Market Overview:

The Latin America Asia Cuisine Market size was valued at USD 55.64 million in 2018 to USD 58.25 million in 2024 and is anticipated to reach USD 83.54 million by 2032, at a CAGR of 4.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Asia Cuisine Market Size 2024 |

USD 58.25 Million |

| Latin America Asia Cuisine Market, CAGR |

4.61% |

| Latin America Asia Cuisine Market Size 2032 |

USD 83.54 Million |

The market is expanding due to growing consumer interest in diverse culinary experiences and the rising appeal of Asian flavors. Urbanization and rising disposable incomes encourage consumers to explore dining beyond traditional local cuisines. Foodservice expansion, including sushi bars, ramen shops, and fusion outlets, has increased availability across major cities. Demand for ready-to-cook Asian meals and sauces is strengthening household adoption, while social dining culture promotes repeated consumption. Tourism also plays a role, exposing locals to authentic Asian cuisines and fueling long-term preference.

Regionally, Brazil leads with a strong urban base and wide acceptance of international dining concepts. Mexico is emerging as a key market, supported by its dynamic restaurant industry and exposure to global culinary trends. Argentina and Chile also demonstrate growing demand, particularly for premium and health-focused Asian cuisines. Peru benefits from its established fusion culture, strengthening cross-regional appeal. Colombia shows rising adoption through urban growth and expanding foodservice presence. Together, these markets highlight both mature and emerging opportunities within Latin America’s evolving culinary landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America Asia Cuisine Market was valued at USD 58.25 million in 2024 and is projected to reach USD 83.54 million by 2032, growing at a CAGR of 4.61%.

- Rising urbanization and disposable incomes encourage consumers to explore diverse Asian dining options across major cities.

- Expansion of sushi bars, ramen shops, and fusion restaurants strengthens foodservice penetration and widens menu availability.

- Growth in packaged sauces, noodles, and ready-to-cook meals increases household adoption of Asian cuisines.

- Supply chain dependence on imported ingredients creates cost challenges and affects product accessibility in smaller markets.

- Brazil leads with strong acceptance of international cuisines, while Mexico and Argentina show rapid expansion of dining formats.

- Emerging markets like Colombia and Peru benefit from cultural openness and rising demand for authentic or fusion Asian offerings.

Market Drivers

Rising Consumer Preference for International Food Diversity

Consumers in Latin America are increasingly drawn to Asian cuisine due to its unique flavors and health-oriented offerings. Growing exposure to global food trends through media and tourism fuels curiosity and trial. Urbanization plays a vital role in expanding restaurant demand as city dwellers prefer diverse dining choices. Rising disposable incomes enable consumers to spend more on premium dining and specialty imports. The Latin America Asia Cuisine Market benefits from the strong interest in sushi, ramen, and Thai dishes. Social dining culture further promotes frequent consumption of Asian meals in group settings. Supermarket chains expand ready-to-cook and packaged Asian products, widening household adoption. It continues to gain traction through the influence of younger demographics with global outlooks.

- For instance, Lee Kum Kee collaborates with leading culinary events in Latin America, highlighting its oyster sauce and other Asian condiments used by top chefs in São Paulo, Lima, and Mexico City, reinforcing its influence in regional gastronomy.

Expansion of Foodservice Outlets and Restaurant Chains

The rapid growth of Asian-themed restaurants, sushi bars, and fusion outlets across Latin America accelerates market penetration. Global chains and local entrepreneurs establish new dining spaces to cater to evolving preferences. Online delivery platforms enhance accessibility, offering diverse menu options to urban consumers. Food courts in malls and airports increasingly integrate Asian cuisine as part of international food offerings. The Latin America Asia Cuisine Market sees momentum from large-scale franchising models. Growth in quick service and casual dining formats allows affordable and widespread reach. The introduction of unique Asian flavors in traditional Latin American meals also fosters hybrid cuisines. It gains further strength through increased investment from global players targeting expansion.

- For example, Sushi Itto, a Mexican-based Asian restaurant chain, uses a franchise model to operate locations primarily in Mexico and Central America. The brand has a history of menu innovation that fuses Japanese cuisine with regional flavors to serve customers in malls and urban centers.

Influence of International Tourism and Cultural Exchange

Tourism introduces Latin American consumers to Asian cuisines while encouraging inbound tourists to seek familiar flavors. Major cities like São Paulo, Mexico City, and Buenos Aires adapt their dining landscape to meet these diverse demands. Events such as food festivals and cultural exhibitions promote Asian culinary experiences locally. The Latin America Asia Cuisine Market benefits from rising travel between the two regions. Airlines and hospitality sectors also partner with Asian chefs to create signature dishes. International students and migrant communities introduce authentic recipes into mainstream offerings. Local culinary schools expand training in Asian techniques, fostering skilled chefs for regional restaurants. It reflects a continuous cross-cultural integration shaping long-term demand.

Growing Popularity of Packaged and Ready-To-Eat Meals

Changing lifestyles and busy schedules push demand for ready-to-cook and instant Asian products. Supermarkets and e-commerce platforms expand offerings of noodles, sauces, and frozen items. Convenience aligns with the needs of working professionals and young households seeking quick meal solutions. The Latin America Asia Cuisine Market gains support from expanding retail infrastructure. Rising preference for home cooking with global ingredients boosts sales of imported Asian condiments. Branding strategies highlight health, authenticity, and convenience, appealing to diverse consumer groups. Cross-promotions with beverages and snacks further enhance category visibility. It evolves with product innovations catering to localized taste preferences.

Market Trends

Integration of Asian Cuisine into Local Culinary Practices

Latin American chefs increasingly experiment with Asian spices and cooking methods in regional dishes. Restaurants fuse sushi with local seafood, or add soy-based sauces to traditional meals. The Latin America Asia Cuisine Market reflects this growing hybridization. Consumers embrace fusion dishes that balance familiar and new flavors. Food bloggers and influencers highlight creative recipes, spreading awareness of such combinations. Cooking shows and culinary schools encourage exploration of Asian styles. It thrives in metropolitan regions where culinary diversity is celebrated. This cultural blending creates a lasting trend shaping consumer dining habits.

- For instance, Virgilio Martínez of Central (Lima) has explored collaborations in Japan, combining Peruvian ingredients with local Japanese culinary practices, highlighting fusion menus that emphasize regional authenticity.

Digital Platforms Driving Awareness and Consumption Growth

E-commerce and food delivery apps expand visibility and accessibility of Asian cuisine. Restaurants partner with online aggregators to showcase menus to wider audiences. The Latin America Asia Cuisine Market benefits from loyalty programs and digital marketing campaigns. Social media platforms popularize viral Asian dishes, from bubble tea to Korean barbecue. Consumers use online tutorials to learn preparation of authentic Asian recipes. E-grocery services also promote specialty ingredients like miso, wasabi, and tofu. It integrates with digital convenience to shape evolving consumption behaviors. Growth in virtual cooking classes further promotes cultural appreciation of Asian food.

Emergence of Health and Wellness-Oriented Asian Dishes

Health-conscious consumers favor Asian meals emphasizing fresh vegetables, lean proteins, and herbal infusions. Demand rises for Japanese sushi, Korean kimchi, and Thai curries known for nutritional value. The Latin America Asia Cuisine Market aligns with wellness trends supporting balanced diets. Restaurants highlight gluten-free, vegan, and low-calorie options in their Asian menus. Nutritional labeling on packaged Asian foods builds consumer confidence. Herbal teas and fermented products gain popularity among younger demographics. It continues to grow through endorsement by nutrition experts. The shift toward mindful eating sustains this trend across multiple consumer groups.

Rise of Experiential Dining and Themed Restaurants

Consumers increasingly value dining experiences beyond traditional meals. Themed Asian restaurants recreate cultural environments through décor, music, and service styles. The Latin America Asia Cuisine Market adapts to this demand by enhancing customer engagement. Sushi-making workshops, hot pot experiences, and interactive grills attract repeat customers. Fine-dining concepts introduce regional specialties from Japan, China, and Korea. Food tourism packages highlight Asian dining trails in major Latin American cities. It drives consumer loyalty by blending entertainment with gastronomy. Experiential formats reinforce emotional connections and elevate the overall dining appeal.

- For instance, Haidilao Hot Pot has implemented AI-powered kitchen management systems and robotic automation in its international outlets, incorporating features such as automated dish tracking, robotic arms, and personalized broth-mixing machines, enhancing operational efficiency and interactive dining experiences.

Market Challenges Analysis

Supply Chain Limitations and Dependence on Imports

The Latin America Asia Cuisine Market faces challenges due to reliance on imported ingredients like seaweed, spices, and specialty sauces. Supply chain disruptions impact cost stability and availability. Regional logistics often lack the infrastructure needed to maintain freshness of perishable goods. Currency fluctuations increase import expenses, making pricing less competitive. It struggles with delays caused by trade policies and customs processes. Small local producers find it difficult to match authentic Asian flavors, limiting options. Dependency on global suppliers restricts growth potential in emerging cities. Consumer access is uneven, favoring only urban areas with strong distribution.

Cultural Adaptation and Consumer Acceptance Barriers

Adapting traditional Asian recipes to align with local taste preferences remains complex. Consumers sometimes perceive flavors like soy, miso, or wasabi as too strong or unfamiliar. The Latin America Asia Cuisine Market addresses this by creating hybrid menus but authenticity often gets diluted. Limited knowledge of preparation techniques among local chefs also restricts menu diversity. Restaurants must invest heavily in training and sourcing to maintain quality. Marketing strategies face resistance when consumers view Asian meals as premium or occasional rather than mainstream. It continues to balance cultural authenticity with broader acceptance. Price sensitivity also challenges expansion beyond high-income segments.

Market Opportunities

Expansion of Retail and E-Commerce Distribution Channels

Retail chains and online platforms provide strong opportunities for expanding product reach. The Latin America Asia Cuisine Market leverages supermarkets and e-grocery services to enhance visibility. Specialty aisles dedicated to Asian ingredients increase household familiarity. E-commerce enables wider access to sauces, snacks, and ready meals in remote areas. Partnerships with digital platforms also allow targeted promotions. It benefits from rising adoption of home delivery among urban families. Growth in cross-border trade agreements also simplifies product availability. This creates long-term potential for deeper consumer penetration.

Growing Demand for Premium and Authentic Dining Experiences

Rising middle-class incomes and cultural openness foster opportunities for premium Asian restaurants. The Latin America Asia Cuisine Market gains momentum from high-end sushi bars and Korean barbecue outlets. Consumers seek authentic experiences with imported ingredients and certified chefs. Tourism growth adds demand for fine-dining experiences showcasing Asian culture. It thrives in metropolitan hubs where global food scenes are celebrated. Celebrity endorsements and culinary events further elevate brand visibility. Younger demographics show willingness to pay more for quality and authenticity. The focus on premium positioning creates new avenues for differentiation and sustained growth.

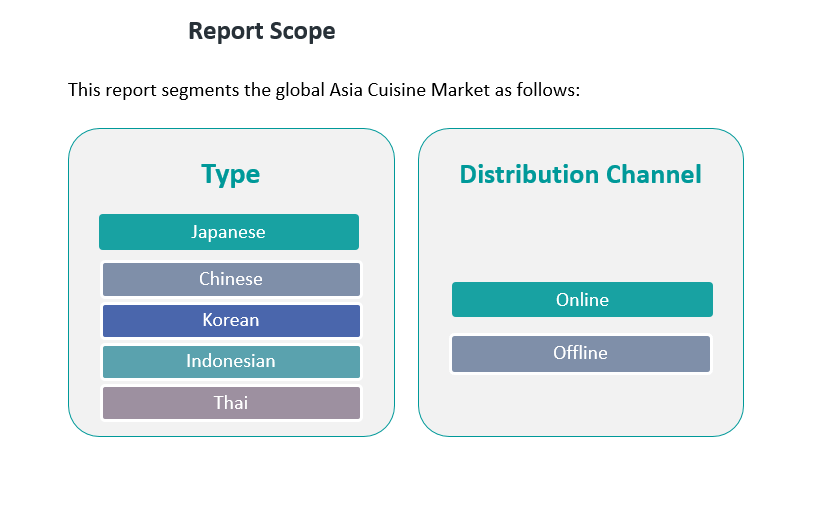

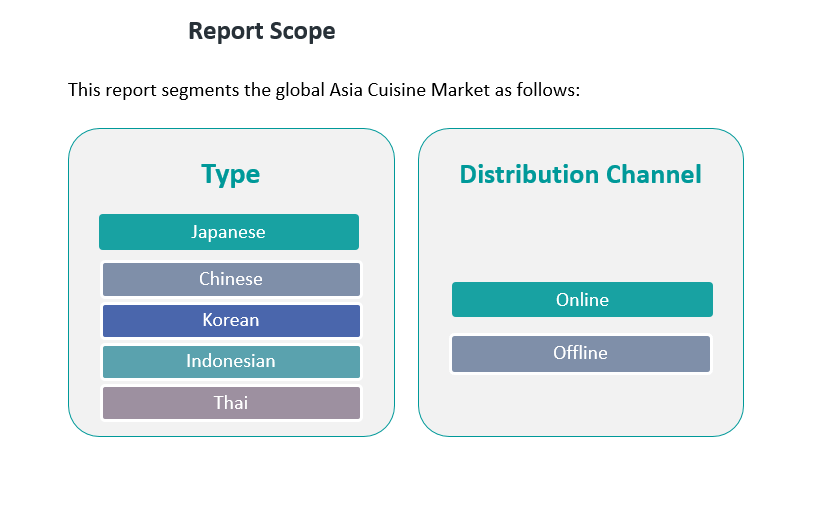

Market Segmentation Analysis

By Type

Japanese cuisine leads the Latin America Asia Cuisine Market with strong consumer demand for sushi, ramen, and seafood-based dishes. Chinese cuisine also holds a significant share, supported by its wide availability and adaptability to local preferences. Korean cuisine is gaining traction with rising interest in Korean barbecue, kimchi, and spicy flavors, particularly among younger demographics influenced by cultural media. Indonesian cuisine is gradually expanding through niche restaurants and specialty dishes, while the “Others” segment, including Thai and Vietnamese food, strengthens diversity and caters to adventurous consumers. It continues to grow through both premium dining and packaged food products that expand accessibility.

- For example, Sushi Itto, a leading Japanese restaurant chain in Mexico, has consistently introduced innovative sushi rolls to engage diverse consumer preferences. As of October 2024, the brand operated 41 locations across Mexico City, with its extensive menu expansion documented on the official Sushi Itto website and verified delivery platforms.

By Distribution Channel

Offline channels dominate the Latin America Asia Cuisine Market through restaurants, food courts, and supermarkets that provide both dining experiences and packaged goods. Quick-service restaurants and fine-dining outlets play a critical role in building consumer familiarity and brand recognition. Supermarkets and specialty stores increase household access to sauces, noodles, and ready-to-eat meals. Online channels are expanding quickly, supported by food delivery platforms and e-commerce services that enhance availability beyond major cities. Growth in digital platforms allows smaller brands to reach broader audiences and diversify offerings. It leverages the increasing role of technology and convenience in shaping purchasing decisions.

- For example, in April 2025, Chipotle Mexican Grill announced its first foray into Latin America through a development agreement with Alsea. In partnership with the leading Latin American restaurant operator, Chipotle plans to open its first restaurant in Mexico by early 2026, with intentions to explore further expansion in the region.

Segmentation

By Type

- Japanese

- Chinese

- Korean

- Indonesian

- Others

By Distribution Channel

Regional Analysis

Brazil and Southern Cone

Brazil leads the Latin America Asia Cuisine Market with a 36% share, driven by a strong urban base and rising middle-class spending power. Major cities such as São Paulo and Rio de Janeiro support growth with diverse restaurant chains, sushi bars, and premium dining outlets. Argentina follows with a 15% share, supported by cultural openness to international cuisines and strong retail penetration. Chile holds a 9% share, benefiting from high per capita income and a mature dining culture. The region thrives on increasing tourism, which accelerates demand for authentic Asian food experiences. It grows through both fine dining and quick-service outlets that attract wide consumer groups. Demand for premium Japanese and Chinese cuisine remains particularly strong in these markets.

Andean Region

Peru accounts for a 12% share of the Latin America Asia Cuisine Market, with Lima recognized for its vibrant fusion cuisine blending Japanese and Peruvian styles. Colombia holds a 10% share, supported by rapid urbanization and the presence of Asian franchises in Bogotá and Medellín. Both markets are expanding due to rising consumer demand for fusion dining and specialty products. Retail chains and supermarkets in these countries strengthen household access to packaged Asian sauces and frozen foods. Culinary schools and food festivals in Peru and Colombia further enhance awareness of authentic cooking methods. It benefits from younger demographics eager to explore international flavors. Growth opportunities remain strong for both casual dining and premium formats across the Andean region.

Rest of Latin America

The Rest of Latin America collectively represents an 18% share of the Latin America Asia Cuisine Market, covering Central American countries and smaller economies in the region. Mexico City plays a key role in expanding awareness of Asian cuisine through a mix of street food and high-end outlets. Central American nations experience growth through digital platforms and increasing supermarket offerings. Rising tourism in Caribbean markets also introduces stronger demand for Japanese and Chinese cuisine. It sees momentum through e-commerce platforms that improve access to imported sauces, noodles, and packaged foods. While smaller in size compared to leading subregions, this segment is building growth through targeted investment and expanding consumer acceptance. Emerging cities offer a strong base for future development of Asian dining concepts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panda Express

- Noodles & Company

- Pei Wei Asian Diner

- The Cheesecake Factory

- Nestlé

- Conagra Brands

- Taco Bell

- McCormick & Company Inc.

- Moods Hospitality Pvt Ltd.

- JFC

Competitive Analysis

The Latin America Asia Cuisine Market features a mix of global chains, regional operators, and packaged food manufacturers competing for consumer attention. Panda Express, Noodles & Company, and Pei Wei Asian Diner expand their footprints in urban centers with quick-service models tailored to local preferences. The Cheesecake Factory integrates Asian-inspired dishes within broader menus, capturing demand for fusion offerings. Nestlé and Conagra Brands strengthen packaged food presence with ready-to-cook Asian products, ensuring household penetration beyond restaurant dining. Taco Bell experiments with Asian flavor profiles, appealing to younger demographics. McCormick & Company supports the market through sauces and condiments, while Moods Hospitality Pvt Ltd and JFC drive restaurant-led expansion. The Latin America Asia Cuisine Market thrives on strong competition across both online and offline channels. Companies invest in menu localization, marketing campaigns, and digital delivery partnerships to strengthen brand recall. It witnesses an increasing shift toward premium and authentic positioning, with global players introducing Japanese, Chinese, and Korean specialties. Regional players differentiate through fusion recipes blending local ingredients with Asian techniques. The competitive landscape continues to evolve through innovation, franchising, and expansion into secondary cities. It highlights a dynamic balance between global brand strength and local adaptability.

Recent Developments

- In September 2025, Aramark Collegiate Hospitality expanded its culinary partnership with celebrity chef Grace Ramirez. This move introduced new bold Latin flavors to campus dining services, bringing authentic Latin American and Asian fusion cuisine menus to several U.S. university campuses—strengthening cross-regional cuisine trends and cultural authenticity.

- In August 2025, Wismettac Asian Foods, Inc. expanded its footprint in the Latin American Asian cuisine market through a strategic partnership with Toyo in Mexico. This collaboration leverages Toyo’s strong local presence and established reputation in distributing Asian food products, aiming to boost operations and deliver greater value to customers and partners across Mexico.

- In May 2025, Chinese digital giant Meituan revealed plans to launch its food delivery service “Keeta” in Brazil. This entry into the Latin American market brings expanded access to Asian cuisine offerings and supports Meituan’s ambition to broaden the reach of Asian food through digital platforms, catering to Brazil’s growing demand for ethnic and fusion food delivery.

- In April 2025, Chipotle signed a development agreement with Alsea, a prominent restaurant operator in Latin America and Europe, to open its first restaurants in Mexico. The first Mexican location is expected to open in early 2026.

Report Coverage

The research report offers an in-depth analysis based on Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Latin America Asia Cuisine Market will experience stronger consumer adoption driven by cultural openness and global food exposure.

- Expansion of quick-service restaurants and fine-dining outlets will diversify growth opportunities across metropolitan and secondary cities.

- Rising demand for fusion dishes blending Asian and Latin flavors will shape innovative menu strategies.

- Growth in online delivery platforms and e-grocery channels will accelerate accessibility for both meals and packaged products.

- Premium positioning of Japanese and Korean cuisine will attract middle- and high-income demographics seeking authentic dining.

- Packaged and ready-to-eat Asian food categories will continue expanding in supermarkets and convenience stores.

- Culinary schools and cultural events will strengthen awareness and encourage long-term skill development in authentic cooking methods.

- Stronger investments from multinational players will stimulate franchising models and broaden regional market penetration.

- Tourism and inbound migration will increase demand for authentic offerings in hospitality and travel-linked dining outlets.

- The market will evolve through localization strategies balancing authenticity with regional preferences to sustain long-term growth.