Market Overview

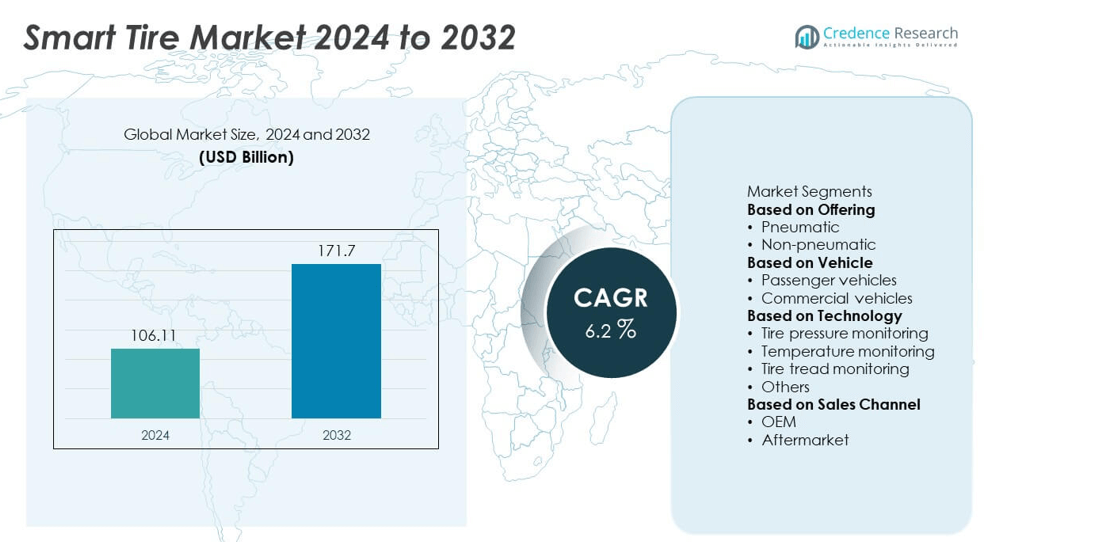

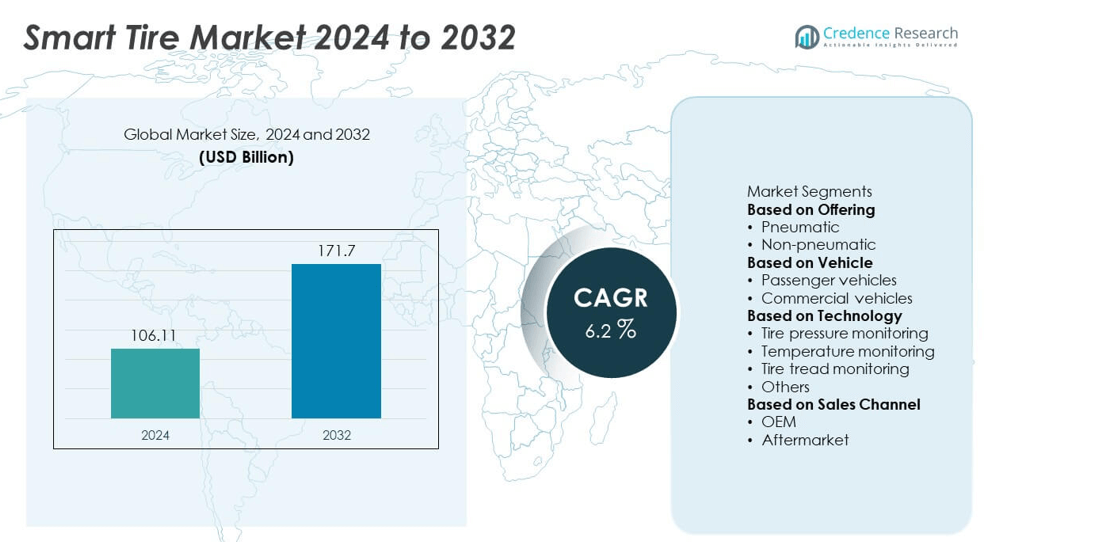

The Smart Tire market size was valued at USD 106.11 billion in 2024 and is projected to reach USD 171.70 billion by 2032, expanding at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Tire Market Size 2024 |

USD 106.11 billion |

| Smart Tire Market, CAGR |

6.2% |

| Smart Tire Market Size 2032 |

USD 171.70 billion |

The smart tire market is driven by top players including Toyo Tire Corporation, Michelin Group, Sumitomo Rubber Industries, Ltd., Nokian Tyres plc, The Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Continental AG, Bridgestone Corporation, Hankook Tire & Technology Group, and NIRA Dynamics AB. These companies compete through innovations in tire pressure monitoring, tread and temperature sensing, and IoT-enabled predictive maintenance solutions. Regionally, Asia-Pacific led the market with 34% share in 2024, supported by high vehicle production and rising EV adoption. North America followed with 33% share, driven by regulatory mandates for tire monitoring systems and strong fleet demand, while Europe accounted for 29% share, fueled by premium vehicle adoption, safety regulations, and sustainability-focused innovations.

Market Insights

- The smart tire market was valued at USD 106.11 billion in 2024 and is projected to reach USD 171.70 billion by 2032, growing at a CAGR of 6.2% during the forecast period.

- Rising safety regulations and the growing need for real-time tire pressure monitoring drive adoption, with pneumatic tires leading the market at over 70% share in 2024 due to their compatibility with both passenger and commercial vehicles.

- Trends include integration of IoT, AI, and predictive analytics into tire technologies, alongside increasing development of non-pneumatic and sensor-enabled tire models for future mobility applications.

- The market is highly competitive with players such as Toyo Tire Corporation, Michelin Group, Sumitomo Rubber Industries, Nokian Tyres, Goodyear, Pirelli, Continental AG, Bridgestone, Hankook, and NIRA Dynamics focusing on smart technologies, digital platforms, and sustainability initiatives.

- Regionally, Asia-Pacific led with 34% share in 2024, followed by North America at 33%, Europe at 29%, while Latin America and Middle East & Africa accounted for 3% and 1% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offering

The pneumatic tire segment dominated the smart tire market in 2024, holding over 70% share, driven by its widespread use in both passenger and commercial vehicles. Pneumatic smart tires integrate advanced sensors that monitor air pressure, performance, and safety in real time, making them highly suitable for mass adoption. Their cost-effectiveness and compatibility with existing vehicle platforms strengthen market penetration. Non-pneumatic tires, though smaller in share, are gaining attention for specialized applications such as defense and off-road vehicles due to their puncture resistance and low-maintenance benefits.

- For instance, Continental’s existing ContiPressureCheck system continuously monitors tire pressure and temperature, providing real-time alerts. Separately, as part of its ContiConnect solution, Continental announced in 2024 a new generation of sensors that, in conjunction with AI-based algorithms, can automatically measure tread depth. This new technology provides daily updates for enhanced fleet safety and maintenance optimization.

By Vehicle

Passenger vehicles accounted for the largest share of over 60% in 2024, supported by rising consumer demand for safety, comfort, and performance-enhancing technologies. The integration of smart tires in passenger cars, particularly in premium and electric vehicle models, drives this dominance. Growing adoption of tire pressure monitoring systems (TPMS) across regulatory markets like North America and Europe further boosts demand. Commercial vehicles are also embracing smart tire solutions to optimize fleet management, reduce downtime, and improve fuel efficiency, though passenger vehicles remain the primary driver of market expansion.

- For instance, tire manufacturers like Michelin and Bridgestone have developed airless tires, also known as non-pneumatic tires, for both passenger and commercial vehicles. These prototypes are designed to absorb shock and eliminate puncture risks, similar to traditional tires.

By Technology

Tire pressure monitoring led the smart tire market with over 45% share in 2024, supported by government regulations mandating TPMS in vehicles across regions such as the U.S. and EU. These systems enhance safety by providing real-time alerts to drivers, reducing accidents caused by underinflated tires. Temperature monitoring and tread monitoring technologies are also gaining momentum, especially in fleet and performance vehicles, to prevent overheating and extend tire life. Other technologies, including advanced predictive analytics, are emerging but remain smaller in adoption compared to the established dominance of tire pressure monitoring systems.

Market Overview

Growing Adoption of Vehicle Safety Regulations

Stringent government regulations mandating tire pressure monitoring systems (TPMS) in regions such as North America and Europe are a major driver for the smart tire market. These regulations aim to reduce accidents caused by underinflated tires and improve fuel efficiency. Automakers integrate smart tire solutions into passenger and commercial vehicles to comply with safety standards. The regulatory push not only accelerates adoption but also increases consumer awareness of advanced tire technologies, positioning safety compliance as a critical growth factor for global smart tire demand.

Rising Demand from Electric and Connected Vehicles

The expansion of electric and connected vehicles is fueling the demand for smart tires that enhance efficiency, range, and performance monitoring. Electric vehicles require precise tire monitoring systems to optimize energy use and ensure safety at higher torque levels. Connected vehicles also rely on real-time data from smart tires for predictive maintenance and improved driving experiences. As global EV adoption continues to surge, smart tires are emerging as a vital component of intelligent mobility solutions, supporting long-term growth in this sector.

- For instance, Continental launched production of its second-generation direct TPMS for passenger cars in India in April 2023. The system does offer a reliable battery life of up to 10 years and enhanced wireless communication capabilities, among other features.

Increased Focus on Fleet Management Efficiency

Commercial fleets are increasingly adopting smart tires to reduce operational costs, improve uptime, and enhance road safety. Smart tire systems provide real-time data on tire pressure, temperature, and tread, enabling predictive maintenance and reducing breakdown risks. Logistics and transportation companies are prioritizing such technologies to optimize fuel efficiency and extend tire lifespan. With global demand for reliable supply chains, fleet operators are turning to smart tire solutions as essential tools for cost reduction and improved performance, driving growth in the commercial vehicle segment.

- For instance, Infineon Technologies introduced the Xensiv SP49 tire pressure sensor in September 2023. The sensor is designed for electric and connected vehicles and has an operational temperature range from -40°C to 125°C. It also provides advanced tire pressure monitoring systems and intelligent tire features.

Key Trends & Opportunities

Integration of IoT and Predictive Analytics

Smart tires are rapidly evolving with IoT-enabled sensors and cloud platforms that deliver predictive analytics. These technologies allow real-time tracking of tire health, predicting wear and potential failures before they occur. Automakers and fleet operators benefit from reduced downtime, lower maintenance costs, and enhanced safety. The growing adoption of Industry 4.0 practices in mobility is creating strong opportunities for technology providers to integrate advanced analytics into tire ecosystems, strengthening the role of smart tires as a core element of intelligent transportation systems.

- For instance, Goodyear’s SightLine platform integrates embedded sensors that sample tire pressure, temperature, and load metrics, feeding this real-time data to cloud-based analytics. The technology is designed to minimize tire-related fleet downtime and was integrated into commercial fleets, including autonomous delivery vehicles for Gatik in 2024.

Emergence of Non-Pneumatic Tire Innovations

Non-pneumatic tires are gaining traction as a promising opportunity in the smart tire market. Their puncture-resistant design eliminates the risk of blowouts, making them suitable for military, off-road, and future autonomous vehicle applications. Companies are investing in developing sensor-enabled non-pneumatic models that deliver real-time performance monitoring. Although still in early stages of commercialization, these innovations highlight the potential to reduce maintenance needs while ensuring safety, presenting significant opportunities for manufacturers to expand their offerings in specialized and high-growth segments.

- For instance, The SMART Tire Company is developing an airless tire based on a nickel-titanium shape memory alloy called NiTinol+, originally created by NASA for lunar and Martian rovers. This material is elastic like rubber but strong like titanium, allowing it to undergo significant deformation and fully recover its shape.

Key Challenges

High Costs of Smart Tire Systems

The integration of advanced sensors, IoT platforms, and data analytics increases the cost of smart tires compared to traditional models. For consumers in cost-sensitive markets, this premium remains a barrier to adoption. Fleet operators also face challenges balancing upfront investments with long-term savings. While declining sensor costs and economies of scale are expected to improve affordability, the high initial price point continues to restrain wider adoption, especially in emerging economies where price competitiveness plays a critical role in vehicle purchasing decisions.

Data Security and Integration Concerns

Smart tires rely on continuous data exchange between sensors, vehicles, and cloud systems, making them vulnerable to cybersecurity threats. Unauthorized access to tire data could impact vehicle safety and user privacy. Additionally, integrating smart tire solutions across diverse vehicle platforms and telematics systems remains complex, requiring standardization and interoperability. These challenges increase implementation costs and create potential reliability issues, slowing adoption in certain markets. Addressing cybersecurity and integration barriers is essential for manufacturers to build trust and scale smart tire deployment globally.

Regional Analysis

North America

North America accounted for 33% share in 2024, driven by strong adoption of tire pressure monitoring systems mandated by government regulations. The U.S. leads the region with widespread integration of smart tire technologies in passenger and commercial vehicles, while Canada shows rising demand through electric vehicle adoption and premium car sales. Fleet operators in logistics and transportation sectors are increasingly investing in smart tire solutions to reduce maintenance costs and improve fuel efficiency. Continuous innovation by key automotive players and a well-established aftermarket ecosystem further reinforce North America’s dominant role in the global smart tire market.

Europe

Europe held 29% share in 2024, supported by strict regulatory frameworks such as the European Union’s tire labeling requirements and safety mandates. Countries like Germany, France, and the U.K. lead in adopting smart tire solutions, particularly in premium vehicles and electric cars. Fleet operators across the region rely heavily on advanced tire monitoring systems to enhance operational efficiency and reduce carbon emissions. Strong consumer preference for safety and sustainability, coupled with leading tire manufacturers headquartered in the region, strengthens Europe’s position as a hub for innovation in smart tire technologies.

Asia-Pacific

Asia-Pacific dominated the smart tire market with 34% share in 2024, led by high vehicle production volumes and growing adoption of advanced automotive technologies in China, Japan, South Korea, and India. Rapid urbanization and rising disposable incomes fuel demand for passenger vehicles equipped with safety and performance-enhancing features. Electric vehicle expansion across the region further accelerates adoption of smart tire solutions. Local and global manufacturers are expanding production capacities and partnerships to cater to demand, making Asia-Pacific not only the largest market but also the fastest-growing hub for smart tire innovations.

Latin America

Latin America captured 3% share in 2024, with Brazil and Mexico leading demand for smart tire technologies. Growing urbanization and an expanding commercial vehicle sector are driving adoption of tire pressure and temperature monitoring systems, particularly in logistics and long-haul transport. Government efforts to improve road safety and fleet efficiency also support market growth. However, high upfront costs and limited awareness remain challenges in the region. Increasing partnerships between tire manufacturers and local distributors are expected to improve accessibility, gradually expanding the penetration of smart tire solutions across Latin America in the coming years.

Middle East & Africa

The Middle East and Africa accounted for 1% share in 2024, reflecting a smaller but emerging market for smart tires. Demand is primarily concentrated in Gulf countries such as the UAE and Saudi Arabia, where investments in premium vehicles and smart mobility infrastructure are growing. South Africa also contributes with adoption in commercial fleets seeking cost efficiency and improved road safety. Despite infrastructure gaps and limited affordability in several countries, rising interest in connected vehicle technologies and smart city projects is expected to create new opportunities for smart tire adoption across the region.

Market Segmentations:

By Offering

By Vehicle

- Passenger vehicles

- Commercial vehicles

By Technology

- Tire pressure monitoring

- Temperature monitoring

- Tire tread monitoring

- Others

By Sales Channel

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the smart tire market is shaped by leading players such as Toyo Tire Corporation, Michelin Group, Sumitomo Rubber Industries, Ltd., Nokian Tyres plc, The Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., Continental AG, Bridgestone Corporation, Hankook Tire & Technology Group, and NIRA Dynamics AB. These companies focus on advancing sensor integration, tire pressure monitoring systems, and predictive analytics to enhance vehicle safety and performance. Strategic collaborations with automakers and fleet operators strengthen their market presence, particularly in passenger and electric vehicles. Investments in research and development drive innovations in non-pneumatic tire models, temperature and tread monitoring, and IoT-enabled platforms. Sustainability also plays a central role, with manufacturers adopting eco-friendly materials and energy-efficient production methods. By expanding partnerships, digital solutions, and product portfolios, these key players continue to lead the transition toward safer, more efficient, and connected tire technologies in the global automotive industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Toyo Tire Corporation

- Michelin Group

- Sumitomo Rubber Industries, Ltd.

- Nokian Tyres plc

- The Goodyear Tire & Rubber Company

- Pirelli & C. S.p.A.

- Continental AG

- Bridgestone Corporation

- Hankook Tire & Technology Group

- NIRA Dynamics AB

Recent Developments

- In February 2025, NIRA launched a digital Tread Wear Indicator (TWI) to monitor tire wear in real time.

- In January 2025, Goodyear announced its SightLine smart tire technology that senses rain and ice, helping trigger automatic emergency braking earlier.

- In 2025, Continental AG showcased smart tire and digital service solutions at TOC Europe, including ContiConnect and TerminalMaster for port logistics.

- In December 2024, Michelin partnered with Beontag to develop RFID-enabled smart tires for passenger and commercial segments.

Report Coverage

The research report offers an in-depth analysis based on Offering, Vehicle, Technology, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing adoption of safety-focused automotive technologies.

- Pneumatic tires will remain dominant while non-pneumatic models gain traction in niche applications.

- Passenger vehicles will continue to lead demand, supported by integration in electric and premium cars.

- Tire pressure monitoring will remain the largest technology segment due to regulatory mandates.

- IoT-enabled and AI-driven predictive maintenance will strengthen smart tire adoption in fleets.

- Asia-Pacific will maintain leadership as the largest and fastest-growing regional market.

- North America will sustain growth through safety regulations and strong fleet management demand.

- Europe will advance adoption with premium vehicles and sustainability-driven innovations.

- Rising electric and connected vehicle adoption will accelerate demand for advanced tire technologies.

- Competition will intensify as global tire manufacturers and tech companies invest in innovation.