Market Overview

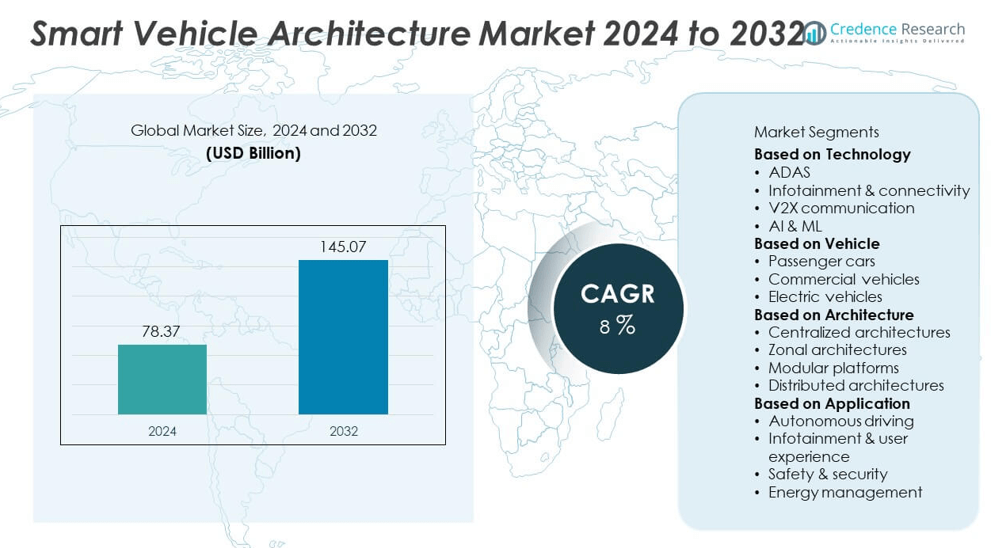

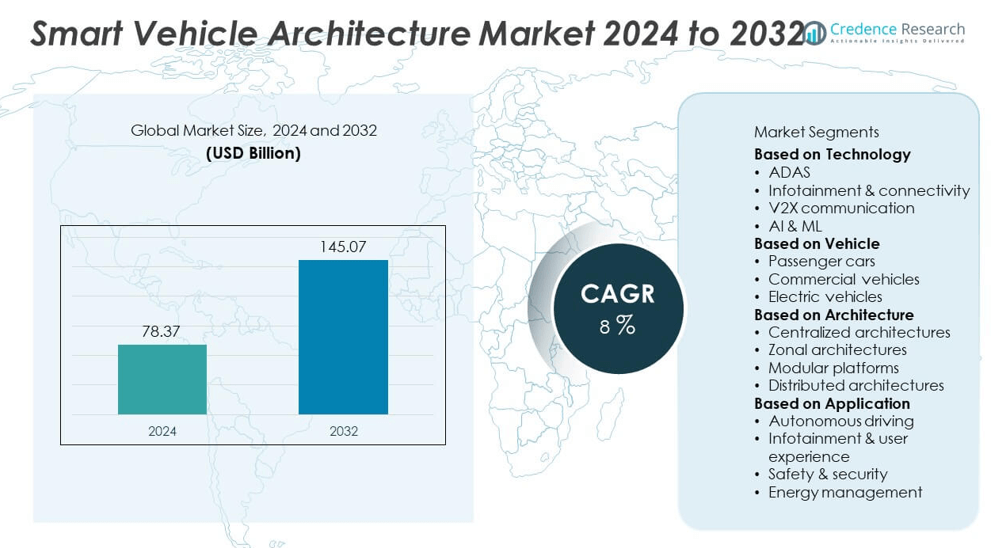

The Smart Vehicle Architecture market size was valued at USD 78.37 billion in 2024 and is projected to reach USD 145.07 billion by 2032, expanding at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Vehicle Architecture Market Size 2024 |

USD 78.37 billion |

| Smart Vehicle Architecture Market, CAGR |

8% |

| Smart Vehicle Architecture Market Size 2032 |

USD 145.07 billion |

The Smart Vehicle Architecture market is led by key players such as Magna, Bosch, Aptiv, Valeo, Infineon Technologies, Continental, ZF Friedrichshafen, Qualcomm, Denso, and NXP Semiconductors. These companies are advancing centralized and zonal architectures, enhancing ADAS integration, and developing software-defined platforms to support connected and autonomous vehicles. Regionally, Asia-Pacific commanded the largest share at 36% in 2024, supported by high vehicle production and rapid EV adoption. North America followed with 31% share, driven by strong demand for connected technologies and regulatory safety mandates, while Europe accounted for 28%, supported by premium vehicle adoption and innovation in sustainable mobility.

Market Insights

- The Smart Vehicle Architecture market was valued at USD 78.37 billion in 2024 and is projected to reach USD 145.07 billion by 2032, growing at a CAGR of 8%.

- Rising demand for advanced driver assistance systems and connected technologies is driving adoption, with ADAS leading the technology segment at over 35% share in 2024.

- Trends highlight the shift toward centralized and zonal architectures, alongside growing opportunities from software-defined vehicles and AI-driven platforms enhancing safety and efficiency.

- Competition is shaped by key players including Magna, Bosch, Aptiv, Valeo, Infineon Technologies, Continental, ZF Friedrichshafen, Qualcomm, Denso, and NXP Semiconductors, who focus on innovation, scalability, and strong automaker partnerships.

- Regionally, Asia-Pacific led the market with 36% share in 2024, followed by North America at 31% and Europe at 28%, while Latin America and the Middle East & Africa captured 3% and 2% respectively, supported by growing adoption of EV and connected mobility solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

ADAS led the market with over 35% share in 2024, supported by regulatory mandates for advanced safety features and rising consumer demand for driver-assistance systems. Increasing integration of adaptive cruise control, lane-keeping assistance, and emergency braking is fueling adoption across premium and mid-range vehicles. Infotainment and connectivity follow closely, driven by demand for seamless digital experiences. V2X communication and AI & ML are gaining traction with connected and autonomous vehicle development, though ADAS remains dominant due to its critical role in improving road safety and compliance with global safety standards.

- For instance, In March 2025, Mobileye announced a partnership with Valeo and Volkswagen for its Surround ADAS platform. The cost-effective system is designed for a high-volume rollout in non-luxury vehicles, and is a vertically integrated solution that runs on a single EyeQ™6 System-on-Chip. It is typically configured with a long-range front-facing camera, four short-range parking cameras, and up to five radars.

By Vehicle

Passenger cars accounted for the largest share of over 50% in 2024, driven by high consumer adoption of connected technologies and rapid integration of advanced architectures in mass-market models. Demand for safety, entertainment, and comfort features continues to boost penetration in passenger vehicles. Electric vehicles represent the fastest-growing sub-segment as OEMs adopt intelligent architectures to optimize energy management and connectivity. Commercial vehicles also show steady adoption, particularly in fleet management and logistics, but passenger cars remain the primary growth engine for smart vehicle architecture adoption worldwide.

- For instance, Nissan announced in 2024 its ProPILOT AD system rollout planned by 2027, integrating 3D mapping, high-resolution radar, and AI algorithms to facilitate semi-autonomous driving in urban and highway contexts, implemented with sensor update frequencies capable of processing hundreds of data points per second for optimal energy and safety management.

By Architecture

Centralized architectures dominated with over 40% share in 2024, supported by rising demand for consolidated control units that simplify vehicle electronics and improve processing efficiency. Automakers are increasingly shifting from distributed to centralized models to reduce complexity, enhance cybersecurity, and support software-driven vehicles. Zonal architectures are gaining momentum as next-generation solutions offering scalability and modularity for EVs and autonomous platforms. Modular platforms further support cost efficiencies across multiple vehicle types. Despite innovations, centralized architectures remain the backbone of current smart vehicle designs, ensuring robust performance and streamlined integration of advanced technologies.

Market Overview

Rising Demand for Advanced Safety Systems

The adoption of smart vehicle architectures is strongly driven by growing safety regulations and consumer demand for driver-assistance technologies. Advanced Driver Assistance Systems (ADAS) require integrated and scalable architectures to support features such as lane departure warnings, collision avoidance, and adaptive cruise control. Regulatory mandates in North America, Europe, and Asia are accelerating OEM adoption. Automakers are increasingly embedding centralized and zonal designs to streamline safety functions, reduce system complexity, and enhance real-time decision-making, making safety requirements a critical growth driver for the market.

- For instance, In 2024, the Advanced Driver Assistance Systems (ADAS) market in North America was valued at over $14 billion. Correspondingly, over 58% of new passenger cars produced globally in 2024 included at least three ADAS functions as standard equipment.

Expansion of Electric and Connected Vehicles

The rising production and adoption of electric vehicles (EVs) are fueling the demand for smart vehicle architectures. EVs require centralized and modular platforms that efficiently manage power distribution, connectivity, and advanced computing requirements. Connected vehicles also rely heavily on architectures that support V2X communication and over-the-air updates. Governments worldwide are providing incentives for EV adoption, further pushing OEMs to integrate scalable architectures. This synergy between electrification and connectivity is driving significant investments, ensuring that smart vehicle architectures become a core enabler of next-generation mobility solutions.

- For instance, Hyundai Motor Group’s Electric Global Modular Platform (E-GMP), powering vehicles such as the 2024 IONIQ 5 N, supports high-voltage 800V architecture enabling ultra-fast charging with 18-minute time to 80% battery capacity and integrates advanced connectivity features, demonstrating a scalable architecture used across multiple EV models.

Integration of AI and Machine Learning in Vehicles

Artificial intelligence (AI) and machine learning (ML) are transforming vehicle operations, driving demand for advanced architectures. Smart platforms must support high computational power to process real-time data from sensors, cameras, and communication systems. Applications range from predictive maintenance to autonomous driving, where data-driven insights improve safety and efficiency. Automakers and technology providers are collaborating to integrate AI-ready architectures that enhance both performance and personalization. This growing reliance on AI and ML accelerates the shift toward centralized and zonal designs, positioning them as essential for future-ready vehicles.

Key Trends & Opportunities

Shift Toward Zonal and Modular Architectures

A key trend in the market is the move from traditional distributed models to zonal and modular architectures. Zonal architectures improve scalability, cybersecurity, and cost efficiency by consolidating functions regionally within the vehicle. Modular platforms allow OEMs to standardize components across multiple models, reducing development time and costs. This shift also supports electric and autonomous vehicles, where high-performance computing and flexibility are critical. As automakers accelerate software-defined vehicle strategies, zonal and modular designs present strong growth opportunities.

- For instance, VVDN Technologies in 2024 worked closely with global OEMs and Tier-1 suppliers to develop high-performance computing platforms managing multiple zonal vehicle functions with real-time responsiveness.

Growth in V2X and Connectivity Solutions

The rising adoption of Vehicle-to-Everything (V2X) communication is creating significant opportunities for smart vehicle architectures. These systems require robust platforms to support real-time data exchange between vehicles, infrastructure, and networks. Applications such as traffic management, predictive routing, and enhanced driver safety depend on advanced connectivity. Governments are investing in smart city infrastructure, further boosting V2X integration. Automakers are aligning with telecom and technology providers to enable seamless connectivity, making this a central trend that enhances both safety and efficiency.

- For instance, In 2024, onsemi developed zonal architecture solutions integrated with 10BASE-T1S Ethernet and remote control protocols. This enables robust data transmission speeds up to 10 Mbps between zone controllers and edge devices, facilitating high-efficiency, cost-optimized communication crucial for vehicle safety applications.

Opportunities in Over-the-Air (OTA) Updates

Smart vehicle architectures are increasingly designed to support over-the-air (OTA) software updates, reducing the need for physical servicing. OTA capabilities enable real-time upgrades to safety features, infotainment, and vehicle performance, enhancing consumer convenience and manufacturer efficiency. This trend also creates recurring revenue opportunities for automakers through subscription-based services. With growing consumer preference for connected solutions, OTA functionality positions smart architectures as future-proof platforms. This opportunity strengthens automakers’ ability to maintain competitiveness and build long-term customer relationships.

Key Challenges

High Development and Implementation Costs

The development of smart vehicle architectures requires substantial investments in R&D, high-performance computing, and integration with advanced sensors. OEMs face challenges in balancing cost efficiency with the need for innovation, especially in price-sensitive markets. Smaller manufacturers may struggle to compete due to high upfront costs, limiting adoption across entry-level models. While modular platforms and economies of scale can mitigate expenses, the financial burden remains a key barrier to widespread implementation of smart vehicle architectures.

Cybersecurity and Data Management Risks

As vehicles become more connected, cybersecurity risks are growing, posing a major challenge for automakers. Smart architectures handle vast amounts of data from sensors, passengers, and external networks, making them targets for cyberattacks. Unauthorized access to safety systems or personal data could result in severe consequences. Automakers must invest in advanced encryption, real-time monitoring, and compliance with global data protection regulations. These requirements increase complexity and costs, while failure to ensure robust security may slow consumer trust and adoption.

Regional Analysis

North America

North America held 32% share of the smart vehicle architecture market in 2024, driven by strong adoption of ADAS, infotainment, and connectivity solutions. The U.S. leads regional demand with high investments in autonomous driving and electric vehicle platforms, supported by regulatory mandates for safety systems. Canada contributes with rising adoption of connected mobility solutions and government-backed EV programs. Strong collaboration between automakers and technology providers strengthens the region’s leadership. Robust infrastructure for over-the-air (OTA) updates and V2X deployment further accelerates adoption, ensuring North America remains a significant hub for next-generation vehicle architecture development.

Europe

Europe accounted for 28% share in 2024, supported by strict safety regulations, sustainability goals, and widespread adoption of premium vehicles. Germany, France, and the U.K. lead regional demand with strong emphasis on electrification and autonomous driving technologies. Automakers in Europe are shifting toward zonal and modular architectures to meet EU carbon emission targets and align with software-defined vehicle strategies. The presence of leading OEMs and R&D facilities drives innovation in centralized platforms. With governments promoting intelligent mobility and connectivity infrastructure, Europe continues to play a key role in shaping the smart vehicle architecture ecosystem.

Asia-Pacific

Asia-Pacific dominated the global market with 34% share in 2024, fueled by large-scale vehicle production, rising EV adoption, and extensive smart city initiatives. China leads the region with strong government support for electric and connected vehicles, while Japan and South Korea drive innovation in AI and V2X communication systems. India’s growing automotive market and digital infrastructure investments further add to regional momentum. Local and global automakers are investing heavily in modular and zonal platforms to meet diverse market needs. Asia-Pacific’s scale, rapid urbanization, and government-backed programs ensure its position as both the largest and fastest-growing region.

Latin America

Latin America captured 4% share in 2024, with Brazil and Mexico leading adoption of smart vehicle architectures. The region is witnessing gradual integration of ADAS and infotainment systems, supported by growing urbanization and middle-class demand for connected vehicles. Government safety regulations are expanding, pushing automakers to adopt advanced architectures in new vehicle models. Fleet modernization programs and rising interest in electric vehicles also contribute to demand. However, limited infrastructure for V2X and higher costs remain challenges. Strategic partnerships between global OEMs and local manufacturers are expected to enhance adoption, supporting steady market expansion in Latin America.

Middle East & Africa

The Middle East and Africa accounted for 2% share in 2024, reflecting slower adoption but emerging opportunities. Gulf countries such as the UAE and Saudi Arabia are driving growth through smart city projects and investments in autonomous mobility. South Africa contributes with rising demand for connected vehicles in urban areas. The adoption of zonal and centralized architectures is tied to premium and electric vehicle demand, particularly in wealthier markets. Despite infrastructure limitations and affordability challenges, government-backed mobility programs and investments in connectivity are creating pathways for future adoption of smart vehicle architectures across the region.

Market Segmentations:

By Technology

- ADAS

- Infotainment & connectivity

- V2X communication

- AI & ML

By Vehicle

- Passenger cars

- Commercial vehicles

- Electric vehicles

By Architecture

- Centralized architectures

- Zonal architectures

- Modular platforms

- Distributed architectures

By Application

- Autonomous driving

- Infotainment & user experience

- Safety & security

- Energy management

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape in the Smart Vehicle Architecture market is shaped by leading players including Magna, Bosch, Aptiv, Valeo, Infineon Technologies, Continental, ZF Friedrichshafen, Qualcomm, Denso, and NXP Semiconductors. These companies drive growth through innovations in centralized and zonal architectures, integration of ADAS, V2X communication, and software-defined vehicle platforms. Their strategies focus on strong collaborations with automakers, development of scalable modular platforms, and investments in AI- and IoT-enabled systems to enhance safety, connectivity, and performance. Partnerships and joint ventures are expanding global reach, while regulatory compliance and sustainability remain key priorities. Intense competition encourages rapid innovation, with companies focusing on semiconductor advancements, cybersecurity frameworks, and cost-efficient architectures to meet the demands of electric and autonomous vehicles. This dynamic environment ensures that top players continue to strengthen market positioning by balancing technological leadership with mass-market adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Magna

- Bosch

- Aptiv

- Valeo

- Infineon Technologies

- Continental

- ZF Friedrichshafen

- Qualcomm

- Denso

- NXP Semiconductors

Recent Developments

- In July 2025, Magna launched an interior sensing system with child presence detection across multiple OEM programs.

- In April 2025, Infineon and Marelli announced innovations in the automotive cockpit domain using MEMS laser scanning.

- In March 2025, Magna announced integration of NVIDIA DRIVE AGX Thor in its next-gen vehicle intelligence platforms.

- In January 2025 (CES event), Continental promoted software-defined vehicle (SDV) solutions and customizable cockpit tech including E-Ink displays.

Report Coverage

The research report offers an in-depth analysis based on Technology, Vehicle, Architecture, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising integration of connected and autonomous vehicle technologies.

- ADAS adoption will grow as safety regulations and consumer demand for assisted driving features increase.

- Centralized and zonal architectures will replace distributed systems for improved scalability and efficiency.

- Software-defined vehicles will drive innovation, enabling continuous updates and feature enhancements.

- AI and machine learning will strengthen predictive analytics and real-time decision-making in vehicles.

- Passenger cars will remain the largest segment, while electric vehicles see the fastest adoption.

- Partnerships between automakers and semiconductor companies will accelerate smart architecture development.

- Asia-Pacific will continue leading growth, supported by high EV production and urban mobility projects.

- North America and Europe will expand adoption through regulatory support and premium vehicle demand.

- Cybersecurity and data privacy will remain critical focus areas as connectivity becomes central to vehicle architecture.