Market Overview

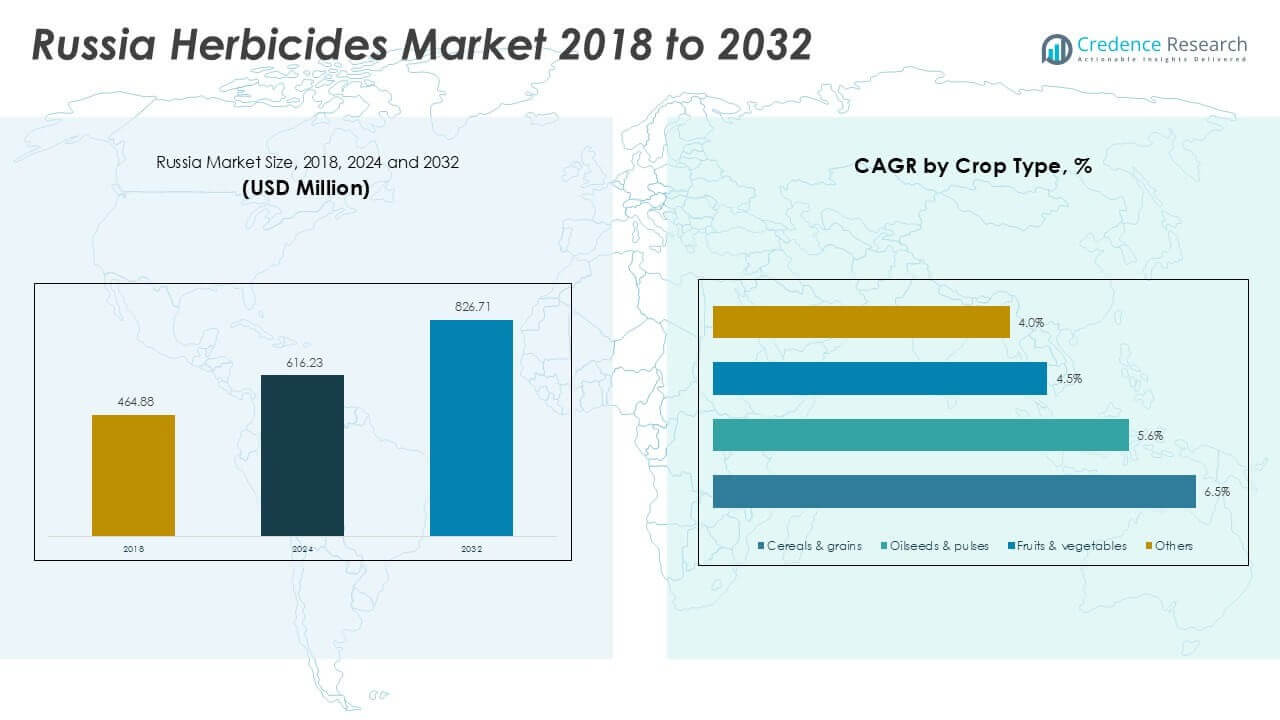

Russia Herbicides Market size was valued at USD 464.88 million in 2018, reached USD 616.23 million in 2024, and is anticipated to reach USD 826.71 million by 2032, at a CAGR of 3.74% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Russia Herbicides Market Size 2024 |

USD 616.23 Million |

| Russia Herbicides Market, CAGR |

3.74% |

| Russia Herbicides Market Size 2032 |

USD 826.71 Million |

The Russia herbicides market is led by major players such as BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group, Nufarm Ltd, FMC Corporation, Sumitomo Chemical Co. Ltd, and Gowan Company, who together capture a significant share through extensive product portfolios and robust distribution networks. These companies focus on glyphosate, acetochlor, and selective herbicides tailored for cereals and oilseeds. Central Russia dominates with over 30% market share, driven by large-scale wheat and barley production, while Southern Russia follows with 28% share supported by oilseed and pulse cultivation. Both regions benefit from advanced mechanization, precision farming adoption, and strong government programs aimed at increasing agricultural productivity, making them the key growth hubs for herbicide consumption in Russia.

Market Insights

Market Insights

- The Russia herbicides market was valued at USD 616.23 million in 2024 and is projected to reach USD 826.71 million by 2032, registering a CAGR of 3.74% during the forecast period.

- Growth is driven by rising cereal and grain cultivation, adoption of herbicide-tolerant crop varieties, and increasing use of precision agriculture technologies to optimize weed management and reduce costs.

- Key trends include growing demand for bio-based and low-toxicity herbicides, modernization of spraying equipment, and wider adoption of foliar applications, which held over 40% share in 2024.

- The market is moderately consolidated with major players like BASF SE, Bayer AG, Corteva Agriscience, and Syngenta Group focusing on innovative formulations, resistance management solutions, and regional expansion to strengthen their market position.

- Central Russia leads with 30% share, followed by Southern Russia at 28% and Volga Region at 25%, with cereals & grains dominating crop type usage with over 45% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Glyphosate dominated the Russia herbicides market in 2024, holding over 35% share due to its broad-spectrum weed control and cost-effectiveness. Farmers prefer glyphosate for its ability to manage resistant weeds and reduce labor costs in large-scale farming. Acetochlor and 2,4-D followed, driven by their effectiveness against annual grasses and broadleaf weeds in cereals. Atrazine retained steady demand in corn cultivation despite regulatory scrutiny. The “Others” category, including bio-based herbicides, is gaining traction slowly as sustainable agriculture practices expand, supported by government initiatives to reduce chemical load in soils.

- For instance, in 2024, UPL Limited announced that it was strengthening its business and go-to-market strategy in Central and Eastern Europe as part of its broader crop protection efforts. The company operates in a variety of markets and offers numerous products, such as glyphosate, for use on crops like cereals.

By Application

Foliar application led the market with more than 40% share in 2024, favored for its quick action and uniform coverage on crops. Russian farmers rely on foliar spraying to ensure effective post-emergence weed control and minimize yield loss. Fertigation is gaining popularity with the expansion of precision irrigation systems, enhancing herbicide efficiency and reducing wastage. Soil application remains important for pre-emergence control in cereals and oilseed crops. Demand for advanced spraying technologies and drift-control solutions further supports the growth of foliar-based herbicide applications across diverse farm sizes in Russia.

- For instance, in March 2022 and its complete exit from the Russian market in June 2024, John Deere delivered no equipment, including self-propelled sprayers, to Russian farms in 2024. The company fully abides by international sanctions against Russia.

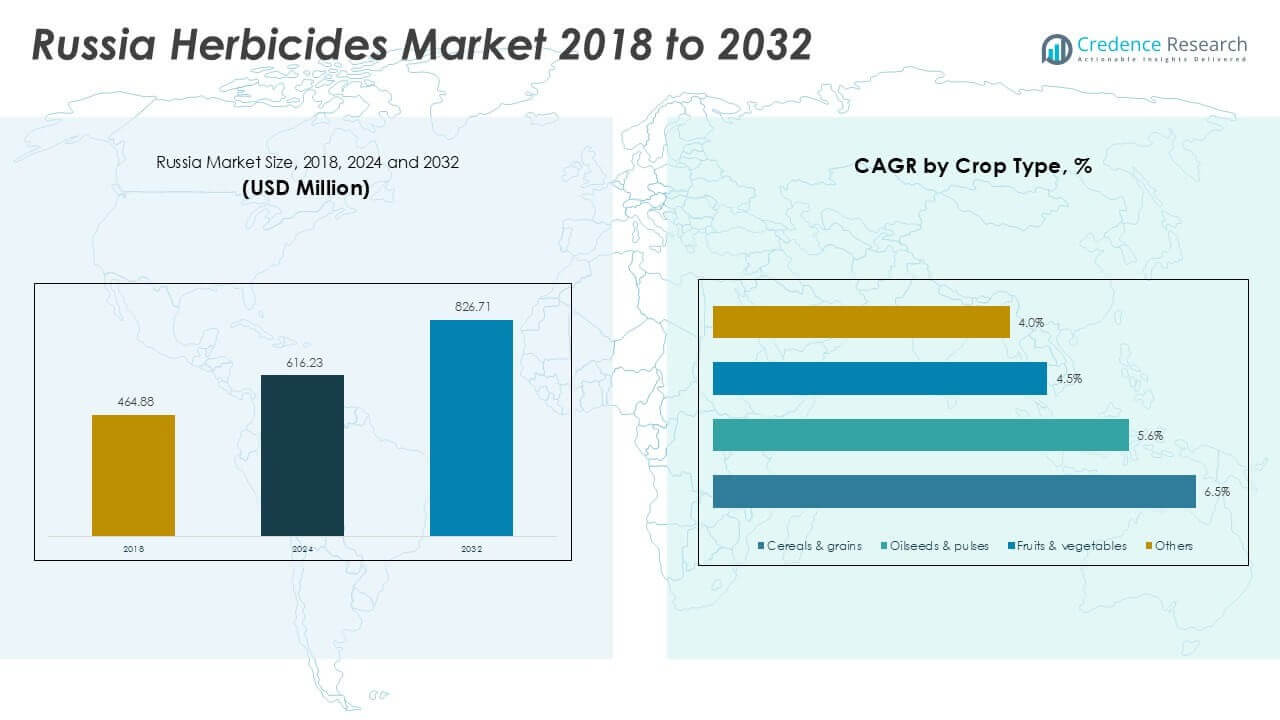

By Crop Type

Cereals & grains accounted for the largest share of over 45% in 2024, driven by Russia’s strong wheat and barley production. Herbicides are widely used to protect yields and maintain quality for export markets. Oilseeds & pulses represent the second-largest segment, benefiting from growing soybean and sunflower acreage supported by domestic crushing facilities. Fruits & vegetables are a smaller but growing segment, with increasing adoption of selective herbicides for high-value crops. Rising mechanization, expansion of arable land, and adoption of integrated weed management strategies continue to drive herbicide use in cereal production.

Key Growth Drivers

Expansion of Cereal and Grain Cultivation

Russia’s growing cereal and grain production, particularly wheat and barley, drives strong herbicide demand. Farmers rely on chemical weed control to secure higher yields and meet export requirements. Government support for modernizing agricultural practices encourages wider adoption of advanced herbicides. Large-scale farms in key regions such as the Volga and Southern Federal Districts continue to invest in glyphosate and acetochlor solutions. Rising global demand for Russian grains further pushes producers to adopt efficient weed management practices to maintain competitiveness and meet international quality standards.

- For instance, PhosAgro supplied over 3.3 million metric tons of agrochemical products to Russian farmers in 2024, maintaining its position as Russia’s leading domestic fertilizer supplier.

Rising Adoption of Precision Agriculture

Precision agriculture is transforming weed control practices across Russia. Farmers increasingly use GPS-guided sprayers and variable-rate technology to optimize herbicide usage and cut input costs. This approach reduces chemical wastage, improves coverage, and minimizes environmental impact. The trend supports greater use of foliar applications and pre-emergence herbicides for targeted weed suppression. Growing government programs promoting smart farming solutions are accelerating adoption. As a result, herbicide producers offering precision-compatible formulations and adjuvants are experiencing increased demand from both large-scale commercial farms and progressive mid-size agricultural enterprises.

- For instance, in recent years, many agricultural equipment manufacturers, including companies like Rostselmash, have developed and deployed precision spraying units that use advanced technologies like ISOBUS. These systems allow for the automated control of application rates and targeted spraying, which can lead to substantial reductions in herbicide usage. While a precise figure depends on many factors, trials in 2024 demonstrated herbicide savings of over 50% on average for farmers using similar precision systems, helping to reduce chemical costs and improve resource efficiency.

Shift Toward Herbicide-Tolerant Crop Varieties

The adoption of herbicide-tolerant seeds, especially for soybeans and corn, is boosting demand for selective herbicides. Farmers benefit from simplified weed management, fewer passes on fields, and improved crop productivity. This shift allows greater reliance on glyphosate-based formulations and combination products. Local seed companies and international breeders are expanding their presence in Russia, offering improved hybrid seeds. The growing popularity of these seeds in oilseed and pulse production supports consistent herbicide consumption, driving long-term market growth. This trend is expected to accelerate as Russia seeks to increase self-sufficiency in feed and edible oil production.

Key Trends & Opportunities

Growth of Bio-Based and Low-Toxicity Herbicides

Sustainable agriculture initiatives are fueling interest in bio-based herbicides across Russia. Farmers and agribusinesses are gradually adopting low-toxicity alternatives to reduce chemical residues and comply with environmental regulations. Startups and global manufacturers are introducing microbial and plant-derived products targeting broadleaf and grassy weeds. While adoption is still limited, supportive government policies and increasing consumer demand for residue-free food are likely to accelerate growth. This trend opens opportunities for companies offering integrated weed management solutions combining conventional and bio-based products for balanced, eco-friendly weed control strategies.

- For instance, BASF markets the bio-based product Serifel®, which is a fungicide used for protecting high-value crops like fruits and vegetables, rather than oilseed and cereal crops.

Increasing Mechanization and Sprayer Modernization

Mechanization rates in Russia are rising as farms adopt modern sprayers with advanced nozzle technology, improving herbicide efficiency. Demand for automated, drone-based, and sensor-guided spraying solutions is growing, especially in large farms. This trend favors herbicide manufacturers developing drift-control formulations compatible with precision spraying equipment. Opportunities exist for collaborations between chemical suppliers and agri-tech firms to deliver integrated weed control packages. The move toward more efficient application methods reduces labor dependency and enhances consistency, supporting better yields and making large-scale farms more competitive in the global grain market.

- For instance, DJI temporarily suspended sales to Russia and Ukraine in April 2022 to prevent its products from being used for military purposes. However, agricultural drones are still used in Russia, supplied through unofficial or third-party channels.

Key Challenges

Rising Herbicide Resistance

Herbicide resistance among weeds is becoming a significant challenge in Russia, particularly with over-reliance on glyphosate. Resistant weed populations reduce effectiveness, forcing farmers to adopt more complex weed management programs. This leads to higher input costs and increased labor for mechanical control. Lack of widespread awareness about resistance management practices worsens the issue. Manufacturers are under pressure to develop new formulations and promote rotation strategies to maintain herbicide performance. Without proactive measures, resistance could significantly impact yield levels and raise production costs for cereal and oilseed farmers.

Regulatory and Environmental Pressures

Stricter regulations on chemical residues and environmental impact are challenging herbicide manufacturers. Compliance with evolving Russian and international standards increases product development and registration costs. Restrictions on certain active ingredients, such as atrazine, create uncertainty for farmers relying on traditional solutions. Public concern over soil health and biodiversity loss adds pressure for reduced chemical usage. Companies must invest in safer, low-toxicity formulations and stewardship programs to maintain market share. Failure to adapt to regulatory changes could limit product availability and slow market growth over the forecast period.

Regional Analysis

Central Russia

Central Russia led the herbicides market with over 30% share in 2024, supported by its vast cereal and grain cultivation areas. The region’s fertile black soil zones favor intensive farming, driving strong adoption of glyphosate and foliar herbicide applications. Large commercial farms invest heavily in mechanized spraying and precision agriculture systems to enhance efficiency. Demand is further fueled by government programs supporting yield improvement and export competitiveness. High production of wheat and barley makes effective weed control essential to maintain output levels, ensuring Central Russia remains the dominant regional market for herbicides through the forecast period.

Southern Russia

Southern Russia accounted for nearly 28% market share in 2024, driven by extensive production of oilseeds, pulses, and cereals. The region’s favorable climate and long growing season encourage double-cropping, increasing herbicide usage across multiple cycles. Glyphosate and acetochlor are widely used for pre-emergence and post-emergence weed control. Farmers are also adopting fertigation-based herbicide applications to improve water and input efficiency. Expanding sunflower and soybean cultivation boosts demand for selective herbicides compatible with herbicide-tolerant varieties. Investment in modern irrigation systems and rising mechanization levels are expected to support further growth in herbicide consumption in Southern Russia.

Volga Region

The Volga Region held around 25% share of the Russia herbicides market in 2024, driven by its strong agricultural base in grains and oilseeds. Farmers in this region prioritize soil-applied herbicides to control early-season weeds and secure yields. The region is witnessing increasing adoption of integrated weed management practices, combining chemical and mechanical methods. Government-backed initiatives to modernize farming practices and improve food security are encouraging greater herbicide adoption. Expanding processing facilities for oilseeds and pulses further stimulate demand. The Volga Region is poised for steady growth as farmers shift to advanced spraying technologies and precision farming solutions.

Siberia and Far East

Siberia and the Far East captured approximately 17% market share in 2024, representing the smallest but growing segment. The region’s harsh climate and shorter growing season limit herbicide use compared to other regions, but rising grain cultivation is creating opportunities. Farmers are adopting broad-spectrum herbicides to maximize productivity within tight seasonal windows. Increased government focus on developing Siberian agriculture and improving logistics infrastructure is boosting input availability. Expansion of arable land and rising investment from large agricultural enterprises are expected to drive herbicide consumption, gradually increasing the region’s contribution to the overall Russia herbicides market by 2032.

Market Segmentations:

By Type

- Glyphosate

- Acetochlor

- 2,4-D

- Atrazine

- Others

By Application

- Fertigation

- Foliar

- Soil

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Geography

- Central Russia

- Southern Russia

- Volga Region

- Siberia and Far East

Competitive Landscape

The Russia herbicides market is moderately consolidated, with leading players including BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group, Nufarm Ltd, FMC Corporation, Sumitomo Chemical Co. Ltd, and Gowan Company holding significant market presence. These companies compete through broad product portfolios, advanced formulations, and strong distribution networks across key agricultural regions. BASF and Bayer dominate glyphosate and selective herbicide sales, while Corteva and Syngenta lead in innovative pre-emergence and post-emergence solutions. Local distributors partner with global manufacturers to ensure supply chain reliability and technical support for farmers. Companies are investing in precision-compatible products, resistance management solutions, and low-toxicity herbicides to align with sustainability goals and regulatory requirements. Strategic activities such as product launches, partnerships with agri-tech firms, and expansion of regional warehouses strengthen their foothold. Intense competition encourages continuous innovation, price optimization, and farmer training programs, supporting adoption of modern weed control solutions across Russia’s growing agricultural sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Bayer AG

- Corteva Agriscience

- Syngenta Group

- Nufarm Ltd

- FMC Corporation

- Sumitomo Chemical Co. Ltd

- Gowan Company

Recent Developments

- In December 2023, ADAMA introduced its most advanced cross-spectrum herbicide called Kampai for the grain business. The new product provides the broadest application window for broadleaf and narrow-leaf weed control for cereal crops.

- In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC’s global expansion efforts, aimed at enhancing its presence in the European market.

- In July 2023, ADAMA introduced new products, Davai A Plus and Clearfield Broad-Spectrum Herbicide Solutions, for imidazolinone-tolerant legumes like lentils, peas, and soybeans.

- In March 2023, BASF announced the launch of a novel corn herbicide named Surtain, which is set to be available for use in the United States in 2024. This innovative herbicide features solid encapsulation technology, marking it as the first of its kind in the industry.

- In January 2023, Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Crop Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Russia herbicides market is expected to witness steady growth driven by expanding grain and oilseed cultivation.

- Adoption of precision agriculture and smart spraying systems will improve herbicide efficiency.

- Demand for glyphosate and selective herbicides will remain strong to manage resistant weed species.

- Bio-based and low-toxicity herbicides will gain market share due to regulatory and environmental focus.

- Investments in research and development will bring advanced formulations and combination products to the market.

- Farmers will increasingly adopt integrated weed management strategies to reduce resistance risks.

- Regional demand will grow fastest in Southern Russia with expansion of soybean and sunflower production.

- Government programs supporting mechanization and export-oriented farming will boost herbicide consumption.

- Collaborations between global players and local distributors will strengthen product availability across remote regions.

- Rising focus on sustainable farming will drive adoption of eco-friendly and precision-compatible herbicide solutions.

Market Insights

Market Insights