Market Overview

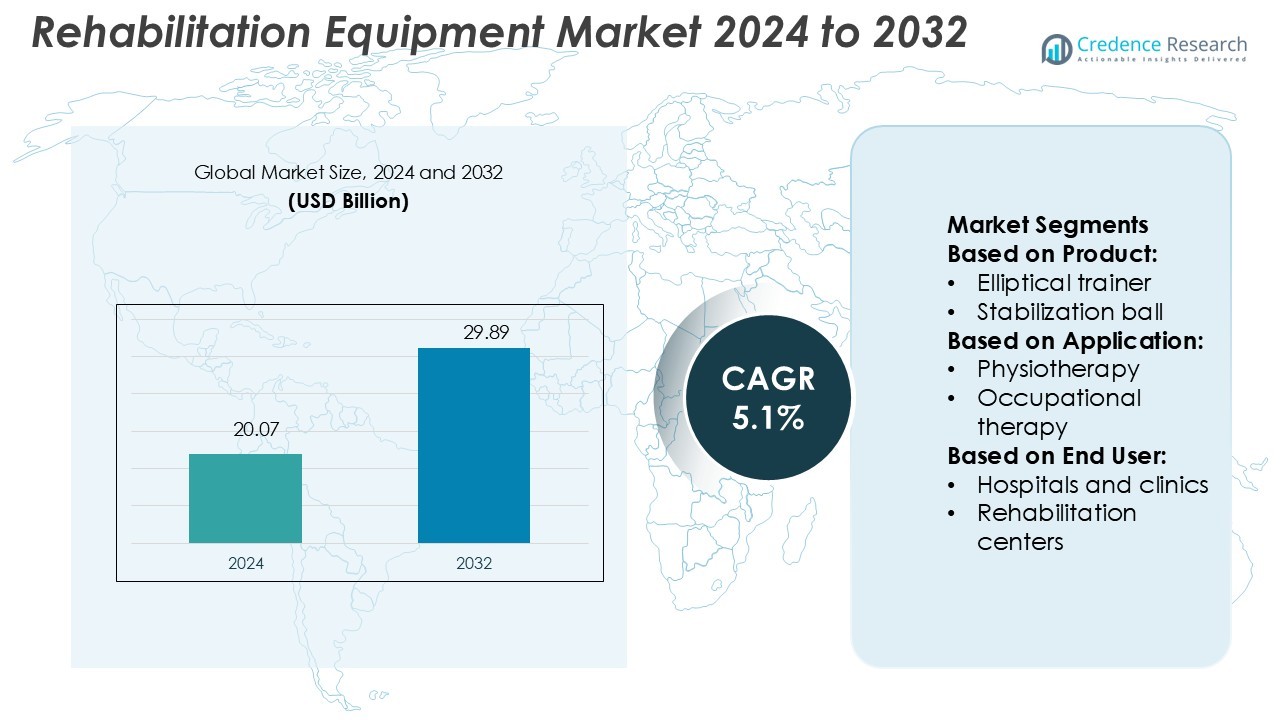

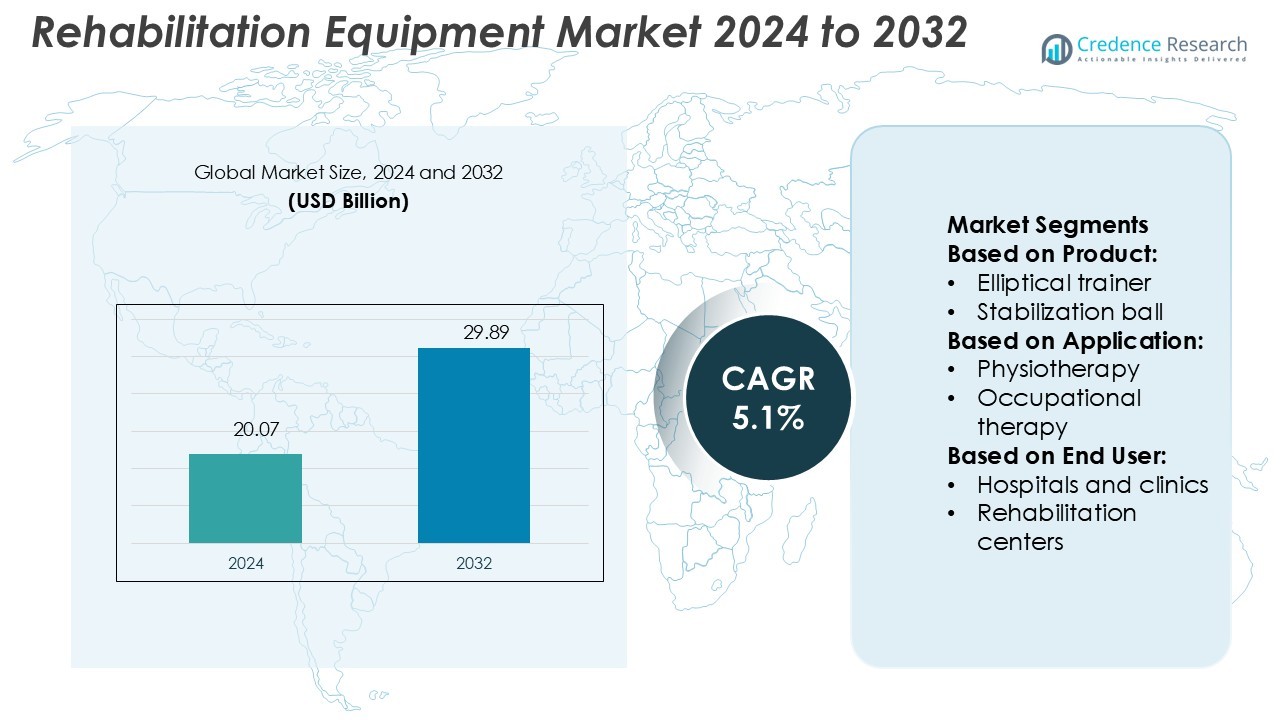

Rehabilitation Equipment Market size was valued USD 20.07 billion in 2024 and is anticipated to reach USD 29.89 billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rehabilitation Equipment Market Size 2024 |

USD 20.07 Billion |

| Rehabilitation Equipment Market, CAGR |

5.1% |

| Rehabilitation Equipment Market Size 2032 |

USD 29.89 Billion |

The rehabilitation equipment market is shaped by leading players such as Caremax Rehabilitation Equipment Co. Ltd, Invacare Corporation, Bioness Inc., Honeywell International, Inc., BioXtreme, DJO Global, Arjo, Halma plc, Dynatronics Corporation, and BTL. These companies strengthen their presence through innovation in physiotherapy, neurorehabilitation, mobility aids, and digitally integrated recovery solutions. Product diversification, strong distribution networks, and strategic R&D investments remain central to their competitive strategies. Regionally, North America leads the market with a 38% share, supported by advanced healthcare infrastructure, robust insurance coverage, and high adoption of smart rehabilitation devices, positioning it as the key growth hub globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rehabilitation Equipment Market was valued at USD 20.07 billion in 2024 and is expected to reach USD 29.89 billion by 2032, growing at a CAGR of 5.1%.

- Key growth drivers include rising prevalence of chronic diseases, aging populations, and increasing demand for homecare rehabilitation solutions.

- Major players focus on innovation in physiotherapy, neurorehabilitation, and mobility aids, with strong R&D investments and global distribution networks strengthening competitiveness.

- High equipment costs and shortage of skilled rehabilitation professionals act as restraints, limiting adoption in developing markets.

- North America leads with 38% share due to advanced healthcare infrastructure, while stationary bicycles dominate product segments, supported by strong adoption in hospitals and rehabilitation centers.

Market Segmentation Analysis:

By Product

Within the rehabilitation equipment market, stationary bicycles hold the dominant share due to their widespread use in both clinical and homecare environments. Their popularity stems from ease of use, adaptability across different patient needs, and proven effectiveness in improving cardiovascular health and lower limb strength. Hospitals and rehabilitation centers prefer stationary bicycles for structured recovery programs, while rising adoption in homecare supports continued dominance. Growing demand for low-impact exercise solutions, coupled with integration of digital monitoring systems, further drives the stationary bicycle segment’s leadership over treadmills, rowers, and other rehabilitation products.

- For instance, Caremax Rehabilitation Equipment Co., Ltd. specializes in producing wheelchairs, rollators, crutches, walking canes, walker frames, commode chairs, and bathroom accessories. The company operates from a 30,000 m² facility in Foshan, Guangdong, China.

By Application

Physiotherapy represents the largest application segment, capturing the dominant market share as it serves patients recovering from musculoskeletal, neurological, and post-surgical conditions. The segment benefits from increasing prevalence of chronic diseases, sports-related injuries, and aging-related mobility issues. Rehabilitation equipment such as stationary bicycles, treadmills, and stabilization balls are heavily integrated into physiotherapy programs to restore function and mobility. Advancements in therapy techniques and supportive reimbursement policies strengthen adoption. As demand for evidence-based recovery solutions grows, physiotherapy continues to lead over occupational therapy and other applications in the rehabilitation equipment market.

- For instance, Dynatron Solaris® Plus 709 device offers up to 5 channels of stimulation and ultrasound therapy simultaneously, providing versatile treatment options for various patient needs.

By End-user

Hospitals and clinics dominate the end-user segment, accounting for the largest market share owing to their comprehensive rehabilitation infrastructure and wide patient base. These facilities invest heavily in advanced rehabilitation equipment, offering structured recovery programs under medical supervision. High admission rates of patients with chronic diseases, post-surgical recovery needs, and injury management create consistent demand for such equipment. Hospitals also benefit from government funding, insurance coverage, and continuous upgrades in rehabilitation technology. While rehabilitation centers and homecare settings are growing steadily, hospitals and clinics remain the most significant contributors to market expansion.

Key Growth Drivers

Rising Prevalence of Chronic Diseases and Disabilities

The increasing incidence of chronic conditions such as cardiovascular disorders, neurological impairments, and musculoskeletal injuries is a major driver for the rehabilitation equipment market. Growing aging populations, particularly in developed countries, contribute to higher cases of mobility limitations and post-surgical recovery needs. This fuels consistent demand for physiotherapy equipment, stationary bicycles, treadmills, and cardiopulmonary devices. Governments and healthcare systems are also focusing on preventive rehabilitation to reduce long-term costs, further boosting adoption across hospitals, rehabilitation centers, and homecare settings.

- For instance, BTL’s Super Inductive System (SIS) operates at frequencies up to 150 Hz, making it suitable for various medical indications. Additionally, its patented Cool Flow Technology™ allows for continuous operation even under high-intensity settings, ensuring prolonged therapy sessions without overheating.

Technological Advancements in Rehabilitation Devices

Advancements in digital health and medical technologies significantly enhance the adoption of rehabilitation equipment. Integration of smart sensors, AI-based monitoring, and virtual reality tools enables real-time patient tracking and personalized therapy. These innovations improve treatment outcomes while allowing healthcare providers to optimize therapy sessions. Manufacturers are focusing on equipment that supports remote rehabilitation, catering to rising telehealth demand. As patient-centric technology evolves, advanced rehabilitation devices are becoming central to both clinical and homecare recovery pathways, accelerating market growth globally.

- For instance, Philips is developing video-based biosensing that estimates respiration rate and pulse rate using only a camera (remote PPG) during virtual consultations; this solution is in the pipeline for US FDA 510(k) clearance.

Growing Homecare and Outpatient Rehabilitation Demand

The demand for rehabilitation equipment in homecare settings is increasing due to convenience, affordability, and the rise of outpatient therapy models. Patients prefer equipment such as stationary bicycles, stabilization balls, and compact treadmills that support recovery outside clinical environments. Insurers and healthcare providers also encourage cost-effective home-based rehabilitation, reducing hospital readmissions and improving long-term care. This trend is further supported by growing awareness of self-care and fitness among elderly and disabled populations, making homecare a major driver of overall market expansion.

Key Trends & Opportunities

Integration of Digital Rehabilitation and Telehealth

A major trend shaping the market is the integration of rehabilitation equipment with telehealth platforms. Remote monitoring, connected devices, and digital applications enable therapy to continue beyond clinical settings. Patients gain access to guided sessions, progress tracking, and real-time feedback, improving adherence and recovery rates. This creates opportunities for manufacturers to develop smart rehabilitation equipment and partner with digital health providers. The shift toward hybrid rehabilitation models positions connected solutions as a significant growth area for the market.

- For instance, Omron has registered 1,661 patents in its healthcare division globally, of which 75 % relate to cardiovascular, blood pressure, or sensing technologies, supporting its connected health strategy.

Rising Investment in Rehabilitation Infrastructure

Governments and private healthcare providers are investing heavily in rehabilitation facilities and advanced equipment. These investments aim to address the rising burden of chronic diseases, sports injuries, and post-surgical care. Rehabilitation centers equipped with advanced treadmills, rowers, and cardiopulmonary devices are increasingly being established in both developed and emerging economies. Public health initiatives and supportive reimbursement structures further drive infrastructure development. This creates long-term opportunities for manufacturers to expand their presence and supply advanced solutions across diverse healthcare settings.

- For instance, the Duolith SD1 device imposes a limit on consecutive shocks: older devices (<serial 5000) permit 6,000 consecutive shocks before requiring a 5-minute pause; newer units (> serial 5000) permit 3,000 consecutive shocks before a 15-minute pause.

Adoption of Sustainable and Ergonomic Equipment Design

Sustainability and patient comfort are becoming central to rehabilitation equipment innovation. Manufacturers are adopting eco-friendly materials, energy-efficient designs, and ergonomic features to improve usability. Lightweight and portable equipment supports homecare demand, while durable, multi-functional systems enhance adoption in hospitals and clinics. This trend creates opportunities for companies to differentiate through environmentally conscious product lines. As healthcare systems emphasize sustainable procurement, rehabilitation equipment designed with eco-friendly features gains competitive advantage, appealing to both institutions and end-users.

Key Challenges

High Cost of Advanced Rehabilitation Equipment

The high cost of technologically advanced rehabilitation equipment remains a barrier, especially in developing economies. Devices integrated with smart sensors, robotics, or digital interfaces demand significant investment, limiting adoption in smaller hospitals and homecare environments. Many patients face affordability issues due to limited insurance coverage or out-of-pocket expenses. This restricts market penetration and creates disparity in access to advanced rehabilitation solutions. Addressing affordability challenges through cost-effective manufacturing and favorable reimbursement policies remains essential for sustained market growth.

Shortage of Skilled Rehabilitation Professionals

A shortage of trained rehabilitation specialists poses a significant challenge to market growth. Physiotherapists, occupational therapists, and rehabilitation experts are critical for operating equipment and guiding therapy programs effectively. In many regions, the limited availability of skilled professionals delays treatment and reduces the efficiency of rehabilitation services. The gap is more evident in rural and developing markets, where healthcare infrastructure is underdeveloped. Expanding training programs, digital guidance tools, and AI-assisted rehabilitation systems are necessary to overcome this challenge.

Regional Analysis

North America

North America leads the rehabilitation equipment market with a 38% share, driven by advanced healthcare infrastructure, high healthcare spending, and strong adoption of innovative rehabilitation solutions. The region’s aging population and growing prevalence of chronic diseases such as arthritis, cardiovascular conditions, and neurological disorders create consistent demand for physiotherapy and occupational therapy equipment. The United States dominates the regional market, supported by robust insurance coverage and investments in digital rehabilitation technologies. Increasing emphasis on home-based recovery and the presence of major manufacturers further strengthen North America’s leadership position in the global rehabilitation equipment industry.

Europe

Europe holds a 29% share of the rehabilitation equipment market, supported by well-established healthcare systems, rising geriatric populations, and strong government support for rehabilitation services. Countries such as Germany, the United Kingdom, and France are leading contributors, with a focus on advanced physiotherapy and post-surgical recovery solutions. Reimbursement policies and public healthcare programs enhance patient access to rehabilitation equipment. The region also emphasizes sustainable and ergonomic equipment designs, driving innovation among manufacturers. Growing investment in rehabilitation centers and demand for occupational therapy solutions continue to support Europe’s steady growth trajectory within the global market.

Asia Pacific

Asia Pacific accounts for 23% of the rehabilitation equipment market and is expected to register the fastest growth. Rapid industrialization, urbanization, and an increasing prevalence of chronic diseases contribute to rising demand. China, Japan, and India are major markets, supported by expanding healthcare infrastructure and government initiatives to improve rehabilitation services. The growing elderly population, particularly in Japan and China, drives adoption of homecare rehabilitation solutions. Rising healthcare expenditure and medical tourism also support growth. With increasing private investment in rehabilitation centers, Asia Pacific is positioned as a key growth engine for the rehabilitation equipment market.

Latin America

Latin America holds a 6% share of the rehabilitation equipment market, with Brazil and Mexico as the leading contributors. The market benefits from growing awareness of physiotherapy and rehabilitation care, alongside increasing investments in hospital and clinic infrastructure. Rising incidence of chronic diseases and sports-related injuries also supports demand for rehabilitation equipment such as stationary bicycles and treadmills. However, limited healthcare funding and affordability challenges restrict broader adoption. Despite these barriers, opportunities exist in expanding homecare rehabilitation solutions and private sector initiatives, which are expected to gradually improve market penetration in the region.

Middle East & Africa

The Middle East & Africa region accounts for a 4% share of the rehabilitation equipment market, reflecting its early-stage adoption. Growth is primarily driven by rising investments in healthcare infrastructure, particularly in Gulf countries such as Saudi Arabia and the UAE. Increased prevalence of non-communicable diseases, along with road traffic injuries, supports demand for rehabilitation solutions. However, limited awareness and shortage of skilled professionals in several African markets hinder wider adoption. Gradual improvement in healthcare access, coupled with international collaborations and public-private partnerships, is expected to drive future expansion in this region.

Market Segmentations:

By Product:

- Elliptical trainer

- Stabilization ball

By Application:

- Physiotherapy

- Occupational therapy

By End User:

- Hospitals and clinics

- Rehabilitation centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rehabilitation equipment market features prominent players including Caremax Rehabilitation Equipment Co. Ltd, Invacare Corporation, Bioness Inc., Honeywell International, Inc., BioXtreme, DJO Global, Arjo, Halma plc, Dynatronics Corporation, and BTL. The rehabilitation equipment market is highly competitive, shaped by continuous innovation, diverse product portfolios, and expanding global demand. Companies focus on advancing technologies such as smart sensors, AI-enabled monitoring, and ergonomic designs to enhance patient outcomes and therapy efficiency. Growing emphasis on homecare rehabilitation and telehealth integration drives product development tailored for remote use. Price competitiveness, quality assurance, and compliance with regulatory standards are critical factors influencing market positioning. Additionally, strategic investments in research and development, mergers and acquisitions, and expansion into emerging economies are strengthening competitive dynamics, making the market increasingly innovation-driven and patient-focused.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caremax Rehabilitation Equipment Co. Ltd

- Invacare Corporation

- Bioness Inc.

- Honeywell International, Inc.

- BioXtreme

- DJO Global

- Arjo

- Halma plc

- Dynatronics Corporation

- BTL

Recent Developments

- In March 2025, Healing Innovations partnered with Barrett Medical to expand access to advanced rehabilitation technology across the U.S., combining Healing Innovations’ Rise&Walk InClinic with Barrett’s Burt robotic trainer to create a comprehensive neurorehabilitation solution.

- In February 2025, WellSky announced significant growth and new innovations in 2024, enhancing its position in the rehabilitation equipment market through technological advancements and expanded service offerings.

- In September 2024, iFIT, a global player in exercise equipment and fitness content, unveiled its latest lineup of innovative products, marking a significant development in the rehabilitation equipment market. This new range boasts advanced hardware, a revamped operating system, the groundbreaking interactive AI Coach (currently in beta), and fresh outdoor content.

- In February 2024, Addverb introduced three robots designed for diverse applications. Venturing into healthcare robotics, the automation solutions provider launched Healan, an advanced medical cobot tailored for rehabilitation and imaging purposes.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for physiotherapy and occupational therapy equipment.

- Homecare rehabilitation solutions will gain stronger adoption due to aging populations and cost efficiency.

- Digital integration with telehealth platforms will transform rehabilitation practices globally.

- AI and sensor-enabled devices will enhance personalized therapy and remote monitoring.

- Investment in rehabilitation centers and advanced infrastructure will continue to rise.

- Portable and ergonomic designs will drive higher adoption in homecare and clinical settings.

- Emerging economies will witness rapid growth due to improving healthcare access.

- Sports injury recovery and post-surgical rehabilitation will remain strong demand drivers.

- Sustainability in equipment design will shape procurement and manufacturing trends.

- Strategic collaborations and R&D innovation will define future market competitiveness.