Market Overview

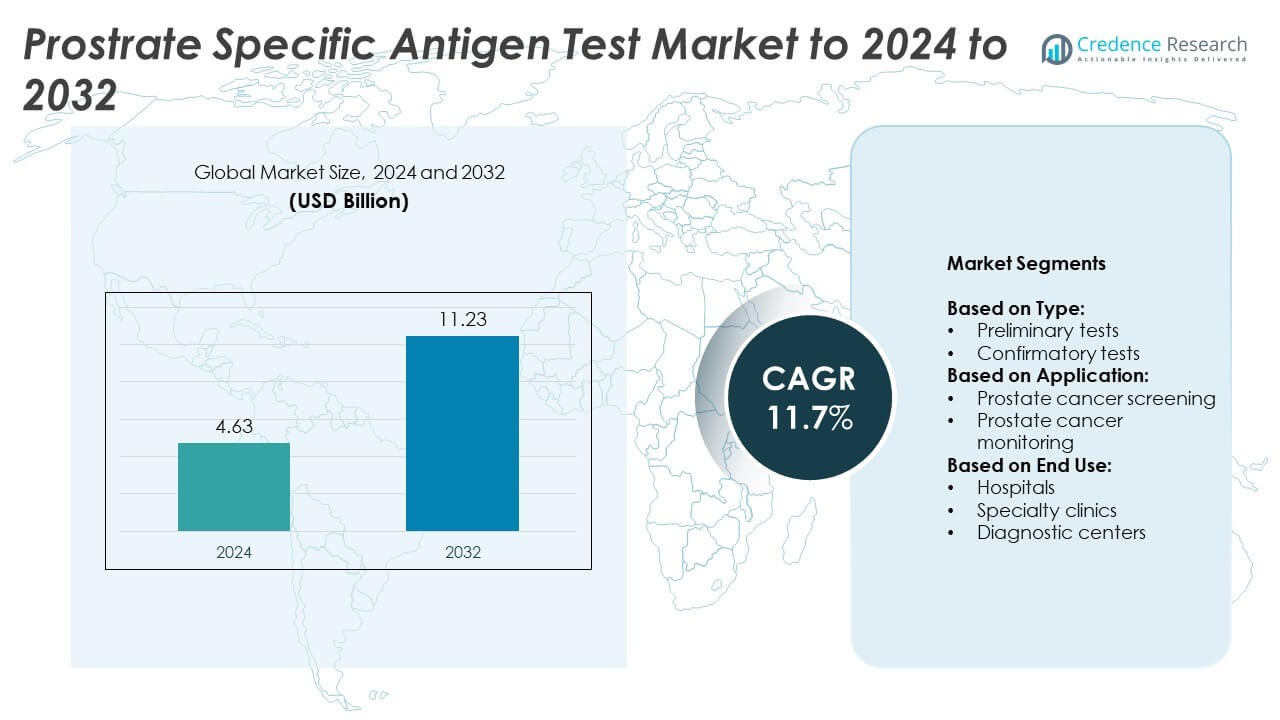

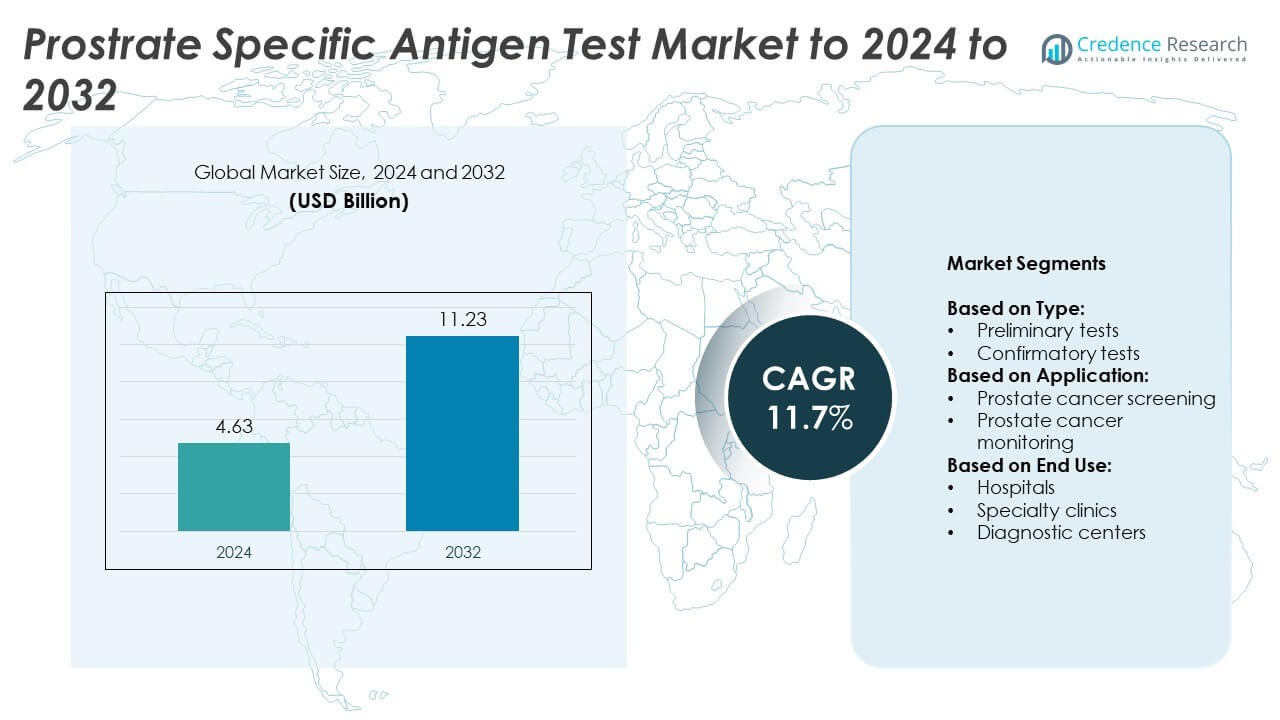

Prostrate Specific Antigen Test Market size was valued at USD 4.63 Billion in 2024 and is anticipated to reach USD 11.23 Billion by 2032, at a CAGR of 11.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Prostrate Specific Antigen Test Market Size 2024 |

USD 4.63 Billion |

| Prostrate Specific Antigen Test Market, CAGR |

11.7% |

| Prostrate Specific Antigen Test Market Size 2032 |

USD 11.23 Billion |

Roche, Abbott Laboratories Inc., Thermo Fisher Scientific, Bio-Rad Laboratories, Inc., GE HealthCare, Beckman Coulter, Inc., FUJIREBIO, Laboratory Corporation of America Holdings, Bayer AG, Abcam plc, Lomina AG, LynxDx, and AdvaCare Pharma are the leading players in the prostate-specific antigen test market, driving innovation and competitive growth. These companies focus on developing highly sensitive and reliable assays to support early detection and monitoring of prostate cancer. Strategic collaborations, research investments, and regional expansions strengthen their market presence. North America led the market in 2024 with a 38% share, followed by Europe at 29%, Asia Pacific at 22%, Latin America at 7%, and the Middle East and Africa at 4%. The region’s dominance is supported by advanced healthcare infrastructure, high awareness, and government-led screening programs, while emerging regions present significant growth opportunities due to rising healthcare investments and increasing patient awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The prostate-specific antigen test market was valued at USD 4.63 Billion in 2024 and is projected to reach USD 11.23 Billion by 2032, growing at a CAGR of 11.7%.

- Rising prostate cancer prevalence, government-led screening programs, and technological advancements in testing are key drivers supporting market growth.

- The market is witnessing trends toward personalized medicine, point-of-care testing, and integration of molecular biomarkers with PSA tests for more precise diagnostics.

- Competitive landscape is dominated by major players focusing on product innovation, strategic collaborations, and expanding regional presence to strengthen market share.

- North America led with 38% market share, followed by Europe at 29%, Asia Pacific at 22%, Latin America at 7%, and Middle East & Africa at 4%; preliminary tests held the largest segment share in 2024.

Market Segmentation Analysis:

By Type

The prostate-specific antigen (PSA) test market by type is segmented into preliminary tests and confirmatory tests. Preliminary tests dominated the segment in 2024, holding over 58% market share. Their wide use as first-line screening tools in routine health check-ups and large-scale cancer awareness programs drives this dominance. High accessibility, lower cost, and simplicity make preliminary tests more widely adopted in both developed and emerging regions. Growing awareness about early cancer detection further strengthens demand for preliminary PSA tests, while confirmatory tests continue to gain traction for precise diagnostics in complex cases.

- For instance, Abbott Laboratories’ ARCHITECT i2000SR immunoassay system can process up to 200 tests per hour, and is used for a variety of immunoassay tests, including PSA.

By Application

Based on application, the market is categorized into prostate cancer screening and prostate cancer monitoring. Prostate cancer screening accounted for the largest share at nearly 62% in 2024, fueled by rising awareness programs and government initiatives encouraging early diagnosis. Increasing prevalence of prostate cancer globally, particularly in aging male populations, has made screening a primary focus. The role of PSA tests as effective preventive tools contributes to their high adoption. In contrast, prostate cancer monitoring is gaining importance as personalized treatment and long-term patient management become more critical in oncology practices.

- For instance, Roche Diagnostics’ Elecsys total PSA assay has a Limit of Quantitation (LoQ) of 0.014 ng/mL and a Limit of Detection (LoD) of 0.010 ng/mL

By End Use

In terms of end use, the market is divided into hospitals, specialty clinics, and diagnostic centers. Hospitals held the dominant position in 2024 with more than 45% share, supported by their advanced infrastructure, large patient base, and comprehensive diagnostic capabilities. The presence of multidisciplinary oncology units in hospitals ensures higher test volumes, particularly for newly diagnosed patients. Additionally, hospital-based reimbursement systems and integration of PSA testing in routine health screenings strengthen this dominance. Specialty clinics and diagnostic centers are expanding rapidly, driven by rising demand for quicker, cost-effective, and accessible prostate cancer testing options.

Key Growth Drivers

Rising Prostate Cancer Incidence

The increasing global burden of prostate cancer remains the most significant growth driver for the prostate-specific antigen (PSA) test market. Rising prevalence, especially among men aged 50 and above, has intensified demand for effective screening and monitoring. The World Health Organization reports prostate cancer as one of the most common cancers in men, pushing healthcare systems to adopt large-scale screening initiatives. Governments and healthcare organizations are also launching awareness campaigns, boosting the adoption of PSA tests as a critical tool for early diagnosis and better patient outcomes.

- For instance, As a major provider of PSA tests in the U.S. for prostate cancer screening and monitoring, LabCorp reported that its total diagnostics volume, measured by requisitions, increased by 2.4% in the fourth quarter of 2023. However, this growth was primarily driven by acquisitions (2.1%) with only a minor contribution from organic volume (0.3%).

Technological Advancements in Testing

Advances in diagnostic technology, including ultrasensitive assays and point-of-care testing, are enhancing the accuracy and reliability of PSA tests. These innovations allow early-stage detection with reduced false positives and negatives, which builds confidence among clinicians and patients. Integration of biomarkers with advanced testing methods is further driving precision medicine approaches. Growing adoption of automated systems in laboratories reduces turnaround times, supporting efficiency in clinical workflows. Such advancements are encouraging higher uptake of PSA tests across hospitals, specialty clinics, and diagnostic centers worldwide.

- For instance, Analyses using large datasets like the Behavioral Risk Factor Surveillance System (BRFSS) and the All of Us Research Program reveal that between 2018 and 2020, PSA testing in U.S. men aged 40 and older was influenced by factors including age, race, and screening guidelines. Specifically, testing rates continued to decline until 2020, a trend further affected by the COVID-19 pandemic.

Government Initiatives and Screening Programs

Government-led initiatives promoting cancer screening are accelerating PSA test adoption across developed and emerging regions. National screening policies, healthcare subsidies, and inclusion of PSA tests in preventive health packages are creating strong demand. Public health authorities are increasingly focused on reducing mortality rates by encouraging early detection, which directly supports market expansion. Insurance coverage and reimbursement programs in developed countries further enhance accessibility. This policy-driven support has positioned PSA testing as a standard diagnostic tool in oncology, ensuring steady market growth throughout the forecast period.

Key Trends and Opportunities

Shift Toward Personalized Medicine

The move toward personalized medicine is reshaping the PSA test market, opening opportunities for more tailored cancer diagnostics. Advanced tests now integrate genetic markers and molecular profiling with PSA levels, enabling improved risk stratification. This approach allows clinicians to design individualized treatment plans, reducing unnecessary biopsies and improving patient outcomes. Growing collaboration between diagnostic companies and biotech firms supports this trend, as innovation accelerates. The emphasis on precision oncology is expected to significantly boost adoption of PSA testing in both developed and emerging healthcare markets.

- For instance, GLOBOCAN 2022 estimated 1,467,854 new prostate cancer cases and 397,430 deaths worldwide.

Expansion in Emerging Markets

Emerging economies present vast opportunities due to increasing healthcare expenditure, improving diagnostic infrastructure, and rising awareness of prostate health. Countries in Asia-Pacific and Latin America are witnessing rapid growth in demand for PSA testing, supported by government health campaigns and private investments in diagnostic facilities. Urbanization and aging male populations further drive this adoption. Additionally, international diagnostic companies are expanding their presence in these regions to tap into the growing patient pool. These factors position emerging markets as high-potential areas for sustained revenue growth in PSA testing.

- For instance, According to a January 2025 analysis by Prostate Cancer UK, based on NHS data, prostate cancer diagnoses in England have surpassed breast cancer diagnoses for two consecutive years. The analysis found there were 50,751 diagnoses of prostate cancer in England in 2022, and this figure rose to 55,033 in 2023. This trend, which saw prostate cancer become the most common form of cancer diagnosed in England in 2023, is partly driven by increased awareness and targeted campaigns.

Key Challenges

False Positives and Overdiagnosis

One of the most pressing challenges in the PSA test market is the risk of false positives, which can lead to overdiagnosis and unnecessary treatments. Elevated PSA levels may result from benign conditions such as prostatitis or benign prostatic hyperplasia, creating diagnostic uncertainty. This often subjects patients to invasive biopsies, emotional distress, and increased healthcare costs. Such limitations have sparked debates about the test’s reliability and clinical value. Addressing these issues through advanced biomarkers and improved test specificity remains critical for building trust in PSA testing.

Limited Awareness in Low-Income Regions

Despite growing adoption globally, limited awareness in low-income regions continues to restrict market expansion. Inadequate healthcare infrastructure, lack of trained professionals, and minimal public education about prostate cancer screening hinder widespread adoption. Men in rural areas often remain unaware of the importance of early detection, resulting in late diagnoses and poor outcomes. Moreover, high test costs relative to local income levels reduce accessibility. Overcoming these barriers requires collaborative efforts between governments, NGOs, and diagnostic providers to expand outreach programs and strengthen healthcare delivery systems.

Regional Analysis

North America

North America led the prostate-specific antigen test market in 2024 with a 38% share. The region’s dominance stems from advanced healthcare infrastructure, widespread adoption of preventive screening, and strong government support for cancer awareness programs. High prevalence of prostate cancer among aging male populations further accelerates demand for PSA testing. Favorable reimbursement policies, well-established diagnostic facilities, and continuous technological innovations strengthen market growth. The presence of leading diagnostic companies and active research initiatives also contribute to the region’s leadership, making North America the largest and most mature market for PSA testing worldwide.

Europe

Europe accounted for nearly 29% of the global prostate-specific antigen test market in 2024. Strong healthcare systems, combined with national cancer screening programs, have increased PSA test adoption across the region. Countries such as Germany, the UK, and France are at the forefront of implementing advanced diagnostic practices. High awareness among patients and support from public health agencies are driving continuous growth. Technological advancements and investments in personalized medicine further enhance market expansion. Despite ongoing debates about overdiagnosis, Europe remains a key market supported by a large aging male population and well-integrated healthcare policies.

Asia Pacific

Asia Pacific captured around 22% share of the prostate-specific antigen test market in 2024, emerging as the fastest-growing region. Rising incidence of prostate cancer, growing healthcare investments, and government-led awareness programs are driving adoption. Countries such as China, India, and Japan are witnessing higher test volumes due to expanding diagnostic facilities and urbanization. Increasing affordability of healthcare services and improvements in infrastructure also support growth. International diagnostic companies are expanding in the region to tap into the large patient base. Asia Pacific’s rapid economic development positions it as a major contributor to future market expansion.

Latin America

Latin America held about 7% share of the prostate-specific antigen test market in 2024. Growth in this region is supported by rising healthcare awareness and increasing focus on early cancer detection. Brazil and Mexico are leading markets, benefiting from expanding private healthcare networks and government cancer screening initiatives. However, limited infrastructure in rural areas and high test costs remain challenges. The region is experiencing gradual improvement as international healthcare providers expand their presence and partnerships increase. Latin America is expected to show steady growth, driven by improving access to diagnostic technologies and rising patient awareness.

Middle East and Africa

The Middle East and Africa accounted for 4% of the global prostate-specific antigen test market in 2024. Market growth is constrained by limited healthcare infrastructure, low awareness of prostate cancer, and affordability issues. Despite these challenges, urban centers in Gulf countries such as the UAE and Saudi Arabia are witnessing rising adoption due to advanced medical facilities. Increasing investments in healthcare and government-led awareness programs are gradually improving access. Africa remains underpenetrated, though non-profit initiatives and international collaborations are expanding outreach. The region holds untapped potential as infrastructure development continues and diagnostic awareness rises.

Market Segmentations:

By Type:

- Preliminary tests

- Confirmatory tests

By Application:

- Prostate cancer screening

- Prostate cancer monitoring

By End Use:

- Hospitals

- Specialty clinics

- Diagnostic centers

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Roche, Abbott Laboratories Inc., Thermo Fisher Scientific, Bio-Rad Laboratories, Inc., GE HealthCare, Beckman Coulter, Inc., FUJIREBIO is an H.U. Group company, Laboratory Corporation of America Holdings, Bayer AG, Abcam plc, Lomina AG, LynxDx, and AdvaCare Pharma are the leading players in the prostate-specific antigen test market, driving innovation and competitive growth. These companies focus on developing advanced, highly sensitive assays to improve early detection and monitoring of prostate cancer. Strategic collaborations, mergers, and partnerships enhance their distribution networks and expand regional presence. Continuous investment in research and development supports the launch of technologically advanced solutions, including automated and point-of-care testing platforms. Companies also prioritize regulatory compliance and quality certifications to strengthen market credibility. Rising awareness of early cancer detection, coupled with competitive pricing strategies, enables these firms to maintain a strong foothold. Overall, the market is characterized by technological innovation, strategic alliances, and increasing adoption across hospitals, specialty clinics, and diagnostic centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Roche

- Abbott Laboratories Inc.

- Thermo Fisher Scientific

- Bio-Rad Laboratories, Inc.

- GE HealthCare

- Beckman Coulter, Inc.

- FUJIREBIO is an H.U. Group company

- Laboratory Corporation of America Holdings

- Bayer AG

- Abcam plc

- Lomina AG

- LynxDx

- AdvaCare Pharma

Recent Developments

- In 2025, Roche confirmed its strategy to grow its diagnostics division through advancements in pathology solutions and blood screening tests, alongside its core PSA offerings.

- In 2025, Thermo Fisher Scientific launched the Orbitrap Astral Zoom mass spectrometer at ASMS 2025, which provides enhanced sensitivity and speed for analyzing proteins and discovering clinical biomarkers, significantly accelerating disease research like that for cancer

- In 2023, LynxDx Commercialized its MyProstateScore 2.0 urine-based prostate cancer screening test.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global prostate cancer prevalence.

- Early detection awareness campaigns will drive wider adoption of PSA testing.

- Technological advancements will improve test accuracy and reduce false positives.

- Point-of-care diagnostics will see increased demand in both urban and rural areas.

- Personalized medicine will integrate PSA testing with genetic and molecular profiling.

- Emerging markets will experience rapid growth due to healthcare investments.

- Hospitals will remain the largest end users, supported by advanced infrastructure.

- Reimbursement policies will continue to support adoption in developed regions.

- Partnerships between diagnostic firms and healthcare providers will enhance market reach.

- Growing male aging populations will sustain long-term demand for PSA testing.