Market Overview:

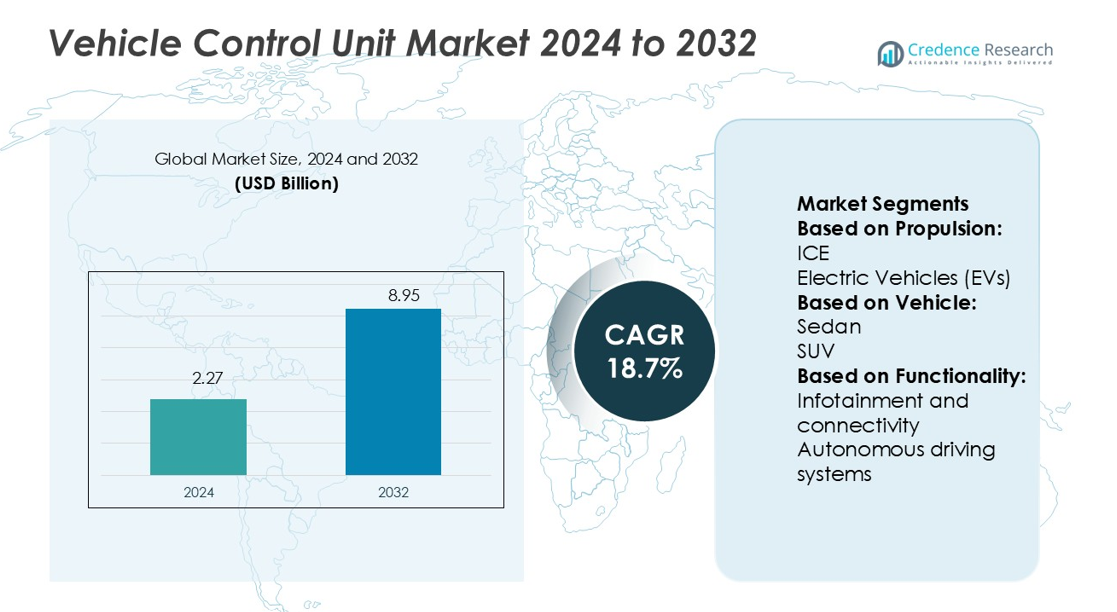

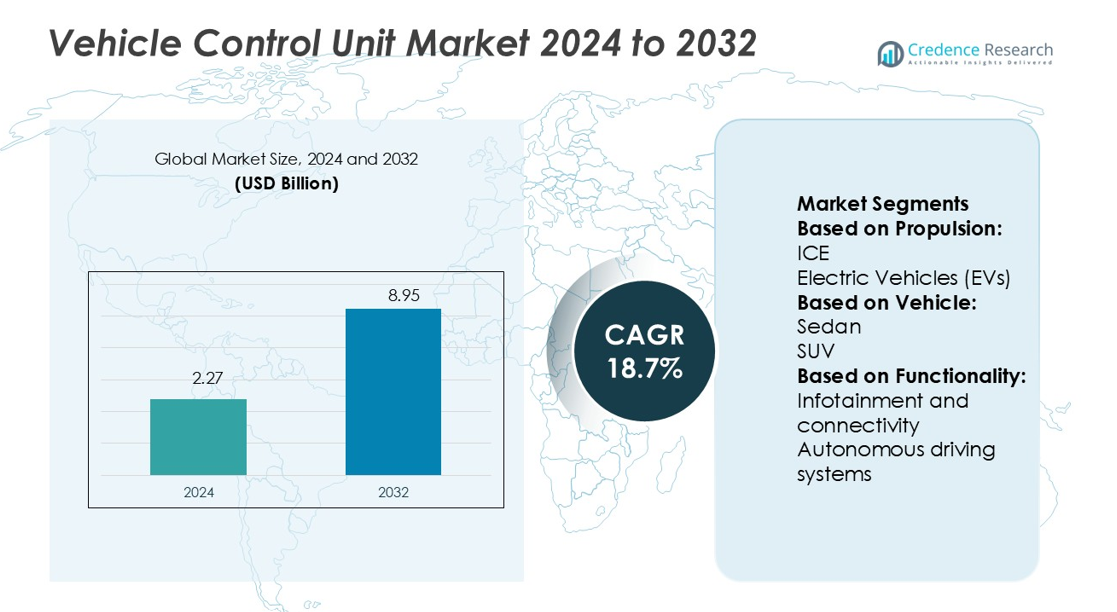

Vehicle Control Unit Market size was valued USD 2.27 billion in 2024 and is anticipated to reach USD 8.95 billion by 2032, at a CAGR of 18.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Control Unit Market Size 2024 |

USD 2.27 billion |

| Vehicle Control Unit Market, CAGR |

18.7% |

| Vehicle Control Unit Market Size 2032 |

USD 8.95 billion |

The Vehicle Control Unit market is shaped by top players including ZF Friedrichshafen AG, Dorleco, Infineon, Continental AG, ASI Robots, NXP Semiconductors, Robert Bosch, Denso, Delphi Technologies, and STMicroelectronics. These companies drive innovation through advanced powertrain control, semiconductor integration, ADAS development, and connectivity solutions. Strong focus on software-defined platforms, autonomous driving support, and energy-efficient designs strengthens their competitive positions. Asia-Pacific leads the global market with a 34% share, supported by large-scale automotive production, rapid adoption of electric vehicles, and government-backed initiatives for smart mobility, positioning the region as the primary growth hub for vehicle control unit deployment.

Market Insights

- The Vehicle Control Unit Market size was USD 2.27 billion in 2024 and will reach USD 8.95 billion by 2032 at a CAGR of 18.7%.

- Rising demand for electric vehicles and ADAS integration acts as a major driver, supported by government regulations and emission reduction goals.

- The market shows strong trends in software-defined vehicle architectures, battery management system integration, and autonomous driving technologies.

- Competition remains intense as key players like ZF Friedrichshafen AG, Robert Bosch, Continental AG, Infineon, and others focus on innovation in semiconductors, connectivity, and powertrain control.

- Asia-Pacific leads with 34% share, followed by North America at 32% and Europe at 29%, with passenger vehicles holding the dominant segment share driven by adoption of advanced safety and connectivity features.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Propulsion

In the Vehicle Control Unit (VCU) market, Internal Combustion Engine (ICE) vehicles hold the dominant share of 58%. Their leadership is driven by the wide global fleet of ICE-powered cars and the presence of mature infrastructure supporting conventional fuels. The market is sustained by strong demand in developing regions where fuel-based mobility continues to dominate. Increasing adoption of control systems for emission management and efficiency optimization further supports this segment. Electric vehicles (EVs) are rapidly gaining momentum due to battery innovation and government incentives, while Fuel Cell Electric Vehicles (FCEVs) remain niche but steadily developing.

- For instance, Electric Vehicle Control Unit (EVCU) switching frequency above 20 kHz is desirable, as it falls outside the range of human hearing, minimizing audible noise from the powertrain. PWM frequencies are commonly in this range for power electronics in EVs.

By Vehicle

Passenger vehicles lead this segment with a 61% share, supported by high ownership rates and continuous demand for sedans, SUVs, and hatchbacks. SUVs contribute significantly due to their global popularity, offering more advanced control units for safety, infotainment, and connectivity features. Commercial vehicles also represent strong adoption of VCUs, particularly in light commercial vehicles (LCVs) where fleet electrification and logistics expansion create opportunities. Medium and heavy commercial vehicles (MCVs and HCVs) increasingly use control units for powertrain management and fuel efficiency. Off-highway vehicles are an emerging niche as automation and precision control grow in agriculture and construction machinery.

- For instance, Infineon’s AURIX TC29xT microcontroller runs at 300 MHz, includes 8 MB flash memory and meets ASIL-D safety requirements, aimed at handling powertrain and body control tasks in passenger, commercial, and off-highway vehicles.

By Functionality

Powertrain control dominates with a 47% share, reflecting its role as the core application of vehicle control units. The segment benefits from growing demand for efficient torque control, fuel optimization, and emission reduction. Battery management system (BMS) integration follows closely, aligned with the rise of electric vehicles requiring efficient battery performance and safety. Advanced driver assistance systems (ADAS) adoption is accelerating, driven by regulatory mandates and consumer preference for enhanced safety. Infotainment and connectivity expand alongside consumer demand for digital driving experiences, while autonomous driving systems, though emerging, attract heavy investments from automakers. Other functions, such as climate and chassis control, also support diversification.

Market Overview

Rising Adoption of Electric Vehicles (EVs)

The rapid expansion of electric vehicles drives strong demand for advanced vehicle control units. VCUs integrate battery management systems, motor control, and energy optimization, making them vital for EV efficiency and safety. Governments worldwide provide incentives and infrastructure support, further accelerating EV adoption. Automakers invest heavily in electrification strategies, boosting deployment of high-performance VCUs. With increasing focus on sustainability and emission reduction, this driver ensures long-term growth for the VCU market, particularly in regions with ambitious carbon neutrality targets and regulatory pressure on ICE vehicles.

- For instance, Continental’s thermal management systems maintain battery temperatures between 20 °C and 40 °C using specialized coolant, refrigerant, and oil lines to prevent range loss and thermal runaway.

Integration of Advanced Driver Assistance Systems (ADAS)

The widespread adoption of ADAS technologies creates significant demand for sophisticated VCUs. These systems manage functions such as adaptive cruise control, lane-keeping assistance, and collision avoidance, requiring real-time data processing and precision control. Regulatory requirements for safety features in passenger and commercial vehicles further accelerate ADAS integration. Automakers increasingly prioritize driver safety and convenience, making VCUs central to enabling these intelligent functionalities. As consumer preference shifts toward safer vehicles, ADAS-enabled VCUs are becoming essential, strengthening their role in both developed and emerging automotive markets.

- For instance, the steering robot actuator in ASI’s kit delivers 60 N·m peak torque at 500°/sec, and maintains 15 N·m continuous torque at 1000°/sec for precise lane keeping and collision avoidance manoeuvres.

Increasing Demand for Connected and Autonomous Vehicles

The growing trend toward connected and autonomous driving reinforces VCU adoption. VCUs enable seamless integration of infotainment, connectivity, and autonomous driving systems, ensuring real-time communication and vehicle intelligence. Rising consumer interest in in-vehicle connectivity and smart mobility solutions supports this growth. Automakers and technology firms collaborate to enhance autonomous functionalities, requiring highly reliable VCUs to manage complex operations. With 5G networks expanding and vehicle-to-everything (V2X) technologies advancing, this driver is set to accelerate market expansion, positioning VCUs as a backbone of future mobility ecosystems worldwide.

Key Trends & Opportunities

Advancements in Software-Defined Vehicles

The shift toward software-defined vehicles creates new opportunities for VCU providers. Modern VCUs rely on software updates to enhance performance, security, and functionality, reducing dependency on hardware changes. Automakers leverage over-the-air (OTA) updates to introduce new features and optimize vehicle efficiency. This trend improves lifecycle value and strengthens customer engagement. Companies developing scalable, software-centric VCU platforms can capitalize on recurring revenue opportunities. As the industry embraces digital transformation, software-defined architectures position VCUs as central hubs for innovation, offering a sustainable competitive advantage in the evolving automotive landscape.

- For instance, NXP’s CoreRide platform integrates the S32N55 processor as central compute, paired with four S32K344 MCUs as zone controllers, allowing safe, isolated execution of multiple vehicle functions on a single system.

Expansion of Commercial Fleet Electrification

Electrification of commercial fleets presents a significant growth opportunity for VCU manufacturers. Logistics companies increasingly adopt electric light commercial vehicles (LCVs) and heavy-duty trucks to reduce operating costs and meet emission regulations. These vehicles require robust VCUs for battery management, load optimization, and predictive maintenance. Governments provide subsidies and charging infrastructure support to accelerate adoption. The demand for reliable fleet management solutions enhances the role of VCUs in ensuring efficiency and uptime. This trend supports higher volume deployment of advanced control systems across logistics, public transport, and last-mile delivery networks.

- For instance, Bosch manufactures an e-axle for commercial vehicles up to 7.5 metric tons that operates at 800 volts and employs silicon carbide inverter technology to shorten charging cycles in urban delivery routes.

Key Challenges

High Development and Integration Costs

Developing advanced vehicle control units involves significant costs related to design, software development, and testing. Automakers face challenges in balancing performance with affordability, particularly in price-sensitive markets. Integration of complex functionalities such as ADAS, BMS, and autonomous systems increases engineering requirements and time-to-market. Suppliers must continuously invest in R&D to remain competitive, adding financial strain. These high costs often limit adoption among smaller manufacturers. As vehicles become increasingly sophisticated, managing development expenses while maintaining profitability remains a critical challenge for industry stakeholders.

Cybersecurity and Data Privacy Risks

The rise of connected and autonomous vehicles increases exposure to cybersecurity threats. VCUs, as central control systems, handle sensitive vehicle data and communication with external networks, making them potential targets for cyberattacks. Breaches can compromise passenger safety, vehicle performance, and consumer trust. Regulatory bodies impose strict standards for data security, further pressuring manufacturers to implement robust protection measures. Ensuring real-time threat detection, encryption, and secure software updates is complex and costly. Addressing cybersecurity risks effectively is a key challenge that determines long-term adoption and trust in VCUs.

Regional Analysis

North America

North America leads the Vehicle Control Unit market with a 32% share, supported by advanced automotive manufacturing, strong adoption of electric vehicles, and regulatory emphasis on safety features. The United States dominates the regional market, driven by high demand for ADAS-enabled passenger vehicles and growing investments in autonomous vehicle testing. Canada follows with rising EV adoption, supported by government subsidies and charging infrastructure. The presence of leading technology firms and automakers ensures innovation in connectivity and software-defined VCUs. Strong regulatory frameworks on emissions and safety standards further drive continuous integration of advanced control systems across vehicle categories.

Europe

Europe accounts for 29% of the Vehicle Control Unit market, driven by stringent emission regulations and a strong push toward electrification. Germany leads the region with its advanced automotive ecosystem and investments in autonomous vehicle technologies. France, Italy, and the UK also contribute significantly through EV adoption and safety feature mandates. Automakers in the region integrate VCUs extensively in passenger and commercial vehicles to meet carbon reduction targets. The European Union’s policies promoting ADAS and connected vehicle technologies strengthen market growth. The shift toward software-defined and electrified mobility positions Europe as a major hub for VCU innovation.

Asia-Pacific

Asia-Pacific holds the largest regional share at 34%, led by China, Japan, and South Korea. China dominates the region with rapid EV adoption, strong government support, and the world’s largest automotive production base. Japan drives innovation in hybrid and fuel cell vehicles, while South Korea invests in advanced mobility solutions and connected car technologies. India also emerges with growing demand for cost-effective VCUs in passenger and commercial vehicles. Regional players benefit from economies of scale, high production capacities, and expanding technology integration. Asia-Pacific remains the fastest-growing region, supported by strong domestic demand and global export opportunities.

Latin America

Latin America accounts for 3% of the Vehicle Control Unit market, with Brazil and Mexico leading adoption. Brazil drives demand through rising passenger vehicle sales and integration of ADAS features in mid-range cars. Mexico benefits from strong automotive manufacturing hubs supplying global markets, which accelerates the use of VCUs in both passenger and light commercial vehicles. Government incentives for electric mobility remain limited, but urbanization and fleet modernization initiatives create opportunities. Despite infrastructure challenges, the region shows steady growth potential as automakers expand product portfolios and incorporate digital connectivity and safety features into mainstream vehicles.

Middle East & Africa

The Middle East and Africa represent 2% of the Vehicle Control Unit market, supported by emerging adoption in the UAE, Saudi Arabia, and South Africa. The Middle East focuses on smart mobility projects, with the UAE investing heavily in connected and autonomous vehicle pilots. Saudi Arabia’s Vision 2030 drives modernization in transportation, creating demand for advanced control units. Africa remains in early adoption stages due to limited infrastructure, though urbanization and gradual electrification initiatives in South Africa provide growth avenues. High costs and lack of EV charging networks pose challenges, but long-term opportunities exist through government-led modernization strategies.

Market Segmentations:

By Propulsion:

- ICE

- Electric Vehicles (EVs)

By Vehicle:

By Functionality:

- Infotainment and connectivity

- Autonomous driving systems

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Vehicle Control Unit market ZF Friedrichshafen AG, Dorleco, Infineon, Continental AG, ASI Robots, NXP Semiconductors, Robert Bosch, Denso, Delphi Technologies, and STMicroelectronics. The Vehicle Control Unit market is defined by rapid technological advancements, increasing electrification, and the integration of intelligent systems. Companies focus heavily on developing software-defined architectures, semiconductor solutions, and AI-enabled platforms to enhance vehicle efficiency, safety, and connectivity. Strategic collaborations between automakers and technology providers strengthen innovation pipelines, particularly in areas such as ADAS, autonomous driving, and battery management systems. Intense competition drives continuous investment in R&D to deliver scalable and cost-effective solutions while meeting stringent regulatory standards. The market remains highly dynamic, with differentiation increasingly centered on software capabilities, cybersecurity resilience, and long-term system reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZF Friedrichshafen AG

- Dorleco

- Infineon

- Continental AG

- ASI Robots

- NXP Semiconductors

- Robert Bosch

- Denso

- Delphi Technologies

- STMicroelectronics

Recent Developments

- In January 2025, Zonar unveiled the Zonar LD Telematics Control Unit (TCU), which enhances the intelligence and security of fleet operators regarding their vehicles. TCU would install more quickly, work with more vehicles, and offer better diagnostics, including towing detection and cold start tracking.

- In November 2024, Marelli launched the VEC_480, an advanced AI-powered Electronic Control Unit (ECU) intended for use in motorsport for advanced engine and vehicle management. Some key developments include a specialized NPU which implements 26 TOPS with a rate of 26 tera operations per second.

- In September 2024, Cummins Inc. announced their partnership with Bosch Global Software and KPIT to release their Eclipse CANought, an open-source project and telematics platform in commercial vehicles.

- In September 2024, Dongfeng Motor and Huawei made a joint investment into the Dongfeng Intelligent Vehicle Control Center, cementing a strategic alliance aimed at refining automotive intelligence technologies and systems automation

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Vehicle, Functionality and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of electric and hybrid vehicles.

- Software-defined vehicle architectures will increase reliance on advanced control units.

- ADAS and autonomous driving systems will drive greater integration of VCUs.

- Battery management systems will become a core focus with growing EV penetration.

- Connected car technologies will strengthen demand for secure and scalable VCUs.

- Semiconductor innovations will enhance processing power and energy efficiency of VCUs.

- Regulatory mandates on safety and emissions will accelerate adoption across all vehicle categories.

- Commercial fleet electrification will create strong opportunities for advanced VCU deployment.

- Cybersecurity solutions will play a critical role in ensuring safe vehicle communication.

- Strategic collaborations between automakers and technology firms will shape competitive growth.