Market Overview

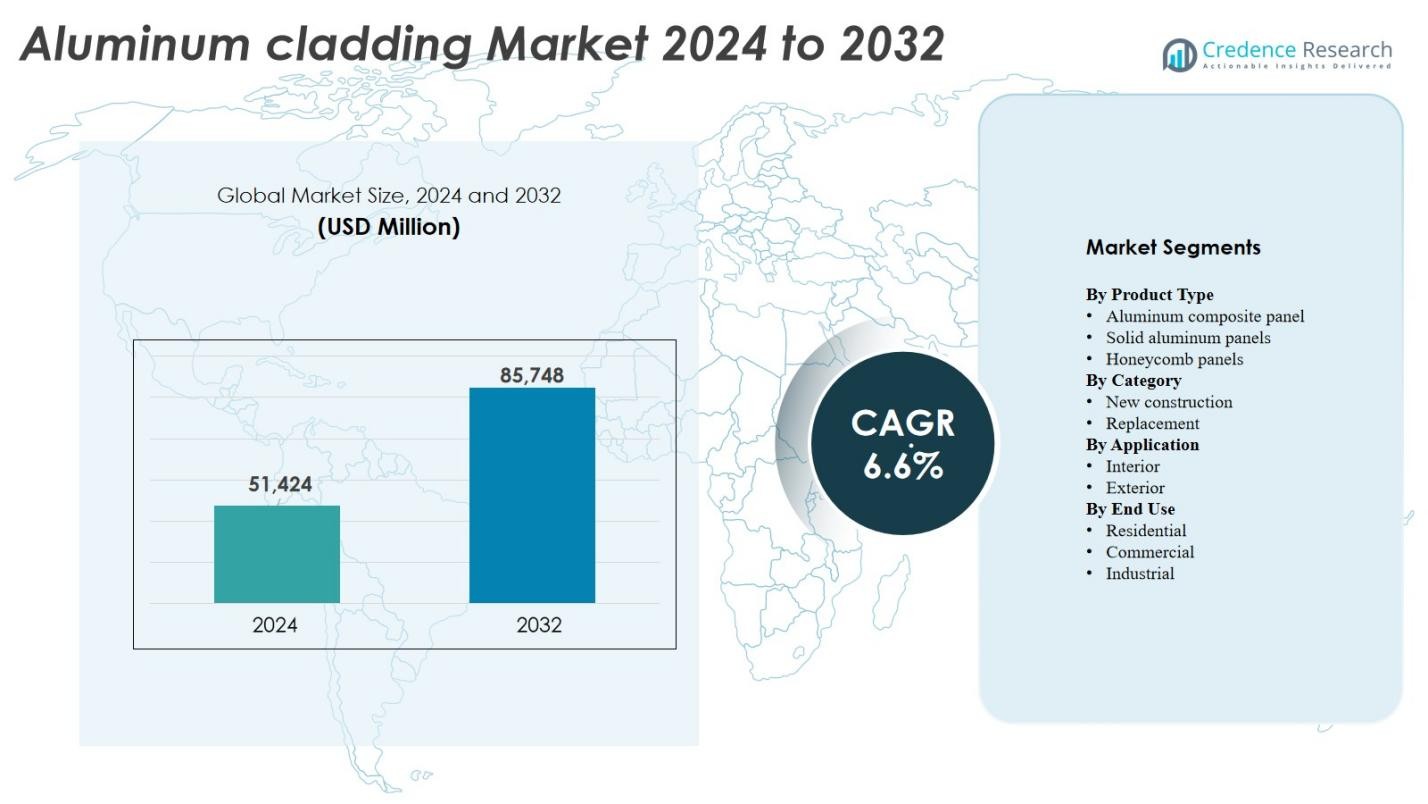

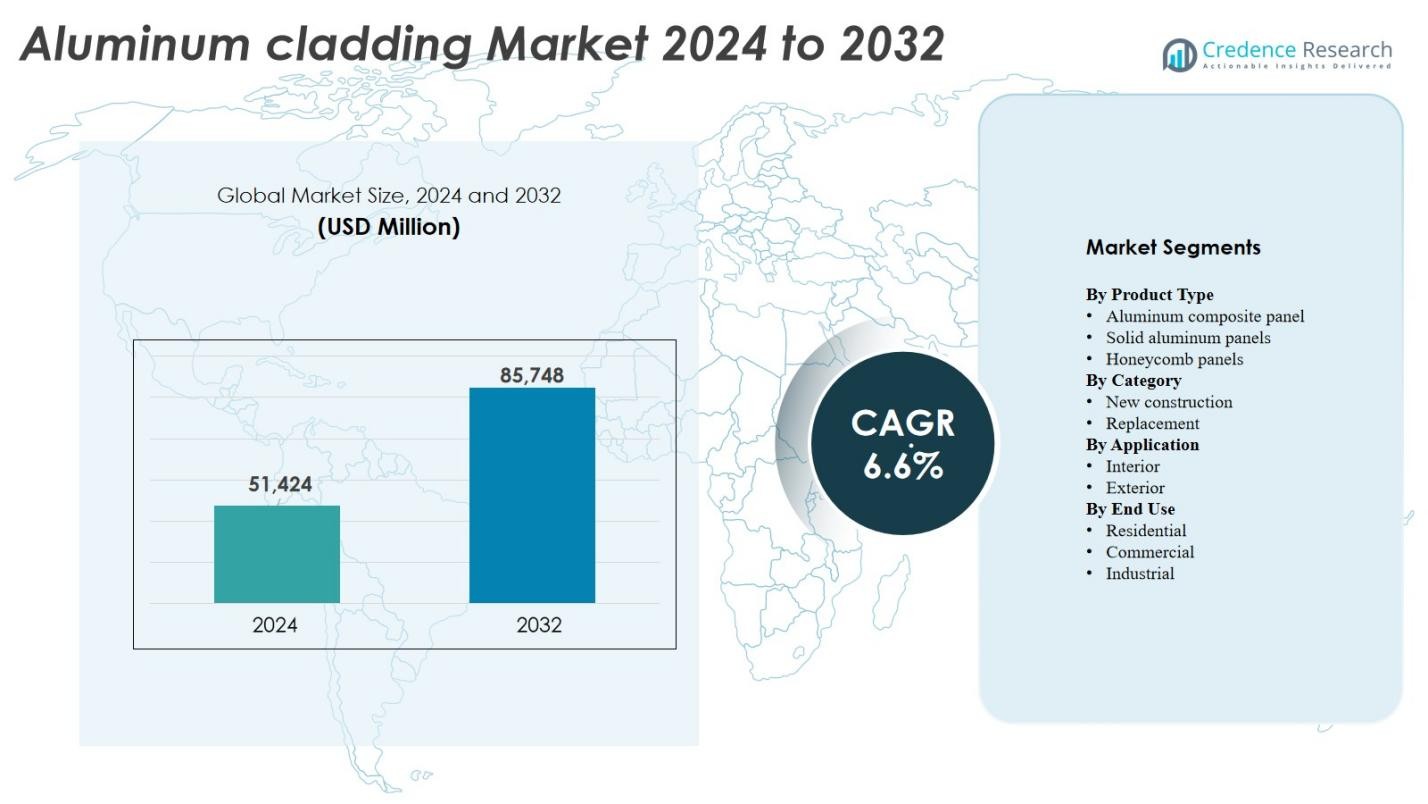

The Aluminum Cladding Market size was valued at USD 51,424 million in 2024 and is anticipated to reach USD 85,748 million by 2032, growing at a CAGR of 6.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aluminum Cladding Market Size 2024 |

USD 51,424 Million |

| Aluminum Cladding Market, CAGR |

6.6% |

| Aluminum Cladding Market Size 2032 |

USD 85,748 Million |

The global aluminum cladding market features key players such as Arconic, Boral Limited, Cembrit Holding AS, Centria, Cladding Corp, Compagnie de Saint‑Gobain SA, DowDuPont, Etex Group, Tata Steel Ltd and Trespa International B.V.. These firms compete through innovation in panel design, fire‑rating solutions, sustainable materials and global supply chain reach. The Asia‑Pacific region leads the market, commanding a share of approximately 36.9 % in 2024, thanks to rapid urbanization, large infrastructure projects and strong adoption of aluminum cladding systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The aluminum cladding market size was valued at USD 51,424 million in 2024 and is projected to reach USD 85,748 million by 2032, growing at a CAGR of 6.6% during the forecast period.

- The demand is driven by rapid urbanization, increasing infrastructure development, and rising investments in energy-efficient building materials globally.

- Key trends include growing integration with smart building systems and an expanding retrofit market, particularly in aging infrastructure.

- Competitive pressure is increasing, with major players like Arconic, Tata Steel, and Compagnie de Saint-Gobain focusing on innovation and sustainable solutions.

- Asia-Pacific leads the market with a share of 36.9% in 2024, while aluminum composite panels remain the dominant product type due to their versatility and fire resistance.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The aluminum cladding market is segmented into aluminum composite panels, solid aluminum panels, and honeycomb panels. Among these, aluminum composite panels dominate the market due to their superior durability, aesthetic appeal, and versatility in various applications. They hold the largest market share owing to their lightweight nature, ease of installation, and fire-resistant properties. The demand for these panels is driven by growing construction and renovation activities, as well as the increasing focus on energy-efficient building materials.

- For instance, Alumideas reports that high-quality aluminum composite panels coated with PVDF have a lifespan of 15 to 20 years, making them a cost-effective and long-lasting cladding choice.

By Category

The market is categorized into new construction and replacement segments. The new construction segment leads, driven by ongoing urbanization and infrastructure development. As new buildings, commercial properties, and residential complexes rise, the demand for aluminum cladding in the new construction segment continues to increase. The replacement segment, while smaller, is growing steadily as existing buildings undergo renovations and upgrades to meet modern architectural standards and energy-efficiency regulations.

- For instance, Petersen Aluminum (PAC-CLAD), which offers a broad range of aluminum wall panels widely used in commercial new construction due to their durability and extensive color options.

By Application

Aluminum cladding is applied in both interior and exterior settings. The exterior application segment holds a larger market share due to the widespread use of aluminum cladding for facades, façades, and building exteriors. This demand is driven by the growing focus on aesthetic and functional building exteriors that require high resistance to weather conditions. The interior segment is expanding as well, with an increase in the use of aluminum cladding for wall panels and decorative features in commercial and residential spaces.

Key Growth Drivers

Rapid Urbanization and Construction Activity

The global rise in construction activity boosts demand for aluminum cladding materials. Emerging economies, especially in Asia‑Pacific, are building urban infrastructure and high‑rise buildings, driving large‐scale façade projects. Aluminum cladding offers a lightweight structural alternative that reduces building load and supports quicker installation times. Architects favor these materials for both aesthetic and functional reasons, creating a robust market environment.

- For instance, Hydro’s building system brands like SAPA and TECHNAL have developed unitized aluminum façade panels that allow for off-site assembly and faster installation on high-rise buildings, meeting the needs of growing urban centers efficiently.

Energy Efficiency and Sustainability Push

Sustainable construction practices favor recyclable and high‑performance materials such as aluminum. Aluminum cladding delivers good thermal insulation, supports green building certifications, and is recycled at high rates, aligning with environmental policy trends. Governments and developers increasingly mandate energy‑efficient façades, which further propels uptake of aluminum solutions. This regulatory environment underpins long‑term growth for the sector.

- For instance, in the United States, Kawneer’s 2500 UT (Ultra Thermal) Unitwall™ system is a high-performance unitized curtain wall system designed to meet stringent energy codes and reduce operational carbon footprints through its advanced thermal capabilities. The system has been installed in various projects, including the Graystone residential tower in Seattle, to achieve high energy efficiency standards.

Technological Innovation and Product Differentiation

Technological advances in coating, manufacturing, and panel design enhance the performance of aluminum cladding. Improved weather resistance, fire performance, and modular installation systems have expanded product applicability. Manufacturers that invest in R&D now offer custom finishes and advanced systems, giving aluminum cladding stronger appeal across new and refurbishment applications.

Key Trends & Opportunities

Integration with Smart Building Systems

The cladding sector is moving toward “smart skins” where panels integrate sensors, adaptive lighting, or building-management systems. This trend opens opportunities for aluminum cladding suppliers to partner with tech firms and enter intelligent façade markets. As buildings become smarter and more sensor-driven, aluminum cladding with embedded functionality presents a compelling value proposition, enabling energy efficiency, real-time data monitoring, enhanced safety, and predictive maintenance for modern sustainable infrastructure.

- For instance, the Britannia Cove life science campus in South San Francisco used aluminum plate panels integrated into its facade, helping achieve a LEED Silver pre-certification by contributing to energy-efficient design.

Growth in Retrofit and Replacement Markets

Beyond new construction, there is significant potential in building renovation and façade replacement. Aging stock in mature markets plus desires to upgrade building performance offer strong retrofit demand. Suppliers can target refurbishment projects by developing lightweight, easy-install panels suitable for minimal disruption, thus capturing additional market share beyond new builds. Incorporating recyclable materials, improved thermal efficiency, and digital design compatibility will further enhance adoption, aligning with sustainability goals and energy-efficiency regulations driving modernization efforts globally.

- For instance, Kingspan offers insulated QuadCore® panels widely used in retrofit projects across the UK, helping public buildings meet 2030 energy targets with ease of installation.

Key Challenges

Rising Raw Material Costs and Supply Chain Volatility

Aluminum production is energy-intensive, and fluctuations in input costs (e.g., bauxite, electricity) impact product pricing and margins. Additionally, trade restrictions and supply chain disruptions add risk, potentially slowing adoption in cost-sensitive segments or regions. Manufacturers must find efficiencies or alternative sourcing to mitigate this challenge and maintain competitive pricing. Rising freight charges and limited availability of raw materials from major producers like China and Australia further intensify cost pressures, prompting firms to invest in recycling and localized smelting capacities for stability.

Competition from Alternative Cladding Materials and Stringent Regulations

Although aluminum offers many benefits, cheaper materials like cement panels, fiber cement, or PVC alternatives present substitution risk. Moreover, evolving fire-safety standards require costly certification and redesign of cladding systems, particularly in high-rise applications. Firms must ensure compliance and demonstrate performance to avoid regulatory hurdles that could inhibit market entry. Growing adoption of eco-labels, carbon-footprint benchmarks, and sustainable building codes also compel aluminum cladding manufacturers to innovate, develop low-emission coatings, and improve recyclability to stay competitive in global markets.

Regional Analysis

Asia‑Pacific

The Asia‑Pacific region commands the largest share of the aluminum cladding market at 36.9% in 2024, driven by rapid urbanization, infrastructure development, and a surge in new construction across China, India, and Southeast Asia. The region’s building sector emphasizes modern facades, aluminum’s recyclable profile, and lightweight properties. These factors enhance demand for aluminum composite panels and other cladding types. Rising industrialization and government investment in commercial buildings further strengthen regional growth prospects throughout the forecast period.

Europe

Europe holds 22.6% of the global cladding market revenue in 2024, reflecting significant adoption of aluminum cladding solutions in Western and Eastern Europe. The region’s stringent energy efficiency and fire safety regulations encourage substitution of conventional façade materials with advanced aluminum systems. Germany, France, and the UK lead renovation and retrofit markets, while rising demand for sustainable and high‑performance building envelopes supports aluminum cladding uptake.

North America

In North America, the market is expanding steadily, underpinned by infrastructure renewal, commercial real estate activity, and green-building mandates. The region holds 28% of the global aluminum cladding market. Growth is supported by the U.S. and Canada investing in façade upgrades, fire-safe material adoption, and modular construction—all of which benefit aluminum cladding manufacturers.

Middle East & Africa

The Middle East & Africa (MEA) region exhibits emerging potential in aluminum cladding, driven by large-scale construction projects in Gulf countries, high-rise developments, and hospitality expansions. The region accounts for about 17% of global market share, with strong demand for decorative yet durable façade materials positioning aluminum cladding for above-average growth. Renewable energy initiatives and renovation of existing structures further underpin regional traction.

Latin America

Latin America presents a modest share of the global aluminum cladding market, accounting for 9% of total market share. The region is characterized by slower new construction and lower façade material investment compared to other regions. Nonetheless, increasing urbanization in Brazil, Mexico, and Colombia, along with renovation of aging commercial stock, is creating incremental opportunities. Manufacturers focusing on cost-effective aluminum solutions and regional supply advantages may gain share in this under-penetrated market.

Market Segmentations:

By Product Type

- Aluminum composite panel

- Solid aluminum panels

- Honeycomb panels

By Category

- New construction

- Replacement

By Application

By End Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aluminum cladding market is characterised by a mix of global metal‑engineering giants and regionally focused building‑materials players. Companies such as Arconic Corporation leverage extensive aluminium‑production capabilities and broad geographic reach to serve large façade projects, while materials‑specialist firms customise finishes, coatings and panel systems for niche architectural requirements. Firms compete on product innovation like fire‑rated panels and smart façade systems as well as supply‑chain efficiency and sustainability credentials. Strategic alliances, mergers and capacity expansions remain common, as companies seek to gain scale, enter emerging markets and meet rising regulatory demands in key regions.

Key Player Analysis

- Tata Steel Ltd

- Etex Group

- Compagnie de Saint-Gobain SA

- Cembrit Holding AS

- Trespa International B.V.

- Cladding Corp

- Boral Limited

- Arconic

- Centria

- DowDuPont

Recent Developments

- In October 2025, 3A Composites India Pvt. Ltd. introduced its next-generation ALUCORE® honeycomb and ACCP composite materials, aiming to transform architectural façade design in India.

- In October 2024, profine Group acquired EFP International B.V. to expand into high-quality aluminium façade systems and bolster its global building-solutions footprint.

- In April 2024, Alumil Group launched the SMARTIA M7000 Barcode Cladding system through its Indian subsidiary, providing innovative wall cladding options for both interior and exterior architectural applications.

- In January 2024, Vivalda Group launched a new UK-designed and manufactured solid aluminium cladding system called MetSkin.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Category, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand steadily as urbanisation drives new commercial and residential construction globally.

- Increasing renovation and retrofit activities will generate strong demand for aluminium cladding in replacement segments.

- Sustainability mandates will favour aluminium because of its recyclability and alignment with green building certifications.

- Technological advances in coatings, fire‑resistance and installation methods will enhance product appeal and broaden application.

- Smart‑building integration will open new opportunities for aluminium cladding to support façade sensors and adaptive systems.

- Emerging markets in Asia‑Pacific, Middle East & Africa will capture growing shares thanks to infrastructure investment and rapid development.

- Manufacturers will focus more on lightweight, high‑performance panels that reduce structural loads and speed up installation.

- Supply‑chain resilience and raw‑material sourcing strategies will become critical to maintain margins and meet demand.

- Competitive pressure from alternative façade materials (e.g., fibre‑cement, composite boards) will push aluminium suppliers to differentiate on performance and value.

- Stringent fire‑safety and building‑code regulations will raise specification standards and increase cost of compliance, favouring leading manufacturers with certified products.

Market Segmentation Analysis:

Market Segmentation Analysis: