Market Overview

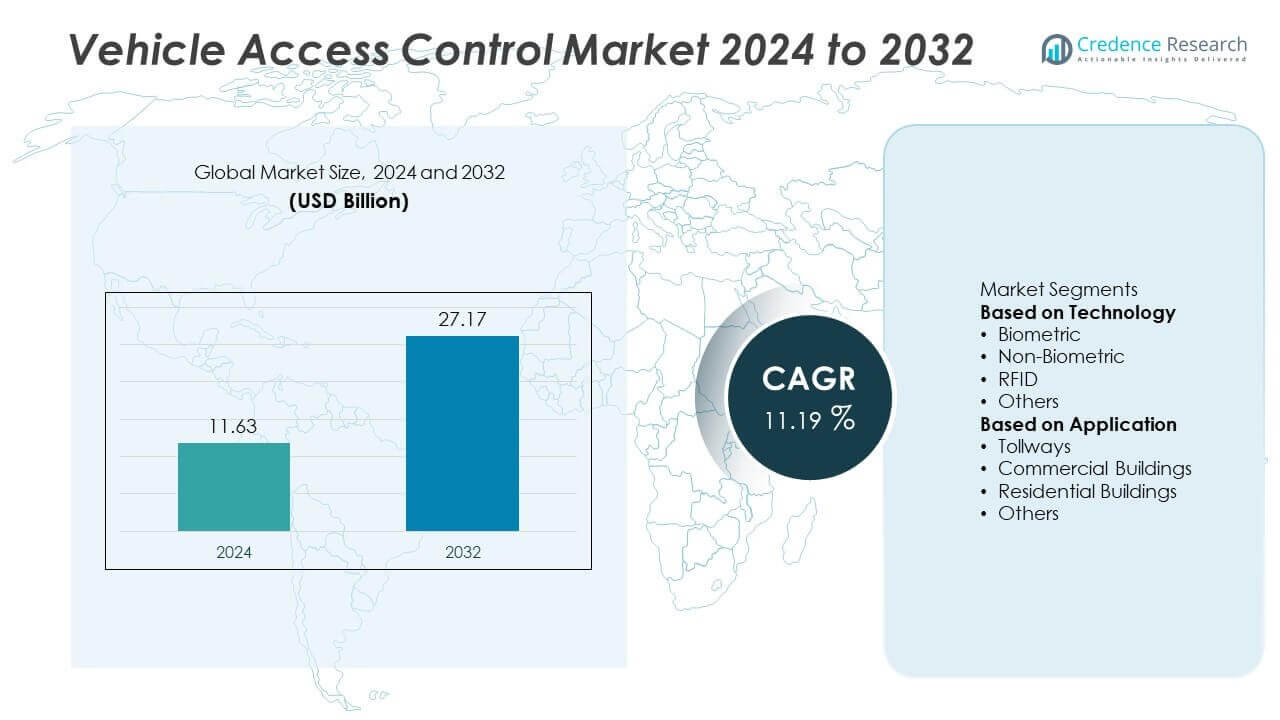

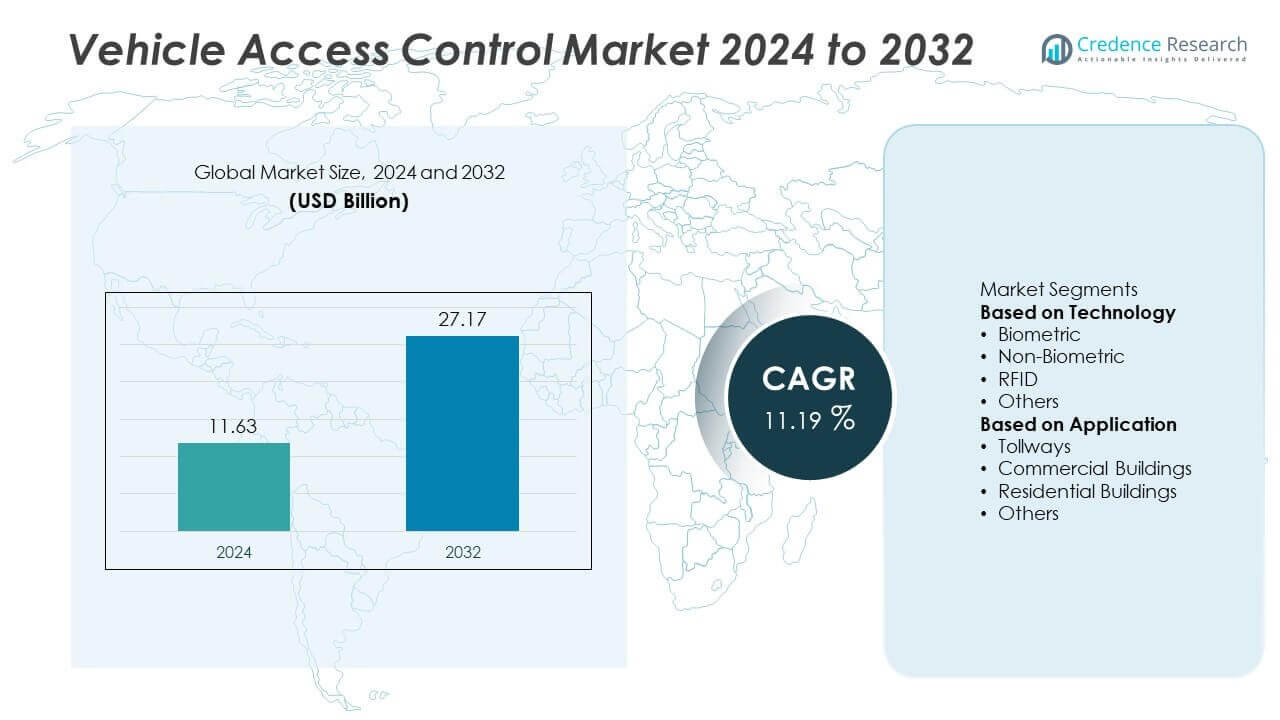

The vehicle access control market was valued at USD 11.63 billion in 2024 and is projected to reach USD 27.17 billion by 2032, growing at a CAGR of 11.19% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vehicle Access Control Market Size 2024 |

USD 11.63 Billion |

| Vehicle Access Control Market, CAGR |

11.19% |

| Vehicle Access Control Market Size 2032 |

USD 27.17 Billion |

The vehicle access control market is led by key players including NXP Semiconductors, HELLA GmbH & Co. KGaA, Robert Bosch GmbH, ALPS ALPINE CO., LTD., Lear Corp, STMicroelectronics, Valeo, AVERY DENNISON CORPORATION, Continental AG, and OMRON Corporation. These companies are driving innovation through biometric access systems, RFID-based toll solutions, and digital key technologies integrated with connected vehicles. North America led the market with 33% share in 2024, supported by strong adoption of smart transportation infrastructure and keyless entry systems. Asia-Pacific followed with 30% share, fueled by urbanization and smart city projects, while Europe accounted for 28% share, driven by advanced automotive manufacturing and regulatory support for vehicle security solutions.

Market Insights

Market Insights

- The vehicle access control market was valued at USD 11.63 billion in 2024 and is projected to reach USD 27.17 billion by 2032, growing at a CAGR of 11.19% during the forecast period.

- Rising demand for advanced security systems, biometric authentication, and keyless entry solutions is driving growth, supported by increasing vehicle theft concerns and smart city infrastructure investments.

- Key trends include the integration of IoT and connected car technologies, adoption of cloud-based access management, and development of multi-factor authentication systems for enhanced security.

- The market is competitive with players like NXP Semiconductors, HELLA GmbH & Co. KGaA, Robert Bosch GmbH, ALPS ALPINE CO., LTD., Lear Corp, and Continental AG focusing on partnerships, product innovation, and compliance with safety regulations.

- North America led with 33% share, followed by Asia-Pacific with 30% and Europe with 28%; by technology, biometric systems dominated with over 40% share, highlighting the growing shift toward secure, contactless vehicle access solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Biometric systems dominated the vehicle access control market in 2024, holding over 40% share due to their enhanced security features and growing integration in connected vehicles. Technologies such as fingerprint recognition, facial recognition, and iris scanning are being adopted by automotive OEMs to improve theft prevention and provide personalized user experiences. Rising demand for keyless entry and secure ignition systems is driving this segment. RFID and non-biometric systems follow closely, supported by wide use in fleet management, toll collection, and commercial parking facilities for efficient and contactless vehicle identification.

- For instance, in 2024, Continental AG and its partner trinamiX won a CES 2025 Innovation Award for their “Invisible Biometrics Sensing Display,” which uses concealed cameras and projectors for touchless authentication via facial recognition and monitors vital signs like heart rate to improve occupant safety and experience.

By Application

Tollways accounted for more than 45% share in 2024, emerging as the largest application segment due to the rapid expansion of smart highway projects and electronic toll collection systems. Vehicle access control solutions improve traffic flow, reduce congestion, and enable automated payments. Commercial buildings are the second-largest application, driven by the need for secure parking management and access control in corporate facilities. Residential complexes are also increasingly adopting advanced systems to enhance safety and enable seamless entry for residents through RFID tags and mobile app-based solutions.

- For instance, in 2024, Kapsch TrafficCom completed a Multi-Lane Free Flow (MLFF) truck tolling system in Spain’s Bizkaia province, which processes over 1.4 million transactions daily and improves traffic flow.

Key Growth Drivers

Rising Demand for Advanced Vehicle Security

Growing vehicle theft rates are driving the adoption of advanced access control systems. Biometric technologies such as fingerprint and facial recognition provide higher security levels and reduce unauthorized access. Automakers are increasingly integrating keyless entry and driver authentication systems in premium and mid-range vehicles. Rising consumer awareness of vehicle safety and data security is further supporting the adoption of innovative solutions. Government regulations mandating anti-theft systems in several countries are accelerating the use of access control technologies across passenger and commercial vehicle fleets.

- For instance, in 2024, BMW expanded the availability of its Digital Key Plus technology across more vehicles, including updates to its OS 8, 8.5, and 9. This system uses Ultra-Wideband (UWB) to securely lock, unlock, and start a vehicle using a compatible smartphone or smartwatch without taking it out of your pocket.

Expansion of Smart Transportation Infrastructure

The development of intelligent transportation systems and smart city initiatives is boosting demand for vehicle access control solutions. Electronic toll collection, RFID-enabled gates, and automatic number plate recognition systems are being widely deployed to manage traffic flow efficiently. Public-private partnerships are supporting the rollout of automated tollways and parking management systems. These solutions improve operational efficiency, reduce congestion, and offer contactless payment options, which are increasingly favored by commuters. This infrastructure expansion is expected to significantly drive market growth during the forecast period.

- For instance, Kapsch TrafficCom is a prominent global provider of electronic toll collection systems, including RFID-based solutions, which contribute to reduced congestion and improved commuter experience. The company reported its revenue for the 2024/25 fiscal year was EUR 530.3 million, with a 74% contribution from its tolling segment.

Integration with Connected and Electric Vehicles

The growing adoption of connected and electric vehicles is creating opportunities for advanced vehicle access control integration. Automakers are deploying digital keys and mobile app-based access solutions to enhance user convenience. These technologies enable remote locking, ignition control, and personalized settings, improving the overall driving experience. Integration with vehicle telematics and IoT platforms also allows real-time monitoring and enhanced security. The rise of shared mobility and subscription-based vehicle services is further increasing the demand for robust access control systems to ensure secure and seamless user authentication.

Key Trends & Opportunities

Adoption of Biometric and Multi-Factor Authentication

The market is witnessing a shift toward biometric authentication methods, including facial recognition and iris scanning, to enhance security. Multi-factor authentication combining biometrics with PINs or mobile apps is gaining popularity, particularly in fleet and corporate vehicle access systems. Automakers are investing in personalization features such as driver profile recognition to improve safety and convenience. This trend presents opportunities for technology providers to develop innovative, tamper-proof solutions that combine security with user-friendly interfaces, meeting the demands of both consumers and regulatory authorities.

- For instance, in 2024, Infineon Technologies AG launched the CYFP10020A00 fingerprint sensor IC specifically designed for automotive applications, providing over 99% accuracy in user authentication and enabling personalized driver settings integration in over 1.2 million vehicles globally by year-end.

Growth of Cloud-Based and IoT-Enabled Access Solutions

Cloud-based platforms and IoT integration are enabling centralized management of vehicle access control systems. Fleet operators and parking service providers benefit from real-time monitoring, data analytics, and predictive maintenance capabilities. This connectivity allows remote updates, improved scalability, and seamless integration with smart city infrastructure. Growing demand for subscription-based access services and pay-per-use models is driving adoption of such platforms, creating opportunities for solution providers to offer flexible, cost-effective, and secure access management systems.

- For instance, companies like HID Global offer cloud-based vehicle access management platforms that enable real-time monitoring and enhance fleet security, with solutions being adopted across North America and Europe.

Key Challenges

High Implementation and Maintenance Costs

The deployment of advanced biometric systems, RFID infrastructure, and integrated software requires significant upfront investment. High costs can limit adoption among small fleet operators and in developing economies. Ongoing expenses for software updates, cybersecurity measures, and equipment maintenance further add to the total cost of ownership. To overcome this challenge, manufacturers are working to develop cost-effective, modular systems that can be scaled according to user requirements and budget constraints, making advanced access control more accessible to a wider market.

Concerns Over Data Privacy and Cybersecurity

The increasing use of connected and biometric systems raises concerns over data privacy and potential cyberattacks. Unauthorized access to stored biometric data or hacking of digital key systems can compromise vehicle security. This risk limits consumer trust and may slow adoption. Manufacturers and solution providers must comply with data protection regulations and invest in robust encryption and cybersecurity protocols. Regular security updates and third-party audits are becoming essential to maintain system integrity and safeguard sensitive user information in connected vehicle ecosystems.

Regional Analysis

North America

North America held 33% share of the vehicle access control market in 2024, driven by strong adoption of advanced security technologies and connected vehicle solutions. The U.S. leads the region due to high demand for biometric access systems, RFID-based toll collection, and keyless entry technologies in passenger cars. Government initiatives to develop smart transportation infrastructure and implement electronic toll collection systems are boosting market growth. Canada also contributes significantly, supported by rising investment in smart city projects and fleet management solutions. The presence of leading automotive OEMs and technology innovators strengthens North America’s dominant market position.

Europe

Europe accounted for 28% share in 2024, supported by stringent vehicle safety regulations and rapid deployment of automated toll and parking management systems. Germany, France, and the UK are leading markets, driven by high adoption of biometric authentication and keyless entry in premium vehicles. The European Union’s focus on reducing traffic congestion and enhancing road safety has accelerated the implementation of intelligent transport systems. Growing demand for connected vehicles and subscription-based mobility services is further supporting adoption of vehicle access control technologies across commercial fleets and residential complexes throughout the region.

Asia-Pacific

Asia-Pacific captured 30% share of the global vehicle access control market in 2024, making it one of the fastest-growing regions. China, Japan, and India are major contributors, with rising demand for keyless entry, RFID toll collection, and biometric authentication systems. Rapid urbanization, increasing vehicle ownership, and government initiatives for smart city development are driving large-scale adoption. The growth of electric and connected vehicles is further boosting demand for integrated access control solutions. Local manufacturers are investing in cost-effective and scalable technologies, making advanced vehicle access systems accessible to mid-range and mass-market vehicles.

Latin America

Latin America held 5% share of the vehicle access control market in 2024, led by Brazil and Mexico. Growing concerns about vehicle theft and the need for secure parking solutions are driving adoption of biometric and RFID-based systems. Expanding highway networks and the introduction of automated toll collection solutions are contributing to regional growth. Government-backed initiatives promoting smart mobility and urban infrastructure upgrades are encouraging the deployment of vehicle access technologies. Despite economic challenges, rising demand for security and connected vehicle features is expected to support steady market expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for 4% share in 2024, with demand supported by rapid infrastructure development and increasing investment in smart transportation systems. The UAE and Saudi Arabia are leading markets, implementing RFID-enabled toll systems and secure access solutions in commercial facilities. Africa is witnessing gradual adoption, driven by the need for theft prevention and fleet management solutions in logistics and public transport. Although high initial costs limit adoption in some areas, government-led projects and rising vehicle sales are expected to drive growth in the coming years.

Market Segmentations:

By Technology

- Biometric

- Non-Biometric

- RFID

- Others

By Application

- Tollways

- Commercial Buildings

- Residential Buildings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vehicle access control market is characterized by major players such as NXP Semiconductors, HELLA GmbH & Co. KGaA, Robert Bosch GmbH, ALPS ALPINE CO., LTD., Lear Corp, STMicroelectronics, Valeo, AVERY DENNISON CORPORATION, Continental AG, and OMRON Corporation. These companies focus on developing advanced biometric systems, RFID solutions, and smart key technologies to meet growing demand for secure and convenient vehicle access. Strategic initiatives include partnerships with automotive OEMs, expansion of production facilities, and investment in IoT-enabled access control solutions. Many players are emphasizing cybersecurity features and compliance with vehicle safety regulations to enhance trust and adoption. Product innovation, miniaturization of electronic components, and integration with connected car platforms remain key priorities. The market is highly competitive, and players are leveraging mergers, acquisitions, and R&D efforts to strengthen their market presence and cater to both premium and mass-market vehicle segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, NXP Semiconductors enabled Xiaomi’s UWB digital car key for smart access.

- In April 2025, ALPS ALPINE showcased automotive sensors and ICs that support digital key platforms.

- In April 2025, STMicroelectronics launched next-gen automotive NFC readers for CCC Digital Key.

- In March 2024, HELLA (FORVIA) won series orders for its UWB Smart Car Access system.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of biometric vehicle access systems will continue to rise for enhanced security.

- Keyless entry and digital key technologies will gain wider use in mid-range vehicles.

- Integration of IoT and connected car platforms will enable remote and personalized access control.

- Demand for RFID and smart toll collection systems will grow with expansion of smart highways.

- Asia-Pacific will remain the fastest-growing region, supported by urbanization and infrastructure projects.

- North America will lead with strong adoption of intelligent transportation and fleet management solutions.

- Multi-factor authentication combining biometrics and mobile apps will become industry standard.

- Automakers will invest in cybersecurity measures to protect vehicle access systems from hacking.

- Partnerships between technology providers and automotive OEMs will accelerate innovation and market reach.

- Growing popularity of shared mobility and subscription-based vehicle services will drive secure access solutions.

Market Insights

Market Insights