Market Overview:

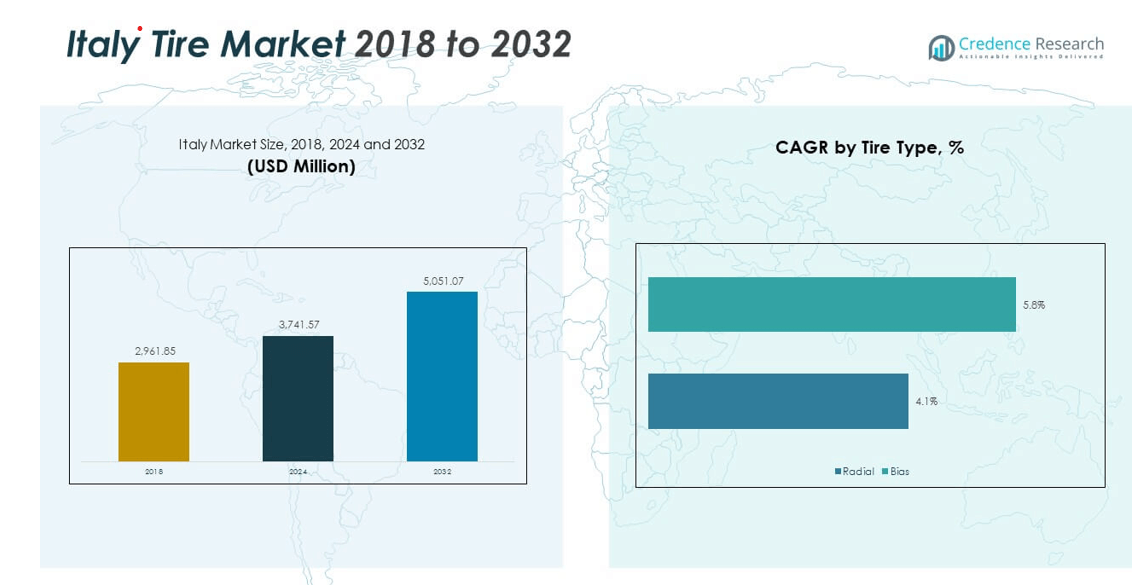

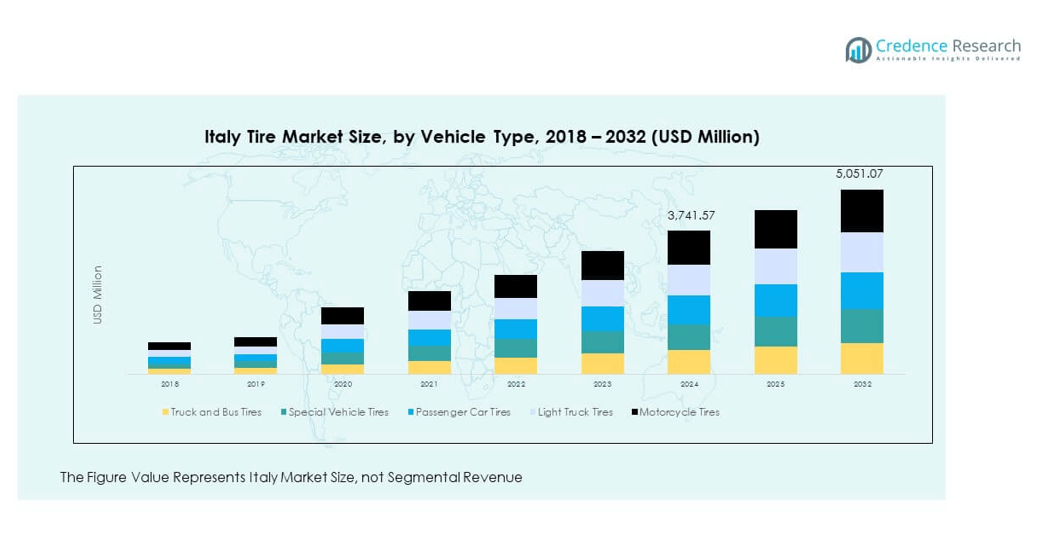

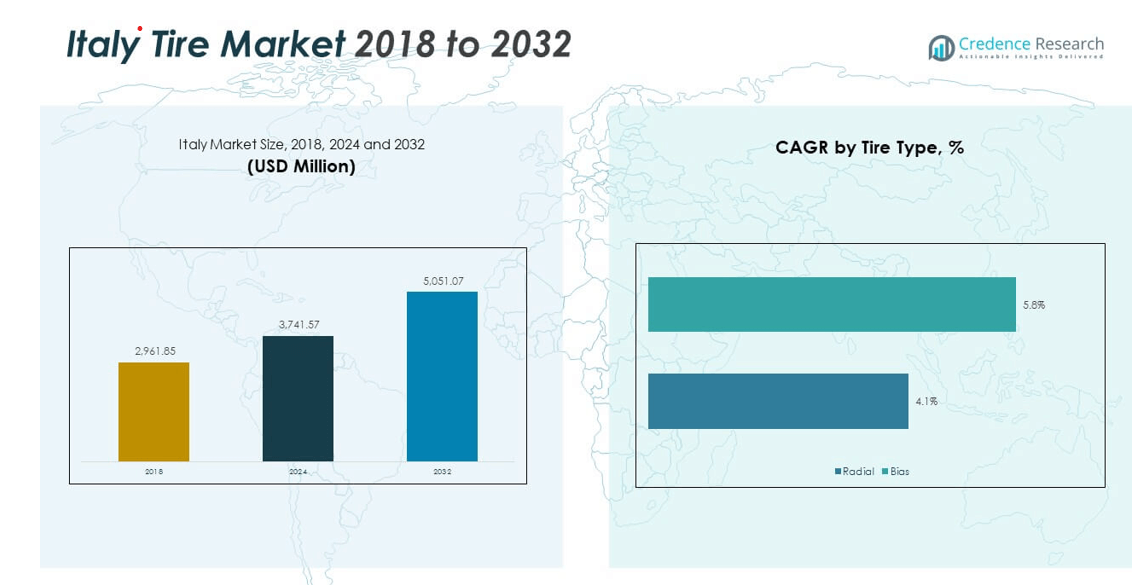

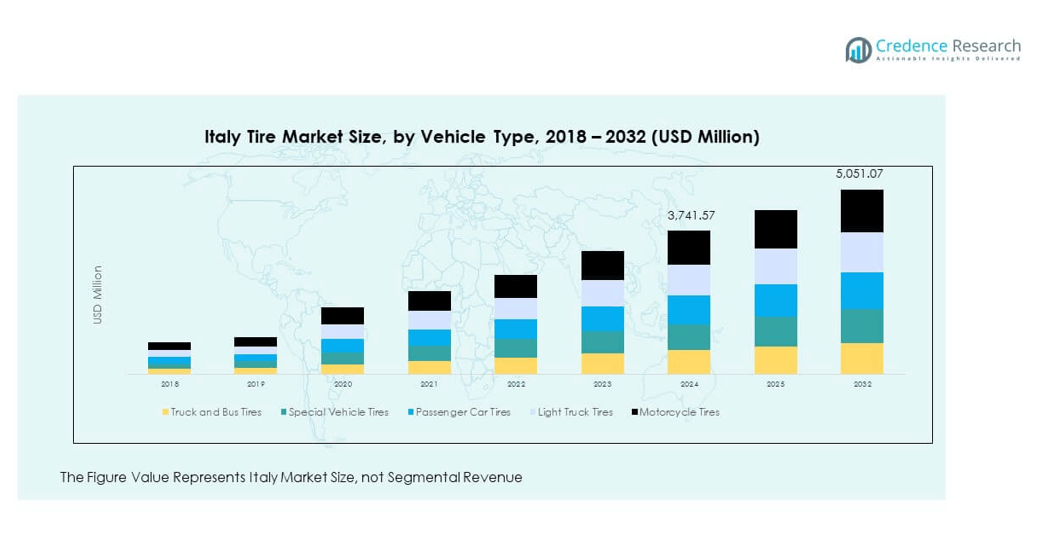

The Italy Tire Market size was valued at USD 2,961.85 million in 2018 to USD 3,741.57 million in 2024 and is anticipated to reach USD 5,051.07 million by 2032, at a CAGR of 3.82% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Tire Market Size 2024 |

USD 3,741.57 million |

| Italy Tire Market, CAGR |

3.82% |

| Italy Tire Market Size 2032 |

USD 5,051.07 million |

Growth in the Italy Tire Market is driven by expanding vehicle ownership, rising demand for replacement tires, and the steady development of logistics networks. Government regulations requiring winter tires and regular vehicle inspections further boost replacement cycles. Increasing consumer preference for premium and high-performance tires also contributes to market expansion. Electric and hybrid vehicle adoption is encouraging tire producers to design advanced solutions focused on durability, efficiency, and safety. It creates strong opportunities for manufacturers with innovative and sustainable products.

Regionally, Northern Italy leads the market due to its strong automotive manufacturing base, premium consumer segment, and strict compliance with seasonal tire regulations. Central Italy is emerging with growing urban mobility needs and rising consumer interest in online tire purchases. Southern Italy, while smaller in size, shows steady demand growth supported by logistics expansion, infrastructure projects, and rising motorcycle and light truck usage. It demonstrates a balanced regional distribution where each subregion contributes to overall market stability and long-term growth.

Market Insights

- The Italy Tire Market was valued at USD 2,961.85 million in 2018, grew to USD 3,741.57 million in 2024, and is projected to reach USD 5,051.07 million by 2032, registering a CAGR of 3.82%.

- Northern Italy holds 42% of the market, supported by its strong automotive base and premium consumer demand, while Central Italy follows with 33% due to rising passenger vehicle ownership, and Southern Italy accounts for 25% with growing logistics and infrastructure activity.

- Central Italy is the fastest-growing region with 33% share, supported by urban mobility expansion, rising online tire purchases, and stronger OEM partnerships.

- Passenger car tires represent the dominant segment with 48% share in 2024, reflecting high personal vehicle ownership and strong replacement demand.

- Truck and bus tires hold 24% share in 2024, driven by logistics expansion, long-haul transport, and higher replacement cycles from fleet operators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Vehicle Ownership and Expanding Automotive Fleet Across Italy

The steady rise in vehicle ownership across Italy continues to drive consistent demand for tires. A strong automotive culture, coupled with increasing disposable incomes, supports steady sales of passenger and commercial vehicles. The Italy Tire Market benefits directly from fleet expansion in logistics and urban mobility sectors. Consumers replace tires more frequently due to road safety awareness and government inspection requirements. Strong aftersales service networks and online availability further support replacement sales. The growth of electric and hybrid vehicles requires specialized tire technologies that ensure durability. It allows companies to introduce advanced products meeting performance and environmental standards.

- For instance, Michelin’s e.Primacy tire is confirmed to deliver an extra 7% range for electric vehicles compared to standard summer tires, and after 30,000 km, it still passes the EU wet braking test.

Expansion of Logistics Sector and Rising Demand for Commercial Tires

Logistics growth in Italy, supported by e-commerce and manufacturing activity, pushes tire demand upward. Commercial fleets operate intensively, generating consistent replacement needs for heavy-duty and light commercial tires. The Italy Tire Market gains traction from fleet operators prioritizing performance, safety, and cost efficiency. The shift toward intercity road transport strengthens the role of high-performance truck tires. It is also influenced by infrastructure upgrades that support long-haul and regional deliveries. Seasonal tire replacement regulations in winter months further stimulate consumption. Digital platforms offering tire management solutions help fleet operators streamline replacements. It creates a recurring demand pattern within the commercial segment.

Government Regulations Supporting Safety and Environmental Compliance

The Italian government enforces strict safety standards, requiring drivers to maintain quality tires. Winter tire regulations mandate timely replacement, contributing to higher seasonal demand peaks. The Italy Tire Market benefits from policies encouraging fuel efficiency and reduced emissions. Regulations push manufacturers toward eco-friendly materials and sustainable processes. Tire labeling standards provide consumers with clear choices on energy efficiency and grip levels. It improves awareness and encourages adoption of premium quality products. Manufacturers investing in compliance gain stronger consumer trust. Continuous alignment with EU regulatory frameworks creates a favorable environment for tire innovation.

Rising Consumer Demand for Premium and Performance-Oriented Tires

Consumers in Italy are shifting preferences toward high-performance and luxury tires. Sports and premium vehicles dominate niche urban markets, requiring advanced tire specifications. The Italy Tire Market capitalizes on increasing demand for enhanced durability and road grip. Rising awareness of safety encourages consumers to opt for trusted international brands. It enables companies to expand portfolios featuring run-flat and all-season models. Marketing campaigns highlighting performance and sustainability create stronger consumer engagement. Digital retail platforms allow buyers to compare and select premium options with ease. Premiumization supports higher margins for manufacturers while meeting evolving consumer expectations.

- For instance, the Pirelli P Zero E is the world’s first ultra-high-performance (UHP) tire containing more than 55% of its materials from natural and recycled sources, certified by Bureau Veritas, and awarded the EU tire label triple-A in all parameters.

Market Trends

Adoption of Smart Tire Technologies and Integration of Sensors

Smart tire technologies are gaining visibility in Italy, supported by rising use of digital mobility solutions. The Italy Tire Market integrates sensors that monitor air pressure, temperature, and wear. Fleet operators rely on such data to enhance efficiency and reduce downtime. It supports predictive maintenance strategies that improve operational safety. Consumer adoption is also increasing with connected vehicle platforms. Drivers benefit from alerts that promote timely replacement or maintenance. Companies offering these solutions establish competitive advantages in both passenger and commercial segments. The integration of smart features reflects the growing role of IoT in automotive ecosystems.

- For instance, in 2025, Bridgestone advanced its smart tire technologies through the integration of artificial intelligence-powered simulators at its EMEA R&D Centre near Rome, improving virtual tire development and supporting the rollout of digitally connected tires for predictive fleet maintenance in Italy.

Expansion of Online Tire Retail and Shift Toward Digital Channels

The Italian tire industry is witnessing strong adoption of e-commerce platforms for tire sales. Online marketplaces and direct-to-consumer websites enhance accessibility for rural and urban buyers alike. The Italy Tire Market reflects this trend through increased penetration of online tire catalogs. Consumers prefer the convenience of browsing, comparing, and ordering tires digitally. It allows flexible appointment scheduling for installation services at partner garages. This shift also drives competitive pricing and discount models. Tire manufacturers and retailers invest in digital marketing strategies to strengthen reach. The expansion of online sales creates new distribution efficiencies across Italy.

Increased Use of Sustainable and Recyclable Materials in Production

Sustainability is shaping tire production practices with growing demand for eco-friendly alternatives. The Italy Tire Market incorporates renewable materials, recycled rubber, and bio-based components. Manufacturers experiment with low-rolling resistance compounds that improve fuel efficiency. It reduces environmental impact and meets EU sustainability goals. Consumers respond positively to branding focused on sustainability credentials. Companies adopt circular economy initiatives, emphasizing collection and recycling programs. International tire leaders set benchmarks by committing to higher recycled content. Sustainable manufacturing reinforces Italy’s alignment with global environmental trends and consumer expectations.

Development of Specialized Tires for Electric and Hybrid Vehicles

The rapid adoption of electric and hybrid vehicles is creating opportunities for specialized tire categories. The Italy Tire Market adapts by introducing tires with low noise, reduced rolling resistance, and higher load capacity. EV tires must withstand unique torque demands, requiring advanced compounds. It encourages research partnerships between automakers and tire producers. Companies invest heavily in R&D for EV-specific performance optimization. Drivers of EVs increasingly prefer tires that extend battery range. Growing charging infrastructure in urban centers supports EV adoption and related tire demand. This trend positions Italy as a competitive market for EV-oriented tire innovations.

- For instance, Continental’s UltraContact NXT line, released in Europe including Italy in mid-2023, is composed of up to 65% renewable and recycled materials, and every model in the series achieved the highest possible “A” rating on the EU tire label for rolling resistance, wet braking, and exterior noise, making it highly suitable for electric vehicles.

Market Challenges Analysis

Fluctuations in Raw Material Prices and Rising Production Costs

Tire manufacturers in Italy face volatility in prices of natural rubber, synthetic rubber, and oil-derived materials. The Italy Tire Market is sensitive to these cost fluctuations, directly influencing profitability. It forces companies to adjust pricing strategies that may affect competitiveness. Supply chain disruptions further create instability in timely raw material availability. Manufacturers must balance rising costs with maintaining affordability for consumers. Import dependencies also expose the market to currency risks and trade-related pressures. Price-sensitive buyers hesitate to adopt premium tire options under cost inflation. Companies navigate this challenge through strategic sourcing and investment in alternative materials.

Intense Competition Among Local and Global Tire Manufacturers

The Italian tire market is highly competitive, featuring global brands and domestic producers. The Italy Tire Market experiences pressure from established multinational companies offering extensive product portfolios. It forces local players to differentiate through niche strategies or pricing advantages. Consumers often prefer internationally recognized brands for safety and reliability. Smaller manufacturers face challenges in scaling distribution and meeting stringent regulations. Competitive pricing strategies reduce margins across the value chain. Innovation cycles are shortened, forcing frequent product upgrades. Companies that cannot match this pace risk losing market share over time.

Market Opportunities

Expansion of Electric Vehicle Adoption Driving Demand for Specialized Tires

The rising adoption of EVs presents a key opportunity for tire producers in Italy. The Italy Tire Market can expand by offering models tailored for EV-specific requirements. It creates demand for low-resistance, high-grip, and noise-reducing solutions. Partnerships with automotive OEMs further strengthen the position of tire manufacturers. Government incentives supporting EV growth also indirectly stimulate related tire consumption. The shift in mobility trends encourages development of innovative EV-focused products. Retailers align portfolios to include EV tires as standard offerings. This shift represents long-term prospects for sustainable growth.

Growth of Digital Retail Channels Offering Broader Consumer Access

E-commerce platforms are unlocking new opportunities for tire companies in Italy. The Italy Tire Market gains from enhanced online reach across both urban and rural areas. It supports convenient buying behavior that aligns with evolving consumer expectations. Integration of digital catalogs helps customers compare products and access transparent reviews. Companies use digital marketing to strengthen engagement and loyalty. Online retailers collaborate with service providers for easy installation and aftersales support. It allows manufacturers to broaden customer access without expanding physical outlets. Digital channels thus open significant opportunities for scaling sales and market share.

Market Segmentation Analysis

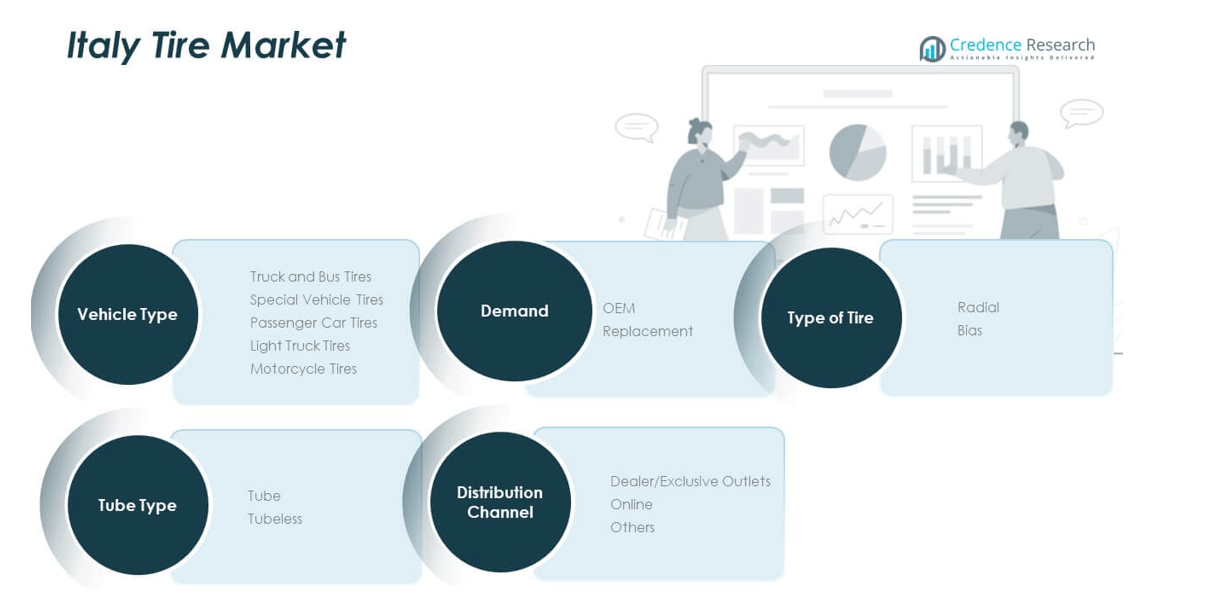

By vehicle type, passenger car tires hold the largest share of the Italy Tire Market, driven by high personal vehicle ownership and steady replacement demand. Truck and bus tires contribute strongly due to logistics growth and long-haul transport. Light truck and motorcycle tires are expanding in urban and semi-urban mobility, while special vehicle tires remain niche but vital for construction and agriculture. It demonstrates balanced demand across both consumer and commercial categories.

By demand, the replacement segment dominates due to frequent tire wear and regulatory checks that mandate timely changes. OEM demand grows steadily, supported by collaborations between tire manufacturers and automotive producers. It shows resilience in both factory-installed tires and aftermarket sales, sustaining overall market momentum.

- For instance, according to Michelin’s 2024 results, the 18-inch and larger segment reached 65% of Michelin-branded passenger car tire sales in Europe, as the company’s improved mix reinforced its position in both OEM and replacement markets.

By tire type, radial tires lead due to durability, performance, and fuel efficiency, while bias tires maintain relevance in heavy-duty and off-road applications.

- For instance, in May 2025, Pirelli launched the fifth generation of its P Zero radial tire, introducing virtual prototype testing and artificial intelligence systems to achieve improved handling and reduced braking distances, as evidenced by the “A” rating on the European wet grip label.

By tube type, tubeless tires capture a rising share with better safety and longer life, though tube tires continue serving older vehicle fleets.

By distribution channel, dealer and exclusive outlets dominate, supported by strong physical networks, while online platforms are rapidly emerging with growing consumer preference for digital convenience. It reflects a diverse market structure adapting to modern mobility needs.

Segmentation

By Vehicle Type

- Truck and Bus Tires

- Special Vehicle Tires

- Passenger Car Tires

- Light Truck Tires

- Motorcycle Tires

By Demand

- OEM (Original Equipment Manufacturer)

- Replacement

By Type of Tires

By Tube Type

By Distribution Channel

- Dealer/Exclusive Outlets

- Online

- Others

Regional Analysis

Northern Italy holds the largest share in the Italy Tire Market with 42%. The region’s dominance is linked to its strong automotive manufacturing base and concentration of premium vehicle owners. Industrial activity, logistics hubs, and cross-border trade with Central Europe strengthen demand for passenger car and commercial vehicle tires. It benefits from the presence of leading tire companies and advanced distribution channels. Seasonal tire replacement regulations are strictly followed, creating recurring demand for winter tires. Urban centers such as Milan and Turin reinforce premium tire adoption.

Central Italy accounts for 33% of the market, driven by rising passenger vehicle ownership and expanding urban infrastructure. The region benefits from increasing consumer preference for digital tire purchases through online platforms. It supports steady growth in replacement tire sales, particularly in mid-range and all-season categories. OEM demand is expanding due to growth in local assembly operations and partnerships with global automakers. It remains a key growth corridor where consumer awareness of safety and fuel efficiency influences tire selection. Service networks are strengthening in cities such as Rome and Florence, creating higher demand visibility.

Southern Italy represents 25% of the Italy Tire Market, reflecting steady but lower growth compared to other regions. The region is gradually expanding due to logistics activities, infrastructure development, and increased vehicle usage in coastal areas. Replacement demand dominates due to harsh road conditions and greater wear. It benefits from government policies promoting mobility and vehicle inspections. Local dealers remain the primary distribution channel, though online penetration is beginning to expand. Demand for motorcycle and light truck tires is rising, reflecting mobility preferences in rural and semi-urban areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pirelli & C. S.p.A.

- Michelin Italiana S.p.A.

- Bridgestone Italia S.p.A.

- Continental Italia S.p.A.

- Goodyear Dunlop Tires Italia S.p.A.

- Hankook Tire Italia S.r.l.

- Yokohama Italia S.p.A.

- Cooper Tire & Rubber Company Italia S.r.l.

- Toyo Tire Italia S.p.A.

- Apollo Tyres Ltd.

- Sumitomo Rubber Industries, Ltd.

- MRF Ltd.

- JK Tyre & Industries

- CEAT Ltd.

Competitive Analysis

The Italy Tire Market is highly competitive, with global leaders and domestic brands competing across segments. Pirelli maintains a strong presence as the leading domestic brand, supported by advanced R&D and partnerships with automakers. Michelin, Bridgestone, Continental, and Goodyear hold significant shares due to their premium product portfolios and distribution networks. It features competitive dynamics where mid-tier brands such as Hankook, Yokohama, and Toyo target cost-sensitive segments with durable offerings. Smaller players face challenges in regulatory compliance and brand visibility but compete through localized strategies. Product differentiation, sustainability initiatives, and EV-specific tire development are shaping competition. Strategic moves such as mergers, partnerships, and regional expansion remain central to gaining market share.

Recent Developments

- In May 2025, Linglong Tire, through its brands LINGLONG, CROSSWIND, and LEAO, introduced several advanced products at the Bologna Autopromotec show, demonstrating its commitment to European market innovation. The company globally launched the DuraMaster Van e with low rolling resistance for vans and upgraded the Sport Master e for electric vehicles, featuring an 8% increase in range and 3.2 dB noise reduction, showcasing their technological advancements and localized Italian production capabilities.

- In September 2024, Bandag Europe, a Bridgestone subsidiary specializing in commercial tire retreading, announced it will close its Lanklaar retread facility by mid-2025. This decision was made in response to declining demand for tire retreads in the EU, ongoing overcapacity, and persistent high energy costs, with the aim of consolidating operations in Poland.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Demand, Type of Tires, Tube Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Tire Market will witness steady demand driven by replacement cycles across all vehicle categories.

- Rising adoption of electric and hybrid vehicles will encourage manufacturers to design specialized tire solutions.

- Sustainability will remain central, with greater use of recycled materials and eco-friendly compounds in production.

- Expansion of digital sales channels will transform consumer access and support broader regional penetration.

- Premium tire demand will increase, supported by urban consumers prioritizing safety, performance, and brand value.

- Seasonal tire regulations will continue to generate recurring demand, especially in northern regions with strict compliance.

- Logistics and commercial fleet growth will enhance the share of heavy-duty and light truck tire demand.

- OEM partnerships with automakers will strengthen, aligning product innovation with evolving mobility requirements.

- Competition will intensify as global brands expand portfolios while local players adopt niche positioning strategies.

- Technological advancements such as smart tire systems will reshape market expectations and drive long-term adoption.