Market Overview

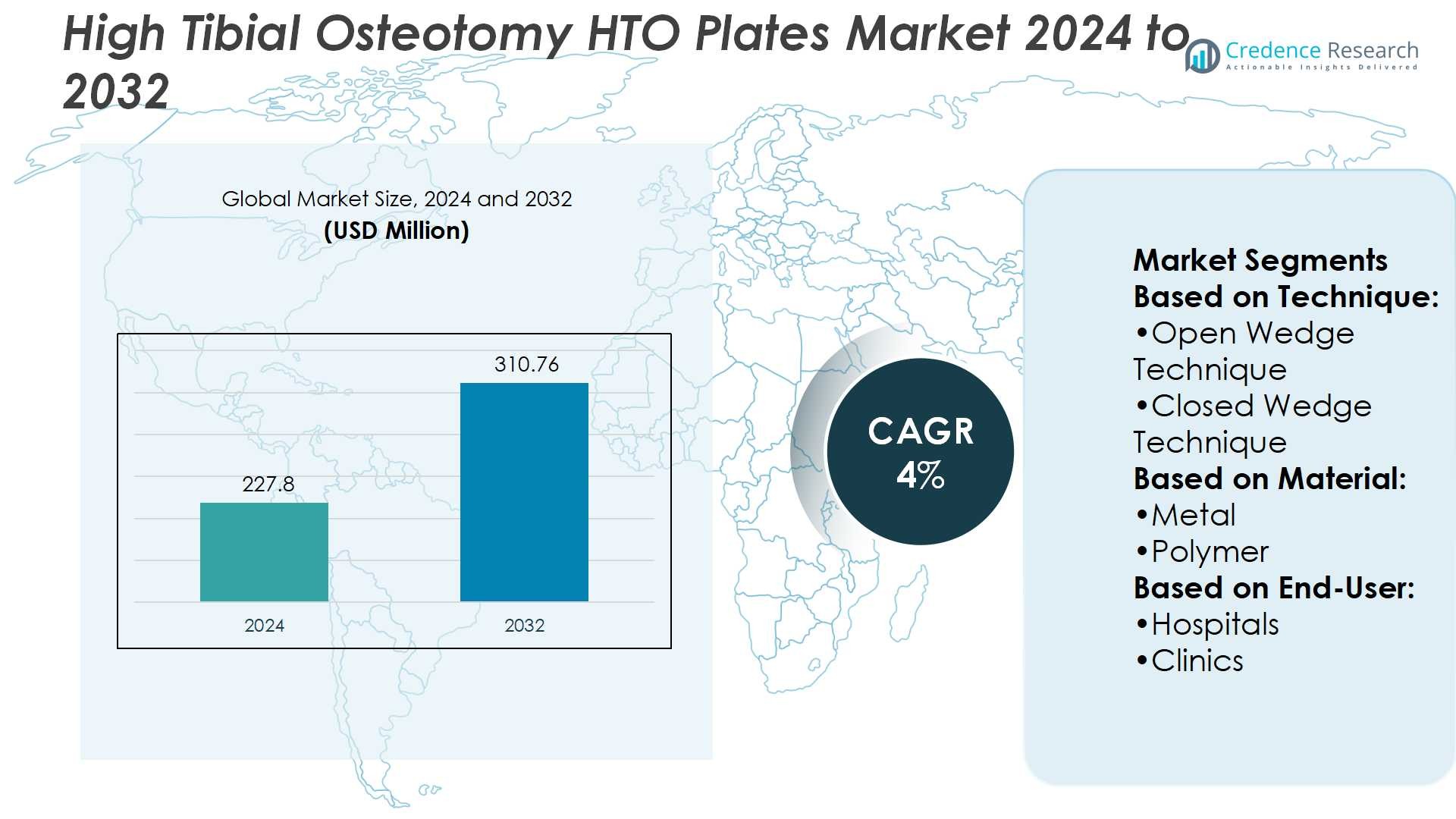

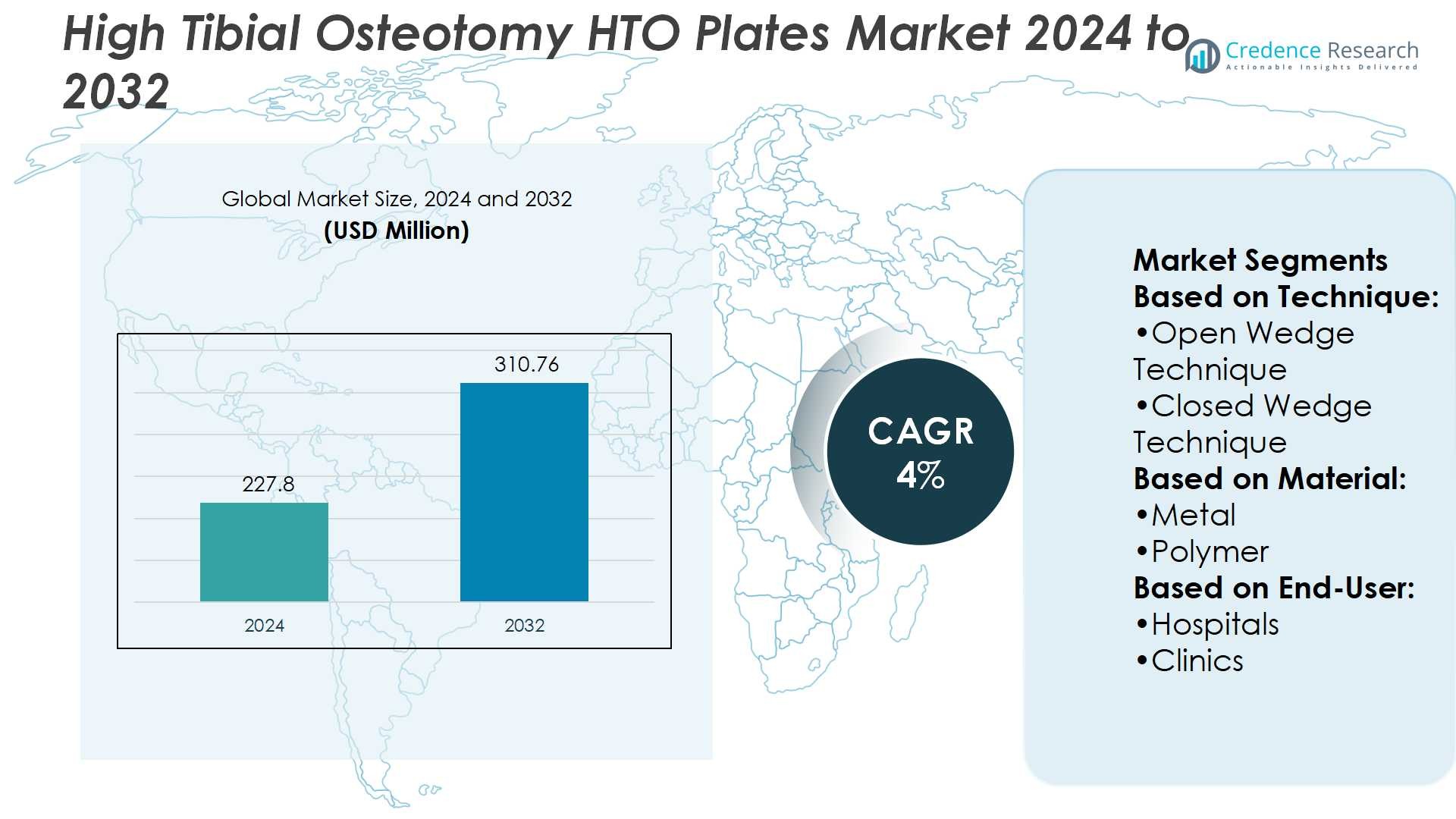

High Tibial Osteotomy HTO Plates Market size was valued at USD 227.8 million in 2024 and is anticipated to reach USD 310.76 million by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Tibial Osteotomy HTO Plates Market Size 2024 |

USD 227.8 Million |

| High Tibial Osteotomy HTO Plates Market, CAGR |

4% |

| High Tibial Osteotomy HTO Plates Market Size 2032 |

USD 310.76 Million |

The High Tibial Osteotomy (HTO) Plates Market grows due to rising knee osteoarthritis prevalence and increasing demand for minimally invasive orthopedic surgeries. Technological advancements in plate design, including anatomical shaping, locking mechanisms, and biocompatible materials, enhance surgical outcomes and patient recovery. The market benefits from growing geriatric populations and active lifestyles, which increase the need for joint-preserving procedures. Surgeons increasingly prefer HTO plates for accuracy, stability, and reduced complications. Additionally, trends such as patient-specific instrumentation, enhanced imaging guidance, and integrated rehabilitation solutions further drive adoption, while ongoing research and development focus on improving durability and optimizing biomechanical performance.

The High Tibial Osteotomy (HTO) Plates Market shows strong presence in North America, holding the largest share due to advanced healthcare infrastructure and high adoption of orthopedic surgeries. Europe follows with significant demand driven by an aging population and well-established surgical facilities. Asia Pacific is the fastest-growing region, supported by increasing knee osteoarthritis cases and expanding healthcare investments. Key players driving the market include Stryker, Zimmer Biomet, NuVasive, Johnson & Johnson Services, Smith & Nephew, Medtronic, Arthrex, Globus Medical, Össur, and Integra LifeSciences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Tibial Osteotomy (HTO) Plates Market was valued at USD 227.8 million in 2024 and is expected to reach USD 310.76 million by 2032, growing at a CAGR of 4%.

- Rising prevalence of knee osteoarthritis and demand for minimally invasive surgeries drive market growth.

- Technological advancements in plate design, including anatomical shaping, locking mechanisms, and biocompatible materials, improve surgical outcomes.

- Surgeons increasingly prefer HTO plates for accuracy, stability, and reduced post-surgical complications.

- Patient-specific instrumentation, enhanced imaging guidance, and integrated rehabilitation solutions are emerging trends supporting adoption.

- North America holds the largest market share due to advanced healthcare infrastructure, while Europe shows steady demand and Asia Pacific grows fastest with increasing healthcare investments.

- Key players such as Stryker, Zimmer Biomet, NuVasive, Johnson & Johnson Services, Smith & Nephew, Medtronic, Arthrex, Globus Medical, Össur, and Integra LifeSciences compete through innovation and product development, while high costs and surgical risks remain potential market restraints.

Market Drivers

Rising Prevalence of Osteoarthritis and Knee Deformities Driving Demand

The High Tibial Osteotomy HTO Plates Market expands steadily due to the rising incidence of osteoarthritis and knee deformities. Growing cases among aging populations create strong demand for corrective surgical solutions. Patients seek alternatives that delay total knee replacement, boosting preference for osteotomy procedures. HTO plates provide stability and faster rehabilitation, which makes them essential in treatment. Increasing awareness among patients and physicians strengthens adoption rates. It continues to position the market as a reliable segment within orthopedic surgery.

- For instance, in a study of 23 patients using 3D-planning and patient-specific instruments with generic HTO systems, the planned hip-knee-ankle (HKA) correction was 9.7° ± 2.6°, and the actual postoperative correction was 8.9° ± 3.2°.

Growing Preference for Minimally Invasive Procedures

Surgeons favor minimally invasive approaches, and this preference fuels the need for advanced HTO plates. Modern plates offer anatomical design, angular stability, and enhanced fixation strength, reducing complications. These benefits encourage hospitals and clinics to prioritize adoption. Patients also prefer shorter recovery times and reduced hospital stays, supporting procedure growth. It highlights the role of innovation in shaping market acceptance. This trend ensures sustained momentum across both developed and developing healthcare systems.

- For instance, in the same Arthrex study, 30% of patients experienced a lateral cortical hinge fracture, but no non-union occurred and only 1.2% showed clinically relevant loss of correction ≥ 3 mm at one year.

Technological Advancements and Product Innovation Strengthening Market Expansion

Continuous advancements in plate design and materials drive significant growth opportunities. Titanium and stainless steel options provide strength, durability, and compatibility with bone structures. Enhanced locking mechanisms improve surgical accuracy and long-term outcomes. Companies invest in R&D to deliver solutions tailored to patient needs. It encourages competitive differentiation through product portfolios. Growing surgeon confidence in advanced technologies strengthens the High Tibial Osteotomy HTO Plates Market outlook.

Rising Healthcare Infrastructure Investments Supporting Accessibility

Expanding healthcare infrastructure worldwide directly supports wider adoption of HTO plates. Government programs and private investments increase access to orthopedic surgeries in emerging economies. Hospitals equip operating rooms with advanced implants and tools, improving procedure success. Rising insurance coverage and reimbursement options further strengthen patient adoption rates. It expands opportunities in markets with growing middle-class populations. The supportive ecosystem fosters long-term demand stability across global regions.

Market Trends

Increasing Adoption of Customized and Patient-Specific Implants

The High Tibial Osteotomy HTO Plates Market records a strong shift toward customized and patient-specific implants. Surgeons adopt solutions designed to match individual anatomy, ensuring higher accuracy. Tailored plates improve load distribution, enhancing long-term joint stability. Hospitals integrate such implants to reduce revision surgeries and improve patient satisfaction. It supports efficiency in surgical planning and execution. The trend drives higher demand among specialized orthopedic centers.

- For instance, a study using the TOKA personalised HTO system in 25 patients reported that difference between planned and achieved hip-knee-ankle (HKA) correction was 2.1° (SD ± 2.0°) and between planned and achieved posterior tibial slope (PTS) was 0.2° (SD ± 0.4°).

Rising Demand for Minimally Invasive and Faster Recovery Solutions

Minimally invasive surgery continues to dominate preference, and HTO plates align with this requirement. Smaller incisions reduce blood loss and hospital stay durations, attracting more patients. Surgeons select advanced plates that provide strong fixation with fewer complications. It drives adoption in both high-income and emerging healthcare markets. Growing focus on rapid rehabilitation supports this direction. The shift highlights the importance of innovation in plate design and placement techniques.

- For instance, a study optimizing the design of short HTO plates compared “optimized short plate” and “long plate (TomoFix)” in models with 10 mm opening wedge gaps; the optimized short plate exhibited micromotion under loading at 0.52 mm vs 1.23 mm for the conventional short plate.

Integration of Biocompatible and Advanced Materials in Plate Manufacturing

Manufacturers invest heavily in the use of advanced materials for HTO plates. Titanium alloys and bioresorbable composites enhance strength and reduce risks of rejection. Improved compatibility lowers post-surgery complications and accelerates healing. It strengthens surgeon confidence in newer systems and widens patient acceptance. R&D activities center on improving performance while lowering long-term costs. The High Tibial Osteotomy HTO Plates Market benefits from ongoing breakthroughs in biomaterials.

Expanding Role of Digital Technologies in Surgical Planning

Digital tools and imaging systems play a vital role in osteotomy procedures. Preoperative planning software improves plate alignment and ensures surgical precision. Surgeons rely on 3D imaging to visualize bone correction angles effectively. It reduces errors and increases success rates across varied patient profiles. Hospitals adopt digital platforms to streamline workflows and improve consistency. Growing reliance on such technologies strengthens the long-term position of this market.

Market Challenges Analysis

High Risk of Surgical Complications and Revision Procedures

The High Tibial Osteotomy HTO Plates Market faces challenges linked to surgical risks and revision needs. Complications such as infection, nerve damage, and non-union limit wider acceptance. Patients may experience post-surgery pain or implant failure, raising concerns for surgeons. Revision surgeries increase costs and recovery times, discouraging some candidates. It highlights the importance of careful patient selection and skilled execution. Hospitals must address these risks to maintain confidence in osteotomy procedures.

Limited Access in Emerging Economies and High Cost of Implants

High costs of implants and surgical procedures restrict adoption across low- and middle-income countries. Limited insurance coverage prevents many patients from accessing advanced HTO plates. Hospitals in emerging regions often lack specialized equipment and trained orthopedic surgeons. It delays the adoption of innovative solutions, widening the treatment gap. Price sensitivity impacts procurement decisions, limiting growth opportunities in developing healthcare systems. The High Tibial Osteotomy HTO Plates Market must overcome these barriers to ensure broader availability.

Market Opportunities

Expanding Demand for Advanced Orthopedic Solutions in Aging Populations

The High Tibial Osteotomy HTO Plates Market holds strong opportunities through rising demand from aging populations. Increasing prevalence of knee osteoarthritis drives patients to seek alternatives that delay total replacement. HTO procedures supported by advanced plates offer extended mobility and pain relief. Hospitals adopt innovative systems that improve fixation and reduce recovery periods. It creates prospects for manufacturers to expand in regions with high elderly populations. Growing awareness of joint preservation techniques further strengthens opportunity pipelines worldwide.

Growing Penetration of Technological Innovation and Emerging Markets

Ongoing innovation in implant design and materials presents favorable growth prospects for companies. Bioresorbable composites, titanium alloys, and 3D-printed plates open new possibilities in treatment. Surgeons embrace digital planning tools that enhance precision and reduce procedural risks. It supports wider adoption in specialized and general orthopedic centers. Expanding healthcare infrastructure in Asia Pacific, Latin America, and the Middle East creates untapped market opportunities. The High Tibial Osteotomy HTO Plates Market benefits from both technology-driven advances and new geographic reach.

Market Segmentation Analysis:

By Technique

The High Tibial Osteotomy HTO Plates Market is segmented by technique into open wedge, closed wedge, progressive callus distraction, chevron osteotomy, and dome technique. The open wedge technique dominates due to its precision in correcting deformities and reduced risk of neurovascular damage. Surgeons prefer this method for its ability to allow gradual correction and bone grafting when required. Closed wedge technique maintains relevance, especially in younger patients, due to its shorter healing time. Progressive callus distraction finds use in cases requiring controlled correction over time. Chevron and dome techniques serve specialized needs, though their usage remains lower compared to open and closed wedge approaches. It shows how diverse surgical requirements sustain demand across multiple techniques.

- For instance, another review comparing open vs closed wedge techniques in 2,084 knees (closed wedge) vs 578 knees (open wedge) showed 10-year survival of HTO in open wedge to be 91.6%, closed wedge 85.4%.

By Material

Segmentation by material includes metal and polymer plates. Metal plates, particularly titanium and stainless steel, hold the largest share due to superior strength, durability, and biocompatibility. Surgeons rely on these plates for high fixation stability and reduced risk of failure. Polymer-based plates, though less common, gain attention for their lightweight properties and potential in bioresorbable applications. Research continues to improve polymer strength and long-term performance, supporting their gradual adoption. It underlines the balance between proven reliability of metals and emerging interest in advanced polymers. The High Tibial Osteotomy HTO Plates Market benefits from innovation across both categories.

- For instance, in a cohort of 41 patients undergoing opening-wedge HTO, the all-PEEK (polymer) implant group (21 patients) showed no hardware removal, while in the metal plate group (20 patients), 4 patients required hardware removal.

By End-user

End-user segmentation includes hospitals and clinics. Hospitals dominate this segment due to advanced infrastructure, availability of orthopedic specialists, and higher surgical volumes. They adopt innovative implants and techniques, supported by better access to imaging and surgical planning tools. Clinics contribute to demand growth by offering HTO procedures in urban and semi-urban regions, catering to patients seeking cost-effective options. It strengthens accessibility and widens the treatment base across healthcare systems. Growth in clinics reflects rising investments in outpatient orthopedic services. The market demonstrates resilience by balancing high-volume hospital procedures with expanding clinical adoption.

Segments:

Based on Technique:

- Open Wedge Technique

- Closed Wedge Technique

Based on Material:

Based on End-User:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share in the High Tibial Osteotomy HTO Plates Market, accounting for 36% of the global revenue. Strong demand arises from the high prevalence of knee osteoarthritis and sports-related injuries. The region benefits from advanced healthcare infrastructure and high adoption of innovative orthopedic implants. Hospitals and specialized centers utilize open wedge and minimally invasive techniques widely, supported by the availability of advanced imaging and planning systems. Growing awareness among patients about delaying knee replacement further supports procedural volumes. It also gains momentum through continuous investment in R&D by leading manufacturers. Favorable reimbursement policies and a growing elderly population strengthen long-term prospects for this region.

Europe

Europe represents the second-largest share with 28% of the global market. Countries such as Germany, France, and the United Kingdom drive demand due to well-established healthcare systems and high surgical expertise. Surgeons across Europe favor advanced titanium and stainless-steel plates that improve outcomes and patient mobility. Rising aging demographics increase osteoarthritis cases, creating demand for corrective procedures that avoid total knee replacement. It expands through supportive government healthcare funding and reimbursement structures. The region also emphasizes medical training and adoption of precision-based digital planning tools. Growing focus on cost-effective yet advanced solutions keeps Europe a strong market base.

Asia Pacific

Asia Pacific captures 22% of the global High Tibial Osteotomy HTO Plates Market and emerges as the fastest-growing regional segment. Rising incidence of lifestyle-related joint disorders and expanding healthcare infrastructure fuel adoption. Countries such as China, Japan, South Korea, and India lead demand through rapid improvements in orthopedic services. Surgeons adopt both traditional and minimally invasive techniques, supported by increasing patient awareness. It also benefits from government initiatives to strengthen orthopedic care and enhance access to advanced implants. Expanding insurance coverage and affordability in private hospitals drive growth further. The region’s large aging population and growing medical tourism industry add significant opportunities.

Latin America

Latin America accounts for 8% of the market share. Brazil, Mexico, and Argentina are the primary contributors, with rising adoption of corrective knee surgeries. The region experiences gradual adoption of advanced plate designs due to improving hospital infrastructure and expanding orthopedic training programs. It faces cost constraints; however, growing middle-class populations support demand for high-quality surgical interventions. Governments invest in expanding healthcare coverage, which indirectly supports orthopedic procedures. Local distributors strengthen accessibility of implants across semi-urban and urban centers. Continuous awareness campaigns about joint preservation methods further improve regional adoption rates.

Middle East and Africa

The Middle East and Africa collectively hold 6% of the global share. Demand grows steadily, driven by increasing investments in healthcare infrastructure in Gulf countries such as Saudi Arabia and the UAE. South Africa also contributes, with rising demand for orthopedic procedures. It faces barriers due to high costs and limited access to specialized surgical expertise in rural areas. However, partnerships with global manufacturers improve availability of advanced implants across private hospitals. Growing focus on medical tourism in the Middle East offers opportunities for expansion. Gradual adoption in urban centers strengthens the foundation for future growth in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic (Ireland)

- Arthrex Inc. (U.S.)

- Johnson & Johnson Services, Inc. (U.S)

- Zimmer Biomet (U.S.)

- Integra LifeSciences (U.S.)

- Össur Corporate (Iceland)

- Globus Medical (U.S.)

- NuVasive, Inc. (U.S.)

- Smith & Nephew (U.S.)

- Stryker (U.S.)

Competitive Analysis

The High Tibial Osteotomy HTO Plates Market players include Stryker (U.S.), Johnson & Johnson Services, Inc. (U.S.), Zimmer Biomet (U.S.), Smith & Nephew (U.S.), Medtronic (Ireland), NuVasive, Inc. (U.S.), Arthrex Inc. (U.S.), Globus Medical (U.S.), Össur Corporate (Iceland), and Integra LifeSciences (U.S.). The High Tibial Osteotomy HTO Plates Market remains highly competitive, driven by continuous innovation and growing demand for advanced orthopedic solutions. Manufacturers focus on developing plates with improved fixation strength, precision, and patient-specific designs to enhance surgical outcomes. Technological advancements, including minimally invasive techniques and digital surgical planning, support faster recovery and reduced complication rates. The market also benefits from expanding adoption in emerging regions, where increasing awareness of joint preservation procedures drives growth. Regulatory compliance, product portfolio diversification, and cost-effectiveness remain critical factors for maintaining market position. It shows that innovation, clinical efficiency, and accessibility are central to sustaining growth in this evolving orthopedic segment.

Recent Developments

- In March 2025, Johnson & Johnson MedTech showcased advanced digital orthopaedics capabilities at AAOS 2025, highlighting the VELYS Robotic-Assisted Solution’s FDA clearance for unicompartmental knee arthroplasty and introducing the VOLT Plating System with dynamic compression and variable angle locking technology.

- In June 2024, Meril, a medical device manufacturer based in India, introduced MISSO, an indigenously developed surgical robotic technology. It is set to offer assistance to healthcare professionals during knee replacement surgeries in real-time.

- In October 2023, DePuy Synthes received U.S. FDA 510k clearance for its lower extremity anatomic plating system, TriLEAP. This modular system is specifically designed to meet the complex needs of podiatric medicine doctors, orthopedic surgeons, and specialists in foot & ankle care.

- In September 2023, Enovis (DJO, LLC) opened a new manufacturing facility in the U.S., which is dedicated to manufacturing reconstructive knee, hip, and shoulder implants.

Report Coverage

The research report offers an in-depth analysis based on Technique, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of minimally invasive surgical techniques will drive HTO plate demand globally.

- Increasing prevalence of knee osteoarthritis will expand the patient pool for HTO procedures.

- Technological advancements in plate design will enhance surgical precision and post-operative recovery.

- Growth in orthopedic centers and specialized clinics will support regional market expansion.

- Rising awareness among patients about joint preservation surgeries will boost procedure rates.

- Integration of patient-specific implants and preoperative planning tools will improve clinical outcomes.

- Expansion of reimbursement coverage in developed regions will increase treatment accessibility.

- Emerging markets will witness faster adoption due to growing healthcare infrastructure and investments.

- Strategic collaborations between manufacturers and hospitals will accelerate product distribution and adoption.

- Continuous R&D and innovation will introduce next-generation HTO plates with improved biomechanical properties.