Market Overview

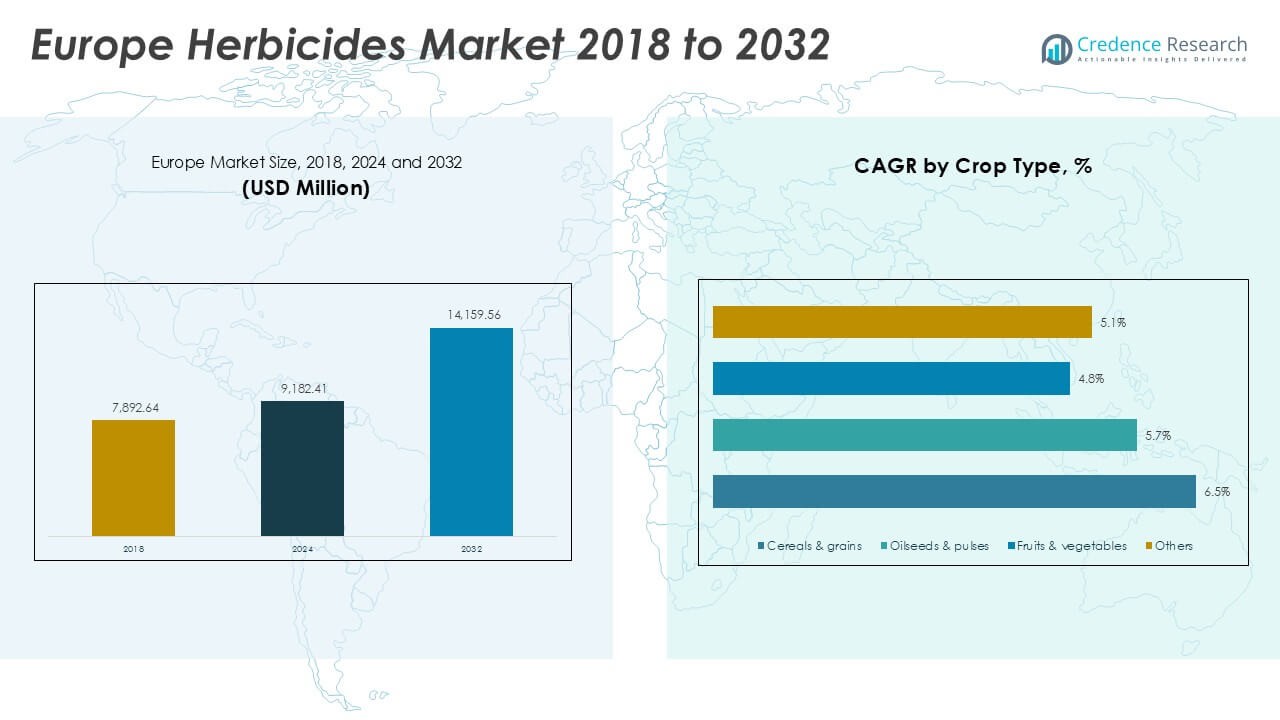

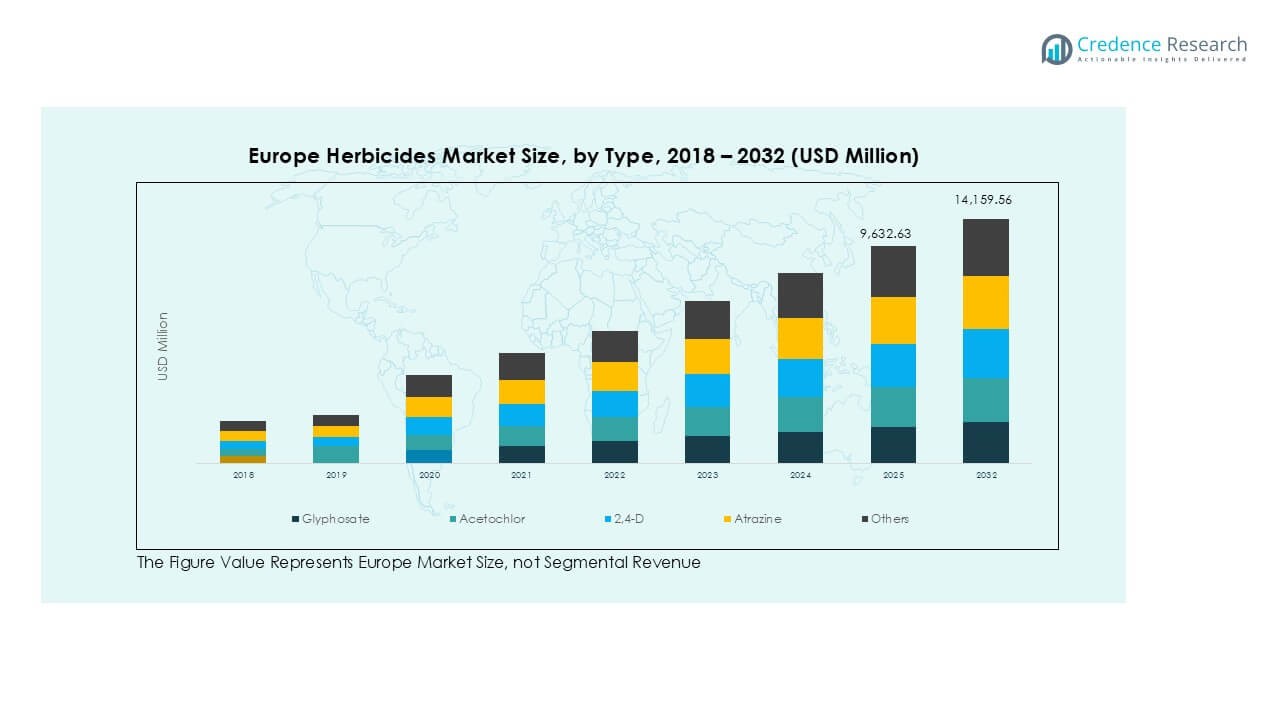

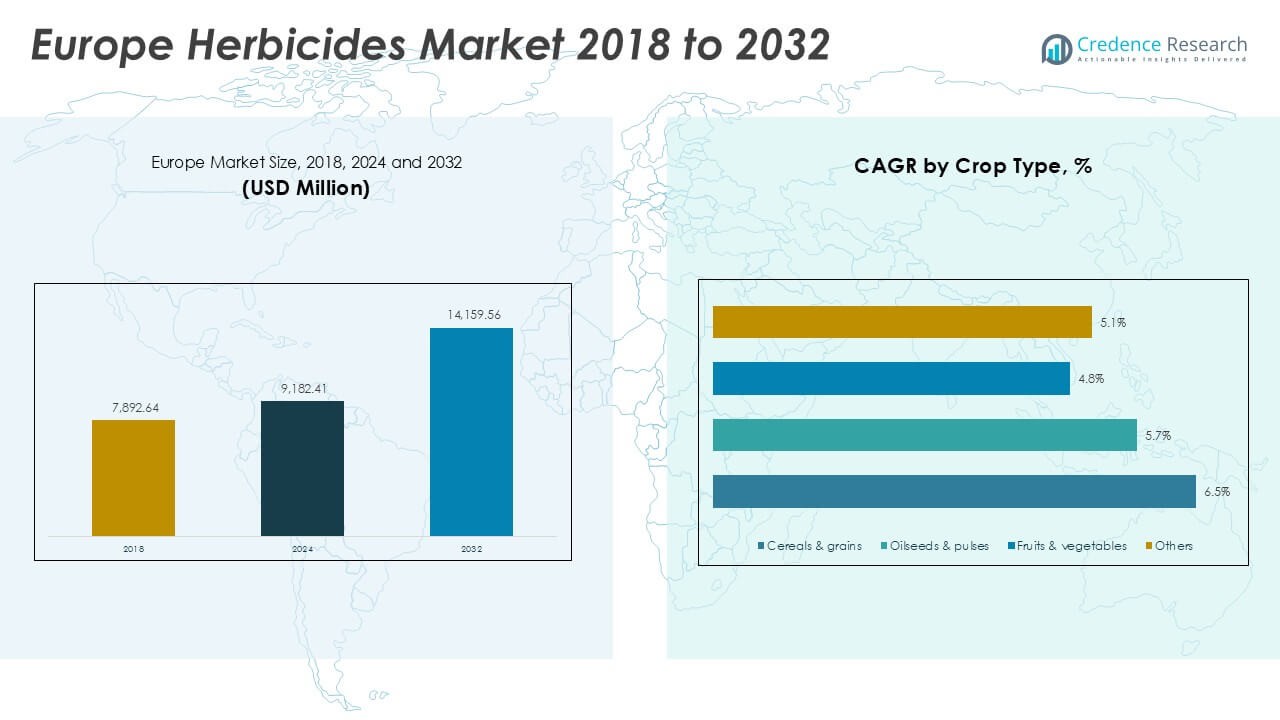

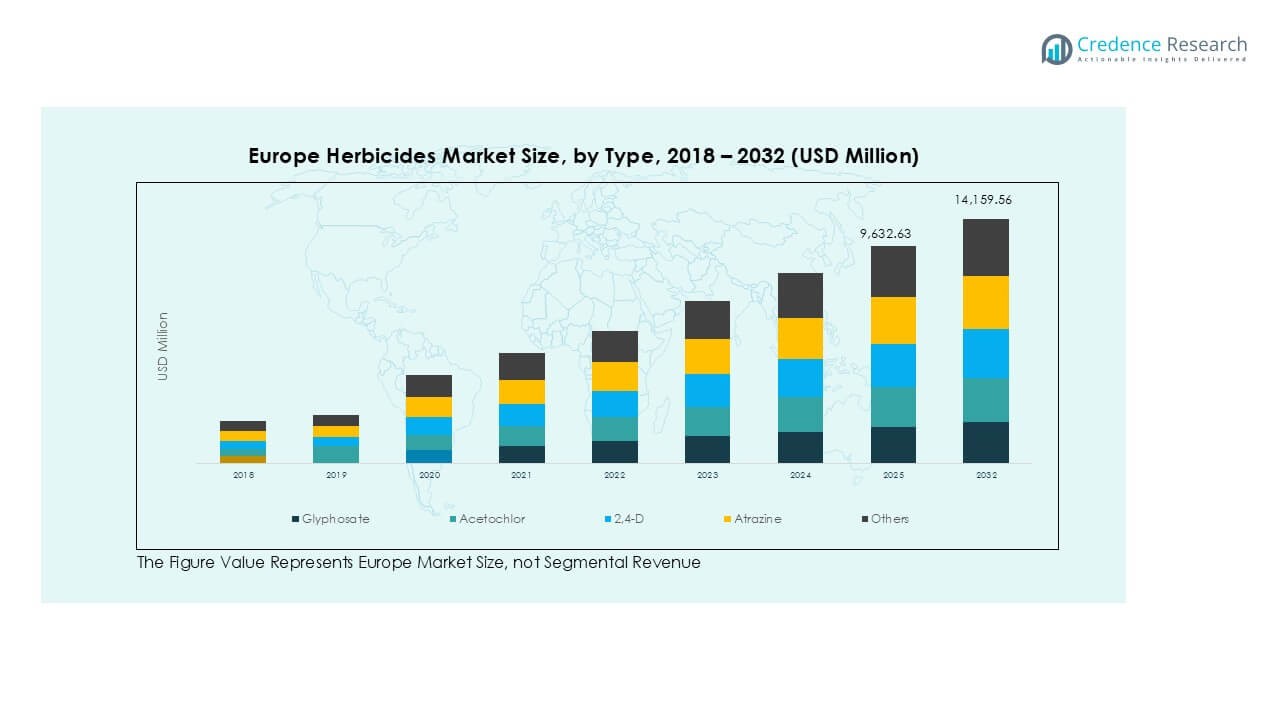

Europe Herbicides market size was valued at USD 7,892.64 million in 2018 and increased to USD 9,182.41 million in 2024. The market is anticipated to reach USD 14,159.56 million by 2032, growing at a CAGR of 5.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Herbicides Market Size 2024 |

USD 9,182.41 Million |

| Europe Herbicides Market, CAGR |

5.56% |

| Europe Herbicides Market Size 2032 |

USD 14,159.56 Million |

The Europe herbicides market is driven by major players such as FMC Corporation, BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd, and Syngenta Group. These companies focus on developing advanced formulations, bio-based herbicides, and precision application technologies to meet strict EU regulations. Western Europe leads the market with over 40% share, supported by large-scale cereal and grain cultivation and rapid adoption of digital farming solutions. Southern Europe follows with around 25% share, driven by high-value crops like vineyards and vegetables. Eastern and Northern Europe collectively contribute the remaining share, offering strong growth opportunities through modernization and sustainable farming practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Europe herbicides market was valued at USD 9,182.41 million in 2024 and is projected to reach USD 14,159.56 million by 2032, growing at a CAGR of 5.56% during the forecast period.

- Rising demand for higher crop productivity, shrinking arable land, and increasing adoption of herbicide-tolerant crops are key drivers boosting market growth across the region.

- Trends include growing use of bio-based and residue-free herbicides, drone spraying, and precision agriculture tools for targeted weed control and reduced chemical wastage.

- The market is highly competitive with FMC Corporation, BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group, and Nufarm Ltd leading through product innovation and sustainable solutions.

- Western Europe dominates with over 40% share, followed by Southern Europe at 25%, while cereals and grains remain the leading crop type segment, driving herbicide demand for large-scale production and sustainable yield enhancement.

Market Segmentation Analysis:

By Type

Glyphosate dominated the Europe herbicides market, holding the largest share due to its broad-spectrum weed control and cost-effectiveness. Farmers prefer glyphosate for no-till and minimum-till farming practices, which support soil conservation. Acetochlor and 2,4-D follow as significant contributors, driven by their effectiveness against grass and broadleaf weeds. Atrazine remains widely used in maize cultivation despite regulatory scrutiny. The “others” category includes selective herbicides targeting niche crops. Rising adoption of genetically modified herbicide-tolerant crops and demand for sustainable weed management are key growth drivers for this segment across European agricultural landscapes.

- For instance, Bayer reported that glyphosate use enables conservation tillage across more than 20 million hectares of EU farmland annually, reducing soil erosion and CO₂ emissions.

By Application

Foliar application leads the market, accounting for the highest revenue share due to its precision and fast action on weeds. Farmers favor foliar herbicides for their direct plant contact and minimal soil disruption. Fertigation is gaining momentum as integrated nutrient and herbicide delivery optimizes resource use and lowers labor costs. Soil application remains essential for pre-emergent weed control, particularly in cereals and oilseeds production. The others segment includes innovative application techniques like drone spraying. Demand for efficient application methods is driven by labor shortages, environmental regulations, and the need for cost-effective weed management solutions.

- For example, Corteva Agriscience’s Enlist herbicide system has seen high adoption across millions of hectares in North and South American farmland.

By Crop Type

Cereals and grains hold the largest share in the Europe herbicides market, driven by extensive cultivation of wheat, barley, and maize. Herbicides are essential to control grasses and broadleaf weeds that affect yield in these staple crops. Oilseeds and pulses form the second-largest segment, supported by rising demand for rapeseed and soybean production in the region. Fruits and vegetables require selective herbicides to protect high-value crops, boosting innovation in residue-free solutions. Growth is further driven by the EU’s focus on sustainable agriculture, precision farming techniques, and the rising need to increase crop productivity per hectare.

Key Growth Drivers

Rising Demand for High-Crop Yields

Increasing food demand is driving the need for higher crop productivity across Europe. Farmers rely on herbicides to control weed growth, reduce competition for nutrients, and enhance yield efficiency. Glyphosate and selective herbicides remain critical for protecting cereal and grain production. Population growth and shrinking arable land are pushing farmers toward intensive farming practices. This driver is reinforced by government support for sustainable farming methods and precision agriculture, encouraging optimized use of herbicides to maintain soil health while achieving maximum output from every cultivated hectare.

- For instance, glyphosate-based programs have been shown to improve cereal yields by 5–15% in European field trials, protecting millions of hectares of wheat and maize annually.

Adoption of Advanced Application Technologies

Modern farming practices are rapidly integrating advanced herbicide application techniques. Foliar spraying and fertigation systems are increasingly used for precision and efficiency. These technologies reduce chemical wastage, labor costs, and environmental impact, aligning with EU sustainability targets. Drone-based spraying and automated applicators are gaining popularity, offering consistent coverage and reduced exposure risks for farmers. This driver supports the adoption of integrated weed management solutions and encourages innovation in herbicide formulations that are compatible with advanced, sensor-based application systems to enhance performance and regulatory compliance.

- For instance, European agriculture is increasingly adopting fertigation systems, a practice that applies water and nutrients directly to a plant’s root zone through irrigation. This approach has proven more resource-efficient than conventional broadcasting, leading to greater crop yields and significant reductions in water and fertilizer use.

Expansion of Herbicide-Tolerant Crops

The rising use of herbicide-tolerant crops is boosting herbicide consumption across Europe. Crops like herbicide-tolerant maize and soybean allow farmers to apply broad-spectrum herbicides without damaging yields. This driver improves farm profitability by enabling effective weed management in a single pass, saving time and resources. Growing acceptance of biotechnology and precision agriculture is reinforcing this trend. Regulatory flexibility for biotech crops in certain European regions and demand for high-efficiency farming methods are accelerating adoption, leading to consistent demand for glyphosate and complementary herbicide formulations.

Key Trend & Opportunity

Shift Toward Bio-Based Herbicides

There is a rising focus on bio-based and residue-free herbicide solutions. European farmers are adopting eco-friendly formulations to comply with stringent EU pesticide regulations. This trend creates opportunities for companies developing natural and microbial-based herbicides. Demand is strong from organic farming sectors and high-value crop producers seeking residue-free certifications. Innovations in bioherbicide formulations, such as plant-extract and enzyme-based products, are gaining market attention. This shift aligns with EU Green Deal targets and presents growth potential for manufacturers offering sustainable alternatives to conventional chemical herbicides.

- For instance, EU organic farming land reached 16.9 million hectares in 2023, creating strong demand for residue-free crop protection inputs.

Integration with Digital Farming Solutions

Digital farming platforms are enhancing herbicide efficiency through data-driven decision-making. Satellite imagery, AI, and IoT sensors enable farmers to apply herbicides only where needed, reducing overuse and operational costs. Precision agriculture adoption is rising, especially in Western Europe, where large-scale farms benefit from these tools. This opportunity encourages partnerships between agrochemical companies and agri-tech providers. The integration of predictive weed-mapping and variable rate technology supports sustainable practices, ensuring compliance with environmental regulations while improving profitability and optimizing herbicide use per hectare.

- For example, John Deere’s See & Spray technology can reduce herbicide use by up to 77% in targeted application trials, saving thousands of liters per growing season on large farms.

Stringent Regulatory Restrictions

Europe’s herbicide market faces strict regulatory frameworks that limit the use of certain active ingredients. Bans and restrictions on products like glyphosate create uncertainty for farmers and manufacturers. Compliance with REACH and EU pesticide regulations increases product development costs and lengthens approval timelines. Farmers are forced to switch to alternative solutions, which may be costlier or less effective. This challenge drives companies to invest heavily in R&D for safer formulations and increases the market demand for bio-based and low-residue herbicide products.

Growing Weed Resistance

Weed resistance to widely used herbicides is becoming a critical challenge across Europe. Over-reliance on glyphosate and other single-mode herbicides has accelerated resistance development in major crops. Resistant weeds reduce yields and increase production costs, forcing farmers to use higher doses or multiple products. This issue is prompting a shift toward integrated weed management (IWM) strategies. Companies must innovate with new active ingredients and formulations to address resistance while ensuring compliance with environmental and safety regulations, maintaining both crop productivity and sustainability goals.

Regional Analysis

Western Europe

Western Europe leads the Europe herbicides market, capturing over 40% market share in 2024. Countries such as Germany, France, and the UK dominate due to large-scale cereal and grain cultivation and high adoption of precision farming practices. Glyphosate remains the most widely used herbicide, supported by advanced distribution networks and strong agrochemical industry presence. Government incentives for sustainable agriculture and growing demand for bio-based herbicides further fuel growth. Farmers in this region are quick to adopt digital farming tools and drone spraying technologies, driving efficiency and reducing environmental impact while ensuring consistent crop yields and regulatory compliance.

Southern Europe

Southern Europe accounts for around 25% market share of the Europe herbicides market, with Spain, Italy, and Portugal being key contributors. The region benefits from diverse crop production, including vineyards, olive groves, and vegetables, which require selective herbicide applications. Foliar and soil applications dominate due to seasonal weed pressures and climatic conditions favoring weed growth. Rising adoption of integrated pest management systems is supporting market expansion. Investments in irrigation infrastructure and precision farming technologies are improving herbicide use efficiency. Demand is further driven by government initiatives supporting sustainable farming practices and export-oriented horticultural production in the region.

Eastern Europe

Eastern Europe holds nearly 20% market share, with Poland, Ukraine, and Romania emerging as significant markets due to expanding arable land and rising mechanization. Herbicide demand is primarily concentrated in cereals and oilseed production, which dominate agricultural output. Farmers are increasingly adopting pre-emergent and post-emergent herbicides to maximize productivity. However, price sensitivity and limited awareness of advanced formulations pose growth challenges. The region presents high potential for market expansion as governments push for agricultural modernization. Rising foreign investments in farming infrastructure and gradual adoption of bio-based herbicides are expected to drive steady growth over the forecast period.

Northern Europe

Northern Europe contributes around 15% market share, driven by countries like Denmark, Sweden, and Finland. The region emphasizes sustainable farming and low chemical residue limits, boosting demand for bio-based and environmentally friendly herbicides. Farmers focus on precision application methods to minimize environmental impact and comply with strict EU pesticide regulations. Foliar applications are widely preferred due to shorter growing seasons and need for fast weed control. Adoption of digital farming solutions is strong, with data-driven weed monitoring enabling optimized herbicide usage. Market growth is further supported by government programs promoting green farming practices and sustainable crop protection.

Market Segmentations:

By Type

- Glyphosate

- Acetochlor

- 2,4-D

- Atrazine

- Others

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Geography

- Western Europe

- Southern Europe

- Eastern Europe

- Northern Europe

Competitive Landscape

The competitive landscape of the Europe herbicides market is characterized by the strong presence of global agrochemical leaders such as FMC Corporation, BASF SE, Bayer AG, Corteva Agriscience, Nufarm Ltd, Syngenta Group, and Sumitomo Chemical Co. Ltd. These players focus on innovation, introducing bio-based herbicides and advanced formulations that meet stringent EU regulations. Strategic collaborations, mergers, and acquisitions are common as companies expand product portfolios and strengthen distribution networks across Europe. Leading players are also investing in precision farming technologies, such as drone spraying and data-driven weed management, to offer integrated solutions. Western Europe remains the core revenue-generating region, driving demand for premium herbicide products. Competition is also shaped by smaller regional players like Belchim Crop Protection and Gowan Company, who cater to niche crop protection needs. The market continues to experience pricing pressure, regulatory compliance challenges, and a push toward sustainable and low-residue solutions to meet evolving consumer and policy requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2023, ADAMA introduced its most advanced cross-spectrum herbicide called Kampai for the grain business. The new product provides the broadest application window for broadleaf and narrow-leaf weed control for cereal crops.

- In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC’s global expansion efforts, aimed at enhancing its presence in the European market.

- In July 2023, ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans.

- In March 2023, BASF announced the launch of a novel corn herbicide named Surtain, which is set to be available for use in the United States in 2024. This innovative herbicide features solid encapsulation technology, marking it as the first of its kind in the industry.

- In January 2023, Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe herbicides market will grow steadily with rising demand for higher crop productivity.

- Adoption of bio-based and residue-free herbicides will increase due to strict EU regulations.

- Precision agriculture and digital farming tools will drive efficient herbicide application.

- Drone spraying technology will see wider use for cost-effective and targeted weed control.

- Demand for glyphosate alternatives will rise as regulatory scrutiny on active ingredients continues.

- Herbicide-tolerant crops will gain popularity, supporting the use of broad-spectrum formulations.

- Integrated weed management practices will become standard to combat herbicide resistance.

- Investments in R&D will focus on sustainable and low-toxicity formulations.

- Market consolidation will continue as major players expand through partnerships and acquisitions.

- Eastern and Northern Europe will emerge as key growth regions with modernization of farming practices.