Market Overview

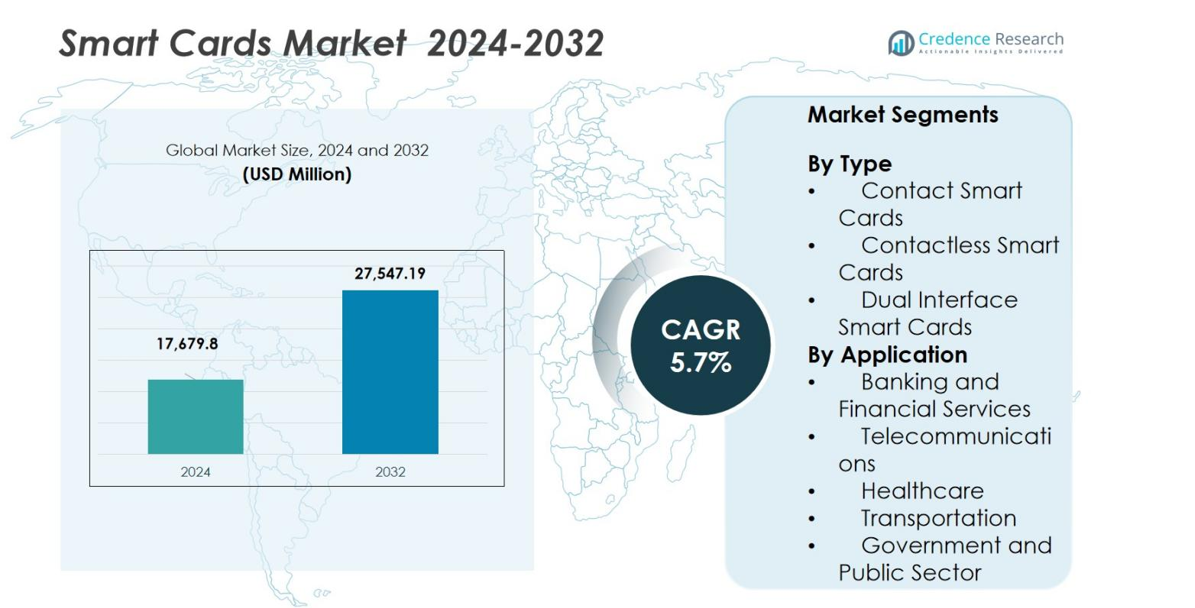

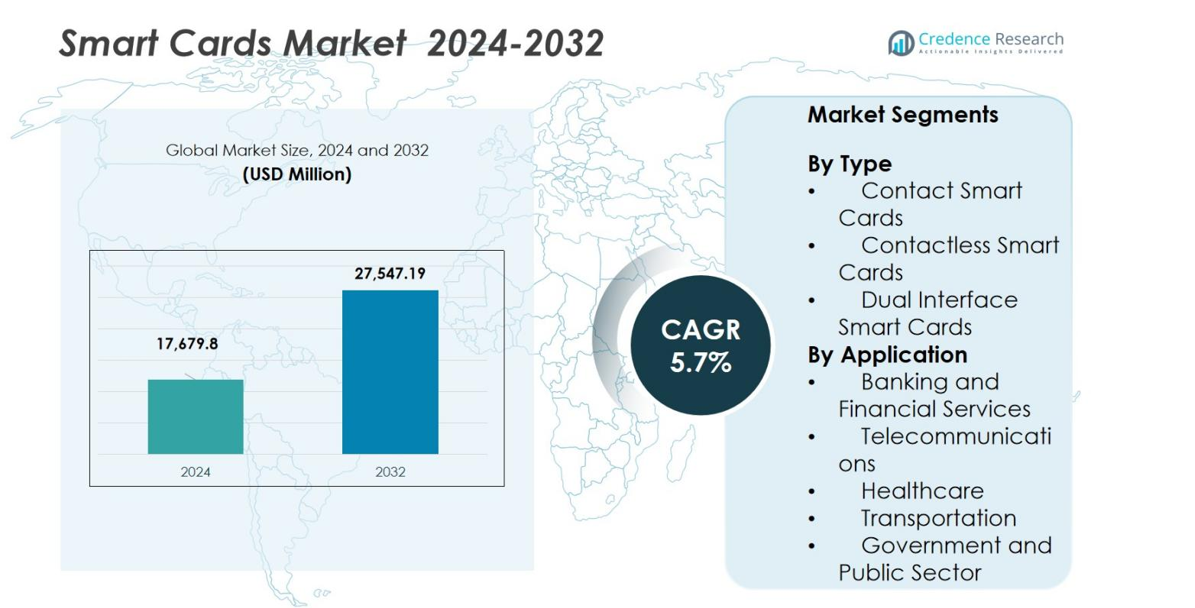

The Smart Cards Market size was valued at USD 17,679.8 Million in 2024 and is anticipated to reach USD 27,547.19 Million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Cards Market Size 2024 |

USD 17,679.8 Million |

| Smart Cards Market, CAGR |

5.7% |

| Smart Cards Market Size 2032 |

USD 27,547.19 Million |

The Smart Cards Market is primarily driven by key players such as IDEMIA, NXP Semiconductors, Gemalto (Thales Group), Giesecke+Devrient, and Infineon Technologies, who lead in offering innovative smart card solutions across various sectors like banking, telecommunications, and government. These companies focus on advanced technologies like chip-based security, contactless capabilities, and encryption, meeting the increasing demand for secure and efficient payment systems. Regionally, North America holds the largest market share at 35%, driven by the widespread adoption of contactless payments and secure financial transactions. Europe follows with a 30% share, fueled by government-driven digital identification initiatives and stringent security regulations. Asia-Pacific, with a 20% market share, is witnessing rapid adoption in countries like China and India, driven by digital transformation and emerging national identification programs.

Market Insights

- The Smart Cards Market size was valued at USD 17,679.8 Million in 2024 and is projected to reach USD 27,547.19 Million by 2032, growing at a CAGR of 5.7% during the forecast period.

- The rising adoption of contactless payment solutions is driving significant growth, especially in banking, retail, and public transport sectors.

- Increasing demand for enhanced security measures, including chip technology and two-factor authentication, is propelling the market, especially in banking and financial services.

- The market is highly competitive with key players like IDEMIA, NXP Semiconductors, and Gemalto leading the charge, focusing on technological advancements and strategic partnerships.

- Regionally, North America holds the largest share at 35%, followed by Europe at 30%, with the Asia-Pacific region accounting for 20%, driven by digital transformation and government initiatives in emerging markets like India and China.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Smart Cards Market is segmented by type into Contact Smart Cards, Contactless Smart Cards, and Dual Interface Smart Cards. Among these, Contactless Smart Cards hold the largest market share, accounting for 55% of the market in 2024. The growth of this sub-segment is primarily driven by the increasing demand for secure and convenient payment solutions, particularly in banking, retail, and transportation. The adoption of contactless technology, offering faster transactions and enhanced user experience, is a key factor driving the market expansion in this segment.

- For instance, Mastercard reported that over 70% of all card-present transactions in Europe were contactless as of 2024, reflecting accelerated consumer adoption.

By Application:

The Smart Cards Market is also segmented by application into Banking and Financial Services, Telecommunications, Healthcare, Transportation, and Government and Public Sector. The Banking and Financial Services sector is the dominant application, holding a market share of 45% in 2024. This is driven by the increasing adoption of smart cards for secure payment methods, fraud prevention, and digital transactions. The growing preference for cashless transactions and the rise of digital banking are major drivers for the dominance of this sub-segment in the market.

- For instance, Thales Group launched its EMV biometric payment card in early 2024, integrating fingerprint authentication for enhanced security in contactless transactions. The card achieves a fingerprint verification success rate of over 95% on the first attempt, making it one of the most reliable biometric payment solutions in the market.

Key Growth Drivers

Increasing Demand for Contactless Payment Solutions

One of the primary growth drivers for the Smart Cards Market is the rising demand for contactless payment solutions. With the growing adoption of digital payment systems, especially in retail and public transportation, contactless smart cards have become an essential tool for fast, secure, and convenient transactions. Consumers’ preference for frictionless payment experiences has driven the adoption of contactless cards, particularly in developed regions. The ongoing shift towards cashless transactions, coupled with the increasing number of mobile wallets, will further fuel this trend and accelerate market growth.

- For instance, Mastercard’s Tap on Phone solution, which enables merchants to accept contactless payments using smartphones, has been deployed in over 110 markets and is being used by micro-merchants and large retailers alike, significantly reducing the need for additional hardware and expanding digital payment access.

Rising Need for Enhanced Security and Fraud Prevention

The increasing need for secure transactions and fraud prevention in various sectors, such as banking and financial services, is a significant driver of the Smart Cards Market. With cybercrimes and identity theft becoming more prevalent, organizations are turning to smart cards equipped with chip technology for higher security. These cards are resistant to counterfeiting and offer two-factor authentication, making them an ideal solution for securing financial transactions. The growing focus on data protection and compliance with industry regulations will continue to propel the adoption of smart cards across various industries.

- For instance, American Express integrates chip technology with unique terminal IDs at point-of-sale devices to detect and prevent fraudulent transaction patterns, enhancing security for cardholders.

Government Initiatives and Regulations

Government initiatives promoting digital identification and secure transactions have significantly contributed to the growth of the Smart Cards Market. Many governments are rolling out national ID systems and digital passports, driving the demand for smart cards for identification purposes. Additionally, regulations aimed at improving security standards in banking, healthcare, and public sectors are boosting the adoption of smart cards. This push for digitalization and security-enhanced solutions is expected to continue, providing long-term growth opportunities for the smart card industry.

Key Trends & Opportunities

Expansion of Smart Cards in Healthcare

The integration of smart card technology in healthcare is a growing trend, providing significant opportunities in the Smart Cards Market. Healthcare providers are increasingly adopting smart cards for patient identification, access to medical records, and insurance claims processing. These cards ensure secure and streamlined management of patient data while reducing administrative costs and errors. With the global shift towards digital healthcare systems and the need for more efficient and secure patient management, the healthcare sector offers considerable growth potential for smart card manufacturers.

- For instance, OneRecord’s app supports SMART Health Cards, allowing patients to gather and share their vaccination history and test results securely via digital QR codes, facilitating better individual healthcare management.

Smart Cards in Transportation Systems

The adoption of smart cards in transportation systems is another key opportunity for market growth. Many urban areas are transitioning to cashless and digital payment systems for public transport, using smart cards for ticketing and access control. As cities expand their infrastructure and focus on efficient transportation management, the demand for smart card-based systems is expected to rise. The convenience of using a single card for multiple transit modes, coupled with government investments in smart cities, will further drive the growth of this application in the coming years.

- For instance, global fintech platform Pine Labs, in partnership with Flipkart, launched the Flipkart Bharat Yatra Card in India, a prepaid digital card designed to streamline payments across buses and metro systems using the National Common Mobility Card infrastructure, thus reducing queue times and enhancing commuter convenience.

Key Challenges

High Cost of Implementation and Infrastructure

Despite their growing popularity, the high cost of implementing smart card infrastructure poses a challenge for market growth, particularly in developing regions. The adoption of smart cards requires substantial investments in card issuance, reader devices, and backend systems. This can be a barrier for small organizations and governments with limited budgets. While the long-term benefits of smart cards are clear, the initial cost burden for businesses and governments remains a challenge in accelerating widespread adoption, particularly in cost-sensitive sectors like healthcare and transportation.

Privacy and Data Security Concerns

As smart cards store sensitive personal and financial data, concerns regarding privacy and data security present a significant challenge. The growing frequency of data breaches and identity theft incidents raises doubts about the robustness of smart card security systems. While smart cards are generally more secure than traditional magnetic stripe cards, they are not immune to hacking or data manipulation. Ensuring the highest level of security while maintaining consumer trust will remain a crucial challenge for stakeholders in the smart card market, as privacy concerns continue to evolve in an increasingly digital world.

Regional Analysis

North America

The North American Smart Cards Market holds a dominant share of 35% in 2024. The market is primarily driven by the increasing adoption of contactless payments and the growing demand for secure financial transactions. With major players like Gemalto, IDEMIA, and NXP Semiconductors operating in the region, the market benefits from robust infrastructure and advanced technology adoption. Additionally, the rise in digital transformation initiatives in sectors like banking, healthcare, and government further propels growth. The U.S. is a key contributor, owing to its technological advancements and regulatory focus on secure identification and payment systems.

Europe

Europe accounts for 30% of the global Smart Cards Market in 2024. The market is growing due to government-led initiatives promoting digital identification and the adoption of smart card technology in financial services. The widespread use of contactless cards, particularly in the UK, France, and Germany, has driven significant market growth. Additionally, the implementation of stringent data protection regulations, such as the GDPR, has further increased demand for secure transaction solutions. The European market is expected to continue growing, driven by advancements in digital payments, public sector projects, and evolving consumer preferences for secure, cashless transactions.

Asia-Pacific

The Asia-Pacific region represents a substantial share of 20% in the global Smart Cards Market in 2024. Countries like China, Japan, and India are leading in the adoption of smart card technologies, particularly in the banking, telecommunications, and transportation sectors. The growing middle class and rapid digitalization are contributing to the demand for secure identification and payment systems. Additionally, government initiatives in emerging markets to implement national identity programs and digital healthcare services are further boosting the region’s market growth. The increasing trend of cashless transactions is expected to accelerate the market expansion across the region.

Latin America

Latin America holds a market share of 8% in the global Smart Cards Market in 2024. The adoption of smart cards in the region is driven by the increasing demand for secure financial transactions, particularly in Brazil, Mexico, and Argentina. Government initiatives to improve national identification systems and enhance digital payments are key factors propelling growth. The rise in mobile payments and the need for secure solutions in telecommunications further support the adoption of smart cards. Although the market is still developing, the rapid digitalization of financial systems is expected to fuel long-term growth in Latin America.

Middle East & Africa

The Middle East & Africa Smart Cards Market accounts for 7% of the global market in 2024. The market is experiencing steady growth due to increased investments in digital infrastructure and the growing need for secure identification solutions. Countries like the UAE and Saudi Arabia are leading the adoption of smart card technologies, driven by initiatives in banking, government services, and transportation. Additionally, the push for smart city developments and cashless payment systems in urban areas is expected to fuel demand in the region. The expanding public sector and financial services will continue to drive growth in this emerging market.

Market Segmentations:

By Type

- Contact Smart Cards

- Contactless Smart Cards

- Dual Interface Smart Cards

By Application

- Banking and Financial Services

- Telecommunications

- Healthcare

- Transportation

- Government and Public Sector

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Smart Cards Market is highly competitive, with key players such as IDEMIA, NXP Semiconductors, Gemalto (Thales Group), Giesecke+Devrient, and Infineon Technologies leading the industry. These companies dominate the market by offering innovative smart card solutions across various applications, including banking, telecommunications, transportation, and government sectors. The competition is driven by technological advancements in card security, such as chip technology, contactless capabilities, and encryption, as well as the increasing demand for secure digital payment solutions. Market players are continuously focusing on strategic partnerships, acquisitions, and collaborations to expand their market presence and enhance their product offerings. For instance, IDEMIA has strengthened its position by acquiring various companies in the identification and secure transaction sectors. Additionally, companies are investing in research and development to improve product performance, reduce costs, and meet evolving consumer demands. As the market grows, competition among established players and new entrants will intensify.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, GlobalFoundries announced a partnership with IDEMIA Secure Transactions (IST), a division of the IDEMIA Group, to produce IST’s smart card integrated circuit using GlobalFoundries’ 28ESF3 process technology.

- In November 2024, QiCard, a global leader in smart card solutions, acquired Miswag, Iraq’s e-commerce platform, in a confidential deal valued in the seven-figure range. The acquisition, completed earlier in the year, was disclosed recently following the successful integration of services, organizational structures, and operational processes.

- In December 2024, Sumeria and IDEMIA introduced a hybrid metal payment card utilizing Ultimate Metal Art technology in France.

- In September 2024, Fingerprint Cards and Infineon Technologies introduced the SECORA Pay Bio biometric payment card solution, offering streamlined production with simplified manufacturing processes and improved reliability, now prepared for mass production.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Smart Cards Market is expected to continue expanding with increasing demand for secure digital payments across various industries.

- Contactless smart cards will dominate the market as consumers and businesses increasingly adopt cashless and frictionless payment solutions.

- The growing focus on cybersecurity and fraud prevention will drive the adoption of smart cards in banking and financial services.

- Government initiatives to implement national digital identification systems will accelerate market growth, especially in emerging economies.

- The healthcare sector will see a rise in the use of smart cards for secure patient identification and management of medical records.

- Advances in chip technology and biometrics integration will enhance the functionality and security of smart cards.

- The rise of smart cities and urban mobility solutions will boost the demand for smart cards in public transportation and access control systems.

- The Asia-Pacific region will experience significant growth as digital transformation accelerates in countries like China, India, and Japan.

- Environmental concerns and the push for sustainable technologies may lead to the development of eco-friendly smart card solutions.

- Market consolidation and strategic partnerships among key players will intensify as companies focus on expanding their market share and innovation capabilities.