Market Overview

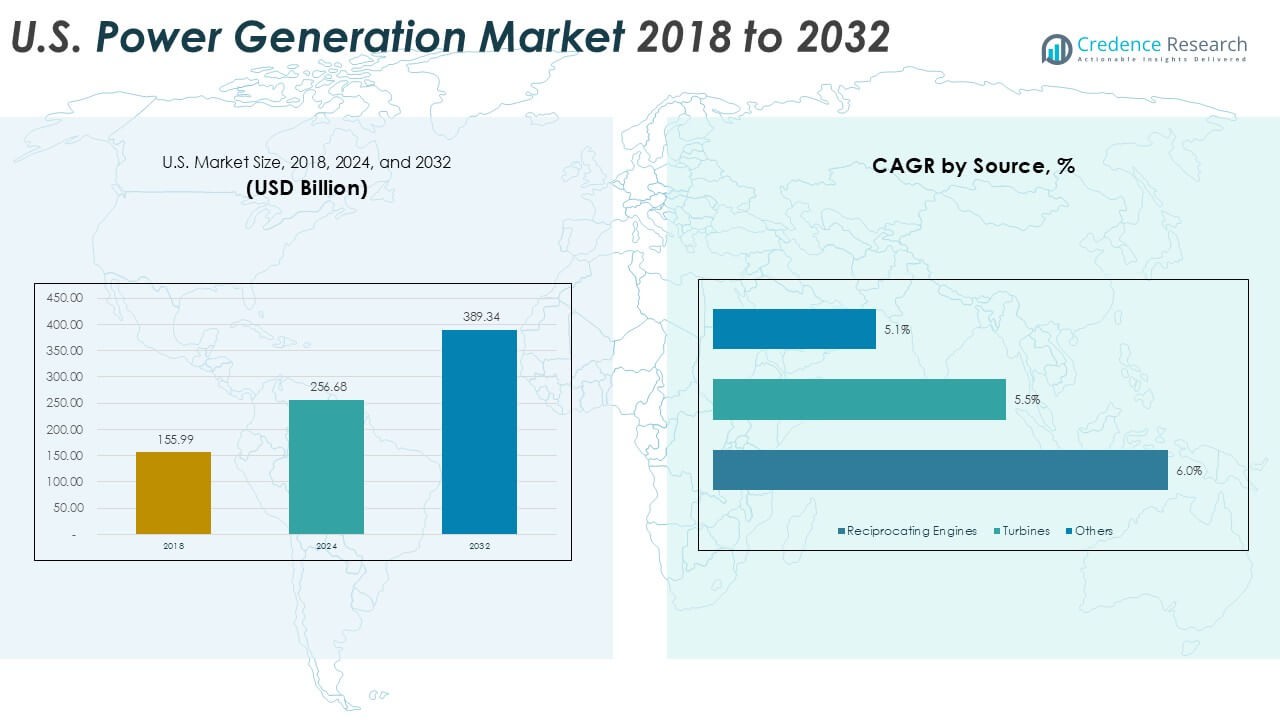

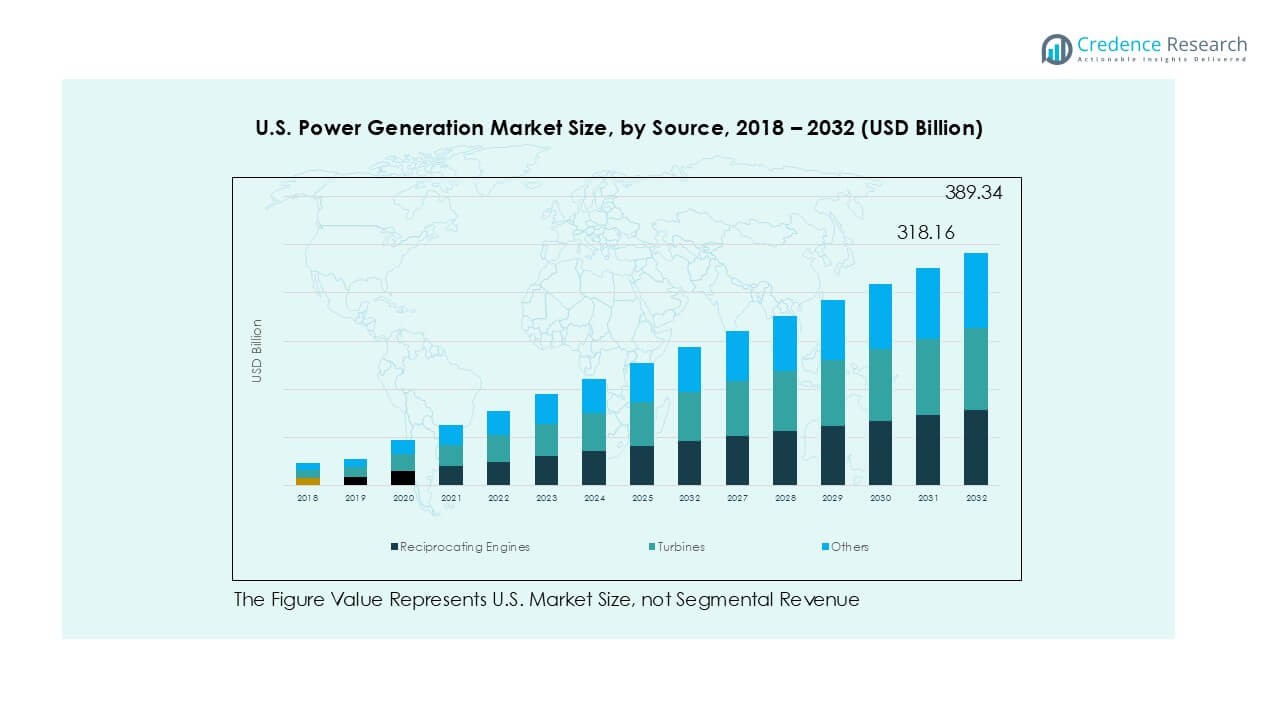

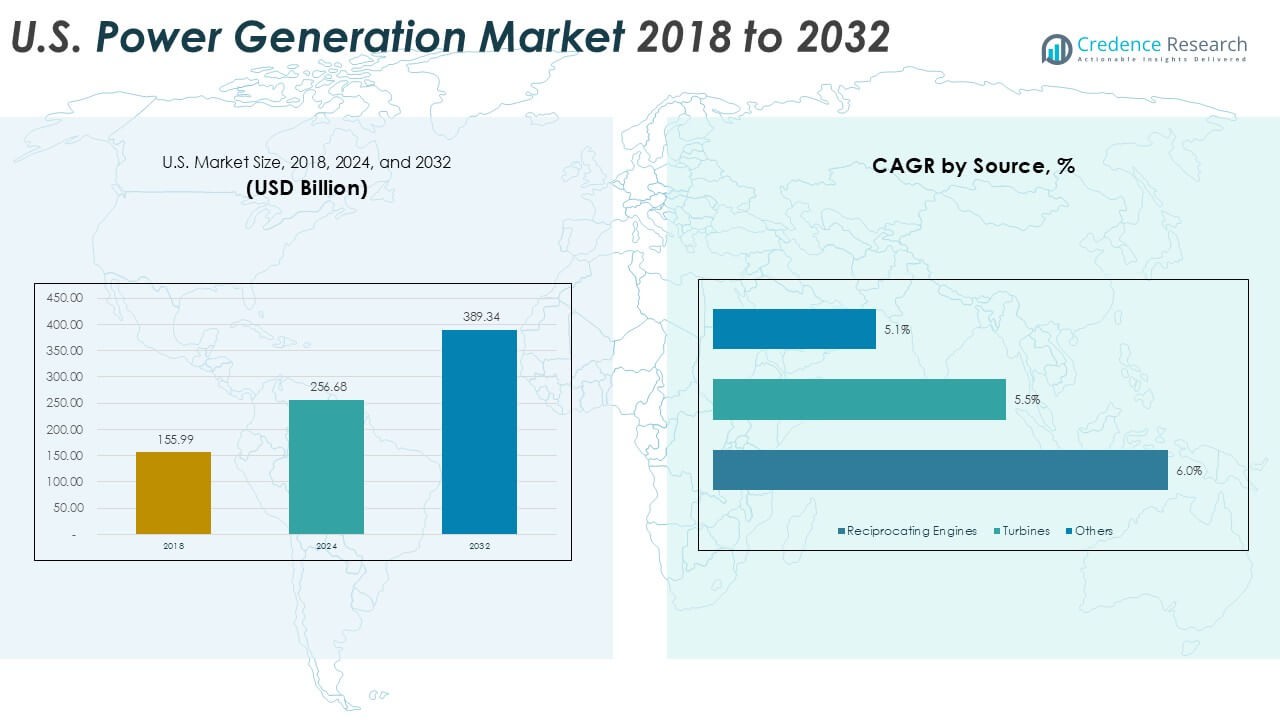

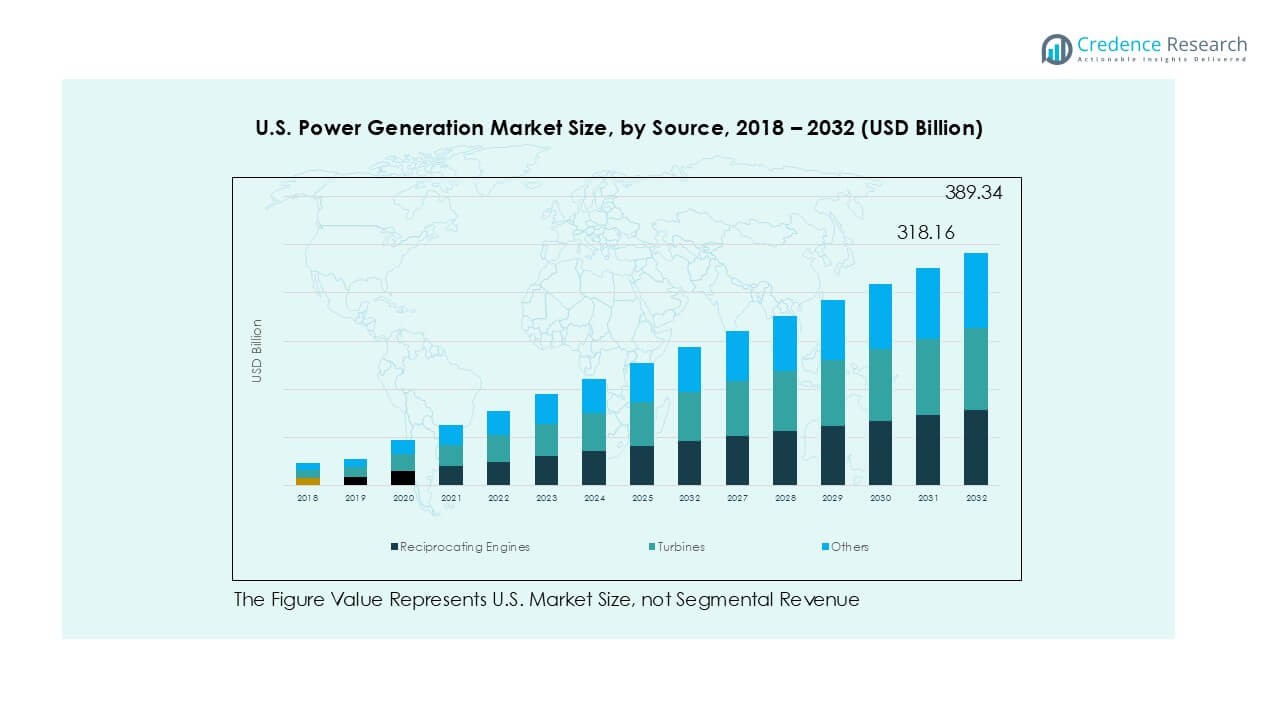

The U.S. Power Generation market size was valued at USD 155.99 million in 2018, growing to USD 256.68 million in 2024, and is anticipated to reach USD 389.34 million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Power Generation Market Size 2024 |

USD 256.68 Million |

| U.S. Power Generation Market, CAGR |

5.2% |

| U.S. Power Generation Market Size 2032 |

USD 389.34 Million |

The U.S. power generation market features key players such as Volta Grid, Wartsila Corporation, Aggreko, ABB, and Raven Volt, alongside several other regional participants. These companies focus on expanding generation capacity through advanced turbine systems, distributed generation, and hybrid renewable solutions to meet rising electricity demand. The South region emerged as the leader in 2024 with a 34.8% market share, driven by strong industrial demand, natural gas capacity, and large-scale renewable projects in Texas and Virginia. The Midwest followed with 23.4% share, supported by significant wind power adoption, while the West accounted for 22.2% due to solar and hydropower projects. The Northeast held 19.6% share, reflecting steady growth from urban energy needs and clean energy mandates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. Power Generation market size was USD 256.68 million in 2024 and is projected to reach USD 389.34 million by 2032, growing at a CAGR of 5.2% during the forecast period.

- Rising electricity demand from industrial sectors, data centers, and utilities is driving investments in advanced power generation systems and renewable integration.

- Key trends include adoption of distributed generation, microgrids, and hybrid renewable solutions supported by digital monitoring and predictive maintenance technologies.

- The market is highly competitive with players such as VoltaGrid, Wartsila Corporation, Aggreko, ABB, and RavenVolt focusing on efficiency, flexible capacity, and alignment with decarbonization goals.

- Regionally, the South led with 34.8% share in 2024 due to strong industrial and utility-scale capacity, followed by the Midwest with 23.4% from wind adoption, the West with 22.2% led by solar and hydro, and the Northeast with 19.6% supported by urban energy demand and state-level renewable mandates.

Market Segmentation Analysis:

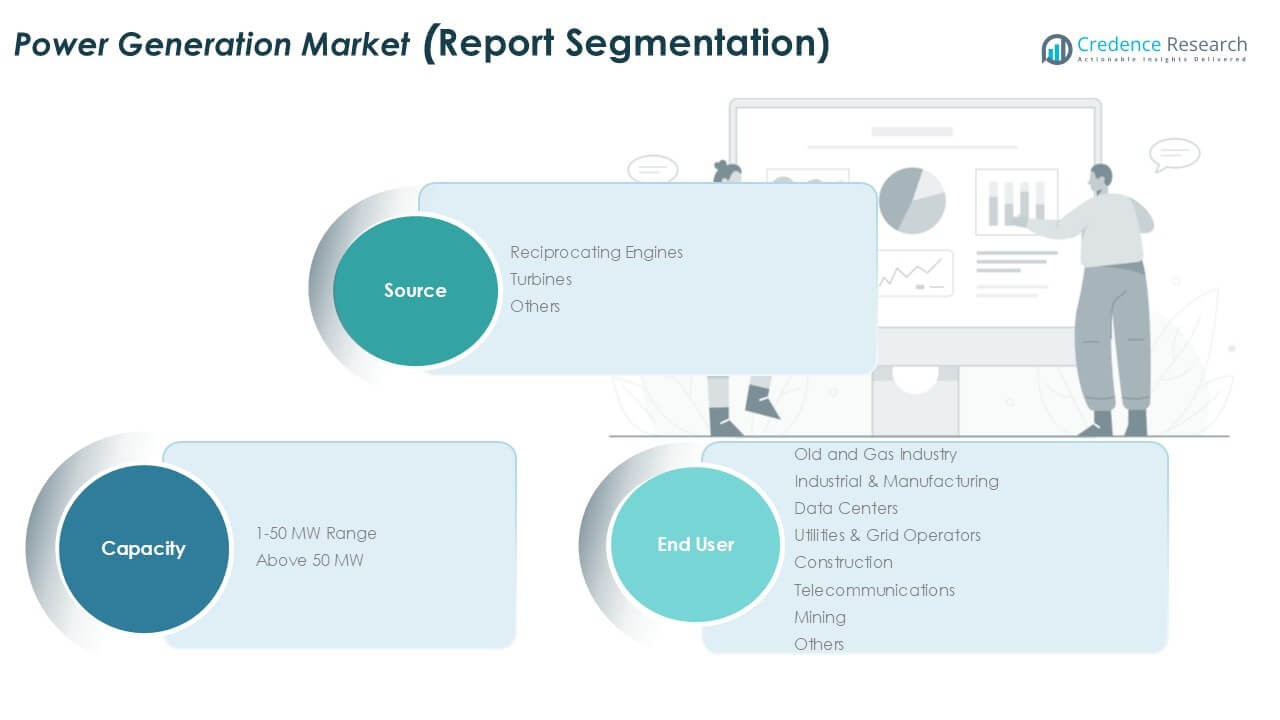

By Source

The U.S. power generation market by source is segmented into reciprocating engines, turbines, and others. Turbines dominated the segment in 2024 with a 48.5% market share, driven by their efficiency in large-scale operations and compatibility with natural gas and renewable sources. The adoption of gas and steam turbines is rising due to their ability to provide flexible and reliable power generation while meeting decarbonization goals. Reciprocating engines are gaining traction in distributed generation and backup systems for data centers and industrial facilities. The “others” category includes emerging sources, contributing marginally but expanding steadily.

- For instance, General Electric installed a 7HA.03 gas turbine at Florida Power & Light’s Dania Beach Clean Energy Center in 2023, delivering 430 MW of flexible capacity to the U.S. grid.

By Capacity

In terms of capacity, the U.S. power generation market is divided into the 1–50 MW range and above 50 MW. The above 50 MW category held 63.2% share in 2024, supported by the rising demand for utility-scale projects, industrial power needs, and grid stabilization. Large-capacity systems are particularly favored in oil and gas, utilities, and manufacturing sectors due to higher operational efficiency and lower generation costs per unit. The 1–50 MW range is growing in distributed energy systems, microgrids, and renewable integration, especially in remote areas and small-scale industrial or commercial applications.

- For instance, Wärtsilä commissioned a 48 MW reciprocating engine power plant in Wisconsin in 2023, supporting distributed generation for industrial facilities and grid reliability.

By End User

The end-user segment includes oil and gas, industrial and manufacturing, data centers, utilities and grid operators, construction, telecommunications, mining, and others. Utilities and grid operators led with 41.7% share in 2024, fueled by rising electricity demand and grid modernization projects. Their dominance stems from large-scale installations and ongoing investments in renewable integration to support clean energy mandates. Data centers are emerging as a fast-growing end-user, driven by the surge in cloud services and AI-based computing. Industrial and manufacturing sectors maintain steady demand due to continuous production needs, while oil and gas rely on reliable onsite power solutions.

Key Growth Drivers

Rising Electricity Demand and Grid Modernization

The U.S. power generation market is driven by growing electricity demand across residential, commercial, and industrial sectors. Increasing electrification of transportation and heating, coupled with rising digitalization, has significantly boosted consumption levels. Grid modernization initiatives are further accelerating investment in advanced generation capacity. Utilities are upgrading infrastructure with smart grids, automation, and flexible generation systems to ensure reliability. Renewable integration is also a priority, requiring stable power sources like natural gas turbines to balance intermittent solar and wind. Federal and state-level clean energy targets push utilities to expand capacity while ensuring low emissions, making demand growth and grid upgrades a dominant driver.

- For instance, in 2023, Duke Energy invested more than $4 billion in U.S. grid modernization projects to enhance system reliability and resiliency against storms, while continuing to advance the integration of renewable energy.

Shift Toward Renewable Energy and Decarbonization Goals

Government decarbonization policies and clean energy mandates are fueling investment in renewable-based power generation. Utilities and independent power producers are prioritizing wind, solar, and hybrid systems to reduce reliance on fossil fuels. The Inflation Reduction Act and state-level renewable portfolio standards provide strong incentives, driving large-scale solar and wind capacity expansion. Gas turbines and reciprocating engines are gaining importance as backup and balancing resources, ensuring reliability when renewables fluctuate. Growing corporate sustainability commitments are also pushing industrial and commercial users to source clean energy. These factors position renewable integration and decarbonization as one of the most influential growth drivers.

- For instance, NextEra Energy’s competitive clean energy business, NextEra Energy Resources (NEER), placed over 5,600 MW of new renewables and battery storage into service in 2023. In the same year, its subsidiary Florida Power & Light (FPL) added approximately 1,200 MW of new solar capacity.

Industrialization and Data Center Expansion

The rapid expansion of data centers and industrial facilities is a critical growth driver for the U.S. power generation market. Data centers, driven by cloud computing, AI, and digital services, require uninterrupted power supply, pushing demand for reliable large-capacity systems and distributed generation. Industrial manufacturing facilities also continue to rely heavily on both grid-based and onsite generation to maintain production efficiency. Oil and gas industries, mining, and construction projects further add to demand for robust power solutions. As industrial activity rebounds and digital infrastructure scales, the need for stable, efficient, and flexible generation capacity will continue to grow, strengthening market expansion.

Key Trends & Opportunities

Adoption of Distributed Generation and Microgrids

A major trend shaping the U.S. power generation market is the growing adoption of distributed generation and microgrids. Businesses, data centers, and communities are investing in localized generation to ensure reliability, energy independence, and resilience against grid disruptions. Renewable-based microgrids supported by storage systems are gaining traction as a cost-effective and sustainable solution. Federal and state-level funding programs encourage microgrid deployment for military bases, hospitals, and critical facilities. This trend creates opportunities for reciprocating engines, small turbines, and hybrid renewable systems. As resilience and sustainability become priorities, distributed generation is expected to grow rapidly as a mainstream solution.

- For instance, Schneider Electric and Wärtsilä commissioned a 20 MW microgrid at the U.S. Marine Corps Air Station Miramar in 2023, integrating solar PV, battery storage, and reciprocating engines to ensure energy security for critical operations.

Technological Advancements in Turbines and Digital Integration

The U.S. market is witnessing rapid technological upgrades in turbines and digital monitoring systems. Next-generation turbines with higher efficiency and lower emissions are being adopted in large-scale projects. Integration of AI, IoT, and predictive analytics into generation systems enables real-time monitoring, reduces downtime, and optimizes fuel efficiency. Digital twins and automated control systems are increasingly used in power plants to enhance performance. These advancements not only reduce operating costs but also support compliance with stringent emission standards. Companies investing in advanced digital solutions and high-efficiency turbine technology are well positioned to capitalize on this trend and expand market presence.

Key Challenges

High Capital Investment and Project Delays

One of the major challenges for the U.S. power generation market is the high capital cost required for large-scale projects. Utility-scale renewable farms, advanced turbine installations, and microgrid systems involve significant upfront investment, often creating financing hurdles. Regulatory approvals and permitting delays further extend project timelines, increasing risks for developers. Grid connection and transmission constraints also slow down capacity expansion, despite rising demand. These challenges impact investor confidence, especially for new entrants. Overcoming financial and regulatory barriers remains critical for sustaining market growth and ensuring timely deployment of power generation projects.

Transition Risks and Policy Uncertainty

The transition toward renewables, while necessary, poses risks for existing power generation assets. Older fossil fuel plants face early retirement due to strict emission norms, creating stranded asset risks. Policy uncertainty at federal and state levels adds further complexity, as shifting regulations and incentive structures impact investment decisions. Utilities and industrial users face challenges in balancing renewable adoption with reliability, especially when storage technology remains expensive. Geopolitical factors and supply chain disruptions also affect equipment availability and fuel prices. Navigating policy shifts and transition risks will be essential for stakeholders to remain competitive in the evolving U.S. power generation landscape.

Regional Analysis

Northeast

The Northeast accounted for 19.6% share of the U.S. power generation market in 2024. The region benefits from a strong focus on renewable adoption, particularly wind and hydro, supported by state-level clean energy mandates. Urban centers such as New York and Massachusetts drive high electricity consumption, encouraging investment in advanced generation technologies. Grid reliability projects are critical due to dense populations and aging infrastructure. Data centers and industrial facilities also contribute to steady demand growth. The Northeast market is expected to expand further as states increase renewable portfolio standards and accelerate electrification across transportation and heating sectors.

Midwest

The Midwest captured 23.4% share of the U.S. power generation market in 2024, driven by abundant wind resources and large-scale industrial demand. States like Iowa, Illinois, and Minnesota lead in wind power capacity, contributing significantly to the renewable mix. Agricultural industries, heavy manufacturing, and utilities maintain high consumption, ensuring consistent generation needs. Grid operators in this region are investing in modernization to balance intermittent renewable supply with stable sources such as natural gas. With favorable geography and federal incentives, the Midwest continues to position itself as a renewable powerhouse while sustaining its industrial energy requirements.

South

The South held the largest share, commanding 34.8% of the U.S. power generation market in 2024. Strong demand from oil and gas, petrochemicals, and large industrial bases fuels growth in this region. Texas leads in both renewable wind capacity and natural gas-based power generation, ensuring dominance. Rising data center expansion in states like Virginia also contributes to higher electricity needs. The region’s deregulated energy market fosters competition and private investment, further boosting capacity. With its diverse resource base and strong industrial demand, the South remains the most influential region in shaping the overall U.S. power generation landscape.

West

The West accounted for 22.2% share of the U.S. power generation market in 2024. California leads renewable adoption, with solar and battery storage playing a pivotal role in meeting clean energy targets. Hydropower from states like Washington and Oregon continues to be a major contributor. High electricity demand from technology hubs and data centers in California drives additional generation capacity. The region faces challenges from grid instability during peak demand and climate-related disruptions such as droughts. However, continued investment in solar, storage, and grid modernization ensures the West remains a leading innovator in clean energy deployment.

Market Segmentations:

By Source

- Reciprocating Engines

- Turbines

- Others

By Capacity

- 1–50 MW Range

- Above 50 MW

By End User

- Oil and Gas Industry

- Industrial & Manufacturing

- Data Centers

- Utilities & Grid Operators

- Construction

- Telecommunications

- Mining

- Others

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The competitive landscape of the U.S. power generation market is defined by the presence of global corporations and specialized domestic players. Key companies such as VoltaGrid, Wartsila Corporation, Aggreko, ABB, and RavenVolt focus on delivering advanced solutions spanning reciprocating engines, turbines, distributed generation, and renewable integration technologies. These players compete on efficiency, reliability, and ability to support decarbonization goals through hybrid systems and digital monitoring. Strategic partnerships and acquisitions are common as companies expand their service portfolios and geographic presence. Strong demand from utilities, data centers, and industrial sectors creates opportunities for firms offering flexible generation and microgrid solutions. Innovation in energy storage and integration of digital platforms for predictive maintenance further intensify competition. Market participants are increasingly aligning strategies with state-level renewable mandates and federal incentives, positioning themselves to address the transition toward cleaner, more resilient power systems while strengthening their market share in a highly dynamic environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2024, Korea Western Power Co. (KOWEPO) and EDF Renewables entered a joint development agreement for a 1.5 GW solar farm in Khazna, United Arab Emirates (UAE). They are also in advanced talks with Abu Dhabi’s Emirates Water and Electricity Co. (EWEC) for a similar project in the Al-Ajban area.

- In February 2024, Energies PH, Inc., through its affiliate San Bernardino Ocean Power Corp., entered a contract with Inyanga Marine Energy Group to build Southeast Asia’s first tidal power plant on Capul Island, Northern Samar, Philippines. The 1 MW plant, using Inyanga’s HydroWing technology, will be deployed in late 2025. It will connect to Capul’s current 750 kW diesel power plant and include a microgrid with tidal power, solar PV, and energy storage, offering a sustainable alternative to fossil fuels.

- In December 2023, Telstra signed a Power Purchase Agreement (PPA) with Global Power Generation (GPG) for electricity from a 100 MW solar farm near Bundaberg, Queensland, Australia. Construction started in 2024, with operations beginning in late 2025. The agreement secures up to 153 GWh annually, enough to power about 30,000 homes.

- In December 2023, Vestas received an order from Pattern Energy to power the SunZia Wind project in New Mexico, U.S. This 1.1 GW order includes 242 V163-4.5 MW turbines, making it the largest single onshore project and the biggest order globally for Vestas’ newest high-capacity turbine.

Report Coverage

The research report offers an in-depth analysis based on Source, Capacity, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with steady growth in renewable and hybrid generation.

- Utilities will prioritize grid modernization to improve reliability and integrate clean energy sources.

- Data center expansion will drive higher demand for distributed and uninterrupted power solutions.

- Natural gas turbines will remain vital for balancing intermittent renewable supply.

- Microgrids and localized generation will see strong adoption across industrial and critical facilities.

- Policy incentives will accelerate investments in solar, wind, and storage technologies.

- Digital platforms using AI and IoT will enhance efficiency and predictive maintenance.

- Companies will focus on partnerships and acquisitions to strengthen portfolios and market presence.

- Industrial and manufacturing sectors will maintain stable demand for high-capacity power solutions.

- Regional leadership will stay concentrated in the South, supported by industrial demand and resource availability.