Market Overview

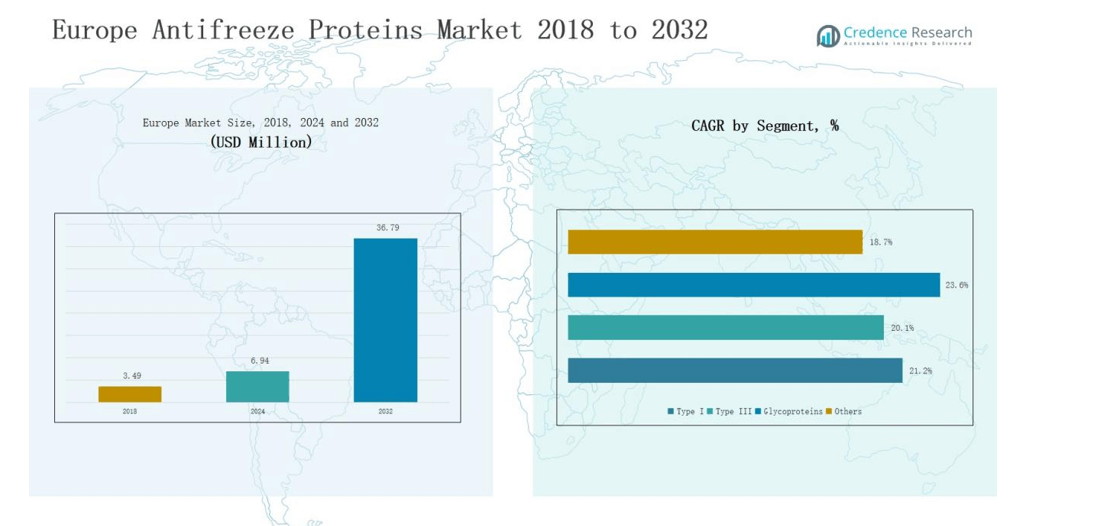

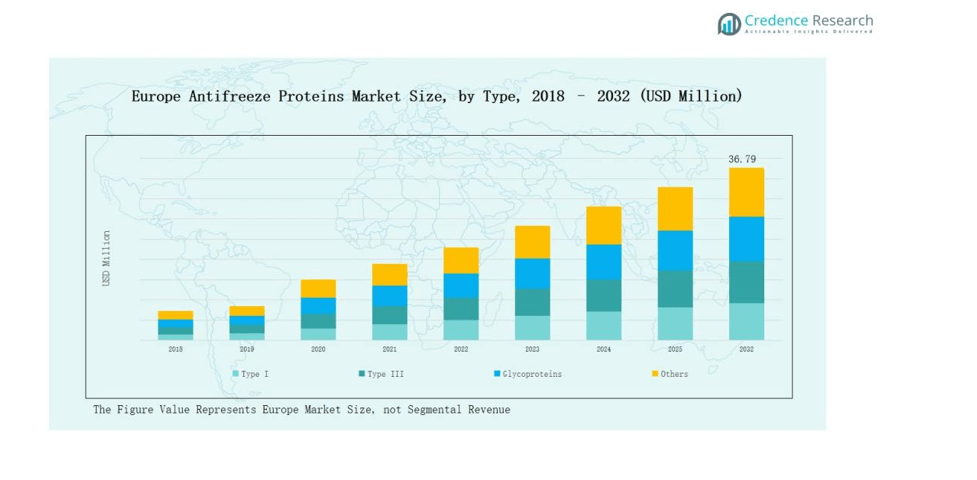

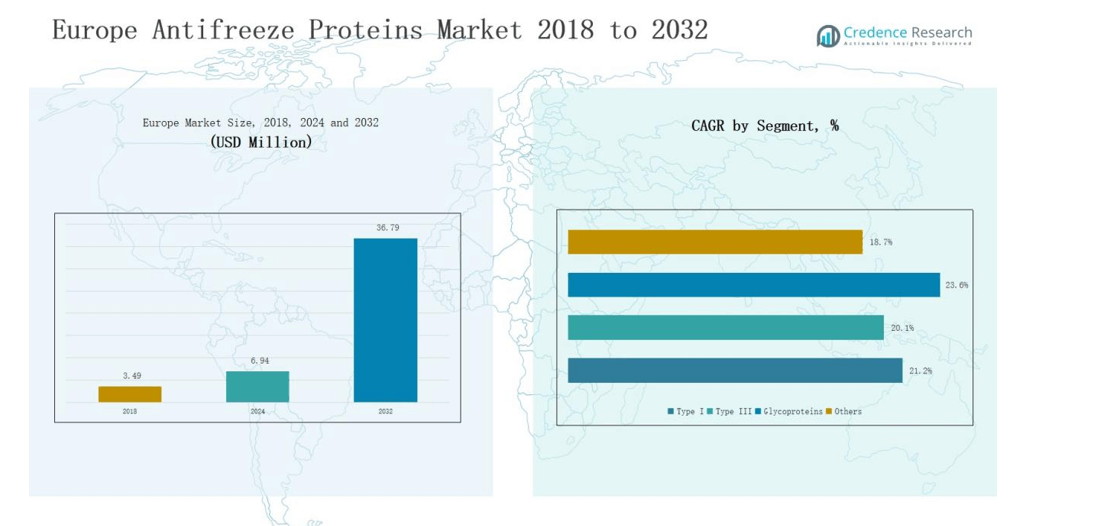

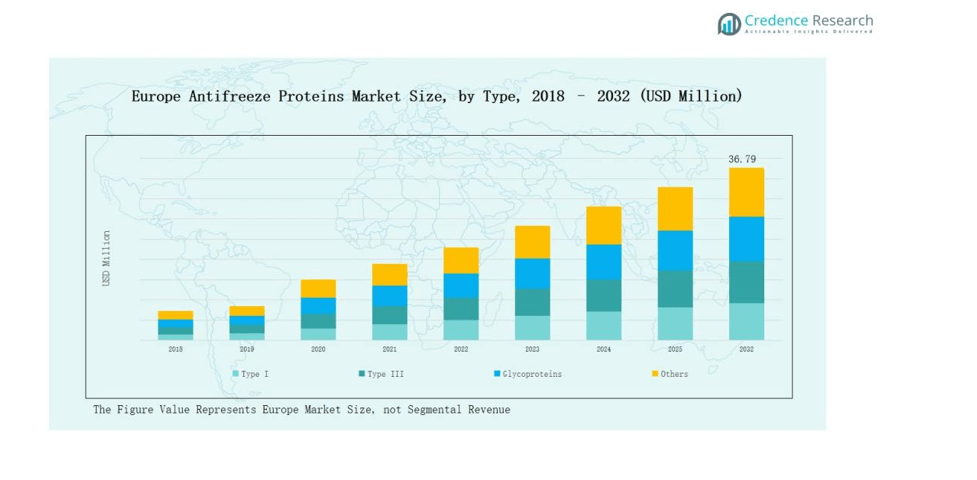

Europe Antifreeze Proteins Market size was valued at USD 3.49 million in 2018, reached USD 6.94 million in 2024, and is anticipated to reach USD 36.79 million by 2032, growing at a CAGR of 21.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Antifreeze Proteins Market Size 2024 |

USD 6.94 million |

| Europe Antifreeze Proteins Market , CAGR |

21.58% |

| Europe Antifreeze Proteins Market Size 2032 |

USD 36.79 million |

The Europe Antifreeze Proteins Market is shaped by the presence of leading players such as Unilever PLC, BASF SE, Novozymes, Evonik Industries, FrieslandCampina, Miltenyi Biotec, Biocatalysts Ltd, CellGenix GmbH, Pluriomics, and Henkel AG & Co. KGaA. These companies strengthen their positions through research-driven innovations, recombinant production technologies, and strategic partnerships across medical, food, and cosmetic applications. Competitive strategies focus on sustainable sourcing, cost efficiency, and expansion into premium product lines. Regionally, the United Kingdom emerged as the leader with a 22% market share in 2024, driven by advanced biotechnology hubs, strong healthcare infrastructure, and early commercialization of antifreeze protein applications.

Market Insights

- The Europe Antifreeze Proteins Market grew from USD 3.49 million in 2018 to USD 6.94 million in 2024 and is projected to reach USD 36.79 million by 2032.

- Type I dominated with a 42% share in 2024, supported by strong adoption in cryopreservation, biotechnology research, and food applications, driven by efficiency in reducing ice recrystallization.

- Solid form led with a 61% share in 2024, favored for stability, shelf life, and adaptability in pharmaceuticals, cosmetics, and frozen food applications across European industries.

- The medical sector held a 48% share in 2024, boosted by organ preservation, cell therapies, and regenerative medicine investments across Germany, France, and the United Kingdom.

- The United Kingdom emerged as the leading region with a 22% share in 2024, supported by biotechnology hubs, healthcare infrastructure, and commercialization in food and cosmetics applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

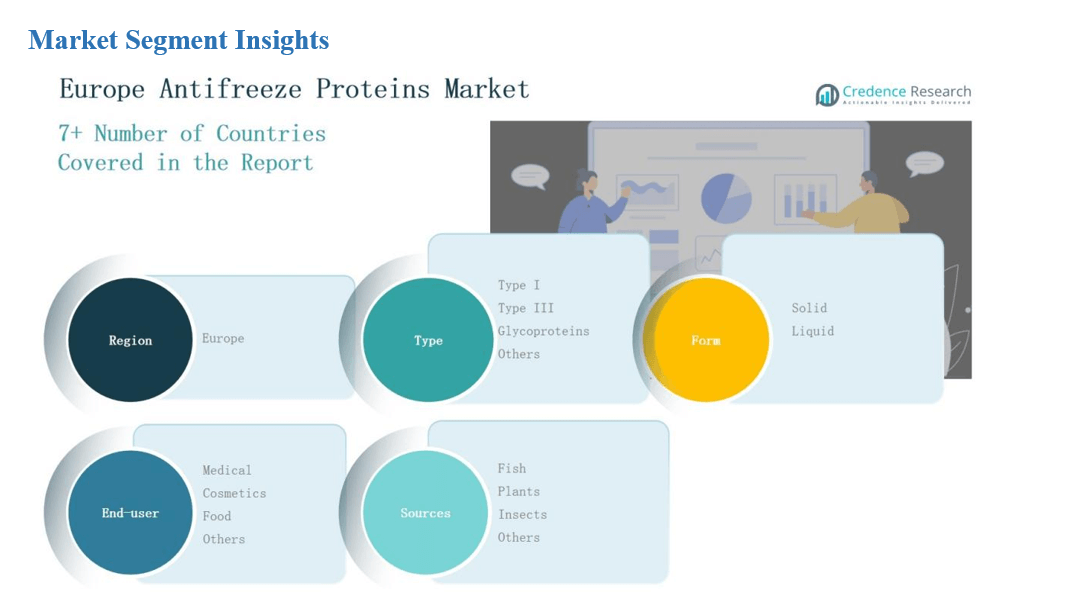

Market Segment Insights

By Type

Type I antifreeze proteins held the largest share of 42% in 2024 within Europe. Their dominance stems from wide use in medical cryopreservation and biopharmaceutical research. Demand is further supported by proven efficiency in reducing ice recrystallization, making Type I proteins a preferred option for both healthcare and food processing industries. Ongoing research collaborations and increased commercial-scale production capacity also contribute to their expanding market presence, particularly as European biotech firms emphasize innovation in sustainable protein applications across medical and industrial fields.

- For instance, Unilever developed a process that uses genetically modified baker’s yeast to produce a synthetic antifreeze protein, with the original gene coming from the ocean pout.

By Form

The solid form accounted for 61% of the market share in 2024. Solid antifreeze proteins are widely used due to their higher stability, extended shelf life, and suitability for transportation. Strong uptake across pharmaceutical and cosmetic industries is driving growth, as solid forms allow easier formulation into creams, serums, and biomedical kits. The segment also benefits from lower storage costs, reliable performance under diverse conditions, and broader adoption by European food manufacturers, who integrate solids into frozen products to enhance quality and texture consistency.

- For instance, Sirona Biochem has been advancing its solid-form antifreeze glycoprotein analogs for use in dermatological products, enabling greater stability in cosmetic formulations.

By End-User

The medical sector led with 48% share in 2024, making it the dominant end-user segment. Increasing adoption in organ preservation, cell therapies, and reproductive health applications drives this demand. Rising investment in regenerative medicine across Europe further strengthens the position of the medical segment in antifreeze protein applications. Advancements in biotechnology, growing clinical trials, and wider use in stem cell preservation provide strong momentum, while healthcare funding across Germany, France, and the UK continues to support expanded usage and regulatory approvals for medical-grade proteins.

Market Overview

Rising Demand in Medical Applications

Medical applications remain the largest driver, with antifreeze proteins widely used in cryopreservation, regenerative medicine, and organ transplantation. The ability to minimize ice formation in cells and tissues improves survival rates, supporting adoption in fertility clinics and biopharmaceutical research. Expanding investments in advanced healthcare across Europe, particularly in Germany, France, and the UK, further drive demand. The strong pipeline of cell therapies and stem cell preservation projects underscores long-term growth prospects, positioning antifreeze proteins as a critical technology for Europe’s growing biomedical sector.

- For instance, European researchers, including those at institutions like the University of Warwick, have used natural and synthetic antifreeze proteins to improve the cryopreservation outcomes of human cells, reflecting Europe’s broader focus on next-generation preservation technologies

Expanding Use in Food and Beverage Sector

The food industry is increasingly integrating antifreeze proteins to improve frozen product texture, stability, and quality. Applications in ice cream, frozen desserts, and ready-to-eat meals enhance shelf life while reducing ice crystal formation. European consumers’ rising preference for premium frozen foods accelerates adoption, particularly in Western Europe. Partnerships between food manufacturers and biotech firms are boosting large-scale commercialization. As sustainability becomes central in the food sector, plant- and insect-based proteins are also gaining ground, offering eco-friendly alternatives that align with Europe’s strict regulatory standards and consumer expectations.

Strong Biotechnology and Research Ecosystem

Europe’s robust biotechnology ecosystem provides a strong growth foundation for the antifreeze proteins market. Research institutions and startups are heavily investing in recombinant production technologies that reduce costs and improve scalability. The presence of established biotech hubs in countries like the UK, Germany, and the Netherlands fosters cross-sector collaboration. EU-funded projects and research grants further support innovation and accelerate product development. These efforts are advancing beyond traditional applications into cosmetics and pharmaceuticals, strengthening Europe’s leadership in biotechnology-driven solutions and ensuring long-term market expansion opportunities for antifreeze proteins.

- For instance, A/F Protein Inc. collaborated with the University of Warwick to advance recombinant antifreeze protein production aimed at improving cryopreservation in medical and industrial applications.

Key Trends & Opportunities

Shift Toward Plant- and Insect-Based Proteins

A major trend in Europe is the move toward sustainable sources of antifreeze proteins. Plant- and insect-derived proteins reduce dependency on fish-based options, addressing environmental and biodiversity concerns. This shift appeals to eco-conscious consumers and aligns with Europe’s strong sustainability regulations. Companies are exploring innovative extraction and production methods, opening opportunities for greener supply chains. Growing demand for ethical, cruelty-free, and vegan-friendly solutions across cosmetics, pharmaceuticals, and food industries presents significant opportunities, making sustainable sourcing a strategic priority in the European antifreeze proteins market.

- For instance, Unilever has explored the use of synthetic and recombinant protein technologies to develop more sustainable and vegan-friendly formulations in its ice cream segment.

Commercialization of Cosmetic Applications

Cosmetics represent an emerging opportunity, with antifreeze proteins increasingly used in skincare and anti-aging products. Their ability to protect skin cells from cold-induced damage and enhance hydration appeals to consumers in colder climates. European cosmetic companies are launching innovative formulations that integrate antifreeze proteins, particularly in premium and organic product lines. Rising consumer interest in natural and bioactive ingredients supports adoption. Partnerships between biotech firms and cosmetic brands are accelerating commercialization, providing opportunities for market expansion and differentiation in Europe’s competitive beauty and personal care industry.

- For instance, biotechnology firm Codif Recherche & Nature introduced IDO-ICEAWAKE, a marine-origin antifreeze protein extract, into its cosmetic ingredient portfolio for use in anti-aging creams.

Key Challenges

High Production Costs

High production costs remain a critical barrier for antifreeze proteins in Europe. Complex extraction and purification processes, combined with limited large-scale manufacturing infrastructure, drive prices significantly higher than synthetic alternatives. This cost factor limits adoption in price-sensitive markets such as mass-market food and cosmetics. While recombinant technologies promise cost reductions, scaling these methods remains challenging. The industry must overcome production inefficiencies to achieve broader penetration across sectors. Until manufacturing becomes more affordable, market growth will remain concentrated in premium applications and research-focused end users.

Limited Consumer Awareness

Despite growing applications, consumer awareness of antifreeze proteins remains low across Europe. End-users in cosmetics and food sectors often lack familiarity with the benefits, restricting mainstream adoption. Many consumers still associate biotechnology-derived ingredients with safety concerns, slowing acceptance. Without effective education campaigns and transparent labeling, antifreeze proteins risk being perceived as niche innovations. Building trust through regulatory approvals, certifications, and industry-led awareness initiatives is crucial to expand demand. Enhanced communication of benefits such as improved product quality, sustainability, and safety can unlock wider consumer acceptance across Europe.

Stringent Regulatory Frameworks

Europe’s strict regulatory environment poses challenges for antifreeze protein commercialization. Approval processes for biotech-derived ingredients in food, cosmetics, and pharmaceuticals are complex, time-intensive, and costly. Manufacturers must meet rigorous safety, sustainability, and ethical standards before launching products, delaying market entry. Differences in regulatory requirements across European countries also create compliance hurdles. Smaller firms face particular difficulties in navigating these frameworks, slowing innovation and competitiveness. Addressing these regulatory barriers requires collaboration between companies, policymakers, and industry bodies to streamline approvals and encourage responsible use of antifreeze proteins in Europe.

Regional Analysis

United Kingdom

The United Kingdom held a 22% share in 2024. The country benefits from strong biotechnology research hubs and collaborations between universities and private firms. Demand is driven by applications in cryopreservation and fertility treatments, supported by significant healthcare investments. The food industry also integrates antifreeze proteins in frozen desserts and ready-to-eat meals to improve quality. Cosmetic companies leverage the proteins for anti-aging and cold-protection formulations. The regulatory framework, while stringent, ensures product safety and boosts consumer trust. The United Kingdom remains a key driver of innovation within the Europe Antifreeze Proteins Market.

Germany

Germany accounted for 19% share in 2024. The market is supported by a strong pharmaceutical and biotechnology industry, with companies focusing on medical-grade applications. Its advanced healthcare system drives demand for organ preservation, regenerative medicine, and stem cell research. Food manufacturers also explore antifreeze proteins to enhance frozen product performance. Cosmetics adoption is increasing, particularly in premium skincare products. Germany’s strict regulatory standards create challenges but also ensure credibility in the marketplace. The country plays a leading role in shaping quality benchmarks across Europe.

France

France represented a 15% share in 2024. Growth is driven by high investment in research institutions and biopharma companies focusing on cryopreservation solutions. The food sector shows rising use of antifreeze proteins to maintain texture and freshness in frozen goods. Cosmetic brands are beginning to incorporate proteins into skincare, targeting hydration and cell protection. Regulatory compliance in France is demanding, which slows new product approvals. However, consumer awareness of biotechnology-based solutions continues to expand. France remains an important growth hub in the Europe Antifreeze Proteins Market.

Italy

Italy captured a 12% share in 2024. The food and beverage industry is the main driver, particularly in frozen dairy and dessert products. Cosmetic firms are gradually introducing antifreeze proteins into premium formulations. Healthcare adoption is lower compared to leading markets, but research initiatives are expanding. The country’s SMEs actively collaborate with European biotech projects to strengthen local production. Stringent safety approvals remain a challenge for smaller firms. Italy contributes steadily to the regional market through its dynamic food sector.

Spain

Spain held an 11% share in 2024. The country’s market is led by food industry applications, including frozen fruits and seafood preservation. Cosmetic adoption is rising, supported by strong consumer demand for natural and bioactive products. Research institutions are investing in alternative protein sources such as plants and insects. Healthcare use is limited but shows gradual improvement with new clinical projects. Spain faces challenges with regulatory timelines, which hinder faster commercialization. Despite hurdles, it remains a key emerging contributor in the Europe Antifreeze Proteins Market.

Russia

Russia accounted for 9% share in 2024. Demand is primarily concentrated in frozen food processing and cold-region cosmetic applications. Medical usage is underdeveloped but offers significant potential in cryobiology research. Local companies are working on plant-based antifreeze proteins to reduce reliance on imports. Limited awareness among consumers restricts adoption in mass markets. Regulatory barriers are high, creating difficulties for small biotech firms. Russia continues to represent a market with untapped growth opportunities.

Rest of Europe

The Rest of Europe region contributed 12% share in 2024. Smaller economies within Scandinavia and Eastern Europe are investing in antifreeze protein research, particularly for cold climate adaptation in food and agriculture. Healthcare applications are limited but gradually developing with cross-border EU collaborations. Cosmetics firms in Nordic countries focus on anti-freeze formulations for skin protection. Regulatory support from the EU enables streamlined innovation across multiple countries. The diversity of applications highlights potential expansion areas. Rest of Europe provides balanced growth opportunities in the Europe Antifreeze Proteins Market.

Market Segmentations:

By Type

- Type I

- Type III

- Glycoproteins

- Others

By Form

By End-User

- Medical

- Cosmetics

- Food

- Others

By Sources

- Fish

- Plants

- Insects

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Antifreeze Proteins Market is characterized by a mix of established multinational corporations, biotechnology specialists, and emerging research-driven firms. Leading players such as Unilever PLC, BASF SE, Evonik Industries, and Novozymes dominate through diversified portfolios and strong research capabilities. These companies invest heavily in recombinant production technologies, partnerships, and product innovations to strengthen their positions in medical, food, and cosmetic applications. Mid-sized firms like Biocatalysts Ltd and CellGenix GmbH contribute by supplying niche formulations and supporting local demand across Europe. Competitive strategies emphasize sustainability, with a growing focus on plant- and insect-based antifreeze proteins to align with regulatory requirements and consumer preferences. Market players also prioritize collaborations with universities and research institutes to accelerate commercialization and reduce production costs. While high barriers in regulation and manufacturing limit new entrants, the market continues to attract investments, underscoring its long-term growth potential within Europe’s dynamic biotechnology ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Unilever PLC

- BASF SE

- Novozymes

- Pluriomics

- Evonik Industries

- FrieslandCampina

- Miltenyi Biotec

- Biocatalysts Ltd

- CellGenix GmbH

- Henkel AG & Co. KGaA

Recent Developments

- In April 2024, Henkel completed the acquisition of Seal for Life Industries LLC, enhancing its protective coatings and sealing solutions.

- In 2023, Unilever advanced its use of ice-structuring proteins to improve frozen food applications.

- In July 2025, Sanofi acquired UK-based biotech firm Vicebio for USD 1.15 billion, strengthening its respiratory vaccine portfolio with molecular clamp technology.

- In October 2024, FrieslandCampina secured EU approval for its Hyvital Whey HA 300 protein hydrolysate for infant formulas.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End User, Sources and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for antifreeze proteins will expand in medical applications including organ preservation and cell therapies.

- Food manufacturers will increase usage to improve frozen product stability and texture.

- Cosmetic companies will adopt antifreeze proteins for premium skincare and anti-aging products.

- Plant and insect-based proteins will gain traction as sustainable alternatives to fish-derived options.

- Recombinant production technologies will scale up to reduce manufacturing costs.

- Collaborations between biotech firms and research institutions will accelerate innovation and commercialization.

- Regulatory approvals across Europe will shape the pace of product launches and adoption.

- Consumer awareness campaigns will play a key role in expanding acceptance across end-use sectors.

- Investments in biotechnology hubs in the UK, Germany, and France will drive regional leadership.

- Smaller markets in Eastern Europe and Scandinavia will emerge as new growth contributors.