Market Overview

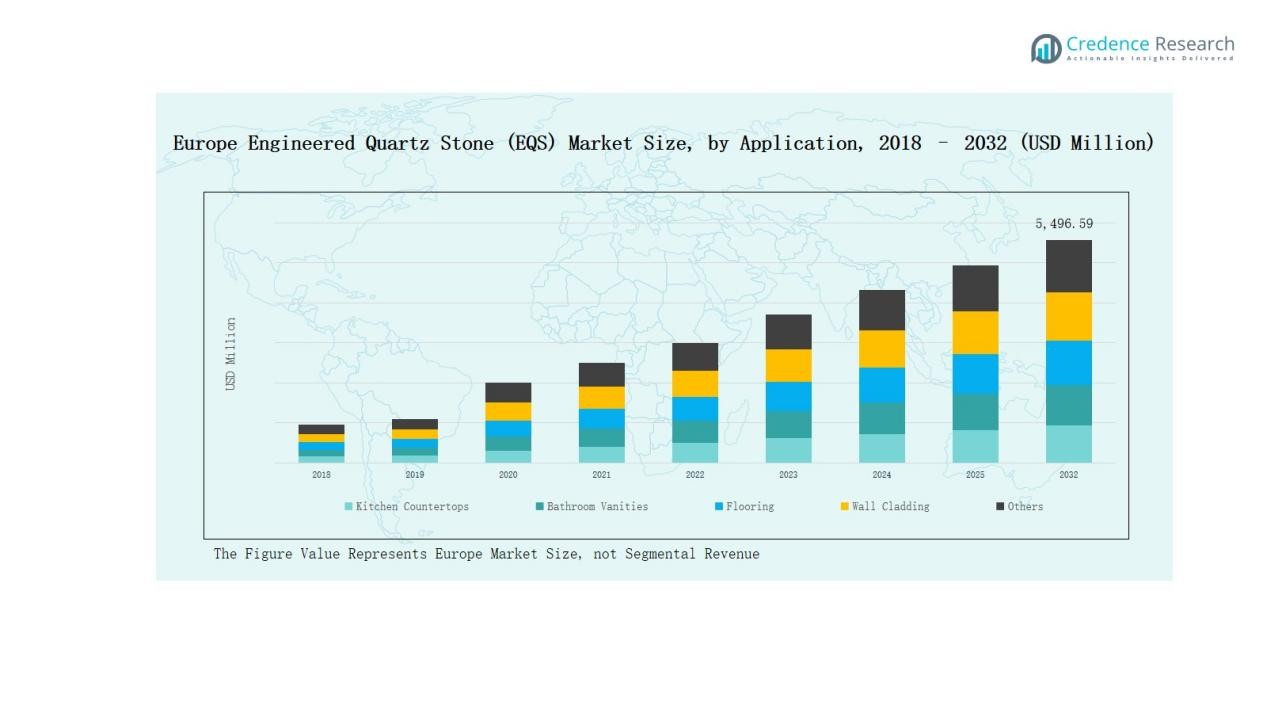

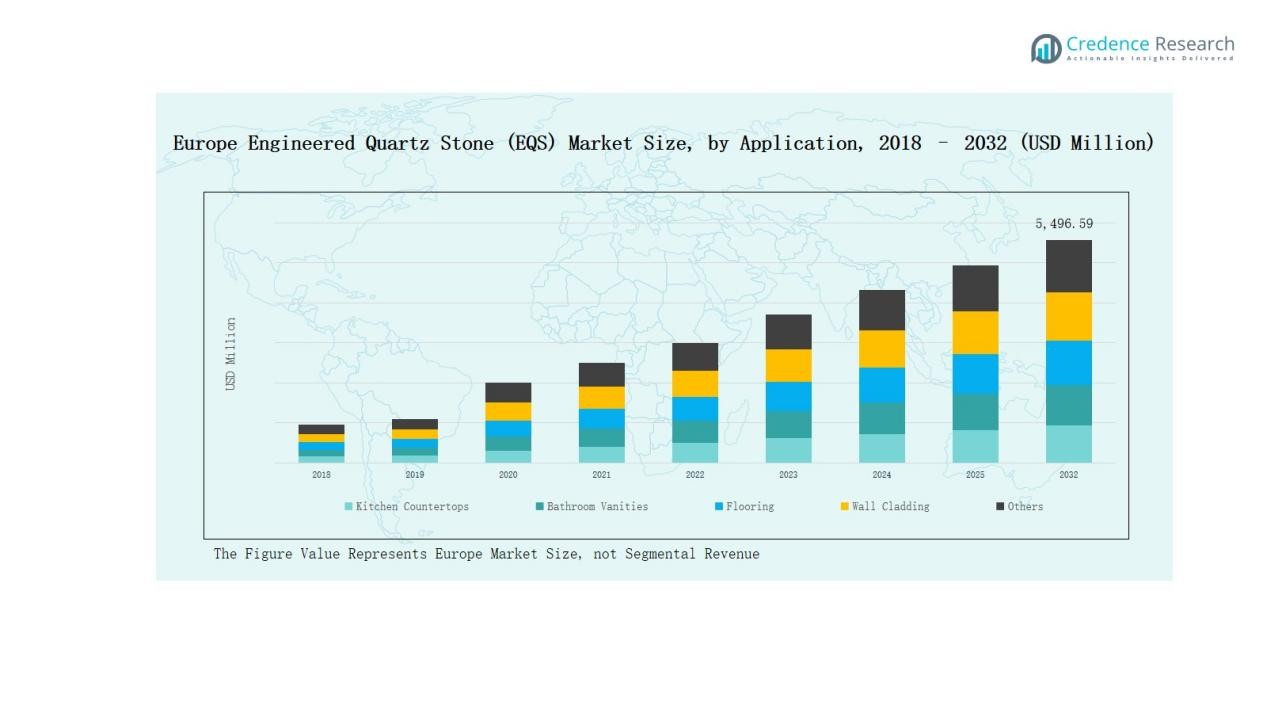

Europe Engineered Quartz Stone (EQS) Market size was valued at USD 2,029.73 million in 2018, reached USD 3,272.18 million in 2024, and is anticipated to reach USD 5,873.83 million by 2032, at a CAGR of 7.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Engineered Quartz Stone (EQS) Market Size 2024 |

USD 3,272.18 Million |

| Europe Engineered Quartz Stone (EQS) Market, CAGR |

7.45% |

| Europe Engineered Quartz Stone (EQS) Market Size 2032 |

USD 5,873.83 Million |

The Europe Engineered Quartz Stone (EQS) Market is shaped by leading companies including Cosentino S.A., Caesarstone, Compac, Technistone, Santa Margherita, Quarella, Breton S.p.A., Lapitec, Quartzforms, and Stone Italiana. These players compete through advanced product portfolios, sustainable quartz solutions, and strong collaborations with distributors, architects, and contractors. They emphasize premium designs, recycled materials, and silica-free innovations to align with Europe’s environmental standards and consumer demand for durable, low-maintenance surfaces. Regionally, the UK led the market with a 22% share in 2024, driven by robust residential renovations, luxury housing projects, and strong adoption in commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Engineered Quartz Stone (EQS) Market grew from USD 2,029.73 million in 2018 to USD 3,272.18 million in 2024, and is projected to reach USD 5,873.83 million by 2032, expanding at 7.45% CAGR.

- Kitchen countertops dominated applications with 52% share in 2024, supported by strong residential renovations and luxury housing demand, while bathroom vanities, flooring, and wall cladding gained steady momentum.

- Distributors and dealers led distribution with 46% share in 2024, driven by strong networks and partnerships with contractors and retailers, while direct sales and home improvement retailers followed closely.

- The UK led the market with 22% share in 2024, followed by Germany at 18%, France at 15%, Italy at 13%, Spain at 11%, Russia at 9%, and Rest of Europe at 12%.

- Key players including Cosentino, Caesarstone, Compac, Technistone, Santa Margherita, Quarella, Breton S.p.A., Lapitec, Quartzforms, and Stone Italiana focus on premium designs, eco-friendly solutions, and strong regional collaborations.

Market Segment Insights

By Application

Kitchen countertops held the dominant share of 52% in 2024, making them the leading application segment in Europe. Rising demand for premium, durable, and low-maintenance surfaces in residential remodeling and luxury housing projects drives adoption. The popularity of modern kitchens with open layouts and integrated islands further supports quartz countertop installations. Bathroom vanities accounted for a smaller but steady share, while flooring and wall cladding are gaining traction in high-end commercial and hospitality spaces.

- For instance, Cosentino expanded its Silestone range with the HybriQ+ technology surface, designed for sustainable and high-performance kitchen applications.

By Distribution Channel

Distributors and dealers accounted for the largest share of 46% in 2024, leading the distribution channel landscape in Europe. Their extensive networks and ability to cater to diverse residential and commercial projects enable wider product penetration across regions. Strong collaborations with contractors, architects, and retailers enhance sales, especially in urban housing developments. Direct sales channels followed closely, supported by established manufacturers with brand recognition. Home improvement retailers are also growing steadily as DIY culture expands across European markets.

- For instance, Travis Perkins plc, one of the UK’s largest distributors of building supplies, partners with housing developers to streamline construction material delivery across multiple urban projects.

Key Growth Drivers

Rising Residential Renovation and Remodeling

The growing trend of home improvement across Europe significantly boosts demand for engineered quartz stone. Rising disposable incomes and consumer preference for premium interiors drive installations of quartz countertops and vanities. Remodeling activities in urban housing, combined with luxury apartment projects in cities such as London, Paris, and Berlin, further accelerate adoption. The durability, stain resistance, and modern designs offered by engineered quartz make it the preferred material in kitchens and bathrooms, establishing its stronghold in the residential segment.

- For instance, Compac launched its Obsidiana series, made from 100% recycled glass, tapping into both sustainability and the premium home design segment, further reinforcing quartz as the material of choice in residential applications.

Expanding Commercial Construction Sector

Europe’s commercial construction sector, including offices, hotels, and retail outlets, continues to create growth opportunities for engineered quartz stone. Builders increasingly choose quartz for flooring, wall cladding, and reception counters due to its durability and aesthetic appeal. The hospitality sector in countries such as France, Spain, and Italy favors quartz surfaces for high-traffic environments. Investments in public infrastructure, particularly airports and healthcare facilities, also contribute to the growing adoption of engineered quartz stone, reinforcing its position in commercial construction projects.

Strong Sustainability and Eco-Friendly Initiatives

Sustainability plays a pivotal role in driving the engineered quartz stone market across Europe. Manufacturers are focusing on producing recycled and silica-free surfaces to meet rising environmental regulations and consumer demand for eco-friendly products. Certifications such as LEED and BREEAM encourage the adoption of sustainable construction materials, boosting quartz usage in green building projects. Leading companies invest in innovative technologies that reduce environmental footprints, aligning with Europe’s strict climate goals and sustainability-driven construction trends. This emphasis strengthens quartz’s long-term market outlook.

- For instance, Cosentino launched its Silestone HybriQ+ technology, which uses a reduced crystalline silica formulation and 100% renewable electric energy during production.

Key Trends & Opportunities

Shift Toward Premium and Customized Surfaces

A major trend in Europe is the shift toward premium, customized quartz surfaces. Consumers increasingly prefer unique colors, textures, and finishes to enhance interior aesthetics. Luxury housing projects and high-end retail spaces fuel demand for tailor-made quartz solutions, including book-matched slabs and seamless designs. The rise of digital design platforms also supports personalization, allowing customers to visualize quartz applications before purchase. This trend creates opportunities for manufacturers to offer bespoke solutions and expand premium product portfolios, strengthening market differentiation.

- For instance, Caesarstone introduced its Pebbles Collection across European markets, offering nature-inspired textures that cater to the demand for personalized aesthetics in residential and commercial spaces.

Growth of Online and Home Improvement Retail Channels

The expansion of digital retail and home improvement chains presents a key opportunity in the European engineered quartz stone market. Online platforms provide consumers easy access to product catalogs, virtual design tools, and convenient purchasing. Home improvement retailers such as Leroy Merlin and B&Q also drive product visibility among DIY-focused consumers. This shift in retail dynamics boosts quartz adoption in both small-scale renovations and large housing projects. Companies leveraging e-commerce and retail partnerships gain stronger market reach and competitiveness.

- For instance, Lowe’s has introduced AR-enabled kitchen design tools in North America that feature engineered quartz options, enhancing product visibility for renovation projects.

Key Challenges

High Production and Installation Costs

One of the major challenges in the European engineered quartz stone market is the high cost of production and installation. Quartz manufacturing requires advanced technology, resins, and skilled labor, which raises overall expenses. Additionally, transportation and customization costs further increase end-user pricing. These factors make quartz less affordable compared to natural stones or laminates, limiting adoption in cost-sensitive residential projects. Price sensitivity in emerging European economies poses a hurdle for market penetration despite growing consumer awareness of quartz’s durability.

Stringent Environmental and Health Regulations

Europe enforces strict regulations on silica exposure and environmental impacts, challenging quartz manufacturers. The presence of crystalline silica during cutting and fabrication raises health concerns for workers, requiring compliance with advanced dust-control systems and protective equipment. Meeting these standards adds to operational costs and creates barriers for smaller companies. Additionally, environmental sustainability rules demand recycled or low-silica alternatives, pushing manufacturers to invest heavily in research and innovation. These regulatory pressures slow down expansion and increase competitive intensity.

Competition from Alternative Materials

Engineered quartz stone faces strong competition from alternatives such as granite, marble, ceramics, and sintered stone. Consumers often compare quartz with these materials based on cost, durability, and aesthetics. While quartz offers low maintenance, natural stones appeal to buyers seeking unique patterns, while ceramics and sintered surfaces gain traction for eco-friendly properties. This competition limits quartz’s market share in some applications, especially in flooring and wall cladding. Overcoming this challenge requires aggressive branding and differentiation through innovation and sustainability.

Regional Analysis

UK

The UK accounted for 22% share in 2024, making it one of the leading regional markets. Strong demand stems from high residential renovation activity and the luxury housing segment. Engineered quartz stone is favored for kitchen countertops and bathroom vanities due to durability and aesthetics. Developers and contractors adopt quartz for commercial projects in London and other urban centers. Growing sustainability standards also support the shift toward eco-friendly quartz solutions. Expanding retail networks and distribution channels enhance product accessibility across the region.

Germany

Germany held 18% share in 2024, supported by its robust construction industry and green building policies. Consumers prioritize sustainable, low-maintenance surfaces, which strengthens demand for quartz countertops and flooring. Large-scale commercial projects, including offices and healthcare facilities, further drive adoption. The market benefits from strict regulatory frameworks that encourage silica-free and recycled quartz products. German manufacturers continue to innovate product lines to meet these environmental requirements. Increasing preference for modern interior solutions reinforces quartz’s position in both residential and commercial spaces.

France

France captured 15% share in 2024, driven by high consumer demand for stylish and durable interior surfaces. Kitchen countertops dominate applications, supported by strong urban housing activity. Hospitality and retail sectors also favor quartz for design flexibility and long-lasting performance. French consumers increasingly select premium, customized quartz designs to align with luxury lifestyle trends. Sustainability initiatives encourage adoption of recycled quartz surfaces in new housing and commercial projects. Distribution through home improvement retailers strengthens product availability and brand visibility nationwide.

Italy

Italy represented 13% share in 2024, influenced by its reputation for design innovation and luxury interiors. The market benefits from consumer preference for elegant kitchen and bathroom applications. Local manufacturers emphasize premium finishes and tailor-made designs, enhancing adoption in high-end residential projects. Italian architects integrate quartz into modern commercial spaces for durability and visual appeal. Growing exports of Italian quartz surfaces also highlight its competitive position. Rising awareness of eco-friendly materials further contributes to demand across residential and commercial sectors.

Spain

Spain accounted for 11% share in 2024, supported by strong construction and tourism-driven hospitality sectors. Kitchen countertops dominate applications, particularly in residential and vacation housing. The market benefits from Spain’s well-established stone processing industry and competitive pricing. Consumers show rising interest in modern quartz designs that combine durability with style. Export-oriented players based in Spain expand regional influence through innovative product portfolios. Investments in sustainable quartz production align with regulatory frameworks and enhance long-term growth prospects.

Russia

Russia held 9% share in 2024, supported by urban development projects and growing middle-class demand for modern housing. Kitchen and bathroom applications drive the majority of quartz adoption, while commercial usage remains limited. Domestic producers and imported brands compete for market share, particularly in urban centers such as Moscow and St. Petersburg. Economic volatility creates pricing pressure, yet durable surfaces like quartz remain attractive. Distribution through dealers and direct channels ensures availability across regions. Rising interest in luxury interiors gradually strengthens the segment.

Rest of Europe

The Rest of Europe contributed 12% share in 2024, covering smaller markets such as Nordic countries, Benelux, and Eastern Europe. Demand is supported by rising residential remodeling projects and gradual adoption in commercial sectors. Nordic countries emphasize sustainable building practices, boosting recycled quartz usage. In Eastern Europe, growing disposable incomes increase consumer interest in durable and stylish kitchen and bathroom surfaces. Home improvement retailers expand market reach by offering diverse product options. The region’s mixed economic environment shapes adoption trends across applications.

Market Segmentations:

By Application

- Kitchen Countertops

- Bathroom Vanities

- Flooring

- Wall Cladding

- Others

By Distribution Channel

- Direct Sales

- Distributors/Dealers

- Home Improvement Retailers

- Others

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Engineered Quartz Stone (EQS) Market features a competitive landscape shaped by established global players and strong regional manufacturers. Companies such as Cosentino, Caesarstone, Compac, Technistone, Santa Margherita, Quarella, and Stone Italiana hold prominent positions, supported by extensive product portfolios and advanced manufacturing capabilities. These players focus on premium designs, recycled quartz offerings, and silica-free surfaces to align with Europe’s sustainability priorities and strict regulatory standards. Partnerships with distributors, architects, and contractors strengthen market penetration across residential, commercial, and hospitality sectors. Regional producers, including Breton S.p.A., Lapitec, and Quartzforms, emphasize innovation and customization to cater to local preferences in Italy, Germany, and other European markets. Competition remains intense as manufacturers expand digital retail channels and enhance brand visibility through marketing strategies. Continuous investment in technology, sustainability, and design innovation positions leading companies to maintain growth momentum and capture rising demand across Europe’s evolving construction landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In January 2025, Vadara Quartz partnered with The Thomas Group to expand distribution in the UK, strengthening its presence in the European engineered quartz stone market.

- In 2025, Caesarstone launched its ICON™ Advanced Fusion collection, a silica-free product line with recycled content, expected to shape sustainability trends in Europe.

- In June 2024, LE Surfaces expanded its handcrafted quartz innovations into Europe, introducing new designs and technology to the regional market.

- On August 4, 2025, Wilsonart introduced new Quartz designs with bold colorways (greens, blues) and fresh textures.

Report Coverage

The research report offers an in-depth analysis based on Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise in residential renovations, especially for kitchen countertops and bathroom vanities.

- Commercial adoption will expand, driven by offices, hotels, and healthcare construction projects.

- Sustainability regulations will push growth of recycled and silica-free quartz products.

- Premium and customized quartz surfaces will gain popularity among luxury consumers.

- Digital retail platforms and online visualization tools will enhance customer engagement.

- Home improvement retailers will strengthen distribution and drive consumer accessibility.

- Local manufacturers will compete with global brands through design innovation and niche offerings.

- Investment in eco-friendly technologies will shape product development and market positioning.

- Rising consumer preference for low-maintenance and durable materials will support steady adoption.

- Growing urban housing demand across Europe will ensure long-term market expansion.