Market Overview

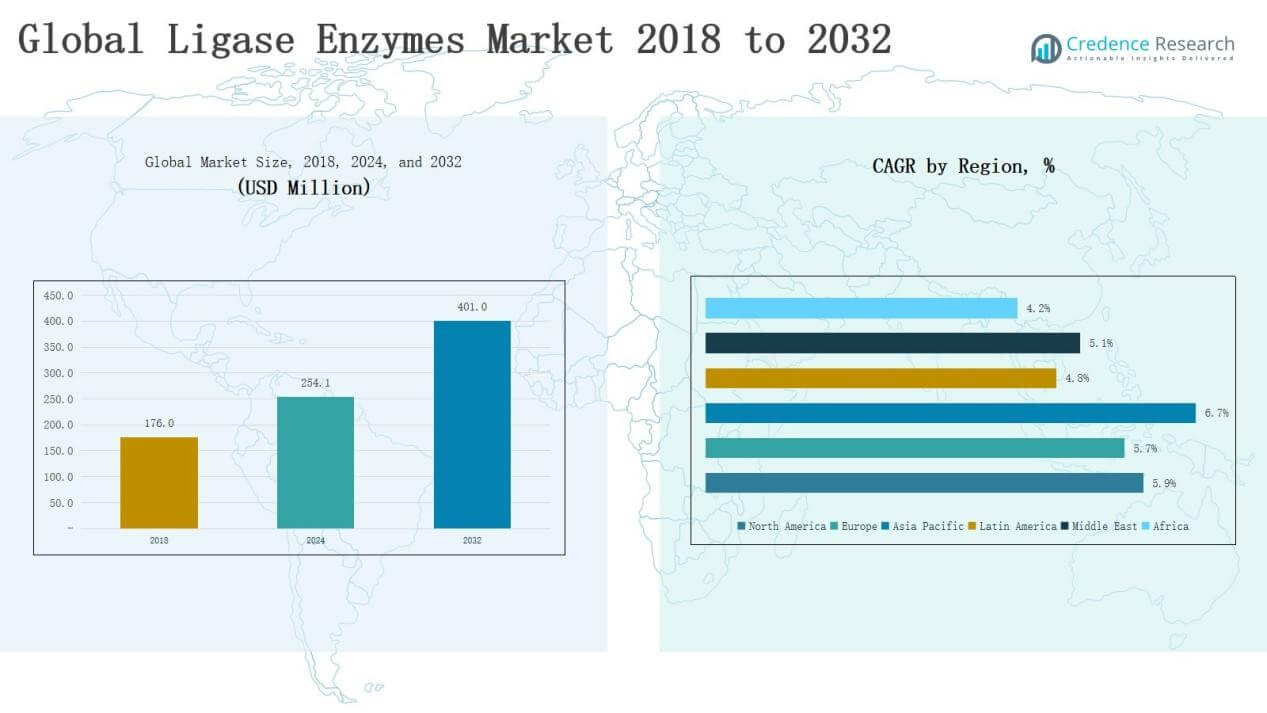

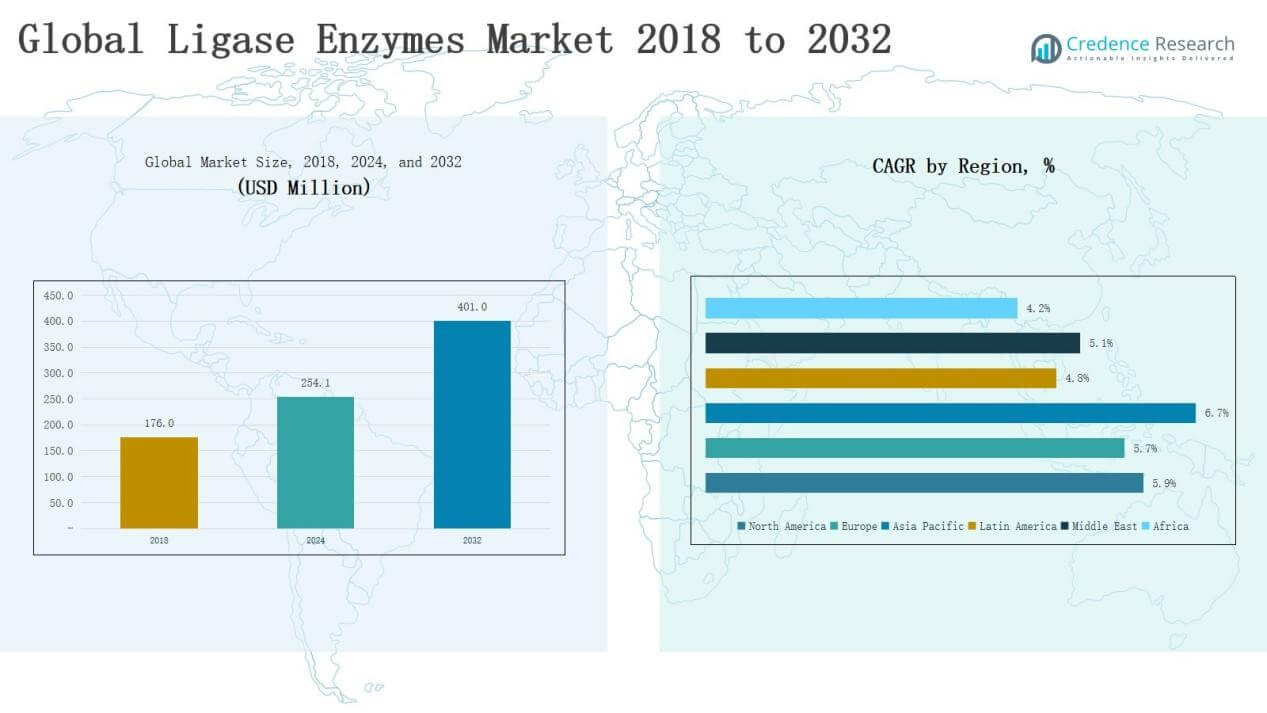

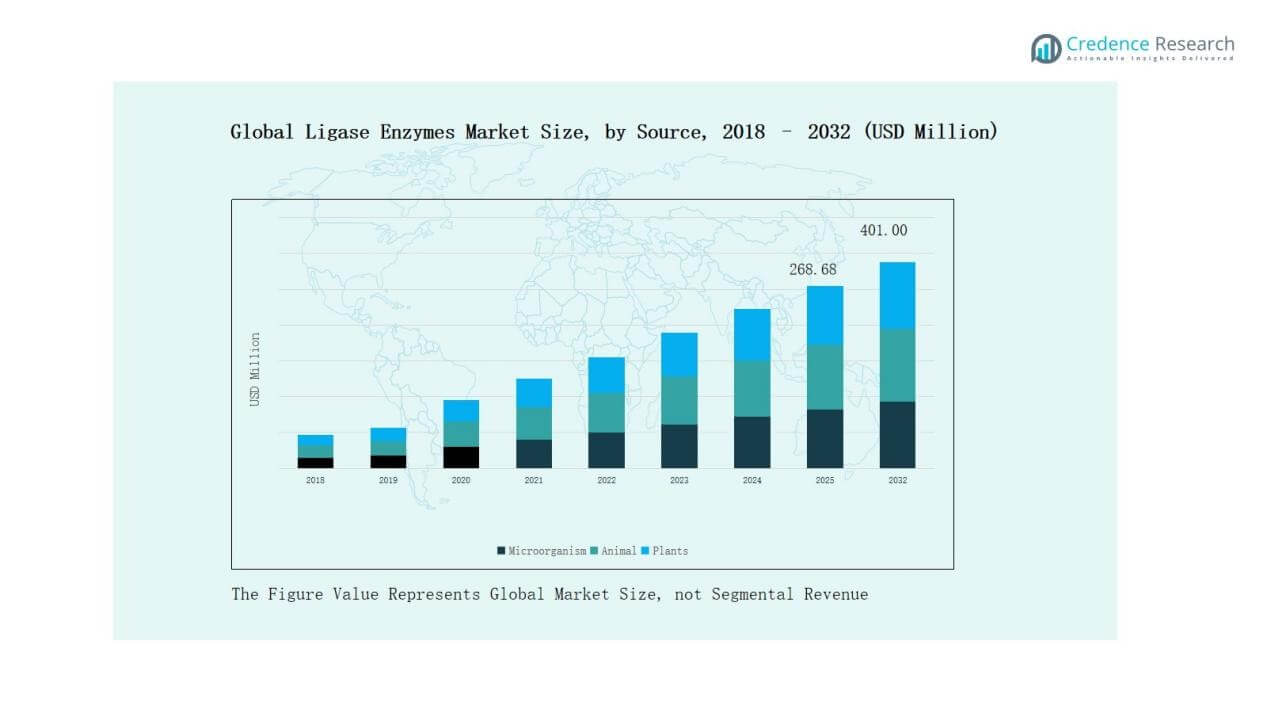

The Global Ligase Enzymes Market size was valued at USD 176.0 million in 2018, rising to USD 254.1 million in 2024, and is projected to reach USD 401.0 million by 2032, growing at a CAGR of 5.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ligase Enzymes Market Size 2024 |

USD 254.1 Million |

| Ligase Enzymes Market, CAGR |

5.89% |

| Ligase Enzymes Market Size 2032 |

USD 401.0 Million |

The Global Ligase Enzymes Market is shaped by the presence of leading players such as Abclonal Inc., New England Biolabs, Promega Corporation, Enzynomics Co. Ltd., Canvax, Thermo Fisher Scientific, Takara Bio Inc., LGC Biosearch Technologies, Creative Enzymes, and Amano Enzyme. These companies strengthen their positions through advanced product portfolios, strategic partnerships, and consistent R&D investments aimed at enhancing enzyme efficiency and stability. Regionally, Europe emerged as the leader in 2024, accounting for 33.8% of the global market share, supported by its robust pharmaceutical research base, strong biotechnology infrastructure, and wide adoption of sequencing and cloning technologies across major countries including Germany, the UK, and France.

Market Insights

Market Insights

- The Global Ligase Enzymes Market was valued at USD 176.0 million in 2018, reached USD 254.1 million in 2024, and is projected at USD 401.0 million by 2032.

- Leading players include Abclonal Inc., New England Biolabs, Promega Corporation, Thermo Fisher Scientific, Takara Bio Inc., Enzynomics, Canvax, LGC Biosearch Technologies, Creative Enzymes, and Amano Enzyme.

- By type, T4 DNA Ligase dominated with a 46.2% share in 2024, driven by broad applications in molecular cloning, DNA repair, and biotechnology research.

- By application, Polymerase Chain Reaction (PCR) led with a 38.5% share in 2024, reflecting its critical role in diagnostics, genetic testing, and disease detection.

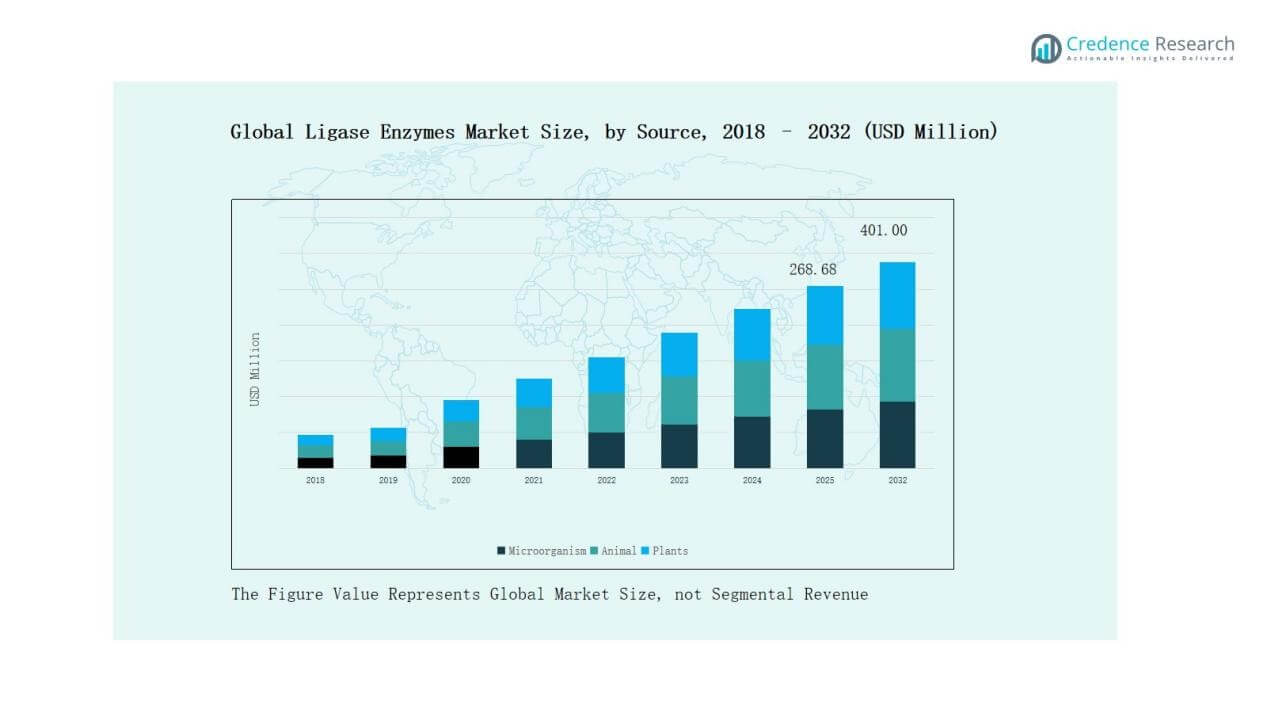

- By source, microorganisms held the largest share at 57.4% in 2024, supported by cost-effective production, high yields, and suitability for industrial-scale enzyme manufacturing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

T4 DNA Ligase dominates the global ligase enzymes market, accounting for 46.2% share in 2024. Its strong position is supported by widespread use in molecular cloning, DNA repair, and recombinant DNA applications. The enzyme’s high efficiency in sealing nicks in DNA strands and broad adoption in biotechnology and life sciences research drive its continued growth. Taq DNA Ligase and other variants serve niche applications, but their shares remain secondary compared to T4 DNA Ligase.

For instance, Thermo Fisher Scientific introduced optimized ligation kits featuring T4 DNA Ligase to support high-throughput cloning for synthetic biology research.

By Application

Polymerase Chain Reaction (PCR) leads the market with a 38.5% share in 2024, reflecting its critical role in diagnostics, genetic testing, and infectious disease detection. The rapid adoption of PCR-based methods in clinical diagnostics, especially post-COVID-19, supports its dominance. Cloning and next-generation sequencing applications are expanding steadily, driven by rising demand for advanced genomics, while drug target and mutation detection applications remain specialized but growing segments.

For instance, Illumina introduced the NovaSeq X Plus sequencer, capable of generating up to 16 Tb of data in a single run, demonstrating strong momentum in next-generation sequencing adoption.

By Source

Microorganisms represent the largest source segment, holding 57.4% share in 2024. Their dominance is attributed to cost-effective production, consistent enzyme yields, and suitability for large-scale industrial processes. Bacterial and fungal sources provide high purity ligase enzymes widely used in biotechnology and pharmaceuticals. Animal and plant sources contribute smaller shares due to limited scalability, ethical concerns, and higher production complexity, but they continue to find selective use in specialized research applications.

Key Growth Drivers

Rising Demand for Genetic Testing and Diagnostics

The expanding use of genetic testing and molecular diagnostics is a key driver for the global ligase enzymes market. Increased awareness of personalized medicine and early disease detection has fueled the adoption of DNA ligation technologies in clinical laboratories. Ligase enzymes are integral to polymerase chain reaction (PCR), mutation detection, and sequencing processes. Their precision in linking DNA fragments makes them essential for accurate results. Growing prevalence of genetic disorders and infectious diseases further strengthens demand from diagnostic centers and healthcare institutions.

For instance, Qiagen expanded its QIAseq targeted DNA panel portfolio to enhance mutation detection efficiency, integrating ligation-based NGS library prep methods for higher accuracy in molecular testing.

Advancements in Genomics and Biotechnology Research

Rapid advancements in genomics and biotechnology research significantly boost ligase enzyme consumption. Academic and commercial research institutions increasingly employ ligase enzymes in cloning, next-generation sequencing, and mutation analysis. These applications enable breakthroughs in synthetic biology, drug discovery, and genome editing. Continuous funding support for R&D from governments and private organizations enhances the adoption of advanced ligation techniques. The development of novel enzyme formulations with higher efficiency and stability further accelerates market expansion, ensuring broader application across biotechnology and pharmaceutical industries.

For instance, New England Biolabs introduced the HiFi Taq DNA Ligase, designed for more accurate targeted DNA assembly and better performance in CRISPR applications.

Expansion of Pharmaceutical and Biopharmaceutical Applications

The rising role of ligase enzymes in drug discovery and therapeutic development supports strong market growth. Pharmaceutical and biopharmaceutical companies integrate ligase-based techniques into processes such as biomarker identification, drug target validation, and recombinant protein production. The demand for innovative therapies, including monoclonal antibodies and gene therapies, amplifies enzyme usage. Increasing pipeline investments and clinical trial activities create sustained opportunities. Ligase enzymes also enhance efficiency in biologics production, reinforcing their importance in commercial-scale applications and ensuring consistent revenue growth from the pharmaceutical sector.

Key Trends & Opportunities

Key Trends & Opportunities

Integration of Ligase Enzymes in Next-Generation Sequencing

Next-generation sequencing (NGS) has emerged as a transformative trend, creating strong opportunities for ligase enzymes. NGS technologies rely on ligation-based protocols to assemble DNA libraries, detect mutations, and analyze genomes with high precision. The rising use of NGS in cancer genomics, rare disease research, and clinical diagnostics is expanding the scope of ligase enzyme applications. Increasing affordability of sequencing technologies and partnerships between research institutions and commercial providers are expected to accelerate enzyme adoption, positioning NGS as a major growth opportunity for the market.

For instance, in the SOLiD sequencing platform, DNA ligase joins fluorescently labeled 8-mer probes to adapters attached to target DNA, enabling highly accurate two-base sequencing with 99.999% precision and production of up to 30 Gb of data per run.

Growing Focus on Personalized and Precision Medicine

The global shift toward personalized medicine represents a vital opportunity for the ligase enzymes market. Healthcare providers increasingly rely on genomic insights to tailor treatments, and ligase enzymes play a central role in enabling accurate DNA sequencing and mutation detection. Expanding clinical use of pharmacogenomics and companion diagnostics boosts demand. As patient-specific therapies gain prominence in oncology, neurology, and rare diseases, the requirement for ligase-based methods continues to rise. This trend aligns with global healthcare’s movement toward targeted, outcome-driven treatments.

For instance, Illumina partnered with AstraZeneca to co-develop companion diagnostics using next-generation sequencing, building on ligase enzyme–based workflows to support patient-matched therapies in oncology.

Key Challenges

High Cost of Enzyme Production and Purification

The production and purification of ligase enzymes involve complex and costly processes, posing a significant challenge to market scalability. Maintaining enzyme activity and stability during large-scale manufacturing requires advanced bioprocessing technologies and stringent quality controls, which increase expenses. Smaller research organizations and laboratories often face difficulties affording high-purity enzymes, restricting widespread adoption. Price sensitivity in emerging economies further limits market penetration. As competition intensifies, companies must balance innovation with cost efficiency to remain profitable while ensuring accessibility across various end-user groups.

Technical Limitations and Process Complexity

Despite their importance, ligase enzymes face challenges related to technical limitations and process complexity. Enzyme performance may vary across experimental conditions, reducing reproducibility in molecular assays. Specialized handling requirements and the need for optimized buffer systems add to operational complexity. Variability in enzyme efficiency can affect accuracy in critical applications such as sequencing or cloning. These limitations restrict usage among less experienced laboratories. To overcome this, continuous innovation in enzyme engineering and improved kits with simplified protocols are required to enhance broader adoption.

Competition from Alternative DNA Manipulation Technologies

The emergence of alternative DNA manipulation technologies, such as CRISPR-Cas systems and recombinase-based methods, presents a competitive challenge for the ligase enzymes market. These tools offer precise genome editing capabilities with growing popularity in research and therapeutic applications. Their adoption in advanced laboratories may reduce dependence on ligase-based methods. While ligase enzymes remain essential for many conventional processes, the threat of substitution could limit long-term demand. Market players need to focus on developing specialized ligase formulations and integrating them with new genomic tools to remain competitive.

Regional Analysis

North America

The North America ligase enzymes market was valued at USD 49.07 million in 2018, increased to USD 71.10 million in 2024, and is projected to reach USD 112.68 million by 2032, growing at a 5.9% CAGR. Growth is driven by advanced biotechnology research, adoption of next-generation sequencing, and rising demand for molecular diagnostics. Strong presence of leading biotech companies, ongoing investment in personalized medicine, and extensive academic research collaborations further reinforce the region’s consistent dominance in the global market.

Europe

The Europe market generated USD 60.20 million in 2018, rising to USD 85.96 million in 2024, and is expected to achieve USD 133.61 million by 2032, at a 5.7% CAGR. Expansion is supported by strong pharmaceutical R&D, robust biotechnology infrastructure, and broad applications of ligase enzymes in genomics and clinical research. Countries such as Germany, the UK, and France lead innovation. Rising investments in mutation detection, cloning, and sequencing strengthen market opportunities, positioning Europe as a major contributor to industry growth.

Asia Pacific

The Asia Pacific market recorded USD 41.26 million in 2018, advanced to USD 62.40 million in 2024, and is forecasted to grow to USD 104.38 million by 2032, registering the fastest 6.7% CAGR. Rising investments in genomics, pharmaceutical manufacturing expansion, and government support for biotechnology drive growth. China, Japan, and India dominate regional adoption, supported by large patient pools and research funding. Growing integration of sequencing technologies in diagnostics and rapid development of personalized medicine applications accelerate the region’s strong upward trajectory.

Latin America

The Latin America ligase enzymes market was valued at USD 13.11 million in 2018, increased to USD 17.84 million in 2024, and is projected to reach USD 25.86 million by 2032, at a 4.8% CAGR. Growth is supported by expanding healthcare infrastructure and molecular biology research in Brazil and Argentina. Rising demand for advanced diagnostics and biotechnology applications strengthens regional opportunities. However, limited R&D funding and dependence on imports constrain faster growth. Partnerships with international players and technology transfer initiatives are expected to aid development.

Middle East

The Middle East market stood at USD 8.22 million in 2018, reached USD 11.37 million in 2024, and is anticipated to grow to USD 16.88 million by 2032, with a 5.1% CAGR. Expansion is driven by healthcare modernization, rising adoption of genetic diagnostics, and growth of biotechnology hubs across GCC nations, Israel, and Turkey. Increased investment in research collaborations, improving healthcare access, and government focus on precision medicine provide further momentum. However, uneven infrastructure across countries creates challenges for uniform adoption of ligase enzymes.

Africa

The Africa market generated USD 4.10 million in 2018, rose to USD 5.44 million in 2024, and is projected to reach USD 7.58 million by 2032, expanding at a 4.2% CAGR. Growth is supported by rising awareness of molecular diagnostics, increasing healthcare investments, and expanding use in South Africa and Egypt. High disease prevalence drives adoption, though limited biotechnology infrastructure and affordability constraints slow market penetration. International partnerships and training initiatives are expected to gradually strengthen capabilities, creating long-term opportunities for enzyme adoption.

Market Segmentations:

Market Segmentations:

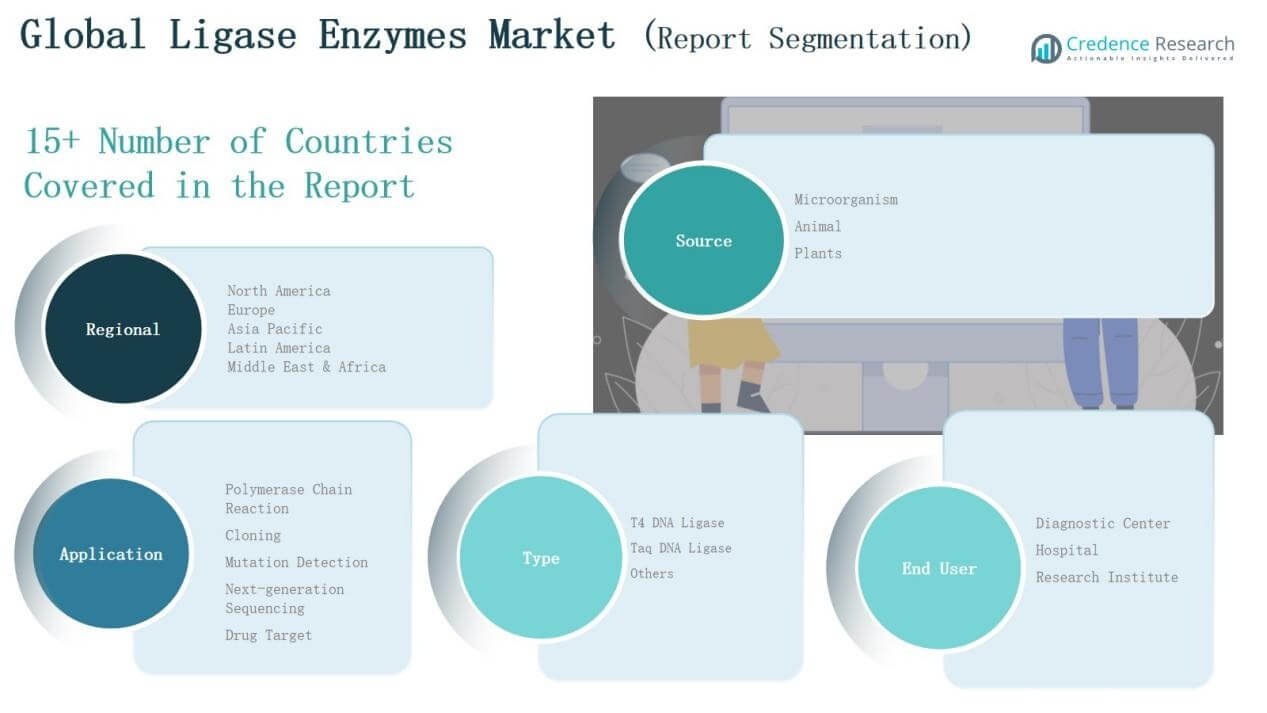

By Type

- T4 DNA Ligase

- Taq DNA Ligase

- Others

By Application

- Polymerase Chain Reaction (PCR)

- Cloning

- Mutation Detection

- Next-Generation Sequencing

- Drug Target

By Source

- Microorganism

- Animal

- Plant

By End User

- Diagnostic Centers

- Hospitals

- Research Institutes

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Global Ligase Enzymes Market is moderately consolidated, with leading players focusing on innovation, product diversification, and partnerships to strengthen their market presence. Companies such as Abclonal Inc., New England Biolabs, Promega Corporation, Enzynomics Co. Ltd, Canvax, Thermo Fisher Scientific, Takara Bio Inc., LGC Biosearch Technologies, Creative Enzymes, and Amano Enzyme dominate through robust product portfolios and established distribution networks. These players invest heavily in R&D to develop advanced ligase enzymes that deliver higher efficiency, stability, and compatibility across diverse applications, including PCR, cloning, sequencing, and diagnostics. Strategic collaborations with academic institutions and pharmaceutical companies further support innovation and market expansion. Emerging players are leveraging niche offerings and cost-effective solutions to penetrate developing markets. Competition is also shaped by the growing demand for next-generation sequencing and personalized medicine, compelling companies to enhance their technological capabilities. Overall, the market reflects intense rivalry, with innovation and strategic partnerships as key success factors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Abclonal Inc.

- New England Biolabs

- Promega Corporation

- Enzynomics Co. Ltd.

- Canvax

- Thermo Fisher Scientific

- Takara Bio Inc.

- LGC Biosearch Technologies

- Creative Enzymes

- Amano Enzyme

- Other Key Players

Recent Developments

- In December 2023, Kerry Group plc acquired a lactase enzymes business to expand its enzyme portfolio.

- In 2024, ArcticZymes Technologies, known for novel enzymes supporting next-generation sequencing and isothermal amplification methods, continued to advance product innovations for molecular diagnostics.

- In October 2024, Pfizer and Triana Biomedicines entered a collaboration to develop molecular glue degraders using E3 ligases.

- In January 2024, Almac Sciences expanded its selectAZyme™ portfolio by introducing an RNA Ligase kit for therapeutic oligonucleotide synthesis.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Source, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for ligase enzymes will rise with expanding genetic testing and diagnostics.

- Growth in personalized medicine will strengthen the use of ligase-based sequencing.

- Pharmaceutical and biopharmaceutical research will increasingly integrate ligase enzymes.

- Advancements in next-generation sequencing will expand application opportunities.

- Enzyme engineering will improve stability and efficiency for broader adoption.

- Emerging economies will see rising investments in biotechnology and molecular biology.

- Collaborations between industry and academic institutions will accelerate product innovation.

- Healthcare modernization in developing regions will boost adoption of ligase enzymes.

- Competition from alternative genome editing tools will shape innovation strategies.

- Strategic partnerships and global distribution networks will remain critical for market growth.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: