Overview

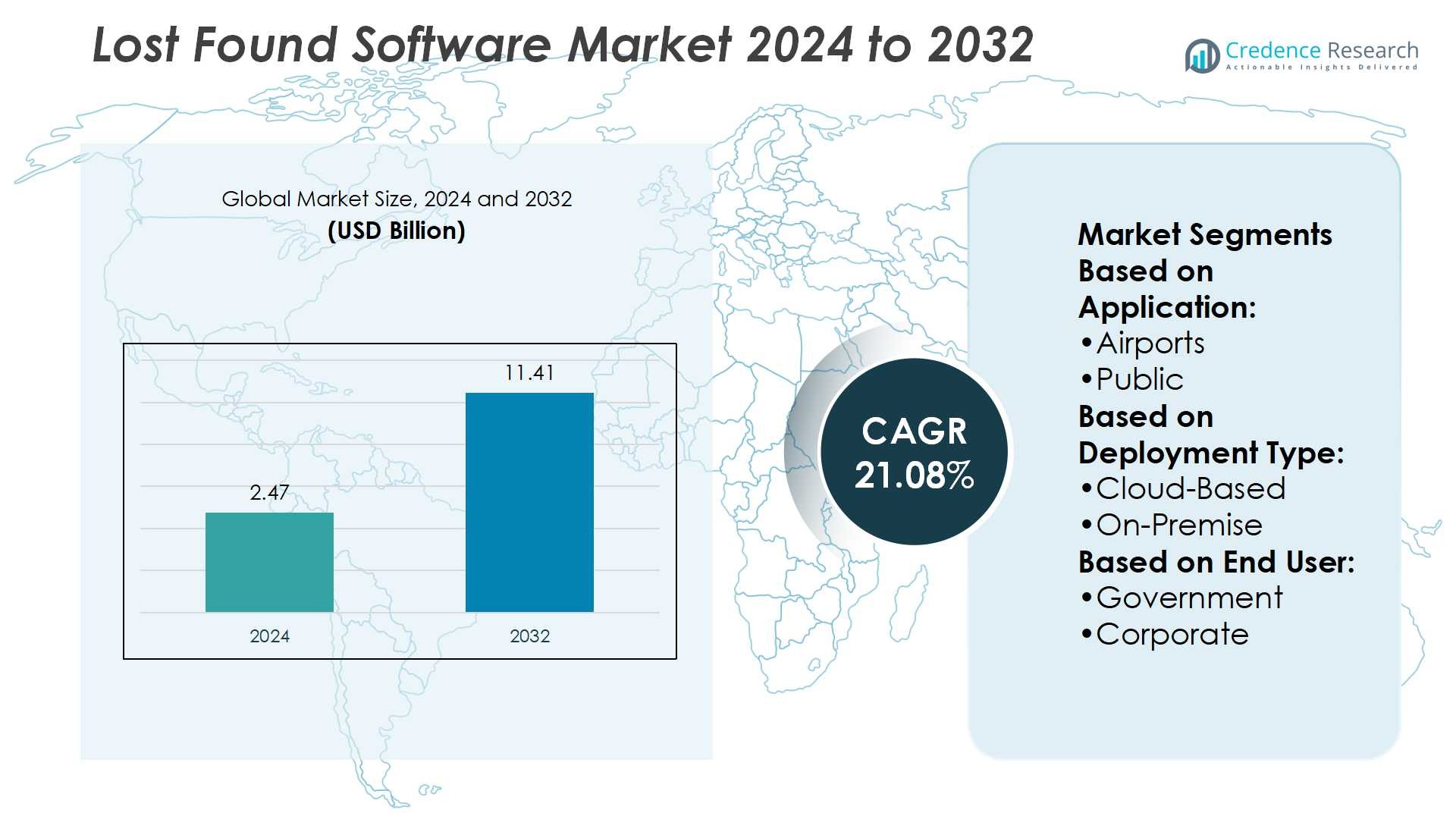

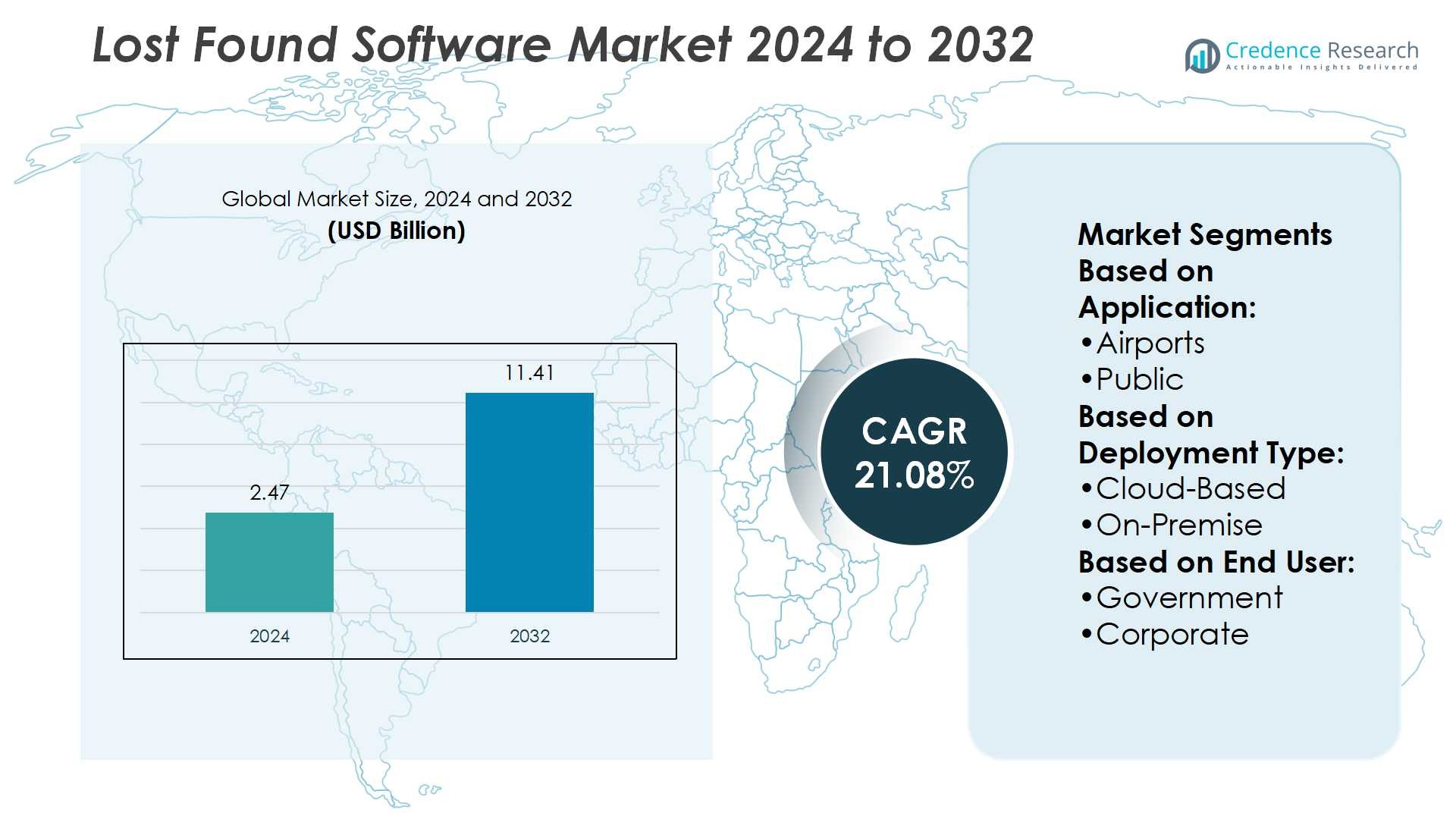

Lost Found Software Market size was valued USD 2.47 billion in 2024 and is anticipated to reach USD 11.41 billion by 2032, at a CAGR of 21.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lost Found Software Market Size 2024 |

USD 2.47 Billion |

| Lost Found Software Market, CAGR |

21.08% |

| Lost Found Software Market Size 2032 |

USD 11.41 Billion |

The Lost and Found Software Market is shaped by prominent players including Hubspot, Inc., SAP SE, Oracle Corporation, Hewlett-Packard Enterprise Company, Adobe, Marketo, Inc., Salesforce.com, Inc., IBM Corporation, SAS Institute, Inc., and Microsoft. These companies focus on delivering advanced cloud-based platforms, AI-driven automation, and mobile-enabled solutions that improve item tracking and enhance customer satisfaction across industries such as transportation, hospitality, retail, and education. Strategic partnerships, product innovations, and service diversification strengthen their global presence. Regionally, Asia Pacific leads the market with a 35% share, driven by rapid urbanization, expanding air travel, and large-scale investments in public transportation and smart city initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Lost and Found Software Market was valued at USD 2.47 billion in 2024 and is projected to reach USD 11.41 billion by 2032, registering a CAGR of 21.08%.

- Strong market drivers include rising passenger traffic, growing adoption of cloud-based deployments, and demand for real-time digital claims and tracking solutions across airports, transport hubs, and hospitality.

- Key trends highlight AI-driven automation, mobile application integration, and expansion into retail and education sectors, creating new opportunities for vendors.

- Competitive analysis shows global technology leaders competing through innovation, partnerships, and diversification, though restraints include high integration costs and data privacy concerns.

- Asia Pacific dominates with a 35% market share, followed by North America at 32% and Europe at 27%; transportation accounts for the largest end-user segment with more than 40% share, supported by increasing reliance on digital systems to improve passenger service quality.

Market Segmentation Analysis:

By Application

In the Lost and Found Software Market, airports hold the dominant share among applications, contributing over 35% of total adoption. Airports manage millions of passengers daily, making efficient lost and found operations crucial for service quality and security compliance. The demand for streamlined item tracking, automated reporting, and real-time customer communication has pushed airports to adopt advanced digital platforms. Public transport and event management also show growing traction, driven by rising passenger traffic and large-scale events, but airports remain the largest revenue contributor due to scale and operational complexity.

- For instance, Nestlé, using SAP Concur, reduced the time required for an employee to complete an expense report from 30 minutes to 10 minutes when creating the report from anywhere. This improvement also cut review delays for line managers, eliminating many email chains and manual steps in approvals.

By Deployment Type

Cloud-based deployment leads the Lost and Found Software Market with more than 60% share in 2024. Organizations favor cloud-based systems due to their scalability, reduced upfront costs, and real-time accessibility across multiple locations. The ability to integrate with mobile apps and customer service portals enhances responsiveness, which is essential for industries like transportation and hospitality. On-premise solutions retain relevance in sectors requiring heightened data security or customization, yet the shift to SaaS models continues to accelerate. The strong adoption of cloud deployment is largely fueled by cost efficiency and operational agility.

- For instance, a nightly data analytics run was reduced from 8.5 hours to 3.5 hours. Other improvements include provisioning new databases in minutes rather than days and achieving 90%time savings on IT efficiency.

By End User

The transportation sector dominates the Lost and Found Software Market among end users, representing over 40% of the total share. Airlines, railways, and urban transport systems prioritize these solutions to reduce passenger complaints and improve service efficiency. Rising passenger volumes and regulatory compliance on handling lost items drive further investments. The hospitality sector is also increasing adoption to enhance guest experiences, while corporate and government users leverage these tools for internal asset management. However, transportation remains the leading segment, supported by its scale, urgency, and high customer interaction requirements.

Key Growth Drivers

Rising Passenger Traffic and Travel Volumes

Increasing global passenger traffic across airports, railways, and public transport systems is driving strong adoption of lost and found software. With millions of items misplaced annually, service providers are turning to automated platforms that reduce manual handling and enhance recovery rates. The software supports digital claim filing, faster tracking, and improved transparency, helping operators boost customer satisfaction. As travel and tourism expand, transportation hubs are prioritizing reliable solutions to manage high item volumes, positioning lost and found systems as a critical operational tool.

- For instance, Marketo’s team integrated Bombora’s Intent data into their marketing automation tools and improved email open counts from 8,000 emails to 16,560 by targeting high-intent accounts; click-throughs rose from 320 clicks to 704 in the same campaign.

Growing Focus on Customer Experience

Organizations are investing in digital tools to enhance customer experience, and lost and found software plays a vital role. Modern platforms allow customers to report missing belongings online, track claim status, and receive real-time updates, reducing frustration and complaints. In sectors like airports and hospitality, positive experiences directly impact brand loyalty and retention. This shift toward service quality is compelling operators to deploy advanced software solutions that ensure efficient resolution, ultimately strengthening customer trust and differentiating service providers in highly competitive markets.

- For instance, a financial services firm using SAS Customer Intelligence 360 handles 5 million interactions monthly, linking transactional and digital behavior data to enable personalized offers; this integration supported campaign execution in less than 72 hours after ideation.

Shift Toward Cloud-Based Deployments

Cloud-based solutions are accelerating adoption due to their flexibility, scalability, and cost efficiency. Operators across transportation, hospitality, and events are moving away from manual and on-premise systems toward centralized platforms accessible from any location. These deployments allow seamless integration with mobile applications, customer portals, and communication tools, enabling real-time responsiveness. The reduced need for IT infrastructure and updates also appeals to organizations with limited resources. This transition is creating a strong growth pathway for software vendors offering SaaS-based models with advanced automation features.

Key Trends & Opportunities

Integration of AI and Automation

Artificial intelligence and automation are emerging as key trends in lost and found systems. AI-driven solutions can categorize items, match lost reports with found belongings, and automate customer notifications, significantly reducing processing time. Automation also supports data analysis, helping operators predict patterns and improve recovery rates. As organizations seek efficiency and faster turnaround times, AI-based features present a major opportunity for vendors to differentiate their offerings, enhance system intelligence, and strengthen adoption across airports, transport hubs, and hospitality sectors.

- For instance, the ABB Absolute Accuracy system ensures an IRB 140 robot maintains tool center point (TCP) accuracy within approximately 0.8 mm across its full working envelope after factory calibration and error compensation.

Expansion into Retail and Education Sectors

Beyond airports and transportation, retail outlets and educational institutions are increasingly adopting lost and found software. Large campuses, malls, and event venues face frequent incidents of misplaced items, requiring efficient systems for collection and return. Software platforms enable centralized tracking, digital claim processing, and accountability in these environments. This expansion represents a growth opportunity for vendors to diversify their customer base. By tailoring solutions to retail and education needs, providers can address untapped demand and establish a strong presence beyond traditional transport-driven applications.

- For instance, Emerson implemented Commvault Cloud HyperScale X to protect 9 petabytes of data across its multi-cloud and hybrid infrastructure, achieving an RTO SLA of 98% in its data-protection operations.

Key Challenges

Data Privacy and Security Concerns

Handling lost and found records involves managing sensitive customer information, raising concerns over data privacy and security. On cloud-based platforms, risks such as unauthorized access, breaches, and data misuse can undermine customer trust. Organizations operating in regulated industries must comply with strict data protection frameworks, increasing the complexity of deployment. Vendors need to ensure robust encryption, access control, and compliance certifications to overcome this barrier. Without strong safeguards, concerns over data security could slow down adoption in privacy-sensitive sectors like government and corporate environments.

Limited Integration with Legacy Systems

Many organizations still rely on manual or outdated legacy systems for lost and found management, creating challenges in adopting new solutions. Integrating advanced software with existing IT infrastructure can be complex and resource-intensive, especially for public institutions and transport authorities. Compatibility issues and training needs further delay transition. Vendors face the challenge of offering flexible, interoperable platforms that can adapt to varied organizational requirements. Without smooth integration pathways, the pace of adoption may remain constrained in sectors with budget and operational limitations.

Regional Analysis

North America

North America holds a market share of 32% in the Lost and Found Software Market, driven by the strong presence of advanced airports, established public transportation systems, and large-scale event management industries. The region benefits from early adoption of digital solutions and high investments in customer experience technologies. The U.S. leads adoption, supported by leading airports and hospitality providers prioritizing automation and real-time item tracking. Regulatory compliance on passenger service quality further accelerates uptake. Canada also contributes significantly, with growing demand in education and corporate sectors. Overall, North America remains a mature and competitive regional market.

Europe

Europe accounts for 27% of the market, supported by strict regulations on passenger rights, customer data protection, and service quality across airports and transport hubs. Countries such as the UK, Germany, and France drive adoption, particularly in aviation, hospitality, and government applications. European operators emphasize compliance with GDPR, encouraging software providers to enhance data security and transparency. The region also witnesses demand from large-scale events and retail environments, where efficient lost and found management enhances customer trust. Europe’s established infrastructure and sustainability-driven focus make it a strong and steady market contributor.

Asia Pacific

Asia Pacific represents the largest regional share at 35%, fueled by rapid industrialization, urbanization, and rising passenger volumes across major countries such as China, India, and Japan. Expanding air travel and growth in public transport networks have significantly boosted demand for digital lost and found systems. The region also benefits from widespread cloud adoption, supporting scalable deployments across transportation and hospitality. Increasing investments in smart city projects further create opportunities for software integration into modern infrastructure. Asia Pacific’s growth trajectory positions it as the most dynamic region, with adoption expanding across both developed and emerging economies.

Latin America

Latin America captures a market share of 4%, with adoption led by countries such as Brazil and Mexico. Growing air travel, urban transit systems, and the expansion of retail malls and event venues are creating demand for efficient lost and found platforms. Regional service providers are investing in cloud-based solutions to reduce costs and improve scalability. However, limited IT infrastructure and budget constraints slow down adoption in certain areas. Despite these challenges, the region offers growth opportunities, particularly as airports and hospitality operators modernize customer service processes to meet rising passenger and guest expectations.

Middle East & Africa

The Middle East & Africa region accounts for 2% of the market, with growth driven by expanding aviation hubs and the hospitality sector. Countries such as the UAE, Saudi Arabia, and South Africa lead adoption, supported by international airports and tourism-driven infrastructure projects. Lost and found software adoption is focused on enhancing passenger experiences and aligning with global service benchmarks. However, overall market penetration remains limited due to slower technology adoption in some parts of Africa. Despite this, increasing investments in aviation and tourism position the region for steady growth in the coming years.

Market Segmentations:

By Application:

By Deployment Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Lost and Found Software Market leaders such as Hubspot, Inc., SAP SE, Oracle Corporation, Hewlett-Packard Enterprise Company, Adobe, Marketo, Inc., Salesforce.com, Inc., IBM Corporation, SAS Institute, Inc., and Microsoft. The Lost and Found Software Market is defined by intense rivalry among global technology firms, specialized software providers, and emerging SaaS vendors. Companies focus on delivering advanced solutions with cloud-based deployment, AI-driven automation, and mobile integration to enhance item recovery efficiency and customer satisfaction. Strategic collaborations with airports, transport operators, and hospitality organizations remain central to market expansion. Vendors also prioritize data privacy, regulatory compliance, and seamless interoperability with legacy systems to ensure smooth adoption. Continuous innovation, acquisitions, and service diversification drive competition, while the rising importance of real-time tracking and digital claims management shapes long-term differentiation strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hubspot, Inc.

- SAP SE

- Oracle Corporation

- Hewlett-Packard Enterprise Company

- Adobe

- Marketo, Inc.

- com, Inc.

- IBM Corporation

- SAS Institute, Inc.

- Microsoft

Recent Developments

- In January 2025, Oracle enhanced its supply chain management platform by integrating AI capabilities. This update enables the automation of various tasks for procurement professionals, such as generating standardized product descriptions and providing supplier recommendations, which can significantly streamline procurement processes.

- In January 2025, Block announced the launch of Goose, an open-source AI agent designed to empower developers with customizable tools. Goose allows users to leverage various large language models, providing flexibility in its application across different tasks and industries.

- In November 2024, Microsoft unveiled cloud-connected software that enables customers to deploy Azure computing, networking, storage, and application services across various environments, including edge locations, on-premises data centers, and hybrid cloud setups.

- In May 2024, Accenture announced the acquisition of Teamexpat, a specialist in embedded software for complex high-tech systems and products. Teamexpat is particularly known for its expertise in software testing, development, and integration for lithography systems utilized in the semiconductor industry.

- In January 2024, ABB announced its agreement to acquire a majority stake in the software service provider Meshmind. This acquisition aims to enhance ABB’s research and development capabilities in AI, Industrial IoT, and machine vision. By integrating Meshmind’s engineering talent, AI expertise, and software knowledge, ABB will establish a new global R&D hub.

Report Coverage

The research report offers an in-depth analysis based on Application, Deployment Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as airports and transport hubs prioritize automated item recovery systems.

- Cloud-based deployments will dominate due to scalability, cost efficiency, and real-time accessibility.

- AI and machine learning will enhance matching accuracy between lost reports and found items.

- Mobile applications will become standard for digital claims and real-time customer updates.

- Hospitality and retail sectors will increasingly adopt these platforms to improve guest and customer experiences.

- Integration with smart city projects will boost adoption in urban transit and public infrastructure.

- Data privacy and compliance requirements will drive stronger investment in security-focused solutions.

- Partnerships with governments and public institutions will strengthen long-term adoption.

- Vendors will expand services through mergers, acquisitions, and portfolio diversification.

- Customer experience will remain the central focus, making seamless communication features a key differentiator.