Market Overview

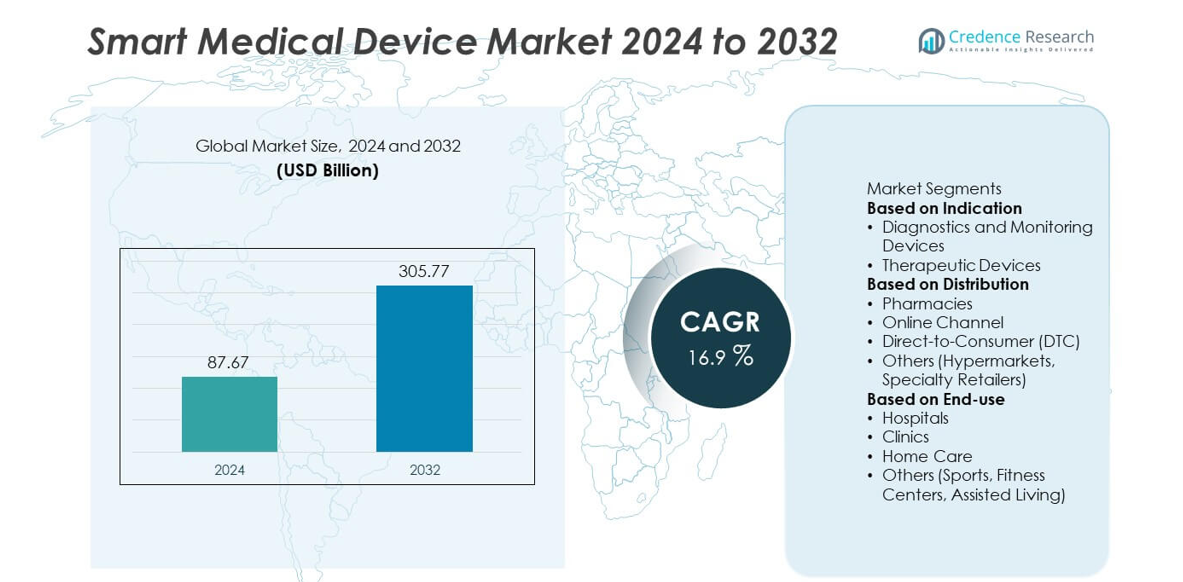

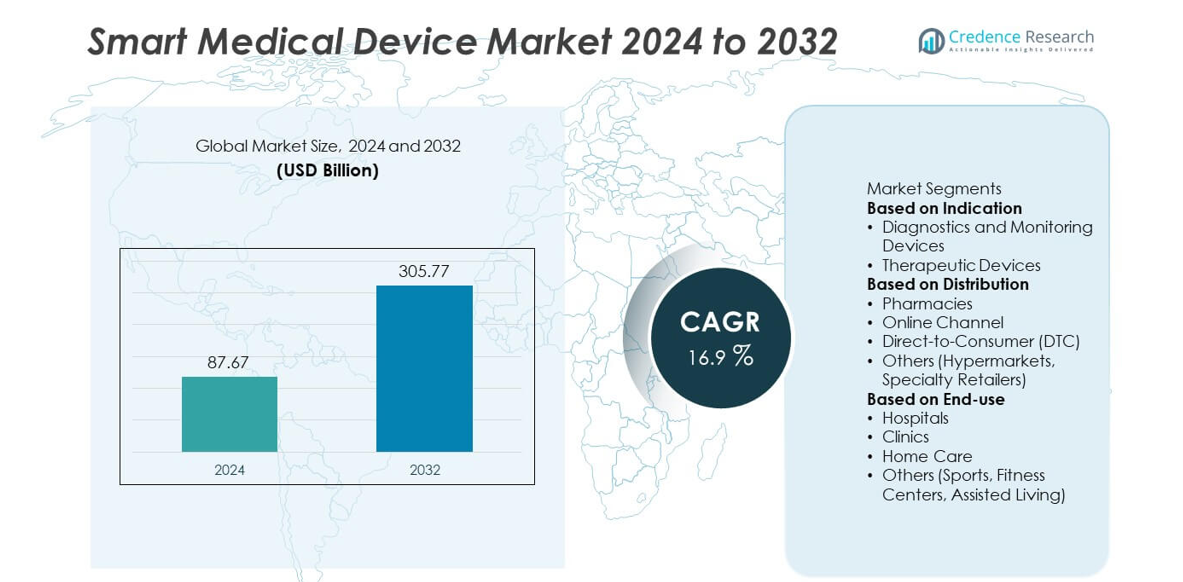

The Smart Medical Device market size was valued at USD 87.67 billion in 2024 and is projected to reach USD 305.77 billion by 2032, expanding at a CAGR of 16.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Medical Device Market Size 2024 |

USD 87.67 billion |

| Smart Medical Device Market, CAGR |

16.9% |

| Smart Medical Device Market Size 2032 |

USD 305.77 billion |

The smart medical device market is driven by top players including ARKRAY, Inc., Beurer GmbH, LifeScan, Inc., Microlife Corporation, Adherium, i-SENS, Inc., NIPRO CORPORATION, ACON Laboratories, Inc., Ascensia Diabetes Care Holdings AG, and AgaMatrix, Inc. These companies compete through innovations in continuous glucose monitoring, wearable diagnostics, and connected therapeutic devices, supported by strong distribution networks and partnerships with healthcare providers. Regionally, Asia-Pacific led the market with 30% share in 2024, fueled by rising healthcare infrastructure and chronic disease prevalence. North America followed with 38% share, driven by telehealth expansion and high healthcare spending, while Europe held 27% share, supported by regulatory frameworks and strong adoption of preventive healthcare solutions.

Market Insights

- The smart medical device market was valued at USD 87.67 billion in 2024 and is projected to reach USD 305.77 billion by 2032, growing at a CAGR of 16.9% during the forecast period.

- Rising prevalence of chronic diseases and growing demand for real-time monitoring drive adoption, with diagnostics and monitoring devices leading the market at over 55% share in 2024.

- Key trends include expansion of telehealth, integration of IoT and AI into wearable devices, and the rise of direct-to-consumer healthcare models for personalized and preventive care.

- The market is highly competitive with players such as ARKRAY, Beurer, LifeScan, Microlife, Adherium, i-SENS, NIPRO, ACON Laboratories, Ascensia Diabetes Care, and AgaMatrix focusing on innovation, partnerships, and affordability.

- Regionally, North America led with 38% share in 2024, followed by Asia-Pacific at 30%, Europe at 27%, while Latin America and Middle East & Africa accounted for 3% and 2% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Indication

Diagnostics and monitoring devices dominated the smart medical device market in 2024, capturing over 55% share, supported by rising demand for real-time health monitoring and preventive care. Devices such as smart wearables, glucose monitors, and cardiac monitors have gained strong adoption due to their ability to provide continuous health insights. The growing prevalence of chronic conditions such as diabetes and cardiovascular diseases drives demand. Increased integration of IoT and AI for data-driven diagnostics further strengthens this segment’s position, making it the largest contributor to market growth.

- For instance, Stryker completed its acquisition of Care.ai in September 2024, a company specializing in AI-assisted virtual care workflows, smart room technology, and ambient intelligence solutions, enhancing real-time diagnostics and preventive care.

By Distribution

Pharmacies held the largest share of over 40% in 2024, driven by strong consumer preference for trusted retail channels and in-person product consultation. Pharmacies also act as key points for device education and accessibility, particularly for older patients and those with chronic illnesses. While online channels are expanding rapidly due to e-commerce penetration and direct-to-consumer models, pharmacies remain dominant. Their ability to ensure credibility, wide product availability, and partnerships with manufacturers keeps them the leading distribution channel in the smart medical device market.

- For instance, Walgreens leverages its extensive network of approximately 8,000 retail pharmacy locations in the U.S. to offer a wide range of home medical equipment and digital health solutions, complementing its partnerships to support clinical research and improve patient care.

By End-use

Hospitals led the market with over 45% share in 2024, fueled by high adoption of smart medical devices for patient monitoring, diagnostics, and therapeutic applications. Hospitals increasingly rely on connected devices such as smart infusion pumps, wireless monitoring systems, and AI-driven diagnostic tools to enhance patient outcomes and improve efficiency. Integration with electronic health records (EHRs) further drives adoption. Although home care and clinics are emerging segments due to telehealth expansion and rising consumer interest in self-monitoring, hospitals remain the largest end-use sector due to their advanced infrastructure and critical role in healthcare delivery.

Market Overview

Rising Prevalence of Chronic Diseases

The growing burden of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders is driving demand for smart medical devices. Continuous monitoring devices, including glucose monitors and cardiac wearables, enable early detection and improved disease management. With aging populations and lifestyle-related health issues increasing globally, the need for real-time monitoring and data-driven care is rising. Smart devices help reduce hospital visits, improve patient outcomes, and support preventive healthcare, positioning chronic disease management as a primary driver for market growth.

- For instance, studies show that Abbott’s FreeStyle Libre system, used by millions of patients worldwide, is associated with a lower incidence of hospitalizations for acute diabetes complications like diabetic ketoacidosis and severe hypoglycemia.

Expansion of Telehealth and Remote Monitoring

The adoption of telehealth and remote patient monitoring solutions is accelerating, especially following the COVID-19 pandemic. Smart medical devices such as wireless monitors, connected diagnostic tools, and wearable sensors play a critical role in enabling remote care. These devices provide continuous health data to healthcare providers, supporting timely interventions and reducing the burden on hospitals. Growing investments in digital health infrastructure, combined with consumer preference for convenience and home-based care, are boosting demand. This trend firmly establishes telehealth integration as a major growth driver in the smart medical device market.

- For instance, Philips deploys remote patient monitoring devices across healthcare networks in Europe and North America, facilitating continuous vital signs monitoring and aiding in the reduction of hospital readmission rates for chronic disease patients.

Technological Advancements in IoT and AI Integration

Integration of IoT, artificial intelligence, and cloud computing into smart medical devices is transforming healthcare delivery. These technologies enable predictive analytics, early detection of abnormalities, and personalized treatment plans. Smart wearables, AI-enabled imaging tools, and connected therapeutic devices enhance both accuracy and efficiency in care delivery. The growing ecosystem of connected health platforms also supports interoperability and seamless data exchange. With continuous innovation from healthcare technology firms, IoT and AI integration remains a critical driver for expanding the adoption of smart medical devices globally.

Key Trends & Opportunities

Growth of Direct-to-Consumer Healthcare Devices

Direct-to-consumer (DTC) models are gaining momentum as consumers increasingly adopt smart medical devices for self-monitoring and preventive care. Devices such as smartwatches with ECG functions, fitness trackers, and home-based diagnostic kits are reshaping patient engagement. Rising health awareness and the convenience of purchasing devices online are boosting adoption. This trend not only empowers individuals but also creates opportunities for manufacturers to expand product offerings through e-commerce channels, subscription-based services, and personalized health solutions tailored to consumer needs.

- For instance, Apple’s Series 9 smartwatch features an FDA-cleared ECG app that can record a 30-second, single-lead electrocardiogram to check for signs of atrial fibrillation (AFib)

Focs on Personalized and Preventive Healthcare

he shift toward personalized medicine and preventive healthcare is creating strong opportunities for smart medical device adoption. Devices equipped with AI-driven analytics provide customized health recommendations, while continuous monitoring ensures timely interventions. Wearable devices that track vital signs, fitness parameters, and chronic disease indicators support healthier lifestyles and early detection of risks. As healthcare systems transition from reactive treatment to preventive models, smart medical devices emerge as central tools for empowering patients and reducing long-term healthcare costs.

- For instance, the HEARThermo wristband, created by the company 19Gale.ai, uses AI algorithms to continuously monitor body surface temperature and heart rate variability to help detect the early onset of medical issues, such as fever. Trials have been conducted with smaller numbers of participants to validate its accuracy.

Key Challenges

High Costs and Affordability Issues

Smart medical devices often carry high upfront costs due to advanced sensors, connectivity features, and integration with digital platforms. This limits adoption in price-sensitive markets and among lower-income populations. Healthcare providers and patients may face challenges balancing the long-term benefits against the initial investment. Although technological advancements and wider production are expected to reduce prices over time, affordability remains a significant barrier, particularly in emerging economies where healthcare budgets are constrained.

Data Privacy and Security Concerns

The reliance of smart medical devices on continuous data collection and cloud-based storage raises concerns around privacy and cybersecurity. Unauthorized access to patient health data could result in breaches of confidentiality and reduced trust in connected healthcare solutions. Regulatory frameworks such as HIPAA in the U.S. and GDPR in Europe impose strict compliance requirements, increasing complexity for manufacturers. Ensuring robust data encryption, secure interoperability, and transparent consent mechanisms remains a critical challenge for the widespread adoption of smart medical devices.

Regional Analysis

North America

North America accounted for 38% share in 2024, driven by strong adoption of advanced diagnostics, monitoring devices, and therapeutic wearables. The U.S. leads the region due to supportive regulatory frameworks, widespread telehealth adoption, and high healthcare spending. Demand for continuous glucose monitors, cardiac monitoring wearables, and connected therapeutic devices remains strong. Integration of smart devices with electronic health records and insurance-driven reimbursements further boosts adoption. Canada adds momentum through digital health initiatives and growing awareness of home care solutions. Robust innovation pipelines from leading medical technology firms solidify North America’s dominant role in the smart medical device market.

Europe

Europe held 27% share in 2024, supported by increasing adoption of smart medical devices across hospitals, clinics, and home care. Countries such as Germany, the U.K., and France lead demand, fueled by rising chronic disease prevalence and aging populations. Strict regulations such as the EU MDR encourage safer and more effective devices, enhancing consumer trust. Smart wearables and monitoring devices see strong growth due to wellness and preventive health awareness. Integration with national digital health frameworks strengthens market expansion, while government-backed investments in connected healthcare reinforce Europe’s position as a leading hub for smart medical device adoption.

Asia-Pacific

Asia-Pacific dominated the market with 30% share in 2024, driven by rising healthcare infrastructure investments, growing chronic disease burden, and increasing digital health adoption. China, Japan, India, and South Korea are major contributors, supported by expanding middle-class populations and government initiatives for telehealth. The region shows rapid uptake of smart wearables, portable diagnostics, and connected devices for both urban and rural populations. Strong growth in smartphone penetration and digital ecosystems enables seamless use of IoT-enabled health devices. With local and global manufacturers expanding their presence, Asia-Pacific is not only the largest but also the fastest-growing regional market.

Latin America

Latin America captured 3% share in 2024, led by Brazil and Mexico, where rising healthcare modernization and growing private investments are driving adoption. Demand for home care devices, including smart wearables and remote monitoring solutions, is increasing as populations embrace telehealth. Governments are encouraging digital healthcare platforms to address access challenges in rural areas. However, affordability concerns and limited infrastructure restrict wider penetration. Partnerships between global manufacturers and local distributors are expanding product availability. Despite constraints, Latin America shows promising growth potential as awareness of preventive healthcare and demand for connected solutions continues to rise.

Middle East & Africa

The Middle East and Africa accounted for 2% share in 2024, reflecting gradual but expanding adoption of smart medical devices. Demand is concentrated in Gulf countries such as the UAE and Saudi Arabia, where investments in digital healthcare and premium medical devices are growing. South Africa adds regional momentum with rising demand for remote monitoring in hospitals and home care. Limited affordability and infrastructure gaps hinder widespread adoption across several African nations. However, government-led smart health initiatives and increasing penetration of telemedicine services are creating opportunities for future growth in this emerging market.

Market Segmentations:

By Indication

- Diagnostics and Monitoring Devices

- Therapeutic Devices

By Distribution

- Pharmacies

- Online Channel

- Direct-to-Consumer (DTC)

- Others (Hypermarkets, Specialty Retailers)

By End-use

- Hospitals

- Clinics

- Home Care

- Others (Sports, Fitness Centers, Assisted Living)

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the smart medical device market is shaped by key players including ARKRAY, Inc., Beurer GmbH, LifeScan, Inc., Microlife Corporation, Adherium, i-SENS, Inc., NIPRO CORPORATION, ACON Laboratories, Inc., Ascensia Diabetes Care Holdings AG, and AgaMatrix, Inc. These companies focus on innovation in diagnostics, monitoring, and therapeutic devices to address the rising demand for chronic disease management and preventive healthcare. Strategic initiatives include expanding wearable health technologies, continuous glucose monitoring systems, and connected diagnostic platforms. Partnerships with hospitals, clinics, and telehealth providers strengthen their global reach, while investments in AI and IoT integration enhance device functionality and user experience. Companies are also aligning with regulatory frameworks to ensure safety and reliability, particularly in developed markets. Growing emphasis on affordability, personalized healthcare, and direct-to-consumer channels further defines competition, as players strive to capture market share in both developed and emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ARKRAY, Inc

- Beurer GmbH

- LifeScan, Inc.

- Microlife Corporation

- Adherium

- i-SENS, Inc.

- NIPRO CORPORATION

- ACON Laboratories, Inc.

- Ascensia Diabetes Care Holdings AG

- AgaMatrix, Inc.

Recent Developments

- In September 2025, Ascensia and Senseonics signed an MoU for Senseonics to take over commercialization and distribution of Eversense 365 from January 2026.

- In April 2025, Ascensia announced Eversense 365 won the Gold Award for Personal Healthcare Monitoring at the Edison Best New Product Awards.

- In February 2025, Ascensia and Senseonics integrated software between SweetSpot and the Eversense 365 CGM system to support endocrinology practices.

Report Coverage

The research report offers an in-depth analysis based on Indication, Distribution, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly with rising adoption of connected health solutions.

- Diagnostics and monitoring devices will continue to dominate due to chronic disease prevalence.

- Wearable devices will gain traction as consumers shift toward preventive healthcare.

- Telehealth expansion will drive demand for remote monitoring technologies.

- IoT and AI integration will enhance predictive analytics and personalized treatments.

- Direct-to-consumer channels will strengthen as online sales and subscriptions expand.

- North America will lead growth with advanced infrastructure and high healthcare spending.

- Asia-Pacific will remain the fastest-growing region with strong digital health adoption.

- Data security and regulatory compliance will shape product innovation strategies.

- Competition will intensify as global and regional players expand affordable offerings.