Market Overview:

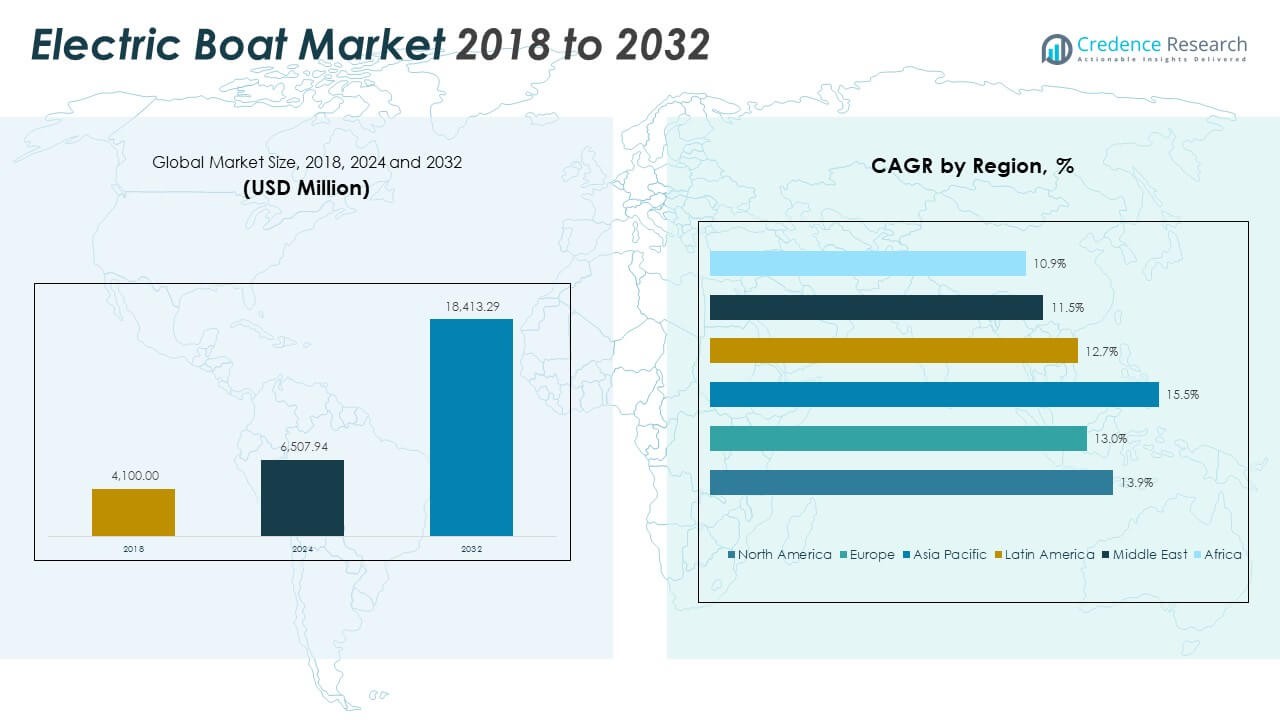

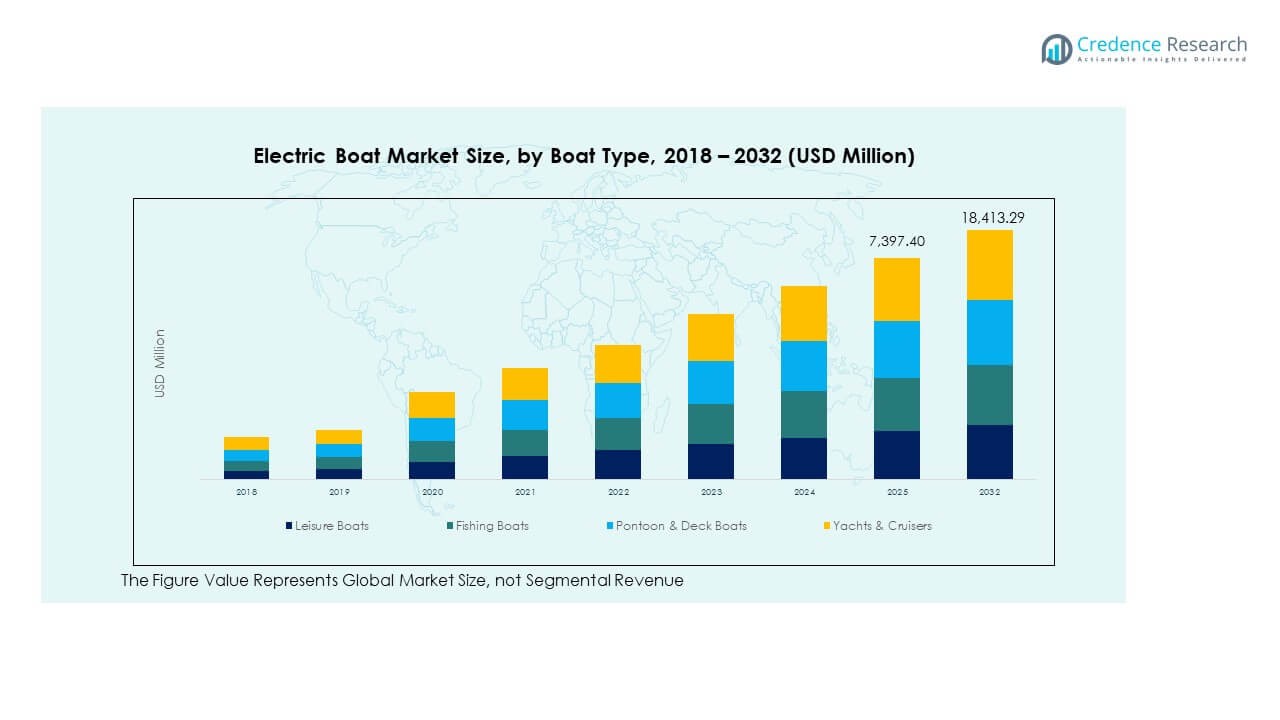

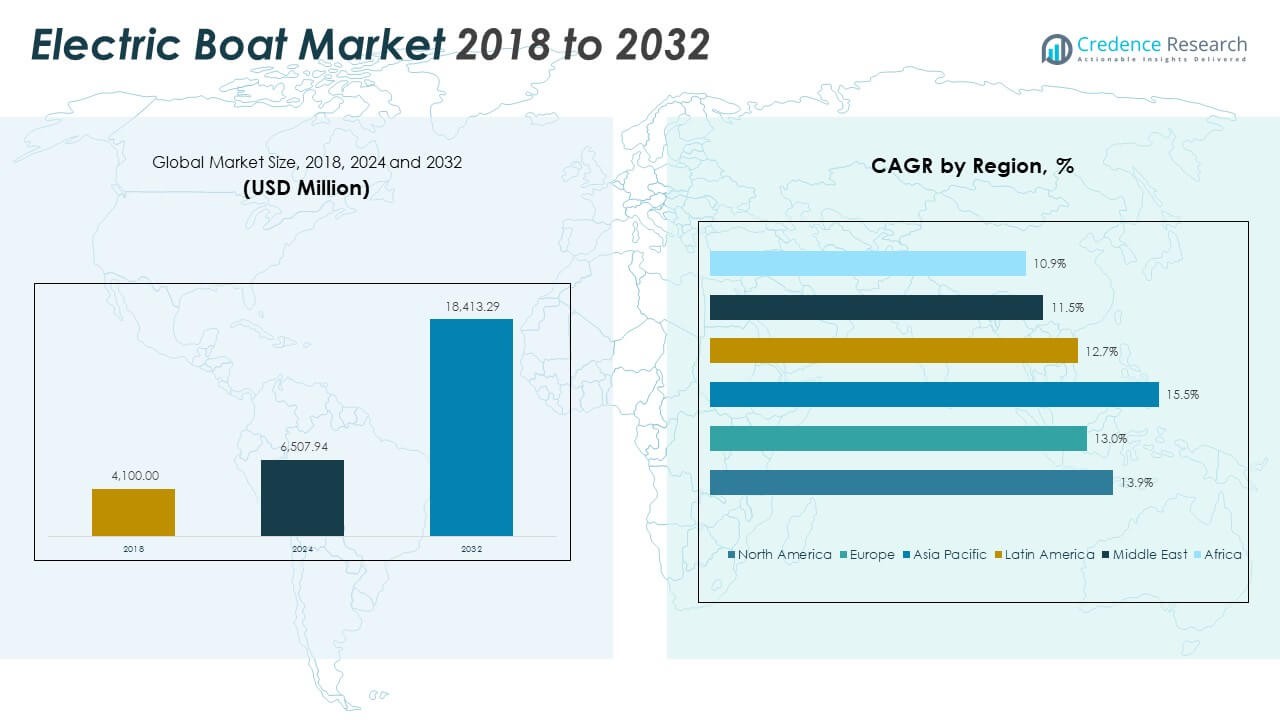

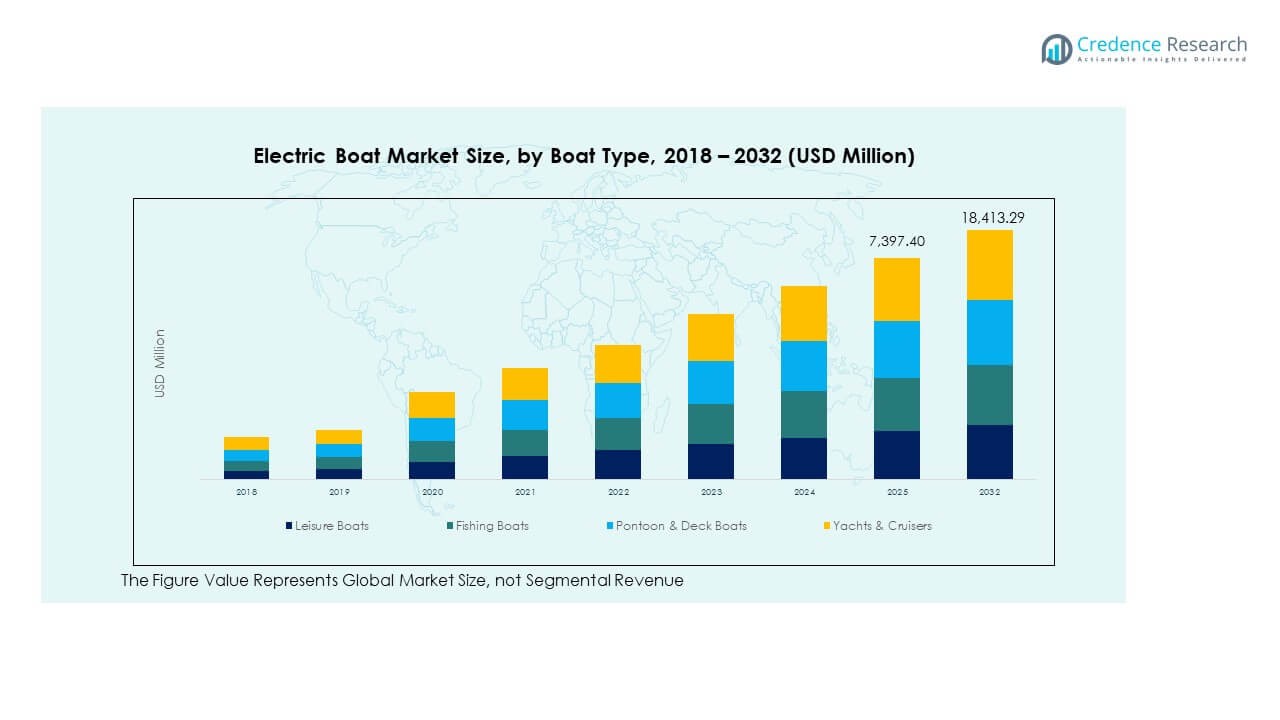

The Electric Boat Market size was valued at USD 4,100.00 million in 2018 to USD 6,507.94 million in 2024 and is anticipated to reach USD 18,413.29 million by 2032, at a CAGR of 13.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Boat Market Size 2024 |

USD 6,507.94 Million |

| Electric Boat Market, CAGR |

13.91% |

| Electric Boat Market Size 2032 |

USD 18,413.29 Million |

The market gains strong momentum through ongoing electrification projects in leisure and commercial boating segments. Manufacturers invest heavily in developing high-performance propulsion systems that deliver extended range and improved durability. Government subsidies and incentives accelerate the transition from diesel-powered boats to zero-emission alternatives. Declining battery prices and efficient charging infrastructure expand accessibility. It benefits from rising eco-tourism and sustainable transport initiatives across key maritime economies.

North America and Europe lead the Electric Boat Market, supported by strong regulatory frameworks and advanced marine infrastructure. The United States, Germany, Norway, and the Netherlands drive large-scale adoption through clean mobility programs. Asia Pacific emerges as the fastest-growing region, with China, Japan, and India expanding their domestic production and green ferry networks. Latin America, the Middle East, and Africa show growing potential driven by coastal tourism and pilot electrification projects. It continues to expand globally with increased investment in ports, charging stations, and renewable energy integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Electric Boat Market was valued at USD 4,100.00 million in 2018, reached USD 6,507.94 million in 2024, and is projected to attain USD 18,413.29 million by 2032, registering a CAGR of 13.91%.

- North America leads with around 45% market share due to strong electrification initiatives, advanced marine infrastructure, and government support for low-emission vessels. Europe follows with about 21% share, driven by sustainability goals and strict environmental standards.

- Asia Pacific holds approximately 25% of the market and records the fastest CAGR of 15.5%, supported by industrial capacity, port modernization, and clean energy projects in China, Japan, and India.

- By boat type, leisure boats represent nearly 37% of the market, supported by rising consumer demand for sustainable and quiet recreational boating.

- Yachts and cruisers account for about 26% of total revenue, with growing interest from luxury buyers and eco-conscious tourism operators globally.

Market Drivers

Growing Shift Toward Sustainable Marine Transportation Driven by Emission Regulations

Stringent environmental regulations drive rapid adoption of electric propulsion systems across global waterways. Maritime authorities enforce cleaner technologies to curb carbon and noise pollution. The Electric Boat Market benefits from this strong regulatory push and growing eco-awareness among boat owners. Manufacturers adopt advanced electric drivetrains and integrate zero-emission technologies into leisure and passenger fleets. Governments implement green port policies to encourage the use of electric vessels. Marina operators expand charging infrastructure to support sustainable boating practices. Shipyards prioritize hybrid-electric designs for improved efficiency. It continues gaining favor among recreational and commercial sectors seeking compliance with future environmental standards.

- For instance, ESEA Propulsion and TECNALIA won the MUBIL Mobility Awards on October 23, 2025, for their high-end electric outboard system noted for responsiveness and integration into recreational boats.

Technological Advancements in Battery Capacity and Marine Power Systems

Continuous improvements in lithium-ion and solid-state batteries extend cruising range and performance reliability. Energy storage solutions reach higher density levels, enabling boats to cover longer distances per charge. The Electric Boat Market benefits from innovation in cooling systems that protect batteries during extended use. Manufacturers explore modular battery configurations that simplify replacement and enhance operational uptime. Increased investment in marine electronics and propulsion integration boosts vessel responsiveness. Compact and lightweight battery packs improve vessel design flexibility. Enhanced safety standards for marine-grade batteries attract buyers concerned about reliability. It drives strong adoption across both commercial ferries and private yachts globally.

- For instance, X Shore launched the X Shore 1 in September 2022 with a 125-kW motor and 63-kWh battery for enhanced range and speed in mid-sized recreational boats.

Expanding Government Support and Incentives for Electrified Vessels

National governments introduce subsidies and tax credits to promote electric marine adoption. Maritime electrification becomes part of clean energy policies in several regions. The Electric Boat Market gains momentum through grants supporting shipyard upgrades and fleet conversions. Ports offer reduced docking fees for electric and hybrid vessels. Public-private partnerships invest in research for efficient motor systems and battery technologies. Local authorities support pilot projects in coastal and inland waterways. These initiatives accelerate deployment in tourism and passenger transport segments. It benefits from strong institutional support for sustainable marine infrastructure expansion.

Rising Consumer Awareness and Preference for Low-Maintenance Vessels

Growing awareness of fuel savings and minimal maintenance drives interest among boat owners. Electric propulsion eliminates frequent servicing linked to diesel engines. The Electric Boat Market gains from improved performance consistency and quieter operation. Consumers value low vibration and instant torque delivery offered by electric systems. Rising electricity affordability compared to marine fuels strengthens buyer interest. Manufacturers promote total cost-of-ownership advantages through targeted marketing campaigns. User-friendly interfaces and smart connectivity improve navigation and energy monitoring. It continues gaining loyalty from private buyers seeking eco-friendly and cost-efficient ownership.

Market Trends

Integration of Smart Connectivity and Autonomous Navigation Systems

Marine technology companies integrate IoT-based systems that enhance navigation and power control. Smart dashboards deliver real-time data on battery status and route efficiency. The Electric Boat Market witnesses adoption of remote diagnostics and predictive maintenance tools. AI-driven systems support collision avoidance and automated docking features. Digital twins help shipyards simulate vessel performance before construction. Wireless updates keep onboard software optimized for safety and efficiency. Integration with smart devices enables users to monitor vessel operations remotely. It strengthens the transition toward intelligent, self-operating electric vessels across marinas.

- For instance, Orca AI’s SeaPod system fuses radar, AIS, and computer vision to detect targets, performing 107 autonomous collision avoidance maneuvers over 40 hours in a Tokyo Bay trial, avoiding 400-500 vessels. Smart dashboards deliver real-time data on battery status and route efficiency.

Emergence of Modular and Scalable Boat Design Concepts

Manufacturers embrace modular design principles allowing flexible power configurations. The Electric Boat Market benefits from hull innovations that integrate battery storage seamlessly. Shipbuilders offer scalable propulsion units adaptable for varying vessel sizes. Prefabricated sections simplify production and accelerate time-to-market. Modular energy systems enable cost-effective upgrades over a boat’s lifespan. Compact electric motors improve internal spacing for passengers and cargo. Builders emphasize design adaptability to meet charter and leisure requirements. It fosters innovation in boat customization for both individual and commercial users.

- For instance, ClassNK’s AI collision avoidance uses reinforcement learning models verified in ship simulations, enabling precise obstacle evasion across varied trajectories. Shipbuilders offer scalable propulsion units adaptable for varying vessel sizes.

Rapid Expansion of Marine Charging Infrastructure and Power Networks

Ports and marinas develop fast-charging stations to accommodate growing electric fleets. Regional authorities allocate funds to strengthen grid connectivity near waterways. The Electric Boat Market benefits from standardized plug systems ensuring compatibility across vessel brands. Companies introduce floating charging platforms in urban waterfronts. Renewable energy sources such as solar pontoons supply clean electricity. Collaborative initiatives among utility firms and boatyards expand availability of marine charging corridors. Increasing battery-swapping pilots in small ferries enhance uptime. It encourages broader consumer trust in electric propulsion reliability.

Luxury and Tourism Segments Driving Adoption of Premium Electric Yachts

High-end yacht builders integrate advanced electric drives into luxury vessels. The Electric Boat Market grows through rising interest from eco-conscious tourism operators. Silent cruising and zero-emission appeal enhance customer experiences in scenic areas. Premium yacht manufacturers adopt lightweight composites to offset battery weight. Design firms focus on seamless integration of solar panels and regenerative propellers. Charter companies promote sustainable travel packages using electric catamarans. Innovations in interior comfort align with green energy aesthetics. It reinforces the perception of electric boats as both luxurious and responsible choices.

Market Challenges Analysis

Limited Battery Range and Charging Infrastructure Constraints Affecting Long-Distance Use

Current battery technology restricts range, limiting operational flexibility for long voyages. The Electric Boat Market faces challenges in balancing energy storage with vessel weight. Many coastal and inland routes lack adequate charging points for commercial operations. High-capacity batteries increase costs and require specialized safety management. Weather conditions can affect power performance on open waters. Operators struggle to plan efficient journeys within limited battery endurance. Manufacturers invest heavily in optimizing propulsion-to-battery efficiency ratios. It must overcome these logistical barriers to match diesel-powered alternatives in endurance.

High Upfront Costs and Slow Adoption Among Traditional Boat Owners

Purchase costs remain significantly higher than those of conventional boats. The Electric Boat Market encounters resistance from buyers prioritizing short-term affordability. Marine dealers highlight uncertainty about long-term resale values. Maintenance savings and lower fuel expenses take years to offset initial investment. Insurance premiums and certification add complexity to ownership. Many small operators remain cautious about adopting new propulsion systems. Financing institutions often lack structured loan programs for electric marine assets. It requires broader awareness and cost-reduction strategies to accelerate consumer conversion.

Market Opportunities

Growing Commercialization of Electric Ferries and Passenger Transport Solutions

Urban waterways adopt electric ferries for low-noise and emission-free transit. Municipal bodies invest in modern fleets to support clean mobility goals. The Electric Boat Market benefits from public contracts and fleet electrification programs. Operators seek scalable solutions that reduce fuel dependency in dense routes. Technology providers collaborate with transport agencies for pilot operations. Battery leasing and energy-as-a-service models lower financial barriers. Improved passenger comfort through silent cruising enhances acceptance. It opens new revenue potential for suppliers and infrastructure developers alike.

Expansion in Recreational Boating and Eco-Tourism Applications Worldwide

Eco-tourism and leisure boating sectors witness growing demand for sustainable experiences. Travelers prefer quiet, emission-free rides in protected marine areas. The Electric Boat Market gains traction through rental services and scenic cruise operations. Start-ups design compact vessels tailored for resorts and private lakes. Solar-assisted propulsion systems attract buyers in tropical destinations. Manufacturers explore partnerships with tourism boards for promotional campaigns. Emerging economies in Asia and Latin America invest in green coastal projects. It continues unlocking growth avenues across leisure and environmental tourism markets.

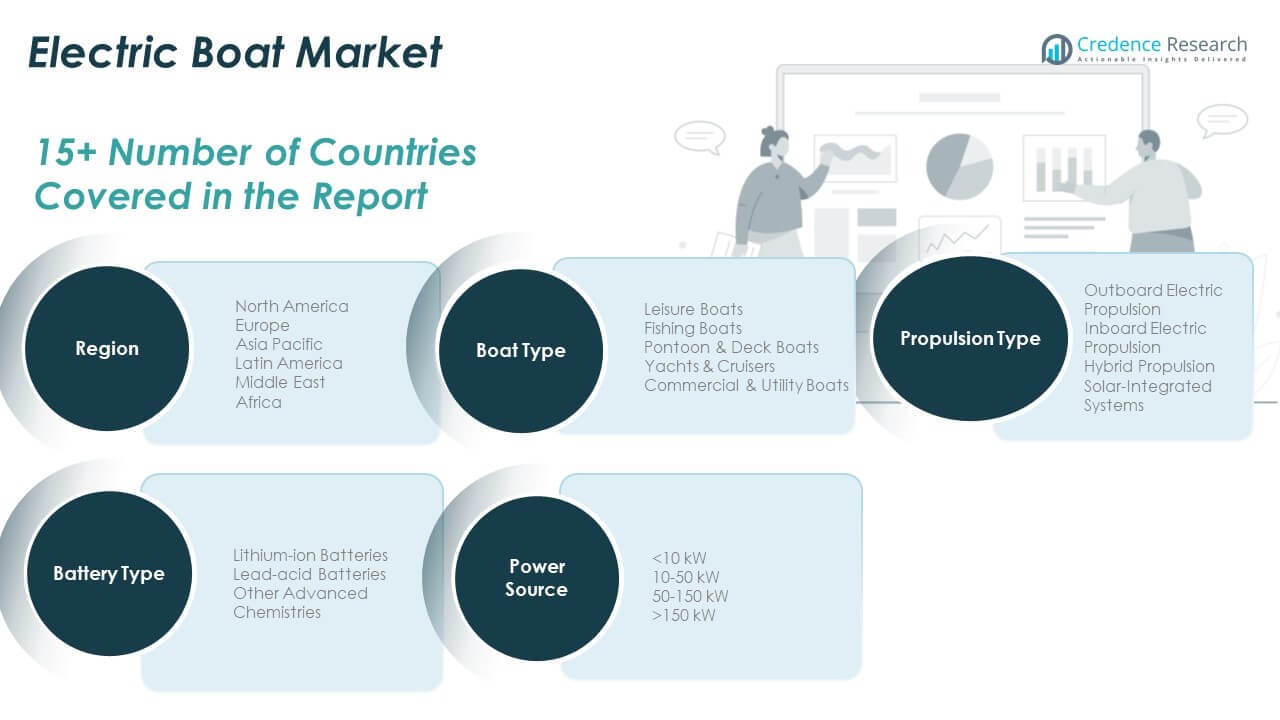

Market Segmentation Analysis:

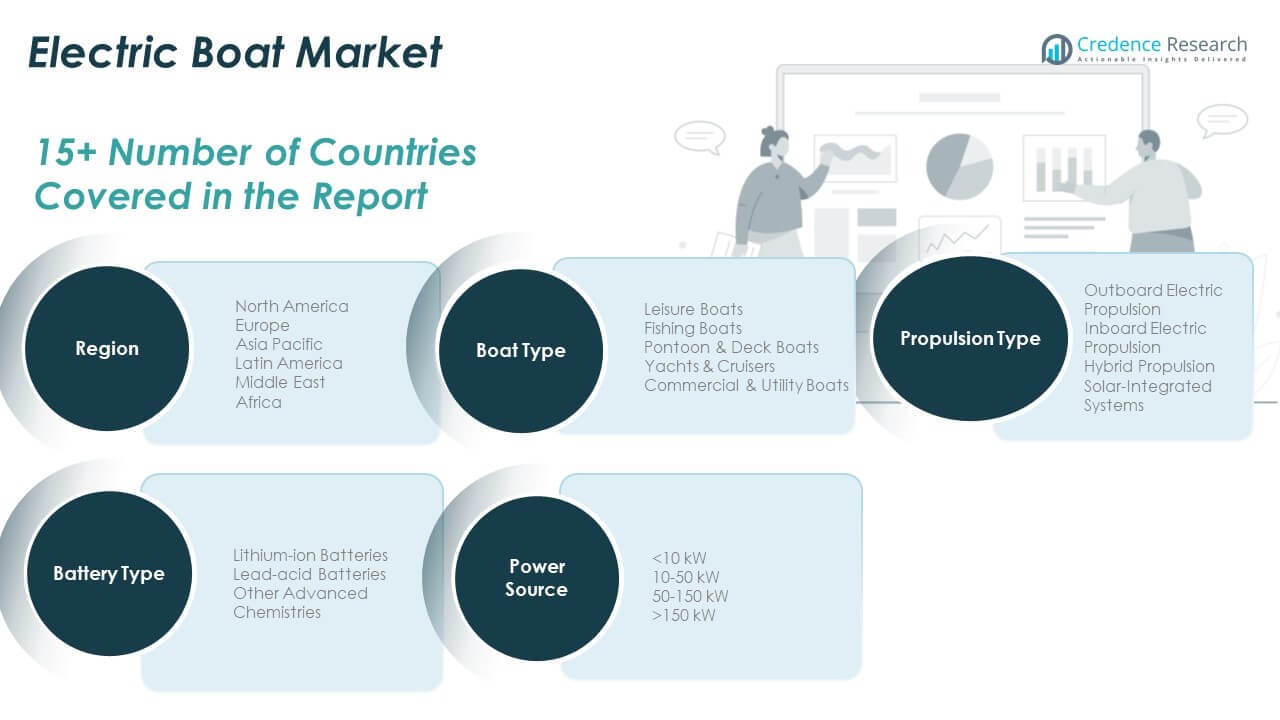

By Boat Type

The Electric Boat Market demonstrates strong diversification across leisure, commercial, and utility applications. Leisure boats hold the largest share due to rising recreational boating activities and consumer preference for quiet, emission-free cruising. Yachts and cruisers capture significant demand in the luxury segment supported by technological upgrades and aesthetic appeal. Fishing boats adopt electric propulsion to reduce noise and enhance environmental sustainability in coastal operations. Pontoon and deck boats gain visibility in tourism and inland transport sectors. Commercial and utility boats integrate electric systems for efficient harbor services and short-distance logistics. It continues evolving with hybridized designs meeting multiple marine functions efficiently.

- For instance, X Shore 1 integrates 125 kW electric motor achieving 93 km range at 37 km/h cruising speed. Yachts and cruisers capture significant demand in the luxury segment supported by technological upgrades and aesthetic appeal, for instance, X Shore Eelex 8000 delivers 170 kW electric motor with 100 nautical miles range.

By Propulsion Type

Outboard electric propulsion dominates due to cost-effectiveness and easier maintenance for small and mid-size vessels. The Electric Boat Market witnesses steady growth in inboard propulsion supported by advanced torque control and integration flexibility. Hybrid propulsion attracts operators seeking extended range without full dependency on grid charging. Solar-integrated systems grow in demand for their energy independence and minimal maintenance in recreational and resort-based boats. Compact motor technology and lightweight materials enhance maneuverability across categories. Increased marine electrification projects boost investment in high-efficiency propulsion systems. It gains further momentum from government-backed programs supporting vessel electrification initiatives globally.

By Battery Type

Lithium-ion batteries lead due to higher energy density, rapid charging, and durability in marine conditions. The Electric Boat Market benefits from continuous improvements in safety, cycle life, and compact design of lithium-based systems. Lead-acid batteries retain demand in cost-sensitive applications where replacement cycles remain manageable. Emerging advanced chemistries including solid-state and nickel-based variants provide next-generation alternatives with enhanced stability and reduced thermal risks. Manufacturers collaborate to standardize battery modules for scalability across boat categories. Energy management systems improve monitoring and optimize storage capacity during extended use. It continues to progress through innovations that reduce charging time and extend operational range.

- For example, the Electric Boat Market benefits from continuous improvements in safety, cycle life, and compact design of lithium-based systems, for instance, X Shore Eelex 8000 packs dual 126 kWh lithium-ion batteries supporting 100 nautical miles at 5 knots.

By Power Source

Power distribution varies based on vessel size and performance requirements. The 10–50 kW range dominates due to widespread adoption across leisure and ferry boats offering balanced power and range efficiency. The Electric Boat Market experiences increasing adoption in the 50–150 kW class driven by commercial and medium-sized transport boats. Systems exceeding 150 kW cater to yachts and high-performance vessels requiring stronger thrust and endurance. Sub-10 kW configurations serve compact personal boats and inland transport applications. Manufacturers emphasize efficient cooling and smart controllers for power optimization. Integration of renewable inputs strengthens the operational reliability of electric boats. It demonstrates continuous refinement in design and energy output alignment across vessel types.

Segmentation:

By Boat Type

- Leisure Boats

- Fishing Boats

- Pontoon & Deck Boats

- Yachts & Cruisers

- Commercial & Utility Boats

By Propulsion Type

- Outboard Electric Propulsion

- Inboard Electric Propulsion

- Hybrid Propulsion

- Solar-Integrated Systems

By Battery Type

- Lithium-ion Batteries

- Lead-acid Batteries

- Other Advanced Chemistries

By Power Source

- <10 kW

- 10–50 kW

- 50–150 kW

- 150 kW

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Regional Analysis:

North America

The North America Electric Boat Market size was valued at USD 1,873.70 million in 2018 to USD 2,945.45 million in 2024 and is anticipated to reach USD 8,324.68 million by 2032, at a CAGR of 13.9% during the forecast period, capturing around 45% of the global share. Strong policy incentives and advanced marine infrastructure drive regional adoption. The United States leads with growing investment in clean mobility and waterfront electrification. Canada supports battery-powered vessel deployment in tourism and fisheries. The region benefits from mature charging networks and technological collaboration among marine manufacturers. Electric yacht production expands across Florida and California due to rising leisure demand. Battery recycling programs strengthen sustainability standards for marine energy storage. It continues gaining traction from government-led emission reduction initiatives and consumer preference for low-noise boating solutions.

Europe

The Europe Electric Boat Market size was valued at USD 963.50 million in 2018 to USD 1,462.81 million in 2024 and is anticipated to reach USD 3,880.65 million by 2032, at a CAGR of 13.0% during the forecast period, holding about 21% of the global market. Countries including Norway, the Netherlands, and Germany lead vessel electrification supported by strong maritime sustainability policies. EU initiatives promote zero-emission shipping corridors and port electrification. Tourism operators adopt electric ferries across scenic waterways and protected ecosystems. Scandinavian firms pioneer hybrid yacht and solar-boat designs for regional exports. Battery integration and lightweight hull materials advance vessel performance. Public grants accelerate charging network expansion in urban marinas. It benefits from collaborative efforts to standardize technology and enhance cross-border maritime electrification.

Asia Pacific

The Asia Pacific Electric Boat Market size was valued at USD 865.10 million in 2018 to USD 1,443.76 million in 2024 and is anticipated to reach USD 4,572.03 million by 2032, at a CAGR of 15.5% during the forecast period, accounting for roughly 25% of the global market. China dominates manufacturing and infrastructure expansion with government-backed clean energy programs. Japan and South Korea invest in smart propulsion systems and marine robotics integration. India explores electric ferry services for river transport and tourism development. Coastal economies across Southeast Asia increase focus on solar-assisted boats for eco-tourism. Regional players expand exports of low-cost vessels and battery systems. Shipyards modernize facilities to meet growing domestic and export demand. It remains the fastest-growing region, driven by industrial capacity and strong renewable energy alignment.

Latin America

The Latin America Electric Boat Market size was valued at USD 224.68 million in 2018 to USD 352.67 million in 2024 and is anticipated to reach USD 914.59 million by 2032, at a CAGR of 12.7% during the forecast period, contributing nearly 5% of the global share. Brazil and Mexico dominate demand with urban waterways and leisure tourism expansion. Governments promote green mobility programs and incentives for sustainable marine solutions. Local shipbuilders experiment with hybrid ferries for coastal and river operations. Ports adopt renewable-based charging infrastructure to reduce dependency on diesel. Chile and Argentina advance research collaborations for marine electrification. Regulatory awareness around emissions continues to strengthen. It experiences rising private investment supporting pilot projects in eco-tourism and public transport.

Middle East

The Middle East Electric Boat Market size was valued at USD 100.45 million in 2018 to USD 143.78 million in 2024 and is anticipated to reach USD 342.59 million by 2032, at a CAGR of 11.5% during the forecast period, representing about 2% of the total market. The UAE and Saudi Arabia drive adoption through luxury marina developments and sustainable waterfront projects. Electric yachts gain visibility across the tourism and hospitality sectors. Marine developers integrate solar-based propulsion to align with national energy diversification plans. Port authorities invest in clean vessel demonstration projects. Demand from high-end coastal resorts encourages new manufacturing partnerships. It benefits from government sustainability agendas promoting carbon-neutral marine operations and smart energy investments.

Africa

The Africa Electric Boat Market size was valued at USD 72.57 million in 2018 to USD 159.47 million in 2024 and is anticipated to reach USD 378.75 million by 2032, at a CAGR of 10.9% during the forecast period, capturing around 2% of the global share. South Africa leads regional development through renewable-powered marine projects. Electric ferries operate across inland lakes supporting eco-tourism. Local innovators develop solar-electric systems suited to remote waterways. North African nations explore electrified vessels for coastal patrol and transport. Limited infrastructure and financing remain key barriers to scale. International collaborations provide technical expertise for energy-efficient boat production. It shows growing potential through government support for sustainable transport and clean coastal initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Yamaha Motor Co., Ltd.

- Vision Marine Technologies

- Duffy Electric Boat Company

- RAND Boats ApS

- SVP Yachts d.o.o. (Greenline)

- ElectraCraft, Inc.

- Frauscher Bootswerft GmbH

- X Shore AB

- Pure Watercraft Inc.

- Volvo Penta Corporation

Competitive Analysis:

The Electric Boat Market shows rising rivalry among established marine manufacturers and newer innovators. Leading companies such as Yamaha Motor Co., Ltd., Vision Marine Technologies, Duffy Electric Boat Company and ElectraCraft, Inc. hold major shares through wide product portfolios spanning leisure, hybrid, and electric boats. Several niche players such as RAND Boats ApS, X Shore AB, SVP Yachts d.o.o. (Greenline), Pure Watercraft Inc. and Frauscher Bootswerft GmbH differentiate through design focus, luxury positioning, and hybrid-electric innovation. Producers intensify R&D in battery integration, propulsion efficiency, and modular boat platforms to capture new segments. Companies invest in smart propulsion systems and marine-grade battery tech to improve reliability and performance. Competitive pressure pushes firms to optimize cost, expand regional reach, and diversify offerings. It strengthens overall market maturity and helps meet evolving regulatory and consumer expectations.

Recent Developments:

- In September 2025, Groupe Beneteau unveiled the Excess 11 48V Hybrid, positioning it as the most attractive electric catamaran on the market during the Cannes 2025 event with 19 new models and 14 world premieres.

- In June 2025, Yamaha Motor Co., Ltd. established a new company in Finland to advance digital transformation and connected technology development for its marine products business, building a global CASE development platform to strengthen its innovative capabilities in marine electrification and smart boating solutions.

- In May 2025, Incat launched “Hull 096,” the world’s largest battery-powered ship (130 m length) designed to carry passengers and vehicles. This vessel marks a major milestone in large-scale electric ferry deployment.

- In April 2025, Sialia Yachts introduced the “Sialia 45,” a new electric cruiser featuring twin 300 kW motors, modular interior configurations, and battery-powered propulsion. This launch reflects growing interest in electric leisure yachts.

Report Coverage:

The research report offers an in-depth analysis based on Boat Type, Propulsion Type, Battery Type and Power Source. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing consumer preference for quiet, low-emission marine transport will strengthen adoption across leisure and utility segments.

- Expanding charging infrastructure in coastal and inland waterways will enhance long-distance usability for electric vessels.

- Advances in lithium-ion and solid-state battery chemistry will extend range and reduce maintenance frequency.

- Hybrid and solar-integrated propulsion systems will gain attention from operators seeking energy efficiency and extended cruising capability.

- Government incentives and environmental mandates will accelerate electric fleet conversion in tourism and commercial operations.

- Collaboration between marine manufacturers and battery suppliers will improve system integration and performance reliability.

- Rising luxury yacht electrification will position premium vessel builders at the forefront of sustainable marine innovation.

- Port authorities investing in green corridors will stimulate demand for eco-compliant passenger and cargo transport.

- New entrants focusing on modular designs will lower costs and expand accessibility for smaller operators.

- Growing focus on carbon neutrality and renewable energy will sustain long-term expansion across global markets.