Market Overview:

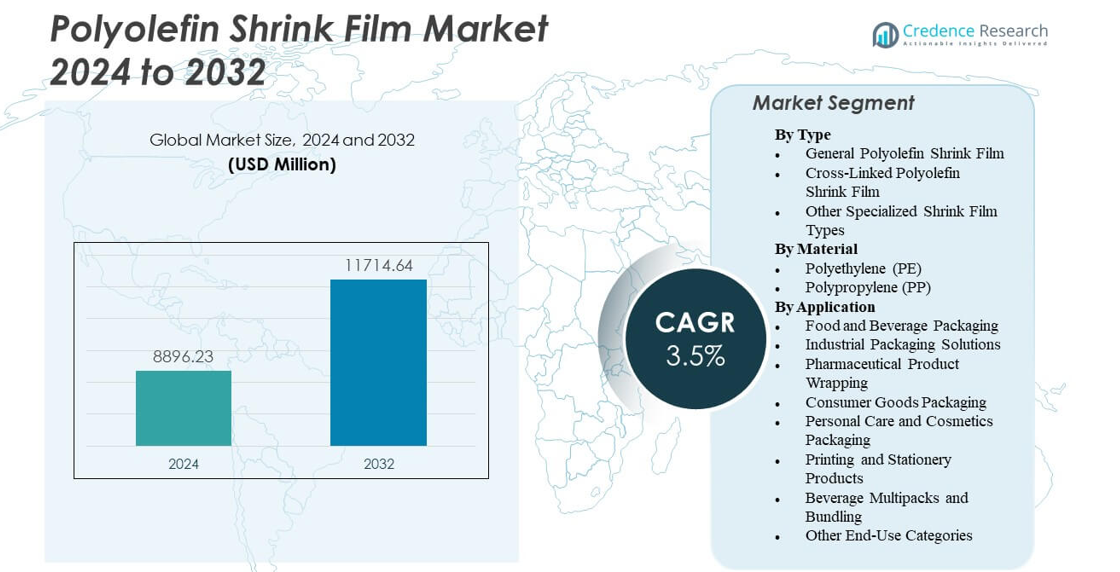

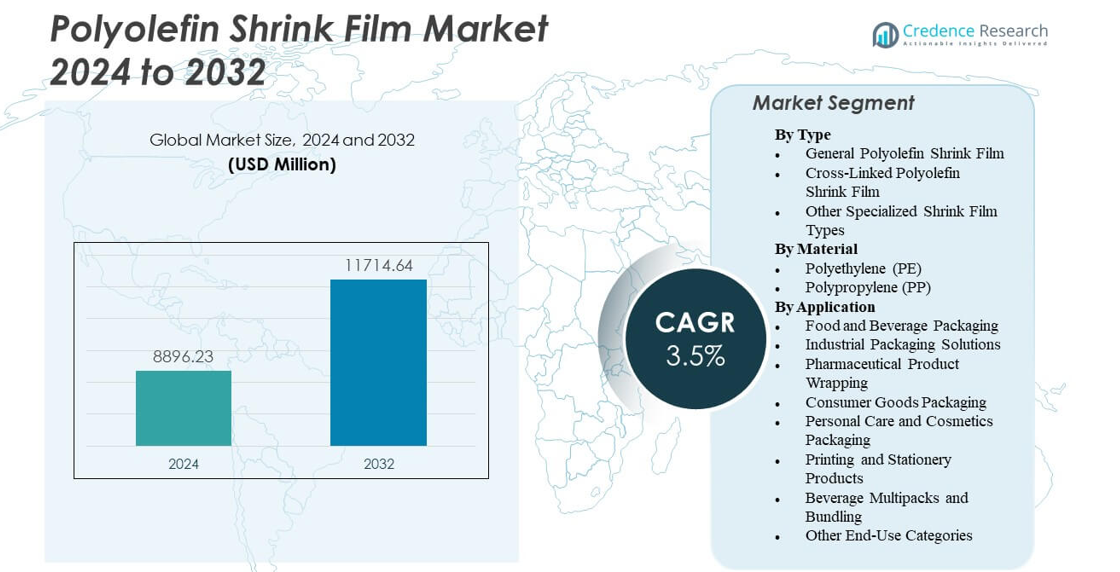

The Polyolefin Shrink Film Market is projected to grow from USD 8,896.23 million in 2024 to an estimated USD 11,714.64 million by 2032, with a compound annual growth rate (CAGR) of 3.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyolefin Shrink Film Market Size 2024 |

USD 8,896.23 million |

| Polyolefin Shrink Film Market, CAGR |

3.5% |

| Polyolefin Shrink Film Market Size 2032 |

USD 11,714.64 million |

Market drivers focus on improved packaging efficiency, strong consumer preference for visually appealing goods and the shift toward recyclable materials. Many manufacturers upgrade extrusion systems to achieve thinner gauges while maintaining strength. The film’s flexibility helps brands handle diverse product shapes and sizes. Steady growth in e-commerce increases the need for secure wrapping across distribution networks. Companies use shrink films to reduce damage, improve safety and support branding. Adoption grows as packaged food demand rises across global markets. These factors reinforce long-term market expansion.

North America leads due to mature packaging infrastructure and strong FMCG production. Europe follows with high emphasis on standardized packaging quality and sustainability-driven material innovation. Asia Pacific emerges as the fastest-growing region supported by expanding manufacturing hubs and rising packaged food consumption. China and India display strong growth due to large retail networks and increasing automation. Latin America shows moderate expansion as companies upgrade packaging operations. The Middle East & Africa gain traction through rising consumer goods demand and growing retail distribution.

Market Insights:

- The Polyolefin Shrink Film Market will rise from USD 8,896.23 million in 2024 to USD 11,714.64 million by 2032, supported by a 3.5% CAGR driven by strong usage across food, retail and consumer goods sectors.

- Market drivers highlight demand for clear, durable and lightweight packaging that supports branding, automation efficiency and reduced material load.

- Market restraints involve sustainability pressures, raw material volatility and rising expectations for recyclable structures that challenge production stability.

- Regional analysis shows North America leading due to advanced packaging systems, Europe following with strong regulatory influence and Asia Pacific emerging rapidly through expanding manufacturing and packaged food demand.

- Long-term momentum will strengthen through technology upgrades, thinner gauge development and broader adoption across e-commerce, FMCG and industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Shift Toward Flexible and Lightweight Packaging Solutions Across Consumer and Industrial Sectors

The Polyolefin Shrink Film Market gains strength through rising demand for flexible packaging across retail and industrial supply chains. Brand owners choose shrink films to improve product visibility and shelf appeal. Packaging teams adopt these films to reduce material weight and improve transport efficiency. Many processors invest in upgraded extrusion systems that support high-clarity output. Food and beverage producers rely on safe sealing features to protect sensitive goods. E-commerce players use shrink formats to reduce damage during transit. Sustainability goals push firms toward recyclable polyolefin structures. Many factors support continued market acceptance.

- For instance, Dow collaborated with RKW Group in June 2024 to launch REVOLOOP™ recycled-plastics resin grades with up to 100% post-consumer recycled content for shrink-film applications.

Increasing Emphasis on High-Speed Packaging Line Efficiency and Cost Optimization Across Production Hubs

High-speed packaging lines drive wider usage due to strong compatibility with automated systems. The Polyolefin Shrink Film Market benefits from stronger demand for clean sealing at rapid cycle rates. Machine operators prefer films that reduce breakage on wrapping units. It helps packaging plants maintain predictable throughput during peak loads. Cost pressure encourages manufacturers to adopt thinner gauges without losing durability. Film converters develop new blends that improve puncture resistance. Retailers rely on consistent wrapping to maintain brand image across stores. Efficiency-driven purchasing supports long-term uptake.

Rising Adoption Across Food, Beverage, and FMCG Brands Seeking Safer and More Attractive Pack Formats

Food and FMCG brands use shrink films to maintain hygiene and support tamper-evident wrapping. The Polyolefin Shrink Film Market gains momentum through increased processed food consumption. Producers need materials that handle variable temperatures during storage and shipping. It supports stable protection against moisture and dust across retail chains. Clear film structures help brands display labels and graphics with stronger impact. Busy lifestyles push consumers toward packaged goods with clean presentation. Packaging experts adopt shrink films to extend shelf presence. Demand continues to rise across large brand portfolios.

- for instance, Innovia Films introduced a next-generation floatable polyolefin shrink film in February 2025 tailored for light-sensitive goods using recycling-friendly material.

Strong Push Toward Reducing Damage Rates and Improving Product Handling Across Expanded Distribution Networks

Distribution networks use shrink films to protect mixed product loads across long routes. The Polyolefin Shrink Film Market grows through strong logistics modernization. Packaged goods move across diverse climates that require steady performance from wrapping films. It helps reduce breakage during stacking and pallet movement. Many firms adopt multipack formats to improve promotional planning. Shrink films support safer handling for fragile goods. Retailers gain better control over inventory with clear outer wraps. Transport-heavy sectors drive continuous adoption.

Market Trends

Expansion of Multilayer Film Structures Supporting Higher Strength, Clarity, and Performance Across Packaging Lines

Multilayer structures gain wide use due to improved toughness and better sealing response. The Polyolefin Shrink Film Market sees rising interest in engineered blends. Film producers upgrade resin combinations to meet strict clarity rules from brand owners. It supports efficient wrapping across high-speed units. New structures help deliver stronger shrink force for irregular items. Companies pursue balanced film properties that lower waste. Packaging teams shift from single-layer formats to multilayer grades. Innovation guides the design of next-generation films.

- For instance, ExxonMobil’s Exceed S 9243ML performance polyethylene delivers high dart drop impact alongside stiffness in blown film lines, reducing the need for HDPE blending while maintaining toughness in functional layers.

Increasing Use of Recyclable and Eco-Focused Film Grades Driven by Strong Sustainability Commitments

Sustainability rules shape demand for recyclable polyolefin options across multiple regions. The Polyolefin Shrink Film Market gains value through greener material development. Many producers test low-impact additives to meet circular economy goals. It supports reduced environmental load without affecting film strength. Packaging buyers choose solutions aligned with corporate responsibility plans. Recycle-ready films gain traction across consumer goods. Brands highlight improved environmental performance in new launches. Green-focused innovation continues to expand.

Growing Integration of Advanced Extrusion and Automation Technologies Across High-Volume Plants

Producers invest in advanced extrusion systems to improve consistency and reduce downtime. The Polyolefin Shrink Film Market benefits from better process control. Automated tools help maintain stable thickness and performance. It drives higher reliability for converters that serve global supply chains. Plants use improved cooling and flow management tools to raise output. Data-driven monitoring strengthens quality across large batches. Faster roll changes improve operational speed. Technology upgrades shape long-term production planning.

Wider Use of Shrink Films in Multipacks, Promotional Bundles, and E-Commerce Packaging Formats

Multipack formats grow due to rising retail promotions and bulk buying patterns. The Polyolefin Shrink Film Market rises through wider use in bundling needs. E-commerce sellers prefer shrink films for compact packaging that reduces void space. It helps improve delivery safety for mixed goods. Many brands adopt shrink formats to simplify display-ready packaging. Multipacks offer flexibility for seasonal campaigns. Retail teams depend on clean wraps for faster shelving. Demand grows across high-volume categories.

- For instance, ExxonMobil’s Exceed XP 7021ML in 1 mil films shows puncture force of 66 N and puncture energy of 5.1 J on blown film lines with 2.5:1 blow-up ratio.

Market Challenges Analysis

Rising Pressure from Sustainability Rules and Shifts Toward Alternative Packaging Formats

The Polyolefin Shrink Film Market faces strict rules tied to plastic reduction goals. Governments push firms to improve waste collection and recycling readiness. It forces producers to redesign structures that meet compliance needs. Some buyers explore paper or compostable formats that compete with shrink films. Public concern over single-use plastic affects purchase decisions. Film converters must upgrade resins to meet clarity and strength targets while staying compliant. Brands need clearer sustainability claims to support customer trust. Regulatory pressure shapes long-term adoption.

Operational Constraints Linked to Raw Material Volatility and High Investment Needs for Technology Upgrades

Producers face fluctuating resin prices that affect planning across large operations. The Polyolefin Shrink Film Market manages cost swings through careful sourcing. It requires stable access to high-quality polyolefin grades. Plants need major capital for new extrusion and automation tools. Small converters struggle to match quality from larger players. Machine downtime affects supply reliability for retail and FMCG clients. Variability in feedstock supply adds further stress. Cost control remains a recurring challenge.

Market Opportunities

Rising Scope for Recycle-Ready Film Structures and High-Performance Grades Across Modern Packaging Chains

The Polyolefin Shrink Film Market gains new opportunities through next-generation recyclable structures. Brands seek materials that support corporate sustainability programs across global markets. It allows converters to design films with fewer additives. High-performance blends open room for advanced sealing and improved clarity. FMCG groups explore thinner gauges that maintain strength. Recycle-ready solutions support stronger acceptance across regulated regions. Innovation in clean formulations expands value. Interest continues to rise among major producers.

Growing Demand Across E-Commerce, Retail Multipacks, and Automated Warehousing Systems Worldwide

E-commerce expansion creates strong openings for compact and protective packaging. The Polyolefin Shrink Film Market benefits from rising shipment frequency across many categories. It helps brands secure goods during long transport cycles. Automated warehouses need wrap formats that run smoothly on robotics and conveyor units. Multipack packaging supports retail promotions across large stores. New product launches strengthen adoption across consumer goods. Emerging economies grow fast due to rising packaged product output. Many sectors drive broad new opportunities.

Market Segmentation Analysis:

By Type

General polyolefin shrink film holds strong usage across high-volume packaging due to its clarity and balanced shrink performance. The Polyolefin Shrink Film Market benefits from steady demand in food, retail, and consumer goods. It supports efficient sealing on automated lines and provides reliable protection during transport. Cross-linked grades gain traction for products that need higher strength and puncture resistance. These films perform well in multipacks and heavy-item wrapping. Specialized shrink films address niche needs tied to label visibility or custom shrink ratios. Each type supports different performance goals across supply chains.

- For instance, Dow’s AFFINITY™ PL 1888G polyolefin plastomer for shrink film achieves 600% tensile elongation at break in the machine direction and 570% in the transverse direction.

By Material

Polyethylene grades lead due to their flexibility, durability, and broad machine compatibility across global packaging plants. The Polyolefin Shrink Film Market sees growing preference for PE due to improved toughness and stable shrink response. It maintains strong adoption in food and industrial wrapping. Polypropylene films offer better stiffness and clarity, making them suitable for high-visibility retail goods. PP supports sharper print presentation and lower haze in display packaging. Many converters use PP for premium consumer products. Material choice depends on needed strength, clarity, and print performance.

- For instance, Jiuteng’s JT01 film exhibits elongation of 138% in machine direction and 135% in transverse direction at 30 microns.

By Application

Food and beverage packaging holds major demand due to strict hygiene needs and high turnover rates across retail channels. The Polyolefin Shrink Film Market expands through growing use in industrial packaging solutions where durability matters. It supports wrapping for tools, hardware, and machine parts. Pharmaceuticals adopt shrink films for tamper-evident protection. Consumer goods use shrink formats to improve display appeal and shelf stability. Personal care and cosmetics brands rely on clear wraps for premium presentation. Printing and stationery benefit from protection against dust and handling damage. Beverage multipacks depend on shrink bundling for stable transport across long routes. Other end-use categories adopt shrink films for safety, visibility, and easy handling.

Segmentation:

By Type

- General Polyolefin Shrink Film

- Cross-Linked Polyolefin Shrink Film

- Other Specialized Shrink Film Types

By Material

- Polyethylene (PE)

- Polypropylene (PP)

By Application

- Food and Beverage Packaging

- Industrial Packaging Solutions

- Pharmaceutical Product Wrapping

- Consumer Goods Packaging

- Personal Care and Cosmetics Packaging

- Printing and Stationery Products

- Beverage Multipacks and Bundling

- Other End-Use Categories

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the leading share of the Polyolefin Shrink Film Market with about 34%, driven by strong packaged food demand and high automation across distribution networks. The region benefits from advanced extrusion capabilities that support stable supply. It sees steady growth from e-commerce and retail multipacks. It maintains wide acceptance across FMCG brands that require clarity and durability. Strong quality rules push producers to upgrade material structures. Market players strengthen capacity to meet rising sustainability targets.

Europe follows with roughly 28% share, supported by strict packaging standards and strong FMCG production strength. The Polyolefin Shrink Film Market in this region benefits from high focus on recyclable structures. It gains traction across food, cosmetics, and specialty consumer goods. Western Europe leads demand due to dense retail networks. Eastern Europe shows firm adoption through growing investment in automated packaging lines. Sustainability rules shape material innovation across converters.

Asia Pacific holds about 30% share and stands as the fastest-growing region due to rising manufacturing output and strong export activity. It gains momentum through expanding packaged food consumption in China, India, and Southeast Asia. It supports high-volume wrapping needs across industrial products. Local producers invest in advanced machinery to meet global quality standards. Many brands shift output to APAC to gain cost advantages. Strong demographic growth supports long-term expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc

- Berry Global Inc.

- Sealed Air Corporation

- Intertape Polymer Group Inc. (IPG, Exlfilm)

- Sigma Plastics Group

- Syfan

- Clysar

- Coveris Holdings SA

Competitive Analysis:

The Polyolefin Shrink Film Market features strong competition driven by material innovation, gauge reduction programs, and sustainability commitments. Global producers invest in multilayer structures that improve clarity and toughness across automated lines. It encourages firms to expand extrusion capacity and strengthen regional distribution. Leading companies compete through resin optimization, recyclable material development, and improved shrink performance for irregular goods. Mid-size converters focus on contract packaging, short-run production, and niche blends for premium segments. Partnerships across FMCG, food, and logistics firms help suppliers align film features with brand needs. Competitive pressure remains high due to pricing sensitivity across major applications. Market players pursue technology upgrades to secure stronger positioning across global supply chains.

Recent Developments:

- In November 2025, Amcor plc announced a major expansion of printing, lamination, and converting capabilities at its North American facilities to support growing demand in protein packaging an investment that will run through the first half of 2026.

- In April 2025, Amcor Plc completed its combination with Berry Global Inc., enhancing its position as a global leader in consumer and healthcare packaging solutions through advanced material science and innovation capabilities.

- In October 2024, Innovia Films expanded its floatable polyolefin shrink range by introducing a 45 µm grade to improve material efficiency and a high-shrink variant tailored for contoured bottles.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyolefin Shrink Film Market will gain strength through wider use across food, retail, and consumer goods.

- Demand will rise as brands adopt high-clarity films that support stronger visual appeal.

- Growth will improve through thin-gauge structures that lower material load without reducing performance.

- Adoption of recyclable blends will increase due to rising sustainability rules across key regions.

- Automated packaging lines will drive interest in films that maintain stable sealing at higher speeds.

- E-commerce expansion will support consistent uptake for protective and lightweight wrapping formats.

- Industrial sectors will prefer reinforced shrink films designed for heavy-load applications.

- Investments in multilayer extrusion technology will improve durability and shrink consistency.

- Emerging regions will expand output due to rising packaged product consumption.

- Partnerships between resin suppliers and converters will shape next-generation shrink film innovation.