Market Overview

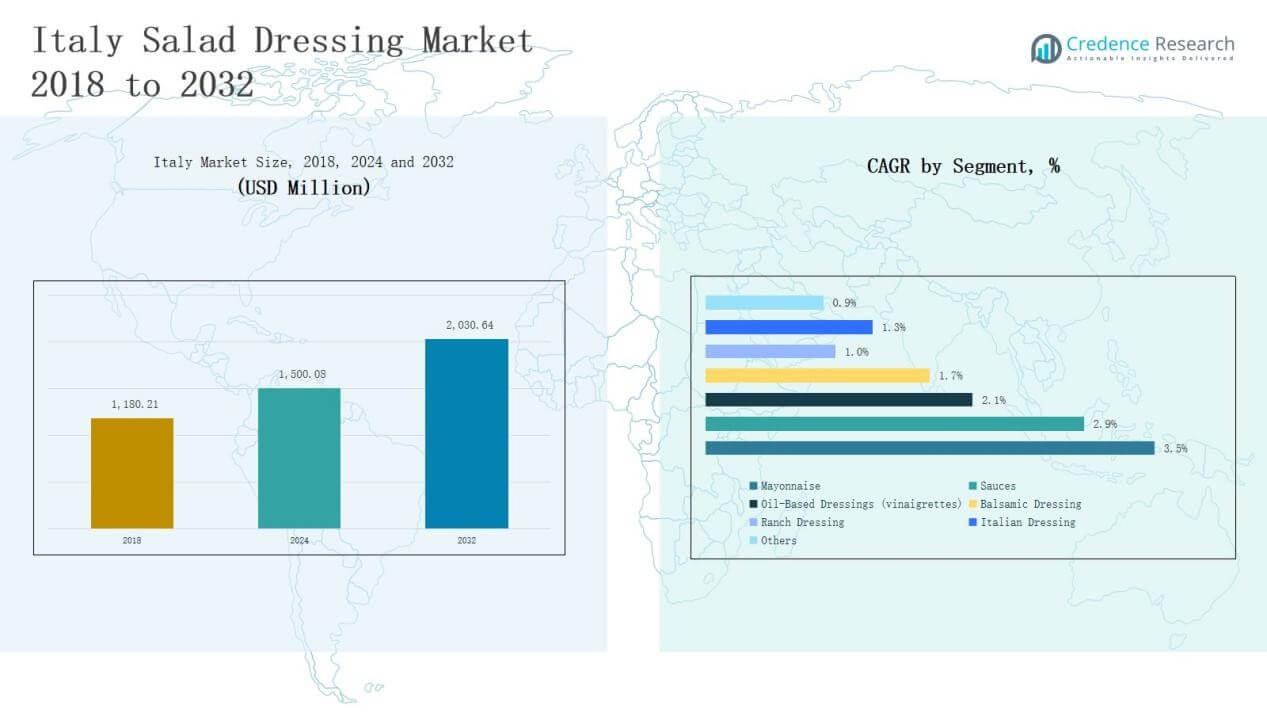

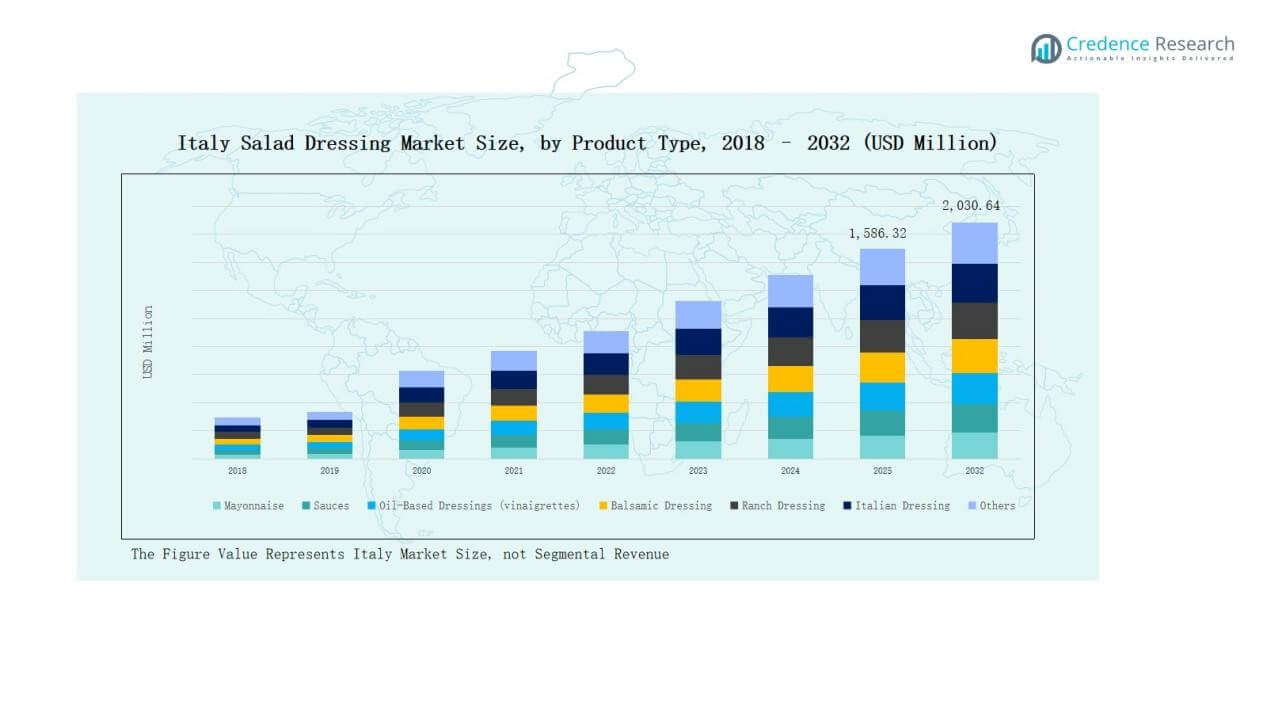

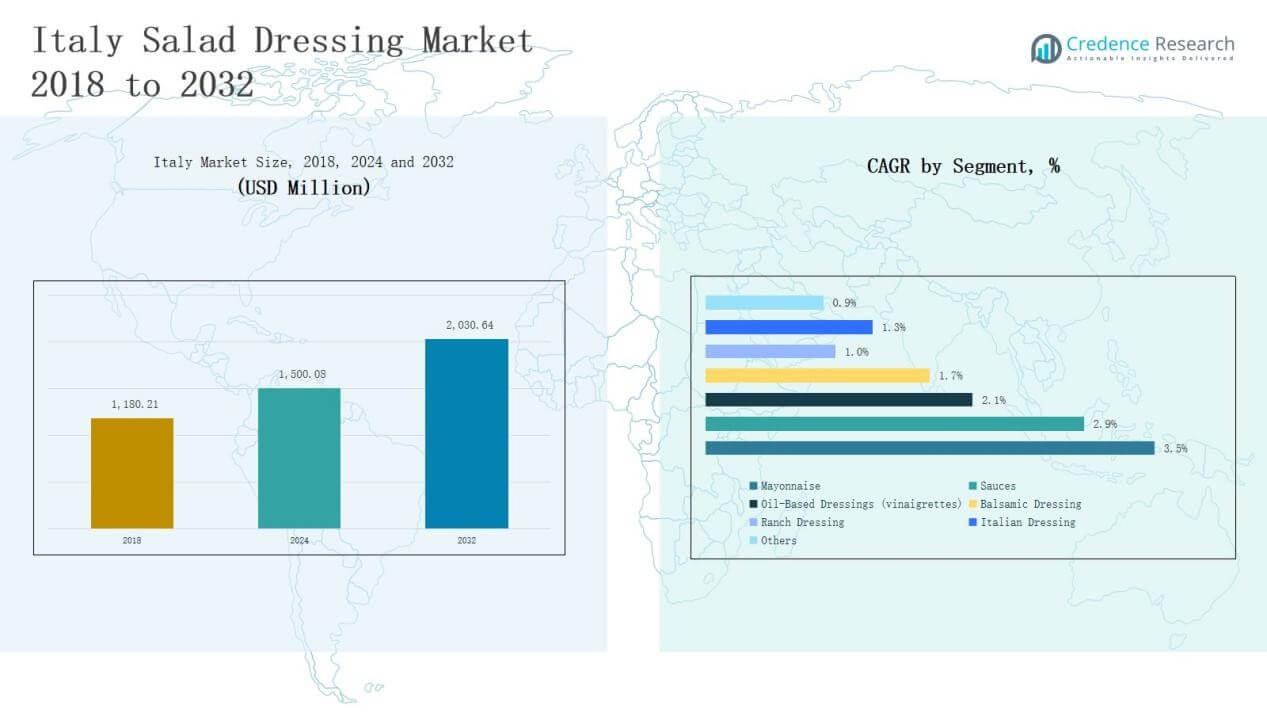

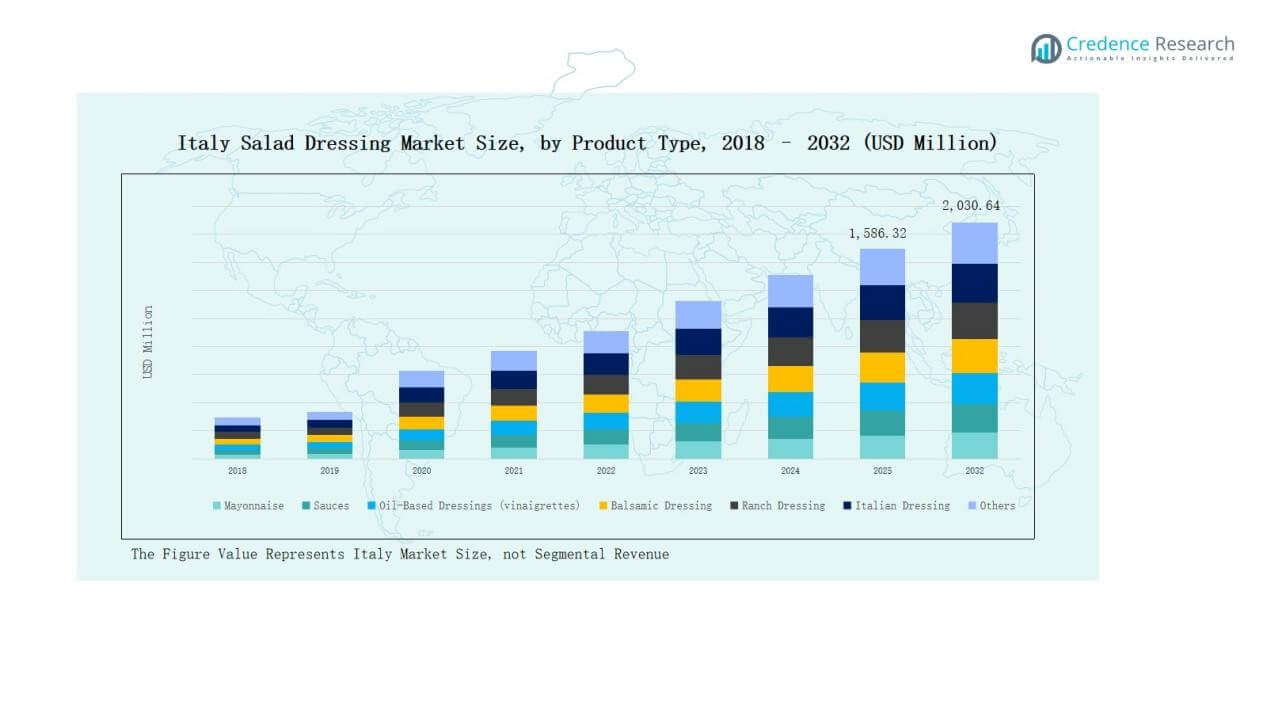

Italy Salad Dressing Market size was valued at USD 1,180.21 million in 2018, reaching USD 1,500.08 million in 2024, and is anticipated to reach USD 2,030.64 million by 2032, at a CAGR of 3.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Salad Dressing Market Size 2024 |

USD 1,500.08 Million |

| Italy Salad Dressing Market, CAGR |

3.59% |

| Italy Salad Dressing Market Size 2032 |

USD 2,030.64 Million |

The Italy Salad Dressing Market features strong competition between domestic producers and multinational brands that emphasize tradition, innovation, and distribution strength. Leading companies include Barilla, De Cecco, Bertolli (Unilever), Cirio, Mutti, Calvé, Saiwa, Saclà, Ponti, and Dante, each leveraging brand recognition and diverse product portfolios to secure consumer loyalty. Barilla and Bertolli dominate through wide retail penetration and strong brand equity, while Saclà and Ponti gain traction with premium and authentic Italian offerings. Mutti and Cirio strengthen their position through tomato-based and sauce-driven dressings, reflecting Italy’s culinary heritage. Regionally, Northern Italy leads the market with a 38% share in 2024, supported by advanced retail infrastructure, high disposable incomes, and a vibrant foodservice culture that accelerates demand for both conventional and premium dressings.

Market Insights

- The Italy Salad Dressing Market grew from USD 1,180.21 million in 2018 to USD 1,500.08 million in 2024 and is projected at USD 2,030.64 million by 2032.

- Mayonnaise leads product type with 34.2% share in 2024, followed by sauces at 27.8% and oil-based dressings at 15.6%, reflecting consumer preference for versatile and healthier options.

- Conventional dressings dominate category share with 82.5% in 2024, while organic dressings at 17.5% show steady growth supported by demand for clean-label and natural ingredients.

- Retail stores account for 55.4% share in 2024, foodservice captures 34.7%, and other off-trade channels including e-commerce hold 9.9% as digital platforms expand.

- Northern Italy leads regionally with 38% share in 2024, followed by Central Italy at 26%, Southern Italy at 21%, and Islands at 15%, reflecting diverse consumption drivers across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Mayonnaise dominates the Italy Salad Dressing Market with a 34.2% share in 2024, supported by its widespread use in household cooking and foodservice menus. Sauces follow closely, holding a 27.8% share, driven by strong demand for pasta-based dressings and Italian culinary traditions. Oil-based dressings, including vinaigrettes, capture 15.6% share, reflecting consumer interest in lighter and healthier options. Balsamic dressing secures 8.9% share, benefiting from Italy’s heritage in vinegar production. Ranch and Italian dressings together account for 9.3%, mainly targeting younger consumers and international dining trends. The remaining 4.2% belongs to niche categories under others, catering to premium and experimental tastes.

For instance, De Nigris expanded its balsamic vinegar-based dressings range by launching a Glaze with White Balsamic Vinegar of Modena, directly supporting growth of balsamic dressing consumption in Italy.

By Category

Conventional salad dressings account for 82.5% share in 2024, driven by affordability, brand familiarity, and high penetration across retail and foodservice channels. Organic dressings, though smaller with a 17.5% share, are expanding steadily due to rising health awareness, demand for clean-label products, and preference for natural ingredients. Growth in organic options is further supported by premium retail stores and specialty outlets that emphasize sustainability and traceability.

For instance, Kraft Heinz launched Kraft Not Company plant-based dressings in the U.S., aligning with consumer demand for cleaner, vegan alternatives.

By Distribution Channel

Retail stores dominate with a 55.4% share in 2024, supported by the popularity of supermarkets, hypermarkets, and specialty food retailers across urban regions. Foodservice channels hold 34.7% share, driven by strong restaurant culture, cafes, and catering services that integrate salad dressings into a wide variety of menus. Other off-trade channels, including e-commerce and direct-to-consumer models, capture 9.9% share, with digital platforms gaining traction as younger consumers shift toward online grocery purchases and subscription-based offerings.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Convenient Meal Solutions

Busy lifestyles and increasing dual-income households in Italy are fueling demand for ready-to-use salad dressings. Consumers seek quick meal preparation options without compromising taste and quality. Mayonnaise, sauces, and vinaigrettes are particularly favored for versatility in pasta, sandwiches, and salads. This preference is reinforced by urbanization and modern retail formats that stock diverse product ranges. The availability of packaged dressings in different portion sizes and flavors continues to attract younger consumers, making convenience a significant growth driver for the market.

For instance, Unilever has expanded its plant-based Hellmann’s mayonnaise range across Europe in response to the growing consumer demand for vegan-friendly options.

Health and Wellness Shift in Consumer Preferences

Italian consumers are increasingly prioritizing healthier eating habits, boosting demand for low-fat, organic, and clean-label salad dressings. Oil-based vinaigrettes and balsamic options align with Mediterranean diet principles, which emphasize natural and balanced nutrition. Manufacturers respond by offering reduced-calorie and preservative-free formulations. This health-conscious movement supports the growth of premium and organic dressing segments. Rising awareness of lifestyle diseases further drives consumers to choose products with functional benefits, ensuring long-term demand for wellness-oriented salad dressings across the country.

For instance, Nestlé’s Garden Gourmet offers a range of plant-based products in Italy, such as marinated filet pieces and Vuna (a plant-based tuna alternative), highlighting nutritional benefits like high protein and being a source of fiber.

Expansion of Retail and E-Commerce Channels

Modern retail stores and online grocery platforms are strengthening salad dressing distribution in Italy. Supermarkets and hypermarkets offer broad visibility for leading brands and private labels, boosting sales. Meanwhile, e-commerce penetration is accelerating, particularly among younger consumers who value doorstep delivery and product variety. Online platforms also support the rise of niche organic and specialty brands that leverage digital-first marketing strategies. This expansion of multi-channel distribution networks enables wider consumer reach, positioning retail and e-commerce as critical growth drivers.

Key Trends & Opportunities

Premiumization and Flavor Innovation

Italian consumers show growing interest in premium salad dressings featuring artisanal ingredients and gourmet flavors. Companies introduce products with unique combinations such as truffle-infused vinaigrettes or herb-enriched sauces. This innovation aligns with Italy’s culinary culture that values authenticity and taste. Premium offerings create differentiation in a competitive market, allowing brands to attract higher-income groups willing to pay for quality. Flavor innovation also supports cross-category growth by integrating dressings into pasta, pizza, and seafood recipes, expanding consumption beyond salads.

For instance, De Nigris offers a variety of glazes, including a “Classic Original” and an “Organic Glaze with Balsamic Vinegar of Modena”.

Sustainability and Eco-Friendly Packaging

Growing awareness of environmental sustainability is driving demand for salad dressings packaged in recyclable, biodegradable, or reusable containers. Italian consumers increasingly favor brands that commit to eco-conscious practices such as reducing plastic and highlighting carbon-neutral production. This trend offers opportunities for both global and local players to align with European Union green initiatives. By adopting eco-friendly packaging, companies strengthen their brand reputation, capture environmentally aware customers, and meet regulatory standards. Sustainability therefore emerges as a key growth opportunity in the market.

For instance, Newman’s Own Organics launched Italian salad dressing packaged sustainably, targeting eco-conscious consumers with no artificial additives.

Key Challenges

High Competition Among Established Brands

The Italy Salad Dressing Market is highly competitive, with established players like Barilla, Bertolli, and Cirio dominating shelves. This intense competition pressures pricing and margins, especially for smaller or emerging brands. New entrants face barriers in brand recognition, shelf space access, and distribution agreements. To succeed, companies must differentiate through innovation, organic offerings, or targeted marketing. However, heavy competition limits growth opportunities for less established firms, creating a challenging environment for market expansion.

Consumer Skepticism Toward Processed Foods

Despite demand for convenience, many Italian consumers remain cautious about processed foods, including packaged salad dressings. Concerns about artificial additives, preservatives, and high fat or sugar content discourage adoption among health-conscious groups. This skepticism challenges mass-market products, particularly conventional mayonnaise and sauces. Brands must work harder to communicate transparency, clean-label credentials, and health benefits to win consumer trust. Overcoming this perception issue is critical for sustaining long-term growth in the Italian market.

Regulatory Compliance and Cost Pressures

Italian and EU food regulations impose strict standards on labeling, ingredient sourcing, and health claims for salad dressings. Compliance often raises production costs, particularly for smaller producers. Rising raw material prices, such as vegetable oils and vinegar, further pressure profitability. Large players may manage costs through economies of scale, but smaller firms struggle to remain competitive. Balancing compliance with affordable pricing poses a persistent challenge, making cost management and operational efficiency vital for sustained success in the market.

Regional Analysis

Northern Italy

Northern Italy holds 38% share of the Italy Salad Dressing Market in 2024, driven by strong urbanization and a well-developed retail network. It benefits from a higher concentration of supermarkets and specialty stores that offer diverse dressing varieties. Foodservice channels in cities such as Milan and Turin further enhance demand, supported by a vibrant restaurant culture. Consumers in this region favor premium and organic dressings, aligning with higher disposable incomes and health-conscious preferences. Growth is reinforced by strong manufacturing presence and distribution hubs. It remains a leading contributor to both domestic consumption and export demand.

Central Italy

Central Italy accounts for 26% share of the Italy Salad Dressing Market in 2024, supported by its traditional culinary culture and balanced retail distribution. Cities like Rome drive sales through both modern retail and strong foodservice demand. The region shows steady adoption of balsamic and oil-based dressings, reflecting its historical links to Mediterranean diets. It benefits from tourism activity, which boosts demand for convenient packaged dressings in hospitality and restaurant sectors. Retail penetration in urban and suburban areas supports consistent market growth. It continues to balance traditional consumer habits with increasing health-driven choices.

Southern Italy

Southern Italy secures 21% share of the Italy Salad Dressing Market in 2024, led by household consumption and smaller-scale retail outlets. The region has strong adoption of conventional mayonnaise and sauces, reflecting affordability and local food habits. Growth opportunities are linked to rising awareness of organic dressings in emerging urban centers. Foodservice adoption is moderate but expanding with tourism and hospitality growth in coastal regions. Retail networks are still developing compared to the north, but steady progress supports gradual demand expansion. It is emerging as a region of interest for both mainstream and niche brands.

Islands (Sicily and Sardinia)

The Islands region contributes 15% share of the Italy Salad Dressing Market in 2024, shaped by unique consumer patterns and growing tourism demand. Local consumption is influenced by Mediterranean flavors, which support demand for oil-based and balsamic dressings. Retail channels are comparatively limited, but specialty stores and modern trade outlets are gaining strength. The region benefits from seasonal spikes linked to tourism and hospitality, which drive higher sales volumes during peak months. Organic offerings are gradually entering premium retail channels. It holds strategic potential for companies focusing on niche products and seasonal sales strategies.

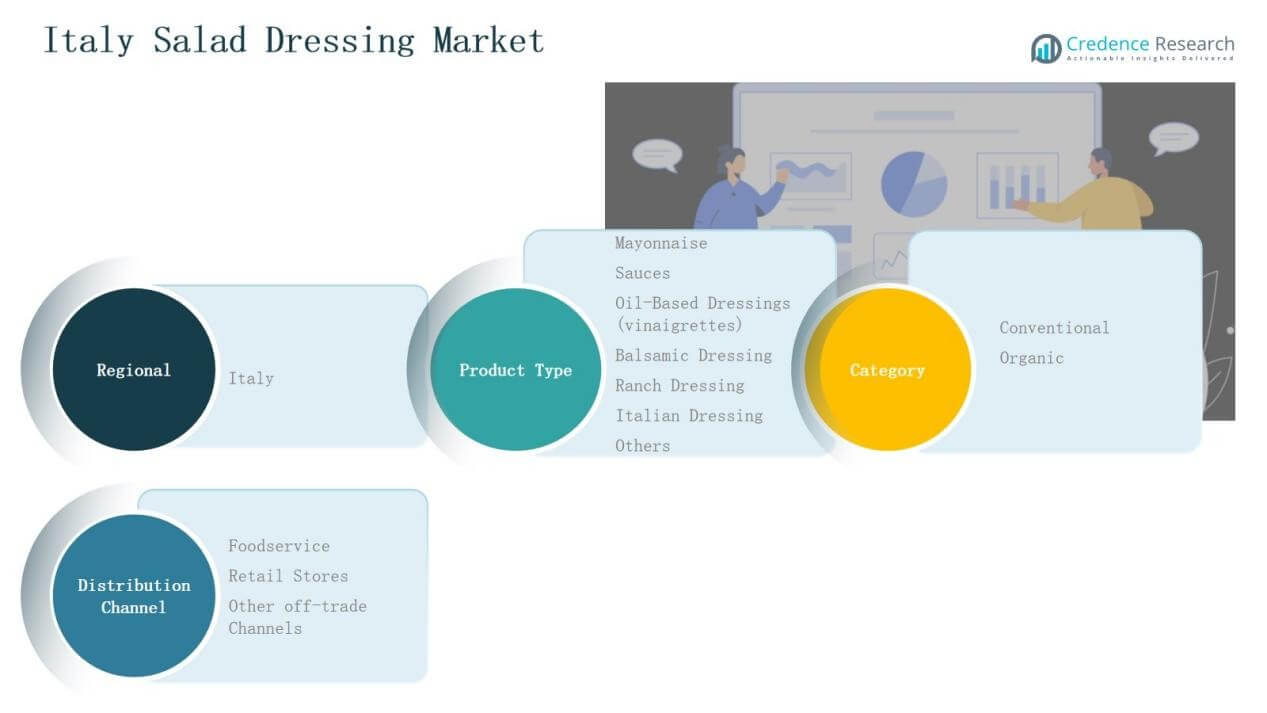

Market Segmentations:

Market Segmentations:

By Product Type

- Mayonnaise

- Sauces

- Oil-Based Dressings (Vinaigrettes)

- Balsamic Dressing

- Ranch Dressing

- Italian Dressing

- Others

By Category

By Distribution Channel

- Foodservice

- Retail Stores

- Other Off-Trade Channels

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Islands

Competitive Landscape

The Italy Salad Dressing Market is characterized by strong competition between domestic producers and multinational brands that leverage deep-rooted consumer trust and extensive distribution networks. Leading companies such as Barilla, De Cecco, and Bertolli (Unilever) dominate shelf presence with established product portfolios and wide retail penetration. Local players including Cirio, Mutti, Saclà, and Ponti strengthen their position through traditional Italian flavors and premium offerings that align with culinary heritage. Global brands introduce innovative and organic formulations to capture health-conscious consumers, while private labels compete on price and accessibility across retail chains. Strategic partnerships with foodservice operators and expansion of e-commerce channels support broader consumer reach. Companies are also investing in sustainable packaging and clean-label products to align with evolving regulatory standards and consumer expectations. Competitive intensity remains high, with differentiation driven by flavor innovation, brand positioning, and the ability to balance affordability with premium quality.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Barilla

- De Cecco

- Bertolli (Unilever)

- Cirio

- Mutti

- Calvé

- Saiwa

- Saclà

- Ponti

- Dante

Recent Developments

- In September 2025, Dole launched its Apple Harvest Premium Salad Kit featuring an apple cider vinaigrette, enhancing salad dressing offerings with unique flavors globally, including Europe.

- In September 2024, Platinum Equity acquired a majority stake in F.lli Polli SpA, an Italian producer of preserved vegetables and condiments, boosting its condiment and sauce offerings.

- In April 2025, Hidden Valley launched seven new ranch flavor varieties with redesigned packaging to boost innovation and consumer appeal; this brand has a presence in Europe including Italy.

- In January 2025, Stonewall Kitchen introduced classic dressing flavors including French, Blue Cheese, Ranch, and Thousand Island as part of expanding everyday dressings globally.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Category Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for organic and clean-label salad dressings will expand steadily across retail shelves.

- Premium and artisanal product offerings will gain traction among high-income urban consumers.

- Online grocery platforms will play a larger role in distributing salad dressings to younger buyers.

- Flavor innovations such as herb-infused and gourmet blends will attract niche customer segments.

- Sustainable and recyclable packaging adoption will become a standard across major product lines.

- Foodservice channels will continue boosting consumption through restaurant and catering demand.

- Domestic producers will strengthen market share by emphasizing authentic Italian taste profiles.

- Private label brands will expand presence in supermarkets, challenging established global competitors.

- Consumer education on healthy eating will increase uptake of low-fat and oil-based vinaigrettes.

- Seasonal tourism in Italy will drive periodic spikes in sales, especially for premium dressings.

Key Growth Drivers

Key Growth Drivers Market Segmentations:

Market Segmentations: