Market Overview

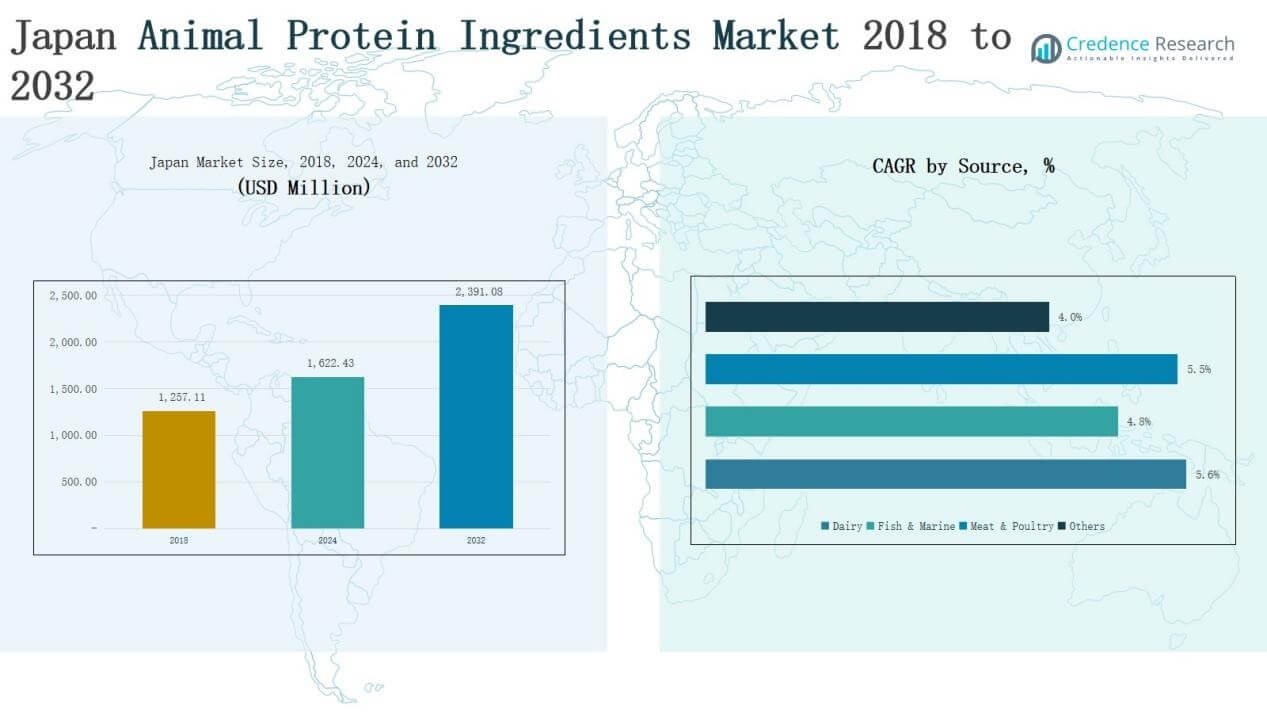

Japan Animal Protein Ingredients Market size was valued at USD 1,257.11 million in 2018, reaching USD 1,622.43 million in 2024, and is anticipated to grow to USD 2,391.08 million by 2032, at a CAGR of 4.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Animal Protein Ingredients Market Size 2024 |

USD 1,622.43 Million |

| Japan Animal Protein Ingredients Market, CAGR |

4.90% |

| Japan Animal Protein Ingredients Market Size 2032 |

USD 2,391.08 Million |

The Japan Animal Protein Ingredients Market features strong competition among global and domestic companies, with Arla Foods, ADM Trading Japan, Meiji, Cargill, Kemin Industries, Tyson Foods, Lacto, Prinova, Darling Ingredients, and Armor Proteines playing key roles. These firms maintain leadership through advanced processing technologies, diversified product portfolios, and expanding applications across nutrition, healthcare, and pet food. Innovation in functional proteins, sustainable sourcing practices, and strategic partnerships further strengthen their positions. Regionally, the Kanto region dominates the market with 38% share in 2024, supported by its large consumer base, advanced food processing industries, and rising demand for clinical and sports nutrition products.

Market Insights

- Japan Animal Protein Ingredients Market grew from USD 1,257.11 million in 2018 to USD 1,622.43 million in 2024 and is projected to reach USD 2,391.08 million by 2032, at a CAGR of 4.90%.

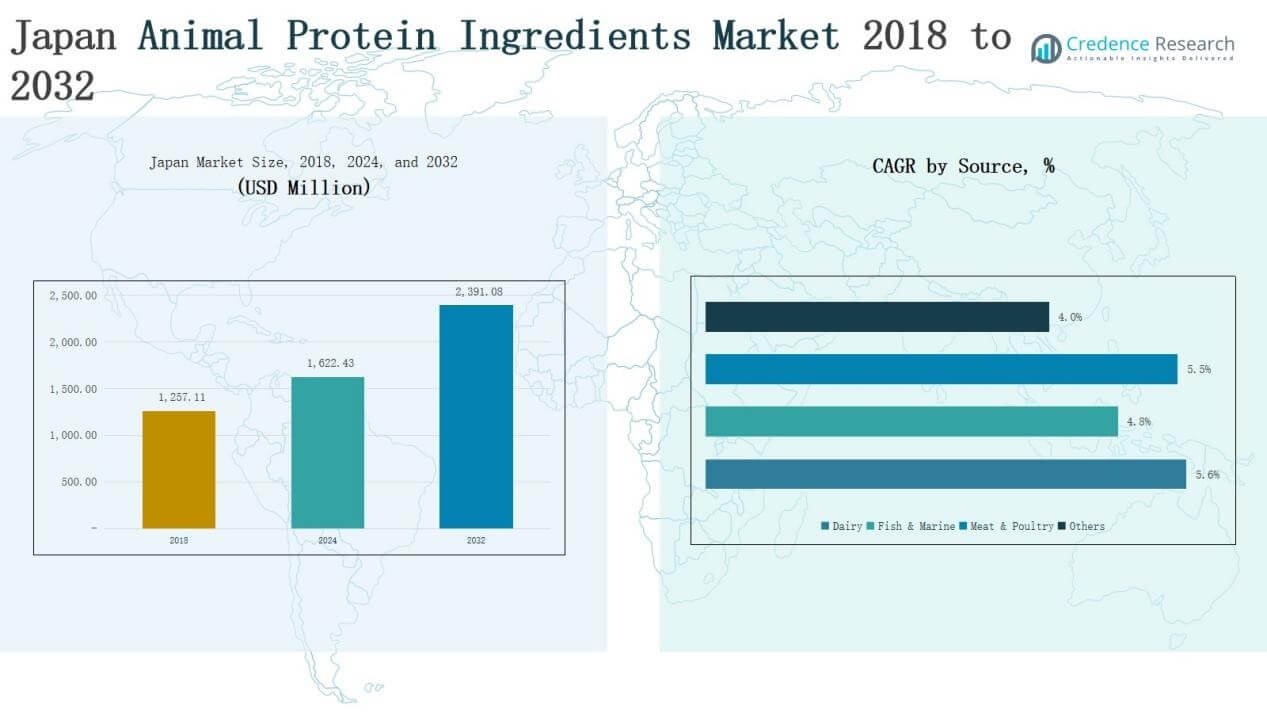

- Dairy leads by source with 40% share in 2024, supported by strong whey and casein demand, advanced dairy processing, and growing adoption of protein-enriched foods and beverages.

- Powders dominate by form with 55% share in 2024, driven by convenience, longer shelf life, and innovation in solubility enhancement, making them widely used in supplements and clinical products.

- Sports and active nutrition leads applications with 35% share in 2024, fueled by rising fitness awareness, protein-enriched diet adoption, and expanding demand from gyms and health-focused consumers.

- Kanto region holds the largest share at 38% in 2024, benefiting from Tokyo’s large consumer base, advanced food processing infrastructure, and rising demand for clinical and sports nutrition products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Source

Dairy dominates the Japan Animal Protein Ingredients Market with an estimated 40% share in 2024. Growth is supported by high consumer demand for whey and casein proteins in functional foods, clinical nutrition, and sports supplements. The segment benefits from Japan’s strong dairy processing industry, innovations in protein concentrates, and rising adoption of protein-enriched beverages. Fish & marine proteins follow, driven by collagen demand and the country’s established seafood sector.

For instance, Nippi Inc., a Japanese collagen manufacturer, expanded its fish-derived collagen peptide exports to Europe and the U.S., highlighting marine protein innovation from Japan’s seafood industry.

By Form

Powders account for the largest share, holding nearly 55% of the market in 2024. Their dominance comes from ease of formulation, longer shelf life, and wide application in supplements, beverages, and clinical products. Japan’s preference for convenient, ready-to-mix products supports growth, alongside innovation in microencapsulation and solubility enhancement. Granules/flakes and liquid/paste forms remain niche, catering mainly to specialized feed and medical uses.

FOr instance, Morinaga Milk Industry introduced a microencapsulated functional powder ingredient aimed at improving stability in clinical nutrition products.

By Application

Sports & active nutrition leads the market with about 35% share in 2024, reflecting the country’s rising fitness culture and growing consumption of protein shakes and bars. Increasing health awareness, aging population needs, and expanding gym memberships fuel this segment. Clinical & medical nutrition also shows strong growth, supported by Japan’s advanced healthcare system and focus on elderly care. Pet food and aquafeed further contribute, leveraging the country’s strong pet ownership and aquaculture base.

Key Growth Drivers

Rising Health and Wellness Awareness

The growing focus on preventive healthcare and balanced nutrition strongly drives demand for animal protein ingredients in Japan. Consumers increasingly associate protein intake with muscle health, weight management, and active lifestyles. Functional foods, fortified beverages, and protein supplements are gaining rapid acceptance, particularly among urban populations. Additionally, the aging demographic actively seeks protein-rich diets to prevent muscle loss and maintain mobility. This lifestyle shift ensures sustained demand for dairy, fish, and meat-based proteins in both retail and healthcare channels.

For instance, Meiji Co. expanded its Meiji SAVAS Whey Protein 100 series with a new functional protein powder targeting muscle recovery for middle-aged and elderly consumers.

Expansion of Clinical and Medical Nutrition

Japan’s advanced healthcare infrastructure and rising elderly population create a strong market for animal protein ingredients in medical applications. Clinical nutrition products enriched with dairy and fish-derived proteins are increasingly used in elderly care, hospital feeding, and rehabilitation programs. The government’s emphasis on reducing healthcare costs through preventive nutrition further supports adoption. Protein formulations tailored for easy digestion, solubility, and high bioavailability meet patient needs. This growth driver positions animal proteins as critical inputs in therapeutic and functional healthcare solutions.

For instance, Ajinomoto introduced Amino-Index Protein Diet Plus, a protein formulation for hospitals targeting elderly rehabilitation programs, emphasizing high digestibility and rapid absorption.

Increasing Pet Ownership and Aquaculture Industry Growth

The rise in pet ownership across Japan fuels demand for high-quality protein ingredients in pet food. Consumers prioritize nutritional value, premium formulations, and traceable ingredients for their pets, boosting usage of meat, poultry, and fish proteins. Simultaneously, Japan’s aquaculture sector is expanding, supported by seafood consumption trends and sustainability goals. Protein-based feed supplements are essential to enhance yield and fish health. Together, these developments broaden application opportunities for animal protein ingredients beyond human nutrition, ensuring diversified and resilient market growth.

Key Trends & Opportunities

Innovation in Functional Protein Products

Japan’s food and beverage industry is actively innovating with animal protein ingredients to meet rising consumer expectations for convenience and health benefits. New formulations such as ready-to-drink protein beverages, high-protein snacks, and functional powders are gaining popularity. Advances in processing technologies improve solubility, flavor, and shelf stability, enhancing consumer acceptance. Companies that focus on product differentiation and align with evolving lifestyles stand to capture greater market share, making innovation a central growth opportunity in the years ahead.

For instance, in Japan, Lacto Japan partnered with Leaft Foods in September 2025 to introduce Rubisco, a novel protein derived from green leaves, which replaces eggs in baked goods and enhances texture in dairy alternatives, meeting high consumer standards for quality and flavor.

Sustainability and Traceability in Supply Chains

Growing consumer concern over sustainability and ethical sourcing presents a key opportunity for animal protein suppliers in Japan. Brands that emphasize eco-friendly practices, transparent sourcing, and responsible farming methods gain consumer trust. Traceability systems ensuring safety, quality, and origin transparency are increasingly valued. With regulatory standards tightening and consumer awareness rising, companies that integrate sustainability certifications and innovative supply chain solutions will strengthen their competitiveness. This trend enhances brand reputation and supports long-term customer loyalty.

For instance, dsm-firmenich partnered with Zenkei Company Limited to implement the Sustell™ platform, an advanced life cycle assessment tool that helps measure and reduce the environmental footprint of egg and feed production.

Key Challenges

Volatile Raw Material Prices

Fluctuations in the cost of raw materials, including dairy, meat, and fish, present a major challenge for producers in Japan. Global supply disruptions, seasonal variations, and rising feed costs influence ingredient availability and pricing. These factors directly affect profit margins and increase production uncertainty. Companies must balance cost pressures with consumer expectations for affordability and quality. Strategic sourcing, partnerships with local suppliers, and investments in efficient production processes become crucial to managing this volatility effectively.

Intense Market Competition

The Japan animal protein ingredients market faces high competition among domestic players and multinational giants. Global firms leverage scale, advanced technology, and strong portfolios, while local companies compete on regional expertise and niche offerings. This environment creates pressure on pricing, product differentiation, and innovation cycles. Smaller players may struggle to maintain market presence without strategic collaborations. To stay competitive, companies must focus on unique formulations, branding strategies, and consistent investments in research and development.

Shifts Toward Plant-Based Alternatives

Rising consumer interest in plant-based diets poses a long-term challenge to the animal protein market in Japan. Although animal proteins remain dominant, the rapid growth of plant-based alternatives is reshaping consumer preferences. Younger demographics and environmentally conscious consumers increasingly explore soy, pea, and other plant proteins. This trend risks slowing growth in traditional animal protein segments if not addressed. Companies must adapt by highlighting nutritional advantages of animal proteins, diversifying portfolios, or integrating hybrid solutions to maintain relevance.

Regional Analysis

Kanto

The Kanto region leads the Japan Animal Protein Ingredients Market with 38% share in 2024. Strong consumer demand in Tokyo and surrounding urban centers drives sales of dairy and fish-based proteins. The region benefits from advanced food processing industries, high fitness culture, and growing elderly population requiring clinical nutrition. Companies invest in research and distribution hubs to meet increasing product demand. It remains a core growth region due to its large consumer base and rising focus on health and wellness.

Kansai

Kansai holds 22% of the market share in 2024, supported by Osaka’s strong food manufacturing and trading industries. High demand for functional beverages and protein powders fuels segment growth. The presence of major food companies in the region supports innovation and product diversification. Rising sports participation and consumer focus on nutrition encourage adoption of protein-enriched products. It continues to strengthen its position through robust distribution networks and growing urban demand.

Chubu

Chubu accounts for 15% market share in 2024, driven by a balance of urban demand and food production activities. Dairy and meat protein consumption remains significant, supported by food manufacturers in Nagoya and surrounding cities. Clinical nutrition products also see demand growth due to an aging population. The region benefits from logistics connectivity that aids product supply to broader areas. It sustains steady growth with strong domestic consumption and industrial support.

Kyushu

Kyushu represents 13% of the market share in 2024, supported by its seafood base and aquaculture industry. Fish and marine proteins dominate, particularly in collagen and feed applications. The region’s proximity to export markets further enhances opportunities for suppliers. Urban centers in Fukuoka add to consumer demand for protein-based functional foods. It shows growth potential through rising aquafeed and pet food applications.

Hokkaido

Hokkaido holds 12% market share in 2024, led by its established dairy farming and meat industries. Strong milk and livestock production supports steady demand for dairy and meat proteins. Consumers in the region increasingly adopt protein powders and supplements. Its supply chain strengths contribute to the national protein ingredient market. It maintains growth with a strong production base and consistent consumer demand.

Market Segmentations:

By Source

- Dairy

- Fish & Marine

- Meat & Poultry

- Others

By Form

- Powders

- Granules/Flakes

- Liquids/Pastes

By Application

- Sports & Active Nutrition

- Clinical & Medical Nutrition

- Pet Food

- Aquafeed & Livestock Feed

- Others

By Region

- Kanto

- Kansai

- Kyushu

- Chubbu

- Hokaido

Competitive Landscape

The Japan Animal Protein Ingredients Market is highly competitive, featuring a mix of multinational corporations and domestic players that focus on dairy, meat, and marine-based proteins. Leading companies such as Arla Foods, ADM Trading Japan, Meiji, Cargill, Kemin Industries, and Tyson Foods maintain strong positions through broad product portfolios, advanced processing technologies, and established distribution networks. Local firms like Lacto and Prinova enhance competitiveness with region-specific expertise and targeted solutions. Competition is shaped by innovation in functional proteins, clinical nutrition formulations, and sustainable sourcing practices. Companies pursue mergers, acquisitions, and strategic partnerships to expand market reach and diversify offerings. Pricing pressure, regulatory compliance, and the growing presence of plant-based alternatives intensify the competitive environment. It remains vital for both global and regional firms to invest in research, strengthen supply chains, and emphasize quality and traceability to sustain market leadership and capture future growth opportunities in Japan.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Arla Foods amba

- ADM Trading Japan Pty Ltd

- Lacto

- Meiji

- Cargill

- Kemin Industries

- Prinova

- Darling Ingredients

- Armor Proteines

- Tyson Foods

- Other Key Players

Recent Developments

- In September 2025, Leaft Foods partnered with Lacto Japan to launch its Rubisco Protein Isolate in the Japanese market.

- In July 2025, Mitsubishi Corporation, through its subsidiary Cermaq Group, acquired three salmon farms from Grieg Seafood in Norway and Canada to strengthen its salmon production.

- In March 2023, Marubeni Corporation partnered with SAS Ÿnsect to introduce insect protein to the Japanese market, marking a significant move toward sustainable protein sources.

- In August 2025, IntegriCulture partnered with Singapore-based Umami Bioworks to develop cosmetics using cultured fish cells.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dairy proteins will expand with growing use in functional foods.

- Fish and marine proteins will gain traction in collagen and nutraceutical applications.

- Meat and poultry proteins will remain stable due to strong pet food consumption.

- Powders will dominate as consumers prefer convenient and long shelf-life formats.

- Clinical nutrition will grow rapidly with rising elderly population needs.

- Sports and active nutrition will benefit from increasing fitness awareness.

- Sustainable sourcing and traceability will become essential for consumer trust.

- Companies will innovate with hybrid protein solutions to counter plant-based competition.

- Distribution networks will strengthen with e-commerce growth and direct-to-consumer models.

- Strategic partnerships between global and domestic firms will drive product diversification.