Market Overview:

The UAE Asia Cuisine Market size was valued at USD 3.24 million in 2018 to USD 3.36 million in 2024 and is anticipated to reach USD 4.45 million by 2032, at a CAGR of 3.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UAE Asia Cuisine Market Size 2024 |

USD 3.36 Million |

| UAE Asia Cuisine Market, CAGR |

3.56% |

| UAE Asia Cuisine Market Size 2032 |

USD 4.45 Million |

The market is driven by the increasing popularity of Asian cuisines among both expatriates and local populations. A diverse demographic mix, rising disposable incomes, and a thriving tourism industry create strong demand for authentic Asian dining experiences. Growing influence of global food trends and the availability of specialty ingredients in retail channels further support expansion. Online delivery platforms enhance accessibility and convenience, boosting growth across different consumer groups.

Regionally, Dubai leads due to its international hospitality industry, multicultural environment, and strong presence of premium restaurants. Abu Dhabi follows with rising demand supported by luxury hotels and corporate dining culture. Sharjah and other northern emirates show steady progress, driven by affordable outlets and increasing online penetration. These regions attract families and younger consumers seeking value-oriented dining experiences. Tourism, expatriate diversity, and cultural openness across the UAE continue to shape market dynamics and fuel adoption of Asian cuisines.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UAE Asia Cuisine Market size was USD 3.24 million in 2018, USD 3.36 million in 2024, and is projected to reach USD 4.45 million by 2032, growing at a CAGR of 3.56%.

- Rising popularity of Asian cuisines among expatriates and locals is driving higher consumption.

- Tourism and hospitality industries continue to stimulate demand for premium Asian dining experiences.

- Supply chain challenges and cultural barriers limit wider penetration across some consumer segments.

- Dubai dominates the market, supported by its global dining culture and diverse demographics.

- Abu Dhabi shows strong growth momentum, backed by corporate dining and luxury hospitality.

- Sharjah and northern emirates provide emerging opportunities, fueled by affordable dining and online ordering.

Market Drivers

Growing Influence of Expatriate Communities and Diverse Consumer Preferences

The UAE Asia Cuisine Market is fueled by the presence of a highly diverse expatriate population seeking authentic Asian flavors. Strong demand comes from communities with established culinary traditions and from locals interested in global food trends. It benefits from multiculturalism, which encourages restaurants and packaged food companies to diversify menus. The steady inflow of tourists further raises demand for premium Asian dining. Quick-service restaurants capture younger demographics seeking affordable yet authentic meals. Fine dining caters to luxury travelers and business professionals. Retail outlets expand access through sauces, condiments, and ready-to-cook meals. A wide demographic mix continues to drive steady adoption.

- For instance, Jollibee, the Filipino fast-food giant, operated 24 outlets across the UAE as of May 2024, serving communities in Dubai, Abu Dhabi, Al Ain, Sharjah, Ajman, and Ras Al-Khaimah, according to Jollibee’s official UAE website and regionally published business news.

Expanding Role of Tourism and Hospitality in Culinary Growth

Tourism plays a central role in advancing the UAE Asia Cuisine Market, with Dubai and Abu Dhabi hosting millions of international visitors each year. Hotels and resorts invest in Asian-themed restaurants to attract tourists seeking familiar flavors. It also benefits from the hosting of global events, where Asian cuisine is highlighted as part of cultural diversity. Culinary festivals supported by government initiatives promote broader acceptance of Japanese, Chinese, and Thai food. Food delivery platforms amplify reach by serving tourists and residents alike. Franchise partnerships enable rapid scaling of Asian dining outlets across prime locations. Growing airline catering services also include Asian dishes, extending exposure further. Tourism-driven expansion continues to fuel steady growth momentum.

- For instance, Zuma Dubai was ranked No. 19 in Middle East & North Africa’s 50 Best Restaurants 2025, as published by The World’s 50 Best Restaurants, confirming its positioning as a regional leader in Japanese and Asian gastronomy.

Innovation in Food Delivery Platforms and Digital Ordering Systems

Digitalization shapes consumer behavior in the UAE Asia Cuisine Market, particularly through advanced delivery platforms. Online food apps have simplified access to Japanese sushi, Korean barbecue, and Chinese noodles. It allows small and mid-sized restaurants to reach broader audiences without heavy infrastructure investment. Discounts, loyalty programs, and personalized recommendations strengthen customer engagement. Integration of AI-enabled platforms boosts operational efficiency and delivery speed. Cloud kitchens optimize resource use and cater to changing consumer demand patterns. Rising smartphone penetration ensures a larger digital customer base. Technology-driven accessibility reshapes how consumers engage with Asian cuisines across the UAE.

Shifting Consumer Lifestyles and Health-Focused Dining Preferences

Consumer lifestyles are evolving, creating opportunities in the UAE Asia Cuisine Market. Younger populations and health-conscious consumers increasingly prefer lighter Asian meals featuring fresh ingredients and balanced nutrition. It aligns with the popularity of Japanese and Thai dishes known for their low-fat and high-protein content. Restaurants adapt menus with vegan, vegetarian, and gluten-free options. Retail companies expand packaged products to include healthy snacks and condiments. Corporate dining preferences also shift toward Asian meals for wellness and variety. Wellness-linked marketing campaigns enhance brand appeal among urban professionals. A growing awareness of health impacts sustains steady demand for balanced Asian cuisines.

Market Trends

Expansion of Culinary Festivals and Government-Backed Food Promotions

Food festivals have become a strong trend shaping the UAE Asia Cuisine Market. Events like the Dubai Food Festival showcase authentic Asian dining experiences to international and local audiences. It highlights Japanese, Chinese, and Korean flavors through curated experiences and promotions. Government-backed collaborations with trade centers bring exclusive products to retail shelves. These festivals raise awareness and attract new consumers toward Asian brands. Partnerships with hotels and malls ensure broad exposure. Seasonal campaigns create recurring excitement for Asian food. Cultural festivals will continue to support this long-term trend.

- For example, The Dubai Food Festival 2024 ran from April 19 to May 12, featuring 769 restaurants, including 56 venues recognized by MICHELIN and Gault&Millau, highlighting the city’s diverse culinary landscape.

Rising Adoption of Fusion Cuisine and Menu Innovation Across Outlets

Fusion dining has gained prominence in the UAE Asia Cuisine Market, catering to adventurous and diverse consumers. Restaurants experiment with blending Asian flavors with Middle Eastern or Western elements. It helps differentiate menus in a highly competitive market. Creative dishes such as sushi burritos, kimchi burgers, and Asian-spiced shawarma capture younger audiences. Chefs incorporate modern cooking methods to appeal to premium customers. Retail brands also release innovative packaged products combining flavors across cuisines. Social media exposure boosts acceptance of experimental menu items. Innovation drives continuous consumer engagement in urban markets.

- For example, Carrefour operates more than 100 stores in Dubai and 175 across the UAE, offering a wide range of international grocery products including Asian sauces, ready-to-eat meals, and specialty ingredients.

Growth of Retail Penetration and Supermarket Offerings of Asian Products

Retail expansion remains a defining trend for the UAE Asia Cuisine Market, with supermarkets and hypermarkets increasing their range of Asian products. It supports household cooking with authentic sauces, condiments, and frozen ready-to-eat meals. Retail shelves prominently feature Japanese miso, Chinese dumplings, and Thai curry pastes. Private labels compete by offering affordable alternatives to premium imports. E-commerce adds another dimension, where specialty products reach niche audiences. Promotional campaigns attract both expatriates and locals to explore Asian flavors at home. Retail growth ensures Asian cuisine becomes part of everyday consumption patterns.

Technology Integration in Restaurant Operations and Customer Engagement

Restaurants in the UAE Asia Cuisine Market adopt technology to improve service quality and efficiency. Automated kitchen systems accelerate preparation times while reducing costs. It enhances consistency and allows outlets to manage high customer flows. Digital kiosks improve ordering speed and reduce wait times. Loyalty apps reward frequent visitors and improve retention. Restaurants also integrate AR menus and QR codes for immersive experiences. Data analytics helps operators understand customer preferences and adapt offerings. Technology investment keeps reshaping consumer interactions with Asian dining outlets across the UAE.

Market Challenges Analysis

High Operational Costs and Intense Competition in Food Service Industry

High operational expenses present a challenge to the UAE Asia Cuisine Market. Prime retail spaces in Dubai and Abu Dhabi command premium rents, impacting profitability for restaurants. It raises barriers for smaller operators competing against global chains with stronger financial backing. Intense competition among Japanese, Chinese, and Korean outlets reduces pricing flexibility. Rising labor costs and the need for skilled chefs add further pressure. Supply chain expenses for imported specialty ingredients increase financial strain. Market saturation in premium malls creates limited room for new entrants. Differentiation strategies become essential for survival in this competitive setting.

Supply Chain Reliance on Imports and Cultural Barriers to Wider Acceptance

Heavy reliance on imports creates vulnerabilities for the UAE Asia Cuisine Market. It depends on consistent availability of fresh seafood, spices, and specialty items sourced from Asia. Disruptions in logistics or trade restrictions can cause shortages and price volatility. Limited local production adds to the dependency on external suppliers. Cultural barriers also restrict wider acceptance among certain consumer groups less familiar with Asian flavors. Perceptions of taste unfamiliarity or dietary differences can slow growth in specific demographics. Restaurants must invest in education and awareness campaigns to address these challenges. Until these factors are managed, adoption across all regions will face constraints.

Market Opportunities

Expansion of Mid-Tier and Quick-Service Asian Outlets Targeting Price-Sensitive Consumers

Opportunities lie in expanding mid-tier and quick-service formats within the UAE Asia Cuisine Market. Affordable outlets can attract young professionals, students, and families seeking authentic yet cost-effective meals. It addresses demand in Sharjah and northern emirates, where price-sensitive segments dominate. Franchise models accelerate growth by reducing risks for investors. Cloud kitchens allow expansion with lower overhead costs. Broader menus with customized options increase appeal. Accessible pricing widens the consumer base significantly.

Rising Scope of Retail Distribution and Packaged Product Diversification

Retail distribution of Asian products offers another opportunity for the UAE Asia Cuisine Market. Expanding supermarket presence of noodles, sauces, and frozen meals broadens reach. It allows households to replicate restaurant-style dishes at home with convenience. Demand for healthier packaged foods such as low-sodium soy sauces and organic condiments supports growth. Partnerships between retailers and international brands enhance product visibility. E-commerce adds further opportunity to capture niche consumers. Packaged food diversification ensures long-term expansion beyond restaurants.

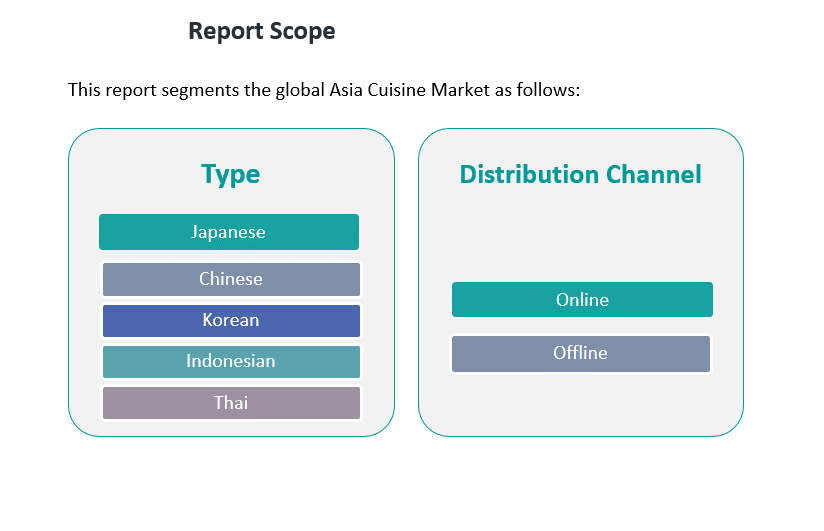

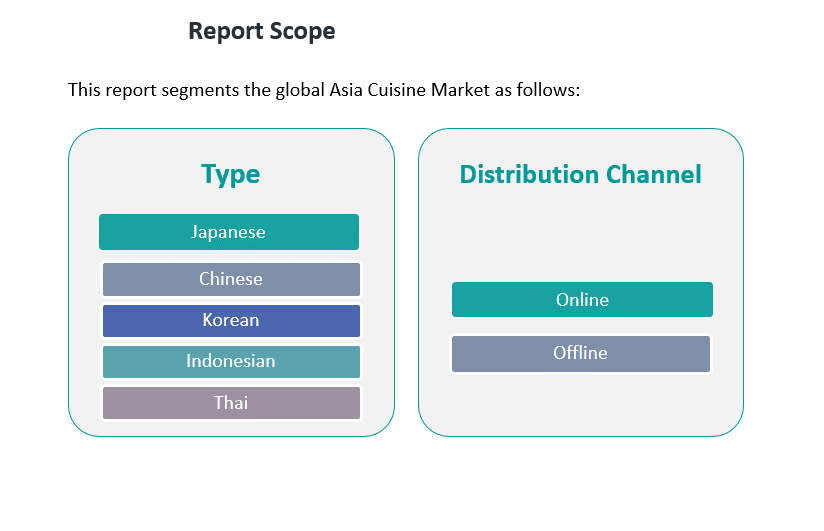

Market Segmentation Analysis

By Type

The UAE Asia Cuisine Market is segmented into Japanese, Chinese, Korean, Indonesian, and Others. Japanese cuisine holds strong traction due to the popularity of sushi and ramen among both locals and expatriates. Chinese cuisine remains a dominant category supported by a wide presence of restaurants and packaged products. Korean cuisine is expanding rapidly, driven by the rising influence of Korean culture and demand for kimchi, barbeque, and fusion dishes. Indonesian cuisine is gradually gaining visibility through specialty restaurants and cultural events. The Others category, including Thai and Vietnamese, attracts health-conscious consumers seeking fresh and aromatic flavors.

- For instance, Kimura-ya, a popular Japanese restaurant in Dubai, introduced four SoftBank robot servers in June 2025, which have improved staff efficiency and fast-tracked service, with plans for further technological expansion in the region.

By Distribution Channel

The UAE Asia Cuisine Market is classified into online and offline distribution channels. Online platforms are growing steadily, supported by the widespread adoption of food delivery apps and e-commerce portals offering packaged Asian foods. It benefits from a young digital-savvy population and rising convenience demand. Offline distribution continues to dominate due to strong restaurant culture, supermarkets, and specialty outlets providing authentic dining experiences. It remains significant because of high tourist footfall and consumer preference for experiential dining. The balance between online expansion and offline dominance ensures broad accessibility for diverse consumer groups.

- For instance, in April 2025, Choithrams UAE launched the Thai Fruits & Food Festival across 12 outlets, supported by the Thai Trade Center Dubai and the Department of International Trade Promotion, featuring discounts of up to 25% on Thai food and fruit products.

Segmentation

By Type

- Japanese

- Chinese

- Korean

- Indonesian

- Others

By Distribution Channel

Regional Analysis

Dubai

Dubai holds the largest share of the UAE Asia Cuisine Market with 46%. The city benefits from its diverse expatriate population and strong tourism inflow, driving demand for authentic Asian dining experiences. Premium Japanese and Chinese restaurants dominate the high-end dining landscape, while casual outlets and food courts provide accessible options for middle-income consumers. It also benefits from being a hub for food delivery services, where online orders for sushi, noodles, and dim sum are high. Government-backed culinary events and global food festivals further promote Asian cuisine. The city’s reputation as a global hospitality hub sustains its market leadership.

Abu Dhabi

Abu Dhabi accounts for 32% of the UAE Asia Cuisine Market. The capital shows strong growth driven by rising disposable incomes and cultural openness toward international cuisines. Upscale Asian restaurants located in luxury hotels attract both residents and international visitors. It also benefits from corporate dining culture, with increasing demand for business lunches and high-quality Asian offerings. Korean cuisine has shown notable traction in recent years, aligning with the city’s younger demographics. Growing investment in retail and food infrastructure supports expansion of offline and online distribution channels.

Sharjah and Other Emirates

Sharjah and other emirates collectively contribute 22% of the UAE Asia Cuisine Market. While smaller in size compared to Dubai and Abu Dhabi, these regions demonstrate steady growth fueled by affordable dining outlets and family-oriented restaurants. It caters to a mix of local families and expatriates seeking diverse food options at accessible price points. Online ordering platforms have accelerated penetration, particularly for Chinese and Indonesian cuisine. Government initiatives supporting tourism in Sharjah increase exposure to Asian food culture. Expanding retail presence of packaged Asian products ensures continued growth across these regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Panda Express

- F. Chang’s

- Sushi Art

- Maki

- Zheng He’s

- The Cheesecake Factory

- Noodles & Company

- Kogi BBQ

- Nestlé

- Conagra Brands

- Ajinomoto

- McCormick & Company Inc.

- JFC

Competitive Analysis

The UAE Asia Cuisine Market features a competitive landscape shaped by international chains, regional players, and packaged food companies. Global brands such as Panda Express, P.F. Chang’s, and The Cheesecake Factory maintain strong visibility through established outlets in premium malls and business districts. It benefits from brand recognition and consistent menu offerings that attract both expatriates and tourists. Regional restaurants like Sushi Art, Maki, and Zheng He’s cater to niche audiences with authentic menus and experiential dining. The segment is further strengthened by the rising presence of Korean and Indonesian specialty outlets, which diversify the competitive environment. Packaged food leaders such as Nestlé, Conagra Brands, Ajinomoto, McCormick & Company Inc., and JFC influence the market through sauces, ready meals, and condiments widely distributed in supermarkets and online platforms. It helps meet the growing demand for home cooking and convenience-based consumption. The competitive structure also includes dynamic SMEs and start-ups introducing innovative menus and fusion dishes tailored to local tastes. Online delivery platforms create opportunities for smaller players to expand reach without significant infrastructure costs. The overall landscape is defined by differentiation in pricing, menu innovation, and distribution strategies, ensuring continuous rivalry and growth.

Recent Developments

- In April 2025, Sushi Art unveiled an exclusive Omakase menu in partnership with Michelin-starred chef Grégoire Berger, launching across all Dubai and Abu Dhabi locations. For instance, the new eight-course set menu, released on April 15, quickly attracted attention in the premium sushi segment by offering a curated chef’s experience at AED 159.

- In February 2025, Berjaya Food, a leading Malaysian food service group, signed a memorandum of understanding (MoU) with Abu Dhabi-based Samaya Food Investments LLC to introduce the South Korean bakery-café chain Paris Baguette to the UAE market. This partnership is designed to meet rising consumer demand for premium Asian café experiences and expand Paris Baguette’s international recognition by bringing its distinctive bakery offerings to the UAE.

Report Coverage

The research report offers an in-depth analysis based on Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising tourism will strengthen demand for premium Asian dining experiences across urban centers.

- Expansion of food delivery platforms will boost growth in online distribution of Asian cuisine.

- Increased adoption of digital ordering and AI-powered personalization will enhance consumer engagement.

- Health-focused menus featuring low-calorie and plant-based Asian dishes will gain stronger traction.

- Growth of Korean Wave will continue to drive higher demand for Korean restaurants and packaged foods.

- Retail expansion of Asian condiments, sauces, and ready-to-cook meals will broaden household adoption.

- Strategic partnerships between hospitality groups and international chains will expand premium presence.

- Cultural festivals and government-backed food events will enhance awareness and consumer preference.

- Investments in mid-range and quick-service outlets will target price-sensitive consumer groups.

- Continuous innovation in fusion dishes will diversify offerings and maintain competitive differentiation.