Market Overview

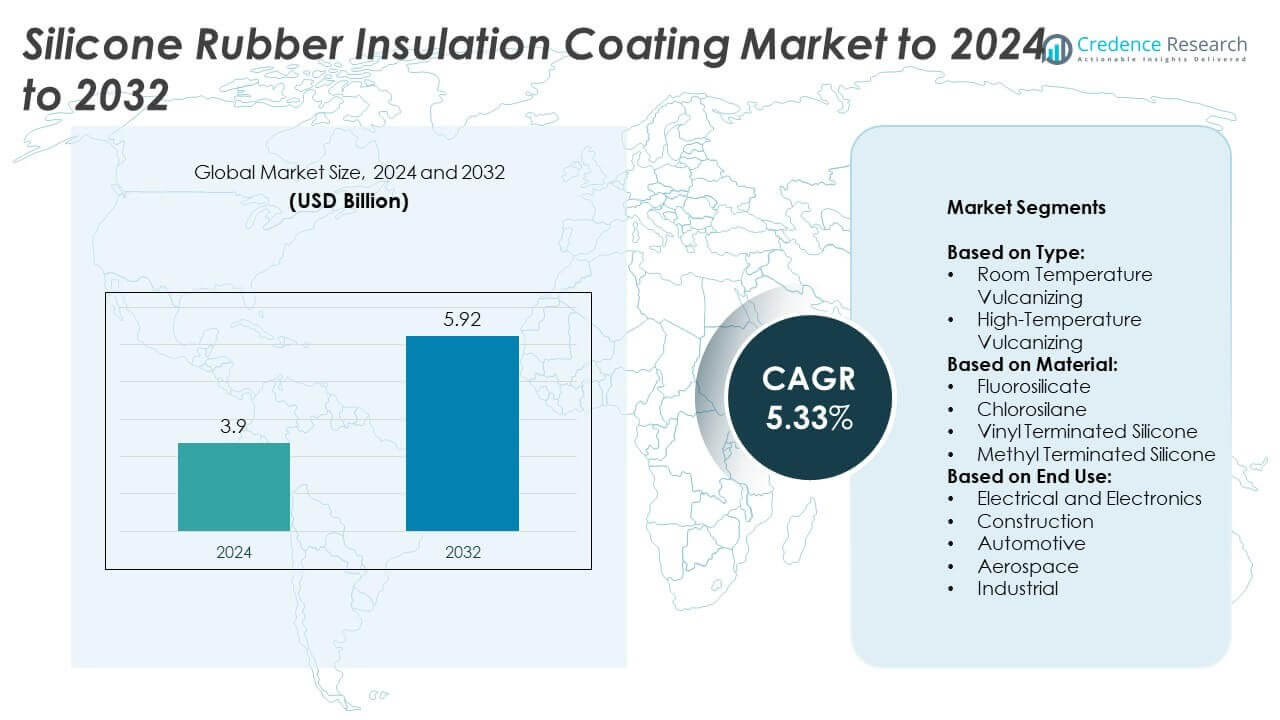

The Silicone Rubber Insulation Coating Market size was valued at USD 3.9 Billion in 2024 and is anticipated to reach USD 5.92 Billion by 2032, at a CAGR of 5.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Rubber Insulation Coating Market Size 2024 |

USD 3.9 Billion |

| Silicone Rubber Insulation Coating Market, CAGR |

5.33% |

| Silicone Rubber Insulation Coating Market Size 2032 |

USD 5.92 Billion |

The silicone rubber insulation coating market is shaped by leading players such as ACC Silicones Ltd., Shin-Etsu Chemical Co., Ltd., Henkel AG & Co. KGaA, Wacker Chemie AG, Elkem Silicones, Evonik Industries AG, Dow Inc., and Momentive Performance Materials Inc., who focus on product innovation, sustainability, and expansion strategies. These companies are strengthening portfolios with advanced insulation solutions to meet growing industrial and regulatory demands. Regionally, North America led the market in 2024 with a 32% share, supported by strong adoption in electrical, automotive, and aerospace industries. Asia Pacific followed closely with 30% share, driven by rapid industrialization, construction growth, and rising electronics production. Europe contributed 27%, with strict sustainability regulations and advanced automotive applications further fueling demand.

Market Insights

Market Insights

- The silicone rubber insulation coating market size was USD 3.9 Billion in 2024 and is projected to reach USD 5.92 Billion by 2032, growing at a CAGR of 5.33% during 2025–2032.

- Rising demand in electrical and electronics, along with expanding construction activities and rapid adoption of electric vehicles, are key drivers fueling market growth.

- The market is witnessing trends toward eco-friendly formulations, low-VOC coatings, and advanced manufacturing technologies that enhance insulation performance and sustainability.

- Competition is intense, with major players focusing on R&D, strategic partnerships, and global expansion to strengthen their presence and offer high-performance solutions.

- North America led with 32% share in 2024, supported by advanced industries, followed by Asia Pacific at 30% driven by rapid industrialization, and Europe at 27% backed by regulatory compliance; Latin America held 6%, while Middle East & Africa accounted for 5%, contributing steadily to global growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The silicone rubber insulation coating market by type is segmented into room temperature vulcanizing (RTV) and high-temperature vulcanizing (HTV). In 2024, room temperature vulcanizing held the dominant share of nearly 58% due to its ease of application, flexibility, and cost-effectiveness. RTV coatings are widely used in electrical insulation, sealing, and protective applications, where quick curing and moisture resistance are critical. HTV coatings are gaining traction in high-performance environments, particularly in aerospace and automotive sectors, as they withstand extreme heat and stress, but their adoption remains limited compared to RTV coatings.

- For instance, GUIBAO operates factories covering 500,000+ m² with 250,000 t/year silicone capacity, supporting large-scale RTV output for electronics and construction

By Material

Based on material, the market is categorized into fluorosilicate, chlorosilane, vinyl terminated silicone, and methyl terminated silicone. Vinyl terminated silicone dominated the segment in 2024 with over 42% market share, supported by its superior bonding capabilities and compatibility with cross-linking agents. This sub-segment is widely preferred in insulation and industrial coatings where high mechanical strength and stability are required. Chlorosilane and fluorosilicate materials are used for specialized, high-performance applications, while methyl terminated silicone caters to cost-sensitive sectors with moderate insulation requirements, maintaining steady demand across automotive and electronics industries.

- For instance, Elkem expanded its Roussillon (France) upstream plant by 20,000 t/year to 100,000 t/year of silicone intermediates used in vinyl-terminated systems.

By End Use

In terms of end use, the silicone rubber insulation coating market is segmented into electrical and electronics, construction, automotive, aerospace, and industrial. The electrical and electronics sector led the market in 2024 with about 36% share, driven by rising demand for high-durability coatings in cables, circuit boards, and electronic housings. The segment benefits from expanding power infrastructure and growth in consumer electronics. Construction applications follow closely, supported by weatherproofing needs and sustainable building practices, while aerospace and automotive demand continues to grow due to performance requirements in thermal protection and vibration resistance.

Key Growth Drivers

Rising Demand from Electrical and Electronics Industry

The electrical and electronics industry is the leading growth driver in the silicone rubber insulation coating market. Increasing adoption of advanced consumer electronics, growing electrification, and expansion of grid infrastructure are fueling demand for high-performance insulation coatings. Silicone coatings offer superior dielectric strength, moisture resistance, and thermal stability, making them essential for cables, connectors, and circuit boards. With smart devices and renewable energy integration expanding, manufacturers are investing in silicone-based solutions, positioning this sector as the strongest contributor to overall market growth.

- For instance, WACKER invested over €100 million to add new liquid silicone rubber capacity in Germany, with additional lines online before end-2022 for high-reliability uses.

Expansion of Construction and Infrastructure Projects

Growing construction and infrastructure activities worldwide are significantly boosting the demand for silicone rubber insulation coatings. These coatings are used extensively in sealing, weatherproofing, and protective applications due to their durability and resistance to harsh environments. Increasing adoption of green buildings and sustainable construction practices further accelerates demand, as silicone coatings enhance energy efficiency and extend building life cycles. Urbanization in Asia-Pacific and Middle Eastern regions continues to drive large-scale adoption, making construction a major sector supporting steady market expansion.

- For instance, Henkel’s LOCTITE digital dispenser supports 3–55 ml syringes and 300 ml cartridges, enabling precise silicone application on dense circuit boards.

Automotive and Aerospace Industry Growth

The rapid development of automotive and aerospace industries is another major driver for the market. Silicone rubber insulation coatings are preferred for their ability to withstand extreme temperatures, vibrations, and mechanical stress, making them ideal for engine components, wiring systems, and aerospace equipment. Increasing production of electric vehicles (EVs) further fuels demand, as EVs require advanced insulation for batteries and power electronics. The aerospace industry’s emphasis on lightweight, durable, and heat-resistant materials also drives growth, creating long-term opportunities for silicone coating adoption in high-performance sectors.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Sustainable Solutions

A prominent trend is the rising focus on eco-friendly silicone rubber insulation coatings. Manufacturers are investing in low-VOC, halogen-free, and recyclable formulations to comply with stringent environmental regulations. Growing awareness about sustainability and carbon reduction goals across industries drives this shift. Companies adopting sustainable materials and production processes gain competitive advantages in winning contracts, particularly in Europe and North America, where regulations are stricter. This trend creates opportunities for innovation and market differentiation, pushing silicone coating suppliers toward greener alternatives.

- For instance, Saint-Gobain’s European sealing site has 40+ years of silicone production experience, delivering custom extruded and molded seals for building envelopes.

Integration with Advanced Manufacturing Technologies

The integration of silicone rubber insulation coatings with advanced manufacturing technologies is opening new opportunities. Automation, robotics, and IoT-driven processes are enhancing coating precision, performance monitoring, and application efficiency. This is particularly impactful in electronics, where miniaturization and high-reliability demands require consistent insulation quality. Growing adoption of Industry 4.0 practices enables manufacturers to streamline operations while ensuring compliance with safety and performance standards. This trend highlights a key opportunity for market players to expand their technological capabilities and offer value-added solutions.

- For instance, Momentive committed $15 million to specialized Electronic Materials production, backing heat-resistant silicone technologies for EVs and avionics.

Key Challenges

High Raw Material Costs

One of the key challenges in the silicone rubber insulation coating market is the high cost of raw materials. Production of high-purity silicone compounds involves complex processes and limited global suppliers, which increases price volatility. Fluctuations in raw material supply, particularly in Asia, directly affect manufacturing costs and profit margins. This creates barriers for smaller companies and restricts widespread adoption in cost-sensitive markets such as automotive and construction, where alternative low-cost materials may be preferred despite lower performance.

Stringent Regulatory Compliance

Compliance with stringent environmental and safety regulations presents another significant challenge. Regulations such as REACH in Europe and EPA guidelines in the U.S. require manufacturers to ensure coatings are free from harmful substances and meet sustainability criteria. Meeting these requirements demands continuous innovation, additional testing, and certification, which increases costs and delays product launches. Smaller players often struggle with these compliance pressures, while larger companies face challenges in aligning global production with diverse regional standards, slowing market penetration.

Regional Analysis

North America

North America accounted for 32% of the silicone rubber insulation coating market in 2024, driven by strong demand across electrical and electronics, automotive, and aerospace industries. The region benefits from advanced infrastructure, rapid adoption of electric vehicles, and investments in renewable energy. The construction sector also contributes to steady demand with increased focus on weather-resistant and energy-efficient materials. The United States leads regional growth due to extensive R&D investments and high regulatory compliance standards, while Canada supports demand with infrastructure modernization and industrial expansion, reinforcing North America’s dominant position in the global market.

Europe

Europe held 27% share of the silicone rubber insulation coating market in 2024, supported by stringent regulatory frameworks promoting sustainable materials. The region’s construction and automotive industries are key consumers, with demand growing for lightweight, durable, and eco-friendly coatings. Germany, France, and the UK drive adoption due to advanced manufacturing bases and focus on energy-efficient solutions. Aerospace applications are also significant, with silicone coatings used in thermal and vibration protection. Ongoing investment in renewable energy projects and strict compliance with REACH standards further encourage market expansion, positioning Europe as a strong contributor to overall growth.

Asia Pacific

Asia Pacific dominated with a 30% share of the silicone rubber insulation coating market in 2024, fueled by rapid industrialization, construction booms, and expansion in electronics manufacturing. China and India lead the region with extensive infrastructure projects and a surge in consumer electronics demand. Japan and South Korea contribute significantly through advanced automotive and semiconductor industries. The region benefits from cost-effective manufacturing and rising adoption of high-performance insulation materials. With urbanization, growing EV adoption, and strong government initiatives, Asia Pacific continues to offer the fastest-growing opportunities, challenging North America’s dominance over the forecast period.

Latin America

Latin America represented 6% share of the silicone rubber insulation coating market in 2024, with growth mainly driven by construction and industrial applications. Brazil and Mexico are the leading contributors, supported by rising infrastructure development and automotive manufacturing bases. Demand for durable insulation solutions in energy and electronics sectors is also expanding. However, the market faces challenges from fluctuating economic conditions and limited technological adoption. Despite these hurdles, increasing investment in smart infrastructure projects and gradual expansion of renewable energy initiatives are expected to sustain moderate growth for silicone coatings across the region.

Middle East & Africa

The Middle East and Africa held a 5% share of the silicone rubber insulation coating market in 2024, with growth concentrated in construction, energy, and industrial applications. The Middle East, particularly Saudi Arabia and the UAE, is investing heavily in infrastructure projects and renewable energy development, boosting demand for high-performance coatings. Africa’s market growth is comparatively slower, constrained by limited manufacturing capacity and reliance on imports. However, expansion in power distribution networks and industrialization efforts provide opportunities. With rising urbanization and government-backed energy projects, the region is expected to maintain steady demand for silicone rubber insulation coatings.

Market Segmentations:

By Type:

- Room Temperature Vulcanizing

- High-Temperature Vulcanizing

By Material:

- Fluorosilicate

- Chlorosilane

- Vinyl Terminated Silicone

- Methyl Terminated Silicone

By End Use:

- Electrical and Electronics

- Construction

- Automotive

- Aerospace

- Industrial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the silicone rubber insulation coating market includes leading companies such as ACC Silicones Ltd., Shin-Etsu Chemical Co., Ltd., Henkel AG & Co. KGaA, Reiss Manufacturing, Inc., Elkem Silicones, MG Chemicals, NuSil Technology Europe, Wacker Chemie AG, KCC Corporation, MPM Silicones, Silchem Silicone Chemicals, Momentive Performance Materials Inc., Nusil Technology LLC, Evonik Industries AG, and Dow Corning Corporation (now part of Dow Inc.). Market players are focusing on expanding production capacity, enhancing product performance, and meeting regulatory standards for sustainable and eco-friendly solutions. Strategies such as mergers, acquisitions, and partnerships are widely adopted to strengthen global distribution and improve technological expertise. Companies are also investing in R&D to develop coatings with improved thermal resistance, flexibility, and electrical insulation properties. Increasing emphasis on cost efficiency, competitive pricing, and regional presence further defines the industry’s structure. Intense rivalry and innovation continue to shape the growth trajectory of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ACC Silicones Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Henkel AG & Co. KGaA

- Reiss Manufacturing, Inc.

- Elkem Silicones

- MG Chemicals

- NuSil Technology Europe (Now part of Avantor)

- Wacker Chemie AG

- KCC Corporation

- MPM Silicones, LLC

- Silchem Silicone Chemicals

- Momentive Performance Materials Inc.

- Nusil Technology LLC (Now part of Avantor)

- Evonik Industries AG

- Dow Corning Corporation (Now part of Dow Inc.)

Recent Developments

- In 2024, Wacker Chemie AG announced plans to strengthen its silicone specialties business and production in Europe, especially for the electromobility and renewable energy sectors.

- In 2023, Shin-Etsu Chemical Co., Ltd. developed a new silicone rubber formulation specifically designed as an insulation covering material for high-voltage cables in the automotive sector.

- In 2022, Dow launched the SILASTIC™ SA 994X LSR series, a new range of self-adhesive liquid silicone rubbers designed for two-component injection molding in automotive applications, including battery vent gaskets and connector seals for electric and hybrid vehicles.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand from electrical and electronics industries.

- Growing adoption of electric vehicles will boost usage of silicone insulation coatings.

- Construction projects worldwide will drive demand for weather-resistant and durable coatings.

- Aerospace and defense sectors will increasingly prefer silicone coatings for high-performance needs.

- Asia Pacific will emerge as the fastest-growing region due to industrialization and urbanization.

- Sustainability regulations will push manufacturers toward eco-friendly silicone coating solutions.

- Integration of advanced manufacturing technologies will enhance product quality and efficiency.

- High raw material costs will remain a challenge for smaller market players.

- Strategic partnerships and product innovation will shape competitive dynamics.

- Rising renewable energy projects will create strong opportunities for insulation coating applications.