Market Overview

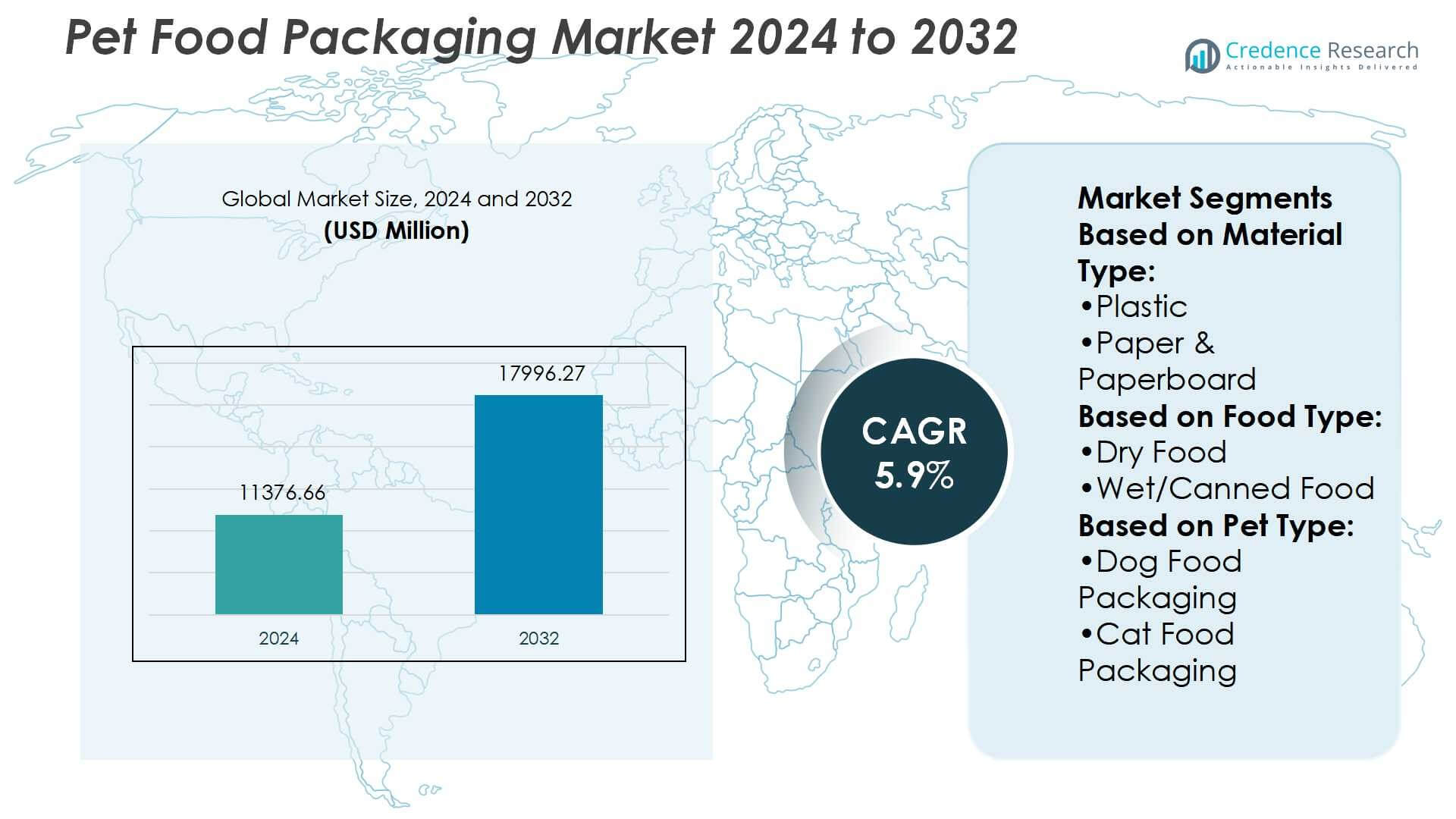

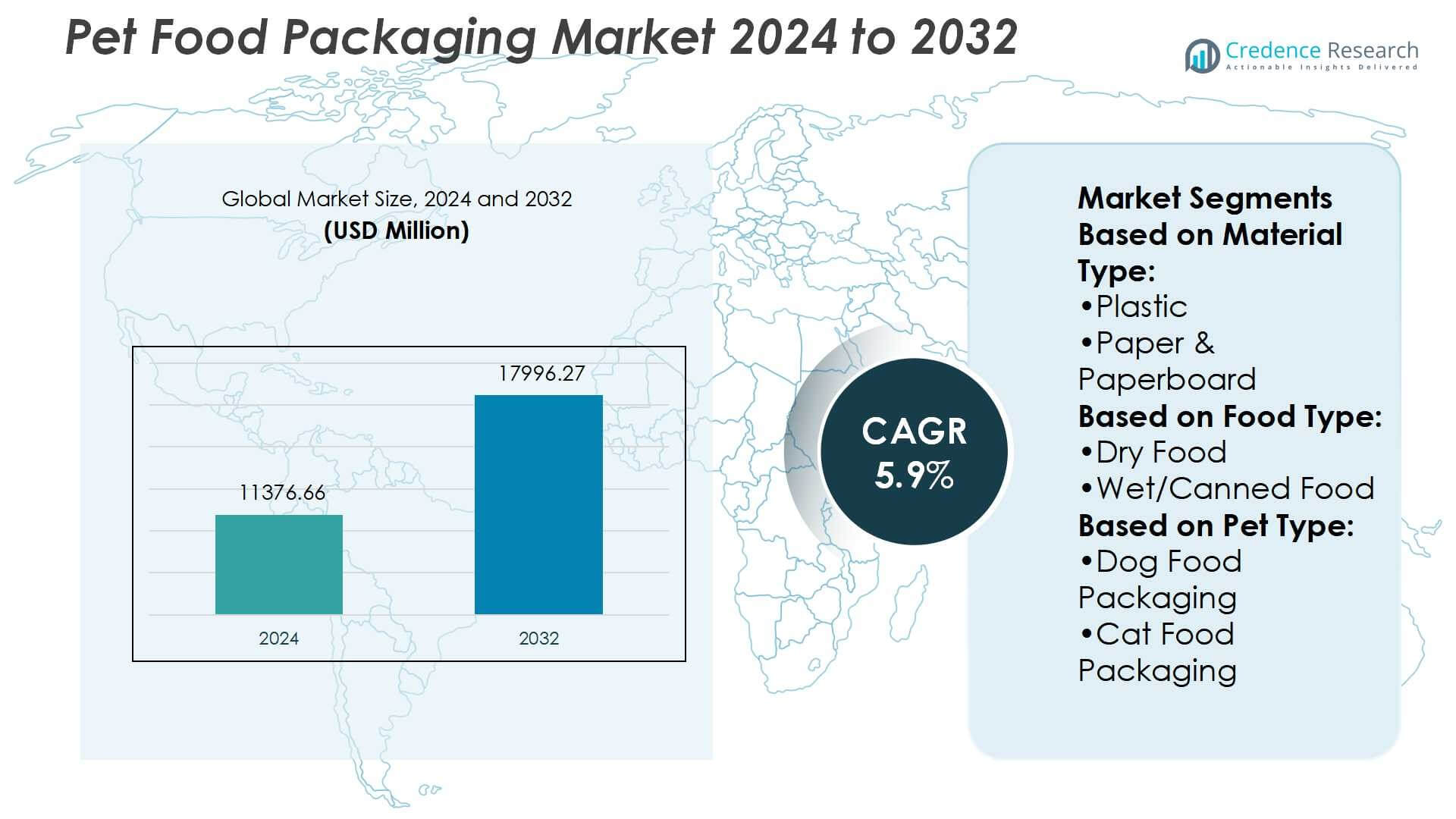

Pet Food Packaging Market size was valued USD 11376.66 million in 2024 and is anticipated to reach USD 17996.27 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pet Food Packaging Market Size 2024 |

USD 11376.66 Million |

| Pet Food Packaging Market, CAGR |

5.9% |

| Pet Food Packaging Market Size 2032 |

USD 17996.27 Million |

The pet food packaging market is shaped by leading players such as Amcor plc, Mondi, Berry Global, Huhtamaki, Sonoco Products Company, Crown, Transcontinental Inc., Silgan Holdings Inc., Winpak, and Sealed Air. These companies focus on sustainable materials, flexible packaging formats, and advanced printing technologies to strengthen their competitive positioning. They actively invest in recyclable plastics, paperboard solutions, and lightweight packaging formats that meet consumer and regulatory demands for convenience and eco-friendliness. Regionally, North America leads the global market with a 37% share in 2024, driven by high pet ownership, strong demand for premium packaged products, and widespread adoption of e-commerce-based distribution models.

Market Insights

Market Insights

- The Pet Food Packaging Market was valued at USD 11376.66 million in 2024 and is projected to reach USD 17996.27 million by 2032, growing at a CAGR of 5.9%.

- Rising pet ownership and premiumization of pet food products are driving demand for flexible, resealable, and eco-friendly packaging formats that ensure freshness and convenience.

- Leading players such as Amcor plc, Mondi, Berry Global, and Huhtamaki focus on sustainable innovations, recyclable plastics, and advanced printing to strengthen competitive positioning.

- High production costs of sustainable packaging materials and regulatory compliance remain key restraints, particularly for small and mid-sized manufacturers.

- North America dominates with 37% share in 2024 due to strong demand for premium packaged food, while flexible packaging holds the largest segment share globally, supported by convenience and affordability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Plastic holds the dominant share in the pet food packaging market, accounting for over 45% of total usage. Its popularity comes from durability, flexibility, and cost efficiency in packaging formats such as pouches, trays, and tubs. Plastic packaging also ensures strong barrier protection against moisture and oxygen, extending product shelf life. Lightweight nature supports e-commerce shipping and storage benefits. Rising demand for resealable and portion-control packaging further drives adoption. Despite growing sustainability concerns, advancements in recyclable and bio-based plastics are helping maintain plastic’s strong market position.

- For instance, Crown introduced its Peelfit™ can technology, which eliminates the need for a metal ring-pull, making the can up to 16% lighter than conventional alternatives. The technology also reduces energy consumption compared to conventional foil seam closures.

By Food Type

Dry food packaging leads the segment, with more than 50% share in global consumption. This dominance stems from the higher sales volume of dry pet food, which is convenient, affordable, and widely used for dogs and cats. Packaging formats like multi-layer bags and pouches ensure protection from moisture while allowing easy storage and handling. Growth in resealable bags is supporting demand, driven by consumer focus on freshness and convenience. Increased production of bulk dry pet food also sustains packaging requirements, reinforcing this sub-segment’s leading role.

- For instance, Silgan’s Custom Containers plastic portfolio uses significant amounts of post-consumer recycled (PCR) resin, including the production of 100 million containers using nearly 12 million pounds of PCR.

By Pet Type

Dog food packaging remains the largest segment, capturing over 55% of the market share. High global dog ownership rates and preference for premium packaged food contribute to this dominance. Packaging innovations focus on large-volume bags, resealable pouches, and easy-to-carry formats suited to frequent purchases. Rising consumer demand for nutritional and specialized dog diets is creating new packaging opportunities. Strong marketing strategies by brands targeting dog owners further boost packaging demand. As dog food spending continues to outpace other pet types, this segment drives consistent growth in packaging solutions.

Key Growth Drivers

Rising Pet Ownership and Premiumization

The growing global pet population, particularly dogs and cats, is driving demand for packaged pet food. Owners increasingly treat pets as family members, fueling purchases of premium, high-quality, and nutritious food. This shift creates strong demand for durable, safe, and visually appealing packaging that enhances shelf presence. Premium packaging formats such as resealable pouches, multi-layer bags, and metal cans gain traction as they align with consumer expectations of convenience, hygiene, and product preservation. Premiumization remains a central growth driver in expanding the packaging market.

- For instance, Sealed Air CRYOVAC® 8490 Vertical Rotary Vacuum Chamber System runs up to 20 cycles per minute, supports product sizes up to 21-inch length and 12-inch width, and offers 100% process yield when used with CRYOVAC® Cook-In Barrier Bags.

Expansion of E-Commerce and Direct-to-Consumer Channels

The rapid growth of e-commerce platforms and subscription models is reshaping packaging requirements in the pet food market. Online deliveries demand lightweight, compact, and durable packaging that ensures product safety during transport. Manufacturers are investing in packaging formats that optimize logistics while offering resealability and portion control. E-commerce channels also create opportunities for personalized branding and premium unboxing experiences. As online retail continues expanding, packaging innovation tailored to shipping efficiency and consumer convenience will drive significant growth in the sector.

- For instance, Berry and Nestlé Purina’s 20 oz and 30 oz Friskies® Party Mix® treat canisters are now made with 100% mechanically recycled PET (excluding lid/label), eliminating more than 500 metric tons of virgin plastic annually.

Focus on Sustainability and Eco-Friendly Packaging

Sustainability initiatives are becoming a major growth driver as consumers demand environmentally responsible packaging. Rising concerns about plastic waste push manufacturers to adopt recyclable, compostable, and bio-based materials. Paper and paperboard packaging, along with recyclable plastics, are gaining momentum in the pet food market. Brands leveraging eco-friendly designs not only comply with stricter regulations but also attract environmentally conscious buyers. Sustainable packaging solutions, combined with reduced carbon footprints and energy-efficient production processes, reinforce brand image while driving wider adoption, making sustainability a central factor for long-term growth.

Key Trends & Opportunities

Innovation in Flexible and Resealable Packaging

Flexible packaging formats such as pouches and bags dominate market trends due to convenience, cost efficiency, and storage benefits. The demand for resealable options is rising as consumers seek freshness retention and portion control. Transparent windows, easy-tear notches, and premium printing are becoming standard features. These innovations not only enhance functionality but also improve brand differentiation on retail shelves. Manufacturers investing in high-barrier flexible packaging can capitalize on opportunities in both offline and online retail, ensuring product safety while meeting evolving consumer lifestyles.

- For instance, Mondi & Saga Nutrition launched in a recyclable mono-material FlexiBag for dry pet food in sizes from 3 kg, with high barrier properties safeguarding against moisture, fat and odour.

Digital Printing and Personalization Opportunities

Advances in digital printing technology are creating opportunities for personalized and visually appealing pet food packaging. Brands are increasingly adopting high-quality printing for unique designs, seasonal editions, and small-batch runs tailored to consumer preferences. This approach improves shelf visibility and builds stronger emotional connections with pet owners. Personalization also supports direct-to-consumer sales channels by enhancing brand loyalty through custom labels and packaging features. Companies leveraging digital technologies gain a competitive advantage, especially in premium and niche product segments where differentiation is critical.

- For instance, Sonoco has deployed a 6-color digital press for direct-to-sheet displays, enhancing its print capability for point-of-purchase displays and other promotional packaging. This investment enables high-impact graphics and faster speed-to-market for customers.

Key Challenges

High Costs of Sustainable Packaging Materials

While sustainability is a major driver, the transition to eco-friendly packaging materials poses significant cost challenges. Bioplastics, recyclable paperboard, and compostable solutions often carry higher production costs compared to conventional plastics. Smaller companies face financial constraints in adopting these alternatives at scale. Additionally, establishing recycling infrastructure remains uneven across regions, limiting adoption. Balancing sustainability goals with affordability is a key challenge for packaging manufacturers. Companies must optimize material sourcing and production efficiency to manage costs while maintaining eco-friendly commitments.

Regulatory Compliance and Safety Standards

Strict regulatory requirements around packaging safety, labeling, and recyclability present challenges for market players. Different countries enforce varying standards on material composition, chemical migration, and food safety compliance. Manufacturers must continuously adapt packaging designs to meet evolving rules, which increases operational complexity and costs. Non-compliance risks reputational damage and product recalls. For global players, harmonizing packaging strategies across multiple regions remains a challenge. Adhering to regulations while ensuring innovation, sustainability, and cost efficiency is a critical balancing act for the industry.

Regional Analysis

North America

North America dominates the pet food packaging market, holding a 37% share in 2024. High pet ownership rates, particularly in the United States, fuel demand for premium and specialized packaging formats. Consumers favor resealable pouches, rigid containers, and eco-friendly materials that ensure freshness and sustainability. Strong presence of global packaging manufacturers and stringent regulatory standards also drive innovation in safe and durable packaging solutions. Growth in e-commerce sales and subscription-based pet food delivery further boosts demand for lightweight and convenient packaging formats across the region.

Europe

Europe accounts for a 28% share of the global pet food packaging market in 2024. Rising adoption of recyclable and biodegradable packaging materials aligns with the region’s strict environmental regulations and consumer sustainability preferences. Premium packaging formats such as aluminum cans and paperboard cartons gain momentum, particularly in Western European countries with higher spending capacity. Germany, the U.K., and France remain key markets with strong demand for dry and wet pet food packaging. Regional growth is also supported by innovation in flexible packaging solutions that combine convenience with reduced environmental impact.

Asia-Pacific

Asia-Pacific holds a 22% share of the global pet food packaging market in 2024, with rapid growth potential. Rising disposable incomes, urbanization, and pet humanization trends in countries like China, India, and Japan fuel strong demand. Flexible pouches and multi-layer bags dominate due to affordability and convenience. Increasing adoption of premium and specialized pet foods also drives demand for advanced packaging formats with barrier protection and resealability. Expanding e-commerce channels create opportunities for packaging designed to withstand shipping while maintaining product safety. Asia-Pacific is projected to record the fastest growth during the forecast period.

Latin America

Latin America captures a 7% share of the pet food packaging market in 2024. Brazil and Mexico lead regional demand, supported by rising pet ownership and growing awareness of packaged pet food benefits. Flexible packaging formats such as pouches and bags dominate due to cost-effectiveness and adaptability across dry and wet pet food segments. Increasing demand for mid-range and premium pet food products is pushing innovation in packaging designs that offer better product safety and shelf appeal. Expanding retail distribution and urban consumer lifestyles further strengthen regional growth prospects.

Middle East & Africa

The Middle East & Africa region represents a 6% share of the global pet food packaging market in 2024. Market growth is driven by rising urbanization, growing disposable incomes, and gradual adoption of packaged pet food in countries such as South Africa, the UAE, and Saudi Arabia. Flexible pouches and cartons dominate due to affordability and practicality, while premium packaging formats are gradually entering urban markets. Challenges include limited manufacturing infrastructure and reliance on imports. However, increasing investments in retail expansion and e-commerce channels are expected to support stronger growth in packaging demand across the region.

Market Segmentations:

By Material Type:

- Plastic

- Paper & Paperboard

By Food Type:

By Pet Type:

- Dog Food Packaging

- Cat Food Packaging

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The pet food packaging market is highly competitive, with key players including Crown (U.S.), Silgan Holdings Inc. (U.S.), Huhtamaki (Finland), Sealed Air (U.S.), Winpak (Canada), Berry Global (U.S.), Mondi (U.K.), Sonoco Products Company (U.S.), Amcor plc (Switzerland), and Transcontinental Inc. (Canada). The pet food packaging market features strong competition driven by innovation, sustainability, and consumer-focused design. Companies emphasize flexible packaging formats such as resealable pouches and multi-layer bags that ensure freshness, convenience, and portion control. Growing demand for eco-friendly solutions accelerates the use of recyclable plastics, biodegradable paperboard, and lightweight materials that reduce environmental impact while meeting regulatory standards. E-commerce growth further reshapes packaging needs, requiring durable yet compact designs optimized for shipping. Manufacturers also invest in digital printing and customized designs to enhance shelf visibility and brand differentiation. The competitive environment is defined by continuous product development, strategic collaborations, and regional expansions to capture evolving opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crown (U.S.)

- Silgan Holdings Inc. (U.S.)

- Huhtamaki (Finland)

- Sealed Air (U.S.)

- Winpak (Canada)

- Berry Global (U.S.)

- Mondi (U.K.)

- Sonoco Products Company (U.S.)

- Amcor plc (Switzerland)

- Transcontinental Inc. (Canada)

Recent Developments

- In July 2024, Mondi launched additions to the company’s sustainable pre-made plastic bags portfolio. The new line, FlexiBag Reinforced, is recyclable packaging, mono-polyethylene-based with enhanced properties such as sealability, stiffness and puncture-resistance.

- In May 2024, ALPLA, a plastic packaging manufacturer, announced the introduction of a new wine container that is recyclable and composed of PET (polyethylene terephthalate). With possible cost reductions of up to 30%, this packaging method reduces carbon footprints by up to 50%.

- In April 2024, Australia has set its sights on transitioning to 100% recycled content PET bottles. The Asahi Group, in alignment with this goal, is actively working to diminish its environmental footprint while ensuring the ongoing use of containers and packaging. Under the banner of ‘3R+Innovation’ (3R stands for reduce, reuse, recycle), the Asahi Group is spearheading initiatives to meet these objectives.

- In January 2024, Sidel, a provider of innovative PET packaging solutions, unveiled its quality control technology for PET bottles. Branded as IntelliADJUST, this technology promises to revolutionize how customers craft PET bottles, elevating them to a new standard of excellence. This intelligent bottle-blowing control system boasts high performance while also offering user-friendly features, empowering customers to consistently achieve superior bottle quality.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Food Type, Pet Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing global pet ownership and rising demand for packaged food.

- Flexible and resealable packaging formats will continue to dominate due to convenience and freshness.

- Sustainability will remain a priority, with higher adoption of recyclable and biodegradable materials.

- Premium packaging designs will gain traction as pet owners seek quality and differentiation.

- E-commerce growth will drive demand for lightweight, durable, and shipping-friendly packaging solutions.

- Digital printing and customization will shape brand identity and consumer engagement.

- Barrier protection technologies will advance to extend shelf life and ensure product safety.

- Emerging economies will provide strong growth opportunities through rising pet adoption and spending.

- Strategic collaborations and acquisitions will increase to expand product portfolios and market presence.

- Innovation in smart and interactive packaging will emerge to enhance consumer convenience and loyalty.

Market Insights

Market Insights