Market Overview

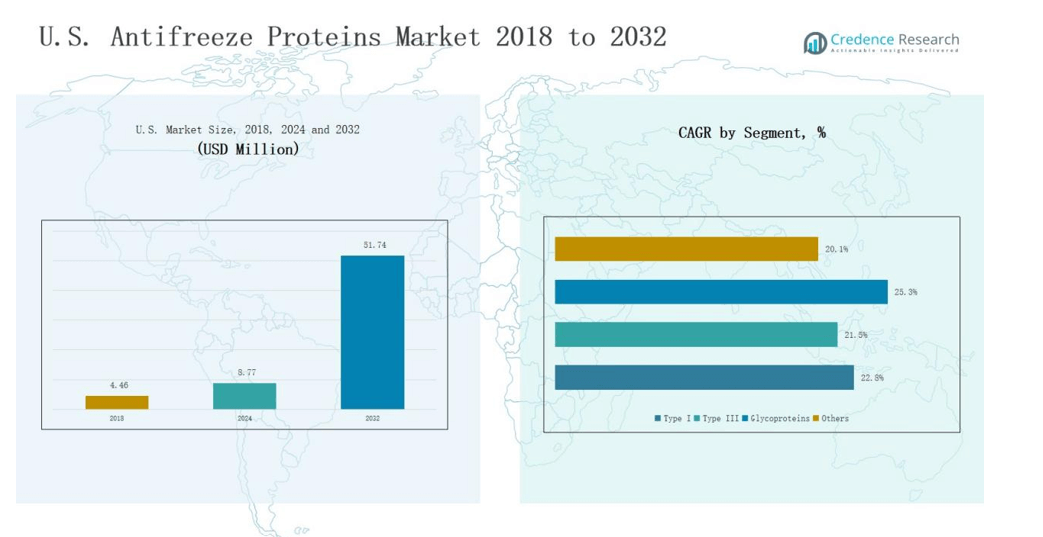

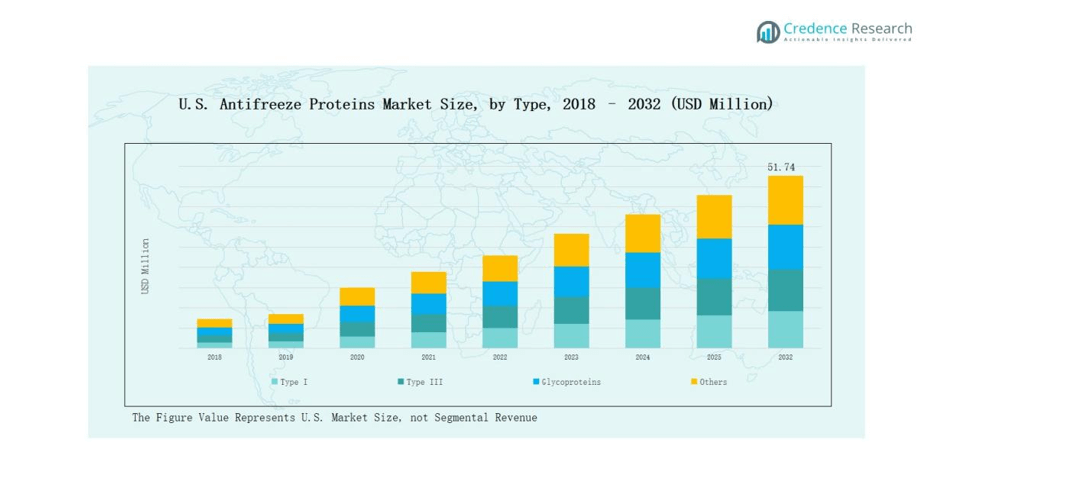

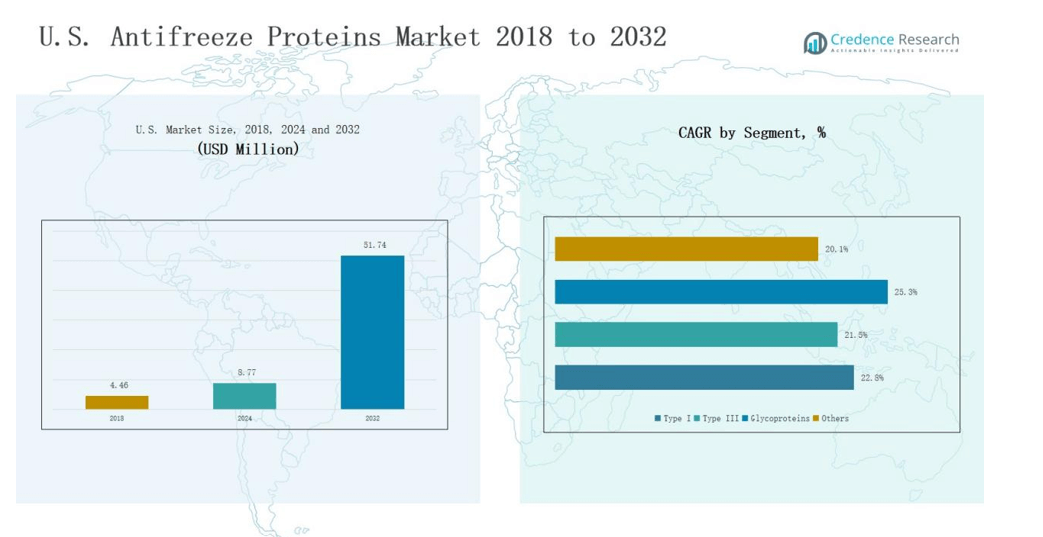

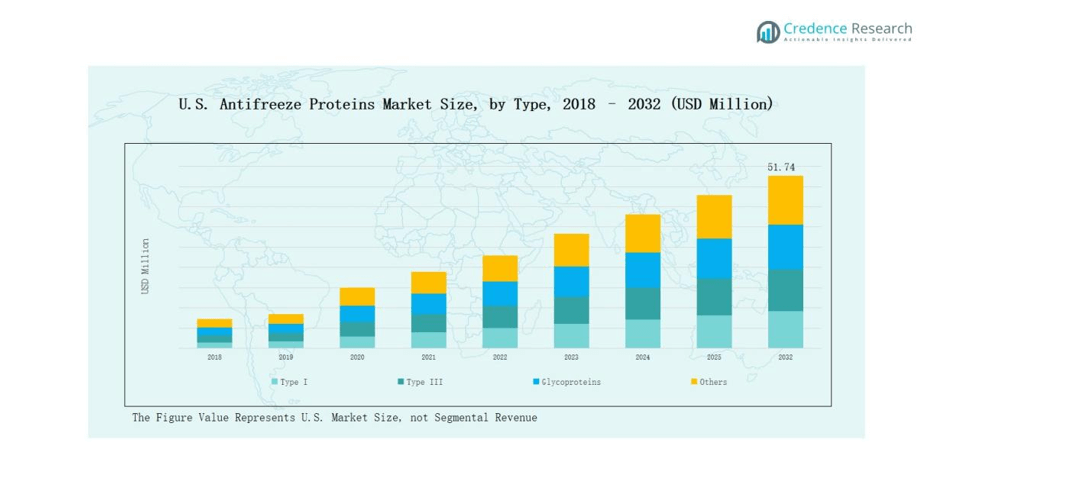

U.S. Antifreeze Proteins Market size was valued at USD 4.46 million in 2018, reached USD 8.77 million in 2024, and is anticipated to reach USD 51.74 million by 2032, growing at a CAGR of 23.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Antifreeze Proteins Market Size 2024 |

USD 8.77 million |

| U.S. Antifreeze Proteins Market, CAGR |

23.18% |

| U.S. Antifreeze Proteins Market Size 2032 |

USD 51.74 million |

The competitive environment of the U.S. Antifreeze Proteins Market is defined by the presence of specialized biotechnology firms, global suppliers, and diversified corporations. Leading players include A/F Protein Inc., ProtoKinetix Inc., AquaBounty Technologies Inc., MyBioSource Inc., Sirona Biochem Corp, Thermo Fisher Scientific, BlueGene Biotech US, Arctic Bioscience US, Unilever US, and Cargill US, each leveraging research capabilities and strategic partnerships to strengthen their positions. Companies actively focus on biomedical, food, and cosmetic applications, expanding product portfolios and scaling recombinant production technologies. Regionally, the West led the market with a 25% share in 2024, supported by California’s biotechnology ecosystem, strong food manufacturing base, and growing adoption in cosmetics, making it the dominant hub for innovation and commercialization.

Market Insights

- The U.S. Antifreeze Proteins Market grew from USD 4.46 million in 2018 to USD 8.77 million in 2024 and is expected to reach USD 51.74 million by 2032, registering strong growth at a CAGR of 23.18%.

- Type I proteins led with 41.6% share in 2024, driven by biomedical research and cryopreservation, while Type III and glycoproteins gained traction in food and cosmetic applications.

- Solid form dominated with 57.3% share in 2024 due to stability and longer shelf life, while liquid form accounted for 42.7% with demand in laboratory and food uses.

- The medical segment held 44.1% share in 2024, followed by cosmetics at 28.6% and food at 20.4%, reflecting strong demand in healthcare and premium skincare applications.

- The West led regionally with 25% share in 2024, supported by California’s biotech ecosystem, food innovation, and cosmetic industry presence, while the South closely followed with equal share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

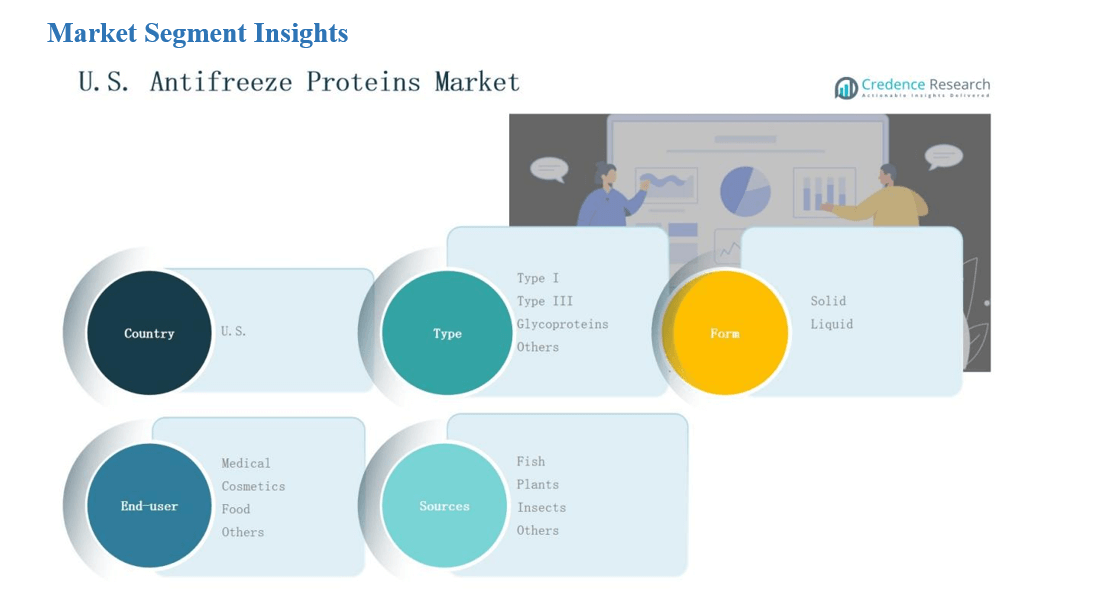

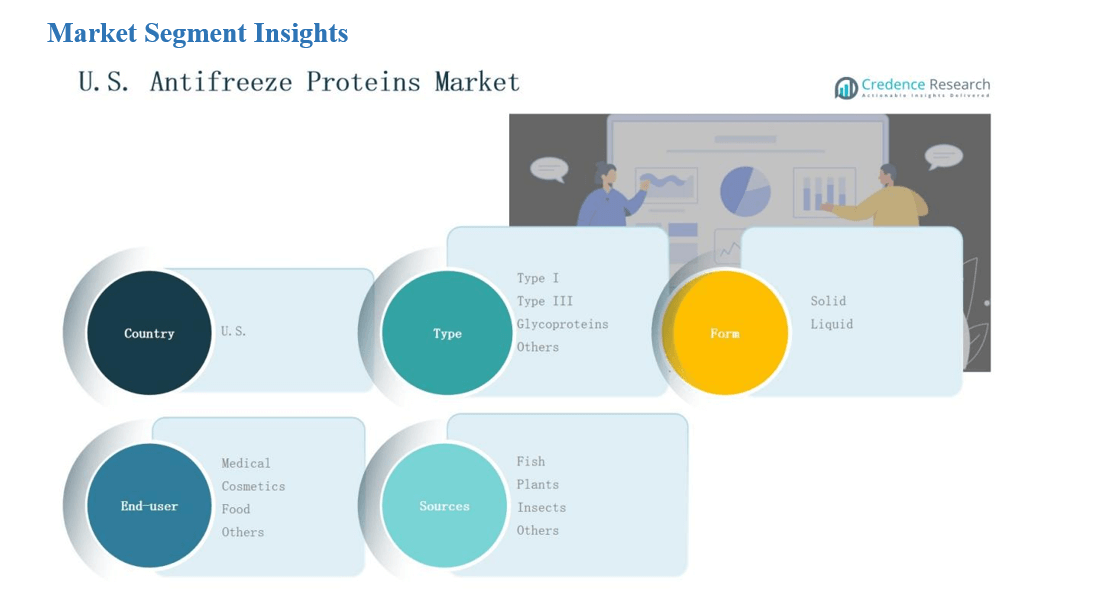

Market Segment Insights

By Type

In 2024, Type I antifreeze proteins dominated the U.S. market with a 41.6% share. Their strong presence is driven by extensive use in cryopreservation and biomedical research. Type I’s superior thermal hysteresis and proven compatibility with biological samples make it the most commercially adopted category. Type III and glycoproteins are gaining traction in food preservation and cosmetic formulations, while the “others” category remains niche with limited applications.

- For instance, Sino Biological has introduced new recombinant protein solutions for laboratory workflows, including a recently launched line of endotoxin-free recombinant proteins tailored for sensitive applications like vaccine and cell therapy research.

By Form

The solid form led the market in 2024 with a 57.3% share. Solid formulations offer greater stability, extended shelf life, and ease of storage compared to liquids, which supports their adoption in large-scale research and industrial applications. Liquid forms, with a 42.7% share, are valued for direct use in laboratories and fast integration into medical or food solutions, but face challenges in long-term stability.

By End-user

The medical segment accounted for the largest share at 44.1% in 2024. Strong demand comes from cryosurgery, organ preservation, and advanced regenerative medicine, where antifreeze proteins enhance cell viability under freezing conditions. Cosmetics followed with a 28.6% share, supported by rising use in anti-aging and skin hydration products. Food applications held 20.4%, driven by frozen dessert stabilization and reduced ice recrystallization, while other industries collectively captured 6.9%.

- For instance, X-Therma Inc. has been developing antifreeze protein-inspired cryoprotectants to extend organ preservation times, enabling safer transplants.

Market Overview

Rising Demand in Biomedical Applications

The U.S. antifreeze proteins market is expanding due to growing use in biomedical research. These proteins play a critical role in cryopreservation of cells, tissues, and organs, ensuring viability during freezing and thawing. Increasing investment in regenerative medicine, stem cell storage, and organ transplantation supports strong adoption. Academic institutions and biotech firms are integrating antifreeze proteins into advanced research, improving survival rates of biological samples. This strong biomedical demand positions the segment as a foundational driver of U.S. market growth.

- For instance, at Hokkaido University, antifreeze proteins extracted from fish and microorganisms are being mass-produced to enhance cold storage technology and medical cryopreservation solutions.

Expanding Role in Food and Beverage Industry

The food sector drives adoption of antifreeze proteins, particularly for frozen desserts, fruits, and seafood. By inhibiting ice crystal growth, these proteins enhance product texture, taste, and shelf life. Rising consumer demand for high-quality frozen food in the U.S., coupled with manufacturers’ focus on product innovation, boosts usage. Food companies see antifreeze proteins as natural stabilizers that reduce reliance on synthetic additives. The trend toward clean-label and premium frozen foods further strengthens this segment’s contribution to market expansion.

- For instance, Unilever has explored antifreeze proteins in its ice cream lines to maintain creaminess during temperature fluctuations and extend storage stability.

Increasing Application in Cosmetics and Personal Care

Cosmetic formulations increasingly incorporate antifreeze proteins for their moisturizing and anti-aging benefits. These proteins protect skin cells from cold-induced damage and enhance hydration, appealing to U.S. consumers seeking advanced skincare. The demand for premium and eco-friendly cosmetic products amplifies interest in protein-based solutions. Rising awareness about bioactive ingredients in personal care products supports commercialization. With strong R&D efforts from cosmetic companies, antifreeze proteins are becoming a critical functional ingredient, driving sustained growth in the U.S. cosmetics end-use segment.

Key Trends & Opportunities

Shift Toward Plant- and Insect-Based Sources

Growing focus on sustainability is reshaping sourcing strategies in the U.S. antifreeze proteins market. Plant- and insect-based proteins are emerging as eco-friendly alternatives to fish-derived options, reducing biodiversity impact and aligning with consumer preferences for ethical sourcing. Companies are investing in advanced extraction technologies to commercialize these alternatives at scale. This transition opens new opportunities across industries such as food and cosmetics, where plant-based ingredients are in high demand. The sustainability focus is expected to redefine supply chains and market growth.

- For instance, biotechnology firms like Polar Tech Biosciences are developing next-generation antifreeze proteins from insect sources, which are projected to grow fastest in market demand due to sustainable farming practices.

Strategic Collaborations and Research Investments

Collaborations between biotech firms, research institutions, and pharmaceutical companies are creating strong growth opportunities. Joint R&D initiatives aim to improve protein stability, scalability, and cost-effective production. U.S. companies are actively engaging in partnerships to expand application areas, from cryosurgery to high-value cosmetics. Government support for biotechnology research further strengthens innovation pipelines. These collaborations accelerate product development, broaden commercial use, and foster market competitiveness. As partnerships increase, the U.S. antifreeze proteins market is positioned for steady long-term expansion across diverse sectors.

- For instance, ArcticZymes Technologies ASA engaged in research collaborations to optimize enzyme-based purification methods for gene therapies and vaccines.

Key Challenges

High Production Costs and Scalability Issues

Production of antifreeze proteins remains expensive, limiting widespread commercial adoption. Extraction and purification processes require advanced technology and specialized facilities, driving costs significantly higher than conventional stabilizers. Scaling up from laboratory to industrial levels remains difficult, creating pricing barriers for food and cosmetic companies. While biotechnological advances are underway, affordability challenges hinder rapid market penetration. Overcoming cost constraints through innovation in synthetic biology and recombinant production methods is critical for long-term sustainability of the U.S. antifreeze proteins market.

Regulatory and Safety Concerns

Regulatory approval processes for antifreeze proteins pose hurdles for commercialization in the U.S. market. Authorities require extensive safety validation for new biological ingredients, especially in food and medical applications. Concerns about allergenicity, toxicity, and environmental impact delay approvals and increase compliance costs. Manufacturers must invest heavily in research and trials to meet FDA and related guidelines. These lengthy procedures slow time-to-market and restrict product launches. Addressing regulatory uncertainties will be essential to support broader adoption across multiple industries.

Limited Awareness and Market Penetration

Despite promising applications, market awareness of antifreeze proteins remains limited outside specialized research circles. Many food and cosmetic manufacturers are unfamiliar with their functional benefits compared to traditional additives. This lack of awareness reduces demand and slows integration into mainstream production. High educational and promotional efforts are needed to demonstrate advantages, such as improved shelf life and natural sourcing. Without broader market education, antifreeze proteins risk remaining a niche solution. Effective awareness campaigns are vital for U.S. market expansion.

Regional Analysis

Northeast

The Northeast accounted for 28% share in 2024, supported by strong presence of research institutions, biotech firms, and pharmaceutical companies. The concentration of advanced healthcare facilities drives adoption of antifreeze proteins in cryopreservation and regenerative medicine. Food companies in states like New York and Massachusetts also integrate these proteins into frozen products to improve quality. Cosmetics manufacturers benefit from consumer preference for bio-based skincare in urban markets. The region shows steady growth, with investments in innovation ensuring wider adoption across medical and consumer industries.

Midwest

The Midwest held a 22% share in 2024, supported by its strong agricultural and food processing base. Frozen food producers in states such as Illinois and Minnesota adopt antifreeze proteins to enhance product stability and extend shelf life. Academic research centers contribute to early-stage development and testing of protein applications. While the cosmetics industry remains smaller, gradual uptake is evident due to increasing consumer awareness. The Midwest market relies on advancements in biotechnology and processing facilities, creating consistent opportunities for expansion.

South

The South captured a 25% share in 2024, with growth supported by expanding biotechnology hubs and strong food manufacturing activity. Medical applications drive revenue, particularly in cryosurgery and organ preservation, as healthcare facilities in states such as Texas and Florida adopt advanced solutions. Rising consumer demand for frozen desserts also supports growth, with antifreeze proteins improving texture and quality. Cosmetics companies find opportunities in warmer climates where demand for hydration products is strong. Strategic partnerships between universities and biotech firms further enhance market strength.

West

The West led with a 25% share in 2024, supported by biotechnology innovation, food product development, and strong consumer demand for natural ingredients. California dominates the region due to its extensive biotech ecosystem and advanced food industry. The presence of major cosmetic manufacturers also supports growth in skincare formulations using antifreeze proteins. Research institutions collaborate with private companies to drive R&D and commercialization efforts. Demand across frozen food, medical, and cosmetic applications creates a balanced growth profile. The region maintains its leadership through strong infrastructure and innovation-driven investment.

Market Segmentations:

By Type

- Type I

- Type III

- Glycoproteins

- Others

By Form

By End-user

- Medical

- Cosmetics

- Food

- Others

By Sources

- Fish

- Plants

- Insects

- Others

By Region

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. Antifreeze Proteins Market is shaped by a mix of specialized biotechnology firms, established pharmaceutical suppliers, and diversified multinational corporations. Key players such as A/F Protein Inc., ProtoKinetix Inc., and AquaBounty Technologies Inc. focus on developing high-purity proteins for biomedical, food, and cosmetic applications. Companies like Thermo Fisher Scientific and Cargill leverage broad product portfolios and global distribution networks to strengthen their presence. Niche firms including MyBioSource Inc., Sirona Biochem Corp, and BlueGene Biotech US concentrate on targeted R&D and innovation to gain traction in specialized segments. Unilever US and Arctic Bioscience US emphasize functional ingredients in cosmetics and food sectors, aligning with sustainability and consumer-driven trends. Market participants actively pursue collaborations, licensing agreements, and research partnerships to expand applications and lower production costs. Competitive intensity remains high, with leadership determined by technological capability, regulatory compliance, and ability to scale cost-efficient solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- A/F Protein Inc.

- ProtoKinetix Inc.

- AquaBounty Technologies Inc.

- MyBioSource Inc.

- Sirona Biochem Corp

- Thermo Fisher Scientific

- BlueGene Biotech US

- Arctic Bioscience US

- Unilever US

- Cargill US

Recent Developments

- In 2023, Unilever advanced its use of ice-structuring proteins to improve frozen food applications.

- In 2024, Kaneka Corporation introduced a novel synthetic antifreeze protein production process to cut manufacturing costs.

- In April 2024, Henkel completed the acquisition of Seal for Life Industries LLC, enhancing its protective coatings and sealing solutions

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End User, Sources and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand from biomedical research will expand with rising focus on cryopreservation and regenerative medicine.

- Food industry adoption will increase as frozen food manufacturers seek natural stabilizers.

- Cosmetic companies will integrate antifreeze proteins into skincare for hydration and anti-aging benefits.

- Plant and insect-derived proteins will gain traction as sustainable alternatives to fish-based sources.

- Partnerships between biotech firms and universities will accelerate innovation and commercialization.

- Improved recombinant production methods will lower costs and enhance scalability.

- Regulatory approvals will shape entry into new food and medical applications.

- Consumer awareness of bio-based ingredients will drive demand across premium product categories.

- Investments in advanced biotechnology hubs will strengthen regional competitiveness.

- Market growth will rely on balancing affordability, safety, and product performance across sectors.