| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Fryer Market Size 2024 |

UUSD 1,220.43 million |

| Air Fryer Market, CAGR |

7.47% |

| Air Fryer Market Size 2032 |

USD 2,160.76 million |

Market Overview:

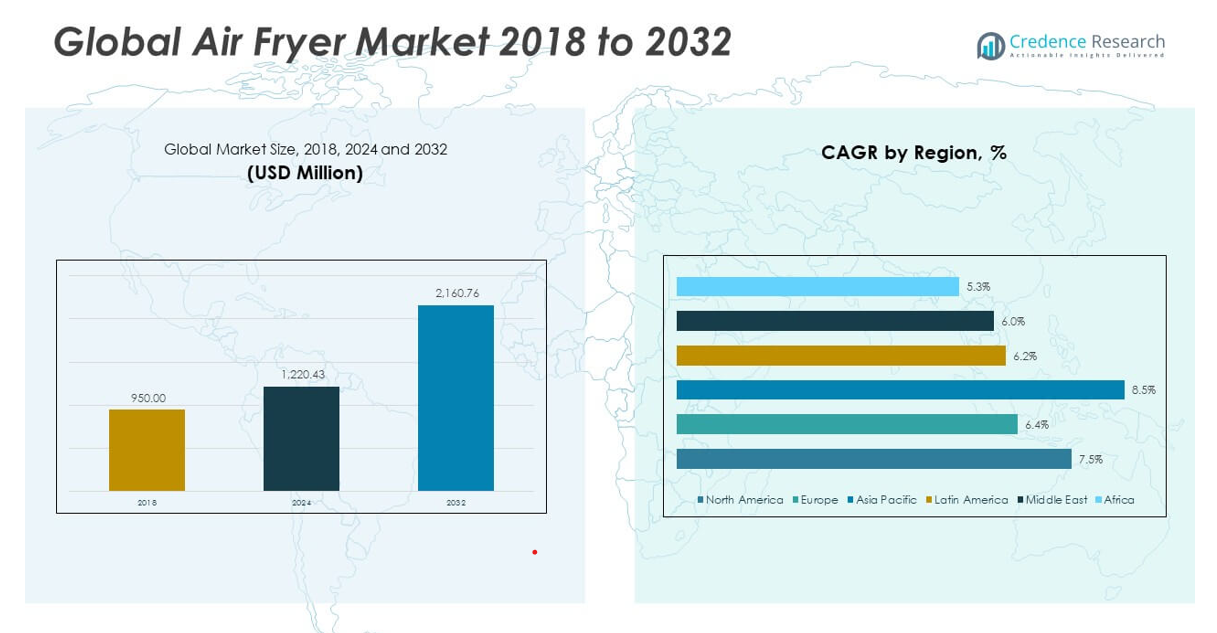

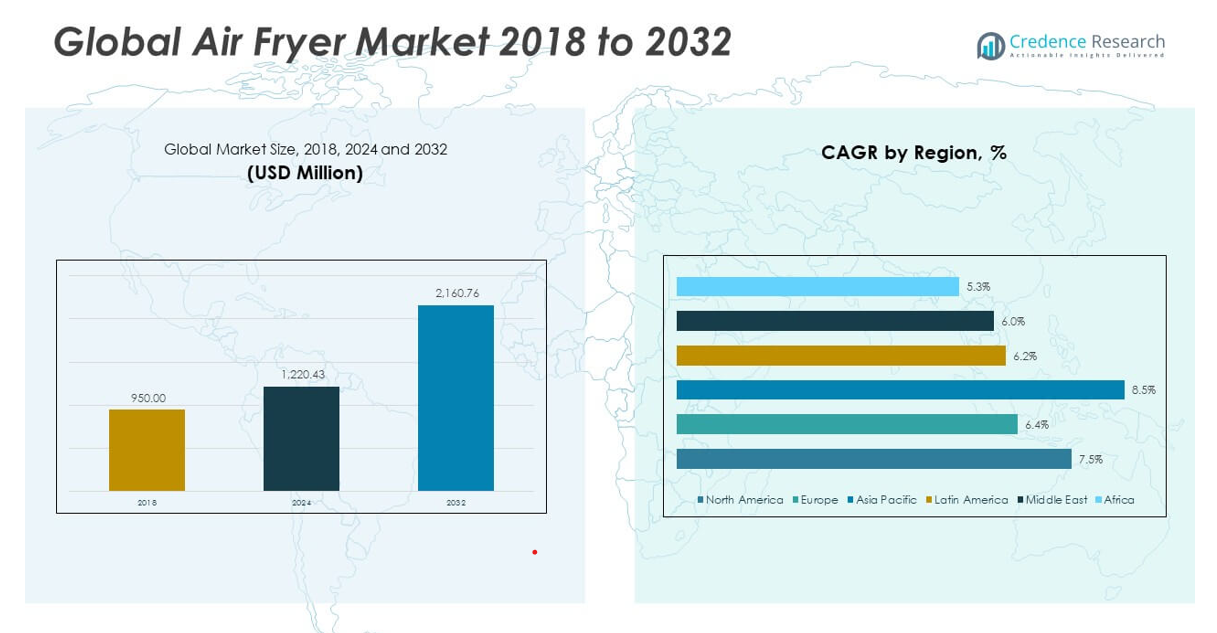

The Global Air Fryer Market size was valued at USD 950.00 million in 2018 to USD 1,220.43 million in 2024 and is anticipated to reach USD 2,160.76 million by 2032, at a CAGR of 7.47% during the forecast period.

Health consciousness is a key force driving demand in the global air fryer market. With growing concerns about obesity, heart conditions, and dietary fat intake, consumers are actively seeking appliances that support low-oil or oil-free cooking methods. Air fryers meet this demand by offering a viable alternative to deep frying, using rapid air circulation technology to produce crispy textures with significantly less oil. This advantage aligns with global nutrition goals and appeals to households focused on wellness and convenience. Moreover, the integration of digital controls, pre-set programs, and app-based features adds strong appeal among tech-savvy users. The rise of compact, energy-efficient models also contributes to adoption in space-constrained urban settings. Manufacturers continue to innovate with dual-basket systems, smart sensors, and multi-functionality such as roasting and baking, enhancing product value. Increasing penetration of online retail channels, aggressive promotional strategies, and influencer-led awareness campaigns further fuel market growth. Commercial adoption across cafes, hotels, and food service outlets adds another dimension to demand, especially for high-capacity models.

Regionally, North America holds the largest share of the global air fryer market. High household income levels, early adoption of smart kitchen appliances, and a strong preference for healthier food preparation methods have solidified the region’s leadership. The United States remains the dominant market in this region, driven by a tech-forward consumer base and broad availability of advanced models through both online and offline retail. Europe closely follows, bolstered by similar trends in health and wellness, sustainable cooking practices, and a robust hospitality industry that incorporates air fryers in commercial settings. Countries such as China, India, Japan, and South Korea are witnessing a surge in demand due to urbanization, rising middle-class incomes, and greater awareness of global dietary trends. India, in particular, has shown significant traction owing to changing culinary preferences, growing digital penetration, and the emergence of domestic manufacturers. Latin America, the Middle East, and Africa also present promising growth potential, supported by improving retail infrastructure and a gradual shift toward modern kitchen appliances. These regions are benefiting from increased marketing activities, broader distribution networks, and product localization strategies tailored to regional needs.

Market Insights:

- The Global Air Fryer Market size was valued at USD 950.00 million in 2018, reached USD 1,220.43 million in 2024, and is projected to reach USD 2,160.76 million by 2032, growing at a CAGR of 7.47% during the forecast period.

- Rising health awareness related to obesity, heart disease, and dietary fat intake is driving strong demand for oil-free cooking appliances such as air fryers.

- Air fryers using rapid air circulation technology offer crispy results with minimal oil, supporting global clean-eating trends and wellness-focused consumer behavior.

- Technological integration—touchscreens, app controls, voice commands, and smart sensors—is enhancing functionality and attracting younger, tech-oriented demographics.

- Urbanization and space-constrained living are increasing the need for compact, multi-functional, and energy-efficient appliances suitable for fast-paced lifestyles.

- E-commerce growth, competitive online pricing, and influencer-led campaigns are accelerating product adoption across both developed and emerging markets.

- North America holds the largest share of the Global Air Fryer Market, led by the U.S., while Asia-Pacific shows the fastest growth with expanding demand in India, China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Health and Wellness Awareness Promotes Oil-Free Cooking Alternatives:

A major driver propelling the Global Air Fryer Market is the global shift toward health-conscious eating habits. Consumers are actively seeking cooking methods that reduce oil usage without compromising taste and texture. Air fryers meet this demand by offering a healthier alternative to traditional deep frying, appealing to individuals managing lifestyle diseases such as obesity, cardiovascular issues, and diabetes. The market benefits from increasing demand for appliances that support fat-reduction efforts while maintaining convenience. It offers a solution that aligns with dietary preferences and clean-eating trends. Rising awareness campaigns and nutritional education further support consumer acceptance of air frying technology. The Global Air Fryer Market continues to gain traction from this health-oriented behavioral shift.

- For instance, Philips Airfryer XXL models with Fat Removal Technology have been independently verified to reduce fat content in fried foods by up to 90% compared to conventional deep frying, as measured in internal and external laboratory tests.

Technological Integration Enhances User Experience and Product Appeal:

Smart technology integration is significantly shaping consumer interest and purchasing behavior. Air fryers equipped with touchscreens, digital timers, smart sensors, and app connectivity provide ease of use, control, and cooking precision. Voice-activated controls, Wi-Fi-enabled models, and adaptive presets align with the broader adoption of smart kitchen ecosystems. It attracts tech-savvy households and younger demographics who value automation and customization. Manufacturers are leveraging IoT and AI-based features to differentiate their products and expand their market reach. Continuous innovation in product functionality also extends usage beyond frying to baking, roasting, and grilling. The Global Air Fryer Market is evolving rapidly through digital transformation and consumer engagement with connected appliances.

- For instance, the COSORI Smart WiFi Air Fryer (2024 model) features app-based remote control, Alexa and Google Assistant voice integration, and over 100 pre-programmed recipes. According to COSORI’s official technical documentation, the device is equipped with a 5.8-quart capacity, a digital touchscreen, and a smart notification system that alerts users when food is ready.

Convenience-Driven Lifestyles Fuel Demand for Compact and Efficient Appliances:

Urbanization and time-constrained lifestyles are reinforcing the demand for compact, multifunctional cooking solutions. Air fryers offer faster cooking times, minimal preparation, and easy cleanup, addressing the needs of busy households. Their versatility and energy efficiency make them suitable for modern kitchens with limited space. It fits well into apartment living and caters to single-person or nuclear families across metropolitan areas. Consumers increasingly prioritize appliances that simplify meal preparation without sacrificing quality. This behavior shift is evident across both developed and developing regions. The Global Air Fryer Market benefits directly from rising interest in convenience-centric kitchen technologies.

E-Commerce and Social Media Influence Expand Market Accessibility:

The expanding digital retail landscape plays a critical role in driving global sales. E-commerce platforms provide consumers with extensive product options, competitive pricing, and user-generated reviews that influence purchasing decisions. Influencer marketing, online cooking tutorials, and social media visibility elevate product awareness and accelerate conversion. It enhances brand-consumer engagement and enables tailored promotions for various demographics. Online retailers offer bundled deals, EMI options, and home delivery, making air fryers accessible even in tier-2 and tier-3 cities. The rise of mobile shopping and digital content consumption further amplifies market exposure. The Global Air Fryer Market is leveraging digital channels to broaden its reach and build sustained consumer interest.

Market Trends:

Shift Toward Multi-Functionality and All-in-One Kitchen Solutions:

Consumers are increasingly gravitating toward appliances that serve multiple purposes within compact kitchen spaces. Air fryers are being redesigned to include additional cooking capabilities such as grilling, roasting, baking, dehydrating, and even slow cooking. This trend reduces the need for multiple devices and appeals to minimalistic and space-saving preferences in urban households. It enhances the appliance’s value proposition and makes it more attractive to consumers looking for versatility and return on investment. Brands are integrating programmable settings to simplify diverse meal preparations in one unit. The Global Air Fryer Market reflects this growing preference for adaptable kitchen solutions that accommodate varying culinary needs.

- For instance, the Ninja Foodi Dual Zone Air Fryer (2024) offers six distinct cooking functions—Air Fry, Max Crisp, Roast, Bake, Reheat, and Dehydrate—within a single device. According to Ninja’s official product specifications, the Dual Zone technology allows users to cook two foods in two ways simultaneously, with independent temperature and timing controls for each basket.

Premiumization Driven by Aesthetic Design and Material Innovation:

Aesthetic appeal and material quality are becoming key differentiators in consumer purchasing decisions. Manufacturers are focusing on modern, sleek designs and premium finishes such as matte black, brushed steel, and color-customized exteriors. These visual upgrades help air fryers integrate seamlessly with contemporary kitchen interiors and elevate their countertop presence. It creates a perception of quality and aligns with lifestyle-driven consumption patterns. High-end models feature enhanced durability, non-toxic coatings, and advanced insulation materials for safety and energy efficiency. The Global Air Fryer Market is witnessing increased demand in the premium segment, where design meets functionality.

- For instance, Breville’s Joule Oven Air Fryer Pro (2025) features a brushed stainless steel finish, 13 pre-set smart cooking functions powered by the Element IQ® system, and guided recipes through the Breville+ app. The device has been recognized with the Red Dot Design Award for its combination of aesthetics and smart technology integration, as documented in Breville’s official press releases and award submissions.

Rising Demand in Commercial and Institutional Kitchens:

Air fryers are no longer confined to residential use; commercial interest is expanding steadily. Quick-service restaurants, cafes, small catering units, and institutional food providers are adopting air fryers to meet growing demand for healthier menu items without compromising speed or taste. It offers these businesses a practical solution to reduce oil consumption, improve operational efficiency, and deliver consistent food quality. The equipment’s ability to maintain flavor while complying with dietary trends attracts attention across hospitality and foodservice segments. The Global Air Fryer Market is capitalizing on this commercial uptake, creating new revenue streams beyond household sales.

Customization and Regional Product Differentiation:

Manufacturers are tailoring product features to meet regional culinary preferences and cooking habits. In Asian markets, brands are introducing models with higher temperature ranges for stir-frying or larger capacities to accommodate family meals. In Europe, focus remains on compact designs suitable for smaller kitchens. It enables companies to align product development with cultural expectations and dietary behavior. Customization extends to recipe books, accessory kits, and localized marketing that resonates with target audiences. The Global Air Fryer Market is adapting to geographic diversity by offering region-specific features and designs that enhance local market penetration.

Market Challenges Analysis:

High Product Cost and Limited Penetration in Price-Sensitive Markets:

One of the key challenges in the Global Air Fryer Market is the relatively high upfront cost of the appliance, which restricts adoption in price-sensitive regions. While premium features and multi-functionality justify the price in developed markets, affordability remains a barrier in many emerging economies. Consumers with lower discretionary income may perceive air fryers as non-essential, particularly when traditional cooking methods are ingrained and cost-effective. It slows market penetration across lower-income groups and rural areas where brand awareness and perceived value are still developing. Limited access to financing options and infrequent promotional pricing further widen the affordability gap. The Global Air Fryer Market must address this challenge to achieve balanced global growth.

Consumer Skepticism and Low Awareness in Untapped Regions:

Despite growing popularity in North America, Europe, and parts of Asia-Pacific, consumer awareness remains low in several parts of Latin America, Africa, and Southeast Asia. Misconceptions regarding the appliance’s effectiveness, durability, and energy consumption create hesitation among first-time buyers. It limits word-of-mouth marketing and delays the transition from curiosity to purchase. Lack of local-language support in user manuals and limited after-sales service infrastructure can negatively affect user experience and brand loyalty. Brands must invest in education, demonstrations, and localized campaigns to dispel doubts and build consumer confidence. The Global Air Fryer Market faces a long-term challenge in overcoming these perception barriers to tap into underserved geographies.

Market Opportunities:

Expansion into Emerging Economies with Rising Middle-Class Demographics:

Emerging markets present a strong growth opportunity for the Global Air Fryer Market. Rising urbanization, increasing disposable income, and shifting dietary habits in countries like India, Brazil, Indonesia, and South Africa create favorable conditions for adoption. A growing middle-class population is showing interest in modern kitchen appliances that promote health and convenience. It allows brands to penetrate new regions with mid-range, feature-rich models tailored to local preferences. Expansion of organized retail and e-commerce platforms in these regions further supports accessibility and visibility. The Global Air Fryer Market can leverage this demographic shift to unlock new revenue streams and gain early-mover advantage.

Development of Energy-Efficient and Compact Models for Smaller Households:

Demand is increasing for air fryers that combine energy efficiency with compact form factors, especially in urban apartments and smaller households. Consumers seek solutions that reduce electricity consumption while maximizing utility within limited kitchen space. It opens opportunities for manufacturers to develop smaller-capacity models without compromising on performance. Integration of modular accessories and stackable designs can enhance appeal in dense urban markets. Sustainability-focused product lines also attract environmentally conscious buyers. The Global Air Fryer Market can expand its consumer base by targeting niche segments that value space-saving and eco-friendly innovations.

Market Segmentation Analysis:

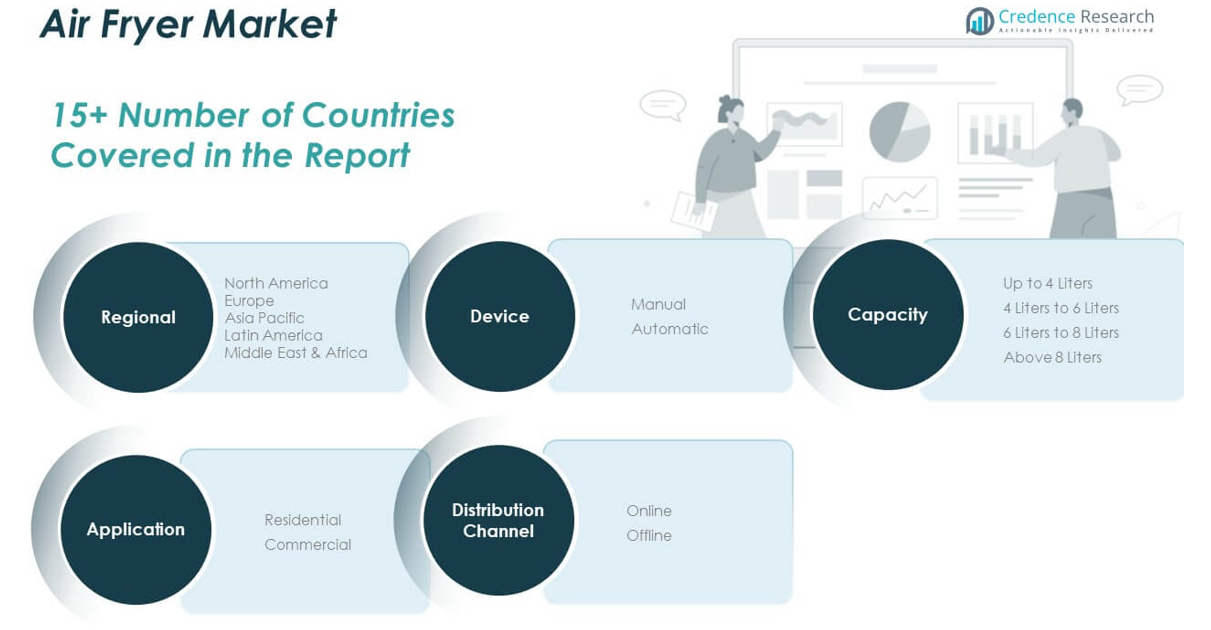

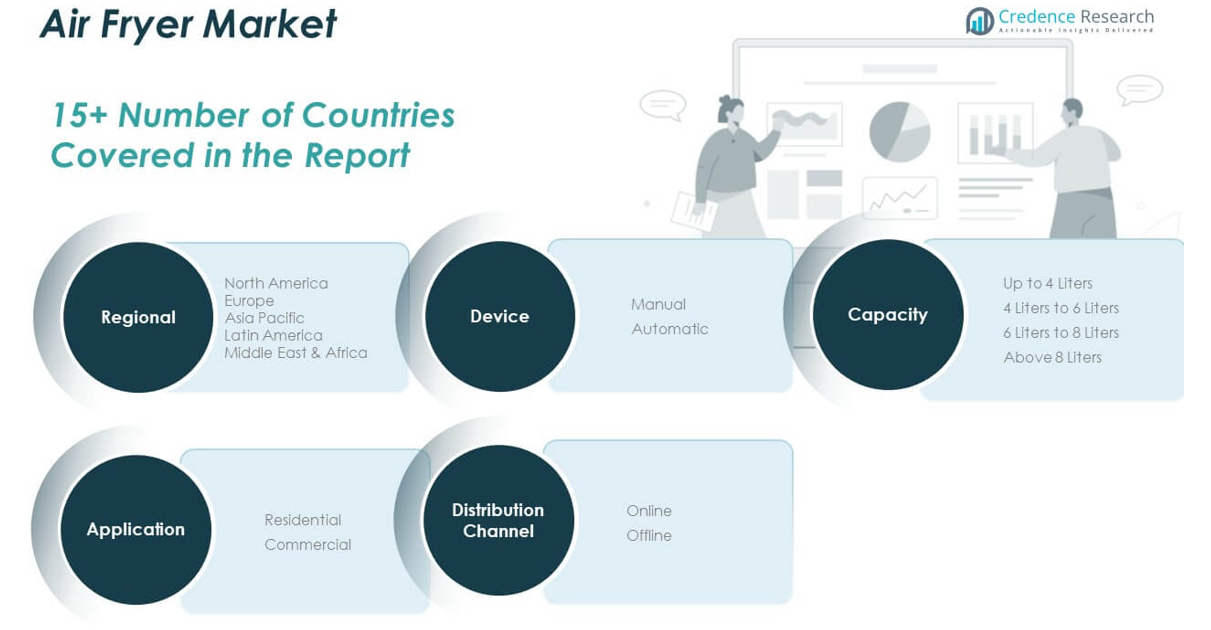

By Device Segment

The Global Air Fryer Market is segmented into manual and automatic devices. Automatic air fryers lead the market due to features such as digital interfaces, programmable settings, and time-saving operation. Manual air fryers appeal to budget-conscious consumers preferring straightforward control without electronic components.

- For instance, the Instant Brands Vortex Plus automatic air fryer (2024) features a digital touchscreen, 6-in-1 functionality (air fry, roast, broil, bake, reheat, dehydrate), and EvenCrisp™ technology. According to Instant Brands’ product documentation, the Vortex Plus uses up to 95% less oil compared to deep frying, with these claims verified in independent laboratory tests.

By Application Segment

The residential segment holds the dominant share in the market, driven by rising health awareness and the shift toward low-oil cooking at home. The commercial segment is expanding gradually, supported by demand from cafés, bakeries, and food trucks integrating compact, energy-efficient appliances into their operations.

- For instance, Henny Penny’s Velocity Series commercial fryers have been independently verified to reduce oil consumption by up to 80% compared to other high-volume fryers, and their low oil volume models use 40% less oil while maintaining output, as documented in Henny Penny’s technical reports and industry case studies from 2024.

By Capacity Segment

Air fryers with a 4 liters to 6 liters capacity are the most in demand, striking a balance between space efficiency and meal volume. The 6 liters to 8 liters and above 8 liters categories are gaining popularity in commercial and large household settings. Units with up to 4 liters capacity continue to serve single users and small households effectively.

By Distribution Channel Segment

Online distribution is growing rapidly, fueled by e-commerce expansion, digital promotions, and customer reviews influencing purchase decisions. Offline channels remain significant, with consumers valuing in-store demonstrations and immediate product availability at electronics and appliance retailers.

Segmentation:

By Device Segment:

By Application Segment:

By Capacity Segment:

- Up to 4 Liters

- 4 Liters to 6 Liters

- 6 Liters to 8 Liters

- Above 8 Liters

By Distribution Channel Segment:

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Air Fryer Market size was valued at USD 345.80 million in 2018 to USD 438.86 million in 2024 and is anticipated to reach USD 775.93 million by 2032, at a CAGR of 7.5% during the forecast period. North America holds a 33% share of the Global Air Fryer Market, leading global consumption. It benefits from strong consumer demand for convenient cooking appliances and a well-established retail infrastructure. High awareness of health-conscious eating and the popularity of oil-free cooking methods support product adoption across the United States and Canada. Manufacturers actively introduce smart and connected models to attract tech-savvy consumers. The presence of key players and aggressive marketing campaigns also bolster regional growth. It maintains steady momentum with robust online and offline sales channels.

Europe

The Europe Air Fryer Market size was valued at USD 187.91 million in 2018 to USD 228.92 million in 2024 and is anticipated to reach USD 375.01 million by 2032, at a CAGR of 6.4% during the forecast period. Europe accounts for 17% of the Global Air Fryer Market, supported by evolving food preparation habits and environmental consciousness. Countries such as Germany, the UK, and France see growing demand for energy-efficient kitchen appliances. Stringent regulations and sustainability standards drive innovation in product design and packaging. European consumers value compact appliances that suit smaller kitchens and urban living spaces. Brands focus on multi-functionality to meet regional preferences. It leverages e-commerce platforms for expanded market penetration and customer engagement.

Asia Pacific

The Asia Pacific Air Fryer Market size was valued at USD 310.65 million in 2018 to USD 412.32 million in 2024 and is anticipated to reach USD 787.17 million by 2032, at a CAGR of 8.5% during the forecast period. Asia Pacific commands a 30% share of the Global Air Fryer Market, driven by rapid urbanization and rising disposable incomes. China, Japan, South Korea, and India exhibit robust growth fueled by changing lifestyles and demand for healthier food options. Regional manufacturers offer competitively priced models tailored to local preferences. Compact designs and multi-cuisine functionalities appeal to younger households and nuclear families. Retail expansion across Tier II and Tier III cities supports wider access. It capitalizes on digital marketing and social media promotions to boost awareness.

Latin America

The Latin America Air Fryer Market size was valued at USD 47.79 million in 2018 to USD 60.64 million in 2024 and is anticipated to reach USD 97.60 million by 2032, at a CAGR of 6.2% during the forecast period. Latin America holds a 5% share of the Global Air Fryer Market, with Brazil and Mexico contributing significantly to regional sales. Rising middle-class income and growing health awareness are increasing demand for alternative cooking solutions. Retailers in the region promote air fryers during seasonal campaigns and offer easy financing options. E-commerce platforms support rural and suburban market access. Product availability in supermarkets and electronics stores also strengthens visibility. It reflects early-stage but promising growth patterns across urban centers.

Middle East

The Middle East Air Fryer Market size was valued at USD 33.82 million in 2018 to USD 40.51 million in 2024 and is anticipated to reach USD 64.19 million by 2032, at a CAGR of 6.0% during the forecast period. The Middle East contributes 3% to the Global Air Fryer Market, supported by growing health and wellness trends in the UAE, Saudi Arabia, and Qatar. Demand rises in metropolitan areas with high expat populations and Western lifestyle influence. Retail chains increasingly stock air fryers in response to shifting culinary preferences. Energy-efficient appliances gain traction under sustainability initiatives. Premium product lines find success in high-income households. It remains a niche yet steadily expanding segment.

Africa

The Africa Air Fryer Market size was valued at USD 24.04 million in 2018 to USD 39.18 million in 2024 and is anticipated to reach USD 60.87 million by 2032, at a CAGR of 5.3% during the forecast period. Africa accounts for 2% of the Global Air Fryer Market, reflecting early-stage adoption. Urban centers in South Africa, Nigeria, and Kenya show increasing interest in modern cooking appliances. Rising awareness of nutrition and oil-free cooking drives gradual market growth. Limited product availability and affordability barriers affect mass adoption. However, expanding retail networks and online sales improve product reach. It presents untapped potential with room for strategic brand positioning and localized marketing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Koninklijke Philips N.V.

- SharkNinja Operating LLC

- Cuisinart

- BLACK+DECKER

- Dash

- Breville

- Havells India Ltd.

- TTK Prestige Ltd.

- Corelle Brands LLC

- Tefal

Competitive Analysis:

The Global Air Fryer Market features a competitive landscape marked by the presence of established appliance brands and emerging regional manufacturers. It includes key players such as Philips, Ninja (SharkNinja), Instant Brands, Cuisinart, and Tefal, each offering a wide product range catering to diverse consumer needs. Companies compete on features, pricing, energy efficiency, and aesthetic appeal. Innovation in smart connectivity, multi-functionality, and compact design remains central to market differentiation. Brands invest in strategic partnerships with retailers and leverage online platforms for broader consumer access. Strong marketing efforts, including influencer collaborations and recipe content, drive brand visibility. It continues to evolve with new entrants offering cost-effective solutions and established players expanding into untapped regions.

Recent Developments:

- In June 2025, TTK Prestige unveiled its latest innovation, the AirFlip Two-in-one Air Fryer, at the Bollywood Hungama Style Icons Summit & Awards. This launch was part of the brand’s strategy to blend style and functionality in modern Indian kitchens, positioning the kitchen as a space for creativity and self-expression.

- In March 2025, Dash announced new partnerships with popular brands such as PEEPS®, Peanuts®, and Disney, unveiling themed kitchen appliances and expanding its product catalog. Dash also introduced the MultiMaker™ Flip & Fry Digital 2-in-1 Grill + Air Fryer, a compact unit that functions as both an air fryer and an indoor grill, catering to the demand for multi-functionality and customization in kitchen appliances.

- In November 2024, Cuisinart’s Air Fryer Toaster Oven with Grill (TOA-70) was recognized as a winner in Good Housekeeping’s 2024 Best Kitchen Gear Awards. This model combines eight functions, including air fry, convection bake, broil, and grill, offering next-generation cooking versatility for home kitchens.

- In September 2024, SharkNinja introduced the Ninja CRISPi™ Portable Cooking System, a fully portable air fryer with a handheld Power Pod that snaps onto glass containers for prepping, cooking, serving, and storing food in one appliance. This innovation addresses consumer needs for convenience and versatility, allowing for both small and large batch cooking with up to 450°F of super-heated air.Earlier in 2024, SharkNinja also launched the Ninja Double Stack XL Air Fryer with Smart Cook System, featuring a built-in digital probe for precise results and a compact design for space-saving kitchens.

Market Concentration & Characteristics:

The Global Air Fryer Market exhibits moderate concentration with a mix of multinational corporations and regional players competing across price tiers. It is characterized by high product innovation, fast adoption cycles, and strong consumer interest in health-centric cooking. Brands focus on user-friendly features, energy efficiency, and compact designs to meet urban lifestyle demands. The market favors companies that invest in R&D and digital marketing to enhance customer engagement. E-commerce platforms play a critical role in product visibility and distribution. It shows strong responsiveness to consumer trends, including sustainability, smart technology, and multifunctional appliance use.

Report Coverage:

The research report offers an in-depth analysis based on device type, application, capacity, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for oil-free cooking will continue to drive household air fryer adoption globally.

- Smart air fryer models with Wi-Fi and app connectivity will see increased consumer interest.

- Asia Pacific will lead growth due to expanding middle-class populations and urbanization.

- E-commerce platforms will remain a dominant distribution channel for both premium and budget models.

- Energy-efficient and multifunctional designs will become standard across new product launches.

- Manufacturers will expand into Tier II and Tier III cities to tap into underserved markets.

- Compact, space-saving units will gain popularity in regions with smaller kitchen spaces.

- Health-conscious consumers will fuel demand for advanced cooking presets and faster air circulation systems.

- Strategic brand collaborations with influencers and chefs will shape consumer preferences.

- Sustainable packaging and recyclable components will influence purchase decisions and brand loyalty.