Market Overview:

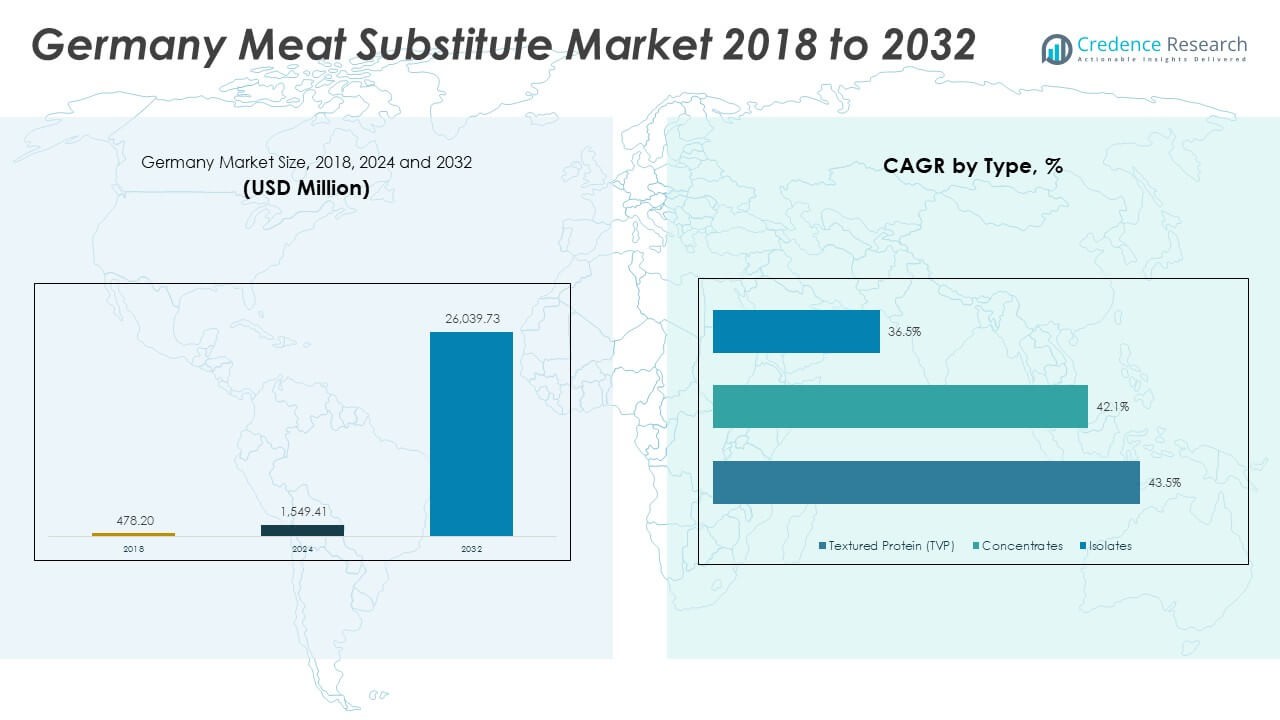

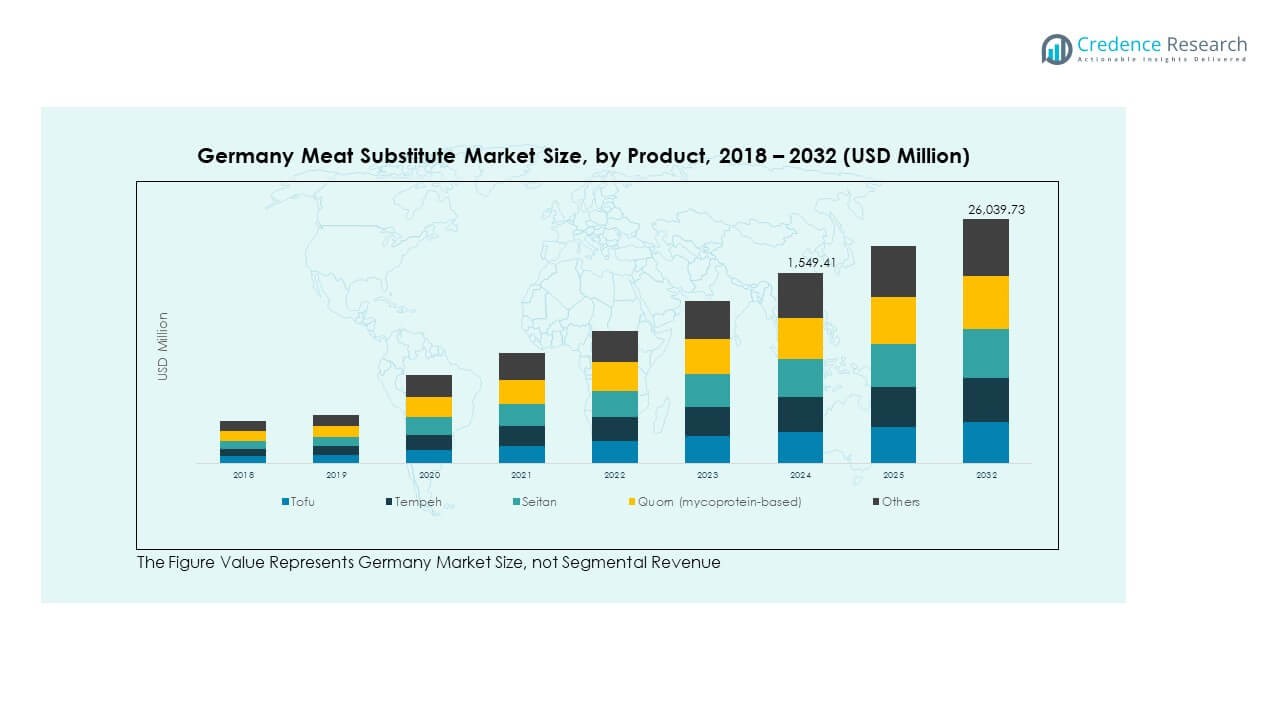

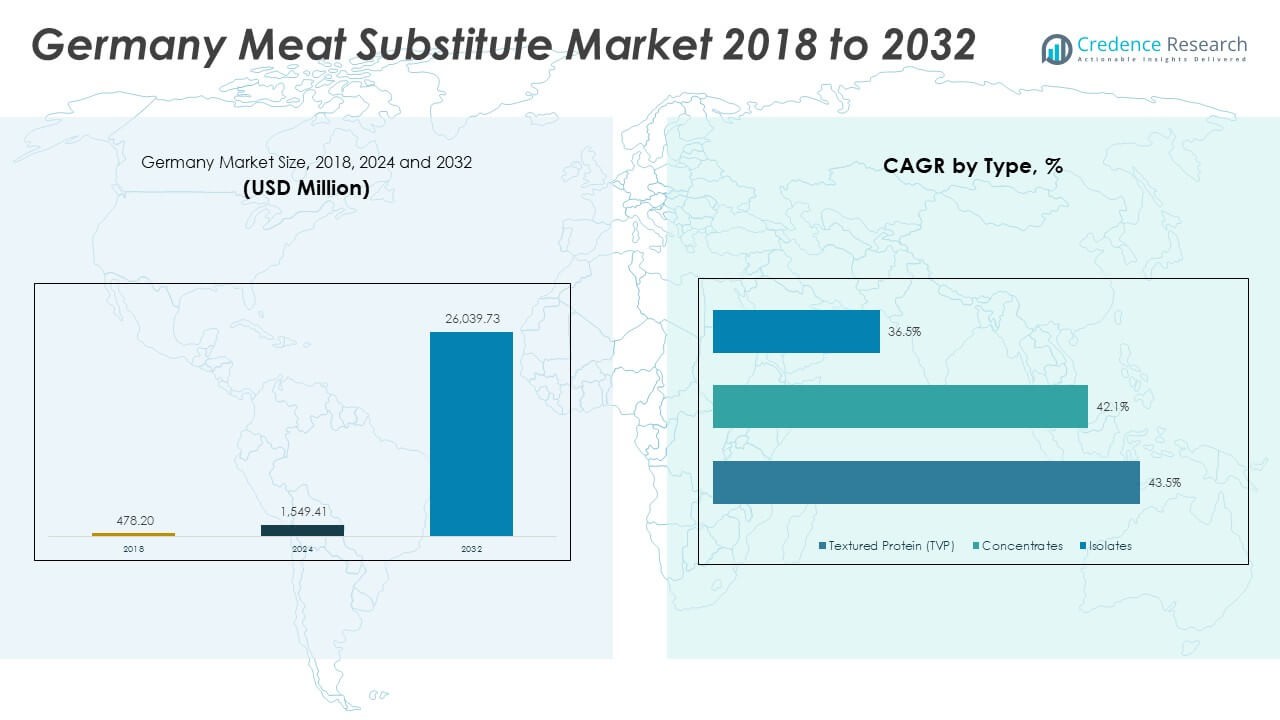

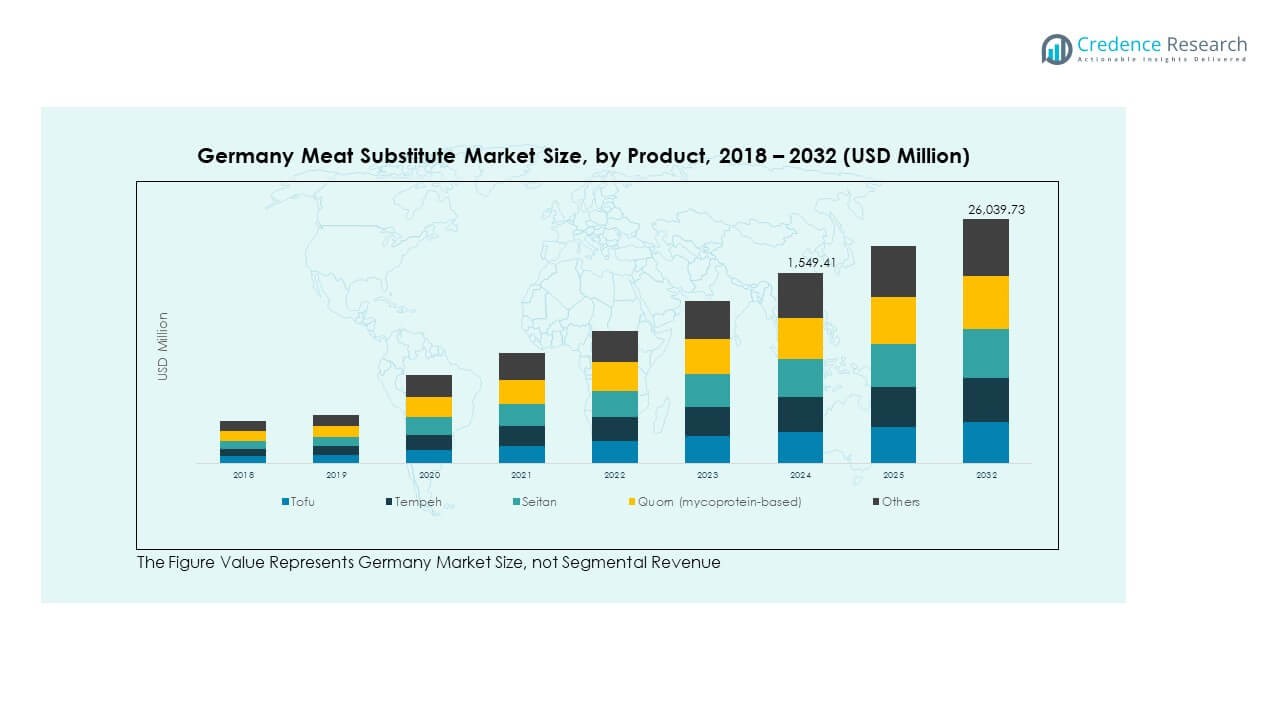

The Germany Meat Substitute Market size was valued at USD 478.20 million in 2018 to USD 1,549.41 million in 2024 and is anticipated to reach USD 26,039.73 million by 2032, at a CAGR of 42.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Meat Substitute Market Size 2024 |

USD 1,549.41 Million |

| Germany Meat Substitute Market, CAGR |

42.29% |

| Germany Meat Substitute Market Size 2032 |

USD 26,039.73 Million |

Growth in the Germany Meat Substitute Market is driven by rising vegetarian and flexitarian populations, growing health awareness, and increasing demand for sustainable diets. Consumers are adopting plant-based products to reduce carbon footprints and improve health outcomes. Food manufacturers are innovating with improved taste, texture, and nutritional profiles, making substitutes more appealing. Government support for sustainability and climate goals also accelerates adoption. Expanding retail presence, partnerships with foodservice providers, and aggressive marketing further strengthen the sector. These factors collectively push strong consumer acceptance and industry expansion.

Regionally, urban centers such as Berlin, Hamburg, and Munich are leading adoption due to younger populations, higher awareness, and diverse consumer preferences. Western Germany shows stronger growth driven by dense retail networks and advanced food processing infrastructure. Eastern regions are emerging markets, fueled by rising affordability and increasing exposure to plant-based diets. Demand from restaurants, retail chains, and online stores is broadening product reach nationwide. With cultural openness to innovation, Germany is positioned as a leader in Europe for plant-based food adoption, while smaller cities and rural areas represent untapped opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Meat Substitute Market was valued at USD 478.20 million in 2018, reached USD 1,549.41 million in 2024, and is projected to hit USD 26,039.73 million by 2032, growing at a CAGR of 42.29%.

- Western Germany led with a 46% share in 2024 due to advanced retail networks, Southern Germany followed with a 28% share supported by innovation hubs, and Eastern and Northern Germany together contributed 26% with growing awareness and distribution.

- Eastern Germany is the fastest-growing region with a 12% share in 2024, driven by rising affordability, retail expansion, and increasing adoption among younger consumers.

- By product, tofu accounted for 32% share in 2024, supported by its traditional presence and versatile use in plant-based diets.

- Quorn (mycoprotein-based) captured 21% share in 2024, driven by demand for innovative protein options and consumer preference for meat-like textures.

Market Drivers:

Rising Health Awareness And Shift Toward Plant-Based Diets

The Germany Meat Substitute Market is gaining momentum as consumers prioritize health and wellness. People are reducing red meat intake due to concerns over cholesterol, obesity, and cardiovascular diseases. Plant-based substitutes offer lower fat and higher fiber, making them an attractive option. Younger generations are particularly receptive to vegan and vegetarian diets. Demand for cleaner labels and nutrient-rich ingredients is pushing producers to innovate. Food companies are investing in alternatives with balanced protein and essential vitamins. The overall market is strengthened by rising awareness of nutrition-focused lifestyles.

- For instance, Rügenwalder Mühle, a leading German brand, reported that since 2022, approximately 60% of its revenue comes from plant-based alternatives, with six of its products ranking among the 13 most successful in 2024, demonstrating strong consumer acceptance and product innovation.

Environmental Concerns Driving Sustainable Consumption

Growing awareness of climate change has increased demand for sustainable diets. The Germany Meat Substitute Market is benefiting from consumers aiming to reduce carbon footprints. Traditional meat production is linked to emissions, water use, and deforestation. Plant-based substitutes provide an eco-friendly alternative with less environmental impact. Many consumers are choosing products aligned with sustainability values. Retailers highlight eco-labels and certifications to promote greener consumption. This alignment with global climate goals reinforces long-term industry growth. The sector continues to benefit from Germany’s strong focus on environmental protection.

- For instance, in 2024, Germany produced 126,500 tonnes of plant-based meat substitute products, marking a 4% increase over the previous year, indicative of growing consumer preference for sustainable options.

Innovation In Taste, Texture, And Culinary Experience

The Germany Meat Substitute Market is supported by constant product innovation. Companies are improving taste and texture to resemble conventional meat. Advances in processing technologies enable better flavor, juiciness, and mouthfeel. Plant-based burgers, sausages, and nuggets attract both vegetarians and flexitarians. Consumers demand substitutes that deliver authentic culinary experiences. Foodservice chains are integrating plant-based items to expand choices for customers. Positive feedback and repeat purchases enhance market acceptance. Innovation ensures that substitutes meet diverse culinary expectations and dietary needs.

Expanding Retail And Foodservice Distribution Channels

The Germany Meat Substitute Market is boosted by broader retail and foodservice availability. Supermarkets dedicate larger shelf space to plant-based categories. Online platforms offer easy access and subscription services for vegan products. Restaurants and fast-food chains increasingly feature plant-based menus. Food delivery services amplify reach and visibility across urban centers. Convenience and accessibility are encouraging more frequent consumer purchases. Strong promotional campaigns and discounts support growing sales volumes. The sector benefits from rising visibility across multiple distribution channels.

Market Trends:

Integration Of Alternative Protein Sources In Product Development

The Germany Meat Substitute Market is witnessing expansion through diverse protein sources. Companies are moving beyond soy to explore pea, chickpea, wheat, and fava beans. This diversification addresses allergen concerns and dietary preferences. Blends of plant proteins are enhancing nutritional content and taste. Innovations also include fermentation-based proteins for better functionality. Hybrid products combining plant-based and cultured ingredients are emerging. Consumers are showing interest in new protein sources offering superior digestibility. These developments strengthen long-term industry resilience and variety.

Premiumization And Focus On Clean-Label Products

The Germany Meat Substitute Market is shaped by rising demand for premium and clean-label goods. Consumers prefer substitutes free from artificial preservatives and additives. Transparency in labeling builds trust and supports purchasing decisions. Premium products highlight organic certifications and non-GMO ingredients. Brands emphasize natural flavors and high-quality sourcing to attract health-conscious buyers. Minimal processing and short ingredient lists resonate strongly with German consumers. Clean-label positioning aligns with regulatory support and public expectations. Premiumization drives higher margins and brand differentiation.

- For instance, Rügenwalder Mühle’s Veganes Mühlen Hack, made with 100% German soy, upholds clean-label standards and is one of their bestsellers, illustrating consumer demand for authentic and high-quality plant-based products.

Expansion Into Ready-To-Eat And Convenience Formats

The Germany Meat Substitute Market is expanding with ready-to-eat offerings. Busy lifestyles are driving demand for quick, nutritious meal solutions. Companies launch frozen meals, pre-seasoned products, and microwave-ready snacks. These options appeal to working professionals, students, and families seeking convenience. Foodservice outlets also adapt menus to include ready-to-eat substitutes. Packaging innovations enhance shelf life and portability. Growing popularity of convenience aligns with Germany’s urban and fast-paced consumer base. Ready-to-eat formats are now a key growth engine for the industry.

Collaboration Between Startups And Established Food Giants

The Germany Meat Substitute Market is evolving with collaborations between startups and established players. Startups bring innovation, agility, and fresh ideas to product development. Large corporations provide capital, distribution networks, and manufacturing scale. Partnerships accelerate time-to-market for new launches and broaden consumer reach. Investments in joint R&D enhance product quality and diversity. Co-branding strategies expand visibility in competitive retail environments. Such alliances strengthen market confidence and increase brand credibility. Collaboration is positioning the industry for sustained growth and global competitiveness.

Market Challenges Analysis:

High Production Costs And Pricing Pressures

The Germany Meat Substitute Market faces challenges linked to high production costs and pricing. Developing substitutes with advanced technologies requires significant investment. Premium ingredients and innovative formulations often increase expenses. Consumers sometimes view substitutes as expensive compared to traditional meat. Price sensitivity in certain consumer segments restricts adoption. Companies must balance affordability with quality to retain competitiveness. Scaling up production is essential to achieve cost reductions. The market is striving to overcome these barriers through efficiency improvements and resource optimization.

Consumer Skepticism And Taste Acceptance Barriers

The Germany Meat Substitute Market also faces skepticism about taste and nutritional quality. Some consumers believe substitutes cannot fully match the flavor of real meat. Concerns about processing levels and additives create hesitation among buyers. Older demographics often prefer conventional meat despite awareness of health impacts. Marketing campaigns need to focus on building trust and awareness. Educational efforts highlighting nutritional benefits are becoming essential. Restaurants and retailers play a key role in encouraging trial. Consumer acceptance remains a critical challenge for broader market penetration.

Market Opportunities:

Rising Flexitarian Population And Lifestyle Shifts

The Germany Meat Substitute Market is positioned to benefit from growing flexitarian lifestyles. Consumers adopting partial meat reduction are creating sustained demand for substitutes. These buyers prefer variety, flavor, and accessibility in plant-based foods. Retailers are responding with broader assortments and innovative products. Companies have an opportunity to expand penetration in mainstream diets. Marketing campaigns targeting this demographic can boost awareness. Expanding partnerships with foodservice outlets further strengthens the market’s reach.

Technological Innovation And Product Diversification

The Germany Meat Substitute Market is advancing through technology-driven innovation. Developments in fermentation and extrusion are improving texture and functionality. Companies explore cultured and blended proteins to meet evolving expectations. Diversification across snacks, frozen meals, and gourmet offerings widens consumer appeal. Export potential into neighboring European markets provides added growth opportunities. Brands investing in continuous R&D are better positioned to capture new segments. The sector’s future lies in innovation-driven differentiation and global expansion.

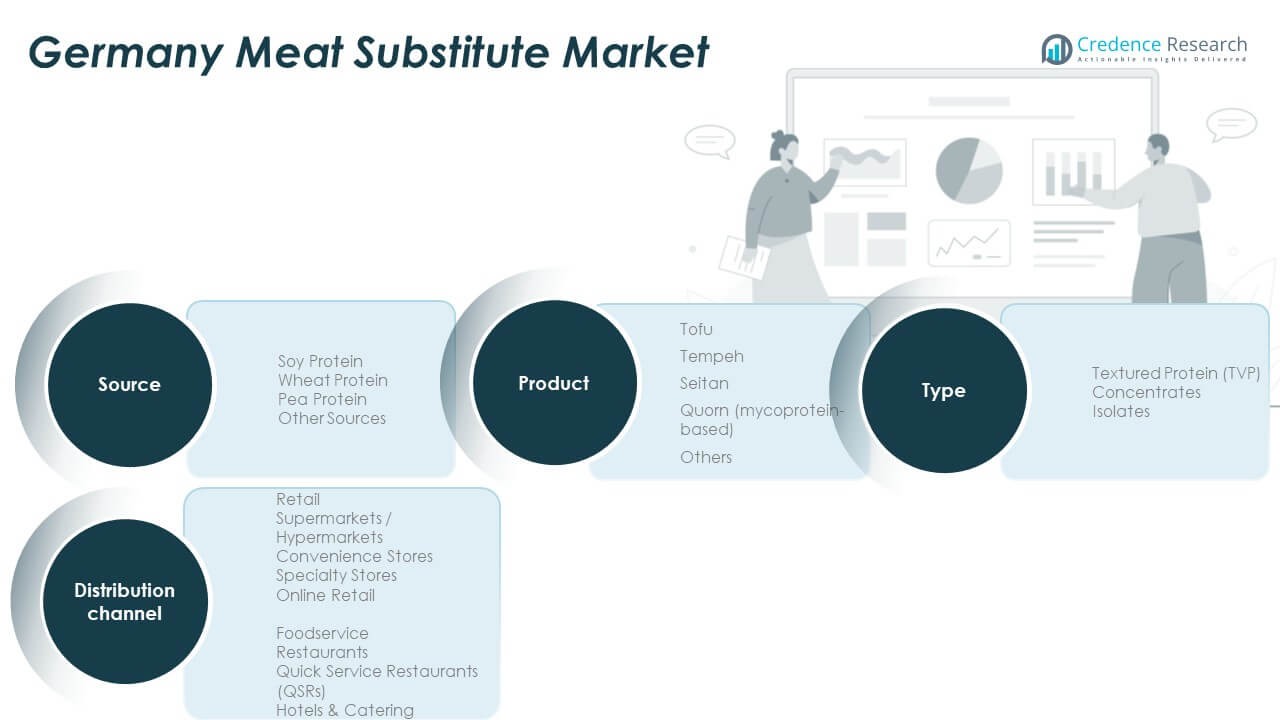

Market Segmentation Analysis:

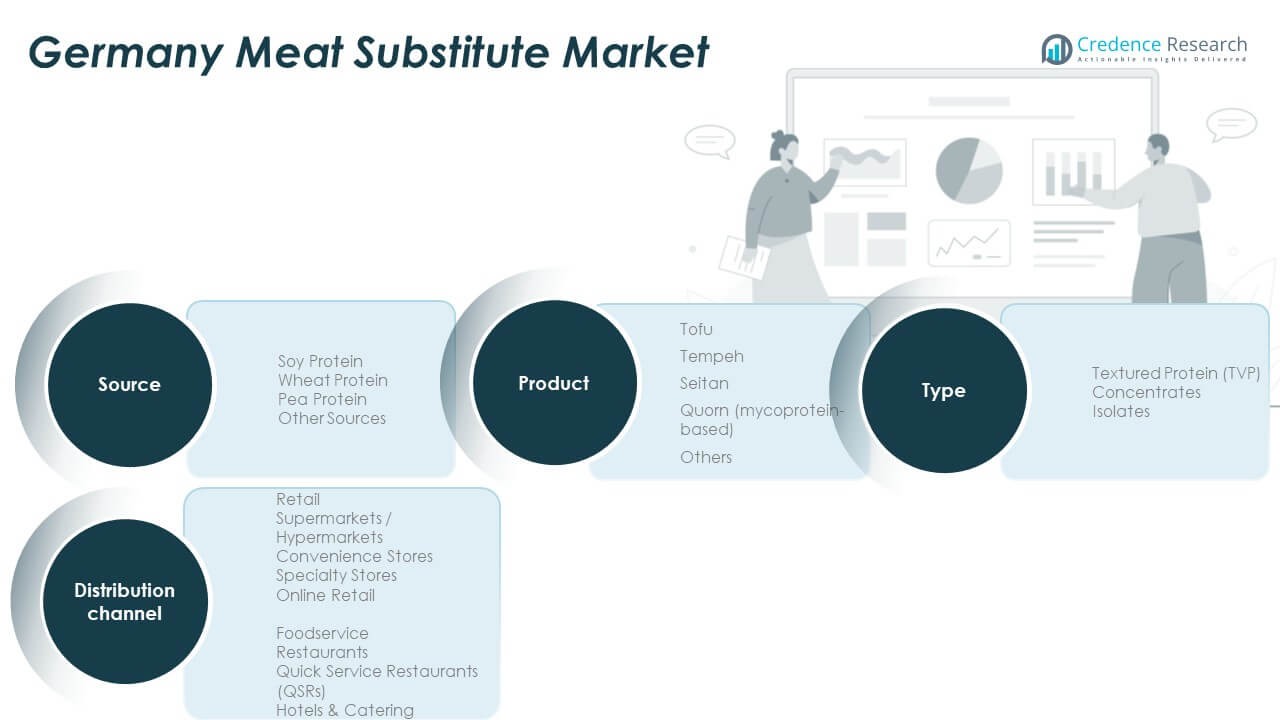

By Type and Source

The Germany Meat Substitute Market is segmented by type into textured protein (TVP), concentrates, and isolates. TVP holds the leading share due to its wide application in burgers, sausages, and ready meals. Concentrates are growing steadily, driven by their balance of functionality and affordability. Isolates, with higher protein purity, are expanding demand among health-conscious consumers. By source, soy protein dominates the market owing to its established use and availability. Wheat protein follows, supported by its versatility in bakery and meat-like textures. Pea protein is gaining traction with allergen-friendly properties, while other sources enhance product diversification.

- For example, the market saw production increases in soy- and pea-based protein products, with soy still maintaining dominance due to its solid supply chain and application range.

By Product

In product segmentation, tofu remains a traditional and widely consumed option, while tempeh is gaining popularity for its nutritional benefits. Seitan shows strong adoption among consumers seeking meat-like texture in plant-based meals. Quorn, based on mycoprotein, has established a strong foothold with its unique positioning. Other niche products such as jackfruit-based substitutes and innovative blends expand variety. The product mix reflects consumer preference for both traditional and innovative solutions. It supports a broad base of flexitarian, vegetarian, and vegan consumers across Germany.

- For instance, in 2021, the production of meat substitutes—including products like tofu sausages, seitan steaks, and veggie burgers—in Germany increased by 17% compared to the previous year, reaching 97,900 tons.

By Distribution Channel

Distribution segmentation highlights retail as the primary channel, with supermarkets and hypermarkets leading sales through strong shelf presence. Specialty stores provide premium offerings and attract niche buyers, while convenience stores contribute to accessible purchases. Online retail is rapidly expanding with subscription models and direct-to-consumer sales. Foodservice plays a crucial role, with restaurants and quick service restaurants promoting trial and acceptance. Hotels and catering services expand demand by incorporating substitutes into diverse menus. This multi-channel presence ensures consistent visibility and consumer reach across the Germany Meat Substitute Market.

Segmentation:

By Type

- Textured Protein (TVP)

- Concentrates

- Isolates

By Source

- Soy Protein

- Wheat Protein

- Pea Protein

- Other Sources

By Product

- Tofu

- Tempeh

- Seitan

- Quorn (mycoprotein-based)

- Others

By Distribution Channel

- Retail

- Supermarkets / Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Foodservice

- Restaurants

- Quick Service Restaurants (QSRs)

- Hotels & Catering

Regional Analysis:

Western Germany Leading With Strong Market Share

Western Germany accounted for 46% of the Germany Meat Substitute Market in 2024, driven by strong retail infrastructure and consumer awareness. Major urban centers such as Cologne, Düsseldorf, and Frankfurt anchor demand through supermarkets, specialty stores, and foodservice outlets. The region benefits from higher disposable incomes and strong preference for sustainable products. Companies leverage dense distribution networks and advanced logistics to ensure product availability. Western Germany is also home to several leading plant-based producers, which strengthens supply consistency. Rising environmental awareness and government-backed sustainability programs reinforce consumer adoption. This region remains the dominant contributor to overall market expansion.

Southern Germany Emerging As A Growth Hub

Southern Germany represented 28% of the Germany Meat Substitute Market in 2024, led by cities such as Munich and Stuttgart. The region benefits from a strong cultural openness to culinary innovation and diverse consumer bases. Universities and research hubs in Bavaria support product innovation and technology-driven growth. Foodservice outlets and premium retailers are highly active in promoting plant-based alternatives. Southern Germany’s affluent population shows strong interest in organic and premium substitutes. The presence of health-conscious consumers is creating higher demand for tofu, tempeh, and other protein-rich offerings. It is evolving into a hub for both premium retail and innovation-driven development.

Eastern And Northern Germany Expanding With Growing Potential

Eastern and Northern Germany together accounted for 26% of the Germany Meat Substitute Market in 2024, showing steady growth potential. Eastern Germany, with cities like Leipzig and Dresden, is catching up due to rising affordability and exposure to plant-based diets. Northern Germany, including Hamburg and Bremen, benefits from strong port cities and foodservice trade. These regions are seeing gradual adoption supported by younger populations and expanding retail channels. Government sustainability initiatives are also boosting awareness and market penetration. Companies are focusing on increasing availability and improving consumer trust in substitutes. Both regions are expected to strengthen their contribution over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- LikeMeat

- Veganz Group

- Rügenwalder Mühle

- Amidori

- Greenforce

- Vantastic Foods

- Emsland Group

- Bene Meat Technologies (Germany operations)

- Berief Food

Competitive Analysis:

The Germany Meat Substitute Market is highly competitive with domestic players like LikeMeat, Veganz Group, and Rügenwalder Mühle leading innovation and market presence. International companies, including Beyond Meat and Nestlé, are strengthening portfolios through strategic investments and collaborations. Startups such as Greenforce and Amidori contribute agility by introducing novel product formats and protein sources. It is marked by continuous product development, marketing campaigns, and partnerships with retail and foodservice channels. Companies compete on price, taste, and nutritional profile, while sustainability remains a strong differentiator. Brand loyalty is evolving, driven by growing awareness of plant-based diets. The competitive landscape emphasizes innovation, accessibility, and sustainability.

Recent Developments:

- In August 2025, LikeMeat rebranded simply to “Like” and launched new flavors, including Like Beef Strips and Like Sweet & Chili. This expanded their product range to 15 plant-based meat alternatives, covering chicken, pork, beef, and spiced variants. The new products were supported by a large marketing campaign and retail sales support in Germany, aiming to strengthen their position as a leading brand in the chilled meat alternatives segment.

- In May 2025, Veganz Group signed a strategic partnership agreement with Jindilli Beverages Inc to bring their Mililk technology-based oat and almond drink products to North America and the Australia-New Zealand region. The deal includes production in Germany and export to these regions, with plans to launch plant-based creamers called Creamer Drops. Revenue from this partnership was expected to start contributing from Q3 2025.

- Rügenwalder Mühle retained its dominant position in Germany’s plant-based meat market with a 43.3% market share in Q1 2025. The company continued to grow through innovation, with six of its products ranked among the top 13 bestsellers in 2024, including its Vegan Hauchgenuss Classic – Chicken Style as the top product. This success was attributed to quality, taste, and brand leadership amidst a declining market sector.

- Veganz Group established a new company, Mililk FoodTech GmbH, in June 2025, to commercialize its patented 2D-printed food technology. Mililk FoodTech focuses on plant-based milk alternatives and aims to attract strategic investors in Q3 2025 for expansion. The company is scaling production capacity in both Europe and North America, with a goal to produce over 60 million liters of milk alternatives per year.

Report Coverage:

The research report offers an in-depth analysis based on type, source, product, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Meat Substitute Market will expand with broader consumer adoption across urban and rural areas.

- Rising flexitarian diets will continue to drive steady demand across retail and foodservice channels.

- Innovations in fermentation and hybrid protein products will reshape product portfolios.

- Retail distribution will strengthen with more shelf space dedicated to plant-based categories.

- Premiumization will support growth as consumers seek clean-label and organic substitutes.

- Partnerships between startups and established food manufacturers will accelerate innovation.

- Foodservice expansion, including QSRs and catering, will boost consumer acceptance.

- Regional adoption will balance as Eastern Germany catches up with Western regions.

- Sustainability positioning will remain central to brand differentiation and consumer trust.

- Technological advances will reduce production costs and improve affordability.