Market Overview

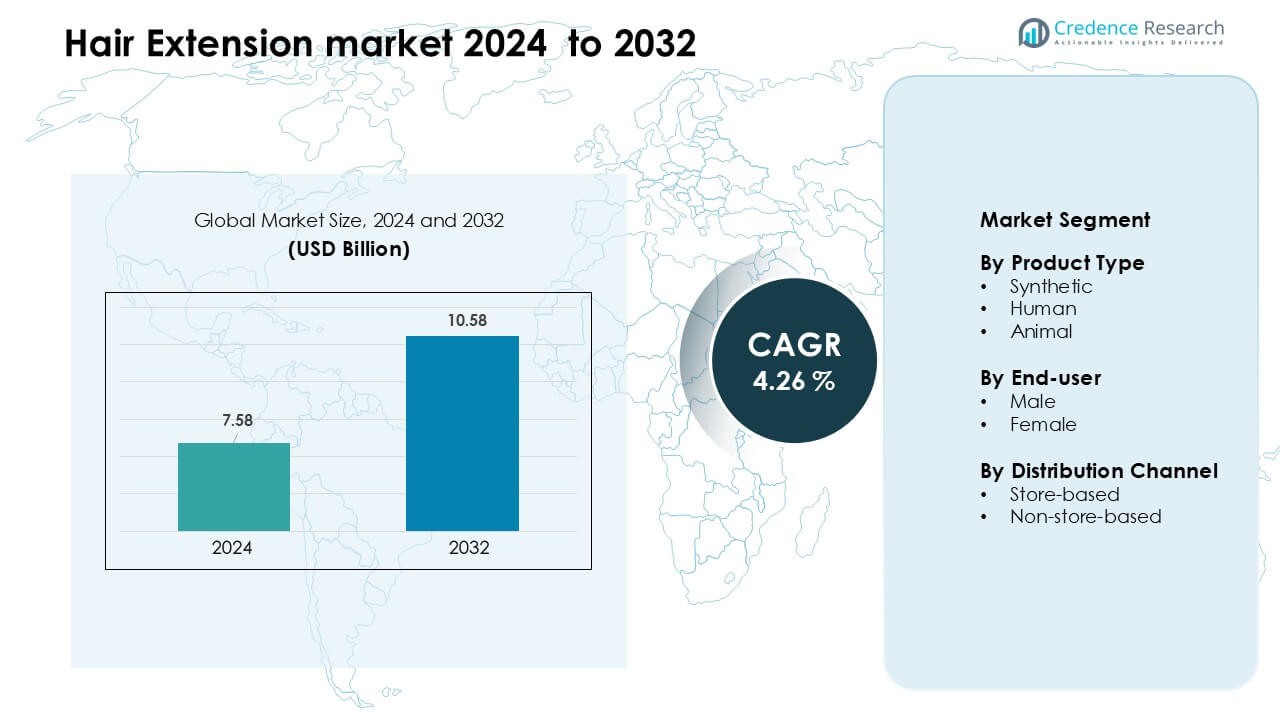

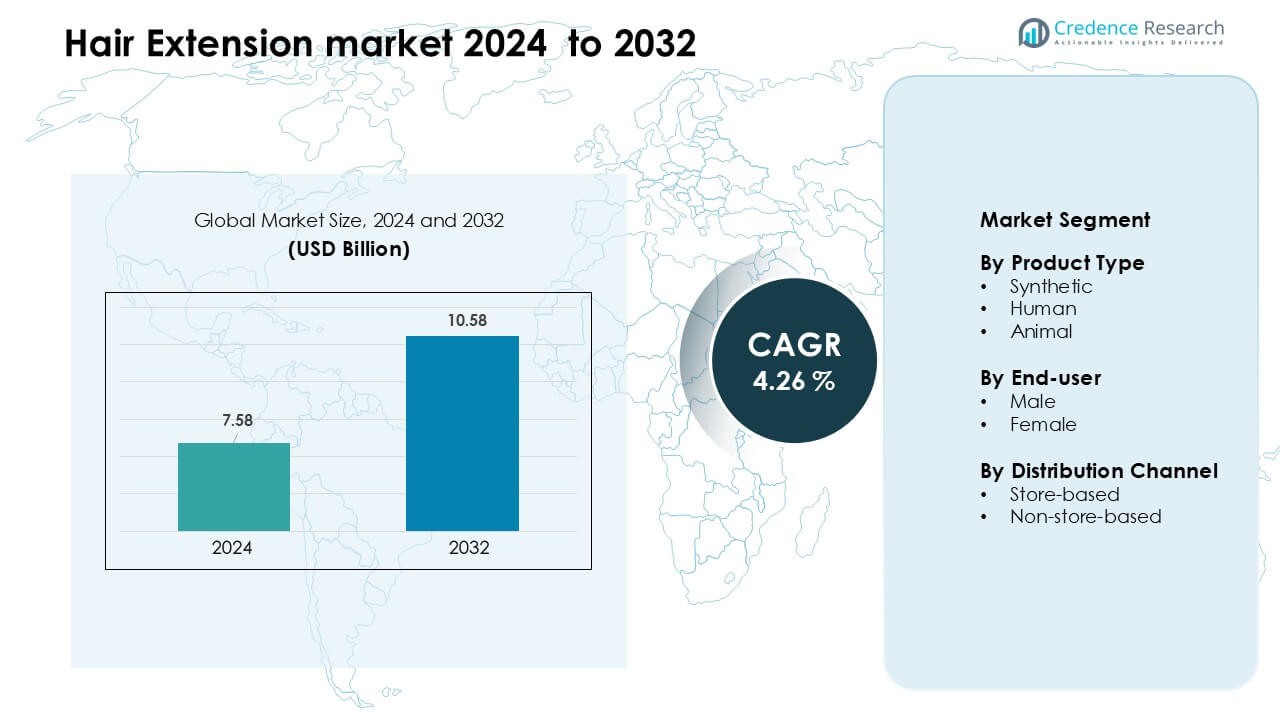

Hair Extension market was valued at USD 7.58 billion in 2024 and is anticipated to reach USD 10.58 billion by 2032, growing at a CAGR of 4.26 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hair Extension Market Size 2024 |

USD 7.58 Billion |

| Hair Extension Market, CAGR |

4.26 % |

| Hair Extension Market Size 2032 |

USD 10.58 Billion |

The hair extension market is shaped by leading companies such as Great Lengths Universal Hair Extensions Srl, Balmain Hair Group B.V., Hair Visions International, Racoon International, Evergreen Products Group Limited, Easihair Pro USA, Cinderella Hair, LE Belleza Hair and Beauty, SO.CAP. Original USA, and Hairlocs. These brands strengthen their presence through premium human hair collections, advanced bonding systems, and strong partnerships with professional salons. North America emerged as the leading region in 2024, holding about 34% share, supported by high beauty spending, strong salon adoption, and consistent demand for natural-looking, durable hair enhancement solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The hair extension market reached USD 58 billion in 2024 and is projected to grow at a CAGR of 4.26 % through 2032.

- Rising beauty awareness, strong salon adoption, and demand for natural-looking styles drive steady market expansion across both human hair and synthetic extensions.

- Key trends include growing preference for ethically sourced human hair, rapid adoption of lightweight heat-resistant fibers, and rising online personalization tools for shade and length matching.

- The competitive landscape features leaders such as Great Lengths, Balmain Hair, Hair Visions International, Racoon International, and others, with companies focusing on premium quality, certified sourcing, and advanced bonding technologies.

- North America led the market with 34% share, while human hair held the largest product-type share at 62%, supported by strong salon ecosystems and rising demand for high-quality, durable extensions.

Market Segmentation Analysis:

By Product Type

Human hair extensions dominated the hair extension market in 2024 with about 62% share. Demand remained strong because buyers prefer natural texture, heat-styling flexibility, and longer durability compared with synthetic and animal-derived options. Growth also came from rising salon applications, influencer-driven beauty trends, and wider availability of premium Remy and virgin hair products. Synthetic extensions gained traction in the value segment due to low prices and color variety, while animal-based products held a niche position. Human hair stayed ahead as consumers sought high-quality, natural-looking enhancement options.

- For instance, Great Lengths is indeed a widely recognized and leading premium human-hair extension brand, known for using 100% ethically sourced human hair with intact cuticles.

By End-user

Female users led the hair extension market in 2024 with nearly 83% share. Women drove consistent spending across clip-ins, tape-ins, fusion, and sew-in products, supported by strong adoption in fashion, entertainment, and everyday styling. Rising social media influence, frequent hairstyle changes, and growth in professional salon services further supported female-focused demand. Male usage expanded in categories such as toupees, wigs, and volumizing solutions, yet adoption remained smaller due to lower grooming frequency and limited product awareness. Female buyers-maintained leadership because of broader styling needs and higher beauty expenditure.

- For instance, Luxy Hair, a direct-to-consumer extension brand, has amassed over 4 million social media followers, reflecting its strong appeal among female consumers who shop extensions online.

By Distribution Channel

Store-based channels held the dominant position in 2024 with around 69% share of the hair extension market. Salons, beauty specialty stores, and offline retailers attracted buyers seeking expert guidance, immediate product availability, and color-matching support. Growth also rose from premium salon installations and rising footfall in beauty retail chains. Non-store-based channels grew quickly through e-commerce platforms that offered wider catalogs, discounts, and direct-to-consumer brands, but offline outlets remained ahead due to trust, hands-on consultation, and professional installation services that strengthened repeat purchases.

Key Growth Drivers

Rising Beauty Awareness and Styling Demand

Global beauty awareness continues to rise as consumers seek fuller and more versatile hairstyles. Demand strengthens as fashion influencers, celebrities, and social media platforms promote frequent styling changes. This trend encourages buyers to use hair extensions for volume, length, color experimentation, and event-based grooming. Growth also expands as salons offer advanced installation methods that improve comfort and durability. Younger consumers adopt extensions for daily styling, while working professionals choose premium options that deliver natural looks. Hybrid applications, such as clip-ins and tape-ins, widen the appeal across budget levels. The driver remains strong because modern beauty habits, social media exposure, and personalized styling preferences sustain consistent demand across both developed and emerging markets.

- For instance, Hairdreams, a luxury extension brand, has deployed its Laserbeamer Nano system, which applies 5 strands at once with fully automated precision — reducing the average installation time per session from over 45 minutes to under 15 minutes.

Expansion of the Professional Salon Ecosystem

The professional salon network plays a major role in pushing extension adoption among global users. Salons promote high-quality human hair options and offer expert installation, which builds trust and encourages premium purchases. Technicians use advanced bonding and weaving techniques that improve results and reduce maintenance effort. Training programs help stylists deliver personalized recommendations, boosting repeat sales and long-term customer loyalty. Premium salons partner with established brands to offer certified, ethically sourced hair that attracts quality-focused buyers. Growing urbanization increases footfall in beauty centers, while franchise salons standardize service quality across regions. This structured salon ecosystem keeps the market moving upward by improving consumer awareness, promoting higher-value products, and enhancing the overall service experience.

- For instance, Great Lengths has trained thousands of stylists globally via its “Fundamental Course,” covering GL Pre-Bonded and Tape methods.

Growth of E-commerce and Direct-to-Consumer Brands

Online platforms reshape market dynamics by offering broader catalogs, transparent pricing, and convenient delivery options. Buyers compare products across multiple brands, examine reviews, and choose suitable solutions without retail limitations. Direct-to-consumer companies use digital marketing to highlight texture quality, color options, and ethical sourcing claims. Online personalization tools help users match shades and lengths, reducing purchase hesitation. Subscription models for maintenance products like shampoos and adhesives strengthen long-term engagement. Social media ads further amplify visibility among younger buyers who explore styling trends through online videos. This channel reduces distribution costs, enabling competitive pricing and faster scaling. As digital adoption rises, e-commerce continues to unlock wider global reach, especially in regions with limited offline salon networks.

Key Trend & Opportunity

Rising Preference for Ethically Sourced and Traceable Hair

Consumers increasingly demand ethically sourced human hair, creating strong opportunities for certified suppliers. Buyers seek transparency regarding origin, processing practices, and worker conditions. Brands respond with supply-chain traceability programs that verify collection and processing standards. Ethical sourcing strengthens brand credibility among premium users who avoid unverified products. Governments in key markets also push compliance norms, supporting regulated trade. Companies offering lab-tested, chemical-free, and sustainably processed hair gain competitive advantage. Transparent labeling, digital authentication, and blockchain tracking tools improve buyer confidence. As awareness grows, ethical positioning becomes a major differentiator, helping responsible brands capture loyal, high-value customers and expand into regulated markets across Europe and North America.

- For instance, Great Lengths sources 100% of its human hair directly from Indian temples, ensuring full donor consent and eliminating middlemen; each hair strand is fully traceable through its supply chain and the company maintains a presence in India to oversee the process.

Rapid Adoption of Lightweight, Heat-Resistant, and Customizable Extensions

Innovations in fibers and processing introduce heat-resistant synthetic extensions that mimic real hair. Lightweight designs improve comfort during long wear, especially in hot climates. Customizable options allow users to select personalized shades, textures, and lengths that match natural hairstyles. Brands invest in hybrid blends combining synthetic durability with human hair aesthetics. New clip-in and seamless tape-in systems offer quick application and removal, increasing convenience for daily styling. These advancements encourage experimentation and attract first-time buyers who seek natural results without premium pricing. As consumer expectations shift toward comfort and personalization, companies that provide innovative and tailored solutions unlock strong growth potential in both mass and premium segments.

- For instance, Revyv’s RealFeel™ synthetic extensions use premium, heat-resistant fiber rated to 180 °C, enabling users to lightly restyle curls or waves delivering human-hair-like finish with affordable, low-maintenance convenience.

Key Challenge

High Cost of Premium Human Hair Extensions

Premium human hair extensions remain expensive due to complex sourcing and processing. High costs reduce adoption among budget-sensitive buyers and limit purchase frequency. Salons offering installation services add further charges, creating a high total ownership cost. This challenge is more visible in emerging markets where disposable income remains low. Price gaps between synthetic and human hair options widen, creating strong demand for mid-range alternatives. However, many users still prefer natural results and hesitate to choose lower-priced substitutes. This cost barrier prevents broader penetration and slows the growth of premium categories despite rising beauty awareness.

Counterfeit and Low-Quality Products in Online Channels

The online marketplace faces significant issues with counterfeit and mislabelled extensions. Many low-quality products claim to be human hair but contain synthetic blends that damage consumer trust. These items often lack proper hygiene checks, ethical sourcing verification, or durability standards. Poor-quality extensions lead to shedding, tangling, and color fading, which affects customer satisfaction and reduces repeat purchases. Weak regulation in some countries allows unauthorized sellers to operate freely. As online adoption grows, the spread of unverified products threatens market credibility. Brands must invest in authentication tools and quality control to protect users and maintain confidence in both online and offline channels.

Regional Analysis

North America

North America held the leading position in the hair extension market in 2024 with around 34% share. Strong demand came from high beauty spending, strong salon culture, and frequent styling habits among consumers. The U.S. drove most sales due to widespread adoption of premium human hair extensions and a large presence of professional stylists. Influencer-driven trends and social media visibility also pushed users toward clip-in, tape-in, and fusion systems. Canada showed rising traction as salon franchises expanded service offerings. Growth stayed steady as consumers preferred natural-looking, high-quality products supported by strong retail and e-commerce networks.

Europe

Europe accounted for nearly 29% share in 2024, supported by demand for ethically sourced human hair, increasing salon services, and sustained beauty awareness across major countries. The U.K., Germany, France, and Italy led adoption, especially in fashion-driven cities with high grooming standards. Regulatory emphasis on quality and sourcing transparency strengthened trust in premium brands. Salon chains promoted certified extensions that offered durability and natural texture, increasing repeat customers. Growth also improved through rising acceptance of extensions for daily styling and special occasions, supported by strong distribution through beauty stores and professional stylists.

Asia Pacific

Asia Pacific represented about 24% share in 2024, driven by expanding urban populations, rising disposable incomes, and strong influence of beauty and entertainment industries. China, India, Japan, and South Korea showed rapid adoption across both premium and value-focused users. Local manufacturers supported availability of synthetic and human hair products at varied price points, boosting wide accessibility. Social media trends and K-beauty styling also shaped consumer preferences, increasing demand for natural-looking hair enhancements. E-commerce strengthened growth by offering customization, broader choices, and fast delivery, helping the region evolve into a strong future growth hub.

Latin America

Latin America captured close to 8% share in 2024, with Brazil and Mexico driving most purchases due to strong beauty cultures and rising grooming awareness. The region saw increasing use of clip-ins and sew-ins, supported by salon professionals skilled in afro-textured hair styling. Economic constraints favored mid-range and synthetic products, yet human hair extensions gained traction in urban centers. Growing exposure to global fashion trends and influencer-led promotions encouraged experimentation among younger consumers. Offline beauty stores and local salons maintained strong presence, while online channels slowly expanded reach across metropolitan areas.

Middle East & Africa

The Middle East & Africa region held roughly 5% share in 2024, with growth centered in the UAE, Saudi Arabia, and South Africa. Demand increased due to rising beauty consciousness, expanding salon networks, and high interest in premium grooming products. Afro-textured hair extensions gained popularity, particularly in African markets where protective styles drive consistent use. Gulf countries favored premium human hair options, supported by strong purchasing power and luxury salon services. E-commerce platforms improved access to global brands, helping the region steadily expand its adoption of both natural and synthetic extensions across varied consumer groups.

Market Segmentations:

By Product Type

By End-user

By Distribution Channel

- Store-based

- Non-store-based

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the hair extension market features a mix of global brands, regional specialists, and salon-focused providers that compete through product quality, sourcing standards, and advanced installation solutions. Leading companies such as Great Lengths Universal Hair Extensions Srl, Balmain Hair Group B.V., Hair Visions International, Racoon International, Evergreen Products Group Limited, Easihair Pro USA, and others strengthen their positions through premium human hair collections, certified sourcing, and strong partnerships with professional salons. Many brands invest in advanced bonding, tape-in, and micro-link technologies that improve durability and comfort. Direct-to-consumer players expand reach through e-commerce, offering shade-matching tools and personalized kits. Manufacturers differentiate by focusing on ethically sourced Remy hair, high-performance synthetic fibers, and customized textures for diverse hair types. Marketing through influencers and beauty educators boosts visibility, while training programs for stylists help secure long-term loyalty. Competition intensifies as firms emphasize traceability, quality assurance, and tailored styling solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hair Visions International (U.S.)

- Racoon International (U.K.)

- LE Belleza Hair and Beauty (India)

- Evergreen Products Group Limited (China)

- CAP. Original USA (U.S.)

- Balmain Hair Group B.V. (Netherlands)

- Easihair Pro USA (U.S.)

- Cinderella Hair (U.K.)

- Hairlocs (U.S.)

- Great Lengths Universal Hair Extensions Srl (Italy)

Recent Developments

- In March 2025, Evergreen Products Group Limited (China / Hong Kong) Evergreen announced its FY2024 annual results on 21 March 2025: revenue of HK$1,016.4 million and gross profit of HK$243.5 million (both reported growth year-on-year). The release confirms continuing wholesale/manufacturing strength in wigs and extensions.

- In February 2025, Racoon International (U.K.) Launched a nationwide Racoon International Salon Finder on their website so consumers can locate Racoon-certified salons, read reviews and book consultations.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand grows for high-quality, natural-looking styling solutions.

- Human hair extensions will remain the preferred choice due to durability and premium texture.

- Ethical sourcing and traceability will become standard expectations among global buyers.

- E-commerce platforms will drive faster adoption through wider product access and personalization tools.

- Salon partnerships will strengthen as brands invest in advanced training and installation methods.

- Heat-resistant and lightweight synthetic fibers will gain traction in the mid-range segment.

- Influencer-led trends will continue to shape consumer buying behavior across all age groups.

- Hybrid extension systems offering quick application and comfort will see rising demand.

- Emerging markets in Asia Pacific and Latin America will contribute stronger growth momentum.

- Innovation in seamless bonding, shade blending, and custom textures will enhance long-term market competitiveness.