Market Overview

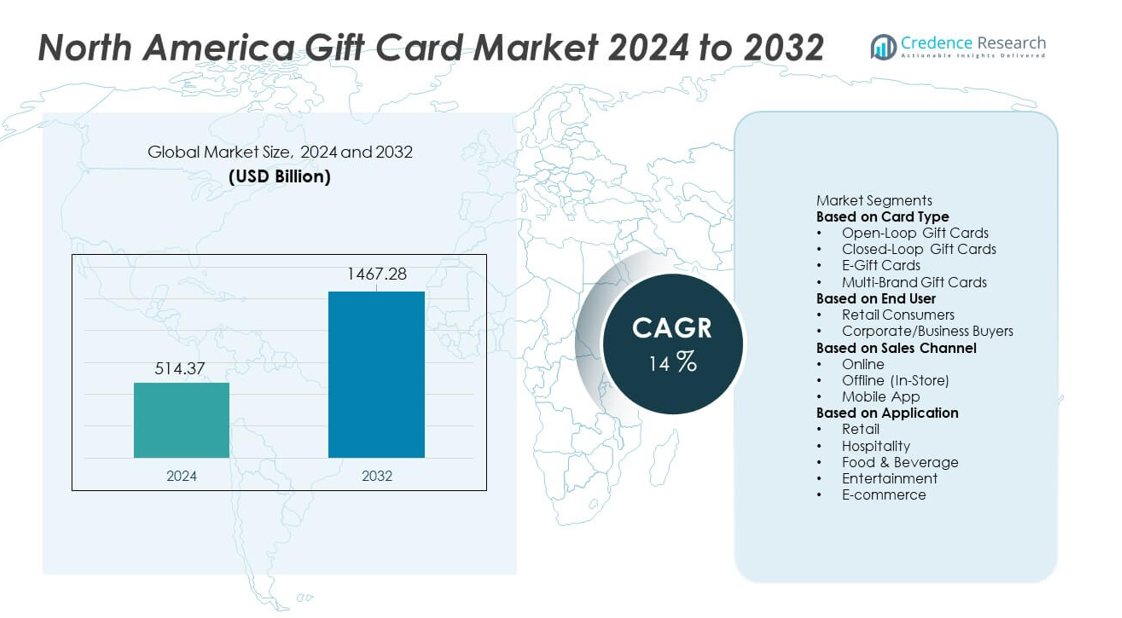

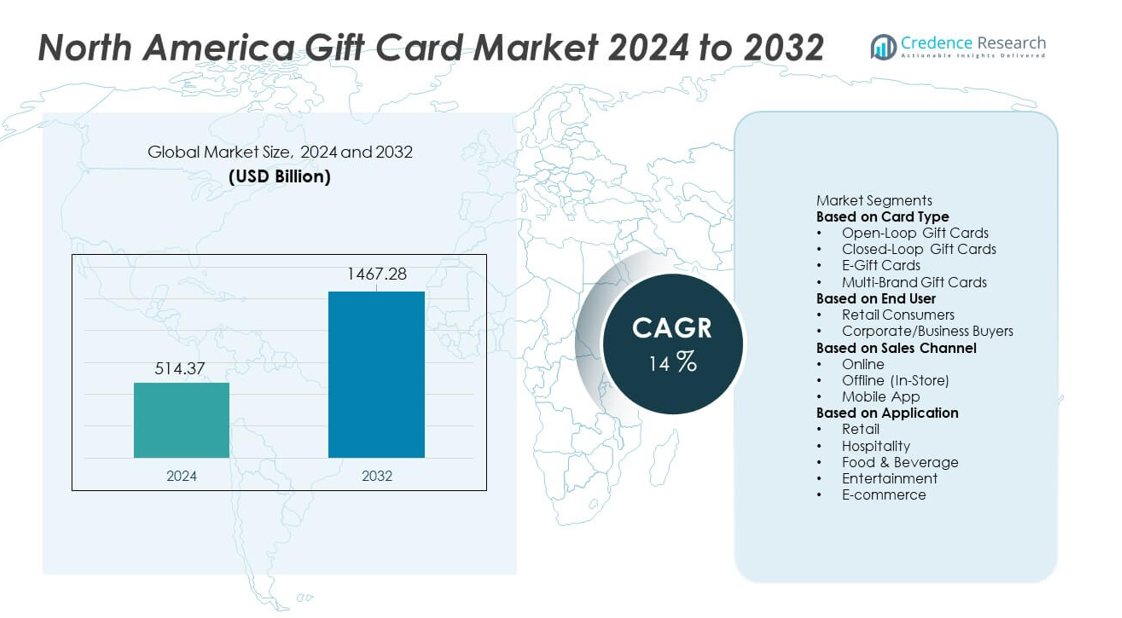

The North America Gift Card market reached USD 514.37 billion in 2024 and is projected to grow to USD 1,467.28 billion by 2032, reflecting a strong CAGR of 14% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Gift Card Market Size 2024 |

USD 514.37 billion |

| North America Gift Card Market, CAGR |

14% |

| North America Gift Card Market Size 2032 |

USD 1,467.28 billion |

The North America gift card market is driven by major players such as Amazon, Walmart, Target Corporation, Starbucks, Apple, Google, Best Buy, Home Depot, Lowe’s, and Sephora, all of which strengthen their presence through strong retail networks, digital gifting platforms, and robust loyalty programs. These companies expand adoption through mobile wallet integration, personalized e-gift options, and seamless redemption across online and offline channels. Regionally, the United States leads the market with 82% share, supported by high consumer spending and advanced digital payment systems, while Canada holds 14% share and Mexico accounts for 4%, reflecting rising e-commerce use and expanding retail ecosystems.

Market Insights

- The North America gift card market reached USD 514.37 billion in 2024 and will grow at a CAGR of 14% through 2032, driven by rising digital gifting and expanding retail ecosystems.

- Strong market drivers include increasing e-commerce activity, wider mobile wallet adoption, and growing corporate demand for employee rewards and customer incentives.

- Key trends include rapid growth of e-gift cards, omnichannel redemption, personalized gifting options, and strong competitive activity from players like Amazon, Walmart, Target, Starbucks, and Apple.

- Market restraints arise from rising fraud risks, digital security concerns, and regulatory challenges related to expiration rules and fee restrictions across states.

- Regionally, the United States leads with 82% share, followed by Canada at 14% and Mexico at 4%. Segment-wise, open-loop cards hold 42% share, retail consumers account for 63%, and online channels lead sales with 48% share across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Card Type

Open-loop gift cards lead the market with 42% share, driven by their wide acceptance across multiple retailers, service providers, and online platforms. Consumers prefer open-loop cards for flexibility, ease of gifting, and suitability for both personal and corporate use. Closed-loop cards remain popular within branded retail chains due to strong customer loyalty programs. E-gift cards gain momentum with rising digital adoption, instant delivery options, and increased mobile wallet usage. Multi-brand gift cards also expand as shoppers seek curated options across food, fashion, and entertainment categories. Growing digital payments and holiday gifting trends continue to drive strong demand across all card types.

- For instance, Amazon has noted that its Amazon Incentives API for developers helps partners integrate gift card solutions.

By End User

Retail consumers dominate the market with 63% share, supported by rising demand for personalized gifting, holiday purchases, and convenient digital gift options. Consumers choose gift cards for birthdays, festive occasions, and online shopping flexibility. Corporate and business buyers steadily increase adoption for employee rewards, customer engagement programs, and sales incentives. Companies integrate gift cards into recognition strategies to strengthen retention and boost productivity. Expanding loyalty programs, promotional campaigns, and bulk purchase discounts continue to drive corporate demand. Strong gifting culture and rapid digitalization keep retail consumers the dominant segment in the North America gift card market.

- For instance, Walmart has a dedicated business-to-business (B2B) gift card team that manages bulk gift card purchases and custom-branded options for corporate gifting programs and employee recognition initiatives.

By Sales Channel

Online channels lead the segment with 48% share, driven by growing e-commerce activity, instant card delivery, and higher mobile wallet usage. Consumers prefer online platforms for convenience, personalized designs, and quick purchase options for both physical and digital cards. Offline in-store sales remain relevant due to placement at checkout counters and strong impulse buying behavior. Mobile app channels grow rapidly as retailers integrate gift card purchases within loyalty apps and digital wallets. Increasing smartphone penetration, rising digital payments, and strong promotional campaigns continue to push online channels as the dominant sales medium in the region.

Key Growth Driver

Rising Adoption of Digital Payments and E-Gifting

Digital transformation strongly accelerates gift card usage across North America as consumers shift toward cashless payments and instant gifting options. E-gift cards gain rapid acceptance due to easy delivery, customization features, and compatibility with mobile wallets. Retailers enhance digital card offerings through app-based redemption, reloadable balances, and real-time tracking. Growing online shopping and increasing smartphone penetration further support this trend. As consumers prioritize convenience, security, and speed, digital payment expansion remains a key driver of sustained growth in the North America gift card market.

- For instance, Apple, in its efforts to combat fraud across the App Store and its payment systems, helped prevent over $1.8 billion in potentially fraudulent transactions in 2023 alone. The company also processed over 1.2 billion ratings and reviews in 2024 as part of its ongoing vigilance against discovery fraud.

Expanding Corporate Incentive and Reward Programs

Corporate buyers adopt gift cards extensively for employee recognition, sales incentives, and customer loyalty programs. Businesses prefer gift cards for their flexibility, easy distribution, and strong engagement impact. Companies integrate gift cards into performance rewards, holiday bonuses, and promotional campaigns to boost morale and retention. Bulk purchasing options and attractive corporate discounts further fuel adoption. As organizations focus more on employee well-being and customer loyalty, demand for corporate gifting solutions continues to rise, positioning this segment as a major growth driver in the regional gift card market.

- For instance, Target offers a corporate gift card program for businesses and organizations that provides benefits such as free shipping, customized messaging, and individual fulfillment options, recognizing the significant role digital and physical gift cards play in the growing global corporate gifting market.

Increasing Retail Promotions and Loyalty Integration

Retailers use gift cards as a key promotional tool to attract customers, increase repeat visits, and strengthen loyalty. Strategic placement at checkout counters, holiday bundles, and bonus card offers encourage higher spending. Loyalty programs integrate gift cards to reward frequent buyers and enhance customer retention. Multi-brand and open-loop cards create added convenience for shoppers seeking flexible choices. Seasonal demand spikes during holidays and special events further boost sales. As retailers expand omnichannel strategies, gift cards continue to play a central role in promotional and customer engagement activities.

Key Trend & Opportunity

Rapid Growth of Mobile Wallet and App-Based Gift Cards

Mobile app-based gift cards create strong growth opportunities as consumers adopt digital wallets for secure and instant transactions. Retailers integrate gift card features into mobile apps, enabling balance checks, automatic redemption, and seamless online or in-store payments. Younger consumers prefer mobile gift cards for their ease of use and ability to personalize designs. Brands also leverage analytics from app-based usage to improve marketing strategies. As mobile commerce expands across North America, gift cards linked to digital wallets and retailer apps become a major opportunity for revenue growth and customer engagement.

- For instance, in the first quarter of the fiscal year 2023, a record $3.3 billion was loaded onto Starbucks gift cards. This activity is supported by its app infrastructure, through which over 30 million Rewards members make mobile orders, accounting for more than 30% of transactions.

Rise of Multi-Brand Gift Cards and Personalization Features

Multi-brand gift cards gain popularity as they offer broader spending flexibility across categories such as fashion, dining, travel, and entertainment. Consumers value curated experiences, making multi-brand cards ideal for gifting across age groups. Personalization trends, including custom messages, themed designs, and tailored bundles, strengthen user appeal. Retailers and issuers use data analytics to create targeted offers and improve redemption experiences. As consumer expectations shift toward more flexible and personalized gifting options, multi-brand and customizable gift cards present a strong opportunity for market expansion.

- For instance, Blackhawk Network issues approximately 1 billion cards annually, leveraging an analytics platform that previously tracked over 1 billion rebate transactions to optimize personalization.

Key Challenge

Increasing Risk of Fraud and Digital Security Threats

Rising online transactions increase exposure to fraud, phishing, and unauthorized access to digital gift card balances. Fraudulent activities such as card cloning, code theft, and scam-based redemption pressure retailers and issuers to strengthen security systems. Companies must invest in real-time monitoring, encryption technologies, and advanced verification tools to prevent losses. High fraud incidents reduce consumer trust and increase operational costs. Ensuring strong security while maintaining a smooth user experience remains a major challenge in the North America gift card market.

Regulatory Variations and Expiration Policy Concerns

Different state-level regulations regarding expiration dates, fees, and consumer protection create compliance challenges for issuers. Retailers must balance regulatory requirements with operational costs and customer expectations. Consumers often express concerns about inactivity fees and limited redemption options, which can reduce adoption. Complex compliance procedures also increase administrative workload for issuers. As the market expands across digital and physical channels, managing regulatory variations becomes a significant challenge for maintaining consistency and customer satisfaction.

Regional Analysis

United States

The United States holds 82% share of the North America gift card market, driven by strong digital payment adoption, widespread retail participation, and high consumer spending on festive and promotional gifting. Major retailers, e-commerce platforms, and hospitality brands actively expand both physical and digital gift card programs to boost customer engagement. E-gift cards gain strong traction due to instant delivery and seamless mobile wallet integration. Corporate demand remains high as companies use gift cards for employee rewards, loyalty programs, and incentive campaigns. Growing mobile app usage, rising holiday sales, and expanding omnichannel retail strategies continue to strengthen the U.S. market.

Canada

Canada accounts for 14% share, supported by steady digital transformation, rising e-commerce purchases, and strong consumer demand for flexible gifting solutions. Retailers invest in digital gift card platforms, loyalty integration, and customizable card options to engage customers. Corporate buyers increasingly adopt gift cards for employee recognition and customer rewards. Mobile wallet usage and app-based card redemption continue to grow, driven by younger consumers seeking convenience. Seasonal demand peaks during holidays and special occasions, boosting overall market activity. Strong retail expansion and improved digital infrastructure continue to support Canada’s role in the regional gift card market.

Mexico

Mexico holds 4% share, with growth driven by expanding retail networks, rising smartphone penetration, and increasing acceptance of digital payment methods. Consumers adopt gift cards for festive events, family gifting, and growing online shopping needs. Retailers introduce multi-brand and e-gift card options to attract urban consumers and strengthen loyalty programs. Corporate demand increases as companies integrate gift cards into employee rewards and promotional activities. Despite challenges such as lower digital penetration in rural areas, improving financial inclusion, mobile payments, and expanding e-commerce platforms support steady growth in Mexico’s gift card market.

Market Segmentations:

By Card Type

- Open-Loop Gift Cards

- Closed-Loop Gift Cards

- E-Gift Cards

- Multi-Brand Gift Cards

By End User

- Retail Consumers

- Corporate/Business Buyers

By Sales Channel

- Online

- Offline (In-Store)

- Mobile App

By Application

- Retail

- Hospitality

- Food & Beverage

- Entertainment

- E-commerce

By Geography

- United States

- Canada

- Mexico

Competitive Landscape

Competitive landscape analysis shows a strong presence of major players such as Amazon, Walmart, Target Corporation, Starbucks, Apple, Google, Best Buy, Home Depot, Lowe’s, and Sephora. These companies expand their market position through robust omnichannel strategies, extensive retail networks, and advanced digital gifting platforms. Leading players invest in mobile wallet integration, personalized e-gift card designs, and loyalty program enhancements to boost customer engagement. Retailers strengthen brand value by offering customized gifting options, instant delivery features, and tailored rewards for frequent buyers. Corporate partnerships also play a growing role, with companies using gift cards for incentives and recognition programs. As digital payments rise and consumer expectations shift toward convenience and personalization, market competition increasingly depends on technology adoption, strong brand presence, and seamless redemption experiences across both online and in-store channels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, Apple held a four-day holiday shopping event at Apple Stores and on apple.com, providing Apple gift cards valued up to $250 with purchases of eligible products.

- In October 2025, a coalition of major retailers, gift-card networks and law enforcement launched a holiday fraud-awareness campaign to warn consumers about rising gift-card scams.

- In 2025, Best Buy launched its 2025 Black Friday / Cyber Monday deals that included free e-Gift cards with purchase of select devices.

Report Coverage

The research report offers an in-depth analysis based on Card Type, End User, Sales Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as digital gifting becomes a preferred choice among consumers.

- E-gift cards will grow rapidly with rising mobile wallet usage and app-based purchases.

- Retailers will introduce more personalized and themed gift card options to enhance user appeal.

- Corporate demand will increase as companies use gift cards for rewards, incentives, and customer engagement.

- Multi-brand gift cards will gain traction due to stronger flexibility and broader spending options.

- Mobile apps will strengthen their role in balance tracking, instant delivery, and seamless redemption.

- Loyalty programs will integrate more gift card rewards to boost repeat purchases.

- Security features will improve with advanced fraud detection and encrypted digital systems.

- Omnichannel platforms will enhance redemption experiences across online and in-store environments.

- Partnerships between retailers, fintech firms, and e-commerce players will expand distribution and market reach.