Market Overview

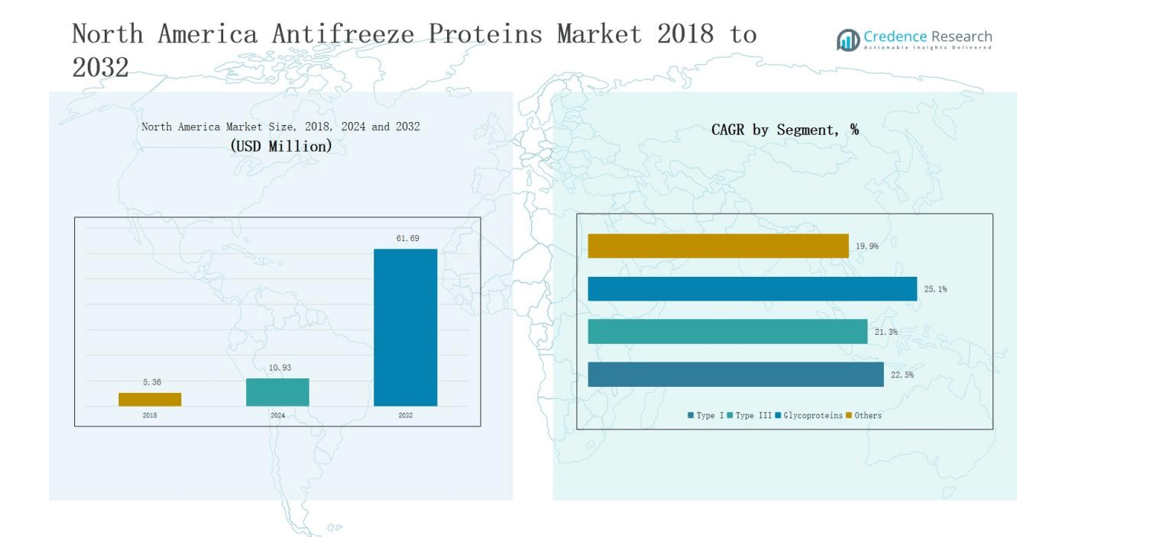

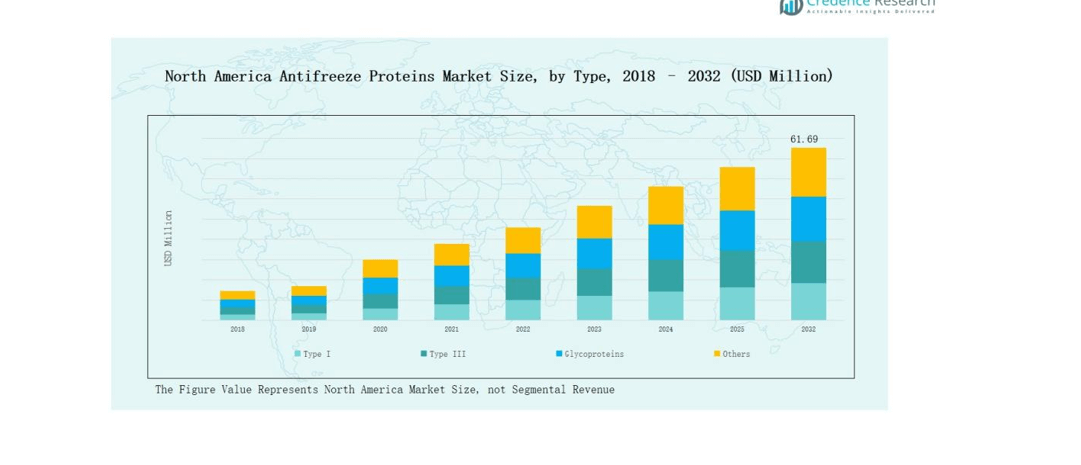

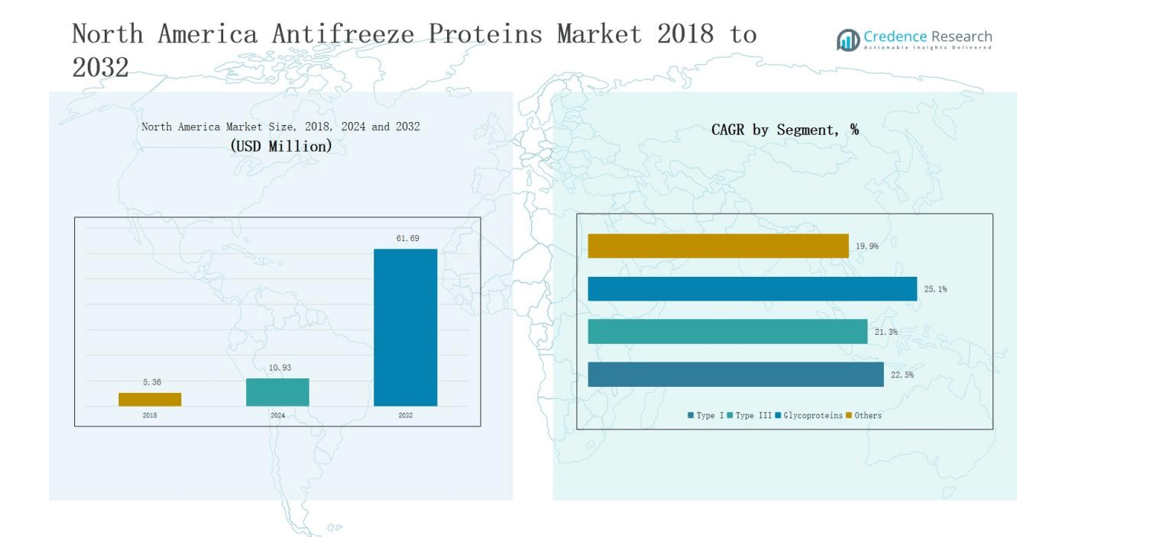

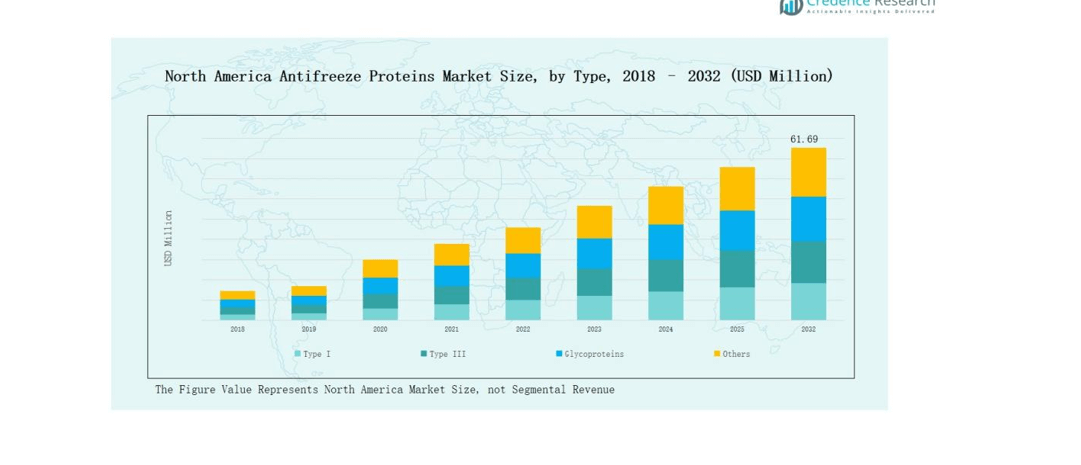

North America Antifreeze Proteins Market size was valued at USD 5.36 million in 2018, reached USD 10.93 million in 2024, and is anticipated to reach USD 61.69 million by 2032, growing at a CAGR of 22.53% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Antifreeze Proteins Market Size 2024 |

USD 10.93 million |

| North America Antifreeze Proteins Market, CAGR |

22.53% |

| North America Antifreeze Proteins Market Size 2032 |

USD 61.69 million |

The North America Antifreeze Proteins Market is shaped by leading players such as A/F Protein Inc., Sirona Biochem Corp, ProtoKinetix Inc., AquaBounty Technologies Inc., MyBioSource Inc., Unilever US, Cargill, Thermo Fisher Scientific, Arctic Bioscience, and BlueGene Biotech. These companies strengthen their presence through research-driven product innovations, recombinant production technologies, and collaborations across medical, food, and cosmetic industries. The competitive landscape emphasizes scaling efficiency, sustainable sourcing, and product diversification to meet rising multi-industry demand. Regionally, the United States leads the market with a 62% share in 2024, driven by advanced biotechnology infrastructure, strong healthcare facilities, and high frozen food consumption.

Market Insights

- The North America Antifreeze Proteins Market grew from USD 5.36 million in 2018 to USD 10.93 million in 2024 and is projected to reach USD 61.69 million by 2032.

- Type I segment led with 42% share in 2024, driven by applications in biomedical research, cryopreservation, tissue engineering, and drug development, while Type III and glycoproteins supported niche demand.

- Solid form dominated with 58% share in 2024, favored for its longer shelf life, stability, and packaging advantages, while liquid formats expanded in pharmaceuticals, diagnostics, and cosmetics.

- The medical sector held 46% share in 2024, supported by cryosurgery, organ preservation, and reproductive medicine, while food and cosmetics gained traction through frozen product quality and skincare innovations.

- The United States led with 62% share in 2024, followed by Canada at 23% and Mexico at 15%, supported by biotechnology strength, food processing, and cosmetic industry adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

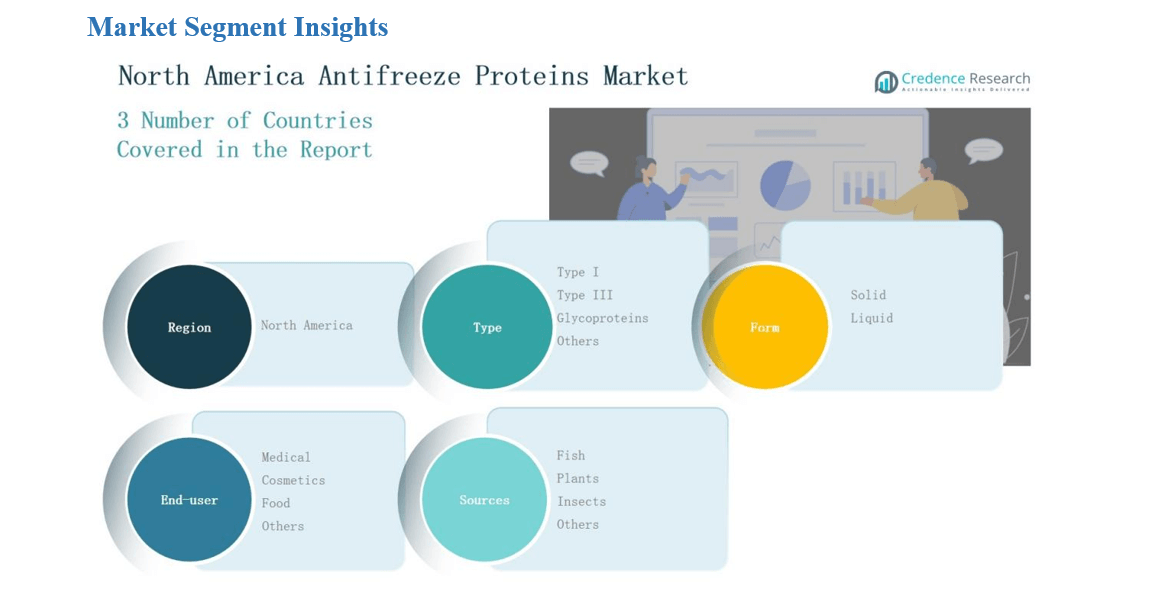

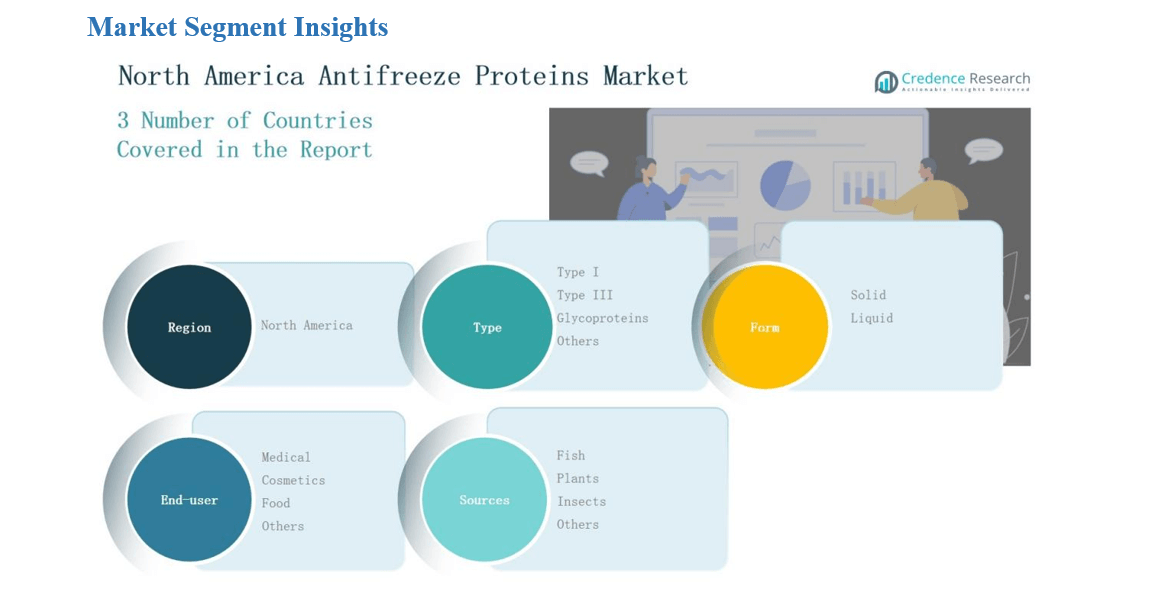

Market Segment Insights

By Type

Type I antifreeze proteins held the dominant share of 42% in 2024. Their strong presence is supported by extensive use in biomedical research and cryopreservation. Rising demand in tissue engineering and organ transplantation drives adoption, while ongoing studies in drug development strengthen their market lead. Type III and glycoproteins follow, with niche applications in food processing and cosmetics. Increasing awareness of their ability to enhance cold resistance in crops and improve frozen food quality also supports growth across regional agriculture and food technology markets.

- For instance, A/F Protein Inc. has supplied recombinant Type I AFPs for applications in cryopreservation of mammalian cells, which has been widely cited in tissue storage research.

By Form

The solid form segment accounted for 58% share in 2024, making it the leading format. Solid antifreeze proteins offer longer shelf life, better stability, and easier handling in medical and food applications. Their suitability for mass-scale packaging and transport further supports growth. The liquid form segment is expanding with cosmetic applications requiring easy formulation integration. Rising demand for liquid solutions in pharmaceutical formulations, diagnostic kits, and skincare products highlights the versatility of this format and ensures significant long-term adoption across multiple industries.

By End-User

The medical sector captured 46% share in 2024, positioning it as the largest end-user. Demand is driven by applications in cryosurgery, organ preservation, and reproductive medicine. Growing investment in advanced biotechnology and clinical trials further accelerates uptake. Food and cosmetics segments are rising steadily, with increasing interest in frozen product preservation and skincare formulations. The expanding healthcare infrastructure in the U.S. and Canada, coupled with rising demand for regenerative medicine, ensures continued dominance of medical applications in North America’s antifreeze proteins market.

- For instance, BioLife Solutions introduced CryoStor® cryopreservation media, widely adopted in cell therapy clinical trials to enhance viability post-thaw.

Market Overview

Advancements in Cryopreservation and Medical Research

The North America Antifreeze Proteins Market benefits from rapid progress in cryopreservation, regenerative medicine, and biotechnology research. Hospitals and research centers increasingly rely on antifreeze proteins to extend organ viability, preserve cells, and support fertility treatments. This scientific advancement fuels demand from the medical sector, which already holds the dominant market share. Continuous investment in biotechnology and strong collaboration between pharmaceutical companies and research institutes further accelerate innovation, positioning antifreeze proteins as critical tools for medical breakthroughs and long-term healthcare sustainability across the region.

- For instance, Massachusetts General Hospital has explored antifreeze protein-based cryopreservation techniques to improve organ transplant viability, aiming to extend storage time beyond conventional methods.

Expanding Applications in Food and Beverage Industry

Growing consumer preference for frozen and processed foods strongly supports antifreeze protein adoption in North America. These proteins enhance frozen food quality by preventing ice crystal formation, improving texture, and extending shelf life. Food manufacturers integrate antifreeze proteins into dairy, meat, and bakery products to preserve nutritional value and product consistency. With the U.S. leading global frozen food consumption, demand continues to rise. Regulatory approvals and ongoing product innovations provide additional momentum, enabling food companies to deliver high-quality products and strengthen their competitive positioning in the expanding market.

Rising Demand in Cosmetic and Personal Care Products

The cosmetics sector is increasingly adopting antifreeze proteins due to their skin protection and anti-aging properties. These proteins help reduce cell damage from cold stress and oxidative factors, making them valuable for premium skincare formulations. Cosmetic brands in North America invest in biotechnology-derived antifreeze proteins to develop advanced creams, serums, and lotions that meet consumer demand for natural and science-driven solutions. The rising preference for eco-friendly and plant-based cosmetic ingredients also supports market expansion, encouraging collaborations between biotech companies and cosmetic manufacturers to commercialize sustainable and high-performance products.

- For instance, A/F Protein Inc. collaborated with cosmetic companies in North America to explore formulations using its recombinant antifreeze proteins, targeting hydration and skin barrier protection in winter care products.

Key Trends & Opportunities

Shift Toward Plant and Insect-Based Proteins

A notable trend shaping the North American market is the shift from fish-derived antifreeze proteins to plant and insect-based alternatives. Sustainability concerns, ethical sourcing issues, and consumer demand for vegan-friendly solutions are driving this transformation. Biotech firms are investing in recombinant technologies to produce plant-based proteins that reduce biodiversity risks while offering equal or superior efficiency. This trend creates significant opportunities for manufacturers to expand into green biotechnology and appeal to environmentally conscious consumers across food, cosmetics, and medical industries.

- For instance, KryoLogyx announced the development of recombinant antifreeze proteins derived from yeast systems, designed for food preservation without reliance on marine sources.

Expansion Through Strategic Collaborations and Licensing

Collaborations between biotech companies, universities, and large corporations present a strong opportunity in the market. Licensing agreements for recombinant antifreeze protein production enable scaling at lower costs, reducing reliance on natural extraction. This approach expands commercial applications across pharmaceuticals, agriculture, and frozen foods. Partnerships also accelerate innovation, allowing small biotech firms to leverage the resources of larger corporations. Such alliances strengthen supply chains, promote sustainable sourcing, and enhance market penetration, positioning collaboration-driven strategies as a central growth pathway in the North America Antifreeze Proteins Market.

- For instance, AquaBounty Technologies partnered with Memorial University of Newfoundland to advance recombinant antifreeze protein research for aquaculture applications, enhancing cold tolerance in farmed fish.

Key Challenges

High Production Costs and Scalability Issues

One of the main challenges is the high production cost of antifreeze proteins, which limits widespread adoption. Natural extraction methods are resource-intensive and unsustainable, while recombinant production requires advanced facilities and significant investment. These costs make final products expensive, reducing their competitiveness in price-sensitive industries like food and cosmetics. Scaling production while maintaining purity and efficiency remains complex, creating barriers for smaller companies. Addressing this challenge requires innovation in cost-effective recombinant technologies and improved bioprocessing techniques to enhance large-scale production feasibility.

Regulatory Hurdles and Approval Delays

Regulatory frameworks in North America pose considerable challenges for antifreeze protein commercialization. Agencies demand extensive safety testing for applications in food, cosmetics, and pharmaceuticals, which extends approval timelines. These lengthy processes increase time-to-market, delaying product launches and revenue generation for companies. Strict compliance requirements also escalate costs, particularly for startups and small biotech firms. Achieving faster approvals without compromising safety standards remains a pressing challenge, as regulatory barriers can restrict innovation and slow the pace of market expansion in the region.

Limited Consumer Awareness and Market Penetration

Despite technological advancements, consumer awareness about antifreeze proteins remains limited outside specialized industries. While researchers and medical professionals recognize their benefits, general consumers often lack understanding of their applications in food, cosmetics, or healthcare. This knowledge gap hinders demand growth and slows adoption across mainstream markets. Effective marketing, educational initiatives, and clear product labeling are required to improve awareness and trust. Without targeted outreach, antifreeze proteins risk remaining niche products, limiting their potential impact in broader commercial sectors like frozen foods and skincare in North America.

Regional Analysis

United States

The United States held the largest share of 62% in 2024 in the North America Antifreeze Proteins Market. Strong biotechnology research facilities and advanced healthcare infrastructure position the country as the leading hub. It drives demand through medical applications such as cryopreservation, fertility treatment, and organ storage. Food manufacturers also integrate antifreeze proteins to enhance frozen food quality and extend shelf life. Cosmetic companies in the U.S. use these proteins in premium skincare products targeting cold protection. Regulatory support for biotechnology innovations further accelerates product development and adoption.

Canada

Canada accounted for 23% share in 2024, supported by its focus on sustainable biotechnology and advanced food processing industries. Research institutions in Canada collaborate with global biotech companies to expand applications in medical and cosmetic segments. Frozen food consumption is high, creating steady demand for antifreeze proteins in packaged food solutions. The healthcare sector in Canada explores wider use of these proteins in regenerative medicine and clinical trials. Cold climate conditions also strengthen the need for effective cryopreservation technologies. It continues to enhance market growth through government-backed innovation programs.

Mexico

Mexico represented 15% share in 2024, supported by rising investment in food and beverage processing. Frozen food demand is increasing as urbanization and changing lifestyles shape consumer preferences. It drives adoption of antifreeze proteins in meat, dairy, and bakery applications. Medical applications remain smaller compared to the U.S. and Canada but show potential growth through private healthcare expansion. Cosmetic product adoption is also gaining traction, particularly with rising demand for affordable skincare solutions. Mexico’s growing manufacturing base and strategic trade networks support wider availability of antifreeze protein-based products.

Market Segmentations:

By Type

- Type I

- Type III

- Glycoproteins

- Others

By Form

By End-User

- Medical

- Cosmetics

- Food

- Others

By Sources

- Fish

- Plants

- Insects

- Others

By Region

Competitive Landscape

The North America Antifreeze Proteins Market is highly competitive, shaped by specialized biotechnology firms, global corporations, and research-driven companies. Key players include A/F Protein Inc., Sirona Biochem Corp, ProtoKinetix Inc., AquaBounty Technologies Inc., MyBioSource Inc., Unilever US, Cargill, Thermo Fisher Scientific, Arctic Bioscience, and BlueGene Biotech. These companies strengthen their positions by expanding product portfolios, investing in recombinant production technologies, and forming partnerships with research institutions and healthcare providers. Strategic focus areas include scaling production, improving cost efficiency, and expanding applications in medical, food, and cosmetic industries. Firms also emphasize sustainable sourcing and plant-based innovations to align with consumer demand for ethical and eco-friendly products. Competitive intensity is increasing, with established players leveraging advanced R&D and distribution networks while smaller biotech firms target niche applications. Continuous innovation, regulatory compliance, and long-term collaborations remain critical factors shaping success in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- A/F Protein Inc.

- Sirona Biochem Corp

- ProtoKinetix Inc.

- AquaBounty Technologies Inc.

- MyBioSource Inc.

- Unilever US

- Cargill

- Thermo Fisher Scientific

- Arctic Bioscience

- BlueGene Biotech

Recent Developments

- l In February 2024, Unilever announced new ice-cream formulations incorporating antifreeze proteins to improve texture and reduce ice crystal formation.

- l In April 2025, RE ProMan, LLC (an alliance partner of Burcon) completed acquisition of a protein production facility in Galesburg, Illinois, which may support scale in protein-based bioproducts.

- l In September 2024, Evonik expanded its portfolio with new plant-based actives, CapilAcid™ and Oleobiota™, for cosmetics.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for antifreeze proteins will expand in advanced cryopreservation and regenerative medicine applications.

- Food manufacturers will increase integration of antifreeze proteins to improve frozen product quality.

- Cosmetic brands will adopt antifreeze proteins for premium skincare and anti-aging formulations.

- Research institutions will drive innovation through recombinant and plant-based antifreeze protein development.

- Strategic partnerships between biotech firms and large corporations will strengthen market growth.

- Government-backed biotechnology initiatives will support new product commercialization.

- Sustainability concerns will accelerate the shift toward plant and insect-derived antifreeze proteins.

- Healthcare providers will explore wider adoption for organ preservation and fertility treatments.

- Expanding trade and distribution networks will improve product accessibility across regional markets.

- Continuous advancements in production efficiency will reduce costs and increase large-scale adoption.