Market Overview:

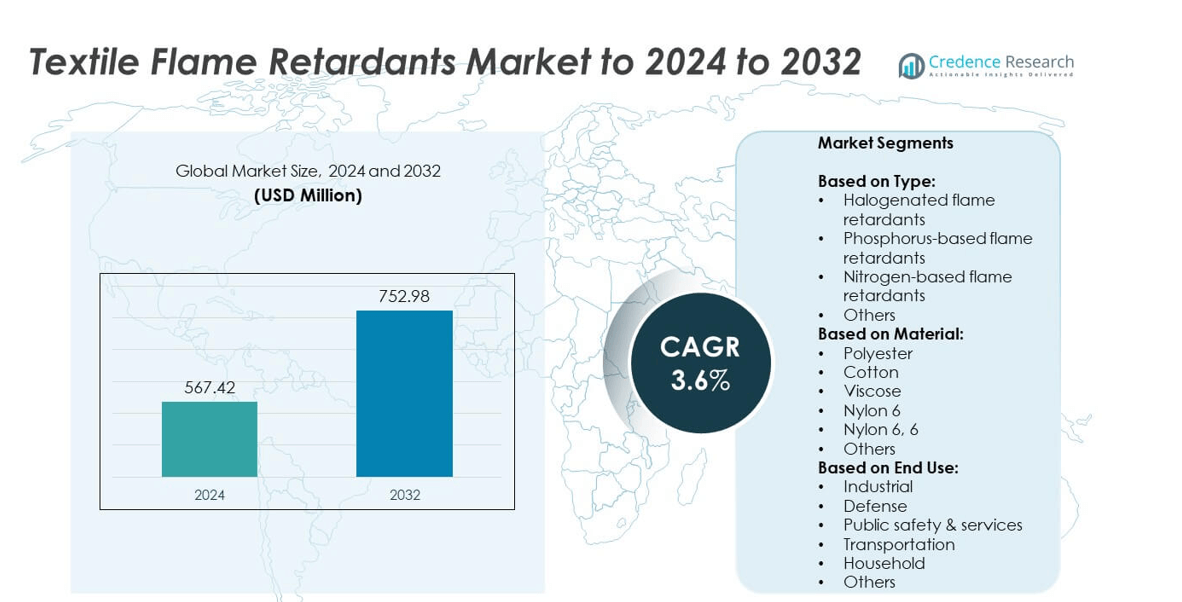

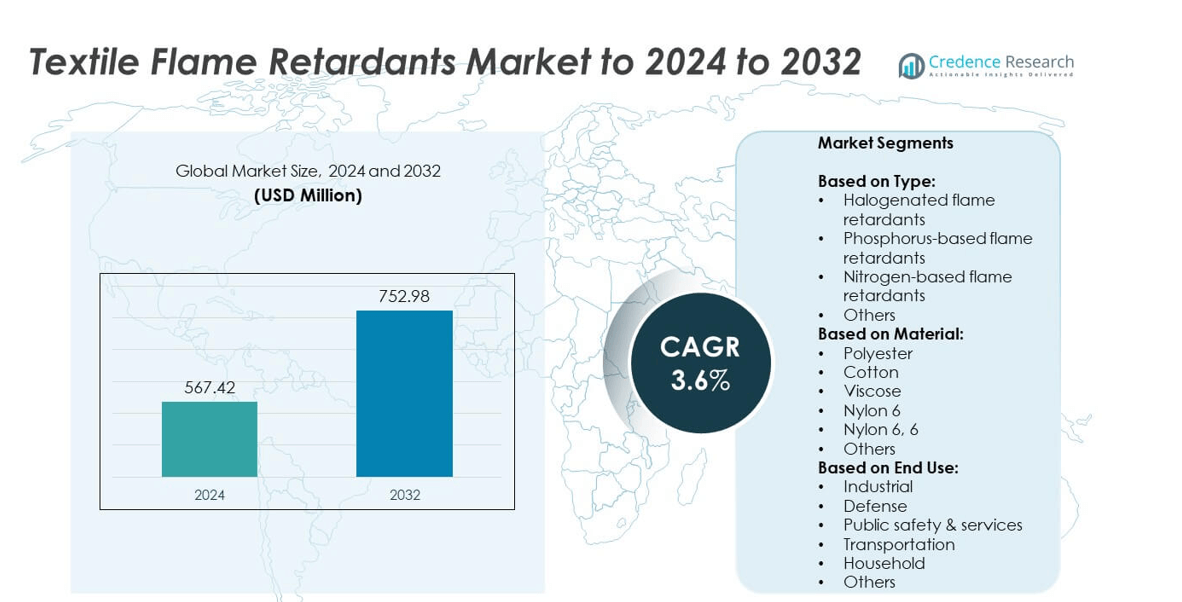

The textile flame retardants market size was valued at USD 567.42 million in 2024 and is anticipated to reach USD 752.98 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Textile Flame Retardants Market Size 2024 |

USD 567.42 million |

| Textile Flame Retardants Market, CAGR |

3.6% |

| Textile Flame Retardants Market Size 2032 |

USD 752.98 million |

The textile flame retardants market features prominent players including Huntsman Corporation, TenCate, Albemarle Corporation, Clariant AG, Thor Group, FRX Innovations, Lanxess AG, ICL Group, Archroma, Sinochem Group, Dow Chemical Company, Jiangsu Yoke Technology Co., Ltd., BASF SE, DIC Corporation, Italmatch Chemicals, Nouryon, and Akzo Nobel N.V. These companies compete through innovation in eco-friendly formulations, strategic partnerships, and expansion into emerging markets. Regionally, North America led the market with a 35% share in 2024, driven by stringent fire safety regulations and high adoption across industrial and household applications. Europe followed with a 30% share, supported by strong regulatory frameworks and sustainability initiatives, while Asia Pacific accounted for 25%, fueled by rapid industrialization and rising demand in defense, transportation, and household sectors.

Market Insights

- The textile flame retardants market was valued at USD 567.42 million in 2024 and is projected to reach USD 752.98 million by 2032, expanding at a CAGR of 3.6% during the forecast period.

- Rising fire safety regulations across industries, increasing demand for protective clothing, and growth in transportation and defense sectors are key drivers supporting steady market expansion worldwide.

- The market is witnessing a clear trend toward eco-friendly and non-halogenated flame retardants, with phosphorus- and nitrogen-based formulations gaining share as industries align with sustainability goals.

- Competition remains intense as leading companies focus on research and development, strategic collaborations, and global distribution networks to strengthen their market presence, though high costs of advanced solutions act as restraints.

- Regionally, North America led with 35% share in 2024, followed by Europe at 30% and Asia Pacific at 25%, while polyester accounted for over 35% of material demand, dominating the market by substrate.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Halogenated flame retardants dominated the textile flame retardants market in 2024, holding over 40% share due to their high efficiency and low dosage requirements. These compounds deliver strong flame resistance, making them widely used in industrial and defense textiles. However, environmental and health concerns are gradually shifting demand toward phosphorus- and nitrogen-based alternatives. Phosphorus-based flame retardants are gaining traction as eco-friendly options, particularly in polyester applications, while nitrogen-based products find use in blends for protective clothing. Regulatory restrictions on halogenated compounds are expected to drive the faster adoption of non-halogenated variants.

- For instance, Clariant specifies Exolit AP 462 at a 10–20% loading rate to impart flame retardant effects in adhesives and sealants. Exolit AP 462 is also used in intumescent coating systems, where it acts as a key component (an acid donor) for fire protection on materials like wood, plastics, and steel. The precise loading for intumescent coatings can vary depending on the application and fire resistance requirements.

By Material

Polyester emerged as the leading material segment, capturing more than 35% share in 2024, driven by its widespread use in industrial textiles, uniforms, and upholstery. Polyester’s durability, low cost, and compatibility with phosphorus- and halogen-based flame retardants make it the preferred substrate. Cotton followed closely due to strong demand in protective clothing and household fabrics, supported by its natural comfort and breathability. Viscose and nylon fibers also contribute significantly in specialty uses, such as defense and transportation textiles. Growing demand for blended fabrics enhances flame retardant performance, strengthening polyester’s dominance across industries.

- For instance, Indorama Ventures (Trevira CS) showed FR polyester with 17 partner companies at Heimtextil 2024.

By End Use

Industrial applications led the market with over 30% share in 2024, reflecting strong use of flame-retardant textiles in manufacturing plants, oil and gas facilities, and electrical environments. The need for compliance with strict safety regulations drives steady demand. Defense and public safety & services sectors also contribute significantly, relying on protective clothing, uniforms, and gear to ensure worker safety in hazardous conditions. Transportation, including automotive and aviation textiles, represents another growing segment. Increasing adoption in household fabrics, such as curtains and upholstery, highlights a broader trend toward safety-conscious consumer demand.

Market Overview

Stringent Fire Safety Regulations

The textile flame retardants market is primarily driven by strict fire safety regulations across industrial, defense, and transportation sectors. Governments and safety agencies mandate the use of flame-retardant fabrics to minimize fire hazards in workplaces and public spaces. Compliance with these standards has pushed manufacturers to adopt effective retardants for textiles used in uniforms, upholstery, and protective gear. This regulatory push ensures consistent demand, making it one of the most critical growth drivers of the market.

- For instance, DuPont sells over 200 million Tyvek® protective garments per year, used in industrial, cleanroom, emergency response and healthcare settings.

Rising Demand in Industrial Applications

Industrial use accounted for the largest end-user share, supported by high adoption of flame-retardant fabrics in oil and gas, construction, and electrical sectors. These industries require protective clothing, insulation materials, and upholstery designed to prevent fire-related risks. Increasing industrialization in emerging economies further amplifies demand for safety-compliant textiles. Employers invest heavily in worker safety gear to meet occupational health standards, positioning industrial applications as a dominant growth driver shaping the future market outlook.

- For instance, During the COVID-19 surge, DuPont significantly increased its Tyvek garment output, reaching more than 9 million garments per month from its own production facilities. The company also launched the #TyvekTogether program to partner with other companies to further expand supply. Through this program, an additional 15 million garments per month were enabled

Expansion of Transportation and Defense Sectors

Growth in transportation and defense industries significantly contributes to the textile flame retardants market. Rising aircraft production, automotive interiors, and defense uniforms demand advanced flame-retardant fabrics. Defense forces and public safety organizations prioritize protective clothing and gear designed to withstand extreme fire hazards. Expanding defense budgets and stricter safety mandates in aviation interiors enhance material adoption. This rising reliance on high-performance textiles ensures that transportation and defense remain a crucial growth driver for market expansion.

Key Trends & Opportunities

Shift Toward Eco-Friendly Alternatives

A major trend in the textile flame retardants market is the shift from halogenated retardants to eco-friendly phosphorus- and nitrogen-based alternatives. Environmental regulations and growing consumer awareness about health hazards associated with halogenated chemicals fuel this transition. Manufacturers invest in sustainable solutions to meet REACH and RoHS standards, creating opportunities for bio-based flame retardants. This trend offers companies the chance to capture growing demand in developed regions, where eco-compliance and sustainability certifications drive purchasing decisions in both industrial and consumer textiles.

- For instance, Milliken announced in December 2024 that it is the first U.S. textile manufacturer to offer non-PFAS materials for all 3 layers (outer shell, moisture barrier, thermal liner) of firefighter turnout gear.

Rising Adoption in Household and Consumer Textiles

Growing safety awareness among consumers drives the integration of flame-retardant fabrics into household products such as curtains, carpets, and upholstery. Rising urbanization and stricter building codes amplify demand for fire-resistant furnishings in residential and commercial spaces. The hospitality sector also presents opportunities as hotels increasingly adopt flame-retardant textiles to comply with safety regulations. This consumer-driven trend opens new revenue streams, allowing manufacturers to expand beyond traditional industrial and defense markets into mainstream household applications.

- For instance, Lavergne and Clariant developed ocean-bound plastic (OBP) recycled polyester compounds with flame retardant that achieved UL 94 V-0 rating at 0.8 mm thickness.

Key Challenges

Environmental and Health Concerns

One of the key challenges in the textile flame retardants market is the environmental and health risks posed by halogenated compounds. These chemicals are effective but associated with toxic emissions and bioaccumulation, raising safety concerns. Regulatory bodies in Europe and North America have imposed restrictions, forcing manufacturers to reformulate their products. Transitioning to sustainable alternatives increases production costs and requires significant R&D investment. Balancing performance, safety, and environmental compliance continues to challenge market participants globally.

High Cost of Advanced Flame Retardants

The high cost of eco-friendly and advanced flame retardant formulations is another key market challenge. Phosphorus- and nitrogen-based alternatives, though safer, involve complex production processes and higher raw material expenses. This raises product costs, limiting adoption in price-sensitive markets, particularly in developing economies. Manufacturers struggle to balance cost-efficiency with compliance while ensuring material performance. This cost barrier slows large-scale adoption across household and low-budget industrial applications, restricting market penetration and competitiveness.

Regional Analysis

North America

North America held the largest share of the textile flame retardants market in 2024, accounting for around 35%. The region’s dominance is driven by strict fire safety standards across industrial, defense, and household applications. High adoption in protective clothing, furnishings, and automotive interiors supports steady demand. The U.S. leads the market with strong regulatory enforcement and continuous innovation in eco-friendly flame retardants. Canada also contributes with rising use in construction textiles. Investments in sustainable alternatives and advanced manufacturing enhance the regional market’s outlook, ensuring North America remains a key consumer of flame-retardant textiles.

Europe

Europe captured nearly 30% share of the textile flame retardants market in 2024, supported by stringent environmental regulations such as REACH and strong focus on sustainable alternatives. The region prioritizes eco-friendly phosphorus- and nitrogen-based retardants over halogenated variants, creating opportunities for innovation. Germany, France, and the UK lead demand with applications in defense, industrial clothing, and household furnishings. Growing construction activity and fire safety requirements in commercial buildings also fuel adoption. Strong emphasis on regulatory compliance and technological advancement makes Europe one of the fastest-evolving markets in the flame retardant textiles segment.

Asia Pacific

Asia Pacific accounted for approximately 25% of the textile flame retardants market in 2024, driven by rapid industrialization and growing infrastructure projects. China, India, and Japan lead regional demand with strong uptake in industrial uniforms, transportation textiles, and public safety applications. Rising defense expenditure and expanding automotive manufacturing further enhance growth prospects. The region also benefits from large-scale textile production capabilities, allowing cost-effective integration of flame-retardant materials. Increasing urbanization and awareness of fire safety standards support long-term market expansion, positioning Asia Pacific as a key growth engine for flame retardant textiles.

Latin America

Latin America represented nearly 6% of the textile flame retardants market in 2024, with Brazil and Mexico driving regional demand. Industrial safety regulations and increasing adoption of protective textiles in oil and gas, mining, and manufacturing industries contribute to growth. The hospitality and residential sectors are also incorporating flame-retardant fabrics to meet fire safety standards. However, high product costs limit widespread adoption in price-sensitive markets. Efforts to expand local manufacturing and rising awareness of workplace safety are expected to gradually improve adoption, though the region remains smaller compared to global leaders.

Middle East & Africa

The Middle East & Africa accounted for around 4% share of the textile flame retardants market in 2024, with growth led by oil and gas, defense, and construction industries. Countries such as Saudi Arabia, UAE, and South Africa adopt flame-retardant fabrics in industrial uniforms and protective clothing to meet safety standards. Rising infrastructure development projects and increasing focus on worker safety fuel market opportunities. However, reliance on imports and limited local production capacity challenge growth. Gradual regulatory alignment with international fire safety standards is expected to enhance demand over the forecast period.

Market Segmentations:

By Type:

- Halogenated flame retardants

- Phosphorus-based flame retardants

- Nitrogen-based flame retardants

- Others

By Material:

- Polyester

- Cotton

- Viscose

- Nylon 6

- Nylon 6, 6

- Others

By End Use:

- Industrial

- Defense

- Public safety & services

- Transportation

- Household

- Others

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The textile flame retardants market is shaped by key players such as Huntsman Corporation, TenCate, Albemarle Corporation, Clariant AG, Thor Group, FRX Innovations, Lanxess AG, ICL Group, Archroma, Sinochem Group, Dow Chemical Company, Jiangsu Yoke Technology Co., Ltd., BASF SE, DIC Corporation, Italmatch Chemicals, Nouryon, and Akzo Nobel N.V. The competitive landscape is defined by continuous innovation, where companies focus on developing eco-friendly and high-performance flame-retardant solutions to meet regulatory standards and sustainability goals. Many players invest heavily in research and development to create non-halogenated and bio-based formulations, addressing growing environmental and health concerns. Expanding production capacity, strengthening global distribution networks, and forming strategic partnerships with textile manufacturers remain core strategies to gain market share. Regional expansion, particularly in Asia Pacific and North America, highlights the effort to capture rising demand from industrial, defense, and household applications. Intense competition encourages product differentiation, cost optimization, and technological advancement to maintain long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huntsman Corporation

- TenCate

- Albemarle Corporation

- Clariant AG

- Thor Group

- FRX Innovations

- Lanxess AG

- ICL Group

- Archroma

- Sinochem Group

- Dow Chemical Company

- Jiangsu Yoke Technology Co., Ltd.

- BASF SE

- DIC Corporation

- Italmatch Chemicals

- Nouryon

- Akzo Nobel N.V.

Recent Developments

- In 2024, Clariant introduced a melamine-free grade of its Exolit AP flame retardant.

- In 2024, FRX Innovations secured its first commercial order for Nofia, a flame retardant, in a new, undisclosed market application beyond textiles, indicating successful expansion potential due to market changes driven by new legislation.

- In 2023, TenCate launched the Tecasafe 360+ fabric, the industry’s first inherently FR stretch fabric. Combining inherent FR materials with XLANCE fibers, the fabric offers a new level of comfort and flexibility for FR workwear

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady growth driven by rising fire safety regulations across industries.

- Demand for eco-friendly phosphorus- and nitrogen-based flame retardants will accelerate.

- Industrial applications will remain the leading end-use segment due to strict compliance needs.

- Transportation and defense sectors will expand their use of advanced flame-retardant fabrics.

- Polyester will continue to dominate as the primary material used in flame-retardant textiles.

- Consumer adoption in household furnishings and upholstery will gradually increase.

- Asia Pacific will emerge as the fastest-growing regional market due to industrialization.

- Innovation in bio-based flame retardants will create new opportunities for manufacturers.

- High production costs of advanced alternatives will remain a key challenge.

- Strategic collaborations and R&D investments will shape competitive dynamics in the market.