Market Overview

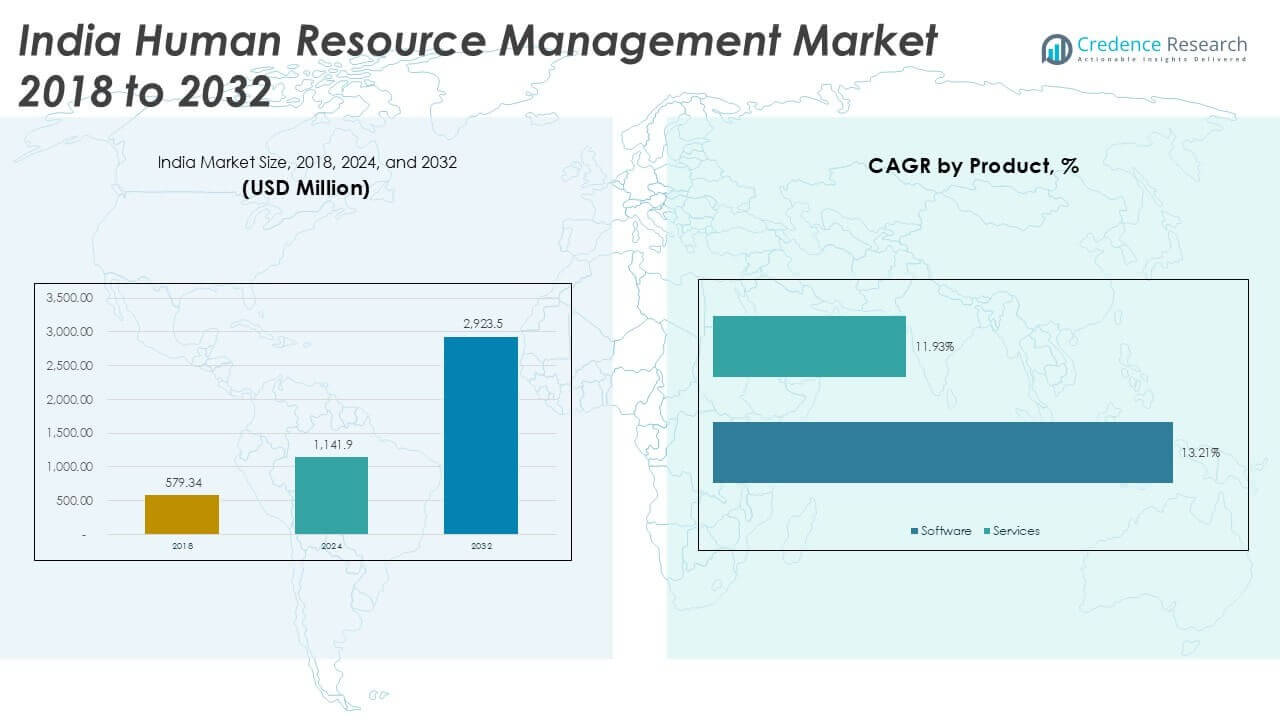

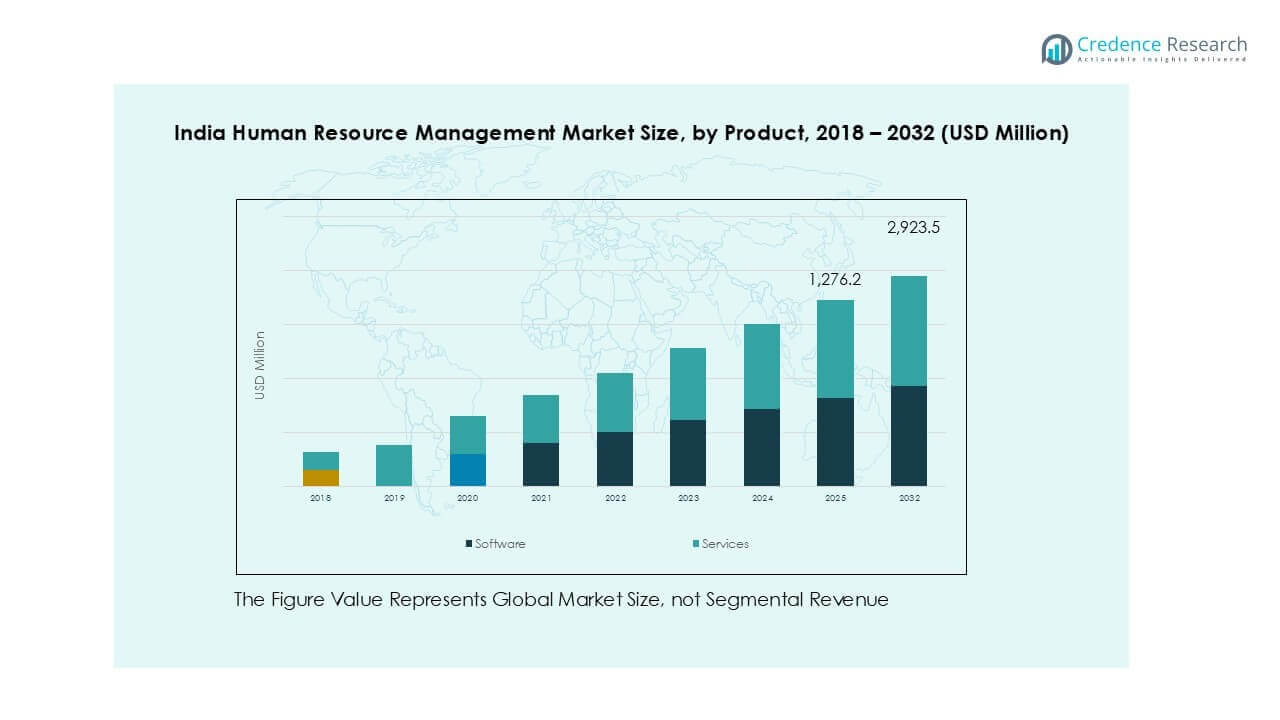

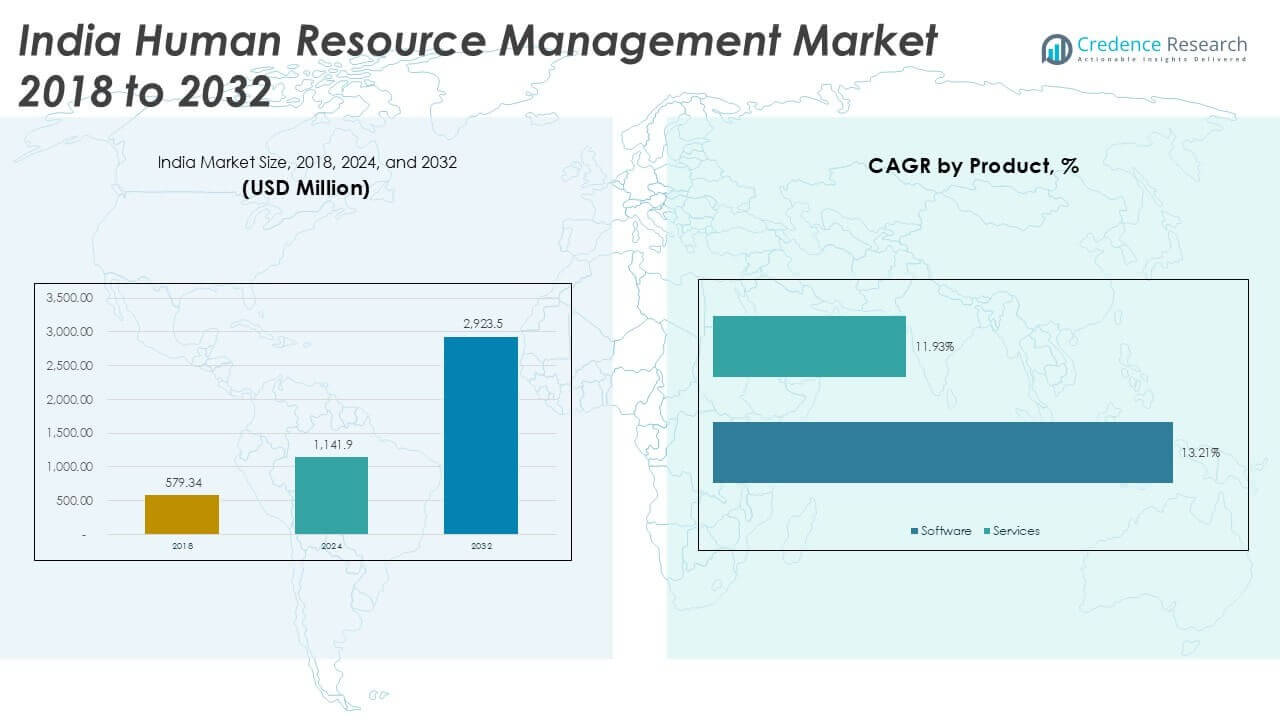

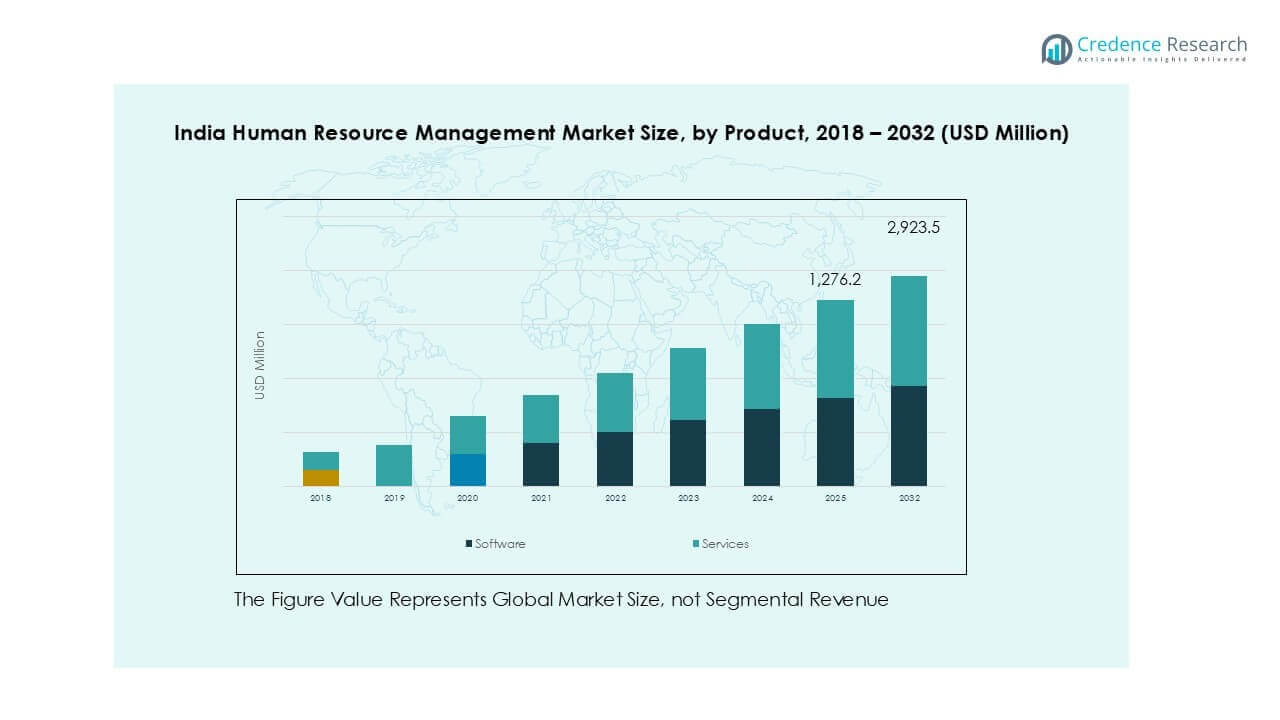

India’s human resource management market was valued at USD 579.34 million in 2018, reached USD 1,141.9 million in 2024, and is projected to hit USD 2,923.5 million by 2032. The market is expected to grow at a CAGR of 12.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Human Resource Management Market Size 2024 |

USD 1,141.9 Million |

| India Human Resource Management Market, CAGR |

12.47% |

| India Human Resource Management Market Size 2032 |

USD 2,923.5 Million |

The India human resource management market is driven by major players such as ADP, Darwinbox Digital Solutions Pvt. Ltd, Zoho People, Greytip Software Pvt. Ltd., PeopleStrong, and Keka Technologies. These companies lead with cloud-based HR software, payroll automation, and talent management platforms tailored for diverse enterprises. Global players like Randstad NV, Recruit Holdings Co., Ltd., and ManpowerGroup expand their reach through recruitment and workforce solutions. North India leads the market with a 35% share, supported by strong enterprise presence and digital adoption. West India follows with 28%, driven by BFSI and IT hubs, while South India holds 25% with dominance in IT and startups.

Market Insights

Market Insights

- The India human resource management market was valued at USD 1,141.9 million in 2024 and is projected to reach USD 2,923.5 million by 2032, growing at a CAGR of 12.47%.

- Growth is driven by rising adoption of cloud-based HR solutions, demand for payroll automation, and focus on employee engagement and compliance management across enterprises.

- Key trends include AI-driven talent analytics, mobile-first HR platforms, and integration of self-service modules to improve workforce productivity and employee experience.

- Competitive landscape features players like ADP, Darwinbox, Zoho People, PeopleStrong, and Keka Technologies, focusing on innovation, partnerships, and scalable SaaS offerings to target SMEs and large enterprises.

- North India leads with 35% market share, followed by West India at 28%, South India at 25%, and East India at 12%; software holds over 65% share by product, and cloud deployment dominates with 70% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

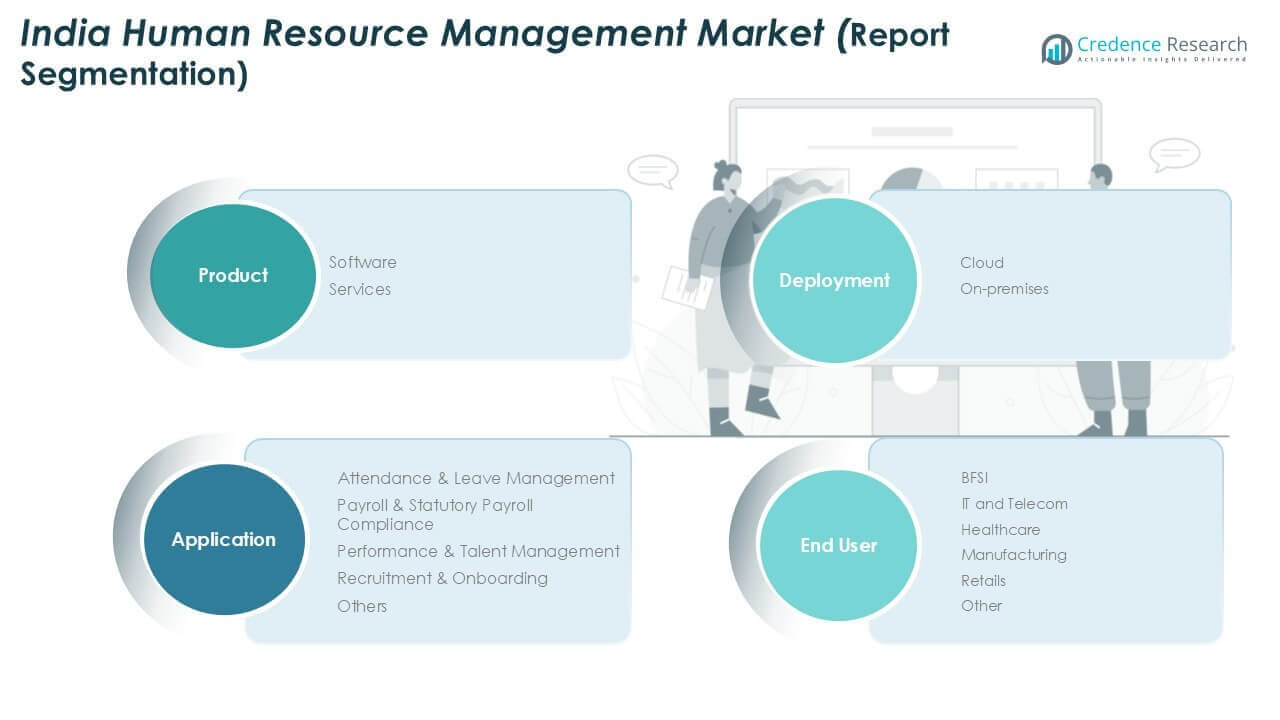

Market Segmentation Analysis:

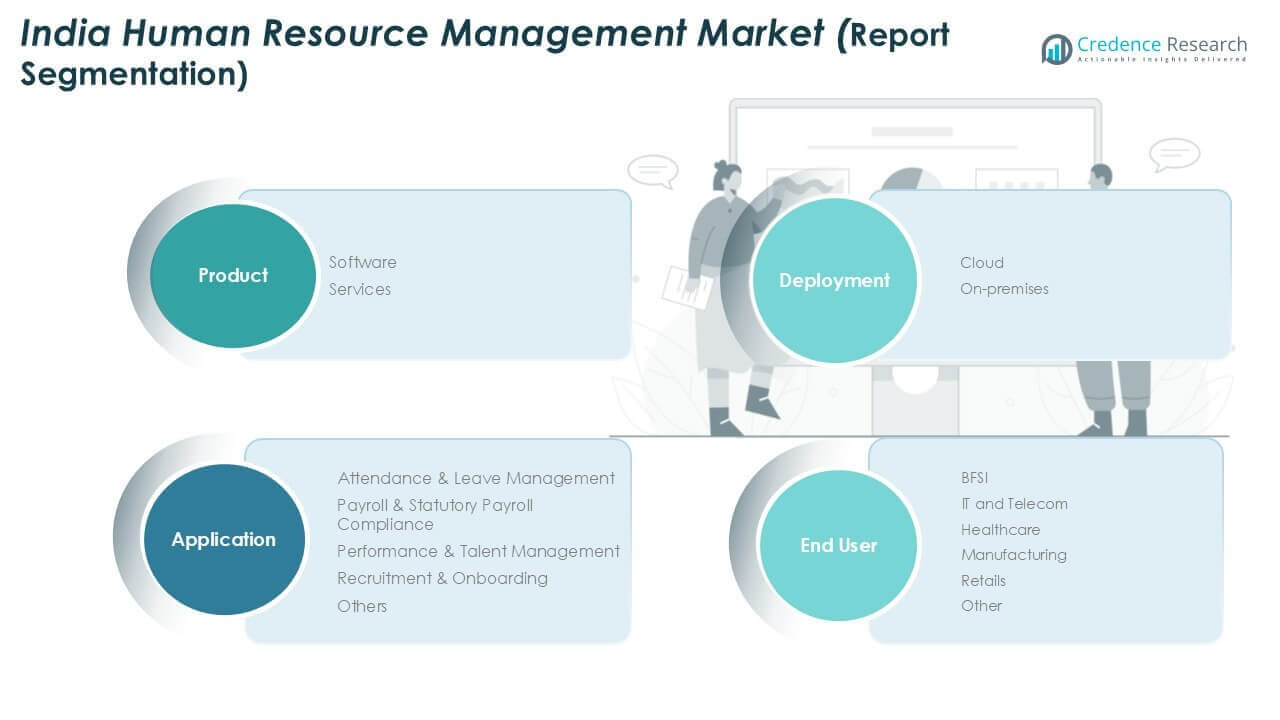

By Product

Software dominated the India human resource management market, accounting for over 65% share in 2024. Growth is driven by rising demand for integrated HR platforms offering automation, analytics, and mobile accessibility. Organizations are investing in cloud-based HR software to streamline workflows, reduce manual errors, and enhance employee experience. Services segment is also growing steadily as companies seek managed HR solutions, consulting, and support to optimize workforce processes. The adoption of software solutions is further supported by India’s growing SME sector and increased focus on digitizing HR operations.

- For instance, in 2024, Darwinbox’s cloud HR platform served over 3 million employees across more than 900 enterprises in 130+ countries.

By Application

Payroll & statutory payroll compliance held the largest share of over 35% in 2024, driven by strict government labor regulations and the need for accurate compliance reporting. Companies are prioritizing automated payroll systems to minimize errors, improve transparency, and ensure timely salary disbursement. Attendance and leave management solutions are witnessing strong adoption, supported by hybrid work models and demand for real-time tracking. Performance and talent management, along with recruitment and onboarding, are expanding due to rising focus on employee engagement, retention, and AI-driven hiring tools. These applications are becoming key enablers of workforce productivity.

- For instance, Keka claims its HR application supports a workforce numbering 2.5 million employees, and the company automates statutory compliance for Indian businesses. Keka is popular among Indian SMEs and startups.

By Deployment

Cloud deployment leads the market with over 70% share in 2024, supported by scalability, cost-efficiency, and remote access capabilities. Organizations prefer cloud solutions to enable seamless HR operations across multiple locations and support remote workforce needs. Cloud-based platforms also offer faster implementation, automatic updates, and data security compliance, making them attractive for SMEs and large enterprises alike. On-premises deployment continues to serve companies with strict data privacy requirements, but its growth is slower due to higher maintenance costs and limited flexibility compared to cloud-based solutions.

Key Growth Drivers

Regulatory Compliance and Payroll Accuracy

Strict labor laws and compliance mandates in India are pushing organizations to adopt automated payroll and compliance tools. These solutions reduce risks of penalties, ensure timely salary disbursals, and maintain accurate statutory filings. Businesses are increasingly investing in systems that integrate payroll, tax calculation, and government compliance modules. Digital adoption is further supported by initiatives such as Digital India, which promote business process automation. This growing emphasis on compliance and error-free operations drives HR solution providers to offer highly reliable and localized products for Indian enterprises.

- For instance, GreytHR processed payroll for over 1.5 million employees in India in 2024, automating compliance filings for more than 20,000 businesses each month.

Adoption of Cloud-Based HR Solutions

Cloud-based HR solutions dominate the market, offering scalability, cost savings, and real-time access to data. Indian enterprises are shifting from manual systems to digital platforms to streamline HR processes. These solutions help organizations manage remote workforces, ensure data security, and integrate multiple HR functions on one platform. Cloud adoption is particularly strong among SMEs seeking affordable and flexible HR systems, driving demand. Vendors providing AI-powered analytics, mobile apps, and seamless compliance tracking are further accelerating adoption across industries and boosting overall market growth.

- For instance, in 2024, Zoho demonstrated strong growth in India, with its various cloud solutions, including Zoho People, driving customer expansion, particularly among small and medium-sized businesses (SMEs).

Focus on Employee Experience and Retention

Companies are prioritizing employee engagement and retention, creating demand for advanced HR solutions. Platforms offering performance management, learning modules, and feedback tools help improve workplace satisfaction and reduce attrition. Rising competition for skilled talent across IT, BFSI, and manufacturing sectors is encouraging businesses to invest in talent management systems. Organizations are using data-driven insights to monitor employee well-being and improve workforce planning. This focus on employee experience is a critical driver fueling steady HR technology adoption across mid-sized and large enterprises in India.

Key Trends & Opportunities

Key Trends & Opportunities

Rise of AI and People Analytics

AI-powered HR tools are transforming decision-making by providing predictive insights on workforce trends. Companies use analytics to forecast attrition, assess employee performance, and optimize recruitment strategies. Chatbots and AI assistants are streamlining employee queries and onboarding processes, reducing HR workload. This trend creates opportunities for vendors offering data-driven platforms tailored for Indian business needs. Demand is expected to grow among large enterprises seeking actionable insights to enhance productivity and improve human capital management.

- For instance, HirePro, an AI-based recruitment platform operating in India, utilizes its technology to help enterprise clients screen large numbers of candidate profiles and improve their time-to-hire.

Expansion of Mobile-First HR Platforms

The growing mobile workforce and smartphone penetration in India are driving adoption of mobile-first HR solutions. Employees prefer self-service apps for leave requests, payroll access, and performance tracking. Companies are investing in mobile-enabled systems to improve accessibility and engagement across distributed teams. This trend supports higher adoption rates, especially among SMEs and startups operating with flexible and remote work models. It also opens opportunities for vendors providing lightweight, cost-effective, and scalable HR platforms optimized for mobile use.

- For instance, ZingHR’s mobile app supports HR operations for “over 1,200+ enterprise customers” across India, the Middle East, Africa, and Southeast Asia. The company reports over 2.8 million users of its mobile app.

Key Challenges

High Implementation and Integration Costs

Despite strong growth prospects, high upfront costs for HR software deployment challenge smaller businesses. Integration with legacy systems often demands additional investment and technical expertise. For cost-sensitive SMEs, these expenses can delay adoption or limit them to partial solutions. Vendors must address this challenge by offering affordable subscription models and simplified implementation processes to capture this price-sensitive segment of the Indian market.

Data Security and Privacy Concerns

Handling sensitive employee information raises significant data privacy and security concerns. Cybersecurity risks, data breaches, and compliance with India’s data protection regulations create adoption barriers. Companies demand assurance of secure storage, encryption, and adherence to legal requirements. Providers must invest in advanced security frameworks and transparent data handling practices to build trust with enterprises and ensure smooth adoption of cloud-based HR solutions.

Regional Analysis

North India

North India held the largest share of around 35% of the human resource management market in 2024. The region benefits from a strong presence of IT, BFSI, and manufacturing hubs across Delhi NCR, Haryana, and Uttar Pradesh. Organizations in the region are rapidly adopting cloud-based HR software to streamline payroll compliance and workforce management. The growing startup ecosystem and adoption of digital transformation initiatives also contribute to market expansion. Government programs promoting digitization and skill development further support the demand for integrated HR platforms across small, medium, and large enterprises in North India.

West India

West India accounted for nearly 28% of the market share in 2024, driven by its thriving commercial centers in Maharashtra and Gujarat. Large enterprises and multinational corporations in Mumbai and Pune are leading adopters of advanced HR technologies. The region’s strong presence in BFSI, manufacturing, and IT sectors fuels demand for payroll automation and talent management solutions. West India is also seeing rising adoption among mid-sized firms, driven by the availability of cost-effective cloud solutions. Focus on compliance, productivity improvement, and employee experience further boosts market penetration in this part of the country.

South India

South India captured approximately 25% of the India human resource management market in 2024. The region’s dominance in IT and IT-enabled services, particularly in Bengaluru, Hyderabad, and Chennai, drives demand for advanced HR systems. Companies are adopting AI-enabled recruitment tools, performance tracking solutions, and mobile-first HR applications to manage large, distributed workforces. The region also benefits from high technology awareness and digital infrastructure, encouraging early adoption of cloud solutions. Demand is further supported by a large pool of SMEs and startups looking to streamline operations, improve employee engagement, and maintain statutory compliance efficiently.

East India

East India represented around 12% of the market share in 2024, showing steady growth driven by emerging industries and infrastructure development. Organizations in Kolkata, Bhubaneswar, and other growing urban centers are beginning to invest in HR software to replace manual processes. Adoption is mainly focused on payroll and compliance management solutions to meet government regulations. The region’s market potential is expanding as more mid-sized companies digitize HR functions to improve productivity and employee retention. Supportive government policies and the availability of affordable, cloud-based solutions are expected to accelerate adoption in the coming years.

Market Segmentations:

Market Segmentations:

By Product

By Application

- Attendance & Leave Management

- Payroll & Statutory Payroll Compliance

- Performance & Talent Management

- Recruitment & Onboarding

- Others

By Deployment

By End User

- BFSI

- IT and Telecom

- Healthcare

- Manufacturing

- Retails

- Others

By Geography

- North India

- West India

- South India

- East India

Competitive Landscape

The India human resource management market is moderately fragmented, with key players such as ADP, Darwinbox Digital Solutions Pvt. Ltd, Greytip Software Pvt. Ltd., Zoho People, PeopleStrong, and Keka Technologies competing for market share. These companies focus on providing cloud-based HR platforms, payroll automation, and AI-enabled talent management solutions to meet the needs of enterprises of all sizes. International firms like Randstad NV, Recruit Holdings Co., Ltd., and ManpowerGroup strengthen their presence through recruitment services and workforce management solutions. Local players are increasingly innovating with mobile-first, affordable offerings targeting SMEs. Strategic partnerships, funding rounds, and product enhancements remain common, with players introducing features like AI chatbots, predictive analytics, and integrated compliance modules to attract clients. This competitive environment fosters continuous innovation, helping enterprises streamline HR operations and improve employee engagement, ultimately accelerating digital adoption across India’s growing HR technology landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, ADP introduced “ADP Assist,” a generative AI-enabled HR assistant that simplifies payroll, benefits, and compliance work. The solution offers real-time insights, automates responses to employee questions, and enhances decision-making for HR professionals, making them more productive and engaged.

- In 2024, Workday solidified its leadership in the Human Resources Management market, by growing its Workday Human Capital Management (HCM) adoption among large retailers to attract and retain high-performing frontline employees. The company also deepened its workforce management capabilities, such as scheduling, talent optimization, and payroll, to enhance employee engagement, productivity, and operational efficiency.

- In 2024, SAP launched AI-powered innovations in its SuccessFactors HCM suite to advance talent management and workforce planning. The new features include a sophisticated talent intelligence hub that combines third-party skills data for a single employee skills profile, enhancing career development and strategic workforce planning. The new SAP SuccessFactors Career and Talent Development solution also enables employees to connect career growth objectives to organizational requirements. AI-driven capabilities, including AI-supported 360-degree feedback and onboarding support through SAP’s AI copilot Joule, also enhance employee experience and decision-making.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Deployment, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, driven by digital transformation and HR automation adoption.

- Cloud-based HR platforms will remain the preferred choice for enterprises of all sizes.

- AI and predictive analytics will become integral for talent management and workforce planning.

- Mobile-enabled HR solutions will gain popularity with the rise of remote and hybrid work models.

- SMEs will increasingly adopt affordable SaaS-based HR tools to streamline operations.

- Demand for payroll and compliance automation will rise with stricter labor regulations.

- Integration of HR systems with enterprise software will improve decision-making and efficiency.

- Employee experience platforms will see higher demand to boost engagement and retention.

- Data security and privacy solutions will become a priority for HR technology providers.

- Regional adoption will expand, with higher penetration expected in East India and Tier 2 cities.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: