Market Overview:

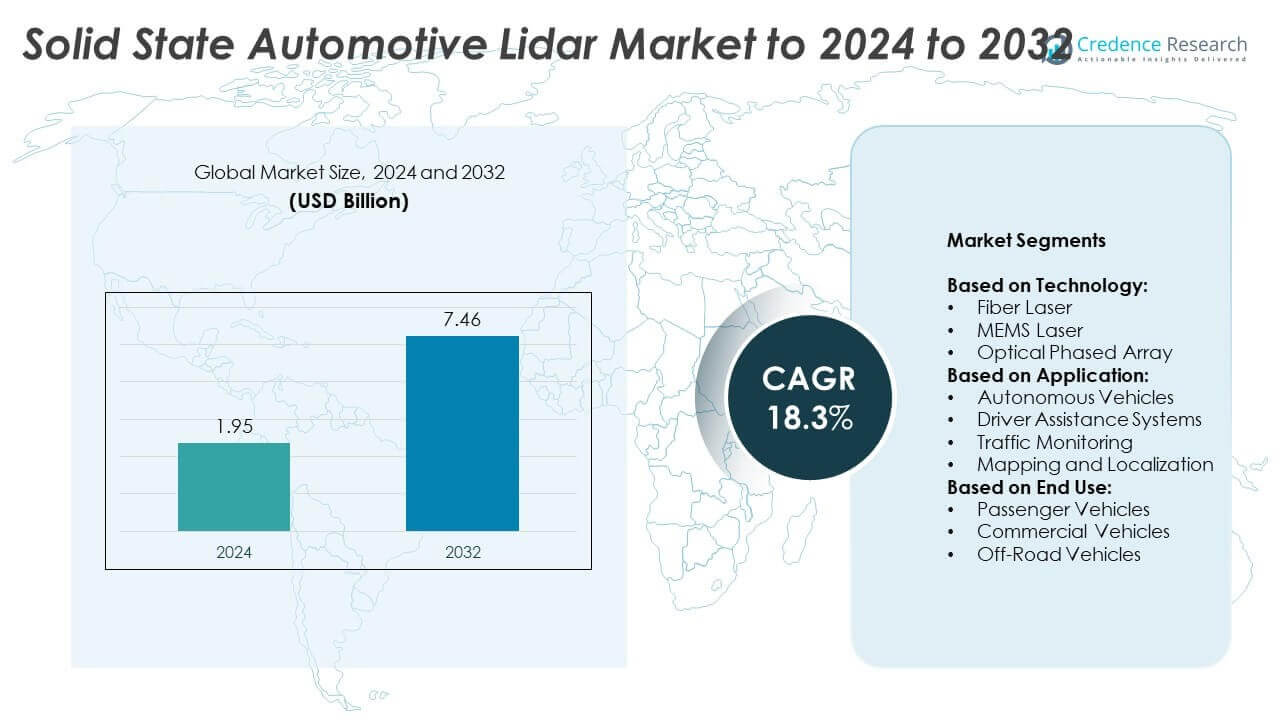

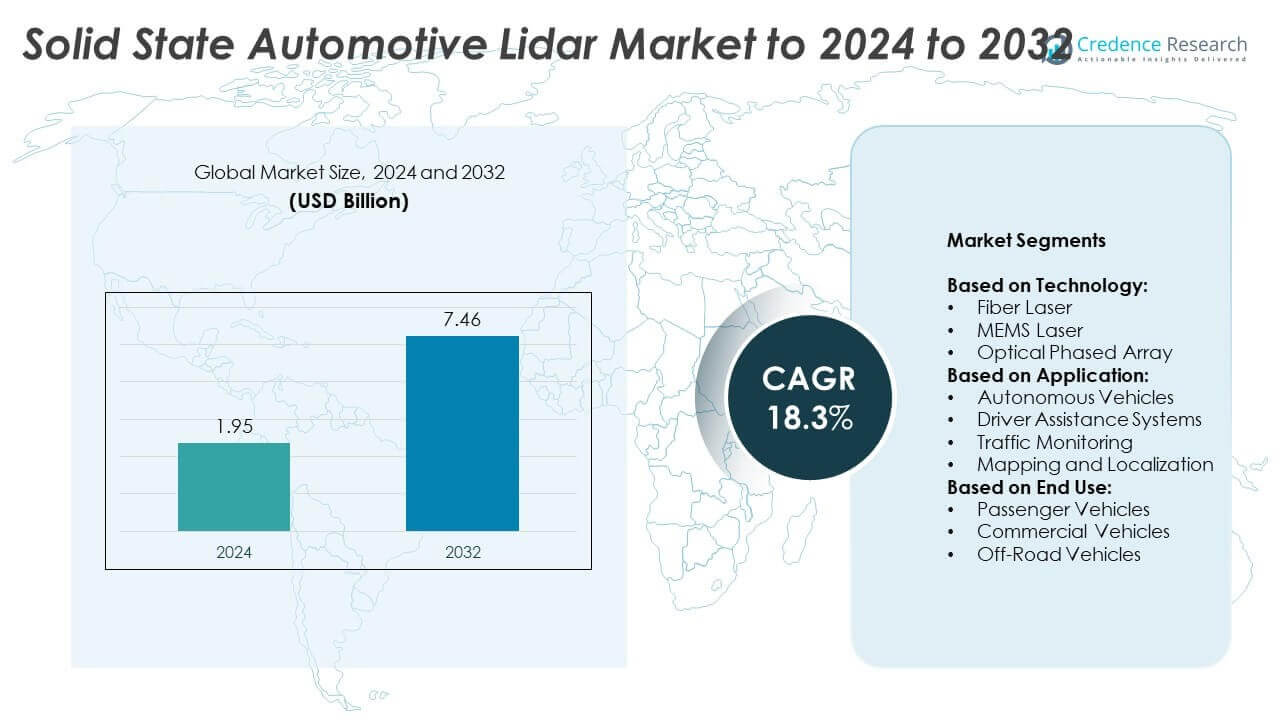

Solid State Automotive Lidar Market size was valued USD 1.95 Billion in 2024 and is anticipated to reach USD 7.46 Billion by 2032, at a CAGR of 18.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solid State Automotive LiDAR Market Size 2024 |

USD 1.95 Billion |

| Solid State Automotive LiDAR Market, CAGR |

18.3% |

| Solid State Automotive LiDAR Market Size 2032 |

USD 7.46 Billion |

The Solid State Automotive Lidar market is driven by top players including LeddarTech, Velodyne Lidar, Luminar Technologies, Innoviz Technologies, Valeo, Ouster, and MicroVision, alongside emerging innovators such as Baraja, Nuro, XenomatiX, and SICK AG. These companies focus on advancing MEMS and optical phased array technologies to enhance range, resolution, and cost efficiency for autonomous driving and ADAS applications. Strategic partnerships with automakers and technology firms remain central to commercialization efforts. Regionally, North America dominated the market with a 36% share in 2024, supported by strong adoption of autonomous vehicles, regulatory mandates, and active R&D programs, followed by Europe with 28% and Asia Pacific with 25%.

Market Insights

- The Solid State Automotive Lidar market was valued at USD 1.95 Billion in 2024 and is projected to reach USD 7.46 Billion by 2032, growing at a CAGR of 18.3%.

- Rising adoption of autonomous vehicles and government safety mandates are driving demand for solid-state Lidar technologies.

- Key trends include integration with AI-driven perception systems, sensor fusion with radar and cameras, and expansion into commercial and off-road vehicle applications.

- The market is highly competitive with established players and emerging firms focusing on miniaturization, cost reduction, and partnerships with OEMs to expand adoption.

- North America led the market with 36% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while MEMS laser technology accounted for the largest segment share of over 45%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The technology segment in the Solid State Automotive Lidar market is led by MEMS laser, holding over 45% market share in 2024. MEMS lasers dominate due to their compact design, lower power consumption, and cost-effectiveness, making them highly suitable for integration in next-generation automotive platforms. Their scalability in mass production and ability to deliver precise 3D imaging further drive adoption. Fiber laser and optical phased array technologies are expanding, with phased arrays gaining traction for offering enhanced solid-state reliability and wide field-of-view capabilities in advanced autonomous systems.

- For instance, Hesai Technology shipped 222,116 total lidar units in 2023, and its AT128 model offers a detection range of 210 meters at 10% reflectivity. The AT128, a hybrid solid-state sensor, began mass production in 2022 and had secured commitments for millions of units from several major automotive OEMs by mid-2023.

By Application

Autonomous vehicles accounted for the dominant share of more than 50% in 2024 across applications of solid-state automotive Lidar. The demand is fueled by rising investments in Level 4 and Level 5 autonomy, where reliable Lidar ensures safe navigation and obstacle detection. Driver assistance systems also represent a growing segment as automakers integrate advanced driver-assistance features in mid-range and premium models. Traffic monitoring and mapping applications, though smaller, are gaining traction with smart city initiatives and infrastructure modernization driving steady deployment of compact Lidar systems.

- For instance, RoboSense’s RS-LiDAR-M1 solid-state sensor has a 120° horizontal field of view and a detection range of 200 meters (for 10% reflectivity targets). In February 2023, RoboSense announced a partnership with FAW-Toyota to supply its M-series lidar for mass-produced models in China, enhancing perception capabilities and driving safety.

By End Use

Passenger vehicles remain the leading end-use segment, holding over 55% of the market share in 2024. The dominance comes from the large production volumes of cars and SUVs and their increasing adoption of ADAS and autonomous technologies. Rising consumer demand for safety features and government regulations mandating collision avoidance systems support passenger vehicle integration. Commercial vehicles, especially fleets and logistics transport, show significant potential as operators seek automation for efficiency. Off-road vehicles, including construction and agricultural equipment, are emerging adopters as Lidar enhances precision and safety in rugged environments.

Market Overview

Rising Adoption of Autonomous Vehicles

The growing demand for autonomous vehicles is the leading driver of the solid-state automotive Lidar market. Automakers are rapidly integrating Lidar to achieve Level 3 and above autonomy, with precise object detection and mapping capabilities ensuring safer navigation. Major automotive OEMs are partnering with Lidar technology firms to accelerate commercialization of fully autonomous cars. This trend is reinforced by significant R&D investments and pilot programs across North America, Europe, and Asia Pacific, creating large-scale opportunities for MEMS and phased array-based Lidar solutions.

- For instance, Mercedes-Benz launched its Drive Pilot Level 3 system in the U.S. in 2023, available on select EQS and S-Class models. The system was initially validated for use on suitable freeways during high traffic density at speeds up to 60 km/h (40 mph).

Government Regulations and Safety Mandates

Strict safety regulations are boosting the adoption of solid-state Lidar in both passenger and commercial vehicles. Regulatory bodies across the U.S., EU, and Asia are mandating collision avoidance and lane-keeping features, driving automakers to deploy reliable Lidar-based ADAS systems. The ability of solid-state Lidar to function in diverse weather and light conditions enhances compliance with advanced safety standards. Supportive initiatives under programs like Vision Zero and Euro NCAP further fuel adoption, making regulatory push a core driver of market expansion.

- For instance, Honda announced in 2021 that its Legend sedan, equipped with its SENSING Elite system, became the first production vehicle approved for Level 3 driving in Japan.

Declining Costs and Scalable Manufacturing

Cost reduction in solid-state Lidar components, such as MEMS mirrors and semiconductor lasers, has made the technology more affordable. The shift from mechanical to solid-state systems has lowered size, weight, and power requirements, enabling mass production and easier vehicle integration. Leading manufacturers are leveraging semiconductor fabrication methods to reduce unit costs significantly. This scalability is driving adoption not only in high-end vehicles but also in mid-range cars, positioning cost efficiency as a critical growth driver for broader market penetration.

Key Trends & Opportunities

Integration with AI and Sensor Fusion

A key trend in the market is the integration of solid-state Lidar with AI-driven perception software and sensor fusion platforms. Combining Lidar with radar, cameras, and ultrasonic sensors enhances reliability by compensating for individual limitations. AI algorithms improve real-time object classification, enabling vehicles to make faster and safer driving decisions. This creates opportunities for advanced driver-assistance systems (ADAS) and full autonomy, where reliable environmental mapping and predictive analysis are crucial. Such integrations are also shaping partnerships between automakers and software companies.

- For instance, in December 2024, Mobileye announced a partnership with Innoviz to integrate InnovizTwo LiDAR into its Mobileye Drive™ autonomous vehicle platform. This integration is planned for a 2026 start of production and combines Innoviz’s LiDAR technology with Mobileye’s cameras, radars, and imaging radars for L4 autonomous driving solutions. Mobileye also unveiled its EyeQ Ultra chip in 2022, a separate development capable of 176 trillion operations per second for L4 applications, though the Innoviz partnership was announced after Mobileye wound down its own internal LiDAR development.

Expansion in Commercial and Off-Road Applications

While passenger vehicles dominate, a major opportunity lies in expanding Lidar adoption across commercial and off-road vehicles. Logistics providers are investing in autonomous trucks for efficient long-haul operations, while construction and agriculture industries deploy Lidar-equipped machinery for precision tasks. This trend diversifies demand beyond traditional automotive markets and ensures long-term growth. The rugged nature and cost-effectiveness of solid-state systems make them suitable for heavy-duty vehicles, offering significant untapped opportunities for manufacturers targeting these niche but growing applications.

- For instance, Kodiak Robotics announced in 2021 that it would partner with Hesai Technology to integrate Hesai’s 360-degree scanning LiDARs onto Kodiak’s sensor pods for side and rear detection.

Key Challenges

High Integration and Calibration Complexity

One of the key challenges in deploying solid-state Lidar systems is the complexity of integration and calibration with existing automotive platforms. Ensuring seamless communication between Lidar and other sensors like cameras and radar requires advanced software, increasing development costs and timelines. Calibration also needs to be accurate across varied driving conditions to maintain reliability. Smaller OEMs face challenges in adopting these systems at scale, slowing widespread deployment despite falling hardware costs. This remains a barrier to mass commercialization in price-sensitive markets.

Competition from Alternative Technologies

The rise of alternative sensing technologies, particularly advanced camera and radar systems, poses a major challenge for Lidar adoption. Many automakers explore camera-radar fusion as a cost-effective substitute, delaying large-scale Lidar integration in mid-range vehicles. Radar’s strong performance in adverse weather and cameras’ affordability appeal to manufacturers seeking balance between safety and cost. This competition pressures Lidar providers to demonstrate clear value in precision, reliability, and redundancy. Convincing automakers of its superiority remains critical for long-term adoption across markets.

Regional Analysis

North America

North America held the largest share of 36% in the solid-state automotive Lidar market in 2024. The region benefits from strong investments in autonomous vehicle development, supported by leading automakers and tech companies. Regulatory frameworks promoting road safety, coupled with early adoption of advanced driver-assistance systems, fuel demand for Lidar integration. The presence of established technology providers and R&D hubs accelerates innovation and commercialization. Growing adoption of electric and autonomous passenger cars, along with pilot projects for driverless trucks, positions North America as a dominant contributor to overall market expansion during the forecast period.

Europe

Europe accounted for 28% of the solid-state automotive Lidar market share in 2024, driven by stringent safety mandates and strong automotive manufacturing presence. Countries such as Germany, France, and the UK are leading adoption with high focus on autonomous driving trials and Euro NCAP safety standards. Automakers in the region are integrating solid-state Lidar in both luxury and mid-segment vehicles to enhance driver assistance capabilities. Additionally, smart city initiatives and intelligent traffic management programs support adoption in non-passenger applications. This regulatory push and automotive expertise keep Europe a major hub for Lidar deployment.

Asia Pacific

Asia Pacific held 25% of the market share in 2024 and is emerging as the fastest-growing region. China, Japan, and South Korea drive growth through investments in electric and autonomous vehicles, supported by government funding and policies favoring intelligent mobility solutions. Local automakers are increasingly partnering with technology providers to integrate affordable Lidar into mass-produced vehicles. Expanding adoption in commercial fleets and rising demand for safety features in passenger cars further strengthen regional growth. The rapid scale of production capabilities in Asia Pacific enhances global supply, reinforcing the region’s strategic importance in market development.

Latin America

Latin America accounted for 6% of the solid-state automotive Lidar market share in 2024, with growth primarily driven by rising adoption of ADAS in urban mobility projects. Countries such as Brazil and Mexico are focusing on modernizing transportation systems and introducing smart city initiatives. While passenger vehicle adoption is slower compared to developed markets, commercial fleets show growing interest in Lidar for logistics optimization and safety. Challenges such as high costs and limited infrastructure availability restrain widespread penetration, but gradual regulatory support and investments in connected mobility solutions present opportunities for market expansion.

Middle East & Africa

The Middle East and Africa region represented 5% of the global solid-state automotive Lidar market share in 2024. Adoption is primarily led by the Middle East, where investments in smart city programs like Saudi Arabia’s NEOM are driving demand for advanced mobility technologies. Luxury and high-end passenger vehicles dominate the adoption base, while commercial applications remain limited. Africa shows slower growth due to cost barriers and limited infrastructure for autonomous mobility. However, rising investments in connected transportation and regional pilot projects for autonomous shuttles are expected to create gradual opportunities for Lidar deployment.

Market Segmentations:

By Technology:

- Fiber Laser

- MEMS Laser

- Optical Phased Array

By Application:

- Autonomous Vehicles

- Driver Assistance Systems

- Traffic Monitoring

- Mapping and Localization

By End Use:

- Passenger Vehicles

- Commercial Vehicles

- Off-Road Vehicles

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Solid State Automotive Lidar market is shaped by leading players such as LeddarTech, Velodyne Lidar, MicroVision, Nuro, Baraja, Motional, Waymo, Ouster, Innoviz Technologies, Valeo, Aptiv, Luminar Technologies, Here Technologies, Decawave, XenomatiX, and SICK AG. These companies focus on advancing Lidar technologies with improvements in range, resolution, and cost efficiency to support autonomous driving and ADAS applications. Strategies include partnerships with automotive OEMs, collaborations with software firms for AI-driven perception, and investments in mass production capabilities to lower unit costs. Vendors also prioritize miniaturization, energy efficiency, and system reliability to meet safety standards and integration requirements in both passenger and commercial vehicles. The competitive environment is further driven by expanding use cases beyond passenger cars, including logistics, traffic monitoring, and smart city applications. Intense R&D activities and regional expansion efforts continue to define the industry, ensuring strong innovation and positioning for long-term market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LeddarTech

- Velodyne Lidar

- MicroVision

- Nuro

- Baraja

- Motional

- Waymo

- Ouster

- Innoviz Technologies

- Valeo

- Aptiv

- Luminar Technologies

- Here Technologies

- Decawave

- XenomatiX

- SICK AG

Recent Developments

- In 2025, Innoviz Technologies announced that InnovizTwo High-Performance LiDAR Platform to be used in L4 autonomous trucks in North America

- In 2023, Luminar Technologies acquired Civil Maps, a 3D mapping data startup, to integrate into its Sentinel platform.

- In 2023, MicroVision released its MOSAIK™ validation software suite and the MOVIA™ flash-based sensor for automotive and non-automotive applications, including industrial, smart infrastructure, and robotics

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising adoption of autonomous vehicles worldwide.

- Passenger vehicles will remain the dominant segment due to strong consumer demand for safety features.

- MEMS-based Lidar will continue leading the technology landscape because of scalability and lower costs.

- Integration of Lidar with AI and sensor fusion platforms will enhance system reliability.

- Commercial and off-road vehicles will create new growth opportunities for manufacturers.

- Regulatory mandates on safety standards will accelerate adoption across developed regions.

- Asia Pacific will emerge as the fastest-growing region driven by large-scale automotive production.

- Declining hardware costs will make Lidar accessible for mid-range vehicle models.

- Partnerships between automakers and technology providers will shape competitive strategies.

- Continuous innovation in optical phased arrays will strengthen long-term growth prospects.