Market Overview

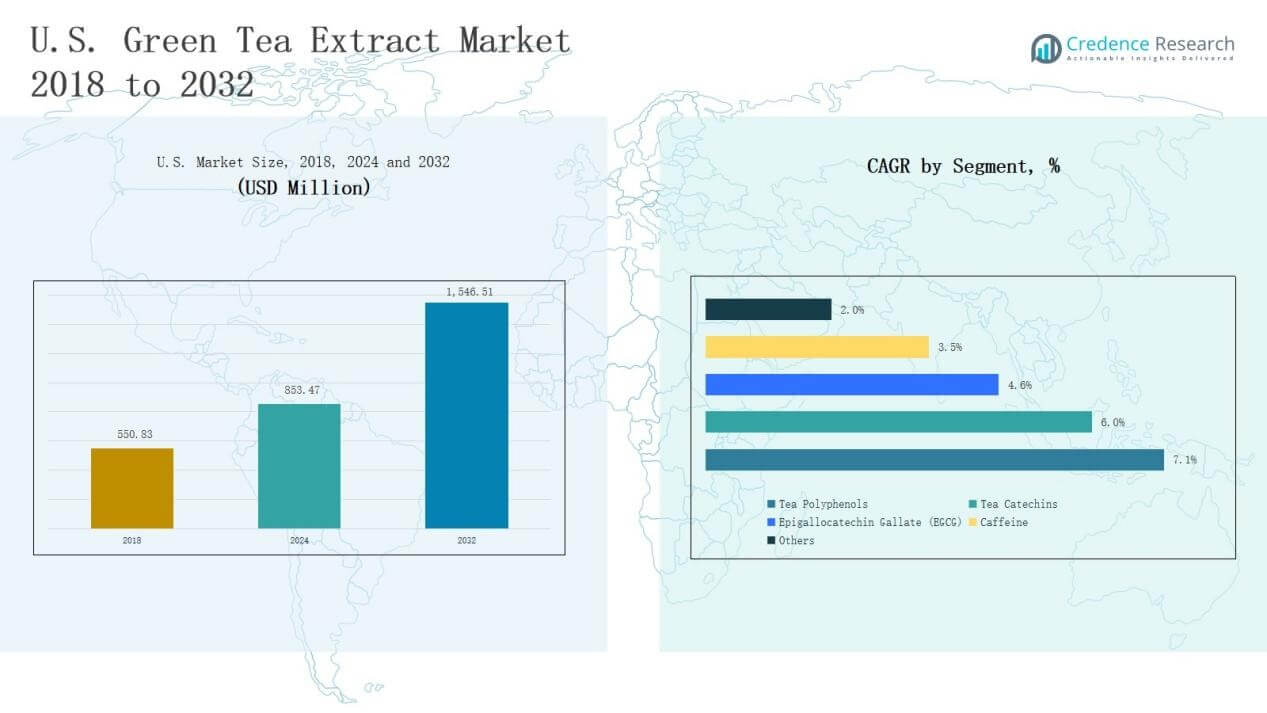

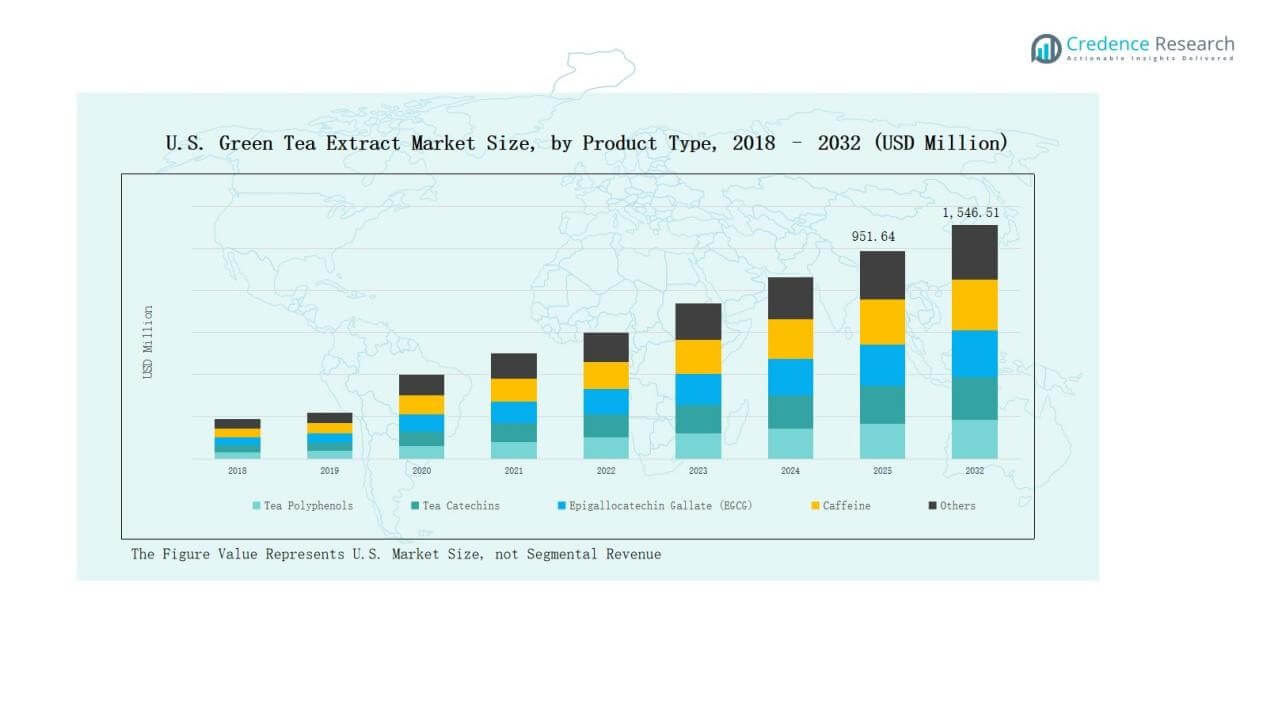

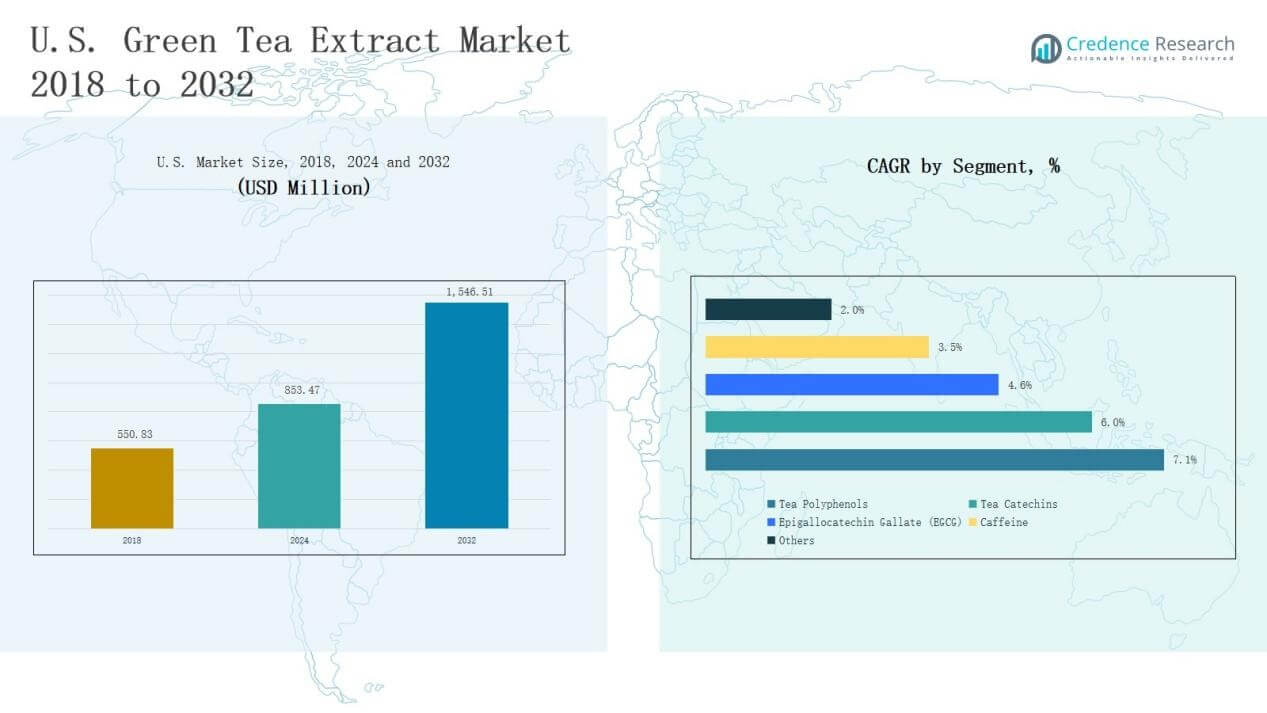

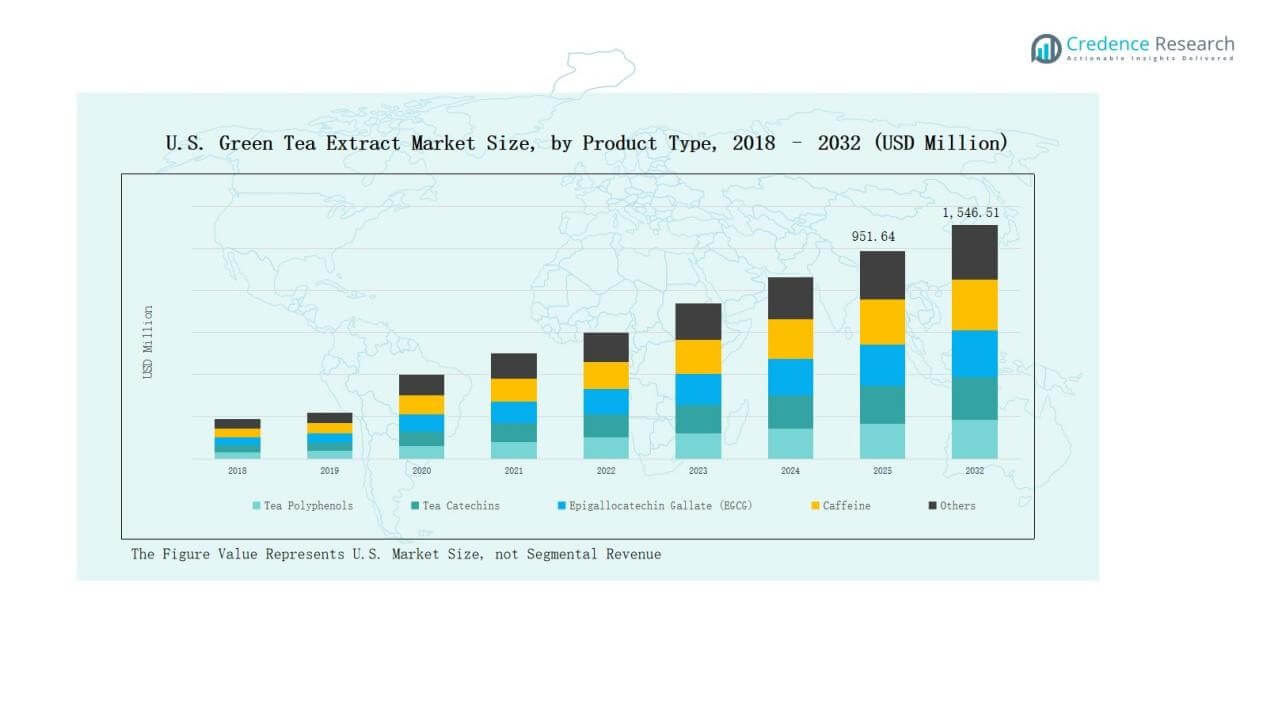

U.S. Green Tea Extract Market size was valued at USD 550.83 million in 2018, reaching USD 853.47 million in 2024, and is anticipated to attain USD 1,546.51 million by 2032, at a CAGR of 7.18% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Green Tea Extract Market Size 2024 |

USD 853.47 Million |

| U.S. Green Tea Extract Market, CAGR |

7.18% |

| U.S. Green Tea Extract Market Size 2032 |

USD 1,546.51 Million |

The U.S. Green Tea Extract Market is shaped by strong competition among global corporations and specialized nutraceutical firms. Leading players such as Archer Daniels Midland Company (ADM), DuPont, Kemin Industries, International Flavors & Fragrances Inc. (IFF), Sensient Technologies, Pharmavite LLC, FutureCeuticals Inc., PLT Health Solutions, NOW Foods, and NutraScience Labs dominate the market through diverse product portfolios, sustainable sourcing initiatives, and continuous investment in R&D. These companies actively focus on clean-label, organic, and EGCG-rich formulations to meet rising consumer demand for natural ingredients. Regionally, the South leads with a 30% share in 2024, supported by strong demand for ready-to-drink teas, expanding nutraceutical adoption, and widespread retail penetration, positioning it as the most influential growth hub in the U.S. market.

Market Insights

- The U.S. Green Tea Extract Market grew from USD 550.83 million in 2018 to USD 853.47 million in 2024 and is projected to reach USD 1,546.51 million by 2032.

- Tea Catechins lead with 38% share in 2024, driven by nutraceutical and pharmaceutical adoption supported by proven antioxidant and anti-inflammatory properties.

- Powder form dominates with 52% share in 2024, favored for versatility, cost efficiency, and shelf stability across food, beverages, and dietary supplements.

- Pharmaceuticals hold the largest application share at 41% in 2024, supported by rising demand in therapies for cardiovascular, metabolic, and cancer-related health conditions.

- The South region leads with 30% share in 2024, driven by strong demand for RTD teas, expanding nutraceutical adoption, and extensive retail penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Tea Catechins dominate the U.S. green tea extract market with a 38% revenue share in 2024. Their leadership is driven by rising adoption in nutraceuticals and pharmaceuticals due to proven antioxidant and anti-inflammatory benefits. Epigallocatechin Gallate (EGCG) follows closely, supported by strong research backing its role in weight management, cardiovascular health, and cancer-preventive formulations. Tea polyphenols and caffeine contribute steadily, while the “others” category addresses niche uses across cosmetics and dietary supplements, reflecting diversified applications.

For instance, DSM-Firmenich launched a new green tea extract with standardized catechin content aimed at functional beverages and immune health products in North America.

By Form

Powder form leads the segment with a 52% share in 2024, favored by its versatility in food, beverages, and dietary supplements. Its extended shelf life, cost-effectiveness, and ease of transport strengthen dominance. Liquid extracts account for growing demand in ready-to-drink teas and functional beverages, reflecting convenience and premium product trends. Soft gels remain a smaller but steadily expanding segment, appealing to health-conscious consumers seeking precise dosing in nutraceuticals.

By Application

Pharmaceuticals hold the dominant position with a 41% market share in 2024, reflecting strong demand for green tea extracts in cardiovascular, metabolic, and anti-cancer therapies. Food & Beverages follow, supported by increasing integration of extracts in functional foods, fortified snacks, and natural flavor enhancers. Ready-to-Drink (RTD) teas represent a dynamic growth area as consumers shift toward healthier on-the-go beverages. Functional foods and other applications, including personal care, further widen adoption and ensure long-term expansion.

For instance, Coca‑Cola Japan launched a new variant of “Ayataka Café” bottled green tea latte containing natural green tea extracts to meet growing demand for RTD functional beverages.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Nutraceuticals and Functional Foods

The increasing focus on preventive healthcare drives strong demand for green tea extracts in the U.S. Consumers are adopting nutraceuticals enriched with antioxidants, polyphenols, and catechins to support immunity, cardiovascular health, and weight management. Functional foods and beverages featuring green tea extracts are gaining popularity, especially among millennials and health-conscious demographics. This shift toward natural, plant-based ingredients fuels market expansion, with nutraceutical firms actively integrating green tea extracts into capsules, powders, and fortified snacks for mainstream and premium product categories.

For instance, Taiyo International relaunched Sunphenon TH30, a green tea extract rich in natural L-theanine, designed for use in supplements, beverages, dairy, and confectionery products with high antioxidant content.

Expanding Applications in Pharmaceuticals

Green tea extracts, particularly catechins and EGCG, have established therapeutic relevance in chronic disease management. Pharmaceutical companies are increasingly incorporating these compounds into formulations targeting obesity, metabolic syndrome, and cardiovascular diseases. Rising R&D investment and clinical studies enhance product credibility and regulatory acceptance. The growing preference for natural, plant-based active ingredients over synthetic alternatives further accelerates integration into drug formulations. This pharmaceutical adoption not only ensures steady demand but also positions green tea extracts as a core bioactive ingredient for medical applications.

Strong Consumer Preference for Natural Ingredients

Consumers in the U.S. increasingly prioritize clean-label and natural ingredients in dietary and lifestyle products. Green tea extracts meet this demand by offering plant-derived, caffeine-containing, and antioxidant-rich options with multiple health benefits. Shoppers actively seek beverages, supplements, and food products featuring green tea extracts as natural alternatives to artificial additives. This consumer preference supports product launches across categories such as RTD teas, energy drinks, and functional foods. The clean-label movement strengthens market visibility, making natural green tea extracts an attractive option for diverse end-use industries.

For instance, Ingredion Incorporated expanded its range of clean-label starches and sweeteners to meet growing demand for simple, transparent ingredients in beverages and functional foods.

Key Trends & Opportunities

Key Trends & Opportunities

Innovation in Functional Beverages and RTD Products

The U.S. is witnessing robust growth in functional beverage consumption, with RTD teas gaining wide acceptance. Green tea extracts are increasingly incorporated into drinks offering weight management, detoxification, and energy-boosting benefits. Beverage companies are innovating with sugar-free, organic, and flavored green tea variants to appeal to evolving consumer tastes. This trend creates significant opportunities for extract manufacturers to partner with beverage brands. The expanding RTD segment strengthens market presence, positioning green tea extract as a versatile functional ingredient with high consumer visibility.

For instance, Arizona Beverages introduced a zero-sugar green tea line in U.S. retail channels, marketed for its antioxidant benefits and appeal to calorie-conscious consumers.

Increasing Focus on Sustainable and Organic Sourcing

Sustainability has become a critical market differentiator, with U.S. consumers preferring products that ensure traceability and eco-friendly sourcing. Companies are investing in certified organic green tea cultivation and transparent supply chains to meet consumer expectations. This focus not only aligns with ethical consumption trends but also supports regulatory compliance and premium pricing. Brands highlighting sustainable sourcing practices gain stronger brand loyalty and expand their consumer base. This growing emphasis on sustainability and organic certification opens new opportunities for market players to achieve long-term growth.

For instance, Steaz, a U.S. brand, uses Fair Trade and USDA Organic certifications for its green tea-based beverages, sourcing tea from Kenya under strict organic farming methods.

Key Challenges

High Production and Processing Costs

The production of green tea extracts requires advanced technology, specialized equipment, and significant raw material inputs. Fluctuations in green tea leaf availability and rising operational costs increase the final product price. This cost intensity poses challenges for small and mid-sized manufacturers seeking to compete with established players. Limited cost efficiency reduces affordability in consumer markets and restricts broader adoption. Addressing this challenge requires investments in process optimization and supply chain management to ensure sustainable production at competitive pricing.

Regulatory and Quality Compliance Issues

Strict regulations surrounding nutraceuticals, dietary supplements, and functional foods in the U.S. create barriers for green tea extract manufacturers. Companies must comply with FDA, USDA organic certification, and labeling requirements to market their products. Any deviations or quality inconsistencies can result in recalls, fines, or reputational damage. Additionally, verifying bioactive content such as EGCG levels adds complexity and cost. Navigating these regulatory challenges while maintaining quality assurance remains a major concern for manufacturers competing in the highly scrutinized U.S. health and wellness market.

Competition from Alternative Natural Ingredients

The U.S. functional food and nutraceutical market is highly competitive, with ingredients like turmeric, ashwagandha, resveratrol, and curcumin gaining traction. These alternatives often provide similar antioxidant and therapeutic benefits, diverting consumer interest from green tea extracts. The presence of multiple botanical options challenges market penetration, especially when substitutes are marketed with stronger brand positioning or better cost efficiency. To address this challenge, companies must differentiate green tea extracts by emphasizing their unique polyphenol profile, clinical validation, and multifunctional health benefits.

Regional Analysis

Northeast

The Northeast holds 27% share of the U.S. Green Tea Extract Market in 2024, supported by strong urban populations and higher health awareness. Consumers in states like New York and Massachusetts adopt green tea extracts through nutraceuticals and premium beverages. Pharmaceutical firms in this region also drive demand with growing use of EGCG and catechins in therapies. Well-developed retail channels ensure easy product access across supermarkets, specialty stores, and pharmacies. The concentration of research centers and innovation hubs further boosts market expansion. It strengthens the region’s positioning as a growth-oriented hub.

Midwest

The Midwest accounts for 22% share of the U.S. Green Tea Extract Market, driven by rising consumer focus on functional foods and dietary supplements. States such as Illinois and Ohio support growth through expanding retail networks and growing health-conscious populations. Food and beverage companies integrate extracts in fortified snacks and beverages to meet demand for natural ingredients. Pharmaceutical adoption is gaining traction with more clinical interest in antioxidant benefits. The growing presence of nutraceutical manufacturers in the region adds resilience to supply chains. It establishes the Midwest as a steady growth region.

South

The South holds 30% share, making it the largest contributor to the U.S. Green Tea Extract Market in 2024. Rising demand for RTD teas and functional beverages in states such as Texas and Florida supports growth. Expanding healthcare networks and higher rates of lifestyle-related disorders encourage adoption of nutraceuticals. Retail penetration across hypermarkets and convenience stores ensures wider consumer reach. Beverage companies targeting younger demographics drive innovation in product offerings. It positions the South as the leading regional market with strong long-term growth potential.

West

The West represents 21% share of the U.S. Green Tea Extract Market, led by California’s strong consumer base for organic and plant-based products. High concentration of nutraceutical firms and clean-label product manufacturers supports innovation and product diversification. Beverage brands in the region actively launch green tea-based functional drinks targeting fitness and wellness segments. Demand is further driven by consumer preference for sustainable sourcing and eco-friendly packaging. Retailers and e-commerce platforms accelerate distribution, expanding reach across both urban and suburban markets. It sustains the West as a dynamic and competitive regional contributor.

Market Segmentations:

Market Segmentations:

By Product Type

- Tea Polyphenols

- Tea Catechins

- Epigallocatechin Gallate (EGCG)

- Caffeine

- Others

By Form

By Application

- Pharmaceuticals

- Food & Beverages

- Ready-to-Drink (RTD) Teas

- Functional Foods

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Green Tea Extract Market is characterized by the presence of multinational corporations, specialized nutraceutical firms, and regional players. Leading companies such as Archer Daniels Midland Company (ADM), DuPont, Kemin Industries, International Flavors & Fragrances Inc. (IFF), and Sensient Technologies dominate through extensive product portfolios, advanced R&D capabilities, and established distribution networks. Nutraceutical-focused players including Pharmavite LLC, FutureCeuticals Inc., PLT Health Solutions, NOW Foods, and NutraScience Labs strengthen competition by offering clean-label, organic, and EGCG-rich formulations tailored to consumer health trends. Companies actively invest in sustainable sourcing practices, clinical research, and innovative delivery forms such as powders, capsules, and ready-to-drink applications to differentiate offerings. Strategic partnerships with pharmaceutical, beverage, and dietary supplement manufacturers further expand market reach. Intense rivalry encourages continuous innovation, price competitiveness, and marketing investments, positioning key players to capture rising demand for natural, plant-based, and multifunctional ingredients in the U.S. market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Archer Daniels Midland Company (ADM)

- DuPont

- Kemin Industries, Inc.

- International Flavors & Fragrances Inc. (IFF)

- FutureCeuticals Inc.

- PLT Health Solutions

- Sensient Technologies

- Pharmavite LLC

- NOW Foods

- NutraScience Labs

Recent Developments

- In October 2024, PLT Health Solutionsintroduced CellFlo6, a patented green tea extract designed for energy, sports performance, and overall wellness.

- In July 2024, Activ’Insidelaunched ImprovD3, a formulation combining vitamin D3 and green tea flavanols to support immune health.

- In August 2025, Wolfson Brands launched advanced fat-burner supplements in the U.S. featuring natural thermogenic ingredients, including green tea extract.

- In June 2025, Gelteq Ltd.partnered with Healthy Extracts, Inc.to expand U.S. operations through an exclusive logistics and distribution agreement.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for clean-label and natural ingredients will continue to strengthen product adoption.

- Pharmaceutical applications will expand with growing research on EGCG and catechins.

- Functional beverages and RTD teas will remain a major growth avenue for manufacturers.

- Sustainable and organic sourcing practices will become central to competitive positioning.

- Nutraceutical firms will invest in innovative delivery formats such as capsules and gummies.

- E-commerce and digital retail platforms will drive wider consumer access and visibility.

- Strategic collaborations with food and beverage companies will enhance market penetration.

- Personalized nutrition trends will boost demand for targeted green tea extract formulations.

- Increasing focus on preventive healthcare will support higher uptake across dietary supplements.

- Product differentiation through flavor innovation and fortified blends will shape future competition.

Key Growth Drivers

Key Growth Drivers Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: