Market Overview

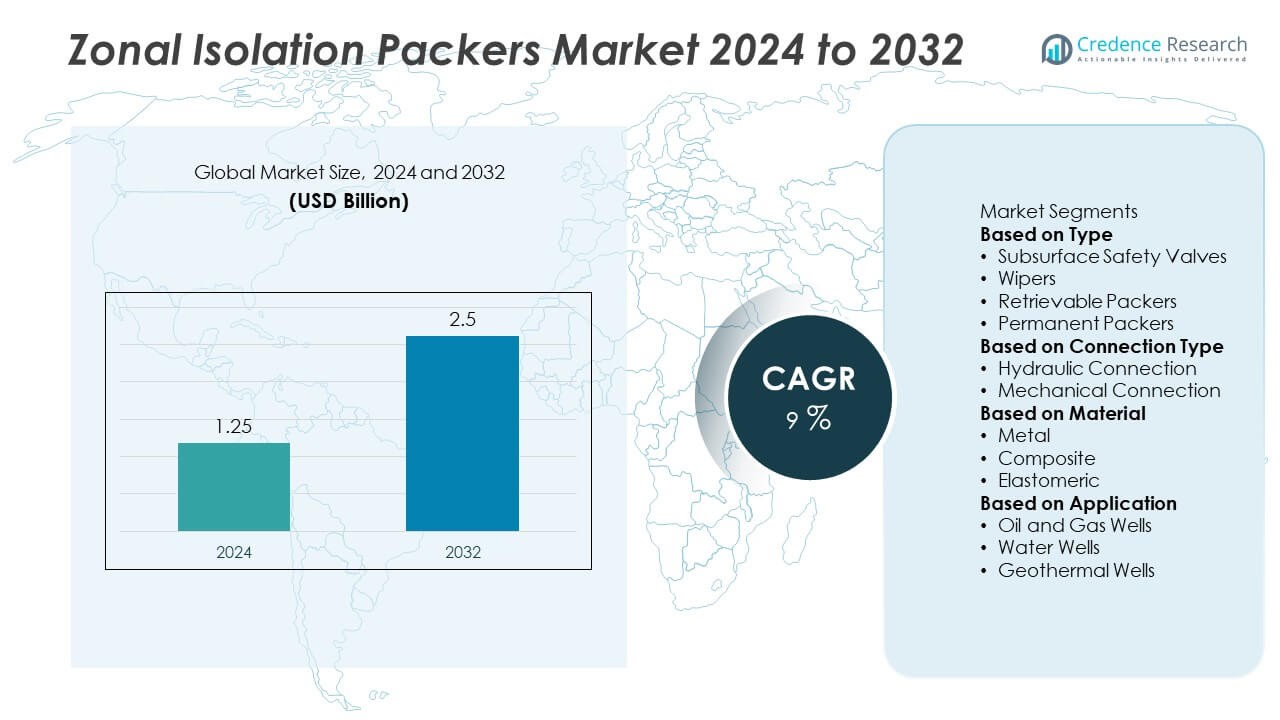

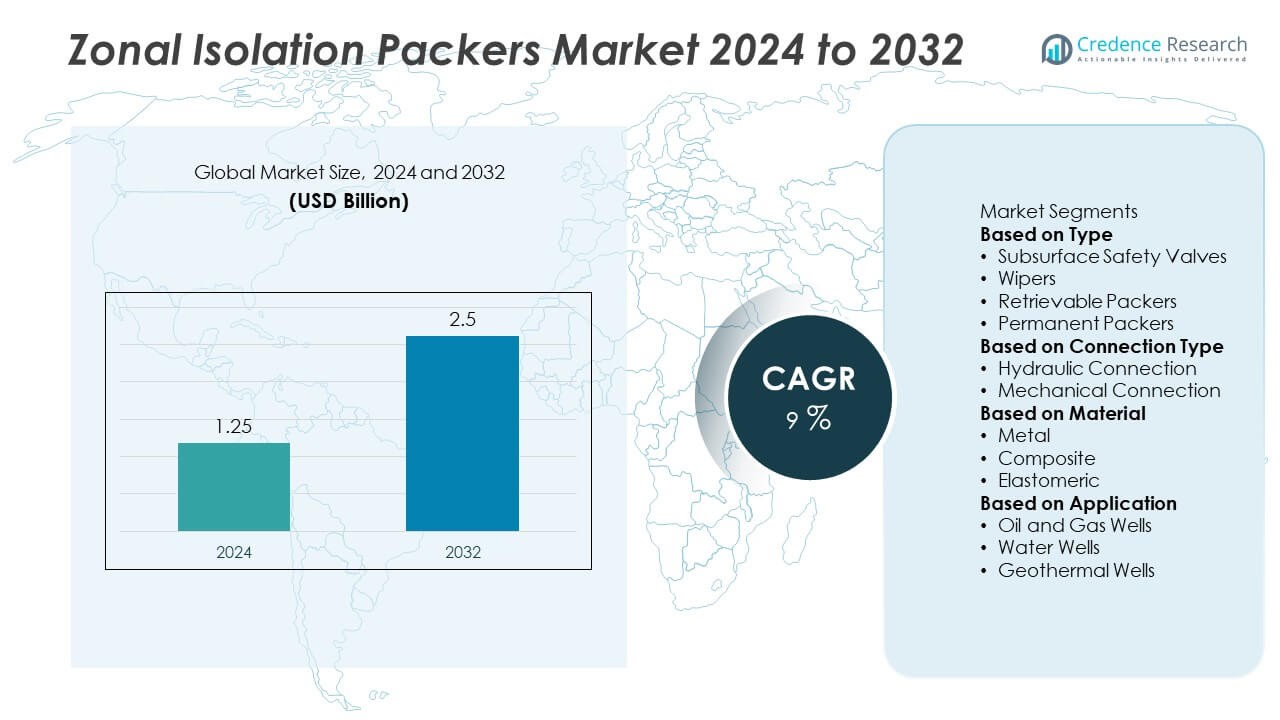

The Zonal Isolation Packers market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.5 billion by 2032, registering a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Zonal Isolation Packers Market Size 2024 |

USD 1.25 billion |

| Zonal Isolation Packers Market, CAGR |

9% |

| Zonal Isolation Packers Market Size 2032 |

USD 2.5 billion |

The zonal isolation packers market is led by key players including Vallourec, Baker Hughes, JFE Holdings, Schlumberger, Nippon Steel Sumitomo Metal Corporation, and Halliburton, who focus on delivering high-performance packers for both onshore and offshore operations. These companies invest in advanced hydraulic and retrievable packer technologies to ensure well integrity and enhance production efficiency in high-pressure, high-temperature wells. North America leads the market with over 37% share in 2024, driven by shale gas development and mature well interventions. Europe follows with 28% share, supported by North Sea projects, while Asia-Pacific holds 22% and is the fastest-growing region with rising energy demand and offshore drilling activity.

Market Insights

- The zonal isolation packers market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 9% during the forecast period.

- Rising demand for well intervention and workover activities drives adoption, with retrievable packers holding over 45% share due to their reusability and cost-effectiveness for mature field operations.

- Key trends include adoption of smart packers with real-time monitoring, use of advanced HPHT materials, and integration of digital tools to enhance well integrity and reduce downtime.

- The market is competitive with leading players such as Halliburton, Schlumberger, Baker Hughes, and Vallourec focusing on R&D, partnerships, and expansion into deepwater and unconventional drilling projects.

- North America leads with over 37% share, followed by Europe with 28%, while Asia-Pacific holds 22% and remains the fastest-growing region, driven by rising offshore exploration and increasing unconventional resource development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Retrievable packers dominate the zonal isolation packers market, holding over 45% share in 2024, due to their ability to be easily removed and reused in workover and stimulation operations. Their cost-effectiveness and versatility make them preferred for temporary completions and well interventions. Permanent packers follow, favored in high-pressure and high-temperature wells where long-term integrity is required. Subsurface safety valves and wipers hold smaller shares, but demand continues to grow as operators focus on safety and wellbore cleanliness. The rising number of mature wells worldwide is further boosting retrievable packer adoption across onshore and offshore drilling projects.

- For instance, the Baker Hughes HS hydraulic-set retrievable packer is a high-performance, single-string packer featuring a shear-release design and barrel slips. It is set by hydraulic pressure without requiring mandrel rotation, which prevents premature setting while running in and is ideal for deviated and horizontal wells.

By Connection Type

Hydraulic connection packers lead the market with over 55% share in 2024, driven by their superior performance in deepwater and high-pressure wells. Hydraulic activation ensures precise setting and high reliability under extreme downhole conditions, making them suitable for complex completions. Mechanical connection packers remain important for cost-sensitive onshore applications and wells where simpler setting mechanisms are sufficient. Growth in unconventional drilling and horizontal wells supports hydraulic connection dominance, as operators prioritize operational safety, reduced intervention time, and remote control capabilities during well completions and production phases.

- For instance, Halliburton’s ZoneGuard HE hydraulic-set packer uses a multi-durometer sealing element with a hydrostatic assist feature, enabling precise setting at differential pressures up to 15,000 psi and temperatures up to 325°F. Its hydraulic activation reduces intervention downtime and improves sealing reliability in deepwater and highly deviated wellbores.

By Material

Metal-based packers account for more than 50% share in 2024, as they offer exceptional strength, durability, and resistance to high-pressure, high-temperature (HPHT) environments. These packers are extensively used in offshore, deepwater, and unconventional well operations where reliability is critical. Composite packers are gaining share due to their lightweight nature and corrosion resistance, making them suitable for challenging well conditions. Elastomeric packers are widely used for low-pressure applications but have lower adoption in HPHT wells. Growing investments in deepwater projects and shale exploration are driving demand for robust, metal-based solutions with longer service life and minimal maintenance requirements.

Market Overview

Increasing Well Intervention and Workover Activities

Rising demand for oil and gas from mature reservoirs is driving well intervention and workover operations globally. Zonal isolation packers are critical in these activities as they provide secure isolation of production zones, allowing enhanced recovery and well stimulation. Their retrievability and ability to be reused lower operational costs and improve efficiency. Growing investments in extending the life of aging fields, particularly in North America and the Middle East, continue to support market growth and boost the demand for advanced, high-performance packer systems.

- For instance, Tenaris offers a range of packers and related accessories designed for workover conditions and mature wells. These products offer multiple setting mechanisms, support rapid installation and retrieval, and are available with varying pressure and temperature ratings to suit different operational requirements.

Rising Offshore and Deepwater Drilling Projects

Offshore and deepwater exploration projects are expanding as operators look for new reserves to meet global energy demand. These environments require robust zonal isolation solutions that can withstand extreme pressure and temperature conditions. Hydraulic connection and metal-based packers are preferred for such projects, offering reliable sealing and enhanced well integrity. Increasing capital expenditure by major oil companies on deepwater exploration in regions like the Gulf of Mexico, Brazil, and West Africa significantly contributes to the market’s growth trajectory.

- For instance, companies like TechnipFMC (formed from the merger of FMC Technologies and Technip) have developed advanced hydraulic setting tools and metal-to-metal sealing technologies for ultra-deepwater completions.

Growth in Unconventional Oil and Gas Production

Shale gas and tight oil development are creating substantial demand for zonal isolation packers, particularly retrievable and composite types. Multi-stage hydraulic fracturing operations require effective isolation to optimize production from each stage. Packers help in precise zone segregation and reduce fluid communication between zones, improving overall well productivity. The surge in horizontal drilling activity across the United States and Canada is a major driver, as operators prioritize efficiency, operational safety, and reliable sealing solutions to maximize recovery rates from unconventional resources.

Key Trends & Opportunities

Adoption of Smart and Digital Packers

A significant trend is the development of smart packers equipped with sensors for real-time downhole monitoring. These advanced systems transmit data on pressure, temperature, and flow rates, enabling predictive maintenance and improved reservoir management. The integration of IoT and digital platforms allows operators to make faster decisions and reduce non-productive time. This technology offers opportunities for service providers to deliver value-added solutions and strengthen customer relationships, particularly in offshore projects where operational efficiency is crucial.

- For instance, Baker Hughes launched its Feedthrough packer system with integrated sensors capable of real-time monitoring of pressure and temperature. The feedthrough packer supports electrical submersible pump (ESP) control through insulated electrical lines, maintaining reliable zonal isolation at pressures up to 12,000 psi and temperatures of 300°F while transmitting data with latency under 1 second to surface control units.

Focus on HPHT and Corrosion-Resistant Materials

The industry is witnessing growing demand for packers made with advanced alloys and composite materials to withstand HPHT conditions and corrosive fluids. Development of high-performance elastomers and composite blends enhances durability and sealing performance, reducing failure risk. This trend opens opportunities for manufacturers to innovate and supply next-generation solutions that cater to complex drilling environments, supporting long-term reliability and lowering total cost of ownership for operators.

- For instance, Schlumberger’s Expandable Annular Zonal Isolation Packer (AZIP), features Saltel Xpandable™ steel technology and bonded elastomer seals rated for 15,000 psi and sustained temperatures of 320°F. The packer’s rugged construction resists thermal cycling and corrosion, ensuring long-term integrity even in irregular or oval wellbores.

Key Challenges

High Operational and Installation Costs

The cost of deploying zonal isolation packers, especially in deepwater and offshore wells, remains a major challenge. Complex installations often require specialized equipment and skilled personnel, increasing overall project expenditure. This can limit adoption in cost-sensitive markets and smaller operators may delay interventions. Service companies are focusing on developing cost-efficient and modular solutions to address this barrier and improve accessibility for a wider range of customers.

Risk of Packer Failure and Well Integrity Issues

Packer failures can lead to costly production losses, remedial workovers, and environmental risks. Challenges include seal degradation, improper setting, and damage during high-pressure operations. These failures can compromise well integrity and impact safety. Manufacturers are working on improving design reliability, developing high-strength sealing elements, and offering real-time monitoring technologies to minimize failure rates and build operator confidence in zonal isolation systems.

Regional Analysis

North America

North America leads the zonal isolation packers market with over 37% share in 2024, supported by extensive shale gas and tight oil production across the United States and Canada. The region’s focus on horizontal drilling and multi-stage hydraulic fracturing drives strong demand for retrievable and composite packers. Investments in well intervention and enhanced oil recovery activities in mature fields further support growth. The presence of leading service providers and early adoption of digital well completion technologies strengthen market penetration. Continuous activity in the Permian Basin and Gulf of Mexico ensures North America remains a key revenue hub.

Europe

Europe holds around 28% share in 2024, driven by steady oilfield development in the North Sea, UK Continental Shelf, and Norway. Offshore drilling projects and well integrity management programs fuel demand for high-performance hydraulic packers. European operators prioritize compliance with stringent safety and environmental regulations, which encourages investment in reliable, high-quality packer solutions. The region’s focus on extending the life of aging wells through interventions and workovers also supports retrievable packer adoption. Growing exploration activity in Eastern Europe and the Black Sea region contributes to future market opportunities for zonal isolation systems.

Asia-Pacific

Asia-Pacific accounts for over 22% share in 2024 and is the fastest-growing region in the market. Rapid industrialization and rising energy demand in China, India, and Southeast Asia are boosting investments in onshore and offshore drilling. National oil companies are increasingly adopting advanced zonal isolation solutions to enhance well productivity and reduce intervention costs. Growth in offshore projects in Australia, Malaysia, and Indonesia further drives demand for hydraulic and metal-based packers. Government support for domestic hydrocarbon production and modernization of oilfield infrastructure accelerates adoption of reliable, high-strength packer technologies across the region.

Latin America

Latin America captures around 8% share in 2024, with Brazil and Mexico leading regional demand due to their large offshore reserves. Deepwater exploration in Brazil’s pre-salt fields and offshore developments in the Gulf of Mexico drive demand for high-pressure, high-temperature packers. Retrievable packers are widely used for workover operations, supporting production efficiency in mature wells. Argentina’s Vaca Muerta shale play is also contributing to rising packer consumption. Despite economic and regulatory challenges, ongoing investments in exploration and production projects continue to strengthen Latin America’s role in the global zonal isolation packers market.

Middle East & Africa

The Middle East & Africa hold around 5% share in 2024, with demand concentrated in Saudi Arabia, UAE, and offshore fields in West Africa. High investments in oilfield development and enhanced oil recovery projects drive packer usage in high-pressure, high-temperature wells. Operators in the region focus on long-term well integrity and efficient production, supporting demand for permanent and hydraulic packers. Africa’s deepwater projects, particularly in Nigeria and Angola, present growth opportunities for advanced packer solutions. Government initiatives to boost hydrocarbon production and expand drilling operations will continue to support steady market growth in this region.

Market Segmentations:

By Type

- Subsurface Safety Valves

- Wipers

- Retrievable Packers

- Permanent Packers

By Connection Type

- Hydraulic Connection

- Mechanical Connection

By Material

- Metal

- Composite

- Elastomeric

By Application

- Oil and Gas Wells

- Water Wells

- Geothermal Wells

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the zonal isolation packers market features key players such as Vallourec, Baker Hughes, JFE Holdings, Schlumberger, Nippon Steel Sumitomo Metal Corporation, Outokumpu, Halliburton, Voestalpine, FMC Technologies, and Tenaris. These companies focus on delivering advanced packer solutions designed to withstand high-pressure and high-temperature (HPHT) environments, supporting both onshore and offshore drilling operations. Leading players invest heavily in R&D to develop robust hydraulic and retrievable packers with enhanced sealing capabilities and real-time monitoring technologies. Strategic initiatives include partnerships with oilfield operators, mergers and acquisitions, and expansion into unconventional resource plays. Many players are adopting digital completion tools and IoT-enabled systems to improve well integrity monitoring and operational efficiency. The competitive environment is shaped by the need for cost-effective, reliable solutions that minimize downtime and extend well life, with companies emphasizing quality, innovation, and global service networks to maintain market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Vallourec

- Baker Hughes

- JFE Holdings

- Schlumberger

- Nippon Steel Sumitomo Metal Corporation

- Outokumpu

- Halliburton

- Voestalpine

- FMC Technologies

- Tenaris

Recent Developments

- In June 2025, Outokumpu announced its new EVOLVE strategy for 2026–2030 focusing on growth through advanced materials and technology innovation. As part of this, the company is investing in developing high-performance alloys for zonal isolation packers that enhance durability and corrosion resistance in extreme downhole conditions.

- In May 2025, Baker Hughes launched an advanced swellable zonal isolation packer that expands in the wellbore to form tight seals without the need for mechanical setting equipment. The system supports pressures up to 12,000 psi and features a swellable polymer capable of maintaining sealing integrity for over 18 months in high-salinity brine environments.

- In August 2024, Baker Hughes Launched InvictaSet regenerative cement system. It reseals after damage and supports durable zonal isolation in varied well conditions.

- In April 2024, SLB (Schlumberger) Published its Expandable Annular Zonal Isolation Packer (AZIP) using Saltel Xpandable steel. Qualified to API Spec 19OH V1 and rated up to 15,000 psi and 320°F

Report Coverage

The research report offers an in-depth analysis based on Type, Connection Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The zonal isolation packers market will grow steadily with rising well intervention and workover operations.

- Demand for retrievable packers will increase as operators focus on cost-efficient well completions.

- Offshore and deepwater projects will drive adoption of hydraulic packers with advanced sealing technology.

- Use of smart packers with real-time downhole monitoring will expand across complex drilling environments.

- Investment in HPHT and corrosion-resistant materials will boost reliability and extend product life cycles.

- Digital integration and IoT-enabled packer solutions will enhance operational efficiency and reduce downtime.

- Asia-Pacific will experience the fastest growth due to rising energy demand and offshore exploration projects.

- Manufacturers will focus on developing modular, cost-effective solutions for unconventional resource plays.

- Strategic partnerships between service providers and operators will accelerate technology adoption worldwide.

- Focus on sustainability and reducing non-productive time will shape innovation in future packer designs.