Market Overview

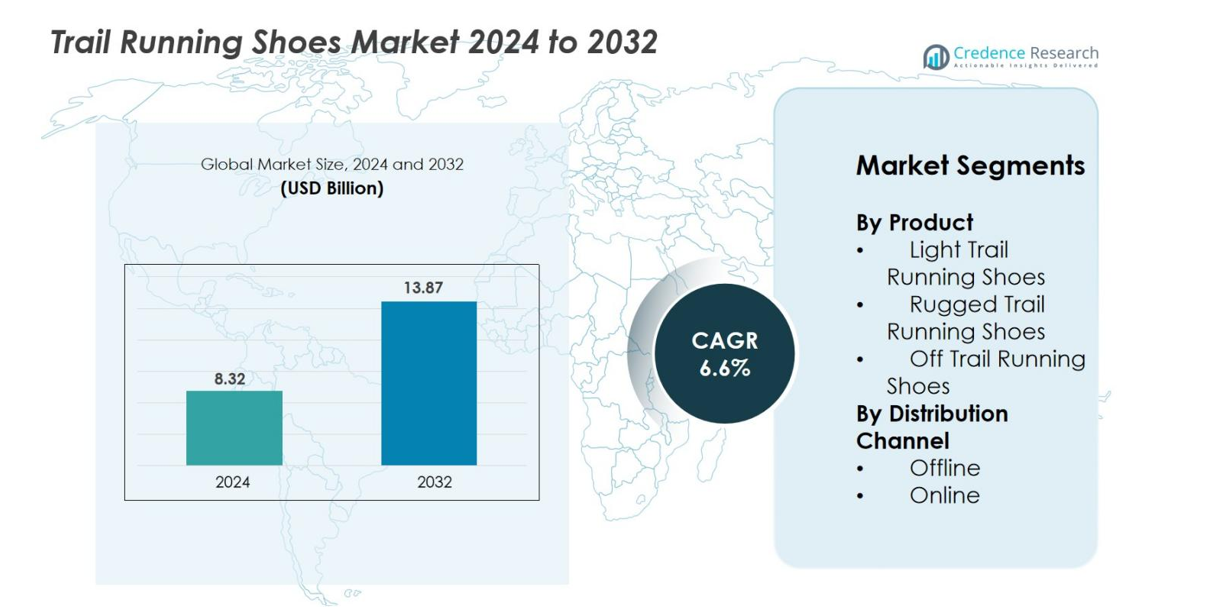

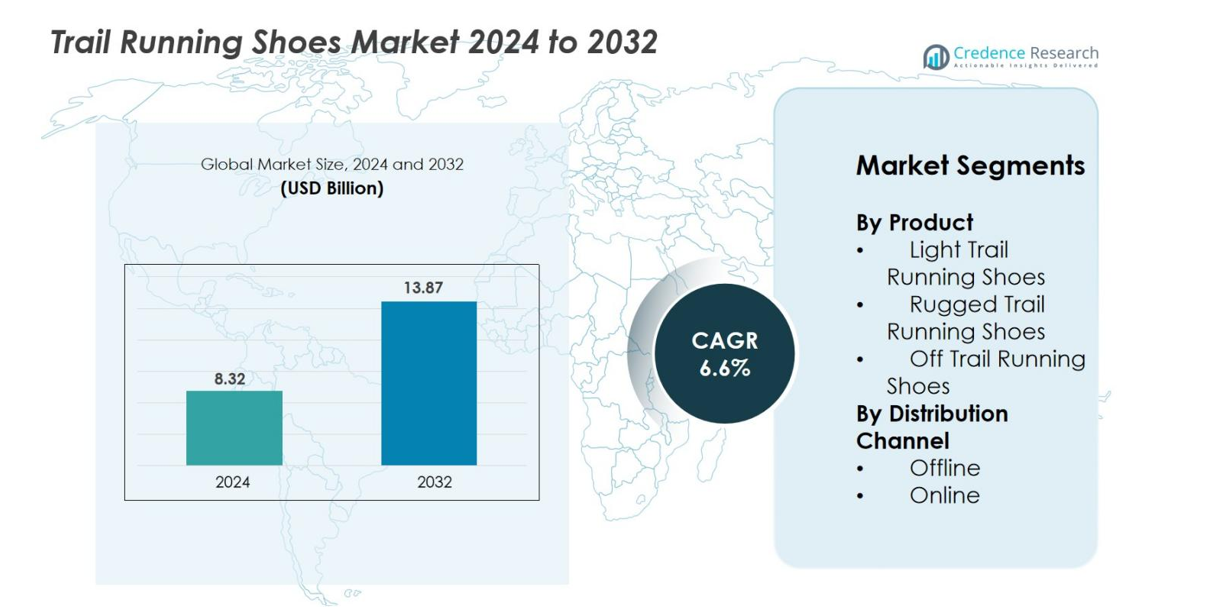

Trail Running Shoes Market size was valued USD 8.32 Billion in 2024 and is anticipated to reach USD 13.87 Billion by 2032, at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trail Running Shoes Market Size 2024 |

USD 8.32 Billion |

| Trail Running Shoes Market, CAGR |

6.6% |

| Trail Running Shoes Market Size 2032 |

USD 13.87 Billion |

Trail Running Shoes Market is shaped by leading players such as Nike, Inc., Adidas AG, Deckers Brands, New Balance, ASICS America Corporation, Brooks Sports, Inc., Wolverine World Wide, Inc., Amer Sports, VF Corporation, and SKECHERS USA, Inc., each competing through innovation, performance technologies, and diversified product portfolios. These brands focus on lightweight designs, enhanced traction systems, and durable materials to meet growing demand from recreational and professional runners. Regionally, North America leads the market with a 32% share, driven by strong outdoor sports participation and high adoption of premium footwear, followed by Europe and Asia Pacific as key growth contributors.

Market Insights

- Trail Running Shoes Market was valued at USD 8.32 Billion in 2024 and is projected to reach USD 13.87 Billion by 2032, registering a CAGR of 6.6% during the forecast period.

- Market growth is driven by rising outdoor sports participation, increasing health consciousness, and expanding demand for lightweight and high-performance footwear across recreational and professional runners.

- Key trends include adoption of sustainable materials, innovation in cushioning and grip technologies, and growing preference for premium models designed for diverse terrains and long-distance running events.

- Leading players such as Nike, Adidas, Deckers Brands, New Balance, ASICS, and Brooks compete through advanced product designs, strong retail presence, and expanding e-commerce channels, while smaller brands face pricing and innovation pressures.

- North America holds a 32% regional share, Europe accounts for 28%, and Asia Pacific captures 27%, while Light Trail Running Shoes lead the product segment with a 46.3% share, supported by strong demand for versatile and lightweight designs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The Trail Running Shoes Market by product is led by Light Trail Running Shoes, accounting for 46.3% of the segment share in 2024. This category dominates due to its lightweight construction, enhanced flexibility, and suitability for mixed-terrain running preferred by recreational and competitive runners. Rugged Trail Running Shoes hold a strong presence with their advanced stability and protection features, while Off-Trail Running Shoes serve niche users requiring extreme durability. Growth across all product types is supported by increasing outdoor sports participation, rising demand for performance footwear, and expanding innovation in cushioning and outsole technologies.

- For instance, the Nike Terra Kiger 9 has a full-length Nike React foam midsole and specifically removed the Zoom Air units (both forefoot and heel) found in previous iterations to bring the foot closer to the ground for enhanced agility and a more connected feel on the trail.

By Distribution Channel

The distribution channel analysis shows that Offline Retail remains the dominant sub-segment, capturing 58.7% of the Trail Running Shoes Market in 2024. Specialty sports stores, brand outlets, and outdoor gear retailers continue to attract buyers seeking proper fit assessment and expert guidance. However, Online Channels are expanding rapidly, supported by wider product availability, competitive pricing, and the convenience of home delivery. The surge in digital commerce platforms, enhanced virtual try-on tools, and growing consumer confidence in online purchases further fuel the online segment’s robust growth trajectory.

- For instance, Decathlon supports offline dominance with a network of over 1,750 physical stores across more than 70 countries, enabling on-site footwear fitting and expert consultations.

Key Growth Drivers

Rising Participation in Outdoor and Fitness Activities

The Trail Running Shoes Market is experiencing strong growth due to the surge in outdoor sports participation, driven by increasing health awareness and the popularity of recreational fitness activities. Consumers across all age groups are adopting trail running for its physical and mental health benefits, contributing significantly to footwear demand. The rise of organized outdoor events, such as trail marathons, mountain running competitions, and endurance races, further boosts product adoption. Additionally, growing interest in adventure tourism, supported by improved access to hiking trails and national parks, accelerates market expansion. Brands are responding with advanced cushioning technologies, lightweight materials, and enhanced grip designs to meet evolving user preferences. The emphasis on performance footwear suited for varied terrains positions trail running shoes as a core category within the broader athletic footwear segment. This rising adoption, combined with lifestyle shifts and global fitness trends, continues to drive steady market growth.

- For instance, The UTMB (Ultra-Trail du Mont-Blanc) registered 10,000+ runners across its race categories in 2023, many equipped with specialized trail footwear supplied through brand partnerships such as Salomon’s event support team of over 200 product specialists

Product Innovation and Technological Advancements

Technological advancements are a crucial catalyst for growth in the Trail Running Shoes Market. Manufacturers are investing in innovative materials and engineering techniques to deliver superior durability, traction, and comfort for demanding terrains. Key innovations include multi-directional lug patterns, energy-return midsoles, and reinforced uppers that enhance stability and protection without compromising weight. Brands are integrating sustainable materials, such as recycled mesh and eco-friendly rubber compounds, to cater to environmentally conscious consumers. Moreover, advancements in gait analysis and biomechanical research have enabled personalized footwear solutions, improving performance and reducing injury risks. These technology-driven improvements help brands differentiate in a highly competitive market while meeting diverse consumer expectations. Continuous R&D investment ensures that trail running shoes evolve rapidly, attracting both seasoned athletes and beginners. As innovation remains central to product development, the market benefits from consistent upgrades, expanded product lines, and enhanced user experience, fueling long-term growth.

- For instance, Brooks incorporates nitrogen-infused DNA Flash foam technology in certain road and trail models to increase energy return and provide lightweight performance.

Expansion of E-commerce and Omnichannel Retailing

The rapid expansion of e-commerce and omnichannel retail strategies serves as a significant growth driver for the Trail Running Shoes Market. Online platforms offer consumers access to a wider range of products, competitive pricing, and detailed product comparisons, making digital shopping increasingly preferred. Brands and retailers are enhancing user experience through virtual try-on tools, AI-driven product recommendations, and advanced sizing systems that reduce purchase hesitation. Omnichannel integration, such as click-and-collect services and seamless returns, further strengthens consumer confidence. Retailers are leveraging data analytics to understand buying behaviors, optimize inventory, and tailor promotions to specific customer segments. Additionally, social media and influencer marketing play a pivotal role in raising brand visibility and promoting outdoor lifestyles associated with trail running. The convenience of online purchasing, combined with expanding global reach and evolving digital strategies, reinforces the segment’s growth trajectory and improves accessibility for both urban and remote consumers.

Key Trends & Opportunities

Sustainability and Eco-Friendly Product Development

Sustainability has emerged as a defining trend in the Trail Running Shoes Market, with consumers increasingly prioritizing eco-friendly materials and responsible manufacturing practices. Brands are incorporating recycled plastics, biodegradable midsoles, and natural rubber outsoles to minimize environmental impact. Waterless dyeing techniques, reduced carbon manufacturing, and ethical sourcing practices are gaining traction across the industry. This shift presents a major opportunity for companies to build brand loyalty by aligning with global sustainability values. Regulatory bodies and environmental organizations are pushing for greener production standards, further motivating manufacturers to adopt sustainable methods. The growing preference for long-lasting and repairable footwear also encourages brands to design more durable products. As environmental consciousness rises and consumers prefer brands that support circular economy practices, sustainability will continue to reshape product innovation and market positioning, offering long-term competitive advantages.

- For instance, Adidas’ Parley program incorporates materials made from intercepted marine waste, with each pair of shoes using the equivalent of approximately 11 recovered plastic bottles, reducing reliance on virgin plastics.

Growing Demand for Premium and High-Performance Footwear

Another key trend shaping the Trail Running Shoes Market is the rising demand for premium, high-performance footwear equipped with advanced functionalities. Consumers are increasingly willing to invest in shoes that offer superior cushioning, enhanced breathability, and specialized traction for diverse terrains. This demand is driven by the growing sophistication of trail running as a sport and the expectations of experienced runners seeking optimized performance. Opportunities arise for brands to expand their premium product portfolios, including waterproof models, carbon-plate infused shoes, and terrain-specific designs. The popularity of long-distance trail events and technical mountain races has amplified the need for products that balance comfort, protection, and speed. Custom-fit footwear and limited-edition performance series are gaining traction among enthusiasts. As consumer preferences shift toward high-value technical products, brands with advanced R&D capabilities have a significant opportunity to capture premium market share.

- For instance, The Nike Ultrafly Trail integrates a full-length carbon plate combined with ZoomX foam and weighs approximately 300 grams in a men’s size 9, engineered for elite racing performance.

Key Challenges

Intense Market Competition and Price Pressure

The Trail Running Shoes Market faces significant challenges due to intense competition among global and regional brands. Established companies with strong R&D investments dominate the market, making it difficult for smaller players to compete on both technology and pricing. Frequent product launches by leading brands increase price pressure, forcing manufacturers to balance cost efficiency with innovation. Additionally, counterfeit and low-quality products in certain regions dilute brand value and disrupt pricing strategies. Retail competition, both offline and online, further compresses margins, as discount-driven promotions become prevalent. Consumers increasingly compare specifications, reviews, and pricing across multiple platforms, raising the requirement for differentiation. Maintaining profitability while delivering advanced features remains challenging for many manufacturers. As competitive intensity grows, brands must strategically innovate, optimize supply chains, and invest in marketing to sustain market presence and protect market share.

Supply Chain Disruptions and Raw Material Volatility

Supply chain instability poses an ongoing challenge in the Trail Running Shoes Market, particularly due to fluctuations in raw material availability and global logistics disruptions. The industry relies heavily on specific materials such as EVA foam, rubber compounds, synthetic fabrics, and eco-friendly alternatives, all of which are prone to price volatility. Environmental regulations and restrictions on certain chemical components can further impact manufacturing processes. Geopolitical tensions, global shipping delays, and labor shortages in manufacturing hubs disrupt production timelines, affecting product availability across key markets. Brands must navigate rising transportation costs and ensure flexibility in sourcing to maintain steady output. Additionally, the push toward sustainability requires new supply partnerships, which can initially increase costs and complexity. Ensuring consistent material quality and timely delivery while managing production costs remains a critical challenge for companies in this evolving and dynamic market.

Regional Analysis

North America

North America holds a 32% share of the Trail Running Shoes Market, driven by strong participation in outdoor sports, well-developed trail infrastructure, and high consumer spending on premium athletic footwear. The U.S. leads the region due to its widespread trail running culture and the presence of major performance footwear brands introducing advanced cushioning and grip technologies. Rising interest in fitness activities, coupled with growing enrollment in trail races and marathons, further strengthens market demand. Retail expansion across specialty sports stores and increasing online penetration also support steady growth, positioning North America as a key revenue contributor.

Europe

Europe accounts for 28% of the Trail Running Shoes Market, supported by a strong outdoor recreation culture and favorable geographical conditions for trail running across countries like Germany, France, Spain, and the Nordic nations. The region benefits from a large base of professional and recreational trail runners, driving demand for durable and performance-enhancing footwear. Increasing participation in ultra-trail and mountain running events also boosts uptake of rugged and lightweight models. Sustainability-focused innovations appeal strongly to European consumers, enhancing brand competitiveness. With a mature athletic footwear market and rising tourism in mountainous regions, Europe maintains a solid growth trajectory.

Asia Pacific

Asia Pacific captures 27% of the Trail Running Shoes Market, emerging as one of the fastest-growing regions due to expanding outdoor sports participation and rising health awareness in China, Japan, Australia, and India. Governments and private organizations are investing in hiking trails, running parks, and adventure tourism, stimulating product demand. Growing urbanization and higher disposable incomes encourage consumers to adopt premium performance footwear. International brands are increasing regional presence through targeted marketing and e-commerce expansion. The surge in local trail running events and growing interest in fitness lifestyle trends further position Asia Pacific as a high-potential market.

Latin America

Latin America holds an 8% share of the Trail Running Shoes Market, driven by increasing interest in outdoor recreational activities and expanding participation in trail races across Brazil, Mexico, Chile, and Argentina. The region’s diverse terrain, including mountains and forest trails, supports rising demand for durable and multi-terrain footwear. Growing adoption of active lifestyles and the expansion of specialty sports stores further strengthen market penetration. E-commerce growth enables broader access to international brands, encouraging faster product adoption. Although the market is still developing, rising fitness engagement and tourism-driven trail activities continue to create opportunities for sustained regional growth.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the Trail Running Shoes Market, supported by increasing outdoor activity participation in countries such as the UAE, South Africa, and Saudi Arabia. Expanding adventure tourism, including desert trails and mountain running zones, is boosting demand for lightweight and rugged footwear. Growth in health consciousness and rising popularity of community-based running events further stimulate market interest. Retail development and improved online availability of global brands enhance accessibility. Although smaller in size, the region shows steady potential as urban populations embrace fitness-oriented lifestyles and seek specialized footwear for challenging terrains.

Market Segmentations

By Product

- Light Trail Running Shoes

- Rugged Trail Running Shoes

- Off Trail Running Shoes

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Trail Running Shoes Market features a dynamic competitive landscape shaped by global brands and specialized outdoor performance companies. Key players such as Nike, Inc., Adidas AG, New Balance, Deckers Brands, ASICS America Corporation, Brooks Sports, Inc., Wolverine World Wide, Inc., VF Corporation, SKECHERS USA, Inc., and Amer Sports dominate the market through extensive product portfolios and strong distribution networks. These companies compete on innovation, focusing on advanced cushioning, lightweight materials, enhanced traction, and sustainable manufacturing to meet evolving consumer expectations. Premium technologies, such as energy-return midsoles, multi-directional grip outsoles, and waterproof membranes, help brands differentiate in a crowded environment. Strategic partnerships, athlete endorsements, and expanding e-commerce reach further strengthen brand visibility and customer loyalty. Additionally, niche outdoor brands continue to gain momentum by offering terrain-specific designs and eco-conscious products. As competition intensifies, companies increasingly invest in R&D, digital engagement, and regional expansion to secure long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nike, Inc.

- Deckers Brands

- Brooks Sports, Inc.

- ASICS America Corporation

- Amer Sports

- Wolverine World Wide, Inc.

- SKECHERS USA, Inc.

- VF Corporation

- Adidas AG

- New Balance

Recent Developments

- In November 2025, Salomon revealed the collaborative trail-running shoe “XT-Whisper” with Aries, set for release 18 November.

- In July 2025, Keen will release its first trail-running shoe “Seek” on July 25 after nearly two years of development.

- In March 2025, The North Face unveiled four new trail-running shoes in its Vectiv 3.0 series.

Report Coverage

The research report offers an in-depth analysis based on Product, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as outdoor recreation and fitness participation continue to rise globally.

- Demand for lightweight, durable, and performance-enhancing footwear will strengthen across beginner and professional runners.

- Brands will increasingly adopt sustainable materials and eco-friendly production methods to meet consumer expectations.

- Premium and technologically advanced shoes with improved cushioning and traction will gain higher market traction.

- E-commerce expansion and digital retail innovations will further boost accessibility and global product reach.

- Custom-fit and personalized trail running shoe solutions will emerge as key differentiation factors.

- Growth in adventure tourism and participation in trail races will drive higher product adoption.

- Regional markets in Asia Pacific and Latin America will expand rapidly due to rising fitness awareness.

- Companies will intensify collaborations with athletes and influencers to enhance brand visibility.

- Continuous R&D investment will lead to advanced shoe designs tailored for diverse terrains and running styles.