Market Overview

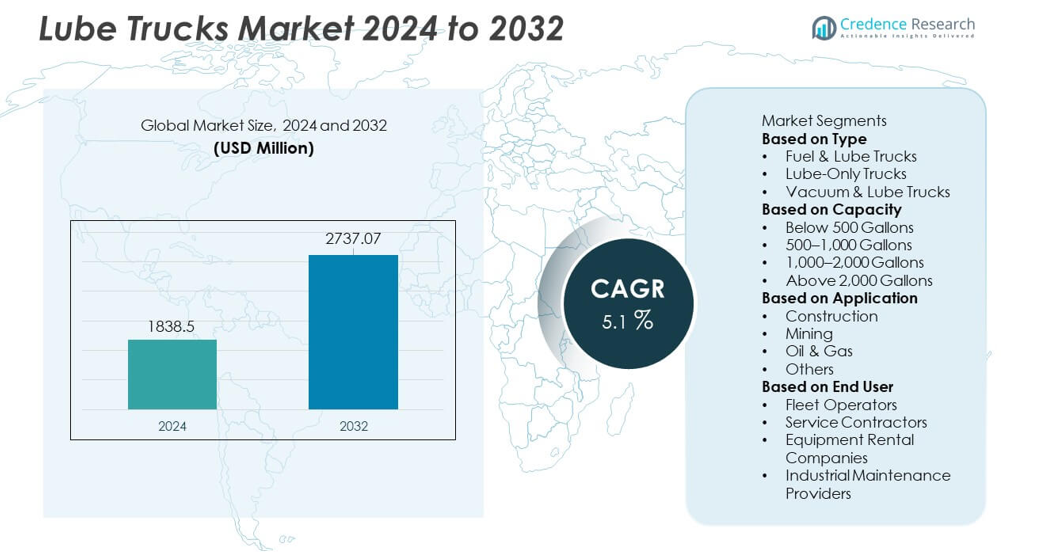

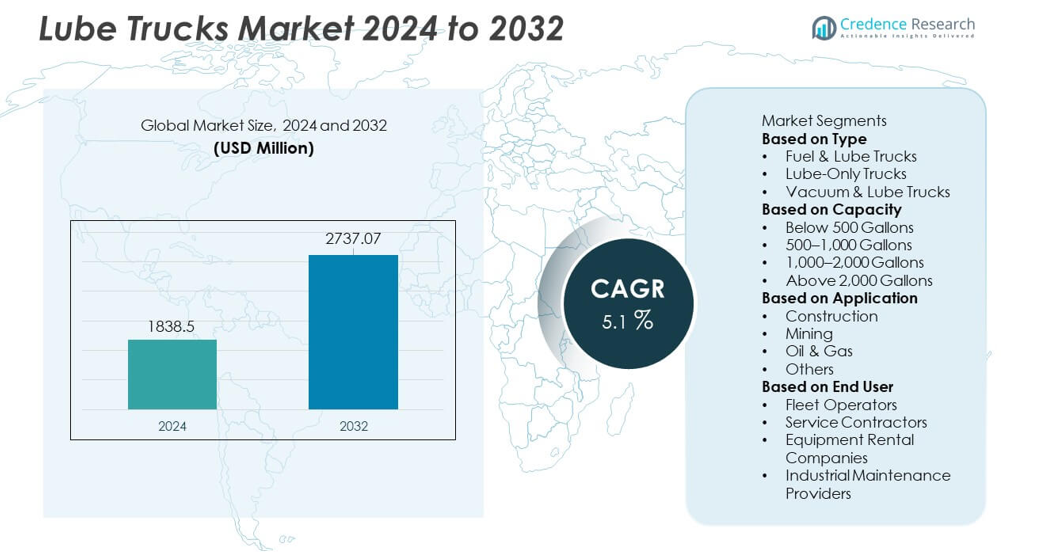

The Lube Trucks market was valued at USD 1,838.5 million in 2024 and is projected to reach USD 2,737.07 million by 2032, expanding at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lube Trucks Market Size 2024 |

USD 1,838.5 million |

| Lube Trucks Market, CAGR |

5.1% |

| Lube Trucks Market Size 2032 |

USD 2,737.07 million |

The top players in the Lube Trucks market include Taylor Pump & Lift, Maintainer Corporation, Schwarze Industries, Service Trucks International, Amthor International, Knapheide Manufacturing Company, NFE, Summit Truck Bodies, Curry Supply Co., and Valew Quality Truck Bodies. These manufacturers expand their market presence through advanced lubrication systems, multi-compartment tank designs, and robust service truck configurations tailored for construction, mining, and oilfield applications. Asia Pacific leads the global market with a 34% share, driven by rapid infrastructure growth and high machinery deployment. North America follows with a 31% share, supported by strong demand in construction and oil & gas sectors, while Europe holds a 22% share due to stringent maintenance standards and steady industrial activity.

Market Insights

- The Lube Trucks market reached USD 1,838.5 million in 2024 and is projected to reach USD 2,737.07 million by 2032, growing at a CAGR of 5.1% during the forecast period.

- Market growth is driven by rising construction and mining activity, growing demand for onsite equipment servicing, and increased adoption of mobile maintenance fleets, with fuel & lube trucks leading the type segment with a 54% share.

- Key trends include advancements in multi-fluid dispensing systems, rising integration of telematics, and growing use of lightweight, corrosion-resistant materials to enhance durability and efficiency.

- Competitive dynamics intensify as major players invest in modular designs, high-capacity tanks, and advanced pumping systems while expanding dealer networks to strengthen global market reach.

- Asia Pacific leads the regional landscape with a 34% share, followed by North America at 31% and Europe at 22%, supported by infrastructure development, heavy machinery usage, and increased reliance on mobile service trucks across key sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Fuel & lube trucks dominate the segment with a 54% market share, supported by strong adoption across construction, mining, and heavy-equipment service fleets. These trucks offer integrated fuel delivery and lubrication systems that reduce downtime and enhance onsite maintenance efficiency. Their ability to support multiple service tasks in remote and high-demand environments drives wider usage across industries with large equipment fleets. Lube-only trucks serve lighter operations but grow slower due to limited functionality, while vacuum & lube trucks retain demand in sectors requiring fluid recovery. Rising emphasis on mobile servicing continues to strengthen demand for fuel & lube units.

- For instance, Taylor Pump & Lift develops and custom-builds a variety of mobile lube systems designed for servicing heavy equipment in the mining, construction, and logging industries, with configurations available such as four 85-gallon oil tanks.

By Capacity

The 1,000–2,000-gallon capacity segment leads with a 47% market share, driven by its suitability for medium to large fleets operating in construction, mining, and oilfield environments. These trucks offer optimal storage for both fuel and lubricants, enabling longer service intervals and efficient deployment across dispersed equipment sites. Units below 500 gallons support compact operations but see limited scalability, while above 2,000-gallon models cater to heavy industrial and large mining sites with higher logistical needs. Increasing project sizes and the need for high-volume mobile servicing continue to propel demand for 1,000–2,000-gallon lube trucks.

- For instance, Maintainer Corporation manufactures custom service trucks that integrate various fluid systems for field maintenance of heavy equipment. These vehicles are designed to support high-pressure grease applications and power multiple fluid reels simultaneously to service machinery like haul trucks and drilling units efficiently.

By Application

Construction applications hold the largest share at 42%, driven by widespread need for onsite servicing of earthmoving machines, loaders, and road-building equipment. Frequent maintenance requirements on busy job sites make mobile lube trucks essential for reducing equipment downtime and improving fleet productivity. Mining operations follow closely, benefiting from large-capacity trucks capable of handling demanding terrain and continuous operations. Oil & gas applications contribute steady demand due to remote field servicing needs. Expanding infrastructure projects and rising equipment utilization strengthen the dominant position of the construction segment in the market.

Key Growth Drivers

Expansion of Construction and Infrastructure Projects

Rapid growth in construction and infrastructure development drives strong demand for lube trucks, as heavy equipment fleets require frequent onsite servicing to maintain productivity. Large project sites rely on mobile lubrication units to reduce downtime, extend equipment life, and streamline maintenance workflows. Governments and private developers continue to invest in road building, mining expansions, and urban development, boosting deployment of high-capacity service trucks. This expansion strengthens the adoption of versatile fuel and lube trucks, especially in regions with growing machinery fleets and remote project locations that depend on mobile maintenance solutions.

- For instance, Curry Supply Co. introduced a service truck platform equipped with a 1,000-gallon fuel tank and a 150-gallon multi-lube system featuring six independent product tanks. The unit also integrates a 20 GPM hydraulic pump that supports rapid servicing of excavators, dozers, and haul trucks across large construction corridors.

Increasing Equipment Utilization in Mining and Oilfield Operations

Mining and oilfield industries operate large, high-value machinery under demanding conditions, creating consistent need for reliable fluid management and lubrication services. Lube trucks support continuous operations by delivering essential fluids directly to remote sites, improving equipment uptime and operational efficiency. Rising extraction activities and expanding drilling operations accelerate demand for high-capacity, heavy-duty service trucks. Companies prioritize mobile servicing to reduce equipment failure risks and extend component life. The push toward productivity optimization and preventive maintenance continues to fuel market growth across mining and oil & gas sectors.

- For instance, Service Trucks International (STI) is a truck dealer that specializes in custom service trucks, including heavy-duty lube truck configurations designed for field servicing of large equipment like mining shovels and drill rigs.

Growing Adoption of Mobile Maintenance Solutions

Industries increasingly shift to mobile maintenance models to minimize equipment downtime and reduce dependency on fixed service facilities. Lube trucks enable onsite servicing of mixed equipment fleets, offering integrated fuel, oil, coolant, and grease delivery capabilities. This shift is driven by the need for faster turnaround times and cost-effective servicing, especially in remote or large operational zones. Fleet operators recognize the value of mobile lubrication units in improving workflow efficiency and maintaining consistent maintenance schedules. The rising complexity of modern machinery further strengthens the demand for specialized mobile service trucks.

Key Trends & Opportunities

Advancements in Customizable and High-Capacity Truck Designs

Manufacturers offer more flexible and customizable lube truck configurations to support diverse industry needs, including multi-product tanks, automated dispensing, and advanced filtration systems. High-capacity models see strong demand in mining and oilfield operations, while mid-sized units support construction and fleet management companies. Technological improvements in pumping systems, metering accuracy, and onboard diagnostics create new opportunities for efficiency-focused buyers. Lightweight materials and corrosion-resistant components further enhance durability. The market benefits from growing interest in modular designs that allow operators to tailor trucks for specific service requirements.

- For instance, Amthor International manufactures a range of highly customizable lube bodies with multi-compartment tank designs, superior pumping systems, and various hose reel options.

Integration of Telematics and Remote Monitoring Systems

A rising trend involves integrating telematics, GPS tracking, and digital fluid monitoring systems into lube trucks to improve service accuracy and maintenance planning. These technologies enable real-time tracking of fluid usage, service intervals, and equipment performance, helping operators enhance operational transparency. Remote monitoring supports predictive maintenance and reduces service delays, especially in distributed work environments. Digitalized workflow management systems allow better coordination between service trucks and heavy-equipment operators. This technological shift presents significant opportunities for manufacturers offering smart, data-enabled service solutions.

- For instance, Knapheide Manufacturing Company integrated a telematics suite that logs over 40 onboard data points, including pump cycles, tank levels, and engine diagnostics.

Key Challenges

High Initial Investment and Operating Costs

Lube trucks require substantial upfront investment due to specialized components such as multi-section tanks, pumping systems, and metering equipment. Maintenance costs, fuel expenses, and compliance-related upgrades further increase ownership costs for fleet operators. Smaller contractors and rental companies often face financial barriers to adopting high-capacity units. These cost constraints limit market penetration in price-sensitive regions. Operators must balance long-term efficiency benefits with high capital requirements, which can slow overall market growth.

Operational Challenges in Remote and Harsh Environments

Lube trucks operating in mining sites, oilfields, and rugged construction zones face harsh conditions that impact vehicle performance and service reliability. Extreme temperatures, rough terrain, and limited access routes increase wear on pumping systems and onboard components. Ensuring consistent fluid delivery in remote environments requires advanced equipment durability and skilled operators. These environmental challenges push manufacturers to enhance truck strength and reliability, but they also raise operational costs and complicate maintenance efforts.

Regional Analysis

orth America

North America holds a 31% market share, supported by strong demand from construction, mining, and oilfield operations that rely heavily on mobile maintenance fleets. The United States leads usage due to extensive infrastructure development and high equipment utilization across large project sites. Fleet operators adopt lube trucks to reduce downtime and improve service efficiency for heavy machinery. The region’s robust rental equipment market also contributes to steady adoption. Investments in shale exploration and expansion of large civil works projects continue to reinforce demand, positioning North America as a key contributor to global market growth.

Europe

Europe accounts for a 22% market share, driven by the region’s well-established construction sector, strict equipment maintenance standards, and high adoption of advanced service vehicles. Countries such as Germany, the United Kingdom, and France exhibit strong demand due to ongoing infrastructure upgrades and large-scale industrial projects. Fleet operators prioritize high-efficiency lube trucks equipped with advanced pumping and metering systems to meet operational and regulatory requirements. Growing focus on environmental compliance boosts preference for modern units with spill-control features. Continuous investment in road development and industrial maintenance strengthens Europe’s position in the global market.

Asia Pacific

Asia Pacific dominates the market with a 34% share, supported by rapid urbanization, large mining operations, and extensive construction activity across China, India, and Southeast Asia. Heavy machinery usage continues to rise due to large-scale infrastructure projects, prompting strong adoption of mobile lubrication solutions. Mining regions in Australia and Indonesia further drive demand for high-capacity lube trucks designed for harsh conditions. The expansion of oil & gas exploration, industrial corridors, and public infrastructure enhances market growth. Increasing equipment rental activity and modernization of maintenance practices solidify Asia Pacific’s leadership in the global landscape.

Latin America

Latin America holds a 7% market share, driven by mining-intensive economies such as Brazil, Chile, and Peru, where large off-road equipment requires frequent onsite servicing. Construction projects across Mexico and Colombia also contribute to rising adoption of lube trucks to support heavy machinery uptime. The oil & gas sector provides additional momentum through demand for mobile maintenance in remote drilling regions. Although investment cycles fluctuate with economic conditions, modernization of fleet operations and the growth of contract mining services support steady long-term demand across the region.

Middle East & Africa

The Middle East & Africa region accounts for a 6% market share, supported by strong oilfield activity, mining operations, and construction projects across Saudi Arabia, the UAE, South Africa, and Oman. Harsh environmental conditions increase the need for durable and high-capacity lube trucks that can support remote field service operations. Major infrastructure development programs and expansion of industrial hubs reinforce the requirement for reliable mobile maintenance units. The region’s focus on equipment uptime and operational efficiency continues to drive adoption, despite varying investment levels across different economies.

Market Segmentations:

By Type

- Fuel & Lube Trucks

- Lube-Only Trucks

- Vacuum & Lube Trucks

By Capacity

- Below 500 Gallons

- 500–1,000 Gallons

- 1,000–2,000 Gallons

- Above 2,000 Gallons

By Application

- Construction

- Mining

- Oil & Gas

- Others

By End User

- Fleet Operators

- Service Contractors

- Equipment Rental Companies

- Industrial Maintenance Providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Taylor Pump & Lift, Maintainer Corporation, Schwarze Industries, Service Trucks International, Amthor International, Knapheide Manufacturing Company, NFE, Summit Truck Bodies, Curry Supply Co., and Valew Quality Truck Bodies. These companies strengthen their market presence through advanced lube truck designs that integrate multi-fluid tanks, high-pressure pumping systems, precision metering, and spill-control features. Manufacturers focus on customization to meet the diverse needs of construction, mining, oilfield, and fleet maintenance operations. Strategic expansions in fabrication facilities and dealer networks support faster delivery and wider geographical coverage. Many players invest in lightweight materials, corrosion-resistant components, and automation-ready configurations to enhance durability and operational efficiency. Partnerships with heavy-equipment OEMs and rental fleet operators help expand service-ready truck offerings. Continuous innovation in ergonomics, safety features, and modular layouts enables companies to maintain strong competitiveness in the global lube trucks market.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Taylor Pump & Lift

- Maintainer Corporation

- Schwarze Industries

- Service Trucks International

- Amthor International

- Knapheide Manufacturing Company

- NFE (North Frontenac Equipment)

- Summit Truck Bodies

- Curry Supply Co.

- Valew Quality Truck Bodies

Recent Developments

- In July 2025, Taylor Pump & Lift began a series of blog posts, continuing through to at least November 2025, highlighting how lube trucks and related equipment can help mining operations and save costs for construction operators.

- In 2025, Taylor Pump & Lift offered “2025 Lube Bodies” with custom build-to-order options — both enclosed or open bodies, and choices of air or hydraulic pump systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for lube trucks will rise as construction and mining fleets expand worldwide.

- Mobile maintenance solutions will gain traction to reduce equipment downtime on remote sites.

- High-capacity and multi-fluid truck designs will see stronger adoption across heavy industries.

- Integration of telematics and digital fluid monitoring will become standard for fleet optimization.

- Lightweight and corrosion-resistant materials will improve truck durability and performance.

- Oil & gas field operations will increase deployment of lube trucks for safer and faster servicing.

- Equipment rental companies will expand service truck fleets to meet customer maintenance needs.

- Customizable lube truck configurations will create new opportunities for specialized applications.

- Asia Pacific will strengthen its lead due to rapid infrastructure growth and mining expansion.

- Manufacturers will focus on ergonomic designs and advanced safety systems to enhance operator efficiency.