Market Overview

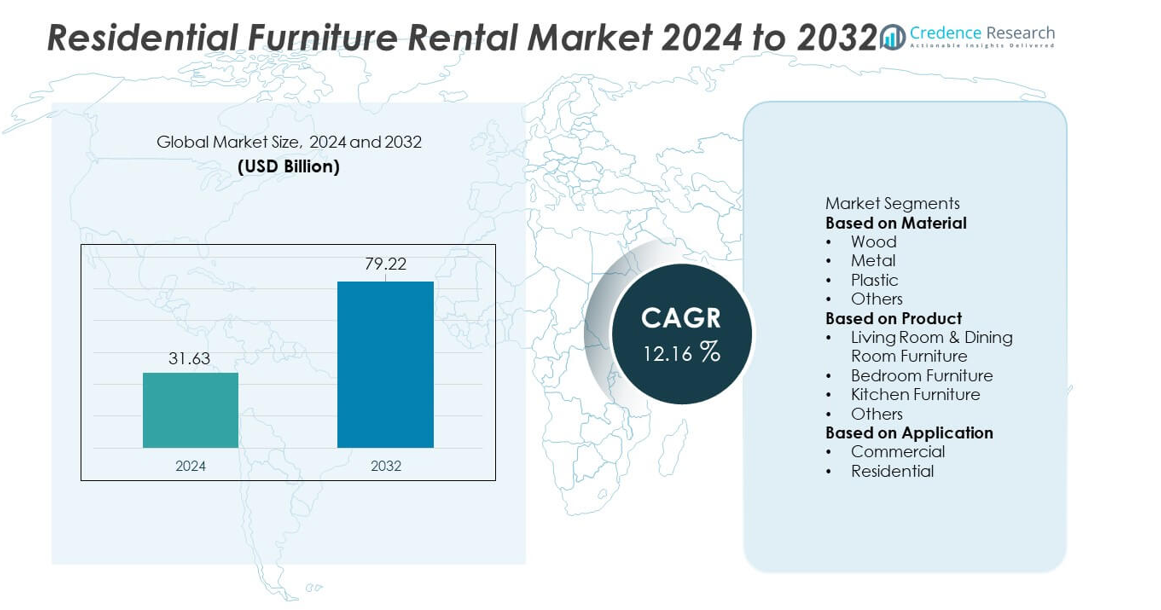

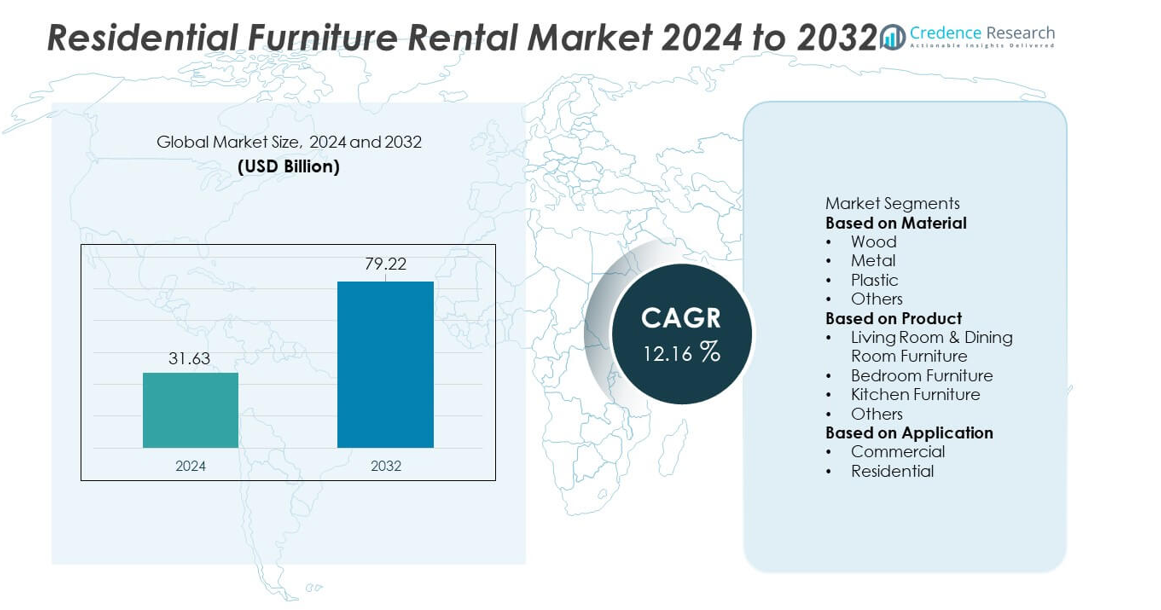

The Residential Furniture Rental market reached USD 31.63 billion in 2024 and is projected to rise to USD 79.22 billion by 2032, registering a CAGR of 12.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Furniture Rental Market Size 2024 |

USD 31.63 billion |

| Residential Furniture Rental Market, CAGR |

12.16% |

| Residential Furniture Rental Market Size 2032 |

USD 79.22 billion |

The Residential Furniture Rental market is shaped by key players such as Furlenco, Rentomojo, Feather, CORT, Fernish, Brook Furniture Rental, CasaOne, Freedom Furniture & Electronics, Inhabitr, and The Everset. These companies expand their presence through flexible subscription models, curated furniture packages, and technology-driven rental platforms that appeal to mobile professionals, students, and corporate clients. North America leads the global market with a 38% share, supported by high rental housing demand and strong adoption of subscription-based living. Asia Pacific follows with a 28% share, driven by rapid urbanization and rising millennial renters, while Europe holds a 27% share backed by growing furnished rental spaces and sustainability-focused consumption trends.

Market Insights

- The Residential Furniture Rental market reached USD 31.63 billion in 2024 and will grow at a CAGR of 12.16% through 2032.

- Demand increases as young professionals and students choose flexible, low-investment furnishing solutions, with wood-based furniture leading the material segment with a 54% share.

- Subscription-based models, digital rental platforms, and sustainable circular-use practices shape market trends as renters seek convenience and design flexibility.

- Competition strengthens as major players expand curated packages, improve logistics networks, and introduce customizable rental plans to attract both short-term and long-term tenants.

- North America leads with a 38% share, followed by Asia Pacific at 28% and Europe at 27%, while living room and dining room furniture dominate the product segment with a 46% share across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Wood dominates the material segment with a 54% share, driven by strong consumer preference for premium aesthetics, durability, and versatility in rental furniture. Rental providers offer modular wooden pieces that suit short-term stays, student housing, and urban apartments, boosting demand. Metal furniture gains traction for its strength and modern design appeal, while plastic options grow among budget-conscious renters seeking lightweight and easy-maintenance solutions. Other materials, including glass and composite finishes, serve niche décor needs. The rise of furnished rentals and flexible living arrangements continues to strengthen the leadership of wood-based rental furniture across global markets.

- For instance, the furniture firm Featherlite expanded its product lines, including office modular workstations, to meet growing demand. The company employs advanced technology and machinery, such as CNC equipment and precision tools, to ensure high quality and consistency across its manufacturing processes.

By Product

Living room and dining room furniture lead the product segment with a 46% share, supported by consistent demand from tenants, shared housing users, and corporate clients seeking complete home setup solutions. Sofas, tables, chairs, and storage units form the core of rental packages, making this category the most utilized. Bedroom furniture follows, driven by the need for beds, wardrobes, and dressers among urban renters and students. Kitchen furniture and other categories expand as customers prefer end-to-end furnishing solutions. Growing mobility, rising renting trends, and subscription-based living models reinforce strong adoption of living and dining furniture rentals.

- For instance, Furlenco enhanced its living room category with a sofa production line that has significant manufacturing capabilities. The company also introduced an assembly system that facilitates quick setup time for delivered packages, with some products available for delivery within a few days.

By Application

Residential applications dominate with a 68% share, as urban households, students, and young professionals increasingly choose flexible rental furniture to avoid upfront purchase costs. The category grows with the rise of relocations, co-living spaces, and short-term rentals. Commercial applications, including corporate housing, serviced apartments, and temporary office setups, hold a steady share as businesses adopt rental models to optimize budgets and enhance workspace flexibility. The residential segment continues to lead due to changing lifestyle patterns, preference for low-commitment furnishing options, and expansion of rental platforms offering customizable packages and subscription-based services.

Key Growth Drivers

Rising Urbanization and Mobility Trends

Rapid urban migration and increasing workforce mobility drive strong demand for residential furniture rental services. Young professionals, students, and short-term tenants prefer flexible furnishing options that reduce upfront investment and support frequent relocations. Rental platforms offer customizable packages, doorstep delivery, and easy returns, making them attractive alternatives to traditional purchases. The rise of co-living spaces and furnished rentals further accelerates adoption. As urban living becomes more dynamic and space-efficient, furniture rental solutions continue to gain traction across major cities worldwide.

- For instance, RentoMojo has scaled rapidly by leveraging automation for efficient operations, including completely automating its consumer verification process. The company offers free delivery and installation services across its many operational cities and has expanded to numerous locations.

Increasing Popularity of Subscription-Based Living Models

-based furniture services attract consumers seeking convenience, affordability, and design flexibility. These models allow renters to upgrade, swap, or return items without long-term commitments, aligning with shifting lifestyle preferences. Companies offer curated packages for living rooms, bedrooms, and full-home setups, appealing to tenants who want stylish interiors without high upfront costs. Growing acceptance of consumption-as-a-service and sustainable use patterns strengthens the market. As more households embrace on-demand living solutions, subscription-driven furniture rental continues to expand rapidly.

- For instance, Furlenco manages active subscription orders supported by a centralized inventory system. The firm’s assembly unit manufactures furniture pieces which are built for easy refurbishment.

Expanding Real Estate and Hospitality Sectors

Growth in furnished rentals, serviced apartments, and corporate housing boosts demand for rental furniture. Property owners use rental furniture to stage homes, improve occupancy rates, and reduce capital expenditure. Hospitality operators rely on flexible rental agreements to manage seasonal demand and upgrade interiors without major investments. The rise of temporary housing for relocated employees also contributes to market expansion. As real estate developers increasingly integrate ready-to-move-in solutions, furniture rental becomes a cost-effective option that enhances tenant experience and operational efficiency.

Key Trends & Opportunities

Sustainability and Circular Economy Adoption

Consumers and businesses increasingly seek sustainable furnishing options, creating opportunities for rental providers offering refurbished, reusable, and long-life furniture. Rental models support circular economy principles by extending product lifespan and reducing waste. Companies invest in durable materials, repair services, and eco-friendly sourcing to meet environmental expectations. Growing awareness of responsible consumption strengthens the appeal of renting over buying. This shift enables providers to differentiate through sustainability-focused product lines and green business practices.

- For instance, Fernish operates a refurbishment facility capable of restoring furniture units using a repair workflow as part of its circular model that aims to prevent furniture from going to landfill.

Technology-Driven Personalization and Service Innovation

Digital platforms enhance customer experience through 3D room visualization, AI-based furniture recommendations, and automated subscription management. Technology enables efficient inventory tracking, predictive maintenance, and faster delivery. Online marketplaces expand reach, making rental services accessible to a broader customer base. As consumers seek personalized home décor, platforms offering modular designs, flexible upgrades, and tailored packages gain competitive advantage. These innovations create new growth opportunities by improving convenience and customer engagement.

- For instance, the former furniture rental company CasaOne was reported to build technology for inventory, supply chain, and large format logistics. The platform offered services such as personalized product suggestions, three-dimensional visualizations, and space-planning expertise.

Key Challenges

High Logistics and Maintenance Costs

Furniture rental businesses face significant operational costs related to transportation, warehousing, cleaning, and repairs. Frequent movement of bulky items increases logistics complexity and reduces profit margins. Maintaining quality standards across rentals requires continuous refurbishment and inspection, raising expenses. Companies must optimize supply chains, adopt durable materials, and streamline reverse logistics to remain competitive. These cost pressures challenge scalability, especially for smaller providers.

Lower Awareness and Adoption in Emerging Markets

In many emerging regions, consumers still prefer owning furniture, limiting rental market penetration. Lack of awareness, limited platform availability, and cultural preference for long-term purchases slow adoption. Trust concerns related to product quality, hygiene, and contract terms also hinder growth. Providers need strong marketing, transparent pricing, and localized service models to build acceptance. Overcoming these barriers is essential for expanding the residential furniture rental market globally.

Regional Analysis

North America

North America holds a 38% share of the Residential Furniture Rental market, driven by strong demand from young professionals, students, and corporate housing sectors. High mobility across major cities, rising preference for flexible living arrangements, and the growth of furnished rental properties contribute to market expansion. Companies offer subscription-based and customizable furniture packages that appeal to tenants seeking convenience and modern interiors. The U.S. leads adoption due to its large rental population and growing co-living spaces. Increasing relocation trends and sustained real estate activity continue to support the region’s leadership in residential furniture rentals.

Europe

Europe accounts for a 27% share, supported by rising urbanization, expanding expatriate communities, and increasing demand for cost-effective furnishing solutions. Countries such as the U.K., Germany, and France see strong adoption due to high rental housing rates and lifestyle shifts toward flexible consumption models. The growth of student accommodation and furnished short-stay apartments further boosts market demand. Sustainability awareness also drives preference for rental furniture as a circular and waste-reducing alternative. Strong digital adoption and expanding rental platforms strengthen Europe’s position as a significant market for furniture rental services.

Asia Pacific

Asia Pacific holds a 28% share, driven by rapid urban growth, rising millennial populations, and the expansion of tech-driven rental service providers. India, China, Japan, and Southeast Asia see increasing demand for flexible home furnishing solutions as young professionals move frequently for work and education. The region benefits from affordable rental plans, fast-growing co-living spaces, and expanding furnished rental housing. Digital platforms offering subscription-based furniture packages accelerate adoption. As urban living becomes more compact and mobile, Asia Pacific continues emerging as one of the fastest-growing markets for residential furniture rentals.

Latin America

Latin America holds a 4% share, supported by rising urbanization and growing interest in cost-effective furnishing options among young renters. Brazil, Mexico, and Colombia lead adoption as rental housing becomes more common in major cities. Furniture rental gains traction among students, expatriates, and professionals seeking temporary setups without long-term investment. Economic constraints also encourage consumers to choose rental models over purchasing new furniture. Although the market is still developing, increasing digital penetration and expansion of rental service providers contribute to steady growth.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by demand from expatriates, corporate housing, and short-term rental properties. Countries such as the UAE, Saudi Arabia, and South Africa see rising adoption as mobile professionals seek convenient and flexible furnishing solutions. The hospitality sector also contributes through serviced apartments and temporary accommodation. Growing real estate development and the expansion of urban rental communities support market potential. While awareness levels remain lower than in developed regions, increasing workforce mobility and expanding digital platforms continue to drive gradual market growth.

Market Segmentations:

By Material

- Wood

- Metal

- Plastic

- Others

By Product

- Living Room & Dining Room Furniture

- Bedroom Furniture

- Kitchen Furniture

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Residential Furniture Rental market features leading players such as Furlenco, Rentomojo, Feather, CORT, Fernish, Brook Furniture Rental, CasaOne, Freedom Furniture & Electronics, Inhabitr, and The Everset. These companies compete by offering flexible subscription models, customizable rental packages, and value-added services such as free delivery, maintenance, and easy upgrades. Many players focus on digital platforms to streamline ordering, enhance customer experience, and support seamless inventory management. Sustainability initiatives, including refurbishment programs and circular-use models, help strengthen brand differentiation. Strategic partnerships with real estate developers, co-living operators, and corporate housing providers expand market presence. Continuous investment in design, durability, and logistics efficiency enables companies to serve mobile professionals, students, and short-term renters. As demand for cost-effective and hassle-free furnishing grows, key players prioritize innovation and customer-centric services to maintain competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Furlenco

- Rentomojo

- Feather

- CORT (A Berkshire Hathaway Company)

- Fernish

- Brook Furniture Rental

- CasaOne

- Freedom Furniture & Electronics

- Inhabitr

- The Everset

Recent Developments

- In September 2025, Furlenco expanded high-end offerings and added swappable kids’ furniture.

- In August 2024, CORT Furniture Rental extended its partnership with Move For Hunger to run new hunger-relief initiatives across the U.S.

- In August 2023, Brook Furniture Rental was acquired by AFR Furniture Rental, which will now handle Brook’s existing customers

Report Coverage

The research report offers an in-depth analysis based on Material, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rental furniture will rise as mobility increases among urban professionals.

- Subscription-based and flexible rental plans will become standard across major service providers.

- Digital platforms will expand, offering personalized packages through AI-driven recommendations.

- Sustainable and circular-use furniture models will gain stronger adoption.

- Partnerships with real estate developers and co-living operators will accelerate market penetration.

- Premium and designer furniture rentals will grow as consumers seek aesthetic upgrades without ownership costs.

- Logistics efficiency and faster delivery cycles will become key competitive factors.

- Refurbished and long-life furniture lines will gain traction to reduce operational costs.

- Emerging markets will adopt rental services as awareness and digital access increase.

- Corporate housing and relocation services will expand their reliance on rental furniture solutions.