Market Overview

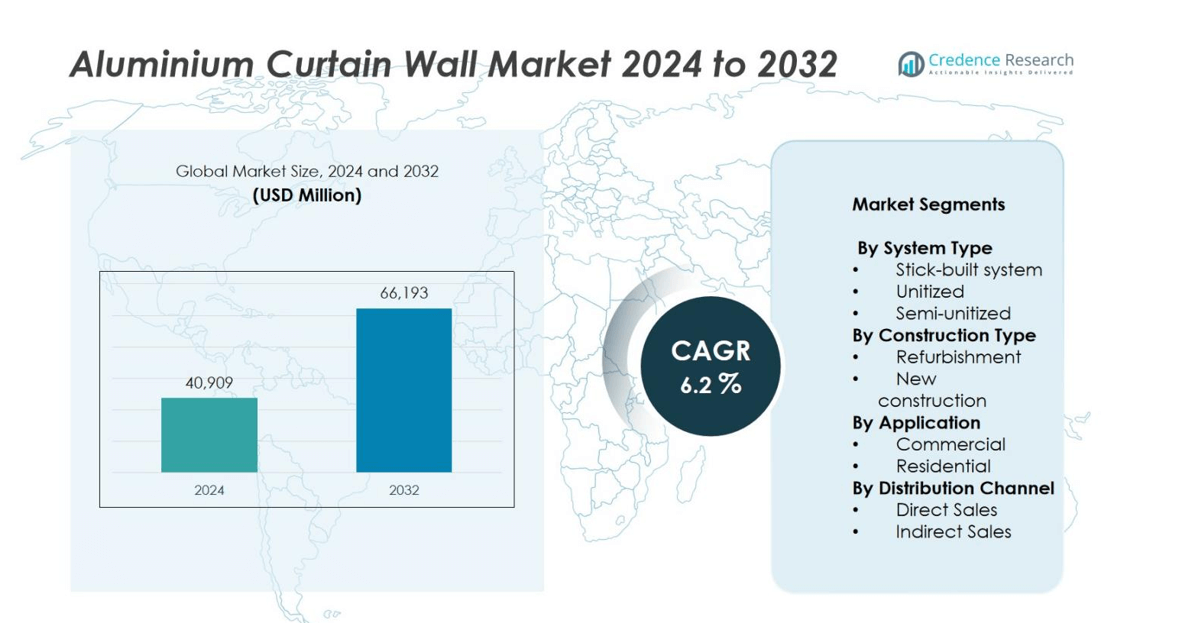

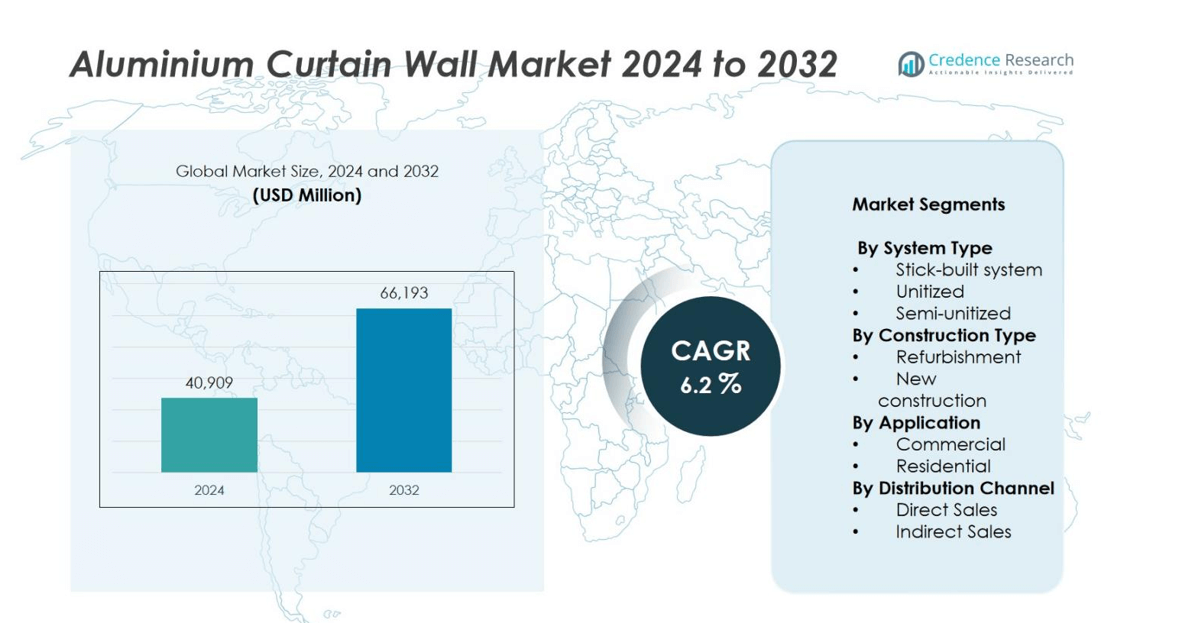

The Aluminium Curtain Wall Market size was valued at USD 40,909 million in 2024 and is anticipated to reach USD 66,193 million by 2032, growing at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminium Curtain Wall Market Size 2024 |

USD 40,909 million |

| Aluminium Curtain Wall Market, CAGR |

6.2% |

| Aluminium Curtain Wall Market Size 2032 |

USD 66,193 million |

The Aluminium Curtain Wall Market is highly competitive, with leading players such as Aluprof SA, Arcadia Inc., Beijing Northglass Technologies Co. Ltd., C.R. Laurence Co. Inc., EFCO Corporation, Extech Exterior Technologies Inc., Hansen Group, Kawneer Inc., METRA SpA, and Petra Aluminum dominating global operations. These companies focus on technological innovation, energy-efficient façade solutions, and strategic partnerships to expand their market presence. Product diversification, enhanced thermal performance, and smart façade integration remain key competitive strategies. North America leads the global aluminium curtain wall market with a 35% share, driven by robust commercial construction, advanced architectural standards, and increasing adoption of sustainable building technologies.

Market Insights

- The Aluminium Curtain Wall Market was valued at USD 40,909 million in 2024 and is projected to reach USD 66,193 million by 2032, growing at a CAGR of 6.2% during the forecast period.

- Market growth is driven by rising demand for energy-efficient and sustainable building solutions, supported by rapid urbanization and increasing adoption of modern façade systems in new construction projects.

- Key trends include the integration of smart and adaptive façades, growing use of unitized systems accounting for 60% of the market, and technological advancements in 3D modeling and BIM-based façade engineering.

- Competitive dynamics are shaped by major players such as Aluprof SA, Arcadia Inc., EFCO Corporation, and Kawneer Inc., focusing on product innovation, energy performance, and strategic regional expansion.

- Regionally, North America leads with a 35% share, followed by Asia-Pacific with 33% and Europe with 25%, reflecting strong infrastructure investment and green building initiatives across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By System Type

In the aluminium curtain wall market, the unitized system sub-segment dominates, accounting for about 60% of the market share. Unitized systems are preferred due to their factory-fabricated nature, which ensures superior quality control, quicker installation, and lower on-site labour requirements. These advantages make them the ideal choice for high-rise and large-scale commercial projects where construction speed and façade performance are crucial. In comparison, stick-built and semi-unitized systems occupy smaller shares, primarily serving low-rise or architecturally complex projects requiring greater design flexibility.

- For instance, Aluprof’s MB-SE65 unitized curtain wall system is recognized for excellent thermal insulation and structural performance, achieved through advanced factory-controlled assembly techniques.

By Construction Type

By construction type, the new construction segment leads the aluminium curtain wall market with 58% of the share. Growth in this segment is driven by rapid urbanisation, commercial infrastructure expansion, and the integration of advanced façade systems in modern architectural designs. New construction projects benefit from the ability to incorporate energy-efficient and visually appealing curtain wall systems during initial design and planning stages. The refurbishment segment, though smaller, is gaining momentum as older structures undergo façade upgrades to enhance aesthetics and improve energy performance.

- For instance, the JTI Headquarters in Geneva uses a Closed Cavity Façade system with triple and single glazing layers, designed to meet European energy directives and deliver enhanced sustainability.

By Application

In terms of application, the commercial segment holds the largest share of 72% in the aluminium curtain wall market. This dominance is attributed to the widespread use of curtain wall systems in office complexes, shopping malls, hotels, and institutional buildings, where large glazed façades and contemporary aesthetics are prioritized. Demand is further supported by stricter energy-efficiency standards and the rising need for durable, sustainable building envelopes. The residential segment, while expanding, represents a smaller portion of demand, driven mainly by high-rise apartment and luxury housing projects.

Key Growth Drivers

Rising Demand for Energy-Efficient Building Solutions

The increasing focus on sustainable construction and energy efficiency is a major driver for the aluminium curtain wall market. Aluminium curtain walls enhance thermal insulation, reduce energy consumption, and support green building certifications. Governments worldwide are enforcing stringent building energy codes, prompting architects and developers to adopt high-performance façade systems. The growing preference for low-emission, recyclable materials further accelerates adoption, as aluminium’s lightweight and durable nature aligns with sustainability goals and modern architectural requirements.

- For instance, Schüco, a leading German manufacturer, integrates advanced thermal breaks and energy-efficient glazing in its curtain walls, as seen in projects like the BMW Welt in Munich, helping buildings meet strict EU thermal insulation mandates.

Rapid Urbanization and Commercial Infrastructure Expansion

Accelerated urbanization and large-scale infrastructure development are fueling aluminium curtain wall demand. The expansion of commercial real estate—such as office complexes, shopping malls, airports, and hotels—has created a surge in modern façade installations. Emerging economies, particularly in Asia Pacific and the Middle East, are witnessing robust construction activities that emphasize aesthetics, energy efficiency, and durability. Developers are increasingly investing in aluminium curtain wall systems to enhance building appearance, improve structural integrity, and attract occupants seeking premium architectural designs.

- For instance, Mitrex, a Canadian company, introduced innovative “solar brick” façades that incorporate aluminium with integrated solar panels, combining visual appeal with renewable energy generation in urban construction projects.

Technological Advancements in Façade Engineering

Innovations in façade design, materials, and installation techniques are significantly boosting market growth. Advancements such as smart glazing, 3D modeling, and unitized system automation have improved design precision, energy performance, and installation speed. The integration of Building Information Modeling (BIM) and digital fabrication methods allows manufacturers to produce customized curtain walls with enhanced structural and thermal characteristics. These technological developments not only reduce project timelines and costs but also strengthen the appeal of aluminium curtain walls in modern, high-performance buildings.

Key Trends and Opportunities

Integration of Smart and Adaptive Façade Systems

The adoption of smart façade technologies is emerging as a prominent trend in the aluminium curtain wall market. Smart curtain walls equipped with sensors, shading controls, and dynamic glazing adapt to changing environmental conditions, improving indoor comfort and energy efficiency. This trend is particularly strong in technologically advanced and environmentally conscious regions where developers prioritize intelligent building systems. The growing synergy between smart glass innovations and aluminium frameworks offers lucrative opportunities for manufacturers to deliver intelligent, energy-optimized façade solutions.

- For instance, Schüco’s AF UDC 80.SI dynamic curtain wall system integrates profile-based textile sun shading that can reduce cooling loads while maintaining aesthetic appeal, exemplifying the fusion of aluminium frameworks with smart shading solutions.

Rising Adoption in Residential and Mixed-Use Developments

While traditionally dominated by commercial applications, aluminium curtain walls are increasingly being integrated into residential and mixed-use developments. Urban population growth and the rise of high-rise residential towers are expanding the use of lightweight, durable, and aesthetic aluminium façades. Developers are adopting these systems to enhance natural light, improve ventilation, and achieve a modern architectural appeal. This shift presents new opportunities for market players to diversify their product offerings and cater to the evolving design preferences of residential and multi-functional spaces.

- For instance, Oldcastle Building Envelope introduced the Reliance™-TC LT curtain wall solution, which combines thermal efficiency with sleek design, boasting a U-factor of 0.29 suitable for extreme climates in North America.

Key Challenges

High Initial Installation and Maintenance Costs

Despite their long-term benefits, aluminium curtain wall systems involve high upfront installation and maintenance costs, posing a challenge for cost-sensitive projects. The expenses associated with precision fabrication, structural glazing, and thermal insulation materials often elevate overall project budgets. Additionally, periodic maintenance to ensure airtightness, prevent corrosion, and retain aesthetics can add to lifecycle costs. These financial constraints may deter adoption in smaller commercial or residential projects, especially in developing economies with limited construction budgets.

Fluctuating Raw Material Prices and Supply Chain Disruptions

Volatility in aluminium prices and global supply chain disruptions remain significant challenges for market participants. Price fluctuations caused by energy costs, trade restrictions, and raw material shortages directly affect manufacturing margins and project costs. The dependency on global supply networks for aluminium extrusion and glass components has also led to delays and procurement uncertainties. To mitigate these risks, manufacturers are exploring local sourcing strategies and investing in advanced recycling processes to stabilize production and maintain competitive pricing.

Regional Analysis

North America

In North America, the aluminium curtain wall market holds 35% of the global share, driven by robust commercial construction activity in the United States and Canada. Developers are increasingly integrating curtain wall systems in office complexes, institutional buildings, and mixed-use developments to meet strict energy-efficiency regulations and aesthetic standards. The presence of well-established façade manufacturers, coupled with advanced building codes, supports the region’s strong market position. North America continues to lead due to sustained investment in infrastructure modernization and the high adoption of sustainable, performance-oriented architectural designs.

Europe

Europe accounts for 25% of the global aluminium curtain wall market, supported by stringent environmental regulations and widespread renovation initiatives across key economies. Demand is strong in Germany, the United Kingdom, and France, where energy-efficient and unitized curtain wall systems are widely used in both new construction and refurbishment projects. The region’s mature construction industry emphasizes superior façade performance, design flexibility, and sustainability. Although market growth is steady rather than rapid, Europe remains a significant contributor due to its strong regulatory focus and long-standing commitment to green building practices.

Asia-Pacific

The Asia-Pacific region commands 33% of the global aluminium curtain wall market, fueled by rapid urbanization, industrial expansion, and large-scale infrastructure investments. Countries such as China, India, Japan, and South Korea are experiencing surging demand for high-rise commercial and residential buildings. The rising adoption of energy-efficient façades and government support for smart city projects further strengthen regional growth. Competitive manufacturing costs and expanding construction activities make Asia-Pacific the fastest-growing regional market, with ongoing opportunities for advanced and sustainable curtain wall solutions.

Latin America

Latin America holds 5% of the global aluminium curtain wall market share, supported by growing commercial and residential development across countries like Brazil, Mexico, and Chile. Economic recovery and increased investment in urban infrastructure are contributing to gradual market growth. While high installation costs and limited awareness of advanced façade systems have slowed adoption, the trend toward sustainable construction and modern architectural designs is gaining momentum. The region presents untapped potential for international façade manufacturers to expand their presence through strategic partnerships and local production facilities.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the global aluminium curtain wall market, driven by ambitious architectural and infrastructure projects across the Gulf countries. Rapid development in cities such as Dubai, Riyadh, and Doha is spurring demand for high-end curtain wall systems emphasizing energy efficiency and visual appeal. Mega construction projects, including commercial towers, airports, and cultural landmarks, continue to fuel market expansion. Although smaller in volume, the region’s focus on luxury developments and sustainable building designs supports strong value growth and long-term investment opportunities.

Market Segmentations:

By System Type

- Stick-built system

- Unitized

- Semi-unitized

By Construction Type

- Refurbishment

- New construction

By Application

By Distribution Channel

- Direct Sales

- Indirect Sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aluminium curtain wall market is characterized by the presence of prominent players such as Aluprof SA, Arcadia Inc., Beijing Northglass Technologies Co. Ltd., C.R. Laurence Co. Inc., EFCO Corporation, Extech Exterior Technologies Inc., Hansen Group, Kawneer Inc., METRA SpA, and Petra Aluminum. These companies compete on the basis of product innovation, energy efficiency, design flexibility, and project execution capabilities. The market exhibits moderate consolidation, with global players focusing on technological advancements such as smart façades, unitized systems, and thermally broken profiles to meet sustainability standards. Strategic partnerships, mergers, and regional expansions are key growth strategies adopted to enhance distribution networks and cater to diverse construction needs. Continuous investments in research and development are strengthening product durability, acoustic performance, and thermal insulation. Furthermore, local manufacturers are increasingly aligning with international standards, intensifying competition across emerging markets in Asia-Pacific and the Middle East.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EFCO Corporation

- METRA SpA

- Petra Aluminum

- C.R Laurence Co., Inc

- Hansen Group

- Arcadia, Inc

- Aluprof SA

- Extech Exterior Technologies, Inc.

- Beijing Northglass Technologies Co., Ltd.

- Kawneer, Inc

Recent Developments

- In November 2024, AluK India is revolutionizing high-rise buildings with the introduction of its W75U Unitized Curtain Walling System, an elegant, innovative solution that not just makes building tall but seen.

- In August 2024, Alumil announced the launch of LOOP 80, a pioneering initiative focused on aluminum recycling. This initiative represents a significant step towards sustainable production.

- In October 2023, Metra S.p.A., a global manufacturer of extruded aluminum completed the acquisition of Belding Machinery and Equipment Leasing, LLC and its subsidiaries

Report Coverage

The research report offers an in-depth analysis based on System Type, Construction Type, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The aluminium curtain wall market is expected to witness steady growth driven by increasing demand for energy-efficient and sustainable building solutions.

- Adoption of unitized and modular façade systems will expand as developers prioritize faster installation and reduced construction time.

- Technological integration, including smart glazing and automated façade control systems, will enhance energy performance and user comfort.

- Rising urbanization and large-scale infrastructure projects in emerging economies will continue to boost market expansion.

- Manufacturers will focus on recycling initiatives and low-carbon aluminium production to meet global sustainability goals.

- Growing preference for aesthetic and lightweight architectural designs will strengthen aluminium curtain wall adoption in high-rise structures.

- Government initiatives promoting green building certifications will drive demand for advanced curtain wall systems.

- Increasing refurbishment of aging commercial buildings will create opportunities for façade modernization and energy retrofits.

- Strategic collaborations between global and regional players will enhance innovation and market penetration.

- The market will increasingly shift toward customized, performance-driven solutions tailored to local climate and building regulations.