Market Overview

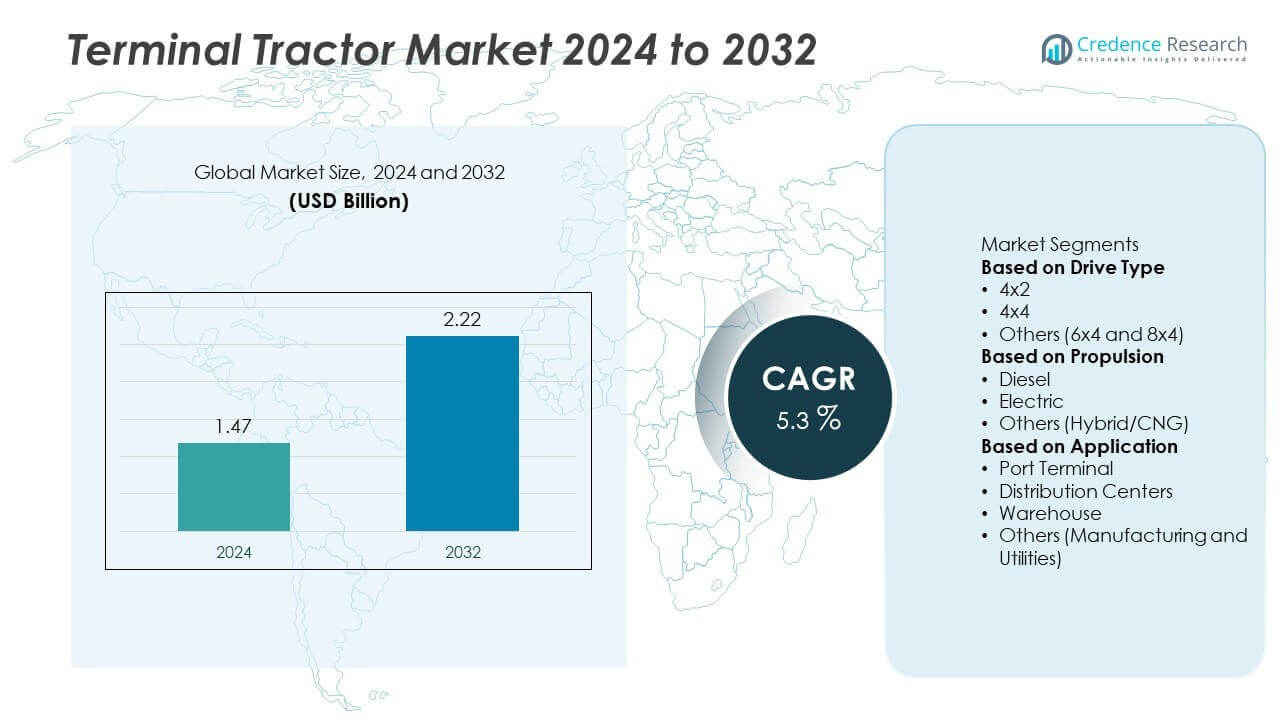

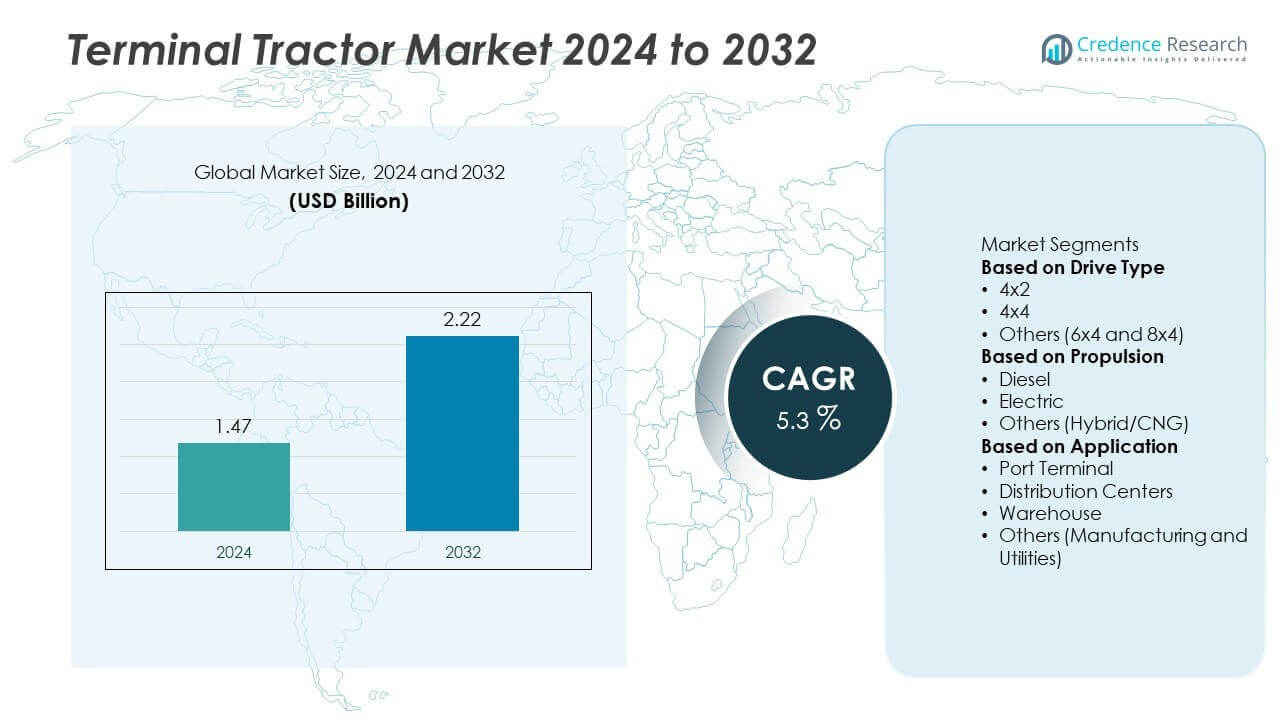

The terminal tractor market was valued at USD 1.47 billion in 2024 and is projected to reach USD 2.22 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Terephthaloyl Chloride (TPC) Market Size 2024 |

USD 1.47 Billion |

| Terephthaloyl Chloride (TPC) Market, CAGR |

5.3% |

| Terephthaloyl Chloride (TPC) Market Size 2032 |

USD 2.22 Billion |

The terminal tractor market is driven by major players including TICO Tractors, Hyster-Yale Materials Handling, Kalmar, Capacity Truck, Sany Group, MAFI Transport-System, Terberg Group, Konecranes, Mol CY, and CVS Ferrari. These companies focus on electric and hybrid product launches, telematics integration, and automation to enhance operational efficiency in ports and logistics hubs. Asia-Pacific led the market with over 40% share in 2024, supported by port expansions, e-commerce growth, and rising container traffic. North America accounted for 28% share, driven by fleet modernization and sustainability initiatives, while Europe captured 22% share, supported by emission regulations and strong intermodal logistics infrastructure.

Market Insights

Market Insights

- The terminal tractor market was valued at USD 1.47 billion in 2024 and is projected to reach USD 2.22 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising global trade and e-commerce growth are boosting demand, with 4×2 drive type holding over 70% share due to its efficiency and suitability for port and distribution operations.

- Key trends include electrification of fleets, deployment of telematics, and development of autonomous terminal tractors to enhance yard productivity and reduce emissions.

- Leading players such as TICO Tractors, Kalmar, Terberg Group, Konecranes, and Hyster-Yale focus on electric and hybrid model launches, strategic collaborations, and fleet management solutions to expand their market presence.

- Asia-Pacific led with over 40% share, followed by North America at 28% and Europe at 22%, with port terminals contributing over 45% share, making them the largest application segment globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Drive Type

The 4×2 drive type dominated the terminal tractor market with over 70% share in 2024, driven by its cost-effectiveness, ease of maintenance, and suitability for port and distribution operations with moderate hauling requirements. These tractors are widely preferred for container handling in ports, warehouses, and distribution centers due to their fuel efficiency and maneuverability in confined spaces. The 4×4 segment captured a smaller share, mainly used in heavy-duty and rough terrain applications where additional traction is required. Growth in global trade and port expansions continues to boost demand for 4×2 terminal tractors.

- For instance, Kalmar, a division of Cargotec, manufactures 4×2 terminal tractors globally, with models like the T2i and Ottawa T2 specifically designed for efficient container handling in tight port and warehouse environments.

By Propulsion

Diesel-powered terminal tractors held nearly 80% share in 2024, making them the dominant propulsion type. Their popularity is attributed to high torque output, robust performance, and long operational life, making them suitable for heavy-duty operations in ports and distribution hubs. However, electric terminal tractors are rapidly gaining traction, supported by zero-emission regulations and fleet electrification initiatives by logistics operators. Hybrid and CNG variants make up the rest of the market, targeting operators seeking lower fuel costs and reduced carbon footprint. Growing sustainability mandates are expected to accelerate the shift toward electric propulsion.

- For instance, Terberg Special Vehicles focused on expanding its production capacity for both diesel and electric terminal tractors in 2024, reflecting its commitment to both robust traditional powertrains and clean energy solutions for ports and logistics centers worldwide.

By Application

Port terminals accounted for over 45% share of the terminal tractor market in 2024, making it the largest application segment. Rising global container trade, port capacity expansion, and investments in automation drive demand for efficient terminal tractors to improve turnaround times. Distribution centers followed as the second-largest segment, driven by the growth of e-commerce and just-in-time delivery models. Warehouses and manufacturing facilities also use terminal tractors for yard management and trailer spotting, contributing to steady demand. Increasing adoption of advanced telematics and fleet management solutions further enhances operational efficiency across applications.

Key Growth Drivers

Rising Global Trade and Port Expansions

Growing international trade volumes are driving investments in port infrastructure, boosting demand for terminal tractors. These vehicles play a critical role in container handling and yard management, improving operational efficiency and reducing turnaround times. Expanding seaport capacities in Asia-Pacific, the Middle East, and Latin America are creating large procurement opportunities for terminal tractors. Global logistics hubs are increasingly standardizing equipment fleets, which supports steady demand for reliable and high-performance tractors designed for continuous heavy-duty operation.

- For instance, Kalmar continues to operate globally, providing a wide range of material handling equipment, including terminal tractors, to ports and logistics hubs. In 2024, Kalmar announced several orders for terminal tractors, such as supplying three heavy terminal tractors to Uniport in Italy and five to Seehafen Wismar in Germany.

Growth of E-Commerce and Distribution Centers

The rapid expansion of e-commerce and retail logistics networks is a major driver for terminal tractors in distribution centers and warehouses. Rising consumer expectations for faster deliveries are pushing logistics operators to optimize yard management and trailer movement. Terminal tractors help reduce bottlenecks, streamline trailer spotting, and support 24/7 operations. Investments in large-scale fulfillment centers across North America, Europe, and Asia-Pacific are driving sustained adoption of terminal tractors to improve productivity and reduce downtime in high-volume facilities.

- For instance, Autocar LLC has a significant presence in the North American terminal tractor market, serving distribution centers and warehouses with a focus on models equipped with advanced ergonomic and safety features to support continuous 24/7 warehouse operations.

Shift Toward Sustainable Yard Operations

The transition toward sustainable logistics operations is accelerating the adoption of electric and alternative-fuel terminal tractors. Governments and regulatory agencies are implementing stricter emission norms for ports and logistics hubs, encouraging fleet operators to switch to zero-emission or low-emission vehicles. Electric terminal tractors reduce fuel costs, lower noise pollution, and support corporate decarbonization goals. Several OEMs are launching battery-electric and hybrid models with improved range and fast-charging capabilities, driving market growth and creating opportunities for green fleet conversions worldwide.

Key Trends & Opportunities

Adoption of Connected and Automated Technologies

Telematics integration, IoT connectivity, and semi-automation are key trends transforming the terminal tractor market. Fleet operators are deploying connected solutions to monitor vehicle performance, optimize routing, and enable predictive maintenance. Autonomous terminal tractors are being tested in leading ports to reduce labor costs and improve safety. The opportunity lies in offering digital-ready tractors with remote diagnostics, over-the-air updates, and compatibility with yard management systems, enabling operators to achieve higher productivity and lower total cost of ownership.

- For instance, FERNRIDE achieved European Machinery Directive certification in 2025 for its autonomous terminal tractor systems, enabling deployment of drive-by-wire autonomous retrofits compatible with major OEM chassis across multiple EU ports, improving operational efficiency while reducing labor costs.

Electrification and Infrastructure Development

Electrification is gaining momentum as OEMs expand their portfolio of battery-electric and hybrid terminal tractors. Growth is supported by investments in charging infrastructure at ports and logistics hubs. Fleet operators benefit from reduced operating costs, government incentives, and compliance with emission regulations. This trend presents opportunities for suppliers to offer modular battery solutions, fast-charging systems, and energy management software that maximize uptime. Collaboration between OEMs, port authorities, and energy providers will accelerate adoption of electric fleets.

- For instance, BYD introduced its new EYT 2.0 Electric Yard Tractor for the European market at IAA Transportation 2024, featuring its Blade Battery technology that allows for up to 16 hours of operation with fast charging between shifts to support zero-emission logistics fleets.

Key Challenges

High Initial Investment Costs

The high purchase price of new terminal tractors, particularly electric models, remains a significant barrier for small and medium-sized operators. Costs associated with charging infrastructure installation, driver training, and maintenance further increase the financial burden. This challenge slows fleet replacement cycles in price-sensitive markets. Manufacturers are addressing this issue by offering leasing programs, financing solutions, and total cost of ownership models to make adoption more feasible for operators.

Limited Charging and Support Infrastructure

Despite growing interest in electric terminal tractors, the availability of adequate charging infrastructure remains a challenge. Ports and logistics hubs in developing regions often lack sufficient power capacity and dedicated charging stations. Downtime during charging can also impact operational efficiency if infrastructure is not properly planned. Collaboration between equipment manufacturers, energy providers, and port authorities is crucial to accelerate infrastructure deployment and support large-scale fleet electrification.

Regional Analysis

Asia-Pacific

Asia-Pacific led the terminal tractor market with over 40% share in 2024, driven by strong growth in port container traffic, rapid industrialization, and rising e-commerce activity. China, India, and Southeast Asia are investing heavily in port expansions and logistics infrastructure to meet rising trade volumes. Governments are supporting modernization of supply chains and adoption of efficient yard management solutions, creating strong demand for terminal tractors. Increasing focus on electrification and deployment of automated equipment in major ports is also boosting adoption, positioning Asia-Pacific as the fastest-growing market during the forecast period.

North America

North America accounted for around 28% share in 2024, supported by the presence of large-scale ports, established distribution centers, and advanced logistics networks. The United States leads demand, driven by e-commerce growth, infrastructure investments, and the adoption of low-emission terminal tractors to meet stringent environmental regulations. Electric terminal tractors are gaining traction in major ports and warehouses with government incentives encouraging fleet electrification. Rising focus on connected solutions and automation is accelerating demand for technologically advanced tractors with telematics and real-time monitoring capabilities across the region.

Europe

Europe captured around 22% share in 2024, fueled by investments in intermodal transport, port automation, and logistics network modernization. Countries such as Germany, the Netherlands, and France are deploying terminal tractors to improve efficiency in container yards and distribution hubs. Strict EU emission regulations are driving the transition toward electric and hybrid terminal tractors, with several pilot projects underway at key ports. The rise in cross-border trade within the EU and growth of e-commerce fulfillment centers continue to support steady demand for efficient and environmentally friendly yard operations solutions.

Latin America

Latin America represented 6% share in 2024, supported by expanding port capacity and growing manufacturing activity in Brazil, Mexico, and Chile. Containerized trade growth and infrastructure development projects are driving the adoption of terminal tractors in port terminals and logistics parks. Distribution centers and warehouses are increasingly investing in equipment to improve trailer spotting efficiency and meet rising consumer demand. However, high equipment costs and limited availability of electric models are challenges in the region. Vendors offering financing solutions and localized service networks are well positioned to capture emerging opportunities.

Middle East & Africa

The Middle East & Africa held 4% share in 2024, with demand driven by logistics infrastructure expansion, free trade zone development, and industrial projects across GCC countries. Ports in the UAE, Saudi Arabia, and Oman are investing in terminal tractors to handle rising cargo volumes and support economic diversification goals. Africa is witnessing gradual adoption in South Africa, Kenya, and Nigeria as containerized trade increases. The region is also seeing initial interest in electric and hybrid terminal tractors, supported by sustainability goals and government efforts to modernize port operations.

Market Segmentations:

By Drive Type

- 4×2

- 4×4

- Others (6×4 and 8×4)

By Propulsion

- Diesel

- Electric

- Others (Hybrid/CNG)

By Application

- Port Terminal

- Distribution Centers

- Warehouse

- Others (Manufacturing and Utilities)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the terminal tractor market is shaped by leading players such as TICO Tractors, Hyster-Yale Materials Handling, Kalmar, Capacity Truck, Sany Group, MAFI Transport-System, Terberg Group, Konecranes, Mol CY, and CVS Ferrari. These companies compete on product innovation, global distribution reach, and after-sales service capabilities. Key strategies include launching electric and hybrid terminal tractors, integrating telematics and automation solutions, and expanding production facilities to meet rising demand from ports, distribution centers, and warehouses. Strategic partnerships with port operators and logistics providers are helping players secure long-term contracts. Many companies are focusing on sustainability initiatives by offering zero-emission and energy-efficient models to comply with tightening emission regulations worldwide. Investments in R&D to enhance driver safety, vehicle performance, and connectivity features are enabling manufacturers to deliver advanced terminal tractors that reduce operating costs and improve yard productivity for customers across multiple industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, TICO Tractors discussed plans for a battery-electric model, the E-Pro Spotter, offering three battery size options.

- In June 2025, Terberg Group highlighted successes with deploying 20 electric terminal tractors at DP World’s Callao terminal in Peru (initial deployment in early 2024).

- In April 2025, Kalmar unveiled the Ottawa AutoTT™, an autonomous terminal tractor; testing underway with full production expected by late 2026.

- In April 2025, Terberg commenced trials and road shows of a new RT-EV 4×4 Ro-Ro electric terminal tractor with key operators ahead of a formal launch later that year.

Report Coverage

The research report offers an in-depth analysis based on Drive Type, Propulsion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as global trade and container volumes increase.

- 4×2 drive type will remain the preferred choice for ports and logistics hubs.

- Adoption of electric terminal tractors will rise with stricter emission regulations.

- E-commerce growth will boost demand for terminal tractors in distribution centers.

- Automation and semi-autonomous solutions will improve yard efficiency and safety.

- Telematics and IoT integration will enhance real-time monitoring and predictive maintenance.

- Asia-Pacific will remain the largest and fastest-growing regional market.

- Manufacturers will invest in R&D for energy-efficient and low-maintenance models.

- Partnerships between OEMs and port operators will support long-term fleet upgrades.

- Infrastructure development and charging station expansion will accelerate electric fleet adoption.

Market Insights

Market Insights