Market Overview

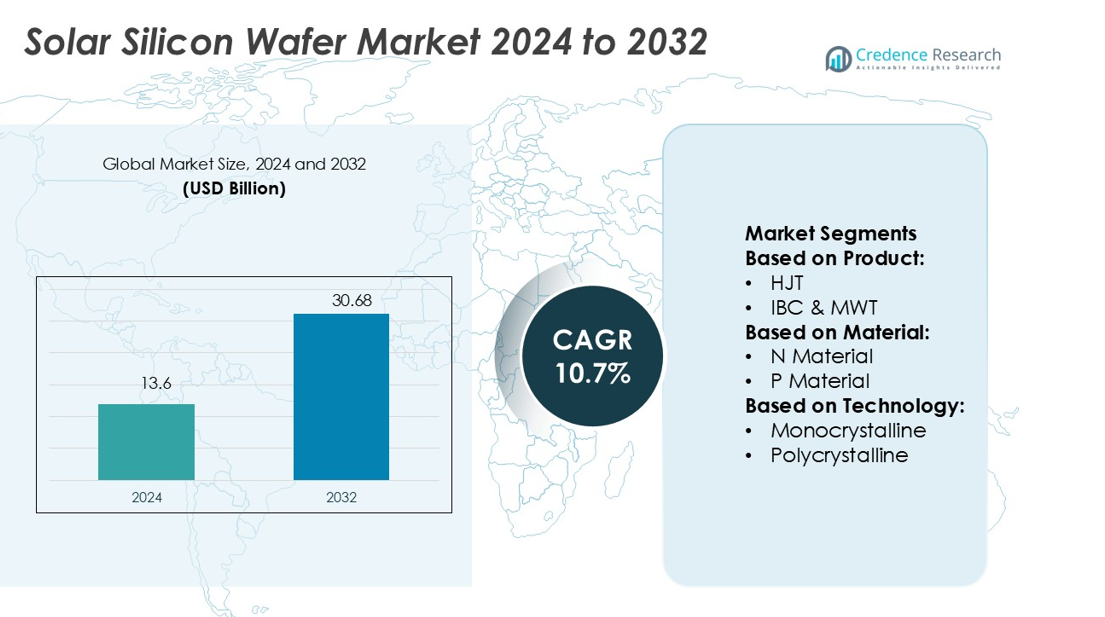

Solar Silicon Wafer Market size was valued USD 13.6 billion in 2024 and is anticipated to reach USD 30.68 billion by 2032, at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar Silicon Wafer Market Size 2024 |

USD 13.6 billion |

| Solar Silicon Wafer Market, CAGR |

10.7% |

| Solar Silicon Wafer Market Size 2032 |

USD 30.68 billion |

The solar silicon wafer market is driven by prominent players including Meyer Burger, Hanwha Q Cells, REC Solar Holdings, JA SOLAR Technology, RENESOLA, Jinko Solar, DuPont, JINERGY, Hevel, and MOTECH Industries. These companies focus on advancing high-efficiency wafer technologies such as PERC, TOPCON, and HJT to strengthen their competitive edge. Asia-Pacific leads the global market with a commanding 42% share, supported by large-scale production capacity, cost-effective manufacturing, and robust supply chains led by China, Japan, and India. The region’s dominance reflects strong government support, rising solar capacity installations, and continuous investments in next-generation wafer technologies.

Market Insights

- The Solar Silicon Wafer Market was valued at USD 13.6 billion in 2024 and is projected to reach USD 30.68 billion by 2032, growing at a CAGR of 10.7%.

- Market growth is driven by rising demand for high-efficiency modules such as PERC and TOPCON, supported by government incentives and large-scale solar projects across key economies.

- A notable trend is the increasing adoption of N-type wafers and advanced technologies like HJT, which offer higher efficiency, reduced degradation, and compatibility with next-generation solar cells.

- Competitive activity is intense, with leading players focusing on cost optimization, material innovation, and global partnerships, while restraints include high manufacturing costs and raw material supply volatility.

- Asia-Pacific dominates the market with 42% share, followed by Europe at 24% and North America at 22%, while monocrystalline wafers lead the technology segment with over 60% share, reinforcing their position as the preferred choice in global installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the solar silicon wafer market, the PERC/PERL/PERT/TOPCON segment leads with over 40% share. Its dominance stems from higher cell efficiency, lower degradation rates, and strong adoption in utility-scale solar projects. Manufacturers increasingly prefer these wafers for their superior performance in varying temperature conditions, making them more reliable than BSF and other traditional technologies. Continuous R&D investments and the push for cost-effective energy conversion drive growth. The segment also benefits from favorable policies encouraging high-efficiency solar modules, further cementing its market position over alternatives like HJT and IBC.

- For instance, Meyer Burger’s heterojunction SmartWire modules reached 21.8% efficiency in production, with individual panels delivering up to 430 W output, reflecting clear performance gains from advanced wafer technologies.

By Material

Crystalline wafers dominate this segment with more than 65% share due to their high efficiency and long-term reliability. Crystalline silicon remains the preferred choice across large-scale solar installations because of its proven stability and mature production infrastructure. N-type material is gaining traction for premium modules, while thin-film technologies see demand in specialized applications. However, crystalline materials continue to outperform on cost-to-efficiency ratios, keeping them the primary material choice. Strong supply chain integration and high-volume manufacturing support crystalline wafers in maintaining leadership, even as alternative materials seek to expand market presence.

- For instance, Hanwha Q Cells has developed different technologies to improve the performance of its crystalline wafer-based modules. Q.PEAK DUO XL-G11.3 module, based on Q.ANTUM DUO technology, achieved module outputs of up to 590 W with efficiencies reaching 21.7%.

By Technology

Monocrystalline technology holds the dominant share, exceeding 60%, driven by its superior efficiency and compact design. The technology is widely adopted in residential, commercial, and utility-scale projects due to better power output per unit area compared to polycrystalline. Falling production costs and advancements in diamond wire sawing have enhanced its competitiveness. Polycrystalline wafers still serve cost-sensitive markets but face declining demand as efficiency expectations rise. Thin-film options such as cadmium telluride and CIGS maintain niche roles in flexible or space-constrained applications. Monocrystalline’s scalability and consistent technological improvements secure its ongoing dominance.

Market Overview

Rising Demand for High-Efficiency Modules

The global shift toward renewable energy drives strong demand for high-efficiency solar modules. Solar silicon wafers with advanced technologies like PERC and TOPCON deliver higher conversion rates, making them critical for large-scale solar farms and residential rooftops. Governments incentivize energy efficiency through subsidies and renewable targets, boosting adoption. Declining costs of high-performance wafers also make them attractive for investors and developers. As countries accelerate clean energy transitions, the demand for efficient wafers ensures consistent market expansion and long-term growth.

- For instance, REC Solar Holdings introduced its Alpha Pure-R modules based on heterojunction cell technology, achieving outputs up to 430 W with a module efficiency of 22.3%, strengthening their position in the high-efficiency module segment.

Expansion of Utility-Scale Solar Projects

Utility-scale projects are a major growth driver in the solar silicon wafer market. Countries such as China, India, and the U.S. are investing heavily in large solar farms to meet carbon reduction goals. High-capacity installations require durable and efficient wafers to maximize output and lower the levelized cost of electricity. Technological improvements enable wafers to operate effectively in diverse climates, supporting global adoption. The surge in capacity additions and government-backed power purchase agreements strengthens wafer demand, ensuring sustained growth in the sector.

- For instance, JA SOLAR Technology’s DeepBlue 4.0 Pro modules are built on its high-efficiency Bycium+ n-type TOPCon cells. The latest 72-cell versions of these modules deliver power outputs of up to 650 W with conversion efficiencies reaching 23.3%, making them well-suited for utility-scale projects.

Technological Advancements in Wafer Manufacturing

Innovations in wafer manufacturing significantly boost market growth by lowering costs and improving efficiency. Techniques such as diamond wire sawing and thinner wafer designs reduce material waste while maintaining durability. Manufacturers increasingly invest in automation and AI-driven quality control to enhance output consistency. These advancements improve scalability, allowing production to meet rising global solar demand. Enhanced wafer technologies also enable integration with next-generation cell designs, such as heterojunction and tandem cells. As efficiency standards rise, technological progress remains a cornerstone of market competitiveness and expansion.

Key Trends & Opportunities

Shift Toward N-Type Wafers

N-type wafers are gaining momentum as they offer higher efficiency, reduced degradation, and longer operational lifespans compared to P-type alternatives. Companies are shifting R&D toward large-scale N-type production, aligning with premium solar module demand. Their compatibility with advanced architectures such as TOPCON and HJT further enhances adoption prospects. With global investors focusing on durable, high-performance solar technologies, N-type wafers create strong opportunities for manufacturers. As costs decline and production scales up, N-type wafers are expected to capture a growing share of the market.

- For instance, Jinko Solar developed its Tiger Neo N-type modules using TOPCon technology. Specific models in the series have delivered power outputs of up to 635 W and have been used in large-scale utility projects.

Integration of Solar in Emerging Applications

The solar silicon wafer market sees opportunities from expanding applications beyond traditional power generation. Building-integrated photovoltaics (BIPV), smart cities, and agricultural solar projects are fueling demand for tailored wafer solutions. Flexible and high-efficiency wafers allow developers to design innovative products like solar rooftops, facades, and off-grid installations. This integration supports governments’ net-zero goals while diversifying revenue streams for manufacturers. As consumer awareness and corporate sustainability initiatives grow, these emerging applications provide significant long-term opportunities for wafer producers to expand into niche markets.

- For instance, MOTECH Industries has developed bifacial modules based on its high-efficiency N-type TOPCon and HJT cells. The company has a diverse product portfolio, including older mono PERC modules with outputs up to 540 W, while its more advanced modules have significantly higher outputs and efficiencies.

Key Challenges

High Manufacturing and Capital Costs

Despite efficiency gains, solar wafer manufacturing remains capital-intensive. Setting up advanced production facilities requires significant investment in equipment and skilled labor. Smaller companies often face barriers in scaling operations, limiting competition and consolidating market power among major players. Additionally, the costs of transitioning from P-type to advanced N-type wafers remain high, slowing adoption in cost-sensitive regions. Although government subsidies provide relief, sustained profitability depends on reducing production expenses. Manufacturers must balance innovation with cost efficiency to remain competitive in a price-driven market.

Raw Material Supply Constraints

The market faces challenges from fluctuations in polysilicon supply, a critical raw material for wafer production. Supply chain disruptions, geopolitical tensions, and trade restrictions can drive up costs and delay manufacturing cycles. Polysilicon price volatility directly affects wafer prices, reducing margins for producers and raising project costs for end users. Dependence on a few global suppliers further intensifies the risk of shortages. To address this, companies explore recycling methods and alternative materials, but reliance on stable polysilicon supply remains a pressing challenge for the industry.

Regional Analysis

North America

North America holds 22% share of the solar silicon wafer market, driven by strong adoption in the U.S. Utility-scale solar projects dominate installations, supported by federal tax credits and state-level renewable portfolio standards. The region benefits from advanced R&D, with companies investing in high-efficiency monocrystalline and N-type wafers. Increasing demand from residential and commercial rooftop installations also supports growth. However, reliance on imported wafers and polysilicon supply disruptions pose challenges. Despite this, expanding solar infrastructure, coupled with the U.S. Inflation Reduction Act incentives, strengthens North America’s position as a key growth hub in the global market.

Europe

Europe accounts for 24% of the market share, with Germany, Spain, and France leading adoption. The region’s ambitious renewable energy targets and strict carbon neutrality goals drive wafer demand across both residential and utility sectors. Investments in high-efficiency technologies such as TOPCON and HJT wafers are growing as governments push for energy optimization. Strong manufacturing support from European firms and partnerships with Asian suppliers also enhance supply stability. However, cost pressures and competition from imported wafers remain significant challenges. Europe’s commitment to green transition ensures continuous demand, positioning it as a critical market for wafer innovation.

Asia-Pacific

Asia-Pacific dominates the solar silicon wafer market with 42% share, led by China, Japan, and India. China’s large-scale production capacity and leadership in wafer manufacturing secure its global dominance. India’s ambitious solar expansion targets and Japan’s adoption of high-efficiency modules further drive regional growth. Low production costs, strong government subsidies, and robust supply chains enhance competitiveness. Companies in the region focus heavily on monocrystalline and N-type wafers to support domestic and export markets. Asia-Pacific remains the fastest-growing region due to rising energy demand, supportive policies, and aggressive capacity expansions, cementing its leadership in global wafer production.

Latin America

Latin America captures 6% share of the solar silicon wafer market, with Brazil, Chile, and Mexico at the forefront. The region benefits from favorable solar irradiation and supportive regulatory frameworks promoting renewable energy adoption. Brazil leads with distributed solar generation, while Chile invests heavily in utility-scale projects. Demand for efficient monocrystalline wafers is rising as investors seek to maximize output. However, economic volatility and high project financing costs challenge growth. Partnerships with Asian suppliers and regional investments in solar infrastructure strengthen the outlook. Latin America’s untapped potential makes it an emerging growth region for solar wafer demand.

Middle East & Africa

The Middle East & Africa hold 6% share, with solar growth concentrated in the UAE, Saudi Arabia, and South Africa. The region’s abundant solar resources drive large-scale utility projects, particularly in desert areas. Governments invest in diversifying energy portfolios, reducing dependence on fossil fuels. Wafer demand is growing as countries develop solar farms under long-term renewable energy strategies. However, limited local manufacturing capacity increases reliance on imports from Asia. Despite challenges, large-scale initiatives like Saudi Arabia’s Vision 2030 solar projects are expanding opportunities, ensuring steady growth and positioning the region as a rising player in global adoption.

Market Segmentations:

By Product:

By Material:

By Technology:

- Monocrystalline

- Polycrystalline

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The solar silicon wafer market features strong competition among leading players such as Meyer Burger, Hanwha Q Cells, REC Solar Holdings, JA SOLAR Technology, RENESOLA, Jinko Solar, DuPont, JINERGY, Hevel, and MOTECH Industries. The solar silicon wafer market is characterized by intense competition, with companies focusing on efficiency improvements, cost reduction, and advanced manufacturing technologies. Continuous innovation in PERC, TOPCON, and heterojunction wafers drives product differentiation, enabling higher conversion rates and enhanced reliability. Strong emphasis on R&D, automation, and scalable production facilities supports growth and global competitiveness. Partnerships, mergers, and regional expansions are common strategies to strengthen market share and access emerging demand centers. Additionally, integration of sustainable practices and recycling methods is gaining momentum, aligning the industry with global renewable energy and carbon reduction goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2025, Chinese solar module manufacturer JinkoSolar Holding Co Ltd announced that it has achieved a conversion efficiency of 33.84% for its N-type TOPCon-based perovskite tandem solar cell, surpassing the previous record of 33.24%.

- In January 2025, ITI Limited issued a tender for the establishment of a 500 MW fully automated solar photovoltaic (SPV) module manufacturing line on a turnkey basis.

- In August 2024, Tongwei launched the TNC-G12/G12R series modules marked a significant industry milestone. These modules offer superior power output, efficiency, and quality, leveraging its proprietary solar cell technology and setting a new benchmark for high-performance solar solutions.

- In April 2024, Adani Group initiated commercial production of wafers and ingots essential for solar power cells at its facility in Gujarat. This move is part of a broader strategy to enhance its renewable energy capabilities, aiming to generate 45 gigawatts (GW) of renewable power by 2030, with a significant portion coming from its Khavda Renewable Energy Park in Gujarat.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of high-efficiency wafer technologies like TOPCON and HJT.

- N-type wafers will gain stronger traction due to higher performance and longer lifespan.

- Demand from utility-scale solar projects will continue to drive large wafer production.

- Technological advancements will reduce production costs and improve scalability.

- Recycling and circular economy practices will play a bigger role in wafer manufacturing.

- Integration of solar wafers into smart cities and BIPV projects will expand applications.

- Asia-Pacific will remain the dominant hub for wafer manufacturing and exports.

- Policy support and renewable energy targets will accelerate global solar wafer demand.

- Competition will intensify with companies focusing on efficiency and material innovation.

- The market will benefit from growing investments in sustainable energy infrastructure worldwide.