Market Overview

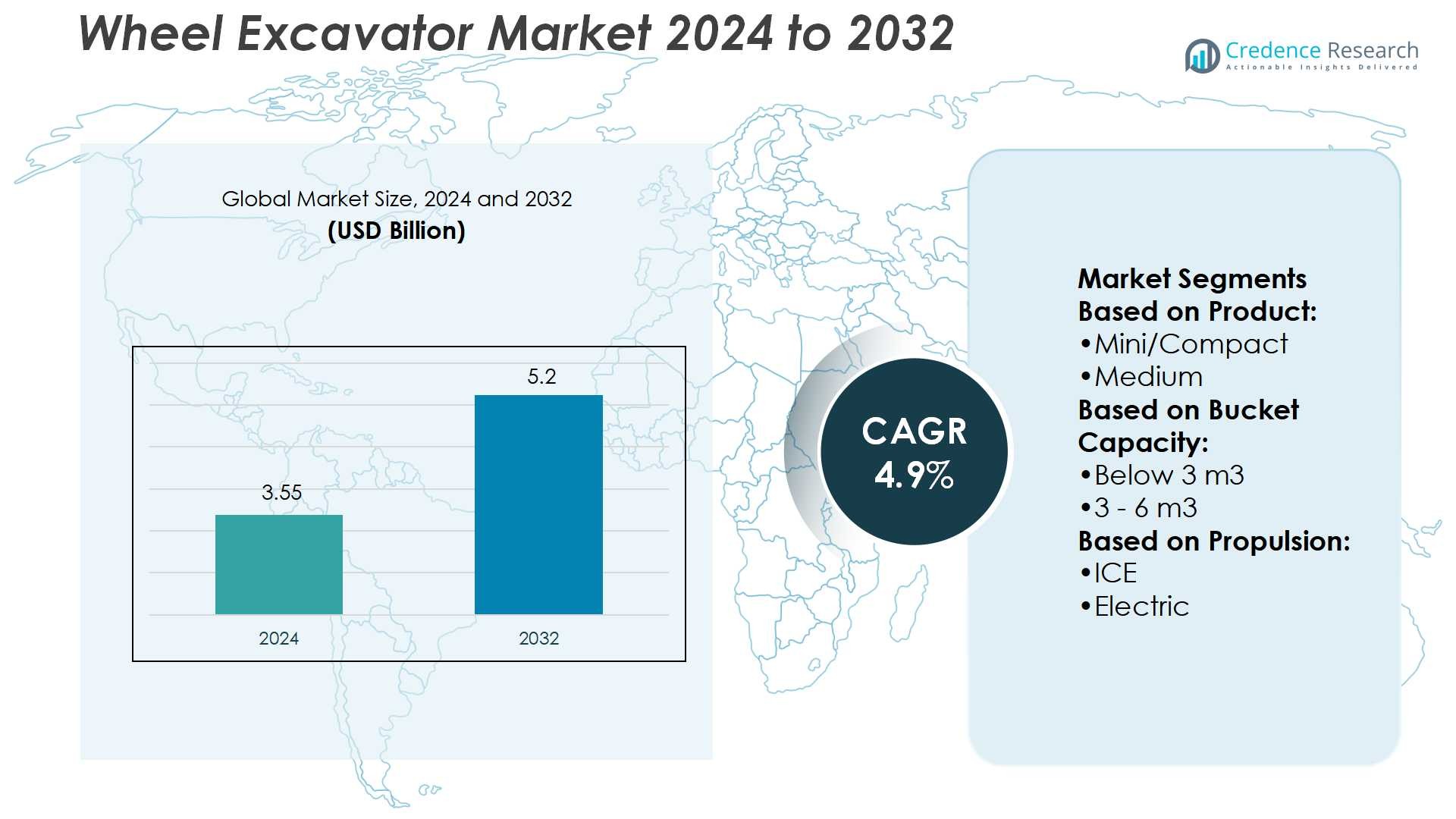

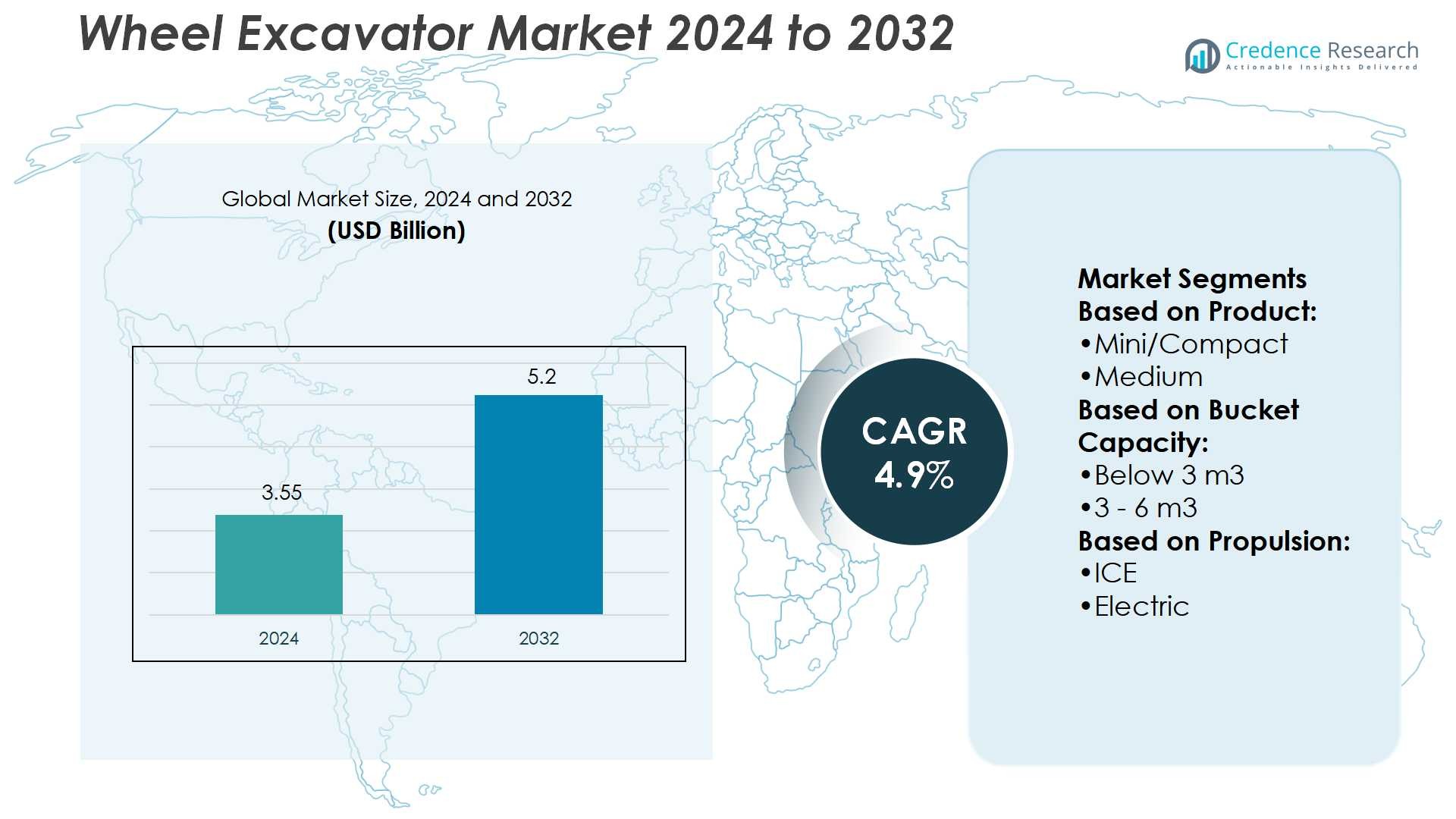

Wheel Excavator Market size was valued USD 3.55 billion in 2024 and is anticipated to reach USD 5.2 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wheel Excavator Market Size 2024 |

USD 3.55 Billion |

| Wheel Excavator Market, CAGR |

4.9% |

| Wheel Excavator Market Size 2032 |

USD 5.2 Billion |

The wheel excavator market is driven by prominent players such as Caterpillar Inc., Komatsu Ltd, AB Volvo, Liebherr Group, Hitachi Construction Machinery Co. Ltd, J.C. Bamford Excavators Ltd, Deere & Company, Sany Heavy Industry Co., Ltd., XCMG, and Doosan Infracore Co. Ltd. These companies focus on technological innovation, digital integration, and sustainable product development to strengthen competitiveness across global markets. Asia-Pacific emerges as the leading region, holding a 34% market share, supported by massive infrastructure investments, rapid urbanization, and strong demand from mining and construction sectors. The dominance of this region is reinforced by government-backed projects, expanding rental fleets, and the rising adoption of advanced excavator technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wheel excavator market size was USD 3.55 billion in 2024 and is projected to reach USD 5.2 billion by 2032, registering a CAGR of 4.9% during the forecast period.

- Rising infrastructure investments, mining activities, and urbanization projects drive demand for medium wheel excavators, which account for the largest product share due to their versatility across multiple applications.

- Key players including Caterpillar Inc., Komatsu Ltd, AB Volvo, Liebherr Group, Hitachi Construction Machinery Co. Ltd, and others focus on digital integration, telematics, and sustainability-driven innovations to enhance competitiveness.

- High ownership and maintenance costs, coupled with emission regulations on internal combustion models, act as restraints, pushing contractors toward rental services and eco-friendly equipment alternatives.

- Asia-Pacific leads the market with a 34% share, followed by North America at 27% and Europe at 24%, while the 3–6 m³ bucket capacity segment dominates globally due to efficiency in construction and mining operations.

Market Segmentation Analysis:

By Product

Medium wheel excavators dominate the market, holding the largest share due to their balance of power and versatility. They are widely adopted in urban infrastructure, mining, and construction projects where both efficiency and mobility are required. Their adaptability across different terrains and cost-effectiveness compared to large models strengthen demand. Increasing investment in road development and smart city projects continues to drive the preference for medium models over compact and large alternatives, reinforcing their leading position within this segment.

- For instance, Liebherr’s A 914 Litronic wheeled excavator delivers an operating weight of 15,200–17,500 kg and engine output of 105 kW (143 HP), ideal for urban road and smart-city infrastructure where both efficiency and mobility matter.

By Bucket Capacity

The 3–6 m³ bucket capacity segment leads the market, supported by its suitability for medium to heavy-duty excavation tasks. This segment is favored in construction, mining, and industrial applications where higher load efficiency reduces operational time and costs. The ability to handle diverse soil types and bulk material transport further adds to its appeal. Contractors prefer this capacity range as it provides an optimal balance between productivity and maneuverability, making it the dominant choice over smaller or oversized alternatives.

- For instance, JCB JS330/370 LC/NLC line of tracked excavators offers a range of buckets and dipper options, including a 3.23-meter dipper range. The JS370 can be fitted with buckets with capacities up to 1.93 m³.

By Propulsion

Internal combustion engine (ICE) wheel excavators remain the dominant segment, accounting for the majority share due to established technology and widespread fueling infrastructure. These machines are preferred in heavy-duty construction, mining, and rural projects where high power output and longer operation cycles are critical. Although electric wheel excavators are emerging with advancements in battery capacity and zero-emission operations, ICE models continue to lead because of their cost efficiency, reliability, and ability to operate in remote areas without charging facilities.

Key Growth Drivers

Infrastructure Development Investments

Rising global infrastructure spending strongly drives demand for wheel excavators. Governments are investing in road construction, urban development, and transportation projects, which require high-efficiency excavation equipment. Wheel excavators, with their mobility and operational flexibility, are particularly suited for urban and semi-urban projects. Their ability to switch between construction sites without additional transport enhances productivity. Expanding investments in smart city initiatives and public infrastructure further strengthen adoption, making infrastructure growth a primary driver for the wheel excavator market.

- For instance, Hitachi’s ZX170W-6 wheeled excavator is a mobile and versatile machine suitable for road and semi-urban projects. With a rated power around 105–128 kW and an operating weight in the 17,300–19,100 kg range, it offers strong digging and travel performance.

Mining and Quarrying Expansion

The mining and quarrying industry increasingly relies on wheel excavators for material handling and excavation. Medium and large wheel excavators dominate this application due to their ability to move bulk loads efficiently. Rising demand for minerals, aggregates, and metals supports continuous investment in heavy-duty equipment. Excavators with larger bucket capacities and improved fuel efficiency are gaining preference. The need for reliable, high-performance machinery in mining operations continues to push the demand for wheel excavators, boosting market growth in resource-driven economies.

- For instance, Deere’s 190G W wheeled excavator has an operating weight of 19,700–20,500 kg and delivers 129 kW net power. Medium and large wheel excavators dominate this application due to their ability to move bulk loads efficiently.

Technological Advancements and Automation

Continuous innovation in automation and telematics significantly boosts the adoption of wheel excavators. Advanced models integrate GPS, IoT sensors, and real-time monitoring systems, enabling operators to achieve higher precision and efficiency. Automated control systems improve digging accuracy, fuel management, and machine diagnostics, reducing downtime and operational costs. Electric propulsion technologies are also emerging, aligning with global sustainability goals. Manufacturers investing in smart excavator technologies attract construction and mining firms seeking productivity gains and compliance with environmental regulations, making technology a vital growth driver.

Key Trends & Opportunities

Shift Toward Electrification

The push for sustainable construction equipment creates opportunities for electric wheel excavators. Urban infrastructure projects, where noise and emission regulations are strict, favor the adoption of battery-powered models. Manufacturers are introducing electric variants with enhanced battery life and fast-charging options. While ICE models dominate, electric excavators present significant long-term growth opportunities, especially in Europe and Asia-Pacific, where governments provide incentives for green machinery. This trend aligns with carbon reduction targets and strengthens opportunities for eco-friendly construction equipment adoption.

- For instance, Komatsu’s the PC138E-11 is equipped with a high-capacity 225.6 kWh lithium-ion battery to ensure long hours of operation. Product specifications explicitly state the motor output is 72.5 kW.

Integration of Telematics and Digital Solutions

The integration of digital platforms is a rising trend across the wheel excavator market. Telematics systems provide real-time tracking, predictive maintenance, and fuel consumption analysis, which optimize fleet operations. Construction companies increasingly prefer models with remote monitoring and automated diagnostics for cost reduction and higher equipment uptime. Opportunities arise for manufacturers to bundle software services with machines, creating new revenue streams. The growing role of connected solutions enhances customer value and positions telematics as a key differentiator in the market.

- For instance, the SY155W has an engine rated at 161 hp @ 2000 rpm, operating weight of 13.5 tonnes, arm length of 2.1 m, and bucket size 0.58 m³, all available for monitoring via telematics.

Key Challenges

High Initial and Maintenance Costs

The wheel excavator market faces challenges from high acquisition and maintenance costs. Advanced models with automation, telematics, and larger capacities require significant upfront investment, which deters small and medium contractors. Maintenance expenses for parts, fuel, and after-sales services also add financial pressure. These costs can limit adoption in price-sensitive markets, especially in developing regions. Although rental models offer relief, ownership costs remain a major challenge that impacts overall market expansion.

Emission Regulations and Compliance Pressure

Strict global emission regulations pose challenges for manufacturers and users of wheel excavators. ICE models, which dominate the market, face compliance risks as governments enforce stricter standards to reduce carbon emissions. Meeting these requirements demands heavy investment in R&D for cleaner engines and alternative propulsion systems. Contractors operating older fleets risk regulatory penalties, limiting their operational scope. Balancing compliance with cost efficiency remains a challenge for both producers and users, slowing widespread adoption of traditional wheel excavators.

Regional Analysis

North America

North America holds a 27% share in the wheel excavator market, supported by robust infrastructure development and strict regulatory frameworks. The U.S. drives regional growth with ongoing investments in urban redevelopment, highways, and smart city projects. Contractors prefer medium wheel excavators for their versatility in municipal construction and road maintenance. Adoption of telematics and fuel-efficient machines is strong, driven by advanced technology integration and environmental compliance standards. Canada contributes significantly with mining and quarrying activities, while the presence of leading manufacturers and rental-based models further sustains demand across the region.

Europe

Europe accounts for a 24% share in the wheel excavator market, led by Germany, France, and the UK. Stringent emission regulations and sustainability goals drive adoption of electric and hybrid excavators. Demand is concentrated in urban construction, road development, and utility projects where mobility is a key factor. Eastern Europe shows rising adoption due to infrastructure modernization initiatives. Rental models dominate as contractors seek cost-effective equipment access. Technological advancements such as automation, telematics, and remote diagnostics are widely used, aligning with Europe’s focus on efficiency and eco-friendly construction machinery.

Asia-Pacific

Asia-Pacific dominates the wheel excavator market with a 34% share, driven by massive infrastructure and industrial projects in China, India, and Southeast Asia. Government-backed investments in highways, railways, and urban development fuel high demand. Medium and large excavators are favored in mining, quarrying, and energy projects across the region. Rapid urbanization increases demand for compact excavators in city-based projects. Japan and South Korea lead in adopting advanced telematics and electric models. The region’s expanding construction and mining sectors, combined with rising equipment leasing services, make Asia-Pacific the fastest-growing market segment.

Latin America

Latin America holds a 7% share in the wheel excavator market, supported by construction and mining activities in Brazil, Mexico, and Chile. Infrastructure projects, including road development and housing, stimulate demand for medium excavators. The mining sector in Chile and Peru further boosts sales of large excavators with high bucket capacities. However, high equipment costs and limited access to advanced technologies restrict broader adoption. Rental-based services are increasingly preferred by contractors managing project-specific needs. Despite economic fluctuations, Latin America remains an emerging market with growth opportunities tied to resource-driven industries.

Middle East & Africa

The Middle East & Africa account for an 8% share of the wheel excavator market, led by energy, oil and gas, and large-scale construction projects. Gulf nations such as Saudi Arabia and the UAE drive demand through megacity and infrastructure initiatives under national development programs. Africa contributes significantly with mining projects in South Africa and Nigeria, requiring heavy-duty wheel excavators. Contractors prefer durable, fuel-efficient models suited for challenging terrains. While reliance on imported machinery remains high, increasing investment in infrastructure and industrial development ensures steady regional demand for wheel excavators.

Market Segmentations:

By Product:

By Bucket Capacity:

By Propulsion:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The wheel excavator market is shaped by leading players including Liebherr Group, J.C. Bamford Excavators Ltd, Hitachi Construction Machinery Co. Ltd, Deere & Company, Komatsu Ltd, Sany Heavy Industry Co., Ltd., Caterpillar Inc., AB Volvo, XCMG, and Doosan Infracore Co. Ltd. The wheel excavator market is highly competitive, characterized by continuous innovation, regional expansion, and shifting customer preferences. Manufacturers focus on developing advanced models with enhanced fuel efficiency, telematics integration, and automation features to meet rising demand for productivity and cost savings. The push toward sustainability drives investments in electric and hybrid wheel excavators, aligning with stricter emission standards worldwide. Rental and leasing services are gaining traction as contractors seek flexibility and reduced ownership costs. Companies also emphasize after-sales support, digital solutions, and strategic partnerships to strengthen market presence and build long-term customer relationships in both developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liebherr Group

- C. Bamford Excavators Ltd

- Hitachi Construction Machinery Co. Ltd

- Deere & Company

- Komatsu Ltd

- Sany Heavy Industry Co., Ltd.

- Caterpillar Inc.

- AB Volvo

- XCMG

- Doosan Infracore Co. Ltd

Recent Developments

- In February 2025, Kubota’s construction equipment introduced two new compact excavators, the U17-5 and KX040-5, in addition to a new compact track loader. The U17-5 is a 1.7 ton zero-tail swing excavator designed with improved operator comfort and maneuverability for tight job sites.

- In July 2024, Liebherr-Werk Bischofshofen GmbH announced plans to expand its production capacity significantly through an additional manufacturing facility in Styria, Austria, focusing on small wheel loaders.

- In April 2024, Michelin launched XTRA DEFEND E4/L4 Tires, engineered for loaders and articulated dump trucks and provides remarkable durability together with flexibility. This tire provides top-level reliability by delivering increased productivity and it fits many vehicle types through six size options to perform best under challenging construction site and mining site conditions.

- In March 2024, The Goodyear Tire & Rubber Company released RL-5K Off-the-Road (OTR) tires for large wheel loaders and wheel dozers. The RL-5K establishes itself as Goodyear’s newest radial OTR tire and operates in the 45/65R45 tire size while its construction allows it to endure necessary air pressure requirements to deliver enhanced three-star load capacity which generates a 16% increase in load potential.

Report Coverage

The research report offers an in-depth analysis based on Product, Bucket Capacity, Propulsion and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for wheel excavators will grow with rising infrastructure development worldwide.

- Electric and hybrid wheel excavators will gain traction due to stricter emission regulations.

- Medium wheel excavators will remain the most preferred category across construction and mining projects.

- Digital integration through telematics and IoT will drive efficiency and predictive maintenance.

- Rental-based services will expand as contractors prioritize cost-effective equipment access.

- Emerging markets in Asia-Pacific and Africa will offer strong growth opportunities.

- Advanced automation and operator-assist features will enhance safety and productivity.

- Mining and quarrying projects will continue to drive demand for large wheel excavators.

- Compact models will see higher adoption in urban and municipal projects.

- Strategic collaborations and R&D investments will shape the future competitive landscape.