Market Overview

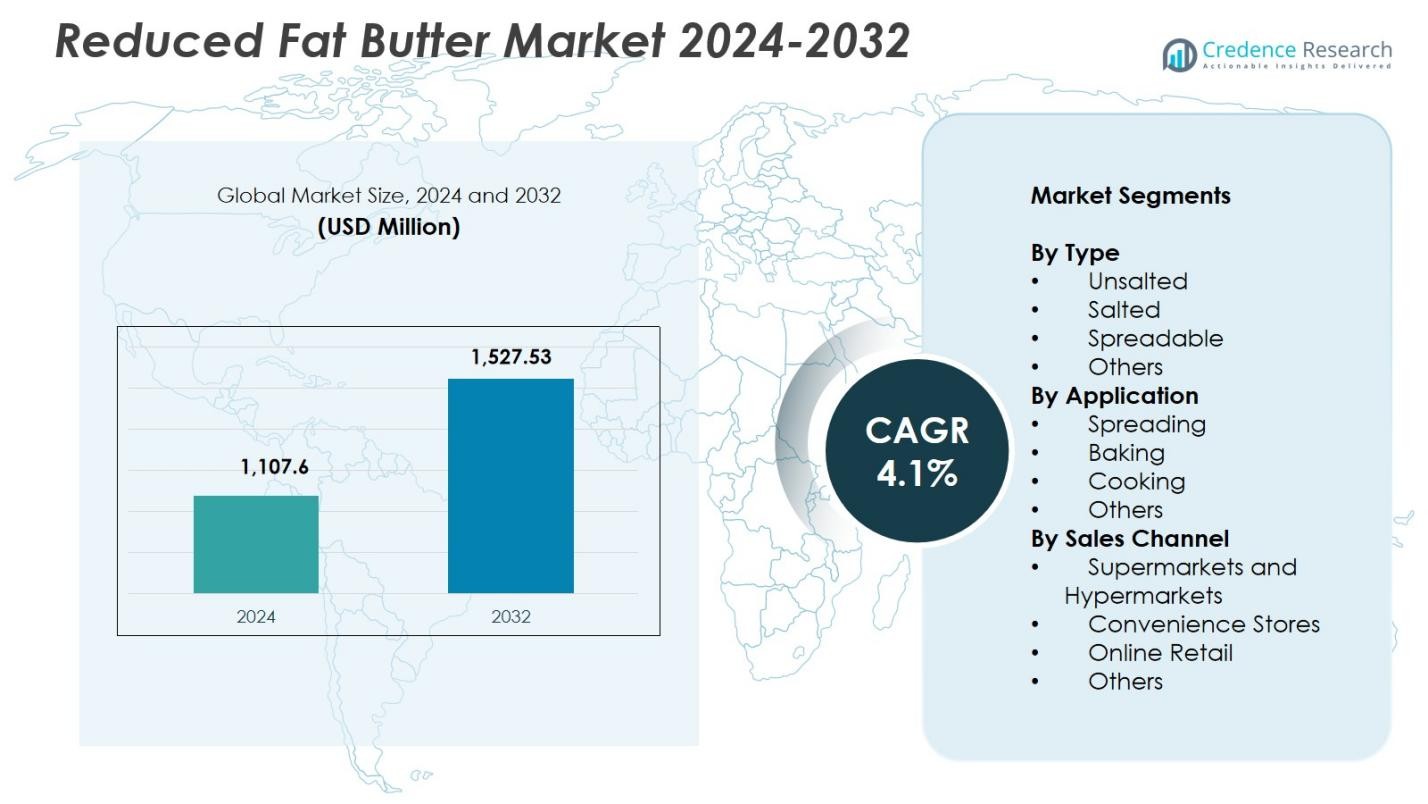

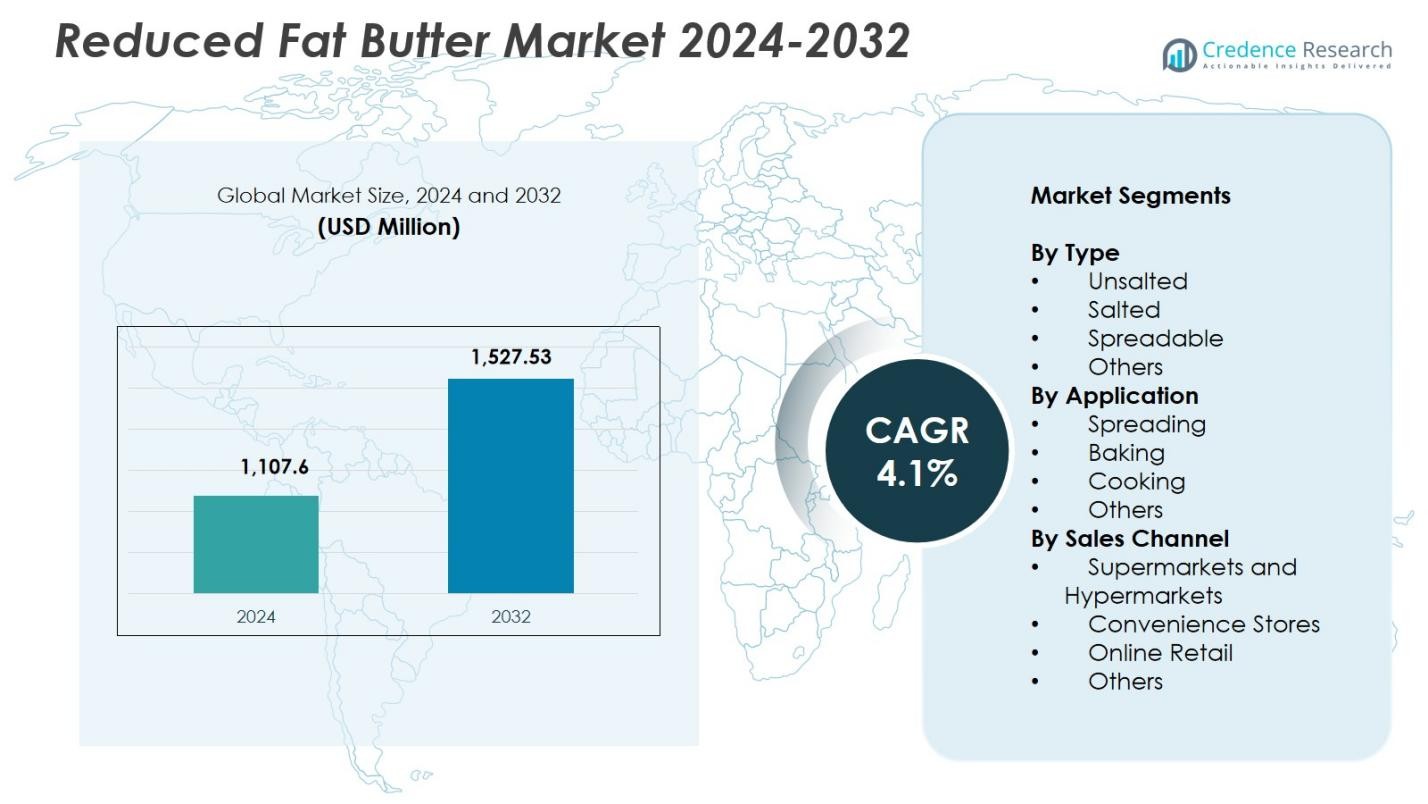

Reduced Fat Butter Market size was valued at USD 1,107.6 Million in 2024 and is anticipated to reach USD 1,527.53 Million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reduced Fat Butter Market Size 2024 |

USD 1,107.6 Million |

| Reduced Fat Butter Market, CAGR |

4.1% |

| Reduced Fat Butter Market Size 2032 |

USD 1,527.53 Million |

Reduced Fat Butter Market is led by key players such as Ornua, Land O’Lakes, Arla Foods amba, Upfield, Saputo Inc., Aurivo Co-operative Society Ltd., Amul Milk Union Ltd, Zydus Wellness, Agral S.A., and Morrisons Ltd, who focus on expanding their product portfolios with spreadable, flavored, and functional reduced fat butter variants. These companies invest in product innovation, R&D, and marketing campaigns emphasizing health benefits and clean-label positioning. North America leads the market with 34.2% share in 2024, driven by high health awareness and adoption of low-fat dairy options. Europe follows with 28.5% share, supported by regulatory emphasis on nutritional labeling and growing demand for spreadable and unsalted variants. Asia-Pacific, holding 21.3% share, benefits from rising disposable incomes and urbanization, while Latin America and Middle East & Africa contribute 9.1% and 6.9% share, respectively, supported by retail expansion and health-focused consumer trends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Reduced Fat Butter Market size was valued at USD 1,107.6 Million in 2024 and is projected to reach USD 1,527.53 Million by 2032, growing at a CAGR of 4.1%.

- Rising consumer preference for healthier dairy alternatives drives the market, with spreadable variants holding 6% share in 2024 due to convenience and improved texture.

- Key trends include increased demand for clean-label, natural, and functional butter, along with the expansion of online retail and direct-to-consumer channels to reach health-conscious buyers.

- Market players such as Ornua, Land O’Lakes, Arla Foods amba, Upfield, Saputo Inc., Aurivo Co-operative Society Ltd., GCMMF, Zydus Wellness, Agral S.A., and Morrisons Ltd focus on product innovation, R&D, and marketing campaigns emphasizing nutritional benefits and private-label offerings.

- Regionally, North America leads with 2% share, Europe holds 28.5%, Asia-Pacific 21.3%, Latin America 9.1%, and Middle East & Africa 6.9%, driven by health awareness, urbanization, and retail penetration.

Market Segmentation Analysis:

By Type:

The Reduced Fat Butter Market by type is led by Spreadable, holding 38.6% share in 2024, driven by rising consumer preference for convenient, ready-to-use butter formats that support quick meals and healthy snacking. Spreadable variants combine reduced fat levels with improved texture, making them ideal for refrigerated and ambient use across households. Unsalted and salted types continue to gain traction among health-conscious consumers seeking lower-fat cooking alternatives, while “Others,” including flavored and functional variants, benefit from growing innovation in dairy reformulation aimed at enhancing taste, spreadability, and nutritional value.

- For instance, Lurpak Lighter Spreadable Slightly Salted contains 57g fat per 100g, achieving 25% less fat than standard Lurpak Spreadable (80g fat per 100g), using just butter, water, rapeseed oil, and salt for fridge-ready spreading on toast or crackers.

By Application:

The application segment is dominated by Spreading, capturing 41.2% share in 2024, fueled by increasing adoption of reduced-fat butter as a healthier table-spread alternative across households, cafés, and foodservice outlets. Rising demand for convenient breakfast options and nutritionally improved spreads strengthens this segment’s growth. Baking and cooking applications also expand as consumers seek lower-fat substitutes without compromising flavor or texture in recipes. “Others,” including sauces and ready meals, gain momentum due to manufacturers incorporating reduced-fat formulations into clean-label and wellness-focused product innovations.

- For instance, Land O’Lakes Light Butter contains 50% less fat and 47% fewer calories than regular butter, suitable for low-fat cooking like glazes on vegetables while staying spreadable from the fridge.

By Sales Channel:

Supermarkets and Hypermarkets dominate the sales channel landscape with 52.7% share in 2024, supported by broad product visibility, extensive brand assortments, and strong promotional programs encouraging the trial of reduced-fat dairy alternatives. Their ability to offer private-label reduced-fat butter further amplifies segment growth. Convenience stores contribute to impulse purchases, while online retail grows steadily as consumers prioritize home delivery and subscription-based grocery shopping. “Others,” including specialty stores, leverage premium and niche reduced-fat butter assortments driven by rising demand for natural, clean-label, and functional dairy products.

Key Growth Drivers

Rising Consumer Preference for Healthier Dairy Alternatives

Growing awareness of dietary fat intake continues to drive demand for reduced fat butter, as consumers shift toward healthier dairy options without compromising taste. Manufacturers respond by reformulating products with balanced fat profiles, clean-label ingredients, and improved textures to resemble full-fat butter. Expanding health-conscious demographics, including weight-management and cardiovascular-focused consumers, reinforces adoption across household and foodservice applications. This shift encourages broader market penetration, supported by marketing campaigns emphasizing reduced calories, natural ingredients, and nutritionally aligned butter spreads.

- For instance, Amul Lite Milk Fat Spread from Amul Dairy contains approximately 20% lower fat and calories than regular butter or margarine, made wholly from milk fat without vegetable oils to deliver a creamy taste for toasts and cooking.

Expansion of Product Innovation and Reformulation Technologies

Advancements in dairy processing technologies accelerate the development of reduced fat butter with enhanced spreadability, flavor retention, and stability. Companies leverage microencapsulation, improved fat-water emulsification, and enzyme-based techniques to deliver superior sensory performance. These innovations allow reduced fat offerings to compete closely with traditional butter in both home and industrial applications. As manufacturers introduce flavored, organic, and functional variants, the category attracts new consumer segments, reinforcing product differentiation and strengthening premium demand within mature dairy markets.

- For instance, Palsgaard developed emulsifier systems like DMG 0298 and PGPR 4175, enabling low-fat spreads and butter down to 10-40% fat levels with stable emulsions and varied water droplet sizes for better texture and plastification.

Growth of Retail Penetration and Private-Label Strategies

Retail expansion across supermarkets, hypermarkets, and online grocery platforms significantly boosts the visibility of reduced fat butter products. Private-label brands invest heavily in healthier dairy alternatives, offering competitively priced options that appeal to cost-sensitive consumers while maintaining quality standards. Retailers enhance shelf positioning, in-store promotions, and digital merchandising to accelerate adoption. The growing integration of health-positioned dairy assortments within modern trade channels increases accessibility, encouraging repeat purchases and supporting sustained market expansion across urban and semi-urban regions.

Key Trends & Opportunities

Rising Demand for Clean-Label, Natural, and Functional Butter Variants

Consumers increasingly prioritize clean-label ingredients, reduced additives, and natural formulations, creating strong opportunities for manufacturers to develop minimally processed reduced fat butter. Functional enhancements such as probiotic enrichment, omega-fortification, or vitamin-infusion further broaden appeal among wellness-oriented buyers. This trend encourages premiumization and fosters new product extensions across retail shelves. As sustainability expectations rise, brands incorporating simple ingredient lists, traceable dairy sourcing, and eco-friendly packaging gain market traction, positioning clean-label reduced fat butter as a high-value growth segment.

- For instance, Land O’Lakes Light Butter with Canola Oil contains 50% less fat and calories than regular butter at 5.6g total fat per serving, staying spreadable straight from the refrigerator.

Expansion of Online Retail and Direct-to-Consumer Models

- commerce growth unlocks new opportunities for reduced fat butter brands through subscription deliveries, customizable assortments, and digital promotional campaigns. Online platforms enable better targeting of health-conscious consumers with tailored messaging and product visibility. Direct-to-consumer models support small and emerging dairy brands by lowering distribution barriers and increasing market reach. Enhanced cold-chain logistics and rapid-delivery services further encourage online grocery adoption, enabling consumers to access a wider variety of reduced-fat dairy options that may not be available through traditional retail channels.

- For instance, Highland Farms provides subscription plans for low-fat A2 dairy products, including low fat A2 cow milk at Rs. 4,250, supporting recurring home deliveries with free shipping and customizable schedules.

Key Challenges

Formulation Complexity Affecting Taste and Texture Consistency

Achieving the sensory characteristics of full-fat butter remains a major challenge, as reducing fat can compromise flavor richness, mouthfeel, and spreadability. Manufacturers must invest in advanced stabilizers, emulsifiers, and processing techniques to maintain product quality without diluting natural appeal. Overcoming consumer sensitivity to taste variations is essential, as perception of lower indulgence may hinder repeat purchases. Maintaining consistency across batches while adhering to clean-label demands intensifies the complexity, requiring significant R&D expenditure and ongoing reformulation efforts.

Rising Production Costs and Supply Chain Volatility

Fluctuations in dairy raw material prices, including cream and milk fat, directly influence the cost structure of reduced fat butter manufacturing. Additional processing requirements such as fat-reduction steps, texture-enhancement technologies, and specialized packaging further elevate production expenses. Supply chain disruptions, energy cost inflation, and logistics constraints create additional pressures, particularly for global and export-oriented producers. These factors can reduce profit margins and limit price flexibility, challenging companies to balance affordability with product quality while sustaining competitive positioning in the market.

Regional Analysis

North America

North America dominates the Reduced Fat Butter Market with 34.2% share in 2024, driven by high health awareness and widespread adoption of low-fat dietary options. The U.S. and Canada witness strong consumer preference for functional and spreadable butter variants. Supermarkets and hypermarkets serve as primary distribution channels, supported by private-label offerings. Growing demand in foodservice, baking, and home cooking applications further fuels regional growth. Manufacturers are increasingly introducing organic, clean-label, and flavored reduced fat butter to meet evolving consumer expectations, while marketing campaigns emphasize calorie-conscious and heart-healthy benefits, reinforcing North America’s leadership in the global market.

Europe

Europe accounts for 28.5% share in 2024, propelled by rising health-conscious lifestyles and regulatory focus on nutritional labeling. Countries such as Germany, France, and the U.K. lead in reduced fat dairy adoption. Spreadable and unsalted variants dominate consumer preference for home cooking, baking, and spreading applications. Retail expansion in supermarkets and online platforms facilitates market penetration. Continuous innovation in clean-label and functional butter products, combined with awareness campaigns on lower saturated fat intake, supports steady regional growth. The presence of well-established dairy manufacturers further strengthens Europe’s position as a key market for reduced fat butter.

Asia-Pacific

Asia-Pacific holds 21.3% share in 2024, witnessing robust growth due to increasing disposable incomes, urbanization, and health-focused consumption patterns. Countries like India, China, and Japan are driving demand for reduced fat butter in cooking, baking, and spreads. Retail modernization, including hypermarkets and e-commerce platforms, enhances product accessibility. Rising awareness of cardiovascular health and weight management encourages adoption of low-fat dairy options. Local manufacturers are investing in product innovation, introducing spreadable, flavored, and fortified variants to cater to regional taste preferences. The growing middle-class population and shifting dietary habits present significant long-term opportunities in the Asia-Pacific market.

Latin America

Latin America contributes 9.1% share in 2024, with Brazil and Mexico as key growth markets. Increasing health awareness and the popularity of Western dietary patterns fuel the demand for reduced fat butter. Spreadable and salted variants dominate household and foodservice applications. Supermarkets and modern trade channels play a central role in distribution, while online retail begins to gain traction. Manufacturers focus on product innovation, clean-label options, and fortified formulations to appeal to health-conscious consumers. Regional expansion efforts and promotional campaigns highlighting lower-calorie alternatives support market penetration, positioning Latin America as a steadily growing market for reduced fat butter.

Middle East & Africa

Middle East & Africa hold 6.9% share in 2024, driven by rising urbanization, increasing retail penetration, and health-conscious consumer trends. Countries such as Saudi Arabia, UAE, and South Africa show significant adoption in home cooking, spreads, and baking applications. Retail modernization, particularly through supermarkets and online channels, strengthens product availability. Manufacturers are introducing reduced fat butter variants with improved taste, functional benefits, and clean-label positioning. Awareness campaigns highlighting heart health and weight management support consumer adoption. The region’s increasing preference for premium and health-oriented dairy products creates growth opportunities, despite traditional consumption patterns still favoring conventional full-fat butter.

Market Segmentations:

By Type

- Unsalted

- Salted

- Spreadable

- Others

By Application

- Spreading

- Baking

- Cooking

- Others

By Sales Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Competitive Landscape of the Reduced Fat Butter Market features key players such as Ornua, Land O’Lakes, Inc., Arla Foods amba, Amul Milk Union Ltd, Saputo Inc., Finlandia Cheese, Inc., GCMMF, Zydus Wellness, Agral S.A., and Morrisons Ltd. These companies focus on product innovation, expanding their portfolio with spreadable, flavored, and functional reduced fat butter variants to meet growing consumer demand for healthier dairy options. Strategic initiatives include mergers, acquisitions, and partnerships to strengthen distribution networks across supermarkets, hypermarkets, and online channels. Investment in marketing campaigns emphasizing nutritional benefits and clean-label positioning enhances brand visibility and loyalty. Key players also leverage private-label offerings and regional production facilities to optimize supply chains and reduce costs. Continuous R&D in texture, taste, and fat-reduction technologies allows companies to maintain competitive differentiation, while market expansion in emerging regions drives sustained growth in the global reduced fat butter segment.

Key Player Analysis

- Devondale.

- Zydus Wellness

- Amul Milk Union Ltd

- Land O’Lakes, Inc.

- Arla Foods amba

- Finlandia Cheese, Inc.

- Kerrygold USA

- Morrisons Ltd

- Agral S.A.

- Ornua

Recent Developments

- In April 2024, Lactalis launched Président Lighter Slightly Salted Spreadable Butter in the UK and Ireland, featuring 50% less fat than traditional butter without vegetable oils.

- In April 2025, Savor unveiled its carbon-based, animal- and plant-free butter in a commercial launch, backed by Bill Gates’ Breakthrough Energy Ventures.

- In January 2025, SMUG Dairy launched Spreadable Blended Oat & Dairy Butter, featuring 40% less saturated fat and added vitamins.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Reduced Fat Butter Market is expected to grow steadily due to increasing health-conscious consumer trends.

- Spreadable and functional butter variants will continue to dominate product innovation efforts.

- Expansion of online retail and e-commerce channels will enhance product accessibility and consumer reach.

- Clean-label and natural ingredient formulations will gain significant traction among wellness-oriented buyers.

- Manufacturers will invest in R&D to improve taste, texture, and stability of reduced fat butter.

- Supermarkets and hypermarkets will remain the primary distribution channels, supported by private-label strategies.

- Growth in emerging markets will be driven by urbanization, rising disposable incomes, and dietary awareness.

- Product fortification with vitamins, probiotics, and omega fatty acids will present new growth opportunities.

- Promotional campaigns emphasizing lower calories and heart-healthy benefits will strengthen consumer adoption.

- Strategic partnerships, mergers, and acquisitions will continue to expand market presence and competitive positioning.