Market Overview

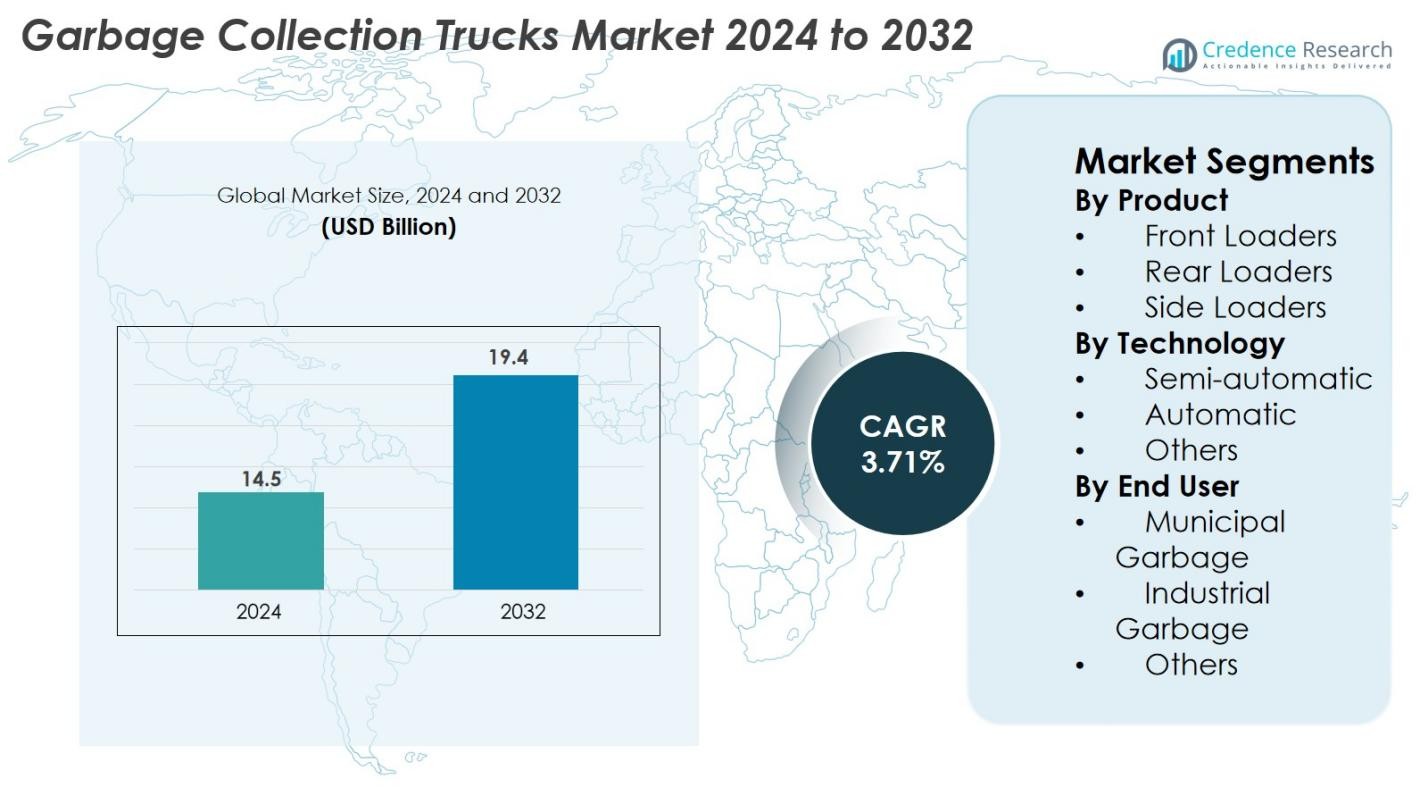

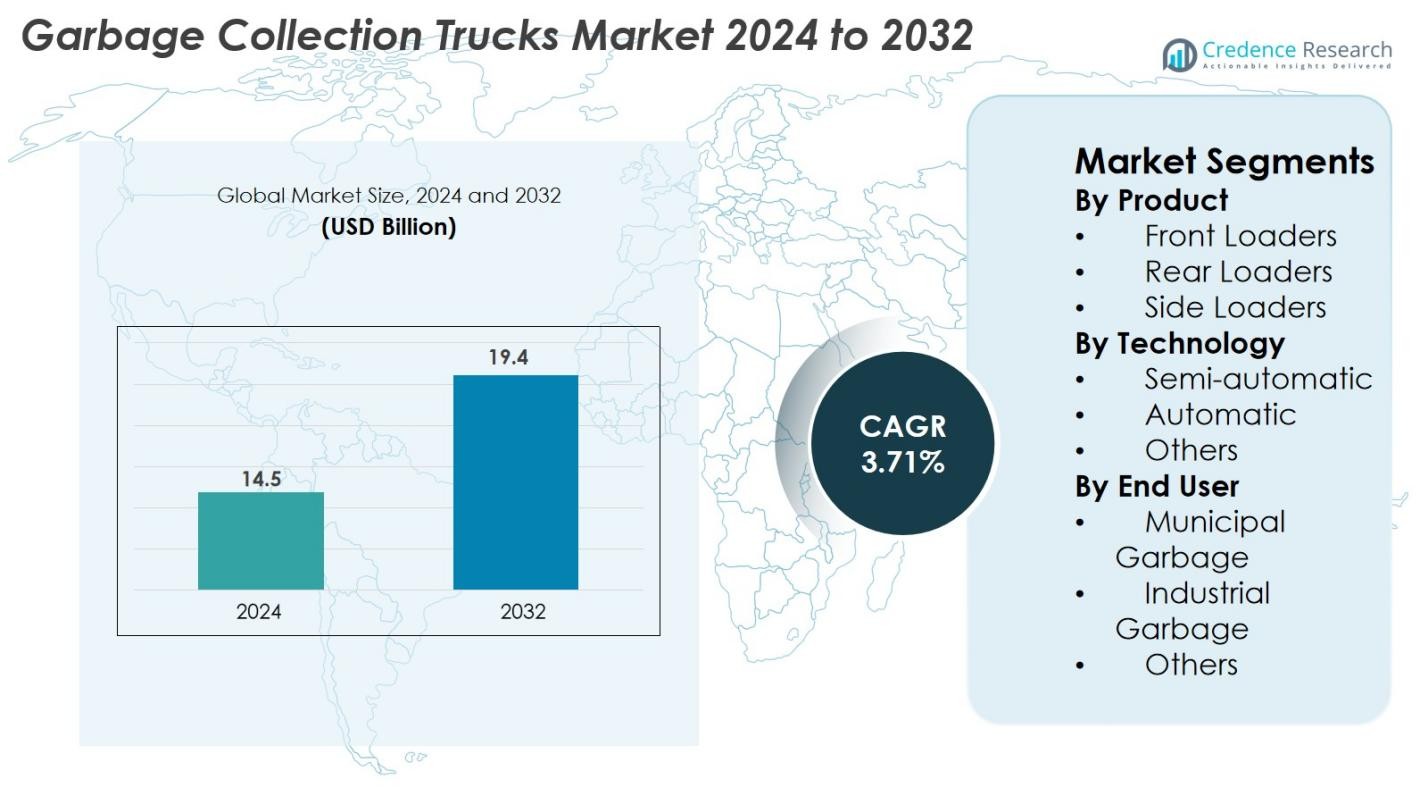

Garbage Collection Trucks Market size was valued at USD 14.5 Billion in 2024 and is anticipated to reach USD 19.4 Billion by 2032, growing at a CAGR of 3.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Garbage Collection Trucks Market Size 2024 |

USD 14.5 Billion |

| Garbage Collection Trucks Market, CAGR |

3.71% |

| Garbage Collection Trucks Market Size 2032 |

USD 19.4 Billion |

Garbage Collection Trucks Market features a strong set of global and regional manufacturers that shape industry growth through advanced product portfolios and technological innovation. Key players such as McNeilus Truck & Manufacturing, Zoomlion Heavy Industry, Fujian Longma Environmental, Dongfeng Motor Corporation, Heil, Sany India, PAK-MOR LTD., FAUN Umwelttechnik, EZ-Pack Refuse Hauling Solutions, and Labrie Enviroquip Group lead the market with a focus on automated systems, high-efficiency compactors, and electric waste-collection fleets. Regionally, North America dominates with a 34% market share, supported by fleet modernization and sustainability initiatives, while Europe holds 29% share, driven by strict emission norms and rapid adoption of electric garbage trucks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Garbage Collection Trucks Market was valued at USD 14.5 Billion in 2024 and is projected to reach USD 19.4 Billion by 2032, growing at a CAGR of 3.71% during the forecast period.

- Rising urban waste generation, municipal fleet modernization, and adoption of automated rear loaders holding 48% segment share drive strong market expansion globally.

- Key trends include increasing deployment of electric and hybrid garbage trucks, AI-enabled route optimization, and smart-compaction technologies adopted by major manufacturers.

- Leading players such as McNeilus, Zoomlion, Dongfeng, Heil, and FAUN enhance competitiveness through product innovation, fleet electrification, and partnerships with municipal authorities.

- Regionally, North America leads with 34% share, followed by Europe at 29% and Asia-Pacific at 24%, driven by sustainability mandates, urbanization, and rising investments in advanced waste-management solutions.

Market Segmentation Analysis

By Product

The Garbage Collection Trucks Market by product type is dominated by rear loaders, holding 48% share in 2024, driven by their high operational flexibility, lower maintenance needs, and widespread adoption across municipal waste-management systems. Front loaders account for around 32% of the market, supported by strong demand from commercial facilities requiring efficient bulk waste handling. Side loaders represent nearly 20% share, benefiting from automation trends and reduced labor dependency. Growing urban solid-waste volumes and modernization of public sanitation fleets continue to strengthen demand across all product categories.

- For instance, Mack delivered its LR Electric refuse truck with a standard battery capacity of 376 kWh, twin electric motors producing 448 hp and 4,051 lb-ft of peak torque

By Technology

In terms of technology, semi-automatic garbage collection trucks lead the market with an 46% share in 2024, supported by their cost-effectiveness, ease of integration into existing waste-collection workflows, and lower technical complexity for operators. Automatic systems capture about 38% share, experiencing rising adoption due to advancements in hydraulic arms, smart controls, and autonomous loading mechanisms that improve efficiency and worker safety. The remaining 16% is held by other technologies, driven by niche applications and emerging hybrid solutions aimed at enhancing energy efficiency and optimizing route-based operations.

- For instance, Heil’s Sierra front loader uses a hydraulic system typically capable of delivering 2,500 psi (pounds per square inch) (or up to 2,750 psi with optional Odyssey controls for the compactor) which enables fast, automated lift cycles with reduced operator intervention.

By End User

The municipal garbage segment dominates the Garbage Collection Trucks Market, commanding 57% share in 2024, fueled by government-led waste-management programs, rapid urbanization, and increasing public-infrastructure budgets for fleet upgrades. Industrial garbage applications account for about 29% share, supported by expansion in manufacturing hubs and higher waste-handling requirements across logistics, mining, and construction sectors. The remaining 14% falls under other end users, driven by institutional, commercial, and community-run waste-collection systems. Growing regulations on waste segregation and sustainability further elevate adoption across all end-user segments.

Key Growth Drivers

Rapid Urbanization and Rising Municipal Waste Generation

Rapid urban expansion and increasing population density continue to significantly elevate municipal solid-waste volumes, pushing cities to modernize and expand their waste-collection fleets. As urban areas generate more residential, commercial, and construction waste, municipalities face heightened pressure to maintain timely and efficient collection cycles. This drives the adoption of advanced garbage collection trucks equipped with higher compaction ratios, automated lifting systems, and greater route-handling capacities. Governments across developing regions are investing heavily in sanitation infrastructure, modern fleet procurement, and waste-management reforms under smart-city and urban-renewal initiatives. Public–private partnerships are further accelerating fleet upgrades, especially in regions lacking adequate waste-handling infrastructure. Additionally, stricter regulations on waste segregation, landfill reduction, and street cleanliness standards compel municipalities to deploy more efficient collection vehicles. Collectively, the surge in urban waste volumes and modernization of public sanitation systems act as a strong long-term catalyst for market expansion.

- For instance, FARID’s rear loader systems integrate compactors capable of achieving a 6:1 compression ratio, enabling efficient handling of dense urban waste streams

Shift Toward Automation, Digitization, and Smart Waste-Collection Technologies

Technological advancements are reshaping the operational landscape of waste collection, creating strong demand for automated and digitally integrated garbage trucks. Automated lifting systems, hydraulic arms, and smart compaction mechanisms reduce labor dependency, enhance worker safety, and shorten collection cycles—benefits highly valued by both municipal authorities and private contractors. The integration of telematics, IoT sensors, and GPS tracking enables real-time fleet monitoring, predictive maintenance, and route optimization based on waste-generation patterns. Digital dashboards and cloud-based data analytics provide actionable insights, helping operators improve operational efficiency, reduce fuel consumption, and minimize downtime. RFID-enabled bin recognition and automation-based waste segregation systems further streamline operations. As cities increasingly adopt smart-waste management frameworks, demand for technologically advanced garbage trucks continues to rise, making digitization and automation one of the most influential growth drivers shaping the market.

- For instance, Wastequip’s Ampliroll hook-lift systems include hydraulic pumps and systems that operate at 5,000 psi (or in some cases up to 5,700 psi max, with a max operating pressure of 4,800 psi).

Push for Sustainability and Adoption of Electric & Low-Emission Garbage Trucks

Growing environmental concerns and tightening emission laws are accelerating the transition toward electric, hybrid, and alternative-fuel garbage collection trucks. Traditional diesel-powered fleets contribute significantly to urban pollution and noise, prompting municipalities to adopt clean, quiet, and energy-efficient alternatives. Electric garbage trucks offer lower operating costs, reduced maintenance requirements, and compliance with zero-emission zones in major cities. Governments worldwide are offering subsidies, tax incentives, and green-fleet mandates, encouraging rapid fleet electrification. Manufacturers are responding with improved battery capacities, extended driving ranges, and fast-charging systems optimized for high-frequency urban waste-collection routes. Hydrogen-fuel garbage trucks are also emerging as a promising option for heavy-duty applications requiring longer operational cycles. As sustainability becomes a core priority for waste-management policies, the shift toward green garbage trucks represents a major growth driver, shaping long-term market transformation.

Key Trends & Opportunities

Growing Adoption of Fully Automated and AI-Integrated Waste Collection Systems

The market is witnessing a strong trend toward full automation and AI-driven operational enhancements, creating significant opportunities for manufacturers and fleet operators. Fully automated garbage trucks reduce the need for manual loaders, enhance worker safety, and speed up waste-collection operations—critical advantages for cities facing labor shortages. AI-powered route optimization systems analyze real-time traffic, bin-level data, and historical waste patterns to create adaptive collection schedules. Integration with smart-city IoT networks allows garbage trucks to communicate with connected sensors, report fill levels, and automate dispatch. Opportunities are growing for companies offering advanced robotic arms, autonomous navigation features, collision-avoidance systems, and digital fleet-management platforms. As cities expand digital waste governance and smart infrastructure, the adoption of fully automated, AI-enhanced trucks is expected to rise significantly, creating long-term demand for cutting-edge waste-collection technologies.

- For instance, Wastequip’s Ampliroll hook-lift systems feature high-pressure hydraulic pumps with a maximum operating pressure of 5,000 psi (or sometimes 4,800 psi, depending on the specific model) for greater performance, as an alternative to the less efficient, low-pressure (3,000–3,500 psi) systems used by some other manufacturers.

Rising Demand for Electric, Hybrid, and Hydrogen-Powered Garbage Trucks

Decarbonization goals and global sustainability commitments are driving strong interest in electric and alternative-fuel garbage trucks. Municipalities increasingly prioritize low-emission fleets to reduce carbon footprints, meet environmental regulations, and minimize noise pollution in residential zones. This shift creates substantial opportunities for manufacturers to develop electric trucks with higher battery capacity, rapid charging features, and optimized energy consumption. Hybrid models support longer routes and provide operational flexibility, while hydrogen-powered trucks are emerging as a viable solution for heavy-duty and long-duration waste-collection operations. Collaborations between OEMs, battery suppliers, and charging-infrastructure providers are accelerating the deployment of green fleets. As governments introduce cleaner-fleet procurement policies, green-fleet subsidies, and urban emission-reduction mandates, the market for sustainable garbage trucks gains momentum, opening avenues for innovation in powertrains and energy-efficient waste-collection systems.

- For instance, Volvo Trucks’ FE Electric refuse model operates with twin electric motors generating a combined maximum output of 370 kW (260 kW continuous power) and up to 850 Nm of torque, enabling efficient zero-emission collection on demanding urban routes.

Key Challenges

High Upfront Costs and Infrastructure Gaps for Advanced and Electric Fleets

Despite the growing emphasis on modernization, high upfront procurement costs for automated and electric garbage trucks remain a significant barrier, particularly for smaller municipalities and private waste contractors operating on limited budgets. Electric models require costly battery systems, specialized charging infrastructure, and periodic replacements, extending total cost of ownership. Automated trucks demand investment in advanced hydraulics, robotic mechanisms, and digital controls, making fleet modernization expensive. Many regions lack adequate charging networks, skilled technicians, and maintenance facilities to support electric or high-tech fleets. Budget constraints, long payback periods, and insufficient government incentives further slow adoption. These financial and infrastructural limitations remain critical challenges impacting widespread market penetration of modern garbage trucks.

Operational Complexity, Maintenance Demands, and Skilled-Labor Shortages

As garbage collection trucks become more technologically sophisticated, operators face increased operational complexity, higher maintenance needs, and growing dependence on skilled technicians. Automated mechanisms, smart sensors, and digital systems require regular servicing, calibration, and software updates, which can strain municipal workshops lacking specialized expertise. In developing regions, limited access to spare parts, unreliable service networks, and inadequate technical training programs further challenge efficient fleet operations. Labor shortages—especially for trained drivers and automation-skilled technicians—slow down adoption and increase downtime. Heavy daily use also accelerates component wear, increasing maintenance frequency and operational costs. These challenges collectively affect fleet uptime, service continuity, and cost efficiency, making it difficult for less-resourced operators to fully embrace advanced waste-collection technologies.

Regional Analysis

North America

North America dominates the Garbage Collection Trucks Market with 34% share in 2024, driven by robust municipal spending, early adoption of automated waste-collection systems, and strong emphasis on sustainability. The United States leads regional growth due to large-scale fleet modernization programs, rising adoption of electric garbage trucks, and strict regulations on emissions and waste-handling efficiency. Canada contributes through increasing investments in smart-city waste solutions and replacement of aging fleets. Advanced infrastructure, high waste generation per capita, and strong presence of leading manufacturers support stable, long-term market expansion.

Europe

Europe accounts for 29% share of the market, fueled by stringent environmental regulations, accelerated adoption of electric and hybrid garbage trucks, and strong government support for low-emission municipal fleets. Countries such as Germany, France, the UK, and the Nordic region lead fleet electrification, supported by subsidies and carbon-reduction mandates. Europe’s advanced recycling ecosystem and strict waste-segregation policies generate consistent demand for high-efficiency rear and side loaders. Ongoing investments in circular-economy initiatives and smart-waste management technologies further strengthen regional adoption.

Asia-Pacific

Asia-Pacific holds 24% market share, driven by rapid urbanization, rising waste volumes, and expanding municipal budgets in China, India, Japan, and Southeast Asia. China leads the region with strong government-led sanitation reforms and growing adoption of smart, automated garbage trucks. India is witnessing fleet modernization under Swachh Bharat initiatives, increasing procurement of compactors and rear loaders. Japan and South Korea contribute significantly with strong replacement cycles and adoption of electric and hybrid models. Rapid industrial growth, population expansion, and infrastructure development position APAC as the fastest-growing regional market.

Latin America

Latin America captures 7% share, supported by gradual improvements in urban waste-management systems and increasing investments in modern sanitation fleets across Brazil, Mexico, Chile, and Colombia. Municipalities in major cities are adopting rear loaders and compactors to address rising waste-generation rates driven by urban growth. Budget constraints slow adoption of advanced automated trucks, but international funding programs and public–private partnerships are expanding fleet modernization efforts. Growing focus on environmental compliance and recycling infrastructure is expected to further support market demand across the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds about 6% market share, with growth driven by government-led urban development projects, expansion of industrial zones, and modernization of public sanitation fleets. Gulf countries such as the UAE, Saudi Arabia, and Qatar are investing in smart-waste management systems and automated trucks to support rapidly developing cities. In Africa, rising urbanization and international development assistance are encouraging gradual fleet upgrades. Challenges such as uneven infrastructure, budget limitations, and regulatory fragmentation persist, but long-term opportunities remain strong due to expanding waste-generation levels and public cleanliness initiatives.

Market Segmentations

By Product

- Front Loaders

- Rear Loaders

- Side Loaders

By Technology

- Semi-automatic

- Automatic

- Others

By End User

- Municipal Garbage

- Industrial Garbage

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Garbage Collection Trucks Market is characterized by a mix of established global manufacturers and regionally strong players competing through technology advancement, product customization, and fleet electrification. Leading companies such as McNeilus Truck & Manufacturing, Zoomlion Heavy Industry, Fujian Longma Environmental, Dongfeng Motor Corporation, Heil, Sany India, PAK-MOR LTD., FAUN Umwelttechnik, EZ-Pack Refuse Hauling Solutions, and Labrie Enviroquip Group actively expand their portfolios with automated, semi-automated, and electric garbage trucks to address rising demand for efficient waste-management solutions. Manufacturers are investing in hydraulic innovations, smart-control systems, and IoT-enabled fleet-management technologies to differentiate their offerings. Strategic collaborations with municipalities, fleet operators, and smart-city programs help strengthen market presence. Companies are also focusing on lightweight designs, improved compaction ratios, and reduced maintenance requirements to meet operational and sustainability goals. As environmental regulations tighten globally, players are accelerating the development of electric and low-emission trucks, intensifying market competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dongfeng Motor Corporation

- Sany India

- Heil

- EZ-Pack Refuse Hauling Solutions, LLC

- FAUN Umwelttechnik GmbH & Co. KG

- McNeilus Truck & Manufacturing, Inc.

- Fujian Longma Environmental Sanitation Equipment Co., Ltd.

- PAK-MOR LTD.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Labrie Enviroquip Group

Recent Developments

- In August 2025, Republic Services together with Mack Trucks and ComEd deployed the first electric refuse-fleet in Chicago featuring the Mack LR Electric garbage trucks.

- In July 2025, Mack Trucks (a unit of Volvo Group) delivered a new LR Electric refuse truck to Royal Waste Services in New York City.

- In October 2024, the city of Louisville (Colorado) launched the nation’s first fully electric residential waste-collection fleet operated by Republic Services (four electric trucks).

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by urban expansion and increasing municipal waste volumes.

- Adoption of electric and hybrid garbage trucks will accelerate as emission regulations tighten globally.

- Automation and AI-based route optimization will reshape fleet operations and improve collection efficiency.

- Municipalities will increasingly replace aging fleets with high-capacity compactors and automated rear loaders.

- Manufacturers will expand investment in lightweight materials to improve fuel efficiency and reduce maintenance costs.

- Smart-waste management systems integrated with IoT sensors will gain wider acceptance across cities.

- Public–private partnerships will rise as governments seek cost-effective fleet modernization solutions.

- Demand for noise-reduced and low-emission trucks will grow in densely populated urban centers.

- Regional markets in Asia-Pacific and Latin America will expand rapidly due to infrastructure development.

- Competitive pressure will intensify as global and regional players innovate with connected, safer, and fully automated waste-collection trucks.