Market Overview

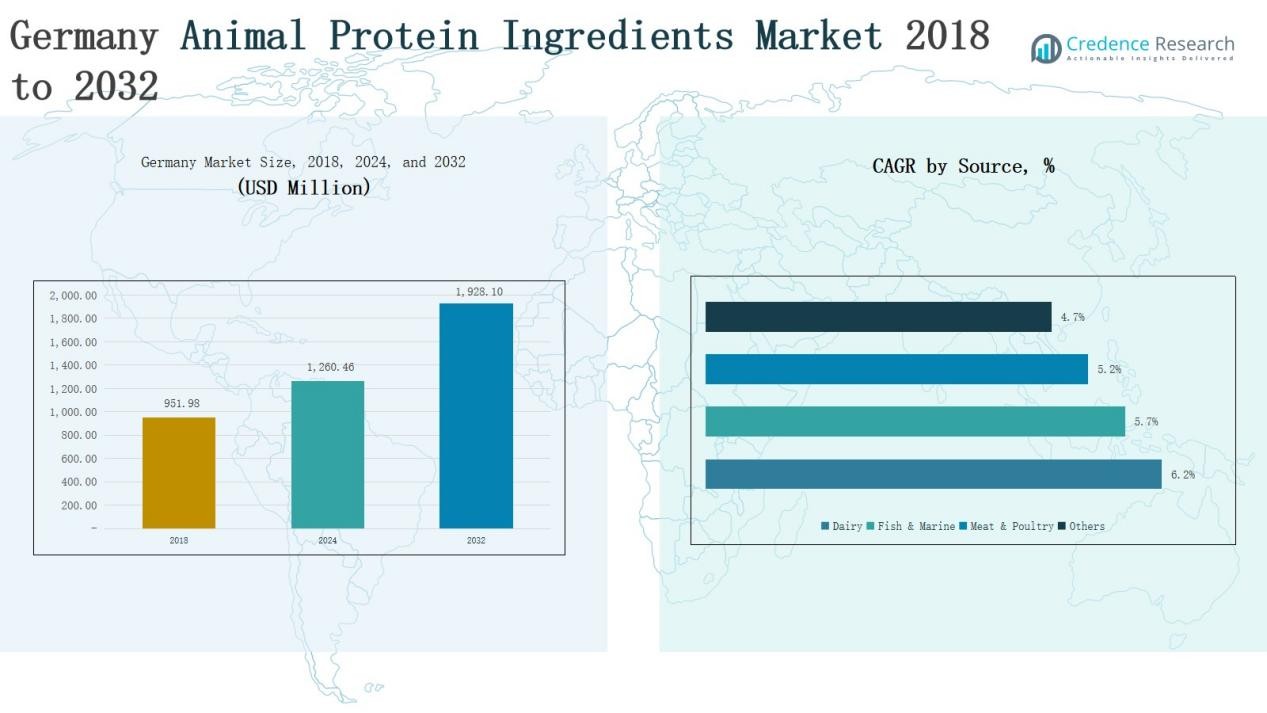

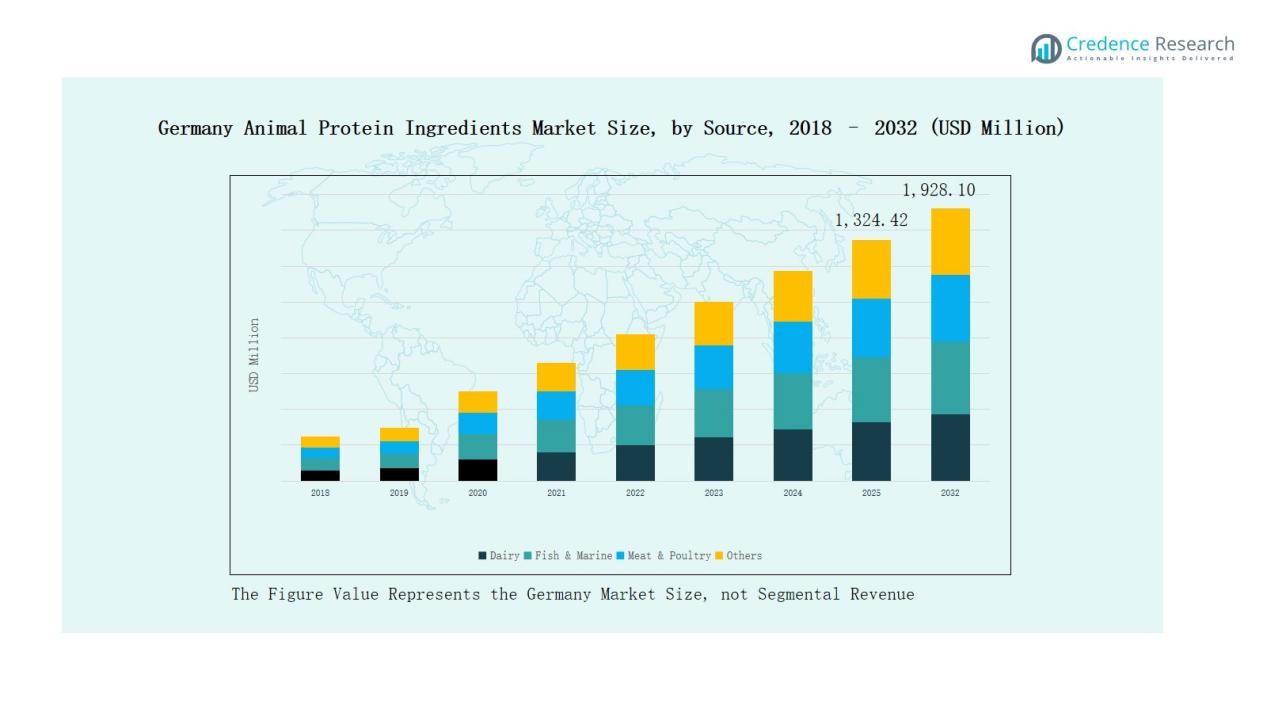

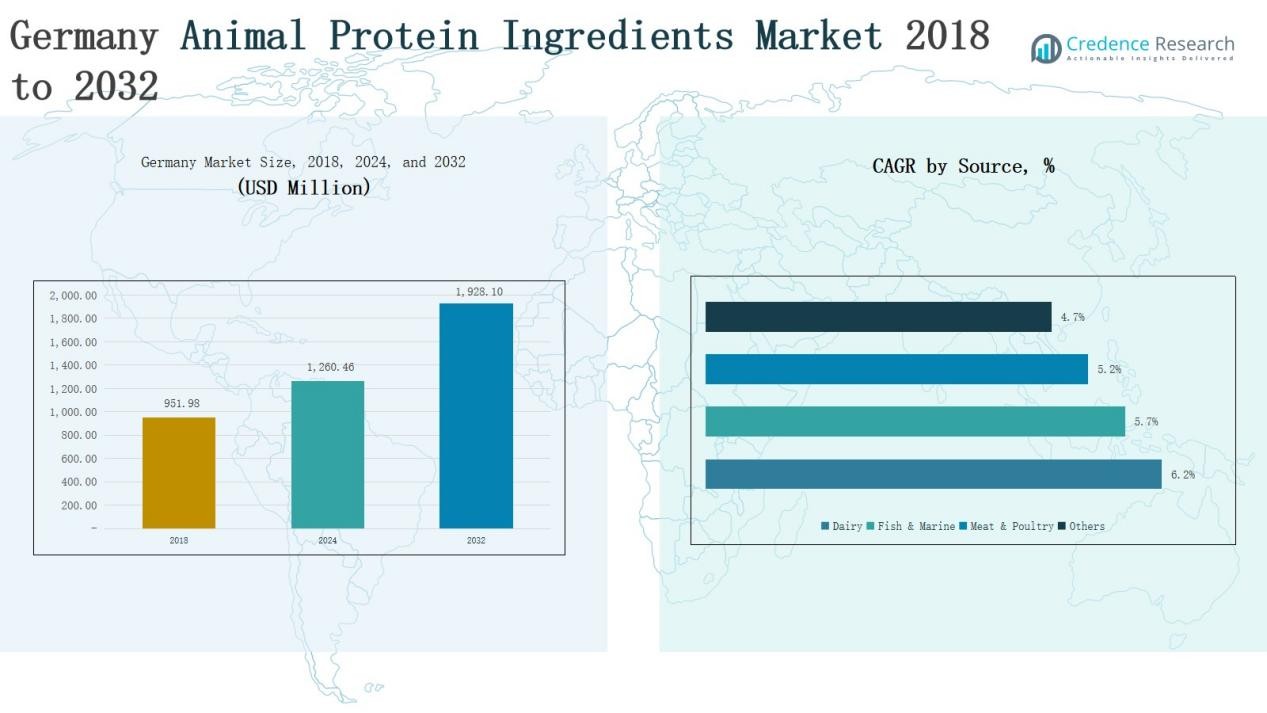

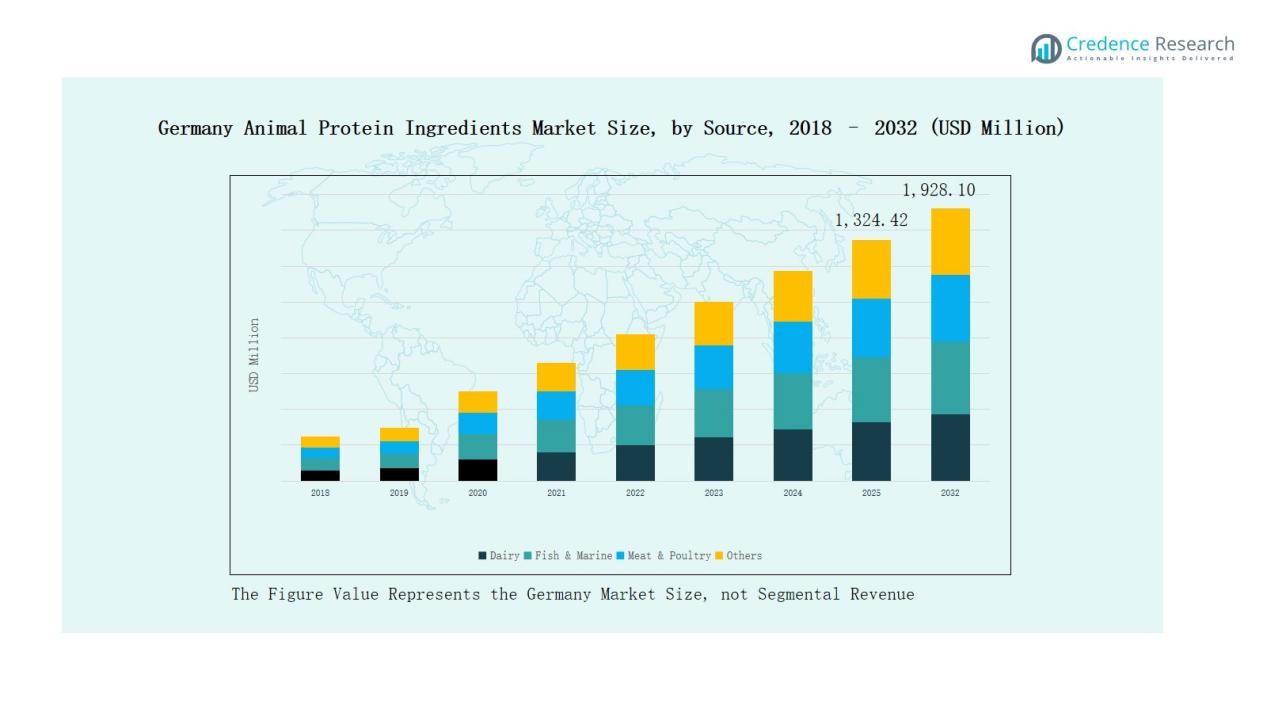

Germany Animal Protein Ingredients Market size was valued at USD 951.98 million in 2018, rising to USD 1,260.46 million in 2024, and is anticipated to reach USD 1,928.10 million by 2032, at a CAGR of 5.37% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Animal Protein Ingredients Market Size 2024 |

USD 1,260.46 Million |

| Germany Animal Protein Ingredients Market, CAGR |

5.37% |

| Germany Animal Protein Ingredients Market Size 2032 |

USD 1,928.10 Million |

The Germany Animal Protein Ingredients Market is shaped by strong competition among leading players such as DMK Deutsches Milchkontor GmbH, Eurial I&N, Armor Proteines, Cargill, Tyson Foods, Darling Ingredients, Kemin Industries, SiccaDania, Kookaburra Limited, and Prinova. These companies emphasize advanced processing technologies, diversified product portfolios, and strategic partnerships to strengthen their positions across applications including sports nutrition, clinical products, and premium pet food. Innovation in sustainable sourcing and compliance with EU food safety standards remain central to their growth strategies. Regionally, Western Germany led the market in 2024 with a 29% share, supported by its dense consumer base, advanced healthcare infrastructure, and strong presence of pharmaceutical and biotechnology clusters. This leadership highlights the region’s role as the hub for innovation, consumption, and distribution in the national market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Germany Animal Protein Ingredients Market grew from USD 951.98 million in 2018 to USD 1,260.46 million in 2024 and is projected to reach USD 1,928.10 million by 2032.

- Western Germany led in 2024 with 29% share, supported by advanced healthcare infrastructure, strong pharmaceutical clusters, and premium pet food production growth.

- By source, dairy dominated with 41% share in 2024, followed by fish and marine at 27%, meat and poultry at 24%, and others at 8%.

- By form, powders accounted for 64% share, granules and flakes held 22%, while liquids and pastes represented 14% share, driven by pet food applications.

- By application, sports and active nutrition led with 33% share in 2024, followed by clinical nutrition at 28%, pet food at 19%, aquafeed and livestock feed at 15%, and others at 5%.

Market Segment Insights

By Source

In 2024, dairy led the Germany Animal Protein Ingredients Market with a 41% share, supported by strong demand in clinical nutrition, dairy-based supplements, and sports formulations. Fish and marine proteins accounted for 27%, driven by rising aquafeed applications and premium nutraceuticals. Meat and poultry held 24%, favored in functional foods and pet nutrition. The remaining 8% share was captured by other sources, including specialty proteins used in niche dietary products.

For instance, Gelita AG introduced PeptENDURE, a bioactive collagen peptide developed to improve endurance training performance, aimed at functional food applications.

By Form

Powders dominated the market in 2024 with a 64% share, reflecting their versatility in sports nutrition, medical applications, and easy integration into beverages and supplements. Granules and flakes contributed 22%, with demand supported by functional food processing and convenience products. Liquids and pastes held a 14% share, mainly driven by their role in pet food and specialized clinical formulations.

- For instance, Glanbia Performance Nutrition expanded its Optimum Nutrition Gold Standard Whey Powder portfolio with new flavors in North America to strengthen its sports nutrition segment.

By Application

Sports and active nutrition emerged as the largest application in 2024, capturing a 33% share, fueled by Germany’s strong fitness culture and growing protein supplementation trends. Clinical and medical nutrition followed with 28%, supported by rising healthcare needs and an aging population. Pet food accounted for 19%, reflecting premiumization trends in animal nutrition. Aquafeed and livestock feed represented 15%, while other niche applications contributed the remaining 5%, driven by innovations in specialty food products.

Key Growth Drivers

Rising Demand for Protein-Enriched Nutrition

Germany’s growing health-conscious population is driving demand for protein-enriched foods, supplements, and beverages. Sports and active nutrition products are increasingly favored by young consumers and fitness enthusiasts. The shift toward preventive healthcare and functional foods also strengthens demand for dairy and specialty proteins. Clinical nutrition applications benefit from an aging population, which relies on protein-based diets for muscle maintenance and recovery. Together, these factors make protein-enriched nutrition a major driver for the animal protein ingredients market.

- For instance, Arla Foods Ingredients launched Lacprodan® ISO.Water, a whey protein isolate designed for clear, high-protein beverages targeting active nutrition in European markets.

Expansion of Clinical and Medical Nutrition

Germany’s advanced healthcare infrastructure and rising prevalence of chronic diseases are boosting the adoption of protein-based medical nutrition products. Hospitals and clinics increasingly integrate protein formulations for patient recovery and nutritional support. Dairy proteins remain the preferred choice due to their digestibility and bioavailability. This growth is further supported by government and institutional emphasis on balanced nutrition. The clinical nutrition segment, with nearly 28% share in 2024, stands as a key growth driver across the German market.

- For instance, Fresenius Kabi launched its Fresubin 3.2 kcal DRINK in Germany, a high-energy oral nutritional supplement containing 20 g of protein per bottle, aimed at patients with malnutrition and chronic illness.

Pet Food Premiumization and Growth

The rising expenditure on pet health and nutrition has accelerated the demand for premium pet food products in Germany. Consumers prefer protein-rich formulations that support animal health, growth, and vitality. Meat, poultry, and marine proteins play an essential role in high-quality pet food offerings. The growing shift toward functional and specialty pet food further expands demand for animal protein ingredients. With pets treated as family members, premiumization trends in the pet food industry act as a strong driver for market growth.

Key Trends & Opportunities

Innovation in Sustainable Protein Sourcing

Sustainability concerns are shaping sourcing practices for animal protein ingredients in Germany. Producers are investing in eco-efficient processing technologies and sustainable aquaculture for marine protein supply. There is also a growing focus on utilizing by-products from the meat and dairy industry to reduce waste and improve circularity. These efforts align with both regulatory requirements and consumer demand for environmentally responsible products, creating opportunities for innovation in sustainable animal protein solutions.

- For instance, Gelita launched GELITA® Soluform PE Hydrolysate, a protein solution derived from rendering meat by-products, aimed at reducing waste in meat processing streams.

Growth in High-Protein Functional Foods

Germany’s rising demand for functional and fortified food products presents a significant opportunity for animal protein ingredients. Manufacturers are developing protein-enriched dairy snacks, ready-to-drink beverages, and bakery items targeted at health-conscious consumers. Powders remain the preferred form due to versatility in formulation. This trend is further supported by the younger demographic that values convenience, nutrition, and fitness. The functional food category thus offers a lucrative pathway for expansion of animal protein applications in the country.

- For instance, Arla Foods launched its Lacprodan® whey protein isolate for use in clear ready-to-drink beverages in Europe, including Germany, aimed at boosting protein intake for active consumers.

Key Challenges

Competition from Plant-Based Proteins

The rapid rise of plant-based proteins presents a significant challenge to the Germany animal protein ingredients market. Consumer preference is shifting toward vegan and vegetarian diets, especially among younger demographics. This creates direct competition in sports nutrition, functional foods, and clinical applications. Companies face pressure to differentiate animal protein offerings and highlight unique benefits such as superior amino acid profiles and bioavailability. Balancing growth alongside the plant-based protein wave remains a core challenge for market players.

Price Volatility and Supply Constraints

Fluctuations in raw material costs, particularly for dairy and meat-based proteins, create pricing instability in the German market. Feed costs, global supply chain disruptions, and environmental factors such as climate change affect production. Import dependency for certain marine protein sources adds further risk. These factors increase operational costs for manufacturers and can limit competitiveness. Ensuring steady supply while maintaining price stability remains a pressing challenge for the animal protein ingredients industry in Germany.

Strict Regulatory and Sustainability Standards

Germany enforces stringent food safety, labeling, and sustainability regulations that challenge protein ingredient producers. Compliance with European Union requirements on traceability, environmental impact, and ethical sourcing demands significant investment. Failure to meet these standards can restrict market access and damage brand reputation. In addition, sustainability targets require companies to adopt eco-friendly production methods. Adapting to these regulatory pressures while ensuring profitability is one of the most critical challenges faced by industry stakeholders.

Regional Analysis

Northern Germany

Northern Germany accounted for 27% share of the Germany Animal Protein Ingredients Market in 2024. The region benefits from strong dairy production, supported by established processing facilities and export-oriented industries. Demand is reinforced by a growing focus on clinical nutrition and sports supplements. Leading companies in dairy and marine proteins maintain a stronghold in this region due to access to raw materials and logistics hubs. It also benefits from aquaculture expansion, which strengthens marine protein availability. Northern Germany remains a vital contributor to the country’s overall protein ingredients supply chain.

Western Germany

Western Germany held a 29% share of the Germany Animal Protein Ingredients Market in 2024. The region is driven by a dense consumer base, advanced healthcare infrastructure, and strong pharmaceutical and biotechnology clusters. Demand for clinical and medical nutrition remains particularly high, supported by hospitals and specialized nutrition programs. Pet food production is also strong in this region, where premium formulations are expanding rapidly. The presence of multinational companies and research institutions reinforces growth. Western Germany continues to lead in innovation and application diversification.

Southern Germany

Southern Germany represented a 24% share of the Germany Animal Protein Ingredients Market in 2024. It benefits from a strong food processing base and consumer demand for functional and fortified foods. Dairy proteins dominate due to a long-standing tradition of milk and cheese production in the region. Sports and active nutrition products show rapid adoption, supported by a young and health-conscious population. Growing emphasis on high-protein functional foods drives further consumption. Southern Germany remains a hub for both traditional and modern protein ingredient applications.

Eastern Germany

Eastern Germany contributed 20% share of the Germany Animal Protein Ingredients Market in 2024. The region is expanding its role in livestock feed and aquafeed production, driving demand for meat and marine proteins. Investment in processing infrastructure is improving efficiency and supporting local industries. Pet food production is also expanding in this area, serving both domestic and export markets. The region faces slower adoption of clinical nutrition compared to Western Germany, but steady growth continues. Eastern Germany is positioned as an emerging contributor to the overall protein ingredients landscape.

Market Segmentations:

By Source

- Dairy

- Fish & Marine

- Meat & Poultry

- Others

By Form

- Powders

- Granules/Flakes

- Liquids/Pastes

By Application

- Sports & Active Nutrition

- Clinical & Medical Nutrition

- Pet Food

- Aquafeed & Livestock Feed

- Others

By Region

- Northern Germany

- Western Germany

- Southern Germany

- Eastern Germany

Competitive Landscape

The Germany Animal Protein Ingredients Market is characterized by intense competition among domestic and international players that focus on product innovation, quality, and distribution strength. Leading companies such as DMK Deutsches Milchkontor GmbH, Eurial I&N, Armor Proteines, and Cargill maintain dominance through extensive dairy and meat-based protein portfolios. Global firms including Tyson Foods, Darling Ingredients, and Kemin Industries leverage advanced processing technologies and diversified applications in sports nutrition, clinical products, and pet food to strengthen their market presence. Regional companies such as SiccaDania and Kookaburra Limited emphasize specialized proteins and niche applications, while Prinova plays a crucial role as a key distributor. The market is highly fragmented, with both large enterprises and mid-tier firms competing for share. Competitive strategies focus on sustainability, premiumization, and partnerships with food, feed, and healthcare industries. Continuous investment in R&D and compliance with strict EU regulations remain central to sustaining long-term growth and market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Eurial I&N

- SiccaDania

- DMK Deutsches Milchkontor GmbH

- Kookaburra Limited

- Cargill

- Kemin Industries

- Prinova

- Darling Ingredients

- Armor Proteines

- Tyson Foods

- Other Key Players

Recent Developments

- In May 2024, Calysta and Dr. Clauder’s launched the first air-dried dog treats in Europe featuring FeedKind Pet protein, a novel fermented protein.

- On February 27, 2025, Marsapet partnered with Calysta to launch MicroBell dry kibble, the first complete dog food incorporating FeedKind Pet protein.

- In April 2024, Arla Foods Ingredients signed an acquisition agreement to acquire the Whey Nutrition division of Volac’s business, a UK-based company specializing in whey ingredients for sports nutrition and animal nutrition.

- In January 2025, ADM partnered with AgriTech company Klim to expand its regenerative agriculture program in Germany, promoting sustainable protein ingredient sourcing through farmer incentives and agronomic support.

Report Coverage

The research report offers an in-depth analysis based on Source, Form, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dairy proteins will continue rising due to strong use in medical nutrition.

- Fish and marine proteins will gain traction with growth in aquafeed and nutraceutical sectors.

- Meat and poultry proteins will see stable demand, especially in premium pet food products.

- Powders will remain the preferred form, supported by versatility in food and supplement applications.

- Granules and flakes will expand gradually, driven by convenience in functional food processing.

- Liquids and pastes will grow in niche areas, mainly pet food and clinical nutrition.

- Sports and active nutrition will remain the leading application, supported by a strong fitness culture.

- Clinical nutrition will grow steadily with an aging population and rising chronic health cases.

- Pet food will expand further as consumers demand high-quality protein-based formulations for animals.

- Sustainability initiatives will drive innovation in sourcing, processing, and eco-friendly production methods.